Market overview

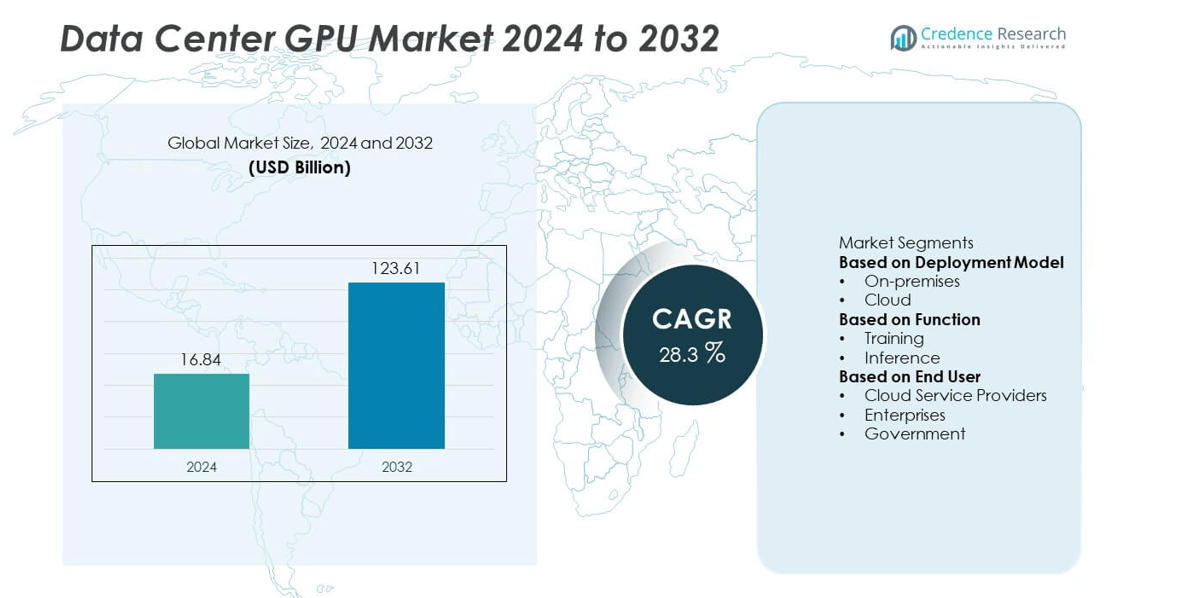

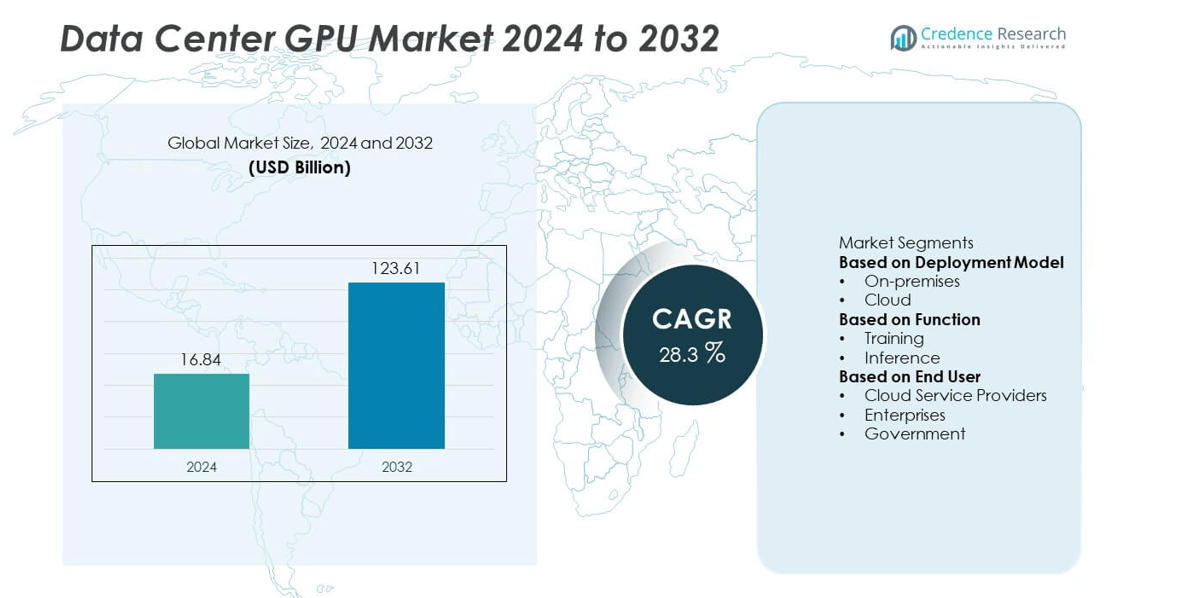

The Data Center GPU market was valued at USD 16.84 billion in 2024 and is projected to reach USD 123.61 billion by 2032, expanding at a CAGR of 28.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center GPU Market Size 2024 |

