Market Overview:

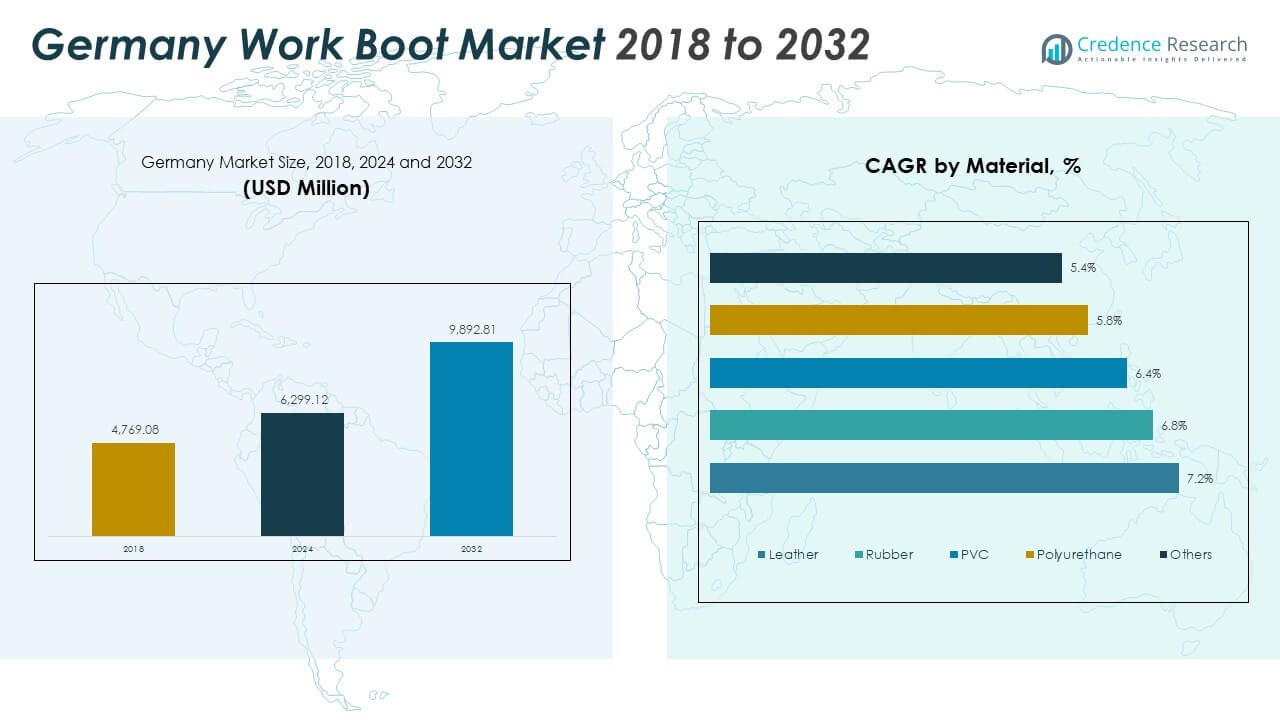

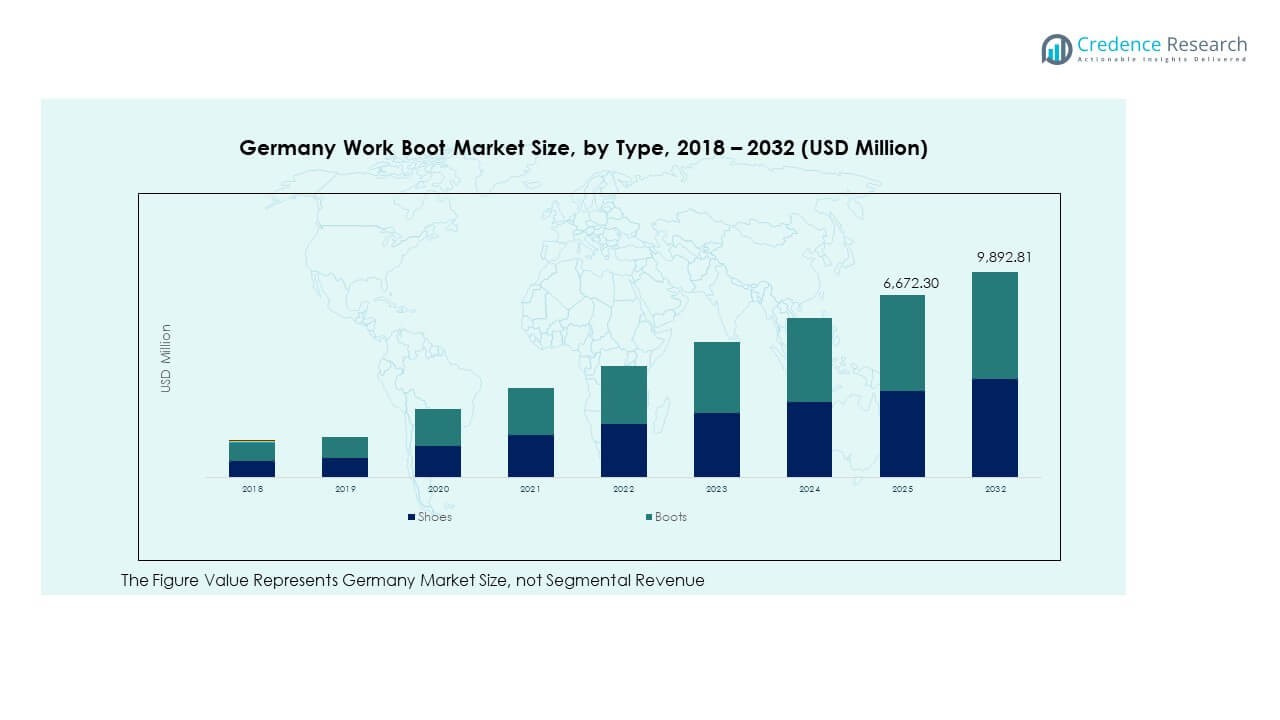

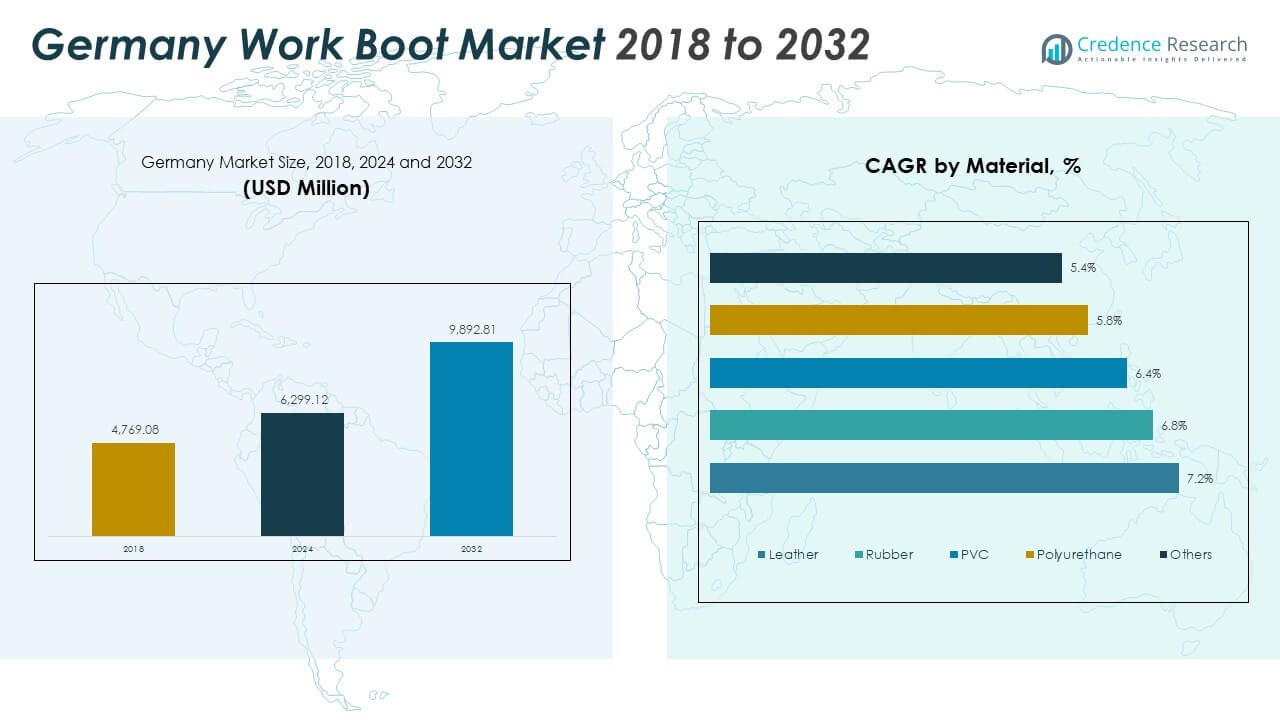

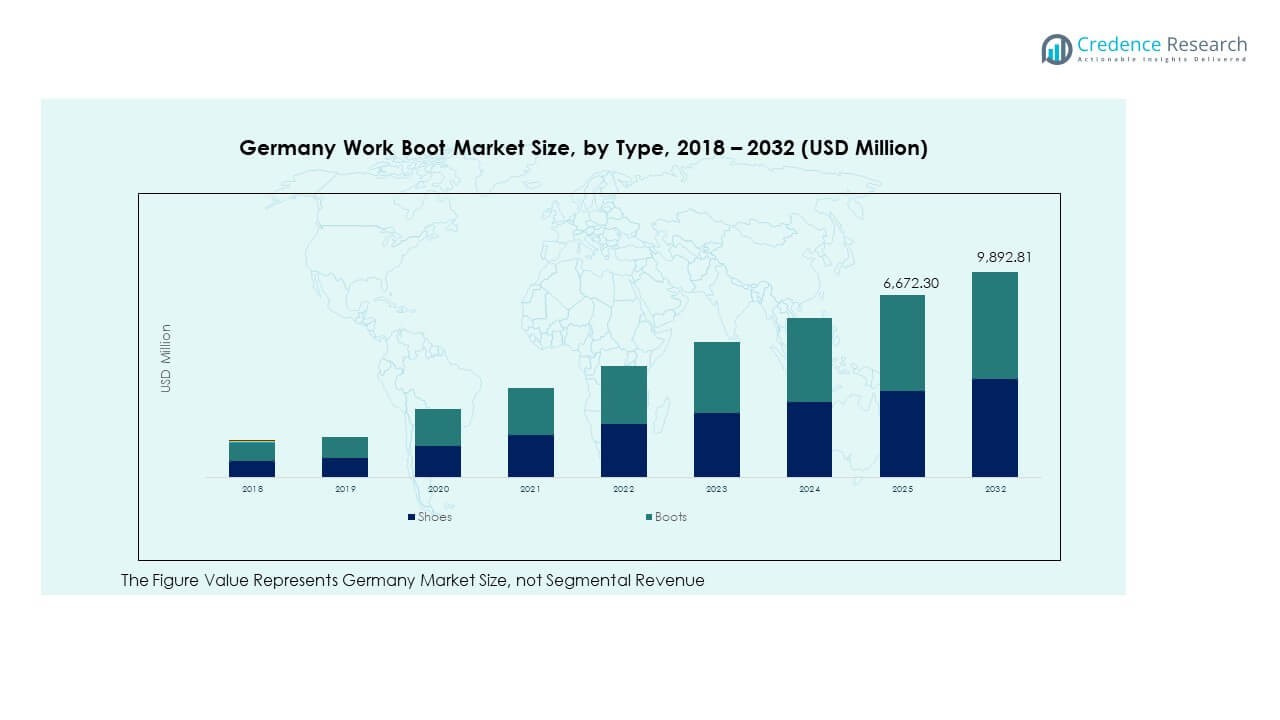

The Germany Work Boot Market size was valued at USD 4,769.08 million in 2018 to USD 6,299.12 million in 2024 and is anticipated to reach USD 9,892.81 million by 2032, at a CAGR of 5.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Work Boot Market Size 2024 |

USD 6,299.12 Million |

| Germany Work Boot Market, CAGR |

5.79% |

| Germany Work Boot Market Size 2032 |

USD 9,892.81 Million |

The market growth is driven by rising industrial safety standards, increasing construction activities, and strong demand from the manufacturing sector. Employers are investing in protective footwear to meet occupational safety regulations and reduce workplace injuries. The popularity of ergonomic and lightweight designs that provide both comfort and durability is boosting product adoption across various industries, including automotive, logistics, and mining. The expanding e-commerce sector is also improving accessibility and brand visibility for global and local manufacturers.

