Market Overview

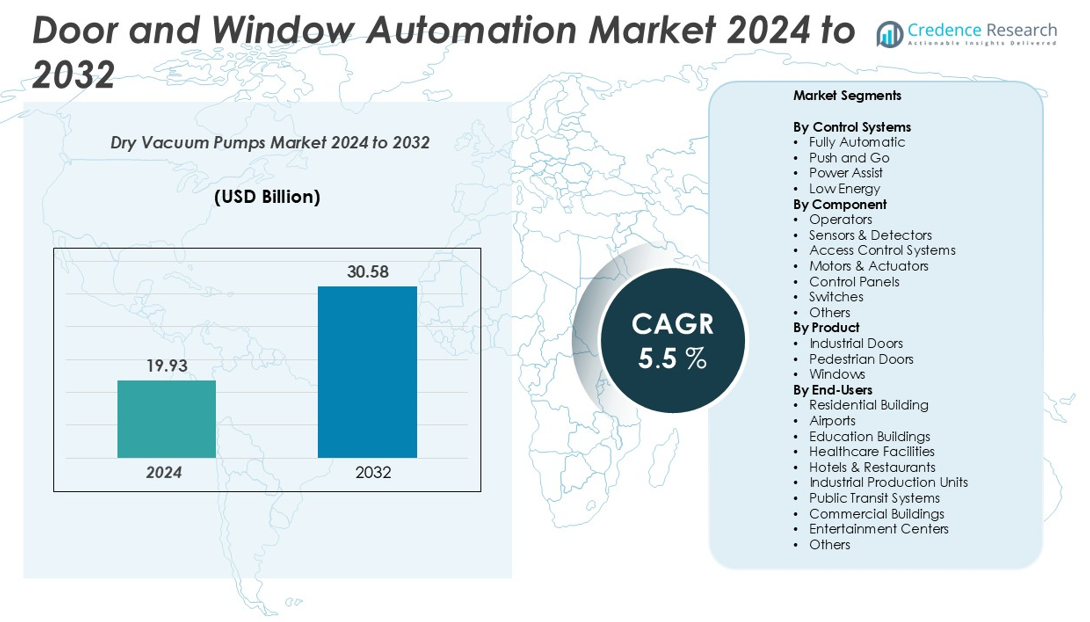

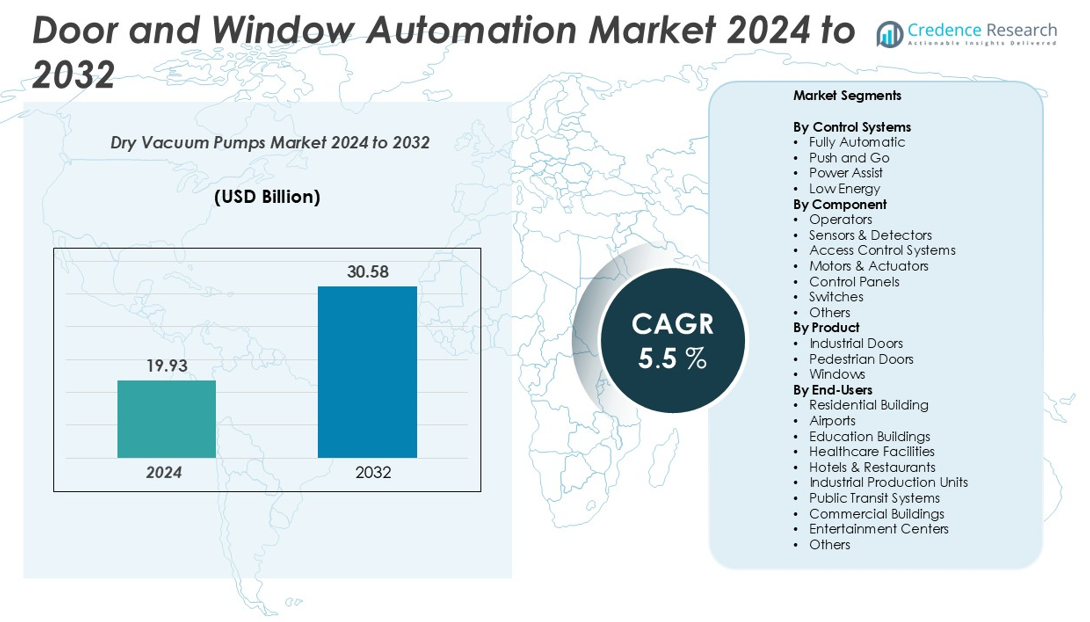

The Door and Window Automation Market size was valued at USD 19.93 billion in 2024 and is anticipated to reach USD 30.58 billion by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Door and Window Automation Market Size 2024 |

USD 19.93 billion |

| Door and Window Automation Market, CAGR |

5.5% |

| Door and Window Automation Market Size 2032 |

USD 30.58 billion |

The door and window automation market is led by major players such as Assa Abloy, dormakaba, GEZE GmbH, Schneider Electric, and Stanley Black & Decker, which dominate through innovation in smart access control, energy-efficient systems, and IoT integration. These companies focus on developing advanced automation solutions for residential, commercial, and industrial applications. North America held the largest regional share in 2024, accounting for 34.2% of the global market, driven by high adoption in commercial buildings and smart infrastructure projects. Europe followed closely with strong demand from industrial and healthcare sectors, supported by stringent building safety regulations and sustainability initiatives.

Market Insights

- The global door and window automation market was valued at USD 18.7 billion in 2024 and is projected to grow at a 6.9% CAGR through 2032.

- Rising demand for smart and energy-efficient infrastructure drives market growth, supported by advancements in motion sensors and microprocessor-based control systems.

- Key trends include IoT-enabled door systems, touchless access solutions, and AI-driven predictive maintenance enhancing user safety and operational efficiency.

- Major players such as Assa Abloy, dormakaba, and Schneider Electric dominate the market through product innovation and strategic expansion into commercial and healthcare automation.

- North America held 34.2% of the market in 2024, followed by Europe with 29.7%, while the fully automatic control systems segment accounted for 46% of total installations due to rising preference for hands-free access in high-traffic environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Control Systems

