Market Overview

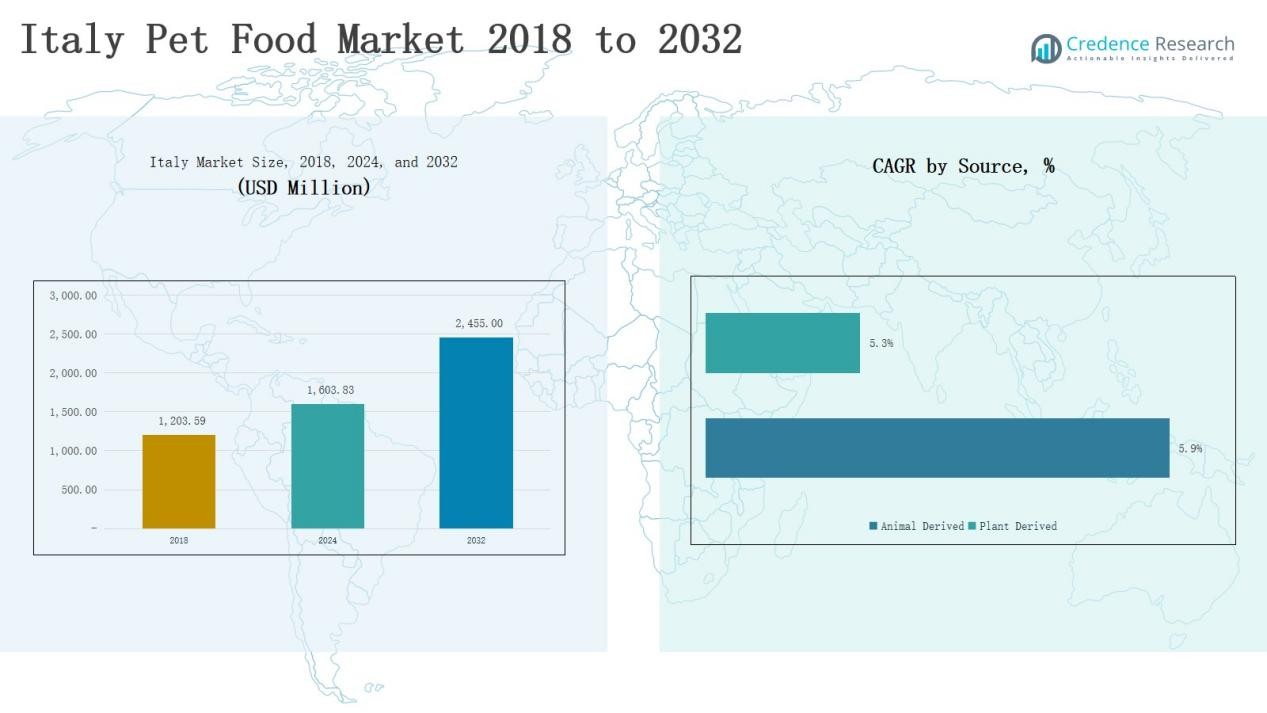

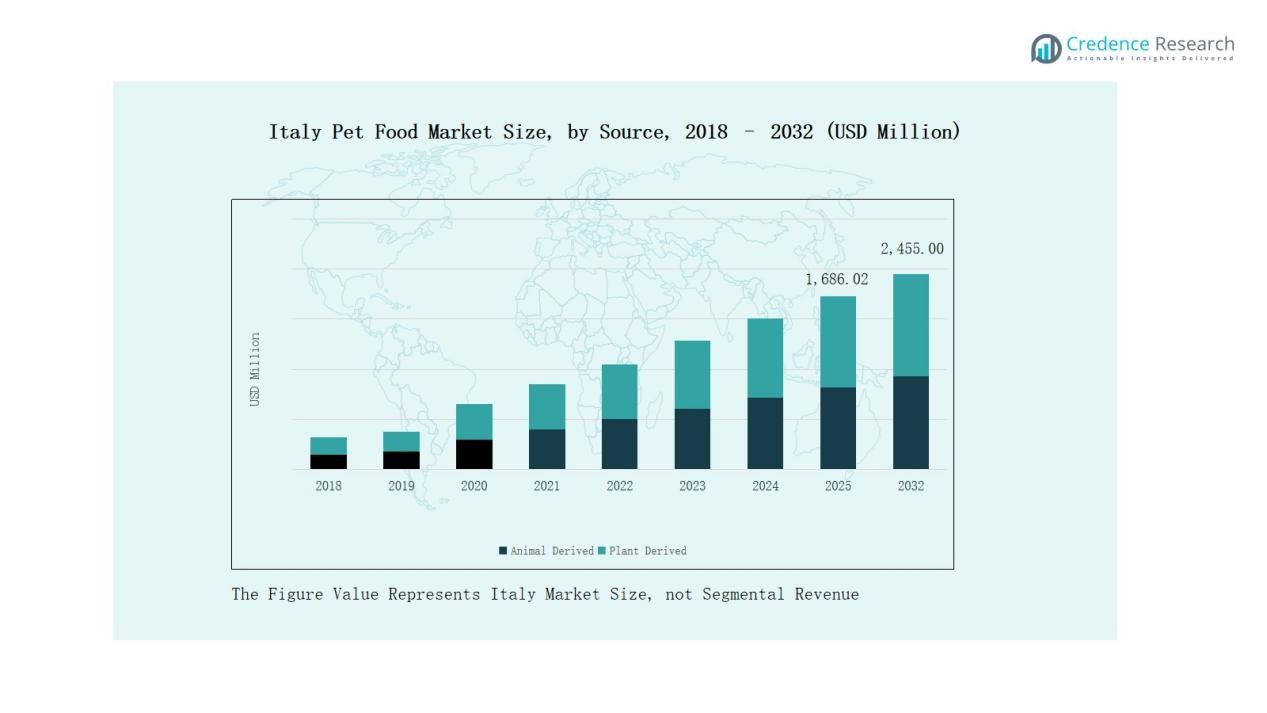

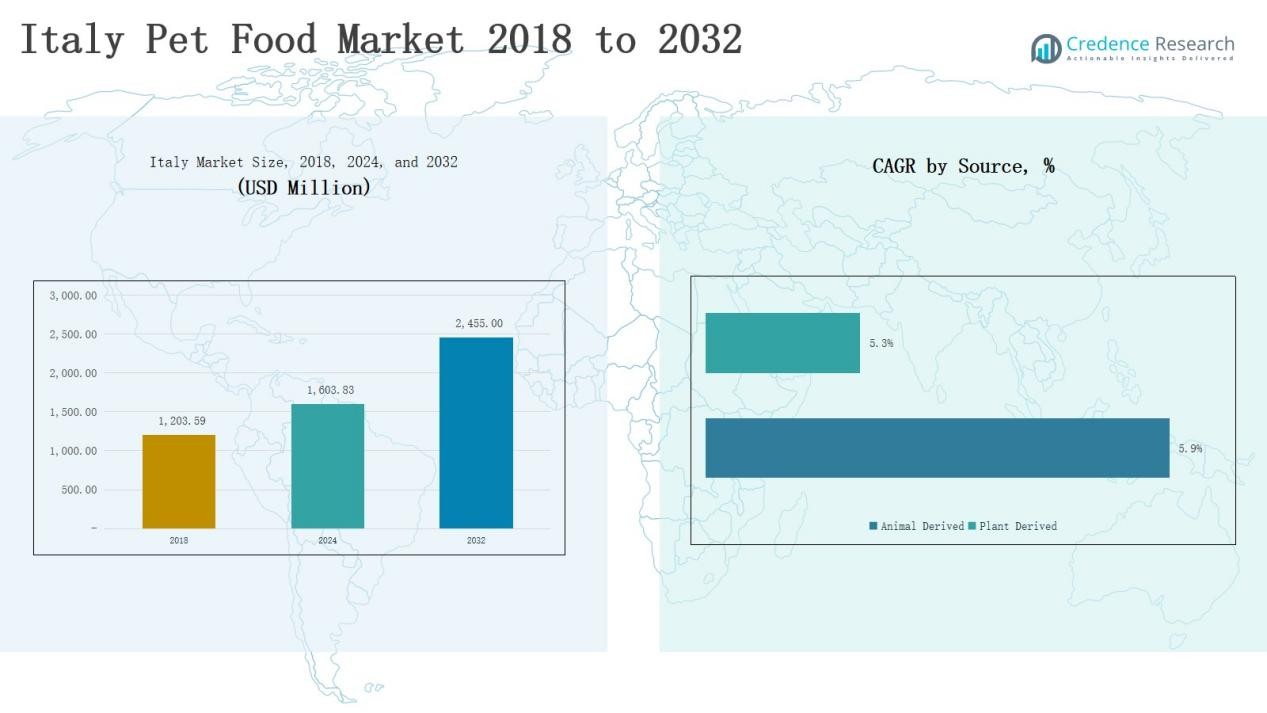