Regionally, Germany remains one of Europe’s leading markets for work boots due to its advanced industrial base and stringent safety norms. Neighboring countries such as France and the Netherlands show growing demand, supported by infrastructure development and increased industrial employment. Eastern European nations are emerging as potential growth hubs due to improving labor safety enforcement and foreign manufacturing investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Work Boot Market was valued at USD 4,769.08 million in 2018, reached USD 6,299.12 million in 2024, and is projected to hit USD 9,892.81 million by 2032, growing at a CAGR of 5.79%.

- Western Germany leads with 41% share due to its large industrial base and strong safety compliance. Southern Germany follows with 27%, supported by automotive and engineering sectors, while Northern Germany holds 18%, driven by port logistics and renewable energy projects.

- Eastern Germany, with a 14% share, is the fastest-growing region, supported by expanding manufacturing zones, infrastructure projects, and foreign industrial investments promoting safety gear adoption.

- By type, boots account for around 61% of total revenue, driven by demand from construction, oil, and chemical industries requiring higher safety protection.

- Shoes represent 39% share, preferred for comfort and mobility in logistics, services, and light industrial environments, contributing to steady segmental growth.

Market Drivers:

Rising Focus on Workplace Safety and Industrial Protection

The enforcement of stringent occupational safety regulations continues to drive demand in the Germany Work Boot Market. Industries such as construction, automotive, and logistics require certified safety footwear to protect workers from hazards like heavy machinery and slippery floors. The adoption of European EN ISO 20345 standards strengthens the need for protective boots with advanced features. Companies invest heavily in safety programs and quality gear to reduce injury rates and compensation costs. Rising awareness among workers about personal safety encourages voluntary usage of protective boots. Growth in infrastructure and energy projects further amplifies consumption across sectors. Employers now consider safety footwear an essential part of workplace compliance, driving consistent product demand.

- For instance, uvex Group launched EN ISO 20345:2022-certified safety footwear, promoting standards-compliant toe protection and puncture-resistant soles for industrial clients across Germany in 2024. Companies invest in high-quality gear to help reduce injury rates and improve compliance.

Increasing Industrialization and Expansion of Manufacturing Sector

Germany’s strong manufacturing and engineering base significantly supports market growth. The rise in industrial automation, logistics centers, and production facilities has created continuous demand for durable safety footwear. Work boots with anti-slip, anti-static, and oil-resistant properties are preferred across mechanical and production lines. The manufacturing sector’s focus on productivity and worker safety drives the replacement of outdated footwear with advanced models. The automotive and chemical industries, in particular, maintain high demand due to exposure to heavy materials and chemical risks. The growing adoption of technologically enhanced designs increases comfort and durability. The shift toward protective footwear in small and medium enterprises widens the consumer base. It sustains momentum for local and international manufacturers serving industrial customers.

- For instance, ELTEN GmbH, a major German manufacturer, reports increased production of anti-slip and specialty safety boots to meet demand in new logistics and manufacturing projects in 2024. The automotive and chemical industries in particular maintain high demand for advanced protective footwear

Technological Advancements Enhancing Comfort and Performance

Innovation in materials and design plays a major role in shaping market growth. Manufacturers use lightweight composites, breathable fabrics, and energy-absorbing soles to improve comfort. Advanced features such as waterproof membranes, steel or composite toe caps, and shock-absorbing midsoles raise performance standards. These developments make safety footwear more suitable for extended working hours and diverse environments. The growing trend of integrating ergonomic designs increases user satisfaction and compliance. Smart work boots with sensors that monitor posture and movement are emerging in specialized applications. It improves worker efficiency and reduces fatigue-related injuries. The shift toward premium and customizable products aligns with the evolving preferences of the German workforce.

Growth of E-Commerce and Changing Consumer Buying Behavior

Online retail platforms are transforming the distribution landscape for safety footwear. The accessibility of multiple brands and detailed product specifications attracts industrial buyers and individuals alike. Germany’s high internet penetration and preference for digital purchases have accelerated online sales. Manufacturers collaborate with e-commerce portals to expand visibility and reach small enterprises. The availability of virtual fitting tools and flexible return policies enhances customer confidence. It allows faster product comparisons and encourages repeat purchases. Online reviews and safety certifications help users make informed decisions. The combination of offline distribution and digital expansion ensures continuous growth momentum across the market.

