Market Overview

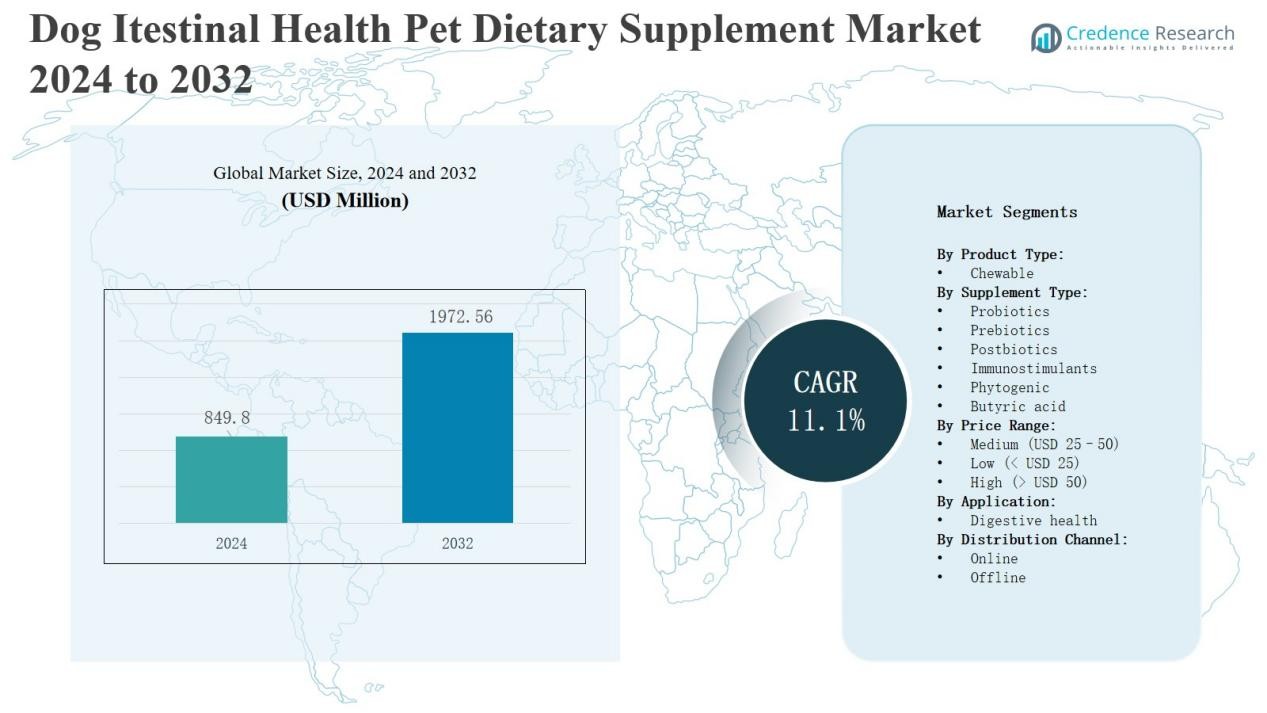

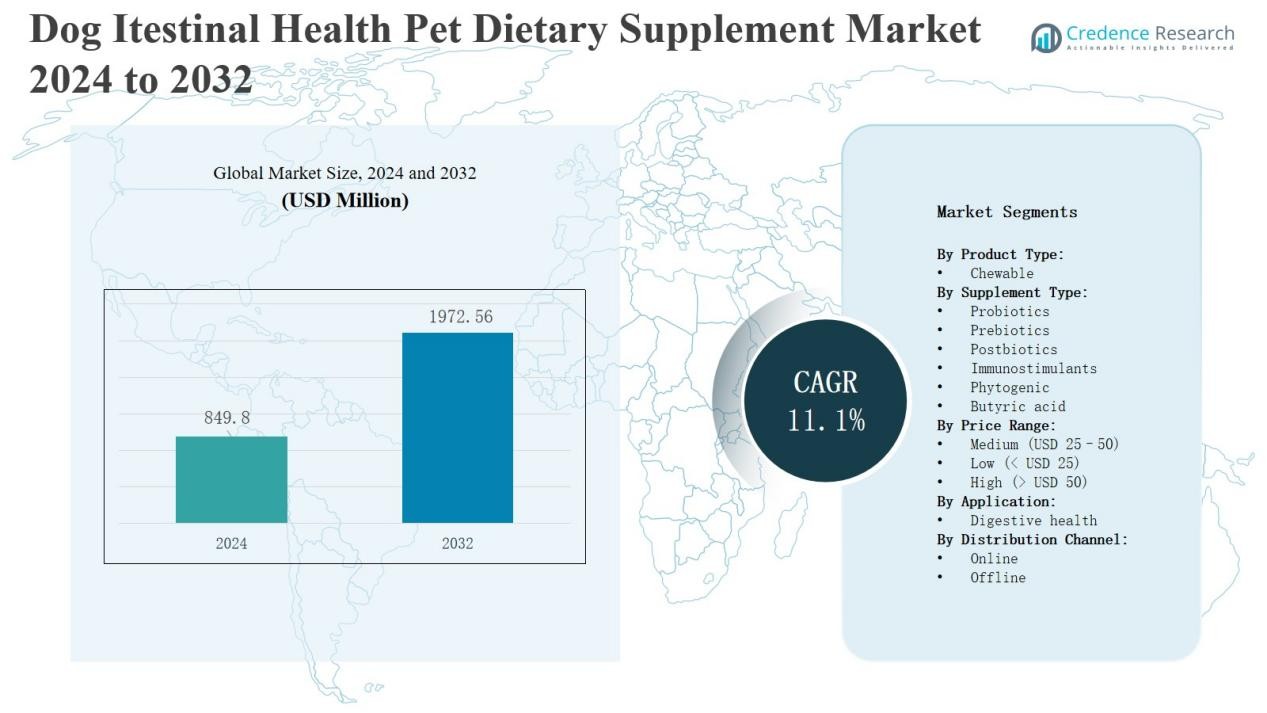

Dog Intestinal Health Pet Dietary Supplement Market size was valued at USD 849.8 million in 2024 and is anticipated to reach USD 1,972.56 million by 2032, at a CAGR of 11.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dog Intestinal Health Pet Dietary Supplement Market Size 2024 |

USD 849.8 Million |

| Dog Intestinal Health Pet Dietary Supplement Market, CAGR |

11.1% |

| Dog Intestinal Health Pet Dietary Supplement Market Size 2032 |

USD 1,972.56 Million |

The dog intestinal health pet dietary supplement market is driven by strong competition among key players such as Mars Petcare Inc., Hill’s Pet Nutrition, Inc., Boehringer Ingelheim Vetmedica, Inc., Elanco, Nestlé, BASF SE, K9 Natural Ltd., Ark Naturals Inc., Dr. Harvey’s LLC, and Nutritional Veterinary Care, Inc. These companies focus on research-based formulations featuring probiotics, prebiotics, and natural ingredients to enhance canine digestive health and immunity. Strategic initiatives, including product innovation, veterinary collaborations, and digital marketing, strengthen their global reach and brand visibility. North America leads the market with a 38% share in 2024, supported by high pet ownership, strong veterinary infrastructure, and growing awareness of microbiome-based nutrition among dog owners.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dog Intestinal Health Pet Dietary Supplement Market was valued at USD 849.8 million in 2024 and is projected to reach USD 1,972.56 million by 2032, growing at a CAGR of 11.1%.

- The chewable segment held the largest share of 72% in 2024, supported by ease of use, flavor appeal, and high absorption that improve compliance among dogs.

- The probiotics segment led the market with a 41% share in 2024, driven by rising awareness of gut microbiome health and increased veterinary recommendations.

- The medium price range category (USD 25–50) accounted for 54% of total sales in 2024, appealing to consumers seeking affordable yet high-quality supplement options.

