Market Overview

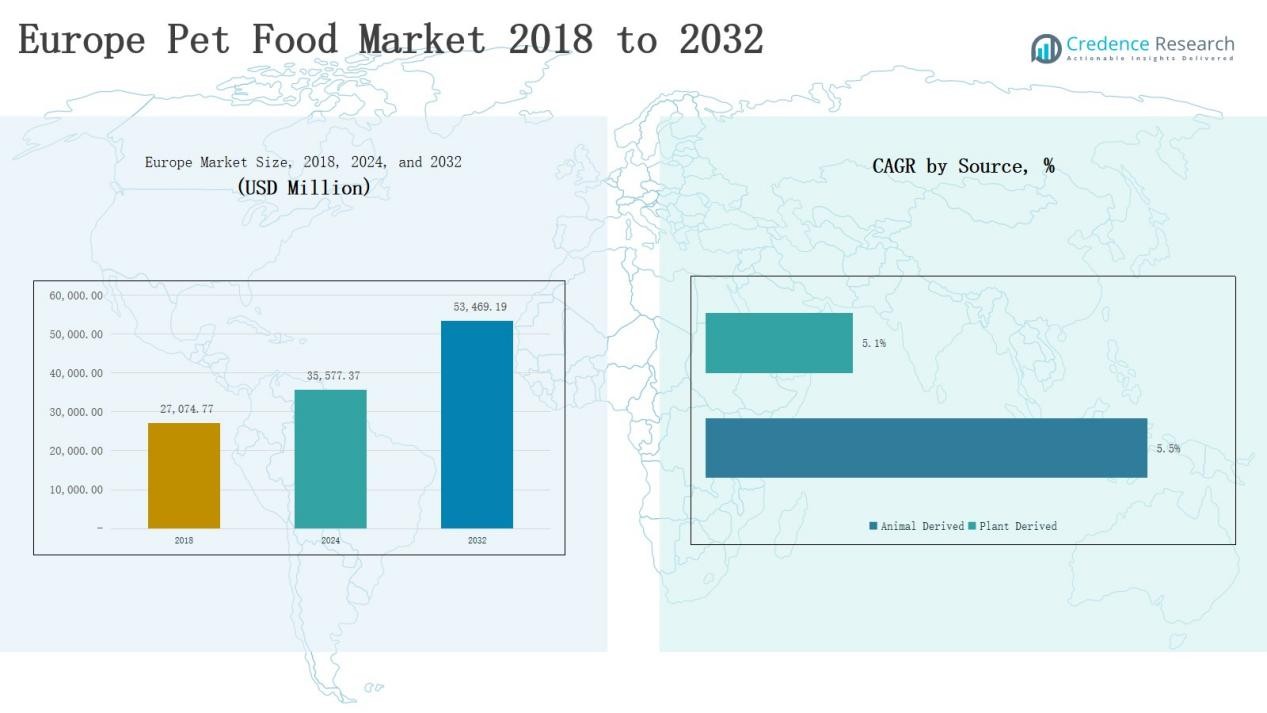

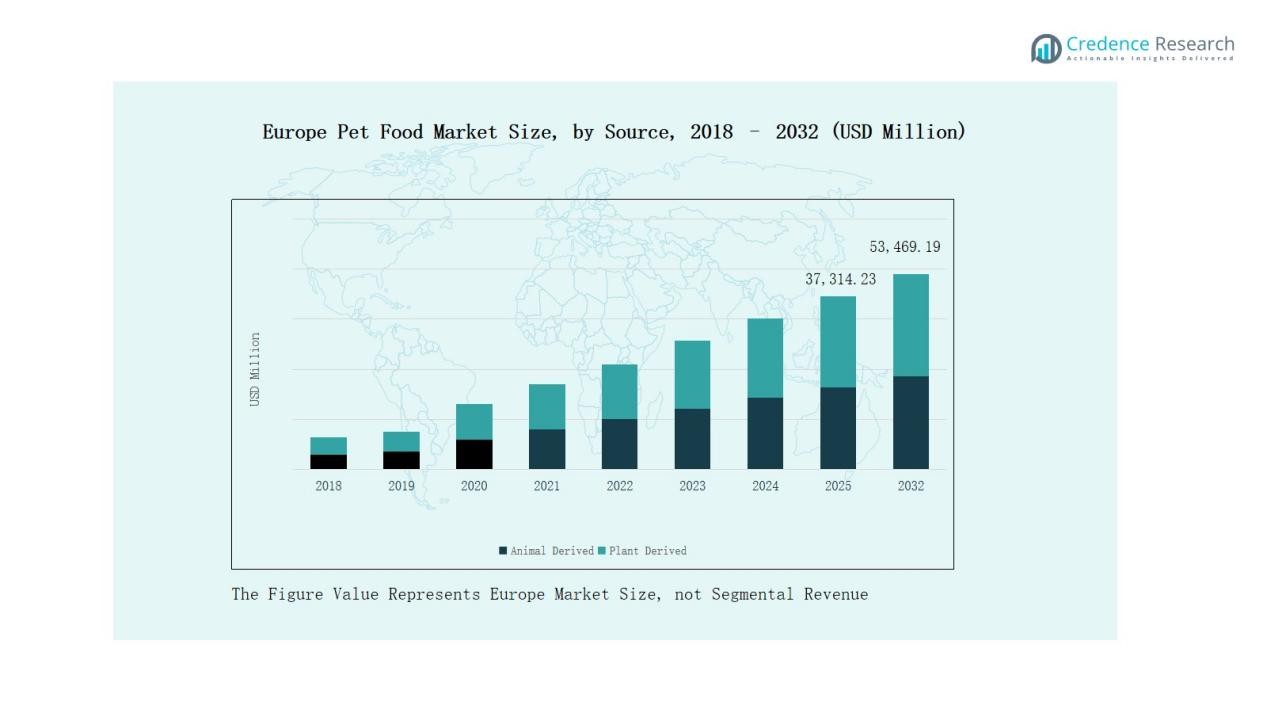

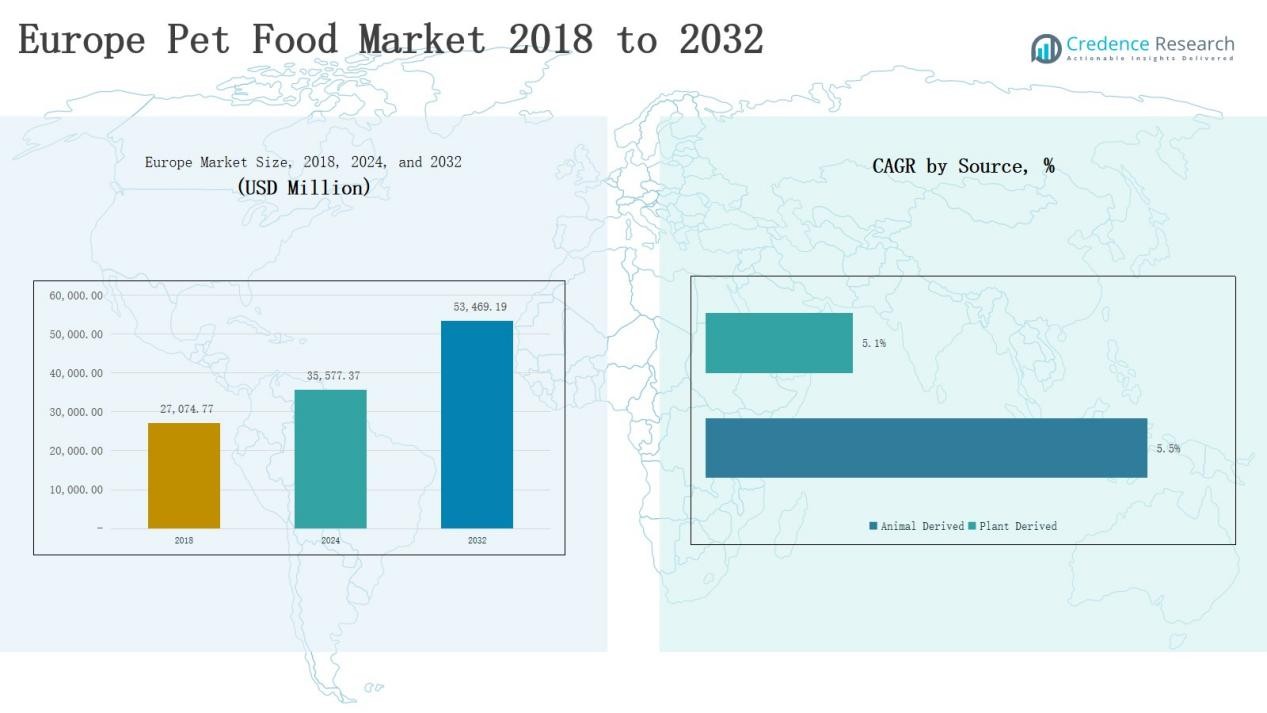

