Market overview

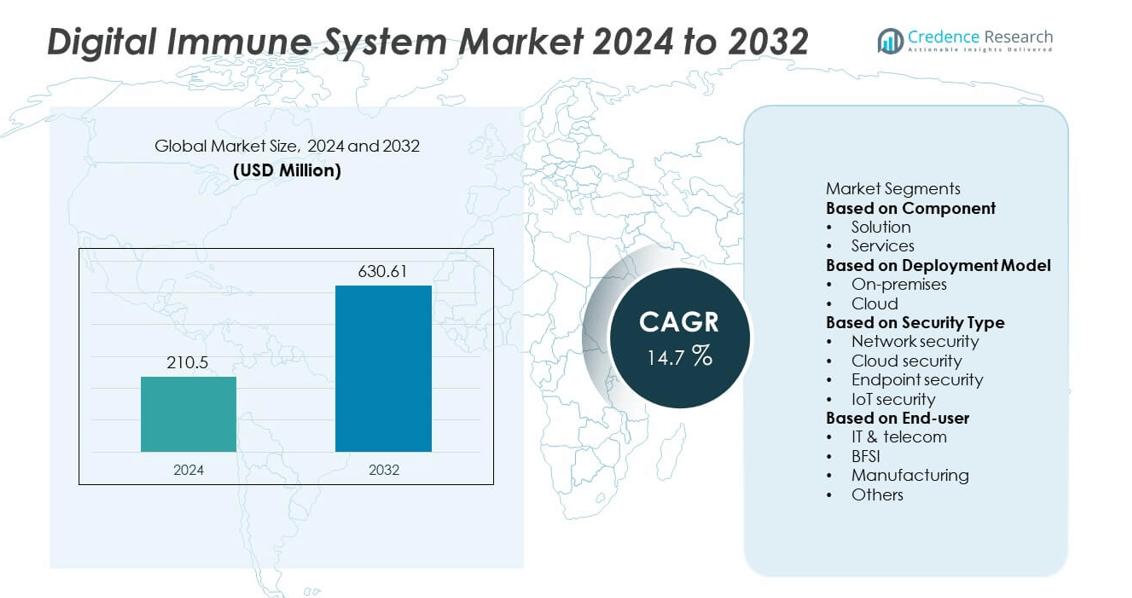

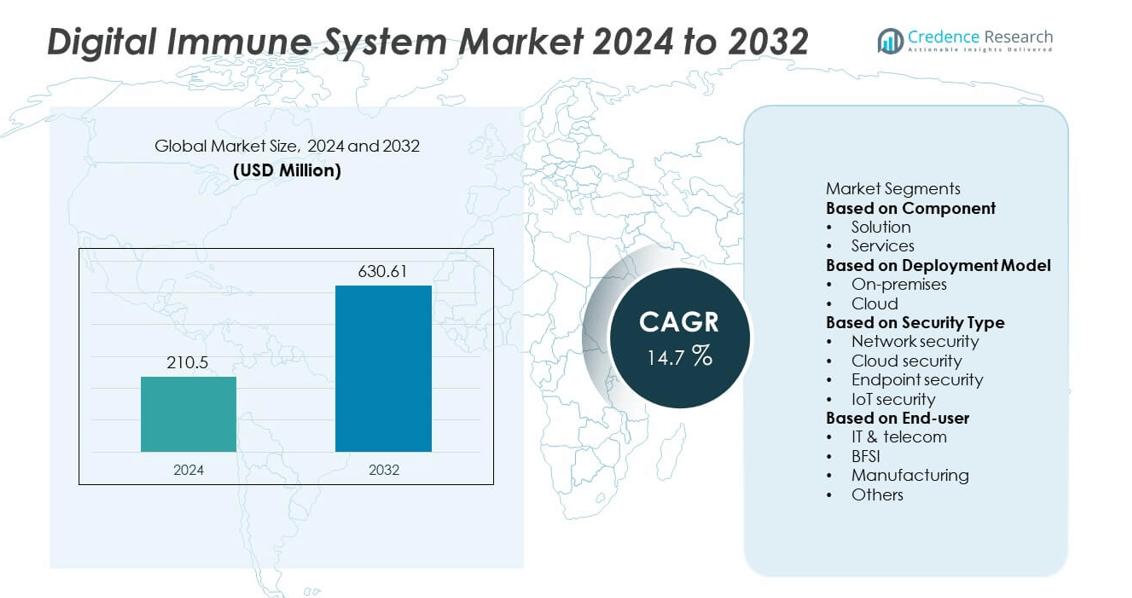

The Digital Immune System market was valued at USD 210.5 million in 2024. It is projected to reach USD 630.61 million by 2032, growing at a CAGR of 14.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Immune System Market Size 2024 |