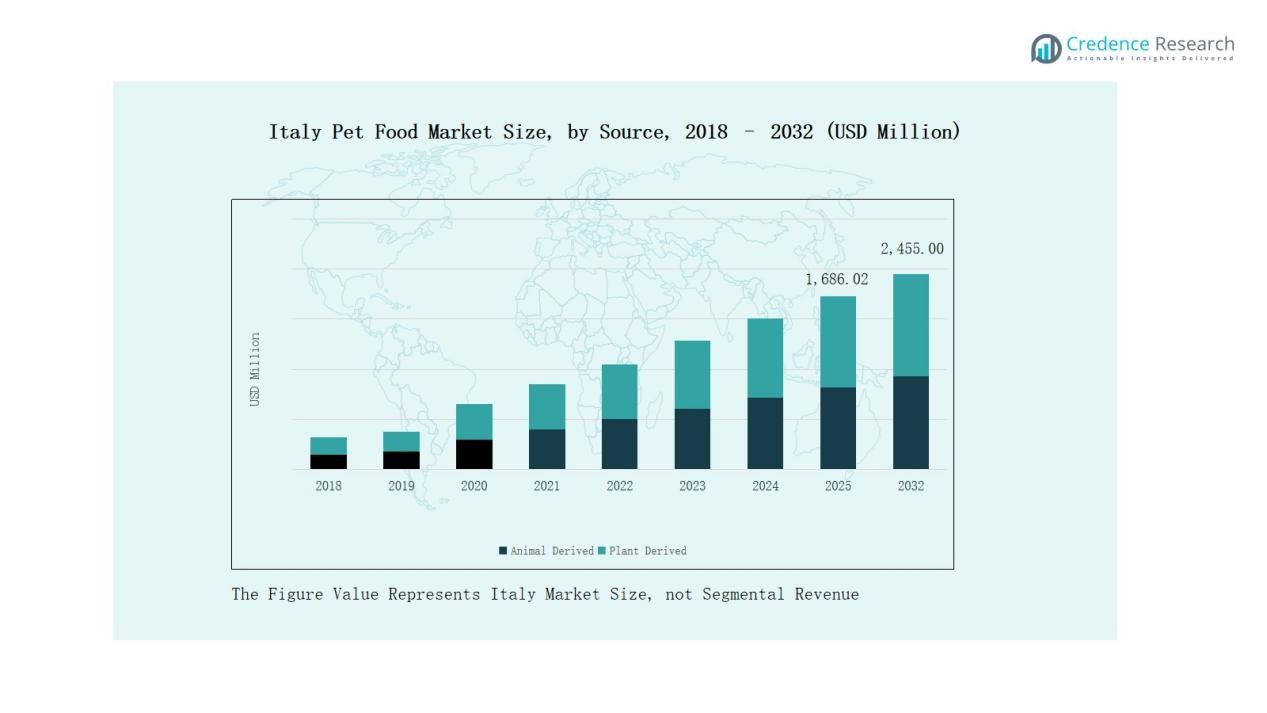

The Italy Pet Food Market size was valued at USD 1,203.59 million in 2018, increased to USD 1,603.83 million in 2024, and is anticipated to reach USD 2,455.00 million by 2032, growing at a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Pet Food Market Size 2024 |

