Market Overview:

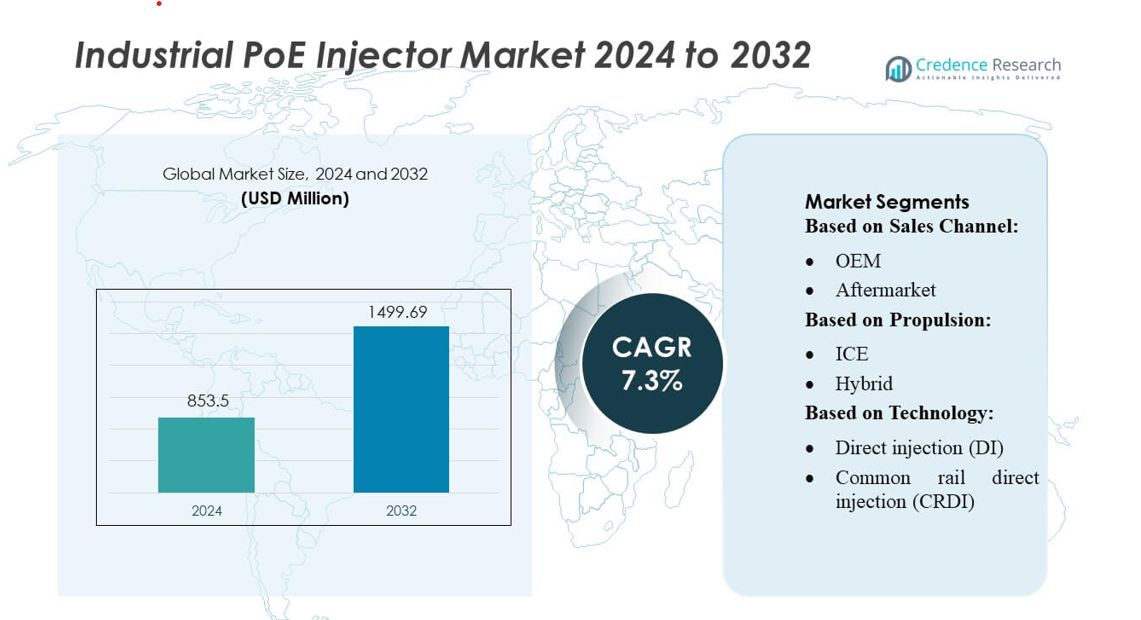

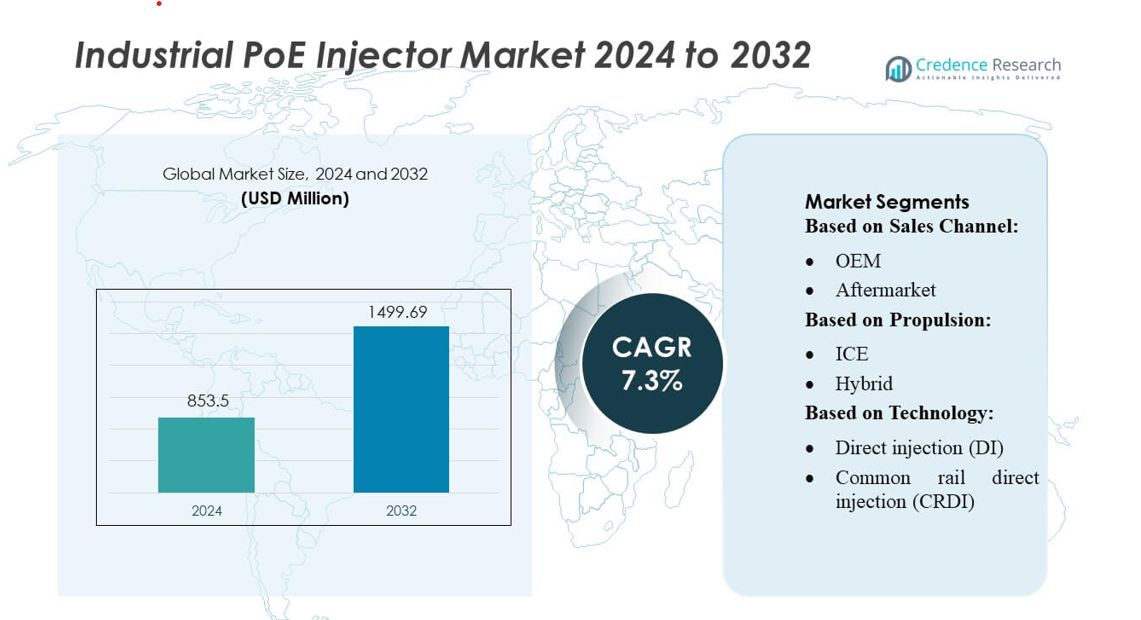

Industrial PoE Injector Market size was valued USD 853.5 million in 2024 and is anticipated to reach USD 1499.69 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial PoE Injector MarketSize 2024 |

USD 853.5 million |

| Industrial PoE Injector Market, CAGR |

7.3% |

| Industrial PoE Injector Market Size 2032 |

USD 1499.69 million |

The Industrial PoE Injector market is highly competitive, with leading players driving technological innovation and expanding regional presence. Companies such as Ypsomed, Amgen, Eli Lilly, Biogen Idec, SHL Medical AG, Mylan N.V., Owen Mumford, AbbVie, Inc., Teva Pharmaceutical, and Pfizer, Inc. focus on enhancing injector reliability, energy efficiency, and integration with smart industrial networks. These players leverage R&D, strategic partnerships, and aftermarket solutions to strengthen their market positions. North America emerges as the leading region, accounting for approximately 36% of the global market, driven by advanced industrial automation, widespread IIoT adoption, and extensive retrofitting of legacy systems. The region’s mature industrial base, strong OEM collaborations, and emphasis on connected and energy-efficient solutions underpin its dominance, while Europe and Asia-Pacific follow closely as key growth regions for PoE injector adoption.

Market Insights

- The Industrial PoE Injector Market size was valued at USD 853.5 million in 2024 and is projected to reach USD 1499.69 million by 2032, growing at a CAGR of 7.3% during the forecast period.

- North America leads the market with a 36% share, driven by advanced industrial automation, IIoT adoption, and retrofitting of legacy systems, while Europe and Asia-Pacific follow as significant growth regions.

- Key growth drivers include increasing industrial automation, expansion of smart manufacturing, and retrofitting of existing equipment with PoE-enabled solutions to improve operational efficiency.