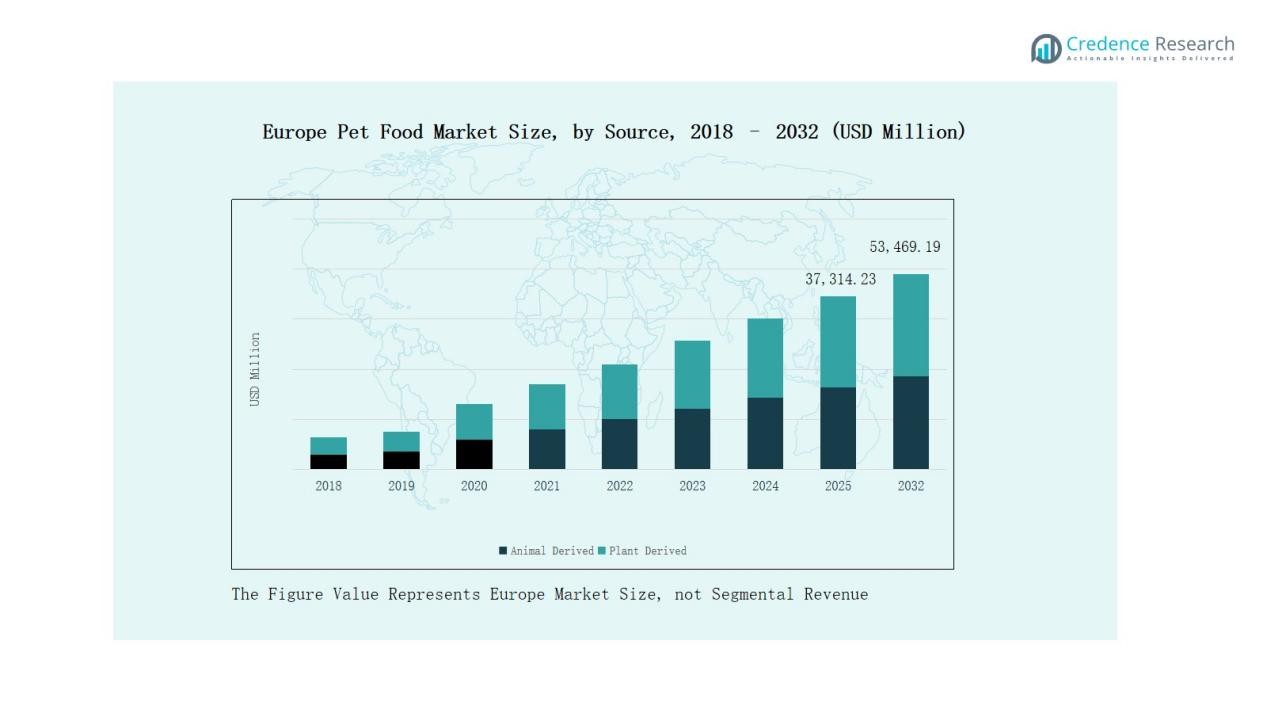

Europe Pet Food Market size was valued at USD 27,074.77 million in 2018, increased to USD 35,577.37 million in 2024, and is anticipated to reach USD 53,469.19 million by 2032, growing at a CAGR of 5.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Pet Food Market Size 2024 |