- North America dominated with a 38% share in 2024, benefiting from strong pet ownership, advanced veterinary infrastructure, and growing awareness of canine digestive wellness.

Market Segment Insights

By Product Type

The chewable segment dominates the dog intestinal health pet dietary supplement market, holding a 72% share in 2024. Its dominance is due to high palatability, ease of administration, and better absorption. Pet owners prefer chewable forms for their convenience and flavor variety, which enhances compliance among dogs. Manufacturers focus on soft-chew formulations enriched with probiotics and vitamins to support gut health, improving digestive balance and overall pet wellness.

- For instance, Purina launched its Pro Plan Veterinary Supplements Calming Care Chews, featuring a proprietary strain of Bifidobacterium longum BL999 aimed at improving gut microbiome stability and digestive comfort in dogs.

By Supplement Type

The probiotics segment leads the market with a 41% share, driven by growing awareness of gut microbiome health in dogs. Probiotic supplements aid digestion, enhance immunity, and reduce gastrointestinal issues like bloating and diarrhea. Increasing recommendations by veterinarians and rising premium pet care spending strengthen demand. Innovations in multi-strain formulations and long shelf-life products further boost the segment’s growth across online and offline retail platforms.

- For instance, Zesty Paws launched its Probiotic Bites Advanced formula, featuring six probiotic strains designed to support gut function and nutrient absorption.

By Price Range

The medium price range segment (USD 25–50) accounts for 54% of the market share in 2024. This range offers a balance between product quality and affordability, appealing to most pet owners. Products in this range often feature scientifically tested ingredients and trusted brands. Expanding e-commerce channels and the preference for premium yet cost-effective supplements drive steady sales growth in this category across North America and Europe.