USD 1,603.83 Million |

| Italy Pet Food Market, CAGR |

5.29% |

| Italy Pet Food Market Size 2032 |

USD 2,455.00 Million |

The Italy Pet Food Market is led by major players such as Mars, Incorporated, Nestlé Purina Pet Care, Hill’s Pet Nutrition, Monge & C. S.p.A., and General Mills, Inc., which maintain strong market positions through premium formulations, nutritional research, and wide retail distribution. Local manufacturers, including Morando, United Petfood, and Landini Giuntini S.p.A., enhance domestic competition by emphasizing affordability, private-label production, and locally sourced ingredients. Strategic investments in sustainability, digital marketing, and functional product lines are driving brand differentiation. North Italy emerged as the leading region in 2024, capturing a 37% share, supported by strong purchasing power, advanced retail infrastructure, and a growing preference for premium and health-focused pet food.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Pet Food Market grew from USD 1,203.59 million in 2018 to USD 1,603.83 million in 2024 and is projected to reach USD 2,455.00 million by 2032, at a CAGR of 5.29%.

- Dry pet food dominated with a 58% share in 2024, driven by convenience, long shelf life, and cost efficiency, while wet and raw pet food gained traction for their nutritional and natural appeal.

- Animal-derived pet food led with a 72% share, supported by strong consumer preference for protein-rich, meat-based formulations, whereas plant-based options grew due to sustainability trends.

- Dog food held the largest share of 61% in 2024, supported by rising ownership and growing demand for functional, premium nutrition; cat food followed with expanding urban adoption.

- North Italy led the market with a 37% share, driven by high purchasing power, advanced retail infrastructure, and growing preference for premium, sustainable, and health-focused pet food products.

Market Segment Insights

By Food Type

Dry pet food dominated the Italy Pet Food Market in 2024 with a 58% share, driven by its long shelf life, convenience, and cost efficiency. Consumers prefer dry food for easy storage and portion control, especially in multi-pet households. Wet pet food held a significant share due to higher palatability and nutritional moisture, appealing to older pets. The commercial raw pet food segment is expanding rapidly, supported by demand for high-protein, minimally processed, and natural diets.

- For instance, Nestlé Purina expanded its Purina ONE DualNature range in Italy, highlighting nutrient-rich dry formulations with natural spirulina to enhance pet vitality.

By Source

Animal-derived pet food led the Italy Pet Food Market in 2024 with a 72% share, supported by strong consumer trust in meat-based protein for improved digestion and muscle health. This segment benefits from local meat sourcing and premium formulations using poultry, beef, and fish. Plant-derived pet food is growing steadily, driven by rising vegan trends and sustainability concerns, as manufacturers introduce grain-free, plant-protein alternatives for health-conscious and environmentally aware pet owners.

- For instance, Farmina Pet Foods expanded its “N&D Quinoa” range with a fish-based formula enriched with quinoa and coconut, targeting pets with skin allergies and improved muscle tone.

By Pet Type

Dog food dominated the Italy Pet Food Market in 2024 with a 61% share, attributed to high dog ownership and growing expenditure on premium nutrition. Italian consumers increasingly seek functional diets promoting joint health and immunity. Cat food followed, supported by urban lifestyles and convenience packaging. Fish and other pet segments maintained niche positions, driven by aquaculture hobbyists and small pet owners emphasizing natural ingredients and balanced nutrition across diverse pet categories.