USD 16.84 billion |

| Data Center GPU Market, CAGR |

28.3% |

| Data Center GPU Market Size 2032 |

USD 123.61 billion |

The data center GPU market is led by major players such as NVIDIA Corporation, Intel Corporation, Huawei Technologies Co., Ltd., Qualcomm Technologies, Inc., IBM Corporation, Samsung Electronics Co., Ltd., Advantech Co., Ltd., Imagination Technologies, Google Inc., and Advanced Micro Devices, Inc. These companies drive innovation through advanced GPU architectures, AI-optimized processing, and strategic collaborations with hyperscale data centers. North America leads the global market with a 41% share, driven by high adoption of AI and cloud infrastructure. Europe follows with 28%, supported by strong enterprise digitization, while Asia-Pacific holds 23%, emerging as the fastest-growing region due to rapid expansion of AI-driven and hyperscale data center facilities.

Market Insights

- The data center GPU market was valued at USD 16.84 billion in 2024 and is projected to reach USD 123.61 billion by 2032, growing at a CAGR of 28.3%.

- Increasing adoption of AI, machine learning, and deep learning applications across enterprises and cloud platforms is driving strong market growth.

- The market trend highlights rapid deployment of GPU-accelerated servers, energy-efficient architectures, and AI-optimized hardware for high-performance computing.

- Key players such as NVIDIA Corporation, Intel Corporation, and Advanced Micro Devices, Inc. lead through innovation, partnerships, and advanced chip design strategies.

- North America dominates with a 41% share, followed by Europe at 28% and Asia-Pacific at 23%, while the cloud deployment segment holds a 63% share, leading due to scalability and flexibility in AI-driven workloads.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Model

The cloud segment dominated the data center GPU market in 2024 with a 63% share. The growth is driven by the rapid expansion of hyperscale cloud providers and increasing adoption of AI-as-a-Service and GPU-accelerated cloud computing. Cloud-based GPU infrastructure offers scalability, flexibility, and cost efficiency, making it ideal for AI workloads and data analytics. Rising demand from enterprises for on-demand GPU resources to manage fluctuating workloads further supports this segment’s leadership. On-premises deployment remains relevant for industries prioritizing data security and low-latency processing in private data centers.

- For instance, Amazon Web Services deployed EC2 P5 instances with NVIDIA H100 Tensor Core GPUs, enabling customers to perform model training workloads up to 6 times faster than prior A100-based clusters, and these P5 instances can scale up to 20,000 GPUs within an EC2 UltraCluster. This significantly improves throughput for large-scale generative AI applications.

By Function

The training segment held the largest share of 58% in 2024, leading the data center GPU market. GPUs are essential for training deep learning models, as they provide massive parallel processing power and faster computation. The rising adoption of large language models, computer vision, and generative AI applications drives this dominance. Companies are investing in high-performance GPUs to enhance model accuracy and reduce training time. The inference segment is growing steadily as edge computing and real-time AI analytics gain traction, demanding faster, power-efficient GPU architectures for deployment.

- For instance, Google offers access to NVIDIA H100 GPUs through its A3 supercomputer instances on Google Cloud. Google has also trained AI models with over a trillion parameters, such as the Switch Transformer model.

By End User

Cloud service providers accounted for the largest share of 52% in the data center GPU market in 2024. The growing need for AI-driven cloud platforms and virtualized GPU environments supports this dominance. Leading hyperscale providers are expanding GPU-equipped data centers to meet the rising demand for AI training and inference workloads. Enterprises are also adopting GPU clusters for analytics, digital twins, and cybersecurity applications. Government agencies increasingly deploy GPUs for defense simulations and data intelligence programs. The trend toward AI-powered infrastructure continues to strengthen cloud providers’ leadership globally.

Key Growth Drivers

Rising Adoption of Artificial Intelligence and Machine Learning

The growing use of artificial intelligence (AI) and machine learning (ML) across industries is a major driver of the data center GPU market. GPUs are essential for training complex neural networks and processing vast datasets efficiently. Enterprises and cloud providers are investing heavily in AI infrastructure to support applications in autonomous systems, healthcare, and financial analytics. The increasing deployment of large-scale AI models and generative AI platforms such as ChatGPT and DALL·E further amplifies the demand for high-performance GPU-powered data centers.