Key Growth Drivers

Rising Awareness of Canine Gut Health

Growing awareness of the link between gut health and overall well-being drives market demand. Pet owners increasingly recognize digestive balance as essential for nutrient absorption, immune strength, and mood regulation. Social media, veterinary campaigns, and premium pet food brands promote probiotic and prebiotic benefits. This rising awareness encourages regular supplement use, fueling consistent sales growth for chewable and powder-based products designed to improve intestinal microbiota and digestive comfort in dogs.

- For instance, Nestlé Purina introduced its Pro Plan Veterinary Supplements FortiFlora SA Synbiotic Action in the U.S., formulated with probiotics and prebiotics to support canine digestive and immune health.

Expanding Pet Humanization and Premiumization Trends

The ongoing humanization of pets encourages owners to treat dogs like family members, increasing spending on preventive healthcare. Owners are prioritizing specialized nutritional supplements for gut health similar to human wellness routines. Premiumization trends further boost demand for scientifically backed formulations containing natural and organic ingredients. This behavioral shift fosters strong market growth, especially in developed markets such as North America and Western Europe, where disposable incomes and pet care awareness remain high.

- For instance, Chewy has embraced pet humanization by referring to pet owners as “parents,” implementing personalized customer engagements like sending painted pet portraits and condolence cards, which underscore the emotional connection driving premium pet product sales.

Veterinary Endorsements and E-Commerce Expansion

Veterinary professionals play a crucial role in recommending intestinal health supplements. Their endorsement enhances consumer trust and product credibility. Simultaneously, the rise of e-commerce platforms offers wider product access and personalized subscription models. Online retail allows brands to target specific digestive concerns through digital marketing and data analytics. The combined impact of expert recommendations and digital convenience strengthens market expansion and encourages frequent repurchases among pet owners worldwide.

Key Trends & Opportunities

Innovation in Microbiome-Based Formulations

Manufacturers are investing in microbiome research to develop advanced formulations combining probiotics, prebiotics, and postbiotics. These blends offer comprehensive digestive support by restoring gut flora balance and improving immunity. Brands are introducing strain-specific products targeting different digestive issues, such as diarrhea or food intolerance. This innovation presents significant opportunities for differentiation, especially as consumers seek clinically proven, science-based supplements tailored to canine digestive health and long-term wellness.

- For instance, Probiotics International Limited introduced a prebiotic formula designed to selectively nourish beneficial gut bacteria, enhancing microbial diversity and digestive wellness in dogs.

Growing Demand for Natural and Functional Ingredients

Pet owners increasingly prefer supplements made from clean-label and plant-based ingredients. Phytogenic additives, butyric acid, and herbal extracts are gaining traction for their anti-inflammatory and gut-protective effects. The shift toward natural formulations aligns with sustainability goals and transparency expectations. Brands focusing on organic sourcing and minimal additives are well-positioned to attract health-conscious consumers seeking safer, eco-friendly intestinal health supplements for their pets.

- For instance, Vitalus offers VitaGOS, a patented natural prebiotic derived from dairy that supports gut health while maintaining palatability across various product formulations.

Key Challenges

High Product Cost and Limited Affordability

Premium dog intestinal health supplements often carry high production costs due to specialized ingredients and quality assurance standards. This makes them less accessible to cost-sensitive consumers, particularly in developing regions. The price gap between low-cost and high-end supplements restricts wider adoption. Manufacturers must balance affordability and efficacy to expand their customer base while maintaining profitability in competitive markets.

Lack of Standardization and Quality Regulation

The absence of uniform global standards for pet dietary supplements poses quality and efficacy challenges. Variations in ingredient labeling, dosage accuracy, and microbial safety reduce consumer confidence. Some unregulated products make unverified claims, leading to skepticism among pet owners. Strengthening industry guidelines and ensuring veterinary validation are essential to build trust and maintain consistent market growth in the intestinal health supplement segment.

Limited Veterinary Awareness in Emerging Markets

In developing countries, many veterinarians lack training or awareness of advanced canine nutritional therapies. This limits professional recommendations and reduces market penetration. Without veterinary guidance, pet owners often rely on unverified online information or generic supplements, which may not address specific gut issues. Expanding educational programs and collaborations with veterinary associations are key to overcoming this awareness gap and driving product adoption.

Regional Analysis

North America

North America dominates the dog intestinal health pet dietary supplement market with a 38% share in 2024. The region’s growth is supported by high pet ownership, premiumization trends, and strong veterinary infrastructure. Consumers are well-informed about digestive wellness, driving demand for probiotic and prebiotic supplements. The United States leads due to a mature pet healthcare industry and presence of leading brands focusing on functional formulations. Expanding online retail networks further enhance accessibility. It continues to benefit from rising awareness of microbiome health in companion animals.