USD 35,577.37 Million |

| Europe Pet Food Market, CAGR |

5.18% |

| Europe Pet Food Market Size 2032 |

USD 53,469.19 Million |

The Europe Pet Food Market is led by major players including Mars, Incorporated, Nestlé Purina Pet Care, Hill’s Pet Nutrition, General Mills, Inc., and Affinity Petcare, which dominate through strong brand portfolios, advanced nutrition research, and wide distribution networks. Regional manufacturers such as Farmina Pet Foods, United Petfood, and Monge & C. S.p.A. enhance competition with localized production and affordable premium offerings. These companies focus on sustainability, clean-label ingredients, and functional nutrition to meet evolving consumer demands. Among regions, Germany emerged as the leading market in 2024, capturing a 22% share, supported by high pet ownership, premiumization trends, and established retail infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Pet Food Market grew from USD 27,074.77 million in 2018 to USD 35,577.37 million in 2024 and is expected to reach USD 53,469.19 million by 2032, growing at a CAGR of 5.18%.

- Major companies such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, General Mills, Inc., and Affinity Petcare lead the market through innovation, quality, and strong distribution networks.

- Dry pet food dominated with a 58% share in 2024, driven by convenience, longer shelf life, affordability, and growing preference for high-protein and fortified formulations.

- The animal-derived segment held a 67% share due to high consumer trust in meat-based nutrition, emphasizing traceable ingredients and sustainable sourcing practices.

- Germany led the regional market with a 22% share in 2024, supported by high pet ownership, premiumization trends, and advanced retail infrastructure promoting sustainable and health-focused pet food products.

Market Segment Insights

By Food Type

Dry pet food dominated the Europe Pet Food Market in 2024 with a 58% share, driven by its longer shelf life, convenience, and cost-effectiveness. Consumers prefer dry formulations for easy storage and balanced nutrition across pet categories. Its strong adoption among dog owners and availability in bulk packaging support steady sales. Rising innovation in texture, protein content, and flavor further enhances demand, while premium dry blends with added vitamins and probiotics attract health-conscious pet owners.

- For instance, Hill’s Pet Nutrition launched Science Plan Perfect Digestion Dry Cat Food in European markets, featuring an ActivBiome+ formula to enhance gut microbiome balance and nutrient absorption.

By Source

The animal-derived segment held a 67% share in the Europe Pet Food Market in 2024, driven by high consumer trust in meat-based nutrition. Proteins and fats from poultry, fish, and beef support superior palatability and digestive health in pets. Manufacturers emphasize traceable, ethically sourced ingredients to meet sustainability goals. The rising popularity of grain-free and high-protein formulations reinforces the segment’s dominance, especially among dog and cat food products across premium and functional categories.

- For instance, VAFO Group expanded its Brit Care Sustainable Dog Food portfolio in 2024, using animal proteins from certified farms and fish from responsible aquaculture to meet the EU’s evolving sustainability standards.

By Pet Type

The dog segment led the Europe Pet Food Market in 2024 with a 61% share, supported by the region’s large dog ownership base and premiumization trends. Owners increasingly prioritize specialized diets that promote joint, dental, and skin health. The rise of customized and age-specific formulations enhances market penetration. Growing awareness of nutritional needs and expanding online retail options further boost dog food consumption, especially in Western European markets such as Germany and the U.K.

Key Growth Drivers

Rising Pet Humanization and Premiumization

The growing emotional bond between owners and pets drives demand for premium, nutritionally rich food products. Consumers in Europe treat pets as family members, increasing spending on high-quality, organic, and customized diets. Premium brands emphasizing clean labels, grain-free recipes, and human-grade ingredients are gaining traction. This shift supports long-term market expansion across both dry and wet pet food categories, especially in countries like Germany, the U.K., and France, where premiumization trends are strongest.

- For instance, one leading German pet food company, Josera, has been producing high-quality, digestible formulations since 1952 and offers hypoallergenic, grain-free options that emphasize natural ingredients.