Market Trends:

Rising Demand for Sustainable and Eco-Friendly Materials

The increasing focus on sustainability drives innovation in materials and manufacturing practices. Consumers and industries prefer eco-friendly work boots made from recycled or bio-based materials. Companies adopt cleaner production methods to reduce carbon emissions and waste generation. Brands highlight their environmental responsibility to attract environmentally conscious customers. Recyclable soles, solvent-free adhesives, and water-efficient processes are gaining popularity. The push for green certifications aligns with Germany’s strong environmental policies. It encourages manufacturers to adopt lifecycle-based product assessments and circular economy practices. This sustainability shift strengthens brand image and customer trust.

- For instance, Steitz Secura, a German work boot manufacturer, highlights eco-friendly lines utilizing recycled content and advanced energy-efficient production, verified on its company site. Engelbert Strauss, a major German supplier, offers collections featuring water-based adhesives and solvent-free finishes as part of its environmentally responsible footwear range. Industry adoption of cleaner production and recyclable materials aligns with Germany’s environmental policies.

Integration of Smart and Connected Footwear Technologies

The market is witnessing the emergence of smart work boots equipped with advanced technology. Embedded sensors can track worker movement, fatigue, and location in real time. These innovations help companies monitor workplace safety and compliance remotely. Bluetooth connectivity allows data transfer to mobile apps for analysis and alerts. The integration of temperature and pressure sensors enhances health and performance tracking. Manufacturers use such innovations to differentiate their products in a competitive market. It also supports predictive maintenance of footwear used in extreme environments. The trend reflects the growing digitalization of industrial safety management in Germany.

- For instance, ELTEN GmbH has launched safety footwear models that integrate sensor applications, enabling features like movement analysis and real-time safety status for workers, as found in their “Innovations and Visions” section. Haix, another leading manufacturer, offers advanced safety footwear with technology for monitoring hazardous workplace conditions and supporting worker protection in Germany.

Shift Toward Custom-Fitted and Ergonomic Work Boots

Personalization in fit and function is gaining traction among industrial workers. Consumers prefer boots designed to match specific work environments and comfort preferences. Advances in 3D scanning and digital modeling enable precise fitting solutions. The emphasis on ergonomics reduces strain and improves long-term foot health. Companies develop adjustable insoles and flexible materials for better comfort. Customization increases worker satisfaction and reduces fatigue-related incidents. It drives higher retention of protective gear in daily use. The Germany Work Boot Market benefits from this premiumization and customization trend.

Rising Influence of Fashion and Lifestyle in Industrial Footwear

Work boots are increasingly merging safety features with contemporary design. Younger workers prefer stylish options that offer both protection and aesthetics. The blending of performance and casual styling expands use beyond workplaces. Brands introduce color variations, sleeker profiles, and urban-inspired collections. Celebrity endorsements and lifestyle marketing campaigns strengthen market appeal. Retailers highlight safety boots as multipurpose products suitable for outdoor and casual use. It attracts new customer segments and supports higher retail visibility. The market’s evolving design perception enhances long-term consumer engagement.

Market Challenges Analysis:

High Production Costs and Price Sensitivity Among Buyers

Manufacturing high-quality safety footwear requires investment in advanced materials and strict quality testing. Compliance with European safety standards increases production complexity and costs. Many local manufacturers face margin pressures due to raw material price fluctuations. Buyers in small and medium industries remain price-sensitive, limiting their willingness to pay for premium products. Imported low-cost alternatives from Asia intensify competition in domestic markets. Maintaining quality while offering affordable pricing remains a persistent challenge. It restricts profitability and innovation budgets for several smaller players. The market faces an ongoing need to balance cost efficiency with high safety standards.

Supply Chain Disruptions and Slow Adoption of New Technologies

The global supply chain instability has affected material availability and delivery schedules. Delays in leather, rubber, and composite imports hinder consistent production cycles. Many manufacturers struggle to integrate automation and digital tools due to high initial investments. Traditional factories rely on manual assembly, limiting scalability and efficiency. The slow pace of technological adoption affects production flexibility and response to demand shifts. The dependency on foreign raw material suppliers exposes companies to global market fluctuations. It increases the risk of production delays and operational costs. The Germany Work Boot Market continues to face pressure to modernize its supply networks and production systems.

Market Opportunities:

Expansion into Green Manufacturing and Sustainable Innovation

Manufacturers can leverage Germany’s environmental leadership to promote sustainable work boots. The use of bio-based materials and renewable energy in production improves brand perception. Companies investing in recyclable designs can attract environmentally responsible consumers. Collaborations with eco-certification bodies strengthen product credibility. The growing demand for green safety footwear across Europe supports export potential. It enables brands to differentiate themselves in a highly competitive market.