Europe

Europe holds a 27% share of the market, driven by widespread adoption of premium pet care products and regulatory emphasis on animal nutrition quality. Countries such as Germany, France, and the United Kingdom promote probiotic supplements for digestive and immune support. Growing humanization of pets and sustainable ingredient sourcing drive market expansion. It also benefits from innovation in postbiotic and phytogenic formulations. Rising consumer preference for clean-label supplements ensures strong regional performance and steady long-term demand.

Asia Pacific

Asia Pacific accounts for 22% of the market share, supported by rapid pet population growth and urbanization. Countries such as China, Japan, and India show increasing adoption of gut health supplements due to rising disposable incomes and improved veterinary awareness. Domestic brands are expanding product portfolios, offering affordable and natural formulations to attract middle-income consumers. It benefits from the growing e-commerce ecosystem and online education on pet wellness. Rising pet expenditure trends indicate strong future market potential across the region.

Latin America

Latin America captures a 7% share, with Brazil and Mexico leading market growth. Rising pet adoption and increasing attention to preventive healthcare drive supplement consumption. Veterinary recommendations and social media influence are encouraging awareness of digestive health products. It is witnessing a gradual transition toward premium and functional formulations. Expanding retail distribution and entry of international brands further enhance market visibility and accessibility in key urban areas.

Middle East & Africa

The Middle East & Africa region holds a 6% share, supported by rising pet ownership and growing awareness of digestive health. Countries such as the United Arab Emirates and South Africa are emerging as key growth markets. The market is still developing, with limited product availability and price-sensitive consumers. International manufacturers are introducing targeted probiotic and prebiotic products through online platforms. It shows gradual improvement driven by expanding veterinary services and growing interest in pet nutrition.

Market Segmentations:

By Product Type:

By Supplement Type:

- Probiotics

- Prebiotics

- Postbiotics

- Immunostimulants

- Phytogenic

- Butyric acid

By Price Range:

- Medium (USD 25–50)

- Low (< USD 25)

- High (> USD 50)

By Application:

By Distribution Channel:

By Region:

-

- Brazil

- Chile

- Rest of Latin America

-

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

-

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- South Asia and Pacific

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- Middle East & Africa

-

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

Competitive Landscape

The competitive landscape of the dog intestinal health pet dietary supplement market is characterized by strong product innovation, brand differentiation, and expanding distribution channels. Leading companies such as Mars Petcare Inc., Hill’s Pet Nutrition, Inc., Boehringer Ingelheim Vetmedica, Inc., Elanco, and Nestlé focus on research-driven formulations to enhance digestive health and immunity. These players invest in probiotics, prebiotics, and natural ingredient blends to meet rising consumer demand for scientifically validated products. Emerging brands like Ark Naturals Inc., K9 Natural Ltd., and Dr. Harvey’s LLC emphasize clean-label and holistic nutrition approaches, appealing to health-conscious pet owners. BASF SE supports industry growth by supplying essential raw materials and functional additives. Strategic partnerships with veterinary clinics and e-commerce expansion strengthen brand reach and customer engagement. It remains a highly competitive market driven by continuous innovation, premiumization, and the growing focus on gut microbiome wellness in companion animals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- K9 Natural Ltd.

- BASF SE

- Nutritional Veterinary Care, Inc.

- Ark Naturals Inc

- Boehringer Ingelheim Vetmedica, Inc.

- Hill’s Pet Nutrition, Inc.

- Harvey’s LLC

- Mars Petcare Inc.

- Elanco

- Nestle

Recent Developments

- In August 2025, Native Pet launched Gutwell™, a new gut-microbiome supplement line designed to improve canine digestive balance.

- In January 2025, Pooch & Mutt acquired BIOME9, a gut-health testing and supplement company, expanding its presence in the functional pet nutrition sector.

- In April 2025, Grizzly Pet Products introduced a liquid gut health supplement formulated with EpiCor® postbiotic to enhance immunity and digestive wellness in dogs.

- In July 2024, Vetnique Labs acquired Lintbells, a supplement manufacturer known for its digestive and wellness products for pets.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Supplement Type, Price Range, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising awareness of gut health among pet owners.

- Demand for natural and probiotic-based supplements will continue to expand.

- Companies will focus on developing breed-specific and age-specific formulations.

- Online retail channels will play a key role in future sales growth.

- Veterinary recommendations will increasingly influence consumer purchase choices.

- Partnerships between supplement brands and pet clinics will strengthen market presence.

- Research on prebiotics and postbiotics will drive new product innovations.

- Premium product lines emphasizing organic ingredients will gain popularity.

- Expansion in emerging markets will provide new revenue opportunities for manufacturers.

- Technological integration in packaging and dosage tracking will enhance product reliability.