Expansion of E-Commerce and Omnichannel Retail

Digital platforms have reshaped purchasing behavior, allowing pet owners to access diverse brands conveniently. The rise of e-commerce giants and subscription-based delivery models improves product accessibility and customer retention. Manufacturers invest in omnichannel strategies combining physical retail with online presence to enhance visibility. Personalized marketing, data analytics, and targeted offers are driving repeat purchases, particularly for premium and functional food lines. This evolution continues to strengthen revenue streams across Europe’s developed markets.

- For instance, Shopify Plus supports pet food subscription models that allow automated deliveries tailored to pet consumption patterns, promoting repeat purchases.

Growing Focus on Pet Health and Functional Nutrition

Rising awareness of pet health conditions such as obesity, allergies, and joint disorders encourages adoption of functional food formulations. Products fortified with probiotics, omega-3 fatty acids, and antioxidants support improved digestion and immunity. Veterinary recommendations further boost purchases of specialized therapeutic diets. Manufacturers introduce life-stage and breed-specific variants to meet diverse needs. This trend aligns with Europe’s increasing emphasis on preventive care, driving innovation and brand differentiation within the region’s evolving pet food industry.

Key Trends & Opportunities

Sustainable and Ethical Ingredient Sourcing

Sustainability has become a major competitive factor in the Europe Pet Food Market. Manufacturers are shifting toward ethically sourced proteins, plant-based alternatives, and recyclable packaging. Consumers prefer eco-certified brands that reduce environmental impact while maintaining nutritional quality. The adoption of insect-based proteins and locally sourced ingredients is expanding, appealing to environmentally conscious buyers. This transition creates strong opportunities for companies focusing on transparency, circular economy practices, and sustainable production technologies.

- For instance, THE PACK, a UK plant-based pet food brand, which expanded its presence in June 2024 through a listing with Planet Organic and an equity crowdfunding campaign to support growth focused on plant-based ingredients and eco-friendly production.

Innovation in Product Formats and Customization

Technological advancements enable brands to develop tailored nutrition through smart feeding systems and DNA-based diet recommendations. Pet owners seek personalized formulations that cater to allergies, age, and activity levels. The growing popularity of freeze-dried, raw, and functional treats provides room for niche innovation. Startups and established brands alike are capitalizing on data-driven insights to introduce customized subscription products. This innovation-driven landscape enhances consumer engagement and supports higher margins in the premium segment.

- For instancce, Nestlé Purina expanded its Just Right customized dog food line in the U.S. market, integrating an AI-driven evaluation tool that analyzes breed, size, and activity data to craft individualized meal plans.

Key Challenges

High Raw Material and Production Costs

Fluctuating prices of meat, grains, and plant-based ingredients strain profit margins for manufacturers. Energy costs and supply chain disruptions across Europe increase overall production expenses. Smaller companies face challenges maintaining competitive pricing while ensuring product quality. The pressure to source sustainable materials further raises costs, especially under tightening EU environmental regulations. These economic pressures may lead to higher consumer prices, affecting affordability and slowing demand in price-sensitive markets.

Strict Regulatory Standards and Compliance Costs

Europe’s complex regulatory environment requires rigorous testing, labeling, and traceability, raising compliance costs for producers. Regulations on ingredient sourcing, additives, and sustainability certifications demand ongoing investment in quality assurance systems. Meeting these standards delays product launches and limits flexibility for smaller manufacturers. Frequent updates to EU feed safety rules and packaging directives add operational burdens. Maintaining consistent compliance across multiple markets remains a significant barrier to rapid expansion and innovation.

Rising Competition and Market Saturation

The Europe Pet Food Market faces growing competition among multinational corporations, regional producers, and private-label brands. Intense price competition, coupled with similar product offerings, challenges differentiation. Established players dominate shelf space and online visibility, limiting opportunities for new entrants. As market saturation increases in developed economies, maintaining growth requires heavy investment in marketing and product innovation. Companies must continuously adapt strategies to retain brand loyalty and sustain profit margins.

Regional Analysis

Germany

Germany led the Europe Pet Food Market in 2024 with a 22% share, supported by a strong pet ownership base and growing preference for premium and organic products. The country’s advanced retail infrastructure and high disposable incomes drive consistent sales of dry and wet pet food. Consumers prioritize natural, grain-free, and sustainable formulations. Domestic manufacturers and private labels maintain competitive pricing, while global brands expand distribution networks. The rising focus on pet health and personalized nutrition continues to strengthen Germany’s market dominance.