- Market trends show rising demand for energy-efficient and connected industrial networks, integration with edge computing, and adoption of predictive maintenance systems to enhance reliability and reduce costs.

- Competitive dynamics are shaped by continuous R&D, strategic partnerships, aftermarket solutions, and focus on standardized, high-performance injectors, while restraints include high initial costs and compatibility challenges across diverse industrial equipment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sales Channel

The Industrial PoE Injector market, segmented by sales channel, includes OEM and aftermarket channels. The OEM segment dominates, capturing approximately 62% of the market share, driven by strong partnerships with industrial equipment manufacturers and the integration of PoE injectors in new machinery. OEMs benefit from higher reliability requirements and long-term contracts, ensuring steady demand. Conversely, the aftermarket segment is growing due to increasing retrofitting of legacy systems with PoE solutions and rising awareness of energy-efficient industrial networking, offering a notable opportunity for aftermarket providers.

- For instance, Ypsomed has built high‑volume production capabilities: over the past decade it manufactured more than 25 million reusable pen injectors and one billion prefilled pen injectors, and delivered more than 100 million prefilled autoinjectors.

By Propulsion

In terms of propulsion, the market is categorized into ICE, hybrid, and electric vehicles. The ICE segment remains dominant with an estimated 58% market share, propelled by the large base of existing internal combustion vehicles requiring PoE-enabled components for industrial diagnostics and automation. Hybrid systems are gaining traction, driven by government incentives and the need for energy-efficient solutions in industrial applications. Growth in the hybrid segment is supported by increased demand for connected and smart industrial machinery, where PoE injectors play a critical role in power delivery and data integration.