Adoption of Digital Platforms and Direct-to-Consumer Sales

Expanding online distribution creates new growth prospects for safety footwear brands. Direct-to-consumer models allow higher margins and personalized engagement. E-commerce enables smaller manufacturers to reach diverse industrial segments efficiently. Digital marketing, 3D visualization, and augmented fitting tools enhance customer interaction. The combination of data analytics and targeted advertising improves sales conversion. It strengthens brand visibility and customer loyalty across the Germany Work Boot Market.

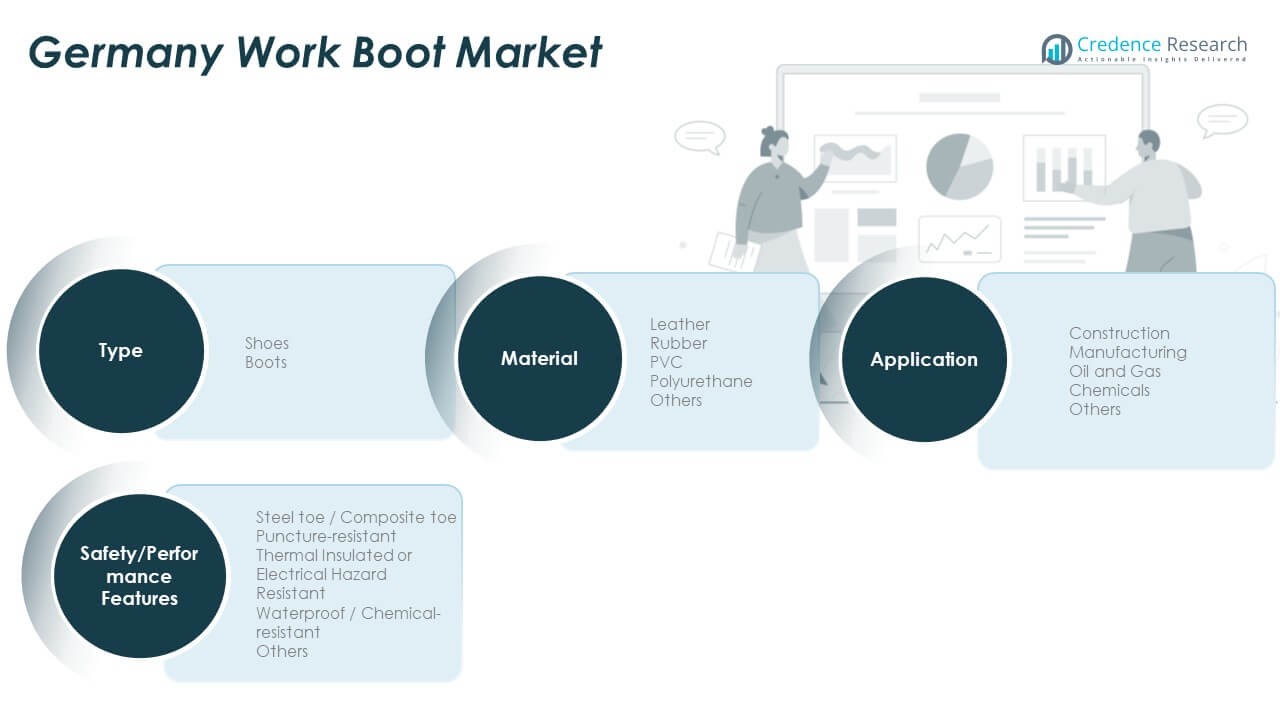

Market Segmentation Analysis:

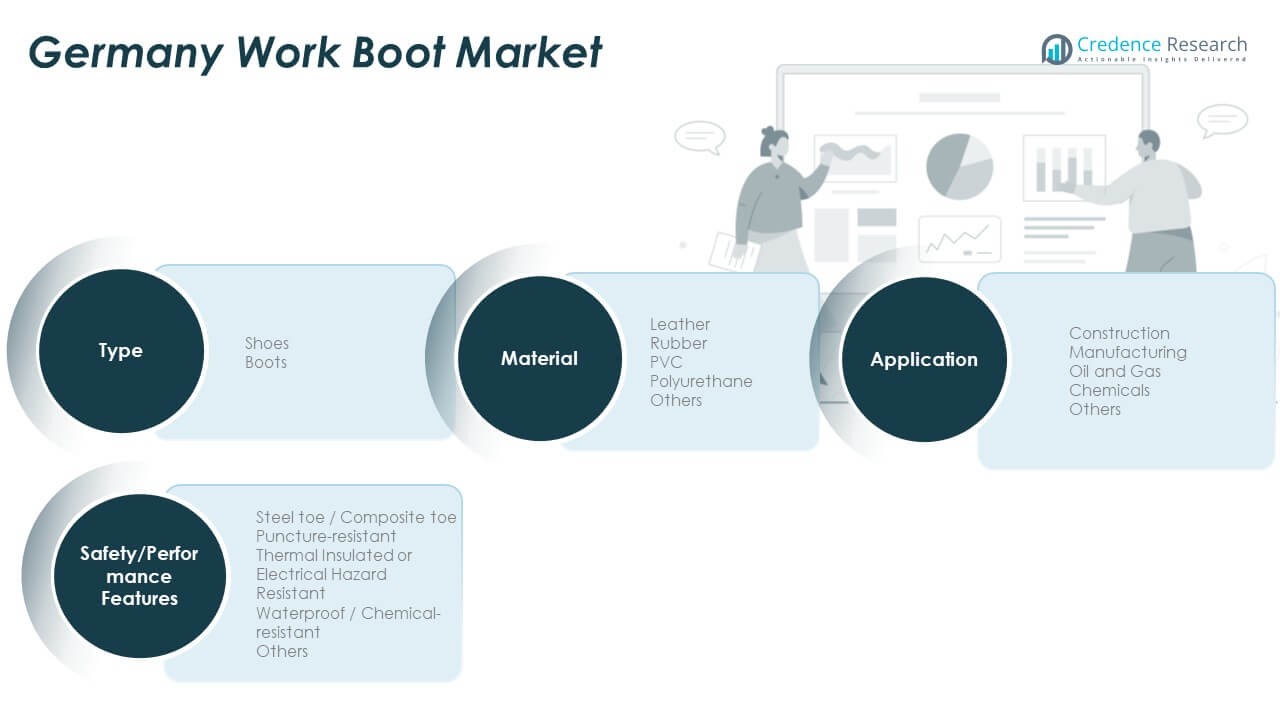

By Type

The Germany Work Boot Market is segmented into shoes and boots. Boots dominate due to their higher protection level and suitability for heavy industrial use. They offer enhanced durability, ankle support, and resistance to impact, making them preferred in construction and manufacturing sectors. Shoes, while lighter, are gaining demand among logistics and service workers seeking comfort and mobility. The availability of both categories ensures broad applicability across industrial and commercial workplaces. It reflects the market’s adaptability to varying safety and comfort requirements.

- For instance, Atlas Schuhfabrik, a well-established safety boot manufacturer, reports boots as its highest-selling category among construction and manufacturing clients in Germany. Shoes, while lighter, continue to gain share in logistics and service sectors, with leading companies including uvex and Elten offering lightweight, certified safety shoes for broader industrial applications.

By Application

Key applications include construction, manufacturing, oil and gas, chemicals, and others. Construction leads due to high demand for safety-compliant footwear on hazardous sites. Manufacturing follows, supported by Germany’s strong industrial base. The oil and gas and chemical sectors prefer boots with chemical-resistant and anti-slip features. Other sectors such as logistics and maintenance also contribute to steady adoption across industries.

- For instance, BASF’s site highlights the supply of polyurethane materials for such footwear in hazardous environments. Logistics and service industries also drive steady demand, supported by offerings from uvex and Engelbert Strauss tailored for warehousing and maintenance clients.

By Material

Segments include leather, rubber, PVC, polyurethane, and others. Leather remains the most preferred due to its strength, comfort, and longevity. Rubber and polyurethane gain traction for waterproof and shock-absorbing properties. PVC appeals to low-cost, lightweight applications. It highlights the material diversification supporting user needs across varying work environments.

By Safety/Performance Features

Features include steel toe or composite toe, puncture-resistant, thermal insulated or electrical hazard resistant, waterproof or chemical-resistant, and others. Steel toe and composite toe dominate industrial demand, offering reliable impact protection. Waterproof and insulated variants are increasingly used in outdoor and extreme environments. The segment reflects ongoing product innovation focusing on worker safety and functionality.

