Market overview

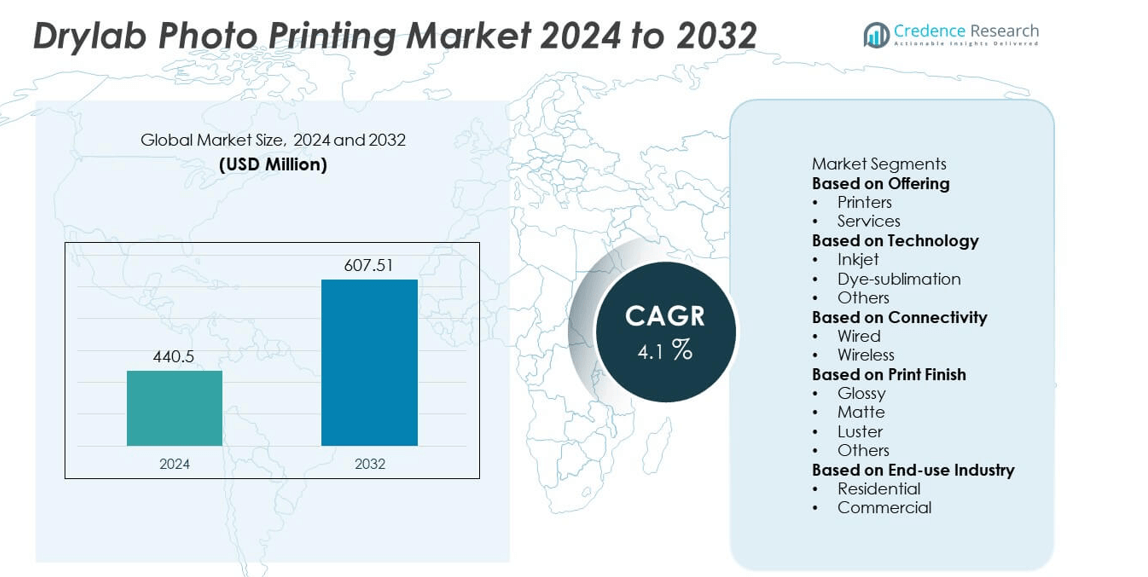

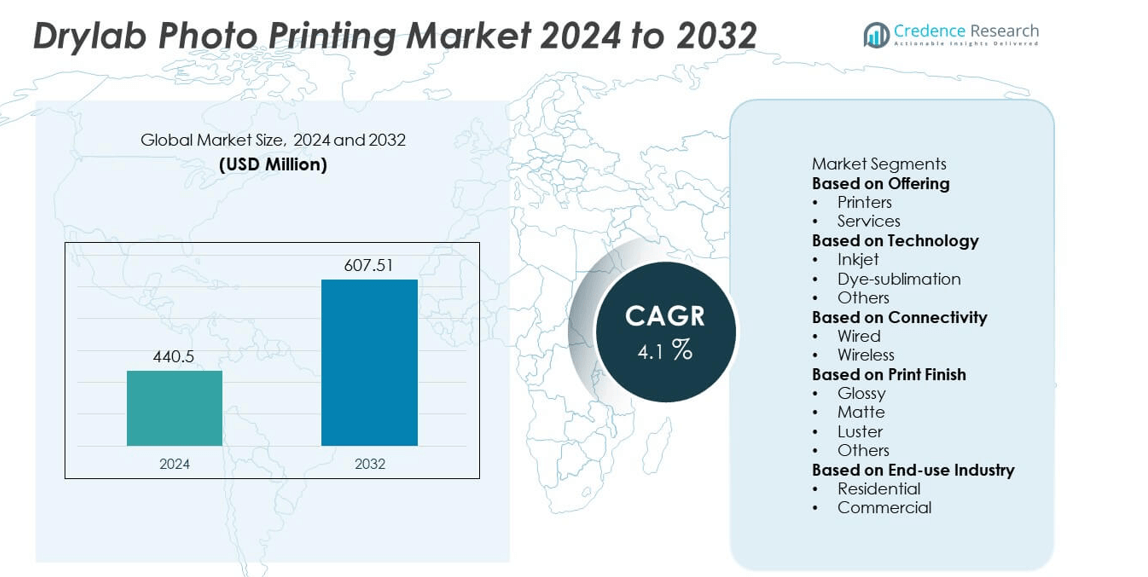

The Drylab Photo Printing market was valued at USD 440.5 million in 2024 and is projected to reach USD 607.51 million by 2032, growing at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drylab Photo Printing Market Size 2024 |