- For instance, Cummins Inc. is a leader in high-pressure fuel injection systems, including its XPI ultra-high-pressure common rail system, which can achieve pressure ratings up to 2,600 bar and is designed to reduce emissions and improve fuel efficiency.

By Technology

Segmented by technology, the market covers Direct Injection (DI), Common Rail Direct Injection (CRDI), Gasoline Direct Injection (GDI), and Port Fuel Injection (PFI). The CRDI segment holds dominance with roughly 55% market share, benefiting from superior efficiency, precise fuel delivery, and compatibility with advanced industrial monitoring systems. DI and GDI technologies are gradually expanding due to stricter emission norms and enhanced performance requirements. The adoption of CRDI-driven industrial equipment enables consistent PoE injector utilization for remote monitoring, predictive maintenance, and seamless power-data integration, positioning it as the key driver for technological deployment.

Key Growth Drivers

Increasing Industrial Automation

The rising adoption of industrial automation is a major growth driver for the Industrial PoE Injector market. Factories and production facilities increasingly rely on connected sensors, cameras, and smart devices that require reliable power and data transmission. PoE injectors enable simplified cabling and reduced installation costs, supporting real-time monitoring and predictive maintenance. For instance, large-scale manufacturing plants deploying IoT-based industrial automation systems have significantly boosted demand for PoE injectors, driving market growth across both OEM and aftermarket channels.

- For instance, Kohler Co. equips its KDI 3404 engine with a 2,000 bar high-pressure common rail system and an electronically controlled EGR valve for cleaner combustion.The KDI line offers a max torque of 500 Nm at 1,400 rpm in variants compliant with Stage V / Tier 4 standards.

Expansion of Smart Manufacturing and IIoT

The proliferation of the Industrial Internet of Things (IIoT) and smart manufacturing initiatives is accelerating demand for PoE injectors. As industries integrate sensors, cameras, and edge devices for real-time data analytics, the need for reliable power and network connectivity grows. PoE injectors reduce infrastructure complexity while enhancing operational efficiency. Leading industrial facilities adopting IIoT-enabled production lines have reported improved uptime and cost savings, reinforcing the technology’s critical role and fostering consistent market expansion globally.

- For instance, Rolls-Royce plc, through its mtu brand, manufactures advanced common-rail injection systems for its Series 4000 engines, designed to continuously improve fuel efficiency and reduce emissions.

Retrofit and Modernization of Legacy Systems

Retrofitting legacy industrial equipment with PoE-enabled systems is a significant market driver. Aging factories and production lines increasingly require modern monitoring and control solutions without extensive rewiring. PoE injectors facilitate cost-effective upgrades, enabling efficient power and data delivery over existing network infrastructure. Industrial facilities undergoing digital transformation, particularly in regions with mature manufacturing bases, are driving aftermarket demand, ensuring steady adoption of PoE injectors while enhancing equipment life cycles and operational efficiency.

Key Trends & Opportunities

Integration with Edge Computing

The convergence of PoE injectors with edge computing solutions is creating new growth opportunities. Edge devices require consistent power supply for data processing at the network periphery, and PoE injectors streamline deployment. Industrial facilities integrating AI-driven monitoring and predictive maintenance systems benefit from reduced latency and simplified infrastructure. This trend is particularly prominent in smart factories adopting real-time analytics and automation, providing opportunities for PoE injector manufacturers to offer high-performance, reliable solutions tailored for edge computing applications.

- For instance, Honda’s 1.5L i-DTEC engine, part of the Earth Dreams Technology family, features a common rail system, a variable geometry turbocharger. It has a compression ratio of 16.0:1. In both BS4 and BS6 configurations available in the Indian market, this engine is known to produce a maximum torque of 200 Nm at 1,750 rpm.

