Market Overview

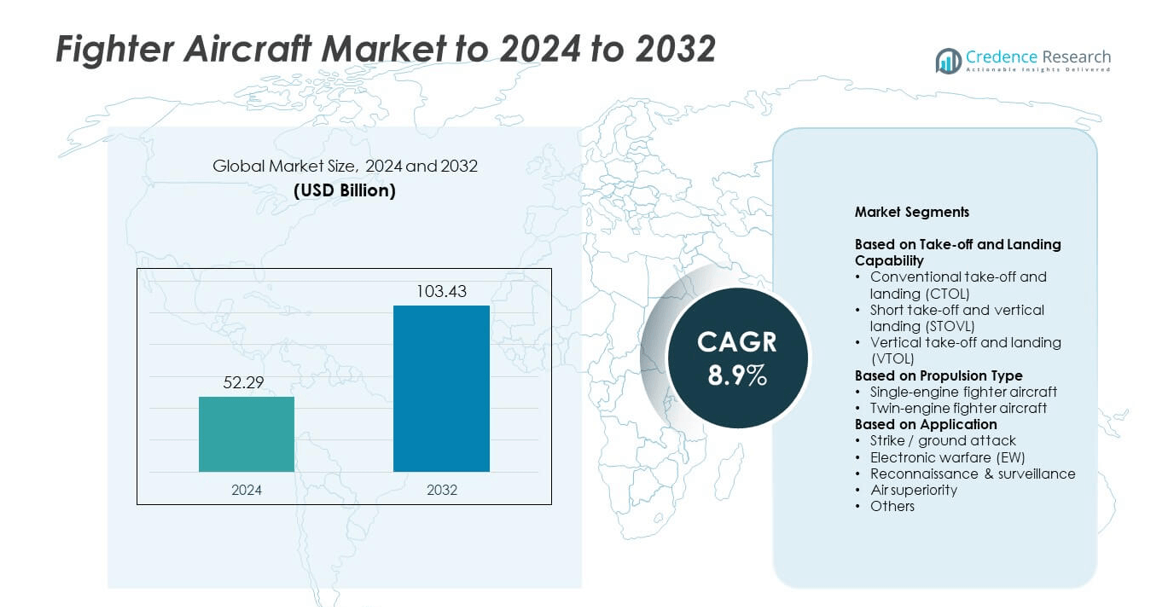

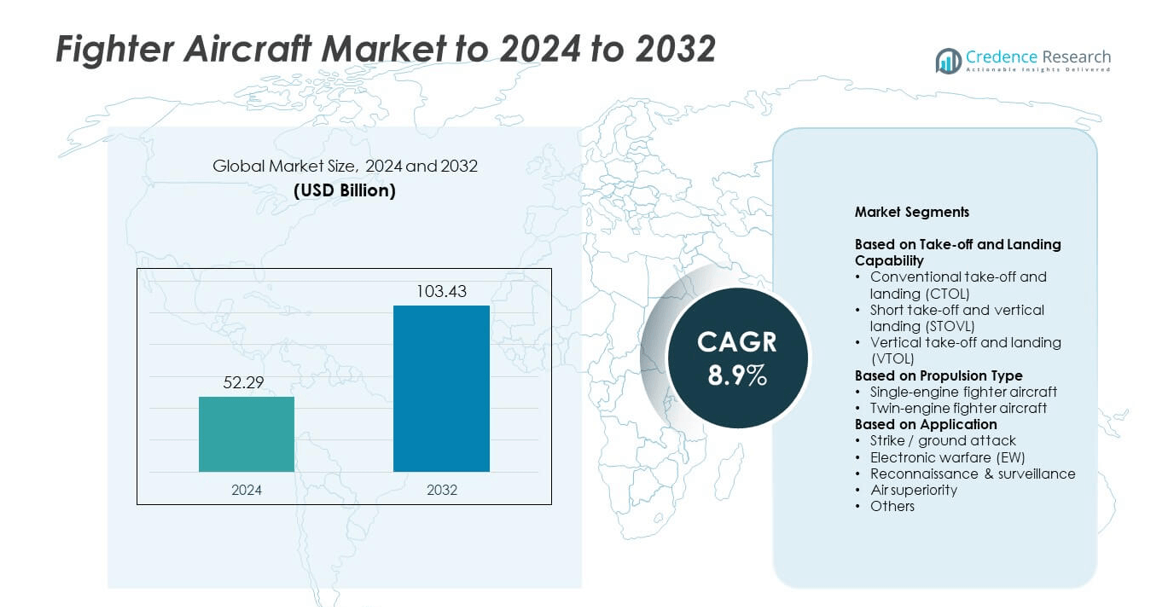

Fighter Aircraft Market size was valued at USD 52.29 Billion in 2024 and is anticipated to reach USD 103.43 Billion by 2032, at a CAGR of 8.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fighter Aircraft Market Size 2024 |

USD 52.29 Billion |

| Fighter Aircraft Market, CAGR |

8.9% |

| Fighter Aircraft Market Size 2032 |

USD 103.43 Billion |

The Fighter Aircraft Market is led by major players including Boeing, Dassault Aviation, Hindustan Aeronautics, Saab Group, Leonardo, Lockheed Martin, Airbus, Korea Aerospace Industries, and BAE Systems. These companies focus on advanced stealth design, next-generation avionics, and AI-driven combat systems to enhance operational efficiency and survivability. Strategic alliances, joint production programs, and export partnerships strengthen their global presence. North America emerged as the leading region, holding a 38% market share in 2024, supported by high defense expenditure and continuous modernization of fighter fleets. Europe and Asia-Pacific follow, driven by rising procurement and indigenous fighter programs.

Market Insights

- The Fighter Aircraft Market was valued at USD 52.29 Billion in 2024 and is expected to reach USD 103.43 Billion by 2032, growing at a CAGR of 8.9%.

- Rising defense budgets, fleet modernization, and advancements in stealth and AI-based avionics are driving market expansion.

- Trends such as the adoption of fifth and sixth-generation aircraft, AI-driven combat systems, and hypersonic weapon integration are reshaping air warfare capabilities.

- The market is competitive with key players focusing on innovation, collaborations, and joint production programs to enhance global reach and cost efficiency.

