Market Overview

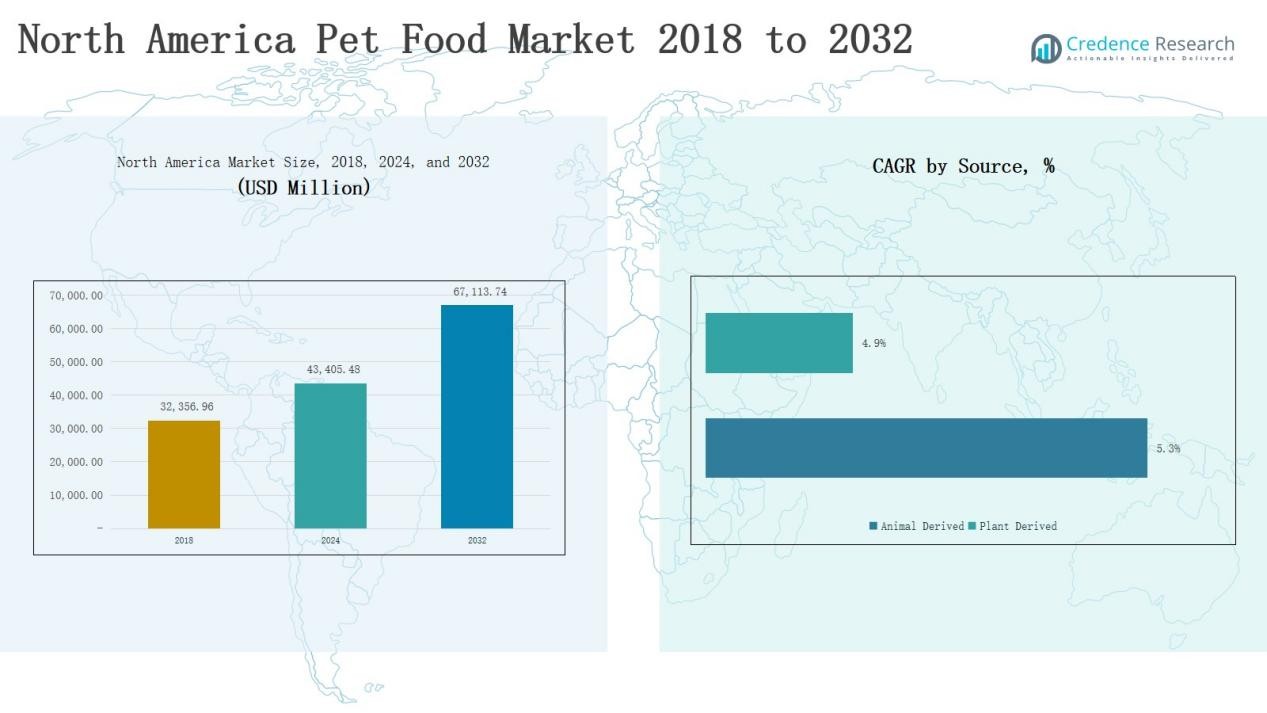

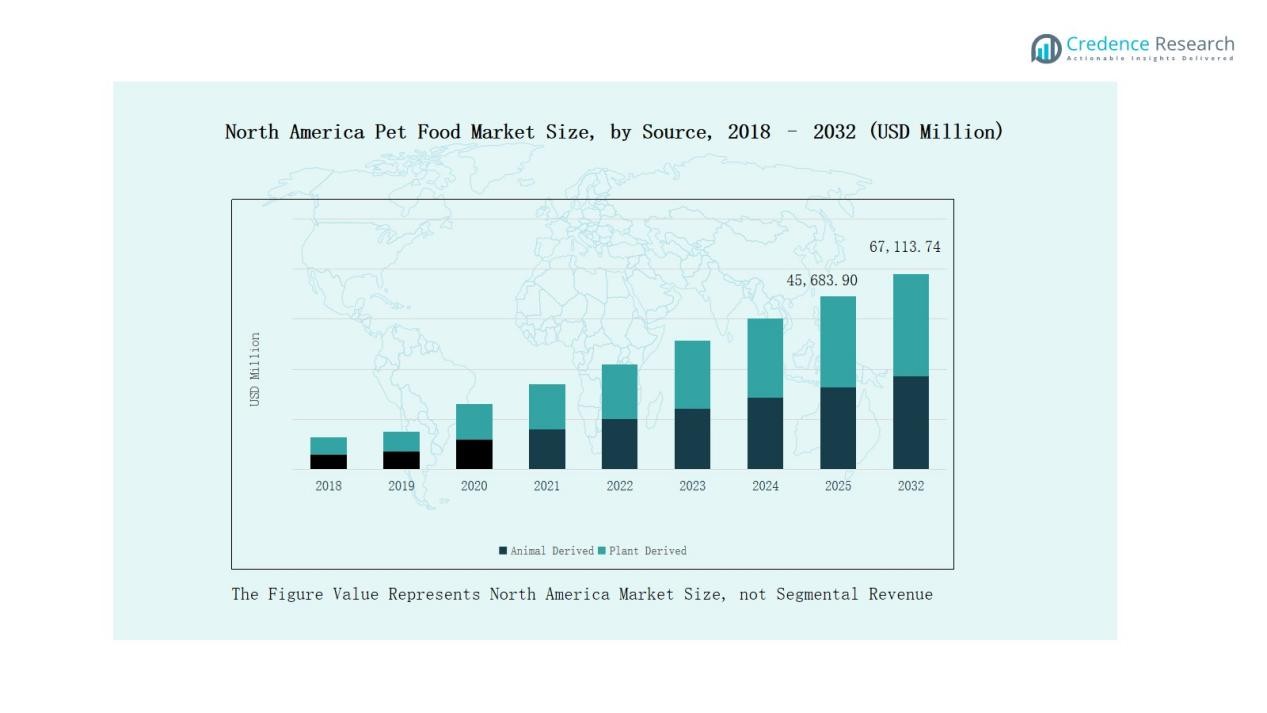

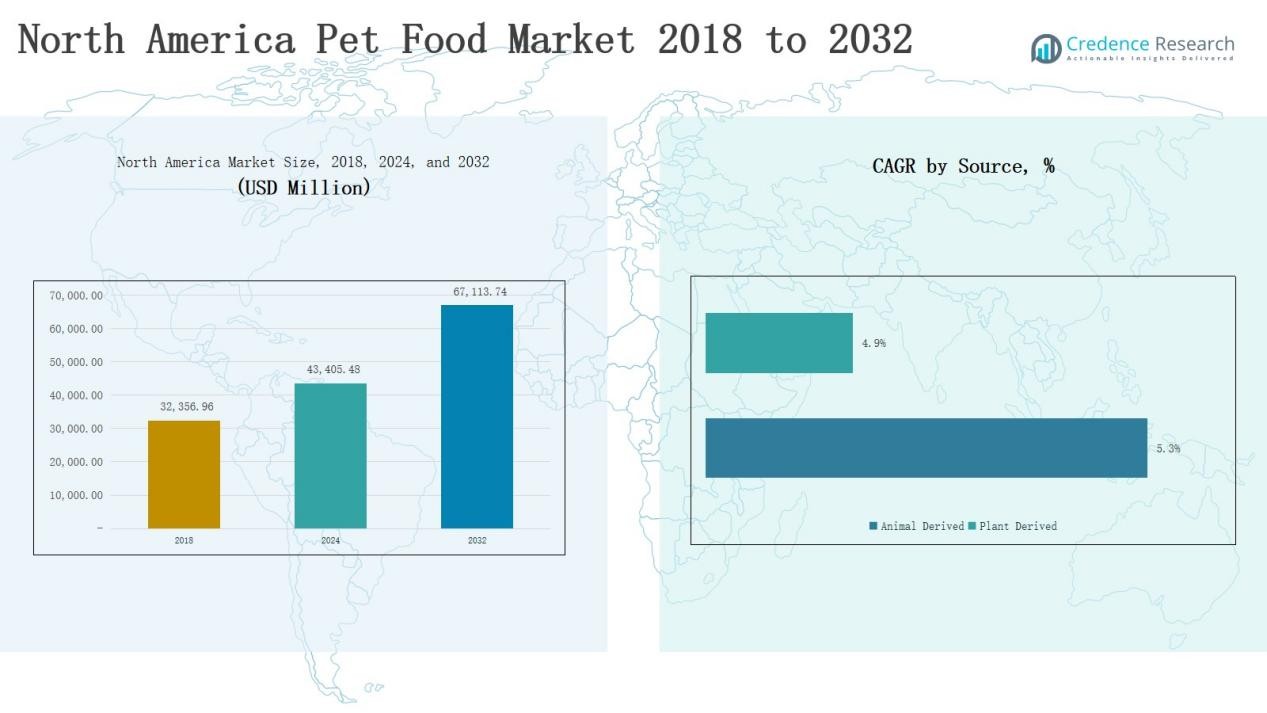

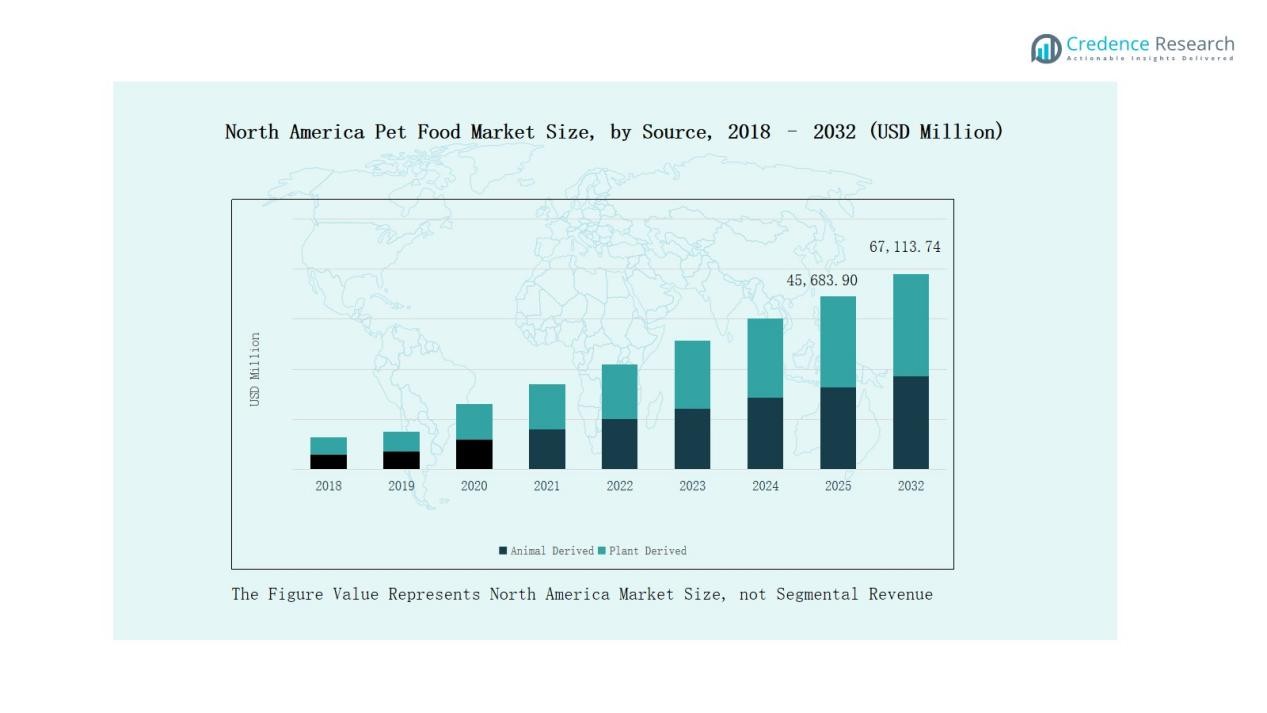

North America Pet Food Market size was valued at USD 32,356.96 million in 2018, increased to USD 43,405.48 million in 2024, and is anticipated to reach USD 67,113.74 million by 2032, growing at a CAGR of 5.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Pet Food Market Size 2024 |

USD 2745.8 Million |

| North America Pet Food Market, CAGR |

14.80% |

| North America Pet Food Market Size 2032 |

USD 9509.24 Million |

The North America Pet Food Market is led by prominent players such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, General Mills, Inc., and J.M. Smucker Co., which dominate through strong brand portfolios, wide distribution networks, and continuous product innovation. Regional manufacturers like United Petfood, Simmons Pet Food, Elmira Pet Products, Real Pet Food Co., and The Great Canadian Petfood enhance competition by offering customized, private-label, and affordable solutions. The United States remains the leading region, capturing a 67% market share in 2024, supported by high pet ownership, premiumization trends, and well-established retail infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Pet Food Market grew from USD 32,356.96 million in 2018 to USD 43,405.48 million in 2024 and is projected to reach USD 67,113.74 million by 2032, at a CAGR of 5.67%.