USD 210.5 million |

| Digital Immune System Market, CAGR |

14.7% |

| Digital Immune System Market Size 2032 |

USD 630.61 million |

The Digital Immune System market is led by major players such as Microsoft Corporation, IBM Corporation, Cisco Systems, Inc., Broadcom Inc., HCL Technologies, Trellix, Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., and CrowdStrike Holdings, Inc. These companies dominate through continuous advancements in AI-driven threat intelligence, automated response systems, and cloud-integrated security solutions. North America leads the global market with a 37% share in 2024, supported by strong technological infrastructure and high cybersecurity spending. Europe follows with a 28% share, driven by strict regulatory compliance and enterprise digitization, while Asia-Pacific accounts for 25% owing to rapid digital transformation and increased investments in advanced cybersecurity frameworks.

Market Insights

- The Digital Immune System market was valued at USD 210.5 million in 2024 and is expected to reach USD 630.61 million by 2032, growing at a CAGR of 14.7%.

- Rising cyber threats and increasing adoption of AI-driven security tools drive market growth, as organizations seek proactive protection against evolving digital risks.

- Key trends include integration of automation, predictive analytics, and self-healing systems that enhance real-time detection and resilience across cloud and hybrid networks.

- The market is highly competitive, with major players such as Microsoft, IBM, Cisco, and Palo Alto Networks focusing on innovation, partnerships, and cloud-based security expansion.

- Regionally, North America leads with 37% share, followed by Europe at 28% and Asia-Pacific at 25%, while by component, the solution segment dominates with 67% share, driven by demand for integrated digital protection frameworks across industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment dominated the Digital Immune System market in 2024, holding around 67% share. Its leadership stems from growing integration of automated threat detection, incident response, and predictive analytics tools across enterprises. Organizations prefer comprehensive solutions that combine AI-driven monitoring, anomaly detection, and real-time protection to enhance digital resilience. Continuous software updates and advanced system modeling improve defense accuracy against evolving cyber threats. Meanwhile, the services segment, including consulting and managed security, is gaining traction as companies seek expert support for deployment, optimization, and maintenance of digital immune platforms.

- For instance, IBM integrated its QRadar Investigation Assistant with generative AI capabilities, allowing the system to assist security analysts in investigating threats more efficiently by generating summaries of offenses using natural language processing.

By Deployment Model

The cloud segment accounted for nearly 61% share of the Digital Immune System market in 2024. Its dominance is driven by scalable infrastructure, flexible resource allocation, and cost efficiency compared to on-premises systems. Cloud-based deployment enables real-time monitoring, faster updates, and integration with multiple endpoints, enhancing adaptive defense mechanisms. Increasing adoption among small and medium enterprises for secure, subscription-based cybersecurity frameworks supports this trend. On-premises deployment continues to serve industries with strict data sovereignty and compliance requirements, especially in defense, government, and financial sectors prioritizing full control over security data.

- For instance, Microsoft’s Defender for Cloud platform monitors over 78 trillion security signals per day across its Azure ecosystem, enabling real-time detection and automated containment of emerging threats. The system leverages AI-driven telemetry from a vast network of endpoints, providing continuous updates to mitigate zero-day vulnerabilities in hybrid and multi-cloud environments.

By Security Type

Network security held the largest share of approximately 39% in the Digital Immune System market in 2024. The segment benefits from rising cyberattacks on enterprise networks and growing demand for adaptive protection across distributed systems. Digital immune frameworks strengthen network visibility, automate response to intrusions, and minimize downtime through continuous behavioral analysis. Cloud and endpoint security segments are expanding quickly as organizations safeguard hybrid environments and remote devices. IoT security also shows strong growth potential with the proliferation of connected sensors and industrial systems requiring intelligent, self-healing security mechanisms.

Key Growth Drivers

Rising Cyber Threat Complexity

The increasing sophistication of cyberattacks is a major driver for the Digital Immune System market. Modern threats such as ransomware, zero-day exploits, and phishing require proactive and adaptive defense mechanisms. Digital immune systems combine AI, machine learning, and automation to predict, detect, and neutralize attacks in real time. Enterprises are investing in these systems to strengthen resilience, reduce downtime, and ensure business continuity. Growing incidents of targeted attacks across financial services, manufacturing, and healthcare sectors further accelerate adoption of intelligent cybersecurity architectures.

- For instance, CrowdStrike’s Falcon platform processes trillions of endpoint-related events daily using AI-driven correlation to detect malicious patterns. The system leverages behavioral analytics and threat intelligence from over 170 countries to identify zero-day threats automatically. It also provides real-time response automation for ransomware mitigation across enterprise networks.