- North America leads with a 38% share, followed by Europe at 27% and Asia-Pacific at 24%, while the twin-engine segment dominates with 68% share due to its superior range, endurance, and operational flexibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Take-off and Landing Capability

The conventional take-off and landing (CTOL) segment dominated the Fighter Aircraft Market with a 62% share in 2024. Its dominance is driven by widespread use across air forces due to lower operational complexity, cost efficiency, and compatibility with existing runways. CTOL fighters such as the F-15EX and Rafale remain preferred for high-speed interception and long-range missions. Advancements in runway-assisted take-off systems and enhanced avionics further strengthen this segment. Growing fleet modernization programs across the U.S., India, and Europe continue to reinforce the CTOL category’s leadership globally.

- For instance, GE Aerospace’s F110-GE-129 engine is a 29,000-lb thrust class powering CTOL F-15EX variants.

By Propulsion Type

The twin-engine fighter aircraft segment accounted for 68% of the market share in 2024, leading due to its superior power, endurance, and combat survivability. Twin-engine models like the F-15EX, Su-35, and Rafale deliver higher thrust-to-weight ratios and better redundancy during missions. These aircraft are preferred for heavy payloads and long-range missions, supporting multi-role combat operations. Increasing adoption by major defense forces and integration of advanced radar systems, stealth coatings, and AI-based control systems continue to drive growth within the twin-engine fighter segment worldwide.

- For instance, Dassault Aviation reported a Rafale backlog of 220 aircraft as of Dec 31, 2024.