- The United States led the regional market with a 67% share in 2024, supported by strong pet ownership, premiumization trends, and advanced retail networks.

- Dry pet food dominated by food type with a 59% share in 2024, driven by convenience, longer shelf life, and cost-effective storage solutions.

- Animal-derived ingredients held a 71% share, favored for high protein content, better palatability, and nutritional value supporting pet health.

- Dog food led the pet type category with a 61% share, fueled by rising adoption rates, breed-specific nutrition demand, and growth in premium functional diets.

Market Segment Insights

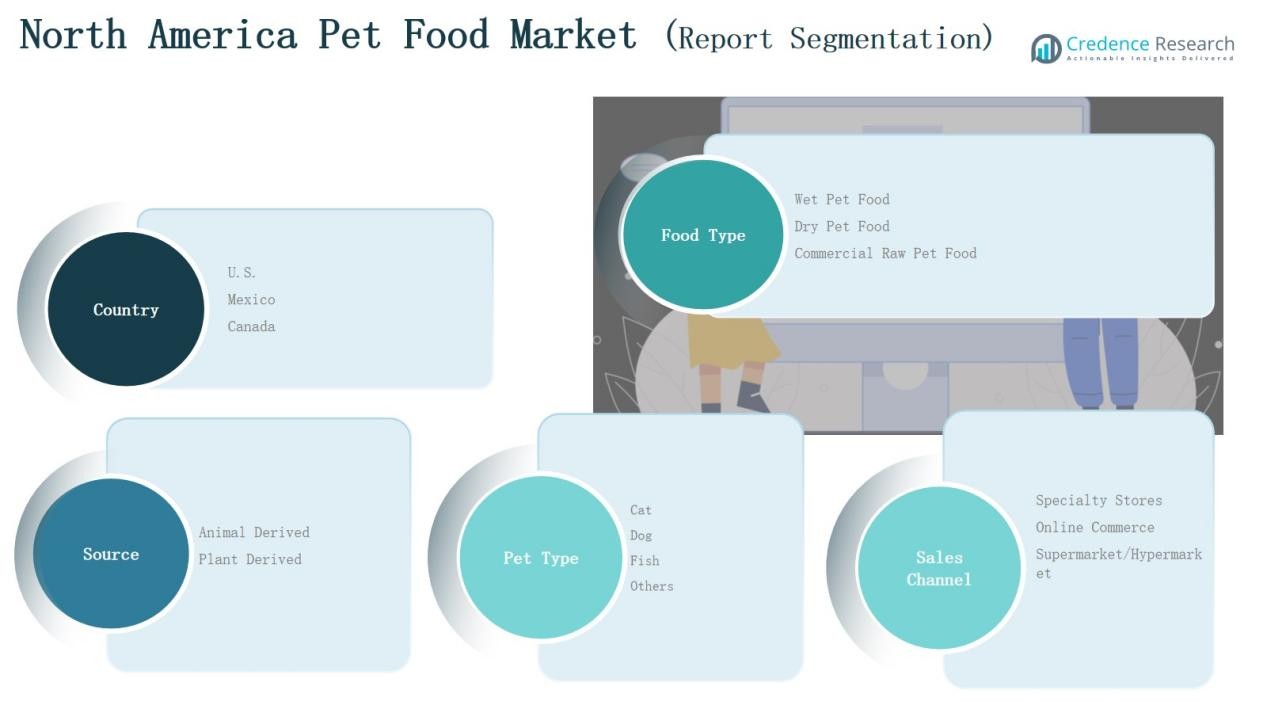

By Food Type

Dry pet food dominated the North America Pet Food Market in 2024 with a 59% share. Its dominance is driven by long shelf life, easy storage, and cost efficiency for both producers and consumers. The segment benefits from high convenience, precise nutrient formulation, and widespread availability through retail and online channels. Increasing preference for portion-controlled, protein-rich dry kibbles among pet owners continues to sustain strong demand across the U.S., Canada, and Mexico.