Expanding Cloud and Hybrid Infrastructure

Rapid cloud migration and the rise of hybrid IT environments are fueling demand for advanced security models. Digital immune systems provide unified protection across on-premises, cloud, and edge environments, ensuring seamless threat detection and response. Businesses increasingly rely on these systems to manage complex workloads securely while maintaining compliance with evolving data protection regulations. The expansion of SaaS applications and remote operations has made adaptive digital security a priority, driving widespread deployment of scalable immune solutions among global enterprises.

- For instance, Cisco offers a unified security portfolio that uses Cisco Talos threat intelligence to protect hybrid and multi-cloud environments. Talos analyzes trillions of security events daily from various sources, including email, web, and network telemetry, and uses machine learning to identify threats and vulnerabilities.

Integration of AI and Automation in Cybersecurity

The integration of AI and automation technologies is transforming cybersecurity practices. Digital immune systems leverage continuous learning algorithms and behavior analytics to identify anomalies before they escalate into threats. Automated response mechanisms reduce reaction time and minimize the impact of security breaches. AI-driven orchestration also enhances visibility across multiple endpoints and networks. This evolution from reactive to predictive defense empowers organizations to maintain system integrity efficiently, fostering greater trust in automated cybersecurity frameworks across industries such as BFSI, telecom, and manufacturing.

Key Trends & Opportunities

Adoption of Self-Healing and Autonomous Security Frameworks

A growing trend in the Digital Immune System market is the adoption of self-healing cybersecurity models. These frameworks autonomously detect vulnerabilities, initiate corrective actions, and restore system stability without human intervention. Enterprises are embracing these solutions to minimize human error and improve operational efficiency. The rising use of digital twins and real-time analytics within immune architectures enables faster remediation and adaptive learning. This approach offers significant opportunities for vendors focusing on AI-driven resilience and continuous system optimization.

- For instance, Palo Alto Networks integrated self-healing automation into its Cortex XSIAM platform, which analyzes over 5 petabytes of telemetry data daily and autonomously executes remediation workflows for detected anomalies. The system uses behavioral AI models that reduce mean-time-to-detect incidents from 20 minutes to under 60 seconds, enhancing real-time system recovery and resilience across hybrid infrastructures.

Rising Demand Across Regulated Industries

Strict compliance requirements in sectors such as BFSI, healthcare, and defense are creating new growth avenues. These industries face mounting pressure to secure sensitive data and ensure uninterrupted operations. Digital immune systems offer continuous threat monitoring, compliance automation, and enhanced data governance capabilities. Organizations are increasingly adopting these solutions to meet regulatory standards like GDPR and HIPAA while reducing audit complexities. This expanding regulatory landscape provides substantial opportunities for cybersecurity providers offering certified and customizable immune solutions.

- For instance, Check Point Software Technologies launched its Infinity Platform with 60 pre-certified compliance modules covering ISO 27001, GDPR, and NIST standards. The platform continuously monitors over 200 security controls per endpoint, providing real-time compliance analytics for financial and healthcare institutions handling confidential records and mission-critical operations.

Key Challenges

High Implementation and Maintenance Costs

The cost of deploying and maintaining digital immune systems remains a major barrier, particularly for small and medium enterprises. The integration of AI, automation, and analytics demands significant investment in infrastructure, skilled personnel, and continuous updates. Many organizations struggle to justify upfront costs against short-term returns. Moreover, ongoing software upgrades and training add to operational expenses. These financial constraints limit adoption among cost-sensitive sectors, slowing the overall market expansion despite rising awareness of cybersecurity importance.

Data Privacy and Integration Complexities

Integrating digital immune systems across diverse IT ecosystems poses data privacy and compatibility challenges. Organizations often face difficulties in aligning legacy infrastructure with new AI-driven platforms. Concerns about sharing sensitive data across hybrid environments hinder full-scale deployment. Compliance with regional data protection laws further complicates integration efforts. Additionally, interoperability issues between existing security tools and immune system components can delay adoption. Addressing these challenges requires standardized frameworks and enhanced collaboration between technology vendors and regulatory bodies.

Regional Analysis

North America

North America held the largest share of 37% in the Digital Immune System market in 2024. The region’s dominance stems from strong adoption of advanced cybersecurity frameworks and AI-driven defense technologies across enterprises. The U.S. leads due to heavy investment in digital infrastructure, stringent data protection laws, and frequent cyberattacks targeting government and corporate networks. Major technology providers and cybersecurity firms actively deploy self-learning security models to counter evolving threats. The growing use of cloud computing, IoT devices, and automation across industries continues to strengthen market expansion throughout the region.