By Application

The air superiority segment held the largest market share of 47% in 2024, driven by ongoing emphasis on air dominance in modern warfare. Advanced fighters like the F-22 Raptor and Eurofighter Typhoon lead in this category, offering enhanced agility, radar evasion, and network-centric warfare capabilities. The demand for 5th and 6th generation aircraft supporting real-time situational awareness and multi-domain operations fuels this segment’s growth. Rising defense budgets and strategic upgrades to maintain aerial supremacy reinforce the air superiority category’s commanding position in the global market.

Key Growth Drivers

Rising Defense Expenditure and Modernization Programs

Global defense budgets are increasing as nations prioritize military modernization to strengthen air combat capabilities. Countries such as the U.S., China, and India are heavily investing in advanced fighter programs featuring stealth, hypersonic weapons, and AI-driven systems. Governments are replacing legacy fleets with multirole fighters to enhance operational readiness and interoperability. This continuous procurement and upgrade activity drives strong demand for next-generation aircraft, ensuring steady market growth across both developed and emerging defense economies.

- For instance, Boeing’s F-15EX program is capped at 98 aircraft in the FY-2025 plan.

Advancements in Stealth and Sensor Technologies

Integration of stealth design and next-generation sensors is reshaping air combat operations. Modern fighters like the F-35 and J-20 use low-observable structures, radar-absorbing materials, and sensor fusion for superior situational awareness. Enhanced radar and electronic warfare systems improve survivability and precision targeting. These advancements increase demand for technologically advanced aircraft that can operate effectively in contested environments, supporting global air dominance strategies.

- For instance, Raytheon has delivered 700+ AN/APG-79 AESA radars for Super Hornet/Growler fleets.

Rising Geopolitical Tensions and Strategic Partnerships

Growing regional conflicts and border tensions are prompting rapid procurement of advanced fighters. Strategic alliances and defense collaborations between countries such as the U.S.–Japan and India–France are boosting co-development and technology transfers. Joint production programs enhance local manufacturing capabilities while reducing dependency on imports. Such initiatives not only strengthen national defense but also expand the global fighter aircraft market footprint through long-term procurement deals.

Key Trends and Opportunities

Shift Toward Multirole and 5th Generation Fighters

Air forces are moving toward multirole platforms capable of performing diverse missions, including strike, surveillance, and electronic warfare. Fifth-generation aircraft offer stealth, supercruise, and advanced communication systems that improve combat effectiveness. The shift toward flexible, high-performance fighters allows defense forces to reduce costs and improve mission adaptability. This trend is expanding opportunities for manufacturers focusing on modular design and hybrid mission configurations.

- For instance, Airbus secured a contract in June 2020 for the development, supply, and integration of 115 CAPTOR-E E-Scan radars for the German and Spanish Eurofighter fleets.

Integration of AI and Digital Combat Systems

Artificial intelligence is transforming fighter aircraft capabilities by enabling predictive maintenance, threat detection, and autonomous mission management. AI-driven avionics improve decision-making speed and reduce pilot workload during complex missions. Integration with digital twin systems enhances aircraft design and operational performance. The growing focus on AI and real-time data fusion is creating lucrative opportunities for defense contractors specializing in advanced software and simulation systems.

- For instance, Northrop Grumman has delivered 1,400+ F-35 center fuselages, with a 30-hour takt per fuselage at Palmdale’s IAL.

Key Challenges

High Development and Procurement Costs

Developing next-generation fighters involves heavy investment in R&D, materials, and testing infrastructure. The high unit cost of platforms like the F-35 limits acquisition by smaller nations, reducing overall market accessibility. Budget constraints and long production cycles further delay procurement programs. Manufacturers face challenges in balancing cost efficiency with advanced technology integration while meeting the performance and safety standards required by global defense agencies.

Complex Maintenance and Supply Chain Limitations

Fighter aircraft require advanced maintenance systems and continuous component upgrades to remain combat-ready. Dependence on global suppliers for