- For instance, Hill’s Pet Nutrition launched its Science Diet Perfect Digestion dry range in Mexico, incorporating ActivBiome+ technology designed to promote healthy gut microbiomes in pets.

By Source

Animal-derived ingredients led the North America Pet Food Market with a 71% share in 2024. The segment’s strength comes from high palatability, superior protein content, and essential amino acids that support pet health. Manufacturers use real meat, fish, and poultry to improve taste and nutrient density. Demand for premium, meat-based pet food continues to grow as consumers prioritize high-quality ingredients and natural formulations for maintaining pet vitality and overall wellness.

- For instance, Mars Petcare introduced its Cesar Wholesome Bowl line using natural beef and chicken ingredients with no fillers or artificial preservatives, emphasizing fresh-meat nutrition.

By Pet Type

Dog food accounted for the largest share of 61% in the North America Pet Food Market in 2024. High dog ownership rates, especially in the U.S., drive strong demand for premium and functional nutrition products. Manufacturers focus on breed-specific, age-appropriate, and allergen-free formulations. Rising expenditure on canine health and increasing adoption of large breeds reinforce consistent sales across wet, dry, and raw food categories in both urban and suburban markets.

Key Growth Drivers

Rising Pet Humanization and Premiumization

Pet owners increasingly treat pets as family members, driving demand for premium nutrition products. Consumers seek natural, grain-free, and high-protein formulations with functional benefits such as digestive health and coat care. Brands respond with human-grade ingredients and transparency in sourcing. The premiumization trend boosts sales of specialized diets and organic variants, reflecting growing willingness to spend more on pet wellness and preventive nutrition across the U.S., Canada, and Mexico.

- For instance, Nestlé Purina expanded its Pro Plan range with formulas containing real salmon and lamb as primary protein sources to boost muscle strength and energy levels in active pets.

Expansion of E-Commerce and Omnichannel Distribution

Online retail growth is transforming pet food accessibility in North America. Consumers prefer convenient ordering, doorstep delivery, and subscription-based services for recurring purchases. Major brands and retailers invest in omnichannel strategies to integrate physical and digital platforms. Personalized recommendations and digital promotions further enhance customer engagement. The surge in e-commerce sales strengthens market penetration across urban and suburban areas, widening the consumer base for both premium and economy pet food brands.

- For instance, Nestlé Purina launched a personalized pet nutrition platform, offering tailored recommendations through its digital channels, and expanded its direct-to-consumer subscription services, further strengthening its digital footprint in the pet food market.

Increasing Focus on Health and Functional Nutrition

Health-conscious consumers are driving strong demand for pet food enriched with probiotics, antioxidants, and omega fatty acids. Formulations targeting weight control, joint health, and aging support are gaining traction. Pet owners are becoming more aware of dietary impacts on long-term health, leading to the popularity of veterinary-recommended and prescription diets. Continuous product innovation by manufacturers to address specific nutritional deficiencies supports steady growth in the functional pet food segment.

Key Trends & Opportunities

Growing Adoption of Sustainable and Ethical Products

Eco-conscious consumers increasingly prefer brands using responsibly sourced ingredients, recyclable packaging, and ethical production. Companies are investing in plant-based and insect-protein formulations to reduce environmental impact. Transparency in labeling and carbon-neutral initiatives further attract environmentally aware buyers. The rising focus on sustainability presents significant opportunities for new entrants offering eco-certified and cruelty-free pet food solutions across major North American markets.

- For instance, Mars Petcare launched the “Next Generation Pet Food” program, collaborating with startups to develop sustainable proteins like cultured and upcycled ingredients to reduce carbon footprint.

Innovation Through Personalization and Technology Integration

The adoption of AI-driven nutrition planning, DNA-based diet recommendations, and smart feeding devices is rising. These technologies help tailor diets to specific pet needs based on age, breed, or health status. Brands are leveraging data analytics to customize product lines and improve customer experience. Personalized pet nutrition and tech-enabled convenience are emerging as major growth opportunities for premium and direct-to-consumer brands in the region.