Key Growth Drivers

Rising Pet Humanization and Premiumization

Pet owners in Italy increasingly treat pets as family members, driving demand for premium and health-focused food products. Consumers seek formulations with natural, organic, and functional ingredients that support digestive health, immunity, and longevity. Brands respond with human-grade, grain-free, and fortified recipes. The shift toward emotional and lifestyle alignment between owners and pets continues to shape purchasing patterns, particularly within urban populations with higher disposable incomes and greater awareness of pet nutrition.

- For instance, Aldog offers organic dry dog food made from carefully selected raw materials sourced from certified Italian supply chains, focusing on balanced nutrition with low cereals and high animal protein content.

Expansion of E-Commerce and Digital Retailing

The rapid growth of online platforms has transformed pet food distribution in Italy. E-commerce provides convenient home delivery, subscription models, and access to a wider variety of premium brands. Retailers and pet food companies leverage digital tools for targeted marketing, customized product recommendations, and loyalty programs. This channel growth particularly benefits small and niche brands, allowing them to reach consumers nationwide without physical retail constraints, enhancing accessibility and consumer engagement across Italy.

- For instance, e-commerce platforms like Amazon Italy have expanded their pet food categories significantly, offering extensive premium and niche brand portfolios that benefit smaller companies by increasing their market reach nationwide.

Growing Focus on Sustainable and Locally Sourced Products

Sustainability has become a key factor in purchase decisions within the Italy Pet Food Market. Manufacturers emphasize eco-friendly packaging, ethically sourced ingredients, and locally produced raw materials. Italy’s rich agricultural base supports traceability and reduced carbon footprint in pet food production. Consumers prefer brands that adopt transparency in sourcing and adopt circular economy principles. This sustainability-driven shift strengthens brand loyalty and aligns with broader European Union goals toward environmental responsibility and sustainable manufacturing.

Key Trends & Opportunities

Rise of Functional and Customized Pet Nutrition

The growing awareness of pet health is fueling demand for functional foods designed for specific life stages and conditions. Companies are developing diets tailored for joint health, allergies, obesity, and digestive care. Customization through online tools and veterinary partnerships enhances consumer trust and long-term retention. This trend creates opportunities for premium product lines and innovation in ingredients such as probiotics, omega fatty acids, and superfoods.

- For instance, Mars Petcare integrates functional ingredients like glucosamine for joint care and marine oils rich in EPA and DHA in their diets, targeting aging dogs with arthritis and skin issues.

Increasing Popularity of Alternative Protein Sources

Manufacturers in Italy are exploring insect-based and plant-derived proteins to meet the rising interest in sustainable pet diets. Alternative proteins offer nutritional balance while reducing environmental impact. These innovations attract eco-conscious consumers seeking ethical and hypoallergenic options. The opportunity lies in developing high-quality, digestible, and affordable formulations that maintain taste and performance standards comparable to traditional animal-based products.

- For instance, Protix’s 2023 pet food trials showed 94% acceptance in dogs and 81% in cats for insect protein-based food, supporting sustainability and palatability

Key Challenges

Volatility in Raw Material Prices

Fluctuating costs of meat, grains, and packaging materials continue to pressure manufacturers’ margins. Global supply chain disruptions and high energy costs in Europe worsen these challenges. Producers face difficulties maintaining stable pricing without compromising quality. Managing procurement efficiency and diversifying ingredient sourcing are crucial to mitigating financial risks in the Italian pet food sector.

Stringent Regulatory Compliance Requirements

Italy’s pet food producers must comply with strict EU regulations concerning labeling, safety, and nutritional content. Continuous updates to animal feed directives and sustainability standards increase compliance costs. Smaller producers often struggle with certification processes and documentation. Maintaining transparency, traceability, and quality assurance remains a challenge that influences competitiveness and operational efficiency within the market.