Segmentation:

By Type

By Application

- Construction

- Manufacturing

- Oil and Gas

- Chemicals

- Others

By Material

- Leather

- Rubber

- PVC

- Polyurethane

- Others

By Safety/Performance Features

- Steel Toe / Composite Toe

- Puncture-Resistant

- Thermal Insulated or Electrical Hazard Resistant

- Waterproof / Chemical-Resistant

- Others

Regional Analysis:

Western Germany – Industrial Core and Dominant Revenue Contributor

Western Germany holds the largest share of the Germany Work Boot Market, accounting for nearly 41% of total revenue in 2024. The region’s dominance stems from its concentration of heavy industries, including automotive, machinery, and construction. Cities such as North Rhine-Westphalia and Hesse host major manufacturing clusters that drive consistent demand for protective footwear. Strong enforcement of occupational safety laws encourages employers to invest in certified safety boots. High workforce density and frequent industrial expansion sustain long-term consumption. It benefits from strong distribution networks and the presence of leading European footwear brands that enhance market accessibility.

Southern Germany – Technological Hub with High Safety Standards

Southern Germany represents about 27% of the market share, driven by strong industrial infrastructure and advanced engineering sectors. Bavaria and Baden-Württemberg lead in adopting innovative, ergonomic, and lightweight safety footwear. The region’s focus on precision manufacturing, automotive production, and renewable energy projects sustains high demand for durable and comfortable work boots. The growing number of SMEs in the region further accelerates safety footwear adoption. Strict workplace safety regulations and the popularity of smart, connected work gear reinforce product innovation. It maintains a steady growth trajectory due to high spending on worker protection and technological upgrades in industrial operations.

Northern and Eastern Germany – Emerging Hubs with Expanding Opportunities

Northern and Eastern Germany collectively account for about 32% of the total market share, showing rapid growth potential. These regions benefit from expanding construction, logistics, and energy projects, particularly near port and industrial zones. Investments in public infrastructure and renewable energy create new safety gear requirements. Growing participation of foreign manufacturers supports market diversification and local employment. Increased government focus on workplace safety standards encourages adoption of affordable, high-performance boots. It is becoming a significant growth frontier for both domestic and international suppliers seeking to expand in cost-sensitive markets. The steady improvement of industrial capacity and supply chains supports long-term regional expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Germany Work Boot Market features a competitive environment dominated by established safety footwear manufacturers. Key players such as Bata Industrials, Uvex Safety, Engelbert Strauss, and Elten focus on product innovation, ergonomic design, and compliance with European safety standards. Global brands like Puma Safety and Red Wing Shoes maintain strong visibility through retail and industrial channels. It remains driven by technology integration, durable material innovation, and sustainability efforts. Local companies gain advantage through regional distribution networks and customer-focused customization. Strategic partnerships and continuous R&D investment strengthen product differentiation and long-term competitiveness.

Recent Developments:

- In July 2025, Uvex, a renowned German protective equipment provider, entered a transformative stage by announcing that global private equity firm Warburg Pincus would acquire a majority interest in the company. The Winter and Grau families will retain a considerable minority stake and remain active in the business. The partnership aims to accelerate Uvex’s global growth, expand its international reach, and drive innovation and mergers within safety footwear and PPE markets.

- In March 2025, Bata Group made a significant move by opening its first retail store in Germany at the Isenburg Zentrum in Frankfurt. The launch not only introduces German consumers to Bata’s global work and safety footwear range but also aligns with a broader Spring/Summer 2025 collection, combining modern design with heritage craftsmanship to enhance its market presence in Germany.

Report Coverage:

The research report offers an in-depth analysis based on type, application, material, and safety/performance features. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for lightweight, ergonomic, and breathable safety boots will expand.

- Manufacturers will adopt eco-friendly materials to align with green regulations.

- Smart footwear with sensor integration will enter industrial applications.

- E-commerce will remain a vital channel for sales and brand expansion.

- Domestic brands will strengthen export potential across the EU.

- Replacement demand will increase with stricter occupational safety norms.

- Custom-fit and gender-specific designs will gain traction.

- Research on advanced polymers will improve durability and flexibility.

- Market competition will intensify through innovation-driven collaborations.

- Industrial modernization will keep long-term growth steady and sustainable.