The fully automatic segment dominated the door and window automation market in 2024, capturing nearly 46% of the total share. This dominance is driven by the widespread use of advanced motion sensors and microprocessor-based controllers in commercial spaces, airports, and healthcare facilities. Fully automatic systems enhance user convenience and hygiene by eliminating physical contact, which has become a key factor in post-pandemic building designs. Their integration with IoT and smart building platforms also supports energy efficiency and centralized control, strengthening demand in modern infrastructure projects.

- For instance, dormakaba Group introduced the ED 100/250 automatic swing door operator, featuring a microprocessor control that performs over 1 million cycles without failure.

By Component

The sensors and detectors segment held the largest market share, accounting for around 38% in 2024. These components are critical for ensuring safety, precision, and efficient operation in automated doors and windows. The growing adoption of infrared, ultrasonic, and microwave sensors in public and commercial spaces boosts this segment’s dominance. Increased emphasis on security and compliance with accessibility regulations further drives demand. Moreover, continuous technological upgrades in motion detection accuracy and response speed have enhanced their use in energy-saving smart automation systems.

- For instance, BEA Sensors launched its IXIO-DT1 dual-technology sensor, which combines a microwave radar for motion activation and active infrared for presence detection. The sensor’s motion activation feature has a typical response time of under 200 ms and a maximum response time of 500 ms.

By Product

The pedestrian doors segment led the market with approximately 55% share in 2024. This segment’s growth is attributed to its extensive deployment in retail outlets, hospitals, airports, and office complexes. Rising urban infrastructure projects and the need for seamless access control systems support its expansion. Automated sliding and revolving doors are increasingly integrated with touchless sensors and AI-based traffic flow management, improving user experience and safety. In addition, the focus on energy-efficient building design promotes the use of pedestrian doors with advanced insulation and motion control technologies.