- For instance, OpenAI uses over 25,000 NVIDIA A100 Tensor Core GPUs within Microsoft’s Azure infrastructure to train and fine-tune its GPT-4 models, achieving processing speeds on a massive supercomputer built for generative AI workloads.

Expansion of Cloud and Hyperscale Data Centers

Rapid growth in cloud computing and hyperscale data centers is accelerating GPU adoption. Leading providers such as Amazon Web Services, Google Cloud, and Microsoft Azure are expanding GPU-enabled clusters to deliver AI-driven services and high-performance computing. GPUs offer scalability, cost efficiency, and flexibility for dynamic workloads, making them crucial for data-intensive cloud operations. The increasing migration of enterprises to hybrid and multi-cloud environments further strengthens GPU integration in large-scale computing infrastructure.

- For instance, Oracle Cloud Infrastructure incorporated up to 16,384 AMD Instinct MI300X accelerators into a single GPU SuperCluster system, which was designed to support demanding AI model training and large language model workloads.

Growing Demand for High-Performance Computing (HPC)

The rising need for high-performance computing across research, defense, and industrial applications is boosting data center GPU deployment. GPUs enable faster simulations, modeling, and data analytics for complex computational tasks. Sectors like climate modeling, genomics, and energy exploration increasingly rely on GPU-accelerated computing to reduce processing time and enhance accuracy. The development of next-generation GPU architectures optimized for parallel workloads supports higher efficiency. The growing integration of HPC systems with AI workloads further drives sustained demand for data center GPUs.

Key Trends & Opportunities

Integration of Generative AI and Large Language Models

The global surge in generative AI applications, including large language models and image synthesis platforms, is transforming the data center GPU landscape. These models require extensive computational power and parallel processing capabilities. GPU vendors are developing specialized AI chips optimized for such workloads. Cloud providers are scaling infrastructure to support advanced AI frameworks, creating new opportunities for GPU manufacturers. This trend is expected to continue as industries adopt generative AI for automation, content creation, and business intelligence.

- For instance, Meta Platforms deployed 6,080 NVIDIA A100 GPUs in its Research SuperCluster (RSC), with plans to scale to 16,000 GPUs to reach a peak performance of nearly 5 exaflops of mixed precision compute.

Emergence of Energy-Efficient and Custom GPU Architectures

Energy efficiency has become a key focus area in data center operations. Manufacturers are introducing GPUs designed with advanced cooling systems and power-optimized architectures to reduce energy consumption. The development of customized GPUs for specific workloads, such as inference or edge AI, is gaining momentum. These innovations support sustainable computing while improving total cost efficiency. The trend toward integrating AI accelerators and custom silicon alongside GPUs presents opportunities for hybrid and specialized data center designs.

- For instance, Intel’s Gaudi2 AI accelerator delivers up to 2.45 terabytes per second of memory bandwidth, enhancing large-scale AI training clusters deployed by Dell Technologies and Supermicro.

Key Challenges

High Infrastructure and Operational Costs

Setting up GPU-enabled data centers involves significant capital investment. High costs of GPUs, cooling systems, and power supply infrastructure increase total deployment expenses. Additionally, operational costs rise with energy consumption and maintenance requirements. Small and mid-sized enterprises often face financial barriers in adopting GPU-based infrastructure. To address this, cloud-based GPU services are emerging as a cost-effective alternative. However, balancing performance, scalability, and affordability remains a persistent challenge for widespread GPU adoption in data centers.

Thermal Management and Energy Efficiency Issues

GPUs generate substantial heat during high-performance computing tasks, creating challenges in thermal management. Inefficient cooling systems can lead to energy waste, performance degradation, and shorter hardware lifespans. As AI workloads grow in intensity, data centers face rising power density and environmental concerns. Managing these thermal loads while maintaining performance efficiency requires innovations in liquid cooling, immersion technology, and advanced airflow design. The ongoing need for energy-efficient operation remains one of the most critical challenges for GPU-powered data centers worldwide.

Regional Analysis

North America

North America held the largest share of 41% in the data center GPU market in 2024. The region’s dominance is driven by strong adoption of AI, machine learning, and cloud computing technologies. The U.S. leads due to major investments from tech giants such as NVIDIA, Google, and Amazon Web Services in GPU-based infrastructure. High demand for hyperscale data centers and advanced computing applications across sectors supports continuous growth. Canada also contributes through increasing data center expansion and government support for AI-driven research and digital transformation initiatives.

Europe

Europe accounted for 28% of the data center GPU market in 2024. Rising focus on data sovereignty, energy-efficient computing, and AI research is boosting regional demand. The U.K., Germany, and France are leading adopters due to large-scale cloud infrastructure investments and growing enterprise digitization. The European Union’s initiatives for AI and supercomputing innovation further support GPU deployment. Data center operators are increasingly adopting GPUs for high-performance computing and deep learning applications, while ongoing efforts to develop sustainable and carbon-neutral data centers strengthen market potential.