USD 440.5 million |

| Drylab Photo Printing Market, CAGR |

4.1% |

| Drylab Photo Printing Market Size 2032 |

USD 607.51 million |

The Drylab Photo Printing market is led by major players including Canon Inc., Fujifilm Corporation, Seiko Epson Corporation, Noritsu Precision Co. Ltd., Kodak Alaris Inc., Dai Nippon Printing Co. Ltd., Hiti Digital, Inc., Mitsubishi Electric Corporation, HP Inc., and Ricoh Company, Ltd. These companies are advancing high-speed, eco-friendly printing solutions with superior image quality and low maintenance. North America dominated the global market with a 34% share in 2024, supported by strong demand from professional studios and retail printing centers. Europe followed with a 29% share, driven by sustainable printing adoption and digital workflow integration, while Asia-Pacific accounted for 27%, fueled by growing photo customization trends and rapid commercial printing expansion.

Market Insights

- The Drylab Photo Printing market was valued at USD 440.5 million in 2024 and is projected to reach USD 607.51 million by 2032, growing at a CAGR of 4.1% during the forecast period.

- Growing demand for instant, high-quality photo printing from professional studios, retail outlets, and event photography services is driving market growth globally.

- Key trends include the rise of wireless and cloud-based printing, adoption of eco-friendly ink technologies, and increasing demand for personalized photo products.

- The market is competitive, with leading players such as Canon, Fujifilm, Epson, and Noritsu focusing on compact designs, improved print speed, and advanced color accuracy.

- North America leads the market with a 34% share, followed by Europe at 29% and Asia-Pacific at 27%, while by technology, the dye-sublimation segment dominates with 59% share due to its superior image durability and professional-grade print quality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

The printers segment dominated the Drylab Photo Printing market in 2024, holding a 68% share. This dominance is driven by the growing demand for compact, high-speed, and energy-efficient photo printers across professional studios and retail printing centers. Drylab printers provide superior image quality, reduced operational costs, and faster output compared to traditional wet lab systems. The increasing adoption of on-demand and instant printing in events, kiosks, and small businesses supports this segment’s growth. Meanwhile, the services segment is expanding steadily, driven by managed print services and maintenance contracts for commercial photo labs.

- For instance, Canon introduced the DreamLabo 5000 photo printer featuring a 7-color dye-based ink system and a maximum resolution of 2,400 × 1,200 dpi. The system produces up to 2,300 postcard-size prints per hour and handles media widths up to 12 inches, offering a high-speed and eco-efficient solution for professional and retail photo production.

By Technology

The dye-sublimation segment led the Drylab Photo Printing market in 2024 with a 59% share. Its leadership is attributed to high image durability, smooth gradation, and consistent color reproduction, making it the preferred choice for professional photographers and photo studios. Dye-sublimation technology offers faster printing speeds and reduced waste compared to inkjet systems. However, the inkjet segment is witnessing strong growth due to its flexibility in printing multiple formats, including matte and glossy finishes. The continuous improvement of pigment-based inks further enhances its competitiveness in high-resolution image printing applications.

- For instance, Fujifilm launched the Frontier-S DX100 inkjet printer, which uses a piezoelectric inkjet system. This printer can achieve speeds of up to 360 prints per hour at 1,440 × 720 dpi. The 6-color VIVIDIA ink system provides precise color gradation and enhanced image stability, enabling professional studios to create durable and fade-resistant photo prints on a variety of paper sizes up to 8 inches wide.

By Connectivity

The wired connectivity segment accounted for 54% share of the Drylab Photo Printing market in 2024. Its prominence stems from its reliability, stable data transmission, and suitability for high-volume commercial photo printing environments. Wired printers are widely used in professional studios and retail labs requiring uninterrupted operation and precise print management. However, the wireless segment is growing rapidly with the rise of mobile printing solutions and cloud-based workflows. Increasing adoption of Wi-Fi-enabled photo printers allows users to print directly from smartphones and digital cameras, driving flexibility and convenience in the modern printing landscape.

Key Growth Drivers

Growing Demand for Instant and High-Quality Photo Printing

The rising consumer preference for instant, high-resolution photo printing is a major growth driver for the Drylab Photo Printing market. Drylab systems offer superior color accuracy, fast output, and consistent print quality, making them ideal for professional studios, retail outlets, and event photography. The increasing use of photo booths, souvenir shops, and personalized printing services further accelerates adoption. Additionally, growing interest in customized photo products such as albums and photo gifts supports sustained market demand for advanced drylab printing solutions.

- For instance, Epson introduced its SureLab D1070 printer equipped with MicroPiezo AMC printhead technology and UltraChrome D6r-S ink, achieving a maximum resolution of 1,440 × 720 dpi.