Key Growth Drivers

Increasing Adoption of Smart Homes and Intelligent Buildings

The rising adoption of smart homes and intelligent building solutions is a primary driver for the door and window automation market. Consumers increasingly demand convenience, energy efficiency, and enhanced security, prompting the integration of automated doors and windows with IoT-enabled systems. Features such as remote operation, sensor-based movement, and integration with home automation platforms allow for seamless control and improved energy management. Residential developers and commercial building operators are leveraging these systems to offer premium amenities and meet sustainability standards. Moreover, the growing penetration of smart infrastructure in urban regions accelerates adoption, creating consistent demand across both residential and commercial segments.

- For instance, KONE’s energy-efficient sliding door solution can reduce the loss of warm or cool air, compared to a standard sliding door.

Energy Efficiency and Sustainability Initiatives

Energy efficiency and sustainability considerations are fueling market growth, as automated doors and windows help reduce energy consumption and environmental impact. By minimizing heat loss in winter and preventing excess cooling in summer, these solutions contribute to lower utility bills and improved carbon footprint management. Regulatory incentives and green building certifications further encourage installation in commercial and residential projects. Advanced materials, motorized systems, and integration with energy management solutions enhance operational efficiency, making automation a preferred choice for environmentally conscious consumers and organizations. This focus on sustainability continues to drive investments and adoption across global markets.

- For instance, KONE’s insulated sliding doors can achieve a U-value as low as 1.0 W/m²·K, indicating excellent thermal insulation properties,” is largely correct based on KONE’s product information.

Rising Construction and Infrastructure Development

The expansion of residential, commercial, and industrial infrastructure worldwide significantly supports the door and window automation market. Rapid urbanization, modernized commercial spaces, and new construction projects increase demand for automated solutions to enhance accessibility, safety, and operational efficiency. Developers are increasingly incorporating automation as a value-added feature to attract tenants and buyers, particularly in high-end real estate projects. Additionally, government initiatives to modernize public infrastructure, airports, hospitals, and educational institutions are driving the adoption of automated doors and windows. The combination of urban development and infrastructural modernization provides a steady growth pathway for market participants.

Key Trends & Opportunities

Integration with IoT and Smart Building Platforms

A major trend shaping the door and window automation market is the integration of devices with IoT and smart building platforms. This enables remote monitoring, predictive maintenance, and real-time performance optimization, enhancing user experience and operational efficiency. Opportunities arise for manufacturers to develop interoperable solutions compatible with multiple platforms, offering seamless control for residential and commercial users. Advanced features such as AI-driven motion detection, energy optimization, and automated security alerts present additional value propositions. The growing trend of connected infrastructure creates opportunities for market players to innovate and capture new revenue streams while enhancing convenience, safety, and energy management.

- For instance, KONE’s 24/7 Connected Services, powered by AWS IoT, have reduced callouts by up to 40% by enabling real-time monitoring and predictive maintenance of elevators, escalators, and automatic building doors.

Rising Demand for Customized and Aesthetic Solutions

Increasing consumer preference for customized and aesthetically pleasing automated doors and windows presents significant opportunities. Modular designs, a wide variety of finishes, and integration with modern interior architecture appeal to both residential and commercial clients. Manufacturers can differentiate themselves by offering tailored solutions that align with architectural trends and functional requirements. Additionally, rising disposable income and demand for premium housing and office spaces drive the adoption of high-end automation solutions. The focus on combining functionality with design aesthetics allows market participants to tap into niche segments while expanding their portfolio to include luxury and smart infrastructure solutions.