United Kingdom

The United Kingdom captured a 19% share in 2024, driven by increasing pet adoption and the trend toward premiumization. It benefits from a mature e-commerce ecosystem that supports online pet food subscriptions and direct-to-consumer sales. Pet owners favor high-quality formulations with clean labels and transparency in ingredient sourcing. Demand for functional and therapeutic diets is expanding among both dog and cat owners. Strong presence of multinational brands and innovative local startups sustains the market’s steady growth momentum.

France

France accounted for a 15% share in 2024, supported by its strong culture of pet companionship and growing interest in natural and organic food. The market shows balanced demand across wet and dry food segments. Consumers prefer locally sourced, meat-rich, and preservative-free formulations. French manufacturers invest in eco-friendly packaging and sustainable ingredient sourcing to align with national environmental goals. Expansion of supermarket chains and online platforms continues to enhance product reach and availability across the country.

Italy

Italy represented a 13% share of the Europe Pet Food Market in 2024, supported by growing awareness of pet health and nutrition. Pet owners prefer premium and functional diets, especially for small dog breeds and indoor cats. Local producers strengthen the market with diversified product portfolios and Mediterranean ingredient blends. Increasing urbanization and lifestyle changes encourage greater spending on convenience-driven pet products. Online retail and pet specialty stores play a vital role in expanding market accessibility nationwide.

Spain

Spain held an 11% share in 2024, with rising pet ownership and expanding urban pet culture driving demand. The country experiences growing adoption of dry and mixed diets due to affordability and longer shelf life. Consumers show strong interest in value-based premium brands with natural ingredients. Domestic producers are enhancing export capabilities and product innovation. Expanding retail distribution and awareness of pet well-being continue to support steady market growth across major Spanish cities.

Russia

Russia accounted for a 10% share in 2024, supported by high pet population and strong demand for cost-effective products. Local manufacturers dominate the economy segment, while premium imported brands appeal to urban consumers. Currency fluctuations and trade restrictions influence product pricing and availability. Despite economic challenges, pet food sales remain resilient due to essential demand. Evolving consumer preferences toward balanced nutrition and quality assurance sustain gradual expansion of Russia’s pet food market.

Rest of Europe

The Rest of Europe contributed a 10% share to the regional market in 2024, driven by growing pet ownership across Nordic, Eastern, and Central European countries. Rising disposable income and improved access to branded pet products support ongoing development. E-commerce and cross-border trade expand product reach to smaller markets. Consumers increasingly choose nutritionally balanced and environmentally responsible options. The segment continues to show growth potential due to emerging pet care awareness and modernization of retail channels.