Asia-Pacific

Asia-Pacific captured a 23% share of the data center GPU market in 2024 and is the fastest-growing region. Rapid digitalization, cloud expansion, and government-backed AI programs in China, Japan, India, and South Korea drive regional growth. Chinese hyperscale providers such as Alibaba Cloud and Tencent Cloud are expanding GPU-powered data centers to support AI and analytics workloads. Growing investments in semiconductor manufacturing and 5G infrastructure enhance the ecosystem. The increasing adoption of AI in financial, healthcare, and manufacturing sectors further accelerates GPU demand across the region.

Latin America

Latin America held a 5% share of the data center GPU market in 2024. Growth is fueled by expanding cloud computing adoption and increasing data traffic from e-commerce and digital services. Brazil and Mexico lead the region, supported by growing hyperscale data center construction and AI-based enterprise applications. The demand for GPU acceleration in data analytics and cybersecurity strengthens regional uptake. However, limited local infrastructure and higher energy costs remain challenges. Strategic partnerships with global cloud providers are helping to bridge the technology and capability gap.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the data center GPU market in 2024. Rapid digital transformation, growing investment in smart cities, and AI-driven public initiatives are driving growth. The United Arab Emirates and Saudi Arabia are leading markets, focusing on national AI strategies and data localization policies. Africa is witnessing gradual adoption as countries develop their digital ecosystems. Investments in hyperscale facilities and government-backed technology hubs continue to expand regional capacity. However, energy limitations and high infrastructure costs still pose challenges to large-scale GPU deployment.

Market Segmentations:

By Deployment Model

By Function

By End User

- Cloud Service Providers

- Enterprises

- Government

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The data center GPU market is highly competitive, with major players including NVIDIA Corporation, Intel Corporation, Huawei Technologies Co., Ltd., Qualcomm Technologies, Inc., IBM Corporation, Samsung Electronics Co., Ltd., Advantech Co., Ltd., Imagination Technologies, Google Inc., and Advanced Micro Devices, Inc. These companies dominate through strong technological innovation, advanced GPU architectures, and strategic partnerships with cloud and data center operators. NVIDIA leads the market with its CUDA platform and AI-optimized GPUs, while AMD and Intel are expanding through high-performance, energy-efficient designs. Tech giants like Google and Huawei invest in in-house GPU development to enhance AI processing efficiency and reduce dependency on third-party hardware. The competitive landscape is shaped by continuous R&D, chip customization for AI workloads, and the growing integration of GPUs into hybrid and edge data centers. Collaboration between hardware providers and hyperscale cloud firms remains central to maintaining technological leadership in the rapidly evolving data center GPU market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NVIDIA Corporation

- Intel Corporation

- Huawei Technologies Co., Ltd.

- Qualcomm Technologies, Inc.

- IBM Corporation

- Samsung Electronics Co., Ltd.

- Advantech Co., Ltd.

- Imagination Technologies

- Google Inc.

- Advanced Micro Devices, Inc.

Recent Developments

- In September 2025, Huawei Technologies disclosed plans for a three-year initiative to overtake Nvidia in AI chips by improving connection and memory access speeds.

- In September 2025, Qualcomm Technologies began integrating NVLink Fusion and Nvidia GPU interconnects into its data center roadmap to support AI workloads.

- In 2025, Advantech Co., Ltd. expanded its server platforms to support dual-GPU modules, including those based on Nvidia and AMD architectures

- In 2025, NVIDIA Corporation unveiled the Blackwell Ultra GPU for data centers, built on its Blackwell architecture and designed for generative AI workloads

Report Coverage

The research report offers an in-depth analysis based on Deployment Model, Function, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for GPU-accelerated computing will rise with the expansion of AI and machine learning workloads.

- Cloud-based GPU services will continue to grow as enterprises shift toward scalable infrastructure.

- Advancements in GPU architectures will improve processing efficiency and reduce energy consumption.

- Integration of GPUs with CPUs and AI accelerators will enhance data center performance.

- Hyperscale data centers will remain the largest adopters of GPU-powered systems.

- Edge computing will drive demand for compact, high-performance GPU solutions.

- Custom AI chips and domain-specific GPUs will gain traction for specialized workloads.

- Sustainability initiatives will push the development of energy-efficient GPU cooling and power systems.

- Partnerships between chipmakers and cloud providers will strengthen global data center ecosystems.

- Asia-Pacific will experience rapid growth, driven by digital transformation and large-scale AI infrastructure investments.