Rising Competition from Private Labels and Imports

Private-label brands and international players are intensifying competition in the Italy Pet Food Market. Retail chains expand their own pet food lines at lower price points, appealing to cost-sensitive consumers. Imported products from larger European producers offer strong marketing and economies of scale. To remain competitive, local manufacturers must focus on brand differentiation, innovation, and sustainability to retain consumer loyalty amid growing market saturation.

Regional Analysis

North Italy

North Italy dominated the Italy Pet Food Market in 2024 with a 37% share, driven by high pet ownership, strong purchasing power, and an established retail network. The region houses several manufacturing facilities and distribution centers, supporting efficient supply chains. Consumers in cities such as Milan and Turin prefer premium and functional pet food brands emphasizing health and sustainability. The demand for organic and locally sourced products is rising, supported by awareness campaigns and veterinary endorsements. E-commerce adoption is also expanding, enhancing brand accessibility.

Central Italy

Central Italy accounted for a 29% share of the Italy Pet Food Market in 2024, supported by growing urbanization and awareness of pet wellness. Consumers in cities such as Rome and Florence show increasing interest in grain-free and natural formulations. The region benefits from strong domestic brand presence and specialized pet stores offering diverse product portfolios. Local producers are focusing on innovation and personalized nutrition. The premium pet food category continues to expand, supported by the region’s affluent customer base.

South Italy

South Italy held a 21% share of the Italy Pet Food Market in 2024, characterized by rising disposable income and expanding retail infrastructure. Consumer preference for affordable and value-based products drives sales growth. Manufacturers are targeting this region with smaller pack sizes and private-label offerings. Awareness of balanced pet nutrition is improving through marketing campaigns and veterinarian guidance. Distribution through supermarkets and online channels is steadily increasing, expanding the availability of both local and international brands.

Islands (Sicily and Sardinia)

The Islands region captured a 13% share of the Italy Pet Food Market in 2024, supported by increasing adoption of companion animals and gradual modernization of retail channels. Growth is driven by the introduction of e-commerce services and rising interest in imported and premium products. Local distributors are strengthening partnerships with major brands to improve supply consistency. Consumers are showing preference for durable, dry pet food due to warmer climate conditions. It continues to present untapped opportunities for manufacturers focusing on niche and sustainable pet nutrition segments.