- For instance, Royal Canin expanded its Individualis range in Europe, offering tailor-made nutrition plans developed through AI-assisted algorithms that analyze pet lifestyle and health data.

Key Challenges

High Raw Material and Production Costs

Rising prices of meat, grains, and specialty ingredients increase production costs for pet food manufacturers. Inflationary pressures and supply chain disruptions strain profitability and limit pricing flexibility. Smaller producers face greater challenges maintaining margins while meeting quality standards. The high dependency on imported raw materials further heightens vulnerability to global market fluctuations, pushing companies to optimize sourcing and production efficiency.

Stringent Regulatory and Quality Compliance Requirements

The North America Pet Food Market faces strict regulations on safety, labeling, and nutritional claims. Compliance with standards set by the FDA, AAFCO, and CFIA increases operational complexity and cost. Frequent inspections and recalls require robust quality assurance systems. Non-compliance risks brand reputation and consumer trust. Companies must continuously adapt to evolving food safety norms while maintaining product consistency and transparency.

Growing Competition and Market Saturation

The presence of established global brands and private labels intensifies competition across the region. New entrants face challenges in achieving differentiation and shelf visibility. Price competition limits profitability, especially in mid-tier segments. Consumers’ loyalty to legacy brands makes it difficult for newcomers to gain market share. Continuous innovation and marketing investment are required to sustain growth in an increasingly crowded and price-sensitive market landscape.

Regional Analysis

U.S.

The U.S. held the largest share of 67% in the North America Pet Food Market in 2024. Strong pet ownership, high disposable income, and preference for premium nutrition drive the market. It benefits from advanced manufacturing, product innovation, and strong retail networks. Consumers increasingly favor organic, grain-free, and functional products with specific health benefits. E-commerce growth and subscription-based models further strengthen demand. The rising number of pet adoptions and humanization trends continue to support consistent market expansion across all food categories.

Canada

Canada accounted for 21% of the regional share in 2024, supported by rising awareness of pet wellness and growing demand for natural ingredients. The market benefits from expanding pet ownership and government regulations promoting product safety. Consumers favor brands offering transparency and locally sourced ingredients. It is witnessing an increase in premium dry and wet pet food purchases driven by urban pet owners. Growth in online retail platforms and sustainable packaging initiatives enhances accessibility and brand differentiation.

Mexico

Mexico captured 12% of the regional market share in 2024, driven by increasing middle-class income and expanding pet adoption. The market shows rising acceptance of commercial pet food over homemade diets. Local manufacturers and global players compete through affordable and nutritionally balanced offerings. It benefits from distribution network expansion across supermarkets and specialty stores. Growing focus on animal health and awareness of complete pet nutrition continue to elevate demand for packaged pet food products nationwide.