- For instance, Specific KONE automatic sliding door models, such as the SD30 and are explicitly described in official product documentation as having a low-profile width design that allows for ample light penetration and versatility across various building types. The slender profile system provides visual openness and stability in various configurations, making them a suitable solution for many different architectural projects.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East present lucrative opportunities for door and window automation providers. Rapid urbanization, growing disposable incomes, and expanding commercial infrastructure fuel adoption in these regions. Market players can leverage local partnerships, joint ventures, and technology adaptation to penetrate these markets effectively. Additionally, government-led initiatives to modernize residential and commercial spaces provide incentives for automation deployment. The relatively untapped potential in emerging markets enables players to achieve growth through strategic investments, tailored product offerings, and awareness campaigns, establishing a strong regional presence while driving global market expansion.

Key Challenges

High Installation and Maintenance Costs

One of the primary challenges for the door and window automation market is the high initial installation and ongoing maintenance costs. Automated systems involve advanced motors, sensors, and control units that increase upfront expenses compared to conventional solutions. Maintenance requires skilled technicians and regular servicing, which can discourage adoption, particularly in price-sensitive residential or small commercial projects. Additionally, repair costs and system downtime can impact operational efficiency, limiting market penetration in regions with lower consumer awareness or budget constraints. Manufacturers need to focus on cost-effective designs, scalable solutions, and service support to overcome this barrier.

Technical Complexity and Interoperability Issues

Technical complexity and lack of standardization pose challenges to widespread adoption. Integration with existing building management systems, varied communication protocols, and compatibility issues with third-party smart platforms can complicate deployment. Users may face difficulties in system configuration, remote control, or multi-device synchronization, affecting user experience and satisfaction. This challenge also extends to training technicians and ensuring reliable performance across different environments. Market participants must invest in simplifying interfaces, standardizing protocols, and providing robust customer support to mitigate interoperability and technical barriers.

Regional Analysis

North America

North America holds a significant share of the door and window automation market, accounting for approximately 32% of the global market. The region benefits from high adoption of smart home solutions, advanced commercial infrastructure, and supportive regulatory frameworks promoting energy-efficient building technologies. The U.S. and Canada lead in integrating automated doors and windows across residential, commercial, and institutional projects. Increasing investments in intelligent building systems, coupled with growing awareness of convenience, security, and energy management, drive steady market growth. Technological innovation and a strong presence of leading automation solution providers further consolidate North America’s dominant position.

Europe

Europe accounts for around 28% of the global market, driven by stringent energy efficiency regulations, high urbanization rates, and increasing demand for intelligent building solutions. Countries such as Germany, the U.K., and France are major contributors, with widespread adoption in residential and commercial sectors. The region witnesses strong growth due to government incentives, green building initiatives, and increasing integration of automated doors and windows with building management systems. Consumers prioritize sustainability, convenience, and security, further boosting demand. The presence of key industry players and ongoing innovation in automation technologies enhance Europe’s position as a leading regional market.

Asia-Pacific

Asia-Pacific is projected to grow rapidly, representing approximately 25% of the global market, fueled by urbanization, rising disposable income, and expanding construction activities. China, India, Japan, and South Korea lead in adoption across residential, commercial, and institutional applications. The region’s growth is supported by increasing smart city initiatives, government incentives for energy-efficient infrastructure, and rising awareness of smart home solutions. Rapid industrialization and modernization of public and private infrastructure provide a strong growth opportunity for automated doors and windows. Expanding partnerships, technology localization, and product customization further enhance market penetration across Asia-Pacific.

Latin America

Latin America holds around 8% of the global market, driven by infrastructure modernization and growing commercial and residential construction. Brazil and Mexico are key contributors, with rising adoption of automated solutions in high-end residential projects, office spaces, and public buildings. Market growth is supported by increasing awareness of energy-efficient solutions and convenience-enhancing automation technologies. However, cost sensitivity and limited technical expertise can restrict adoption. Regional players are focusing on affordable, scalable solutions and partnerships with global vendors to tap growth potential. The combination of urban development and emerging smart infrastructure initiatives presents long-term opportunities for market expansion.