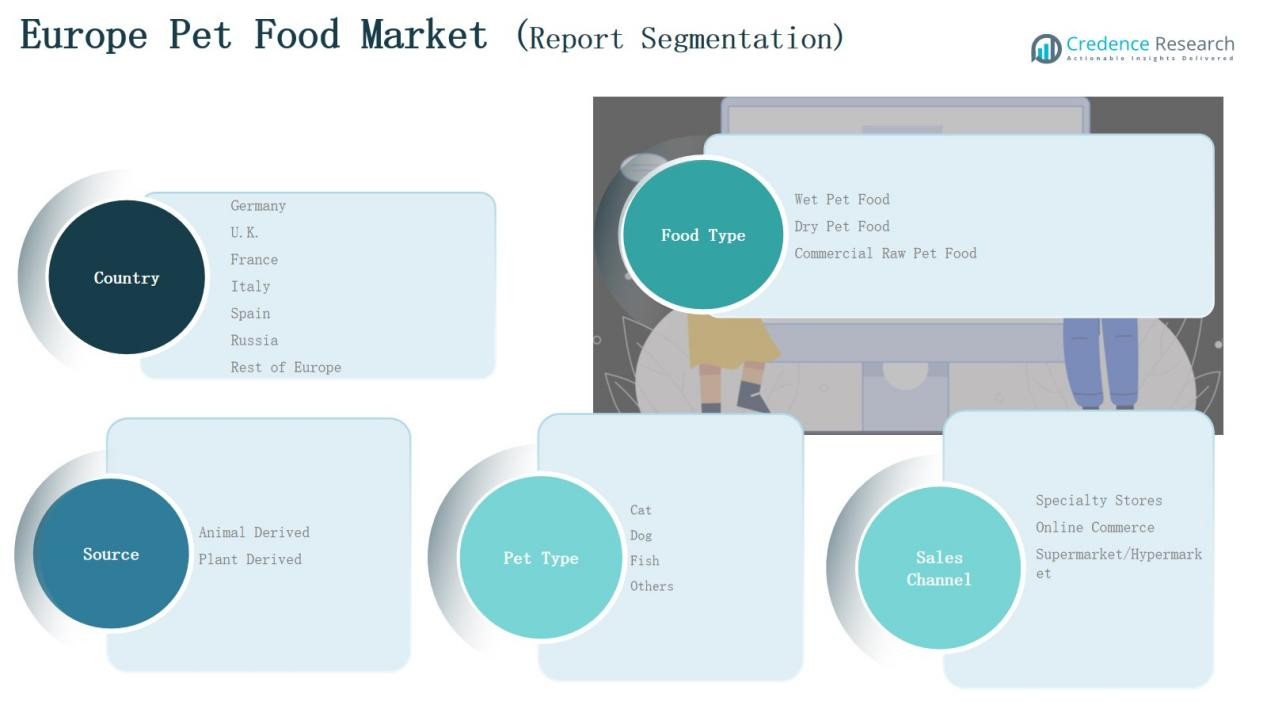

Market Segmentations:

By Food Type

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source

- Animal Derived

- Plant Derived

By Pet Type

By Sales Channel

- Specialty Stores

- Online Commerce

- Supermarket/Hypermarket

By Country

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Pet Food Market features a highly competitive landscape dominated by global and regional players focusing on innovation, product quality, and sustainability. Leading companies such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, and General Mills, Inc. maintain strong market positions through extensive product portfolios and advanced research in pet nutrition. Regional manufacturers like Affinity Petcare, Farmina Pet Foods, and United Petfood strengthen the competition with locally sourced, cost-effective offerings tailored to European consumer preferences. Companies emphasize clean-label ingredients, functional formulations, and recyclable packaging to meet rising sustainability standards. Strategic investments in digital marketing, e-commerce channels, and customized nutrition solutions enhance brand visibility and customer loyalty. Continuous product innovation, mergers, and partnerships define market dynamics, as firms expand their geographic presence and adapt to shifting pet ownership trends. This strong competitive environment ensures sustained innovation and steady growth across both premium and value-based segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Affinity Petcare

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- General Mills, Inc.

- M. Smucker Co.

- United Petfood

- Farmina Pet Foods

- Elmira Pet Products

- Monge & C. S.p.A.

- Gatchinsky KKZ

- Others

Recent Developments

- In September 2025, Virbac launched Vikaly, the first medicated cat food combining renal kibble and veterinary drug.

- In July 2025, WH Group acquired Pupil Foods (Poland), expanding its European pet food footprint.

- In April 2025, The Nutriment Company also acquired Bulmer Pet Foods in the UK to broaden its natural raw pet food offerings.

- In 2024, General Mills acquired Belgian premium pet-food brand Edgard & Cooper to strengthen its European presence.

Report Coverage

The research report offers an in-depth analysis based on Food Type, Source, Pet Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium, natural, and organic pet food products will continue to rise.

- E-commerce and subscription-based models will expand their share in pet food sales.

- Sustainability will drive packaging innovation and ethical ingredient sourcing.

- Functional and therapeutic formulations will gain popularity among health-conscious pet owners.

- Plant-based and alternative protein pet foods will attract growing consumer interest.

- Customized nutrition solutions based on breed, age, and lifestyle will increase adoption.

- Private-label brands will strengthen their presence through affordable, high-quality offerings.

- Digital marketing and direct-to-consumer channels will enhance brand loyalty.

- Regional manufacturers will expand exports through partnerships and localized production.

- Investments in research and pet health innovation will shape long-term market competitiveness.