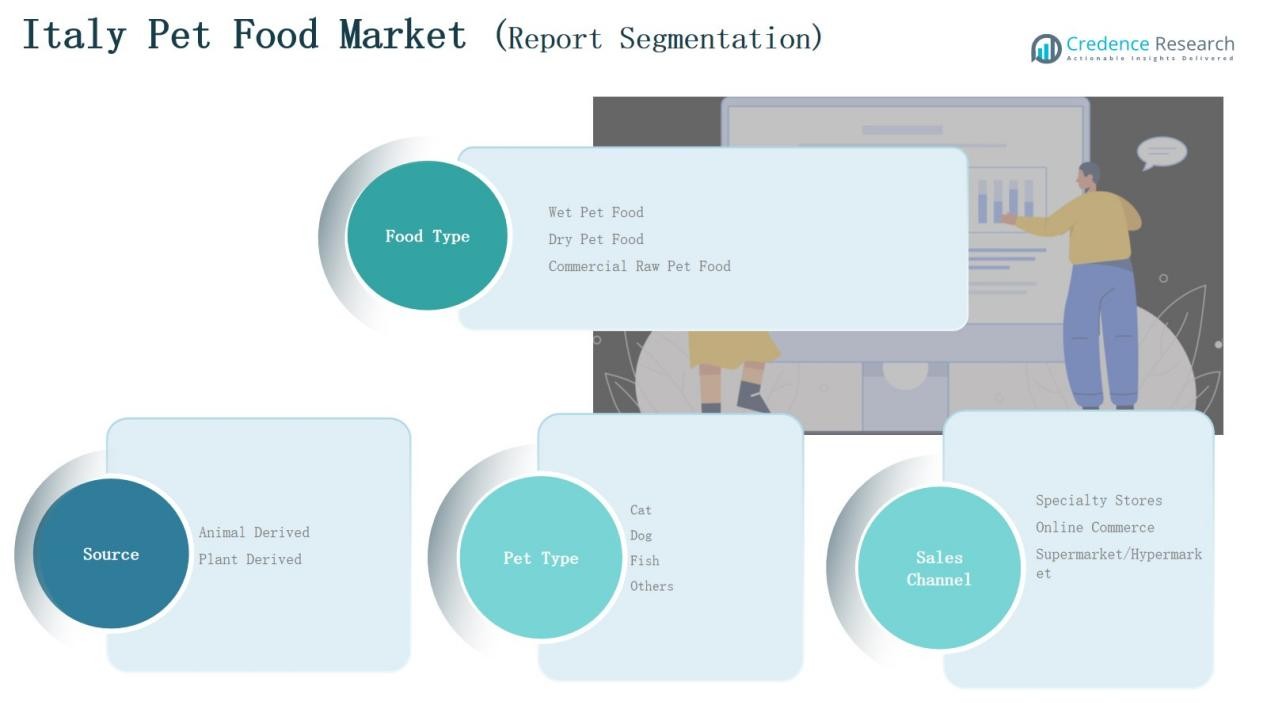

Market Segmentations:

By Food Type

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source

- Animal Derived

- Plant Derived

By Pet Type

By Sales Channel

- Specialty Stores

- Online Commerce

- Supermarkets/Hypermarkets

By Region

- North Italy

- Central Italy

- South Italy

- Islands Italy

Competitive Landscape

The competitive landscape of the Italy Pet Food Market is characterized by the strong presence of global and domestic players offering diverse product portfolios. Leading companies such as Mars, Incorporated, Nestlé Purina PetCare, and Hill’s Pet Nutrition maintain dominance through advanced research, premium formulations, and extensive retail networks. Local manufacturers including Monge & C. S.p.A., Morando, and Landini Giuntini S.p.A. strengthen regional competition by emphasizing locally sourced ingredients, affordable pricing, and private-label production. The market is witnessing increased investment in product innovation, sustainability, and digital marketing strategies to attract health-conscious consumers. Companies are expanding their e-commerce presence and launching functional, organic, and grain-free product lines to align with evolving consumer trends. Continuous collaborations between retailers and producers enhance brand visibility, while mergers and product diversification efforts support long-term market consolidation and growth within the Italian pet food sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Monge & C. S.p.A.

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- General Mills, Inc.

- Morando

- United Petfood

- Landini Giuntini S.p.A.

- Affinity Petcare

- Pets Choice

- MPM Products

- Other Key Players

Recent Developments

- In November 2023, First One (via Arcaplanet/Agrifarma) opened a new Italian plant to scale pet food production with Industry 4.0 technologies.

- In July 2025, Andriani Group launched a new carbon-neutral, plant-based pet food line called Proggy Care, entering the pet nutrition space from its roots in human food.

- In June 2024, Partner in Pet Food (PPF) welcomed CVC Capital Partners IX as its new majority shareholder, aiming to boost its European expansion and pet food innovation.

Report Coverage

The research report offers an in-depth analysis based on Food Type, Source, Pet Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and functional pet food will continue to increase across Italy.

- Online retail and subscription-based pet food delivery will gain stronger adoption.

- Sustainability and eco-friendly packaging will remain a core focus for manufacturers.

- Locally sourced and traceable ingredients will attract health-conscious consumers.

- Customized and breed-specific nutrition will see higher product development activity.

- Private-label pet food brands will expand their presence in retail chains.

- Investment in research for digestive health and immunity-enhancing diets will rise.

- Alternative proteins such as insect and plant-based sources will gain wider acceptance.

- Partnerships between global and domestic players will strengthen market competitiveness.

- Increased awareness of animal welfare and responsible ownership will support long-term market growth.