Shift from Wet Lab to Eco-Friendly Drylab Systems

The global transition from traditional wet lab photo printing to chemical-free drylab systems is significantly boosting market growth. Drylab printers eliminate the use of hazardous chemicals, reduce water consumption, and generate less waste, aligning with sustainability goals. Their low maintenance requirements and reduced operational costs make them attractive to businesses seeking environmentally friendly and cost-efficient printing solutions. This shift toward eco-conscious operations, combined with regulatory pressures on chemical waste reduction, continues to strengthen the demand for drylab technology.

- For instance, Noritsu developed its QSS Green IV drylab printer that operates entirely without silver halide chemistry or water-based processing. The system’s maximum power consumption is 1,000 VA and it supports print widths up to 12 inches (305 mm).

Rising Adoption Across Retail and Commercial Printing Sectors

Expanding applications of drylab photo printing in retail and commercial sectors are driving market growth. Retail chains, kiosks, and online print-on-demand services are increasingly integrating compact drylab printers to offer instant, professional-quality prints. These systems support high-volume printing with minimal setup time, enhancing workflow efficiency and profitability. Furthermore, event photographers and small studios are adopting portable drylab solutions for on-site printing. The growing emphasis on digital printing and the rise of customized visual content have made drylab systems essential tools in the commercial printing ecosystem.

Key Trends & Opportunities

Integration of Wireless and Cloud-Based Printing Solutions

The rapid adoption of wireless and cloud-enabled printing technologies is reshaping the Drylab Photo Printing market. Wi-Fi-enabled printers allow seamless photo transfers from smartphones, cameras, and online platforms, improving user convenience and efficiency. Cloud-based systems enable remote management, real-time monitoring, and automated updates for large-scale printing operations. This trend supports the expansion of mobile and e-commerce printing businesses, allowing customers to order customized photo products online. As connectivity improves globally, manufacturers are focusing on developing smart, network-ready drylab systems to capture emerging digital printing opportunities.

- For instance, HP developed its SmartStream Production Pro Print Server integrated with HP Indigo digital presses, enabling simultaneous cloud-based job submission and print queue management

Growing Popularity of Personalized Photo Products

The surge in demand for personalized photo items such as calendars, greeting cards, and photo albums is creating new opportunities in the Drylab Photo Printing market. Consumers increasingly seek customized photo experiences for gifts and home décor, driving steady growth in on-demand printing. Businesses are responding by offering flexible print sizes, creative templates, and multi-format output options. Integration of drylab printers with digital design tools further enhances customization capabilities. This rising trend toward personalization, coupled with the expansion of online photo printing services, is boosting the market’s long-term growth potential.

- For instance, Mitsubishi Electric introduced its CP-M1A dye-sublimation printer designed for personalized printing applications, delivering 300 × 300 dpi output with color gradation up to 16.7 million tones. The printer produces a 4×6-inch photo in just 12.5 seconds and supports matte or glossy finishes without changing ribbons, enabling studios and retail outlets to deliver high-quality customized photo merchandise efficiently.

Key Challenges

High Equipment and Maintenance Costs

The initial investment required for drylab photo printers remains a key restraint for small businesses and independent photographers. High-end models with advanced printing capabilities and media compatibility demand substantial upfront costs. Additionally, ongoing maintenance, ink replacement, and software upgrades contribute to long-term operational expenses. These cost factors often limit adoption among price-sensitive users. While technological innovation continues to reduce costs over time, affordability remains a significant barrier to widespread market penetration, particularly in emerging economies with limited commercial printing infrastructure.

Competition from Digital Display Alternatives

The growing popularity of digital photo frames, online galleries, and social media sharing platforms poses a challenge to the Drylab Photo Printing market. Consumers are increasingly storing and viewing photos digitally, reducing the frequency of printed photographs. This shift in behavior impacts demand for physical prints, especially in consumer-oriented segments. To counter this trend, manufacturers are focusing on value-added printing applications such as event souvenirs, personalized gifts, and professional-grade photo services. However, the convenience and low cost of digital alternatives continue to challenge long-term growth in traditional photo printing markets.

Regional Analysis

North America

North America held a 34% share of the Drylab Photo Printing market in 2024. The region’s growth is driven by high demand for professional-quality photo printing and rapid adoption of digital printing technologies. The United States leads the market due to the widespread use of drylab printers in retail chains, photography studios, and event-based printing services. Rising popularity of personalized photo products and advancements in wireless printing further boost market expansion. Additionally, strong consumer spending on premium photo merchandise and increased presence of global printing brands support continued market growth.