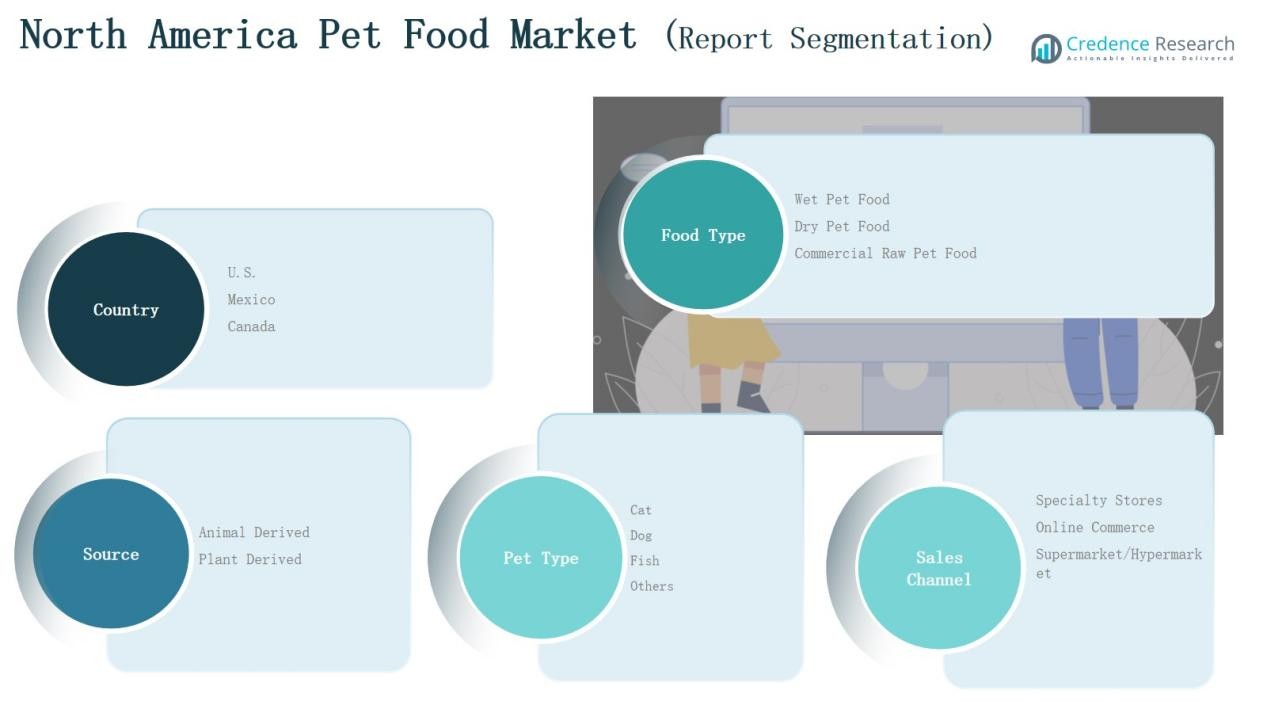

Market Segmentations:

By Food Type

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source

- Animal Derived

- Plant Derived

By Pet Type

By Sales Channel

- Specialty Stores

- Online Commerce

- Supermarket/Hypermarket

By Country

Competitive Landscape

The North America Pet Food Market is highly competitive, featuring a mix of global corporations and regional producers focused on quality, innovation, and branding. Leading players such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, General Mills, and J.M. Smucker Co. dominate the market through broad product portfolios, strong distribution, and research-driven formulations. These companies invest heavily in premium, functional, and sustainable pet food lines to meet changing consumer preferences. Regional firms like United Petfood, Simmons Pet Food, and Elmira Pet Products strengthen competition by offering customized and private-label solutions. The market is witnessing increasing mergers, acquisitions, and capacity expansions to improve geographic reach and production efficiency. Continuous innovation in flavor, texture, and health benefits, combined with the growth of e-commerce and direct-to-consumer channels, drives strong competition among key players aiming to capture greater market share across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- The Hartz Mountain Corporation

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- General Mills, Inc.

- M. Smucker Co.

- United Petfood

- Simmons Pet Food

- Elmira Pet Products

- Real Pet Food Co.

- The Great Canadian Petfood

- Other Key Players

Recent Developments

- In June 2025, General Mills launched a new fresh variant under its Blue Buffalo brand, aiming to compete in the fresh pet food segment.

- In May 2025, Post Consumer Brands launched multiple new products across its pet food labels including 9Lives Kitten Essentials Chicken & Ocean Fish dry cat food.

- In June 2025, General Mills launched its new “Love Made Fresh” line under the Blue Buffalo brand, marking its entry into the fresh pet food category.

- In February 2025, Hill’s Pet Nutrition acquired Prime100, expanding its portfolio in therapeutic fresh dog food products.

Report Coverage

The research report offers an in-depth analysis based on Food Type, Source, Pet Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and natural pet food products will continue to increase.

- Sustainable packaging and eco-friendly sourcing will gain wider industry adoption.

- Online and subscription-based pet food sales will expand rapidly across major cities.

- Functional nutrition targeting health-specific benefits will drive product innovation.

- Manufacturers will invest more in research to enhance ingredient quality and safety.

- Private-label and regional brands will strengthen their market presence through affordability.

- Personalized pet nutrition solutions using AI and data analytics will become mainstream.

- Strategic mergers and partnerships will accelerate to enhance distribution and capacity.

- Consumer preference for grain-free and protein-rich formulations will remain strong.

- The rise of plant-based and alternative protein pet food will open new growth avenues.