Middle East & Africa

The Middle East & Africa (MEA) region represents approximately 7% of the global market, driven by the adoption of advanced building technologies in the Gulf Cooperation Council (GCC) countries. Rapid urbanization, luxury residential developments, and modernization of commercial and institutional infrastructure boost demand. Countries such as the UAE, Saudi Arabia, and South Africa are leading adopters, leveraging smart automation for energy efficiency, security, and convenience. Growth is supported by investments in smart cities, high-end real estate, and industrial complexes. Challenges include high installation costs and limited skilled workforce, but strategic collaborations and localized solutions are helping players expand market presence in MEA.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Control Systems

- Fully Automatic

- Push and Go

- Power Assist

- Low Energy

By Component

- Operators

- Sensors & Detectors

- Access Control Systems

- Motors & Actuators

- Control Panels

- Switches

- Others

By Product

- Industrial Doors

- Pedestrian Doors

- Windows

By End-Users

- Residential Building

- Airports

- Education Buildings

- Healthcare Facilities

- Hotels & Restaurants

- Industrial Production Units

- Public Transit Systems

- Commercial Buildings

- Entertainment Centers

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The door and window automation market is moderately consolidated, with major players such as Assa Abloy, dormakaba, GEZE GmbH, and Stanley Black & Decker leading through strong product portfolios and global distribution networks. These companies focus on advanced automation technologies that enhance safety, energy efficiency, and convenience across residential, commercial, and industrial sectors. Firms like BEA, Bosch Security Systems, and Honeywell International Inc. are strengthening their presence through sensor innovation, integrated access control, and building management solutions. CAME Group, Legrand, and Schneider Electric are expanding through smart connectivity and IoT-enabled automation platforms. Meanwhile, NABCO Entrances Inc., Record USA, and Panasonic Corporation are investing in motion sensing and AI-based predictive maintenance to improve operational reliability. Siemens AG and Insteon focus on intelligent control systems and building integration, positioning themselves as key players in energy-efficient and sustainable automation infrastructure worldwide.

Key Player Analysis

- Assa Abloy

- BEA

- Bosch Security Systems

- CAME Group

- dormakaba

- GEZE GmbH

- Honeywell International Inc.

- Insteon

- Legrand

- NABCO Entrances Inc.

- Panasonic Corporation

- Record USA

- Schneider Electric

- Siemens AG

- Stanley Black & Decker

Recent Developments

- In November 2022, Assa Abloy launched Yale Assure Lock 2 & August Smart Lock Pro, Honeywell enabled HomeKit integration, Legrand released the Netatmo Smart Door Lock, Schneider introduced Wiser smart window shades, Somfy expanded Connex Smart Home System.

- In March 2022, ASSA ABLOY acquired JOTEC Service & Vertriebsges. mbh, a leading provider of industrial doors and related services in Germany. This acquisition is expected to reinforce ASSA to expand its portfolio of entrance automation systems.

- In March 2022, GEZE GmbH released the GC 342+ safety sensor for automatic swing doors based on laser technology to ensure the building’s safety, hygiene, and comfort.

Report Coverage

The research report offers an in-depth analysis based on Control Systems, Component, Product, End-Users and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of AI and IoT will enhance smart automation and remote control features.

- Demand for touchless access systems will continue to rise in commercial and healthcare buildings.

- Integration with building management systems will improve energy efficiency and safety compliance.

- Growth in smart home construction will boost residential automation installations worldwide.

- Manufacturers will focus on sensor accuracy and faster response times for higher safety.

- Expansion of 5G networks will support real-time monitoring and predictive maintenance.

- Sustainable materials and energy-saving designs will become central to new product development.

- Collaboration between automation firms and construction companies will strengthen large-scale adoption.

- Europe and North America will remain major innovation hubs for automation technologies.

- Emerging economies in Asia-Pacific will witness strong growth due to rapid urban infrastructure development.