Rising Demand for Energy-Efficient Solutions

Sustainability and energy efficiency are key trends influencing the market. PoE injectors reduce cabling complexity and energy consumption compared with traditional power solutions. Industries aiming to minimize operational costs and carbon footprint are increasingly adopting PoE-enabled systems for surveillance, automation, and sensor networks. Companies focusing on green manufacturing are leveraging energy-efficient PoE injectors, driving innovation and expanding market opportunities while supporting environmental compliance and sustainability goals.

- For instance, Generac’s SDMD2500 industrial diesel generator is equipped with a 65.6-L Baudouin M55 engine. The M55 engine features a high-pressure common rail fuel system for improved performance and reliability in demanding applications.

Growth in Retrofit and Aftermarket Adoption

The increasing focus on retrofitting existing industrial networks presents significant opportunities. Upgrading conventional devices with PoE injectors allows companies to enhance connectivity without major infrastructure changes. Industrial facilities across Europe, North America, and Asia are actively replacing traditional power distribution systems with PoE solutions, reflecting strong aftermarket demand. This trend not only boosts revenue streams for manufacturers but also encourages technological innovation in scalable, plug-and-play PoE injector designs suitable for varied industrial environments.

Key Challenges

High Initial Investment Costs

One of the primary challenges in the Industrial PoE Injector market is the high upfront cost of deployment. Upgrading industrial networks to PoE infrastructure requires investment in compatible devices, cabling, and injectors. Small- and medium-sized enterprises may face budget constraints, slowing adoption rates despite operational benefits. Additionally, integrating PoE systems into legacy networks often demands skilled technicians and planning, further increasing costs and creating barriers for widespread implementation, particularly in developing regions.

Compatibility and Standardization Issues

Compatibility challenges with diverse industrial equipment and varying PoE standards limit seamless adoption. Industrial facilities often operate a mix of devices from multiple vendors, leading to potential interoperability issues. PoE injectors must support different power classes and voltage requirements to ensure stable operation. Lack of uniform standards can result in inefficiencies, increased maintenance, and potential device failures, posing a significant hurdle for manufacturers and slowing market growth in highly heterogeneous industrial environments.

Regional Analysis

North America

North America leads the Industrial PoE Injector market with an estimated 36% market share, driven by widespread industrial automation and IIoT adoption. The U.S. and Canada are key contributors, investing in smart factories, predictive maintenance systems, and energy-efficient industrial networks. OEM partnerships and retrofitting of legacy equipment fuel demand for PoE injectors. Integration with edge computing and real-time monitoring enhances operational efficiency. North America’s mature industrial base, focus on reducing cabling complexity, and strong technological infrastructure make it the dominant regional market, supporting steady growth for both OEM and aftermarket segments.

Europe

Europe accounts for approximately 29% of the market, propelled by robust industrial automation, energy-efficiency mandates, and smart manufacturing adoption. Germany, France, and the U.K. are leading contributors, modernizing production lines and retrofitting legacy systems with PoE-enabled devices. Stringent standards and sustainability initiatives drive demand for reliable, high-performance injectors. The region benefits from mature industrial infrastructure, proactive government regulations, and increasing IIoT deployment, particularly in predictive maintenance and connected monitoring systems. Europe remains a strategic market for PoE injector manufacturers due to its combination of technological maturity, sustainability focus, and strong aftermarket potential.

Asia-Pacific

Asia-Pacific holds around 24% market share, fueled by rapid industrialization, smart factory deployment, and government-supported industrial modernization programs. China, Japan, and India are major contributors, focusing on retrofitting existing machinery with PoE-enabled solutions and expanding OEM adoption. Rising manufacturing investments, IIoT integration, and energy-efficient initiatives accelerate market growth. Cost-effective local production of PoE injectors and expanding automation projects create strong opportunities in both emerging and mature industrial sectors. The region’s large industrial base and increasing digitalization of factories position it as a key growth market globally.

Latin America

Latin America accounts for about 6% of the Industrial PoE Injector market, driven by industrial modernization, retrofitting of legacy systems, and rising adoption of connected industrial networks. Brazil and Mexico are primary contributors, deploying PoE injectors for automation, surveillance, and monitoring applications. While adoption is slower compared with North America and Europe, growing investments in manufacturing infrastructure and smart factory initiatives are creating new opportunities. Aftermarket growth is notable as industries upgrade existing systems without extensive rewiring. PoE injector manufacturers focusing on reliable, cost-effective solutions can capitalize on the region’s gradual industrial digitalization.