Europe

Europe accounted for a 29% share of the Drylab Photo Printing market in 2024, supported by a strong base of professional photography studios and growing interest in sustainable printing technologies. Countries such as Germany, the U.K., and France are leading adopters of drylab systems due to their superior print quality and eco-friendly operation. The region benefits from the growing demand for customized photo printing and the expansion of e-commerce-based print-on-demand services. Technological advancements in inkjet and dye-sublimation systems also contribute to the region’s dominance in professional and retail photo printing markets.

Asia-Pacific

Asia-Pacific captured a 27% share of the Drylab Photo Printing market in 2024, driven by rapid urbanization and the expansion of the photography industry. Countries such as Japan, China, and India are experiencing increasing adoption of drylab printers in retail kiosks, wedding studios, and commercial printing setups. Growing middle-class income and rising consumer preference for customized photo gifts and albums are fueling demand. The region also benefits from the presence of major printing equipment manufacturers and ongoing digital transformation in imaging technology. Continuous innovation and cost-effective production further strengthen Asia-Pacific’s market position.

Latin America

Latin America held a 6% share of the Drylab Photo Printing market in 2024. The region’s growth is supported by expanding retail photo studios and rising adoption of digital printing solutions in countries such as Brazil and Mexico. Increasing demand for personalized printing services and event photography is stimulating equipment sales. However, limited technological infrastructure and high import costs restrain faster adoption. Partnerships between regional distributors and global printing brands are helping improve access to affordable printing solutions, supporting steady market development across residential and small-scale commercial sectors.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the Drylab Photo Printing market in 2024. Growth in the region is driven by the rising use of photo printing services in hospitality, tourism, and event sectors. The UAE and Saudi Arabia are leading markets, supported by the expansion of professional photo studios and retail printing outlets. Increasing investments in digital imaging and the introduction of compact, cost-effective printers are promoting market adoption. In Africa, gradual urban development and growing consumer awareness of digital printing benefits are contributing to long-term market potential.

Market Segmentations:

By Offering

By Technology

- Inkjet

- Dye-sublimation

- Others

By Connectivity

By Print Finish

- Glossy

- Matte

- Luster

- Others

By End-use Industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the Drylab Photo Printing market is defined by major players such as Canon Inc., Fujifilm Corporation, Seiko Epson Corporation, Noritsu Precision Co. Ltd., Kodak Alaris Inc., Dai Nippon Printing Co. Ltd., Hiti Digital, Inc., Mitsubishi Electric Corporation, HP Inc., and Ricoh Company, Ltd. These companies focus on enhancing print quality, speed, and color accuracy through advanced inkjet and dye-sublimation technologies. Strategic initiatives such as product innovation, partnerships, and expansion into emerging markets are central to maintaining competitiveness. Leading players are integrating IoT and cloud-based connectivity features to support mobile and on-demand printing services. Continuous improvements in compact printer design and sustainability are also shaping market direction. Intense competition, coupled with growing consumer demand for high-resolution, eco-friendly, and cost-efficient printing solutions, is driving innovation and consolidation within the global Drylab Photo Printing industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Canon Inc.

- Fujifilm Corporation

- Seiko Epson Corporation

- Noritsu Precision Co. Ltd.

- Kodak Alaris Inc.

- Dai Nippon Printing Co. Ltd.

- Hiti Digital, Inc.

- Mitsubishi Electric Corporation

- HP Inc.

- Ricoh Company, Ltd.

Recent Developments

- In July 2025, Fujifilm launched the Frontier DX400W compact inkjet printer, expanding its dry lab lineup for photofinishing.

- In 2025, Canon markets the DreamLabo 5000 digital photo printing system, which runs at 2,400 dpi and produces 2,300 prints of 6″ × 4″ size per hour.

- In 2023, Epson launched its SureLab D1070 High-Production Minilab printer. It is designed for retail, event and e-commerce applications, the drylab printer is built for high-volume photo and graphic production and engineered for reliable, high-performance printing

Report Coverage

The research report offers an in-depth analysis based on Offering, Technology, Connectivity, Print Finish, End-use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for instant and high-resolution photo printing will continue to grow across studios and retail outlets.

- Integration of wireless and cloud-based technologies will enhance workflow efficiency and connectivity.

- Dye-sublimation printers will remain preferred for professional-grade photo printing due to superior color quality.

- Compact and portable drylab printers will gain popularity among event photographers and small studios.

- Adoption of eco-friendly inks and chemical-free printing systems will increase with sustainability trends.

- Manufacturers will focus on automation and AI-driven color correction for improved output consistency.

- Expansion of online and mobile photo printing services will support market growth.

- Partnerships between printer manufacturers and retail chains will strengthen distribution networks.

- Rising consumer demand for personalized photo products will boost commercial printing applications.

- Emerging economies in Asia-Pacific will offer strong growth opportunities through retail and event-based printing demand.