Europe

Europe accounted for a 28% share of the Digital Immune System market in 2024. Rising data protection regulations such as GDPR and increased focus on digital sovereignty drive demand for robust cyber defense frameworks. Countries including Germany, the U.K., and France are rapidly deploying AI-based threat detection solutions across financial, manufacturing, and public sectors. The region’s emphasis on secure digital transformation, coupled with government-backed cybersecurity initiatives, supports adoption. Expanding cross-border data flows and reliance on hybrid IT environments further encourage investment in intelligent and adaptive immune system technologies.

Asia-Pacific

Asia-Pacific captured a 25% share of the Digital Immune System market in 2024, driven by rapid digitalization and expanding IT infrastructure. Nations such as China, Japan, India, and South Korea are witnessing rising cyber incidents, pushing enterprises to adopt AI-powered security solutions. The region’s growing cloud adoption, industrial automation, and digital payment systems demand advanced protection. Government programs promoting cybersecurity resilience are further boosting market penetration. Increasing investments by local technology firms and startups in intelligent security ecosystems enhance the region’s position as a key growth hub for digital immune systems.

Latin America

Latin America held a 6% share of the Digital Immune System market in 2024. Countries such as Brazil and Mexico are leading adoption due to rising digital transformation across banking, retail, and government sectors. The growing number of cyberattacks and digital frauds has encouraged organizations to implement automated threat detection and mitigation systems. Limited cybersecurity awareness and budget constraints have slowed adoption in smaller enterprises. However, regional collaborations with global cybersecurity providers and the expansion of cloud-based platforms are creating favorable conditions for long-term market growth.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the Digital Immune System market in 2024. The region’s growth is fueled by increased government focus on national cybersecurity strategies and rising digital investments in sectors like energy, defense, and finance. Gulf nations such as the UAE and Saudi Arabia are rapidly integrating AI-driven defense systems to protect critical infrastructure. Meanwhile, African countries are gradually adopting cloud-based solutions to enhance threat visibility. Ongoing digital transformation projects and cross-border data protection initiatives are expected to strengthen regional market performance.

Market Segmentations:

By Component

By Deployment Model

By Security Type

- Network security

- Cloud security

- Endpoint security

- IoT security

By End-user

- IT & telecom

- BFSI

- Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the Digital Immune System market is defined by the presence of key players such as Microsoft Corporation, IBM Corporation, Cisco Systems, Inc., Broadcom Inc., HCL Technologies, Trellix, Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., and CrowdStrike Holdings, Inc. These companies focus on integrating AI, machine learning, and automation into cybersecurity platforms to deliver adaptive and proactive defense solutions. Strategic partnerships, mergers, and continuous product innovation remain central to their growth strategies. Leading firms are investing in real-time analytics and cloud-based architectures to enhance detection accuracy and system resilience. Expansion into hybrid and multi-cloud security ecosystems has intensified competition, with vendors offering scalable, self-healing, and predictive threat management frameworks. Additionally, regional players are emerging with specialized offerings tailored to industry-specific compliance and data protection needs, further diversifying the market and driving advancements in next-generation cybersecurity intelligence systems.

[cr_cta type=”customize_now“]

Key Player Analysis

- Microsoft Corporation

- Trellix

- IBM Corporation

- HCL Technologies

- Broadcom Inc.

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- CrowdStrike Holdings, Inc.

Recent Developments

- In June 2025, Trellix deepened integration with AWS, embedding AI-driven security controls to simplify deployment of cybersecurity in cloud environments.

- In April 2025, Trellix upgraded its DLP capabilities to handle non-text file formats and visual labeling, boosting compliance tools for structured and unstructured data.

- In May 2024, IBM Corporation and Palo Alto Networks announced a partnership to integrate IBM’s Watsonx AI models into Palo Alto’s security offerings, aiming to strengthen threat detection and response across both platforms

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Security Type, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven cybersecurity frameworks will continue to expand across industries.

- Cloud-based digital immune systems will dominate due to scalability and lower maintenance costs.

- Integration of self-healing and autonomous response mechanisms will strengthen system resilience.

- Increasing cyberattacks will push enterprises toward predictive and adaptive security models.

- Collaboration between cybersecurity firms and cloud service providers will accelerate innovation.

- Government initiatives promoting digital security compliance will support broader market growth.

- Growing digitalization in developing regions will create new opportunities for vendors.

- Continuous learning algorithms will enhance real-time threat detection and response accuracy.

- Small and medium enterprises will increasingly adopt subscription-based immune system solutions.

- Expansion of IoT and connected devices will drive demand for intelligent, unified defense platforms.