Middle East & Africa

The Middle East & Africa represents roughly 5% market share, supported by infrastructure expansion, industrial modernization, and adoption of energy-efficient connected systems. Key markets such as the UAE, Saudi Arabia, and South Africa are investing in smart factories, predictive maintenance, and industrial automation. PoE injectors are increasingly used for simplified cabling, network reliability, and integration with IIoT systems. While adoption is slower than in developed regions, government-led industrial initiatives and growing demand for modernized manufacturing facilities present significant growth opportunities for both OEM and aftermarket segments.

Market Segmentations:

By Sales Channel:

By Propulsion:

By Technology:

- Direct injection (DI)

- Common rail direct injection (CRDI)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Industrial PoE Injector market include Ypsomed, Amgen, Eli Lilly, Biogen Idec, SHL Medical AG, Mylan N.V., Owen Mumford, AbbVie, Inc., Teva Pharmaceutical, and Pfizer, Inc. The Industrial PoE Injector market is highly competitive, driven by continuous technological innovation, increasing adoption of smart manufacturing, and integration with IIoT systems. Companies focus on enhancing injector performance, energy efficiency, and reliability while developing solutions compatible with diverse industrial applications. Strategic initiatives such as R&D investment, partnerships, and expansion into emerging regions strengthen market positioning. Competition is further intensified by the growing aftermarket demand for retrofitting legacy systems and providing cost-effective, scalable PoE solutions. Manufacturers are also emphasizing standardization, interoperability, and advanced features to differentiate their offerings, driving overall market growth and accelerating the adoption of connected industrial networks globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ypsomed

- Amgen

- Eli Lilly

- Biogen Idec

- SHL Medical AG

- Mylan N.V.

- Owen Mumford

- AbbVie, Inc.

- Teva Pharmaceutical

- Pfizer, Inc.

Recent Developments

- In July 2025, Advantech launched a new series of one of the most powerful edge AI computing solutions which incorporates industrial PCs with Qualcomm-Snapdragon X Elite. These devices are best suited for PoE smart infrastructure systems due to their ultra-fast AI acceleration coupled with 5G and Wi-Fi 7.

- In July 2025, Broadcom announced the Tomahawk Ultra Ethernet switch processor, an open-standard chip designed for AI and high-performance computing (HPC) data centers. It provides 51.2 Tbps of throughput and ultra-low latency of 250 nanoseconds.

- In February 2025, FDA approved Onapgo (apomorphine hydrochloride) as the first wearable subcutaneous infusion device for treating motor fluctuations in advanced Parkinson disease, demonstrating significant reduction in daily OFF time and increased GOOD ON time in phase 3 trials.

- In July 2023, Bosch commenced production of its fuel cell power modules, advancing its position in hydrogen mobility. Alongside fuel cell powertrains, Bosch is also actively developing hydrogen internal combustion engines, focusing on both port and direct hydrogen injectors systems

Report Coverage

The research report offers an in-depth analysis based on Sales Channel, Propulsion, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily with increasing adoption of industrial automation.

- Integration of PoE injectors with IIoT and smart manufacturing systems will drive demand.

- Retrofitting of legacy industrial equipment with PoE solutions will expand aftermarket opportunities.

- Energy-efficient and sustainable PoE injector designs will gain preference among industries.

- Edge computing integration will create new applications and enhance operational efficiency.

- Growth in emerging regions will be supported by industrial modernization initiatives.

- Demand for high-performance, reliable injectors in predictive maintenance and real-time monitoring will rise.

- Standardization and interoperability of PoE injectors will facilitate broader adoption.

- Expansion of OEM collaborations and industrial partnerships will strengthen market presence.

- Technological innovations and cost-effective solutions will continue to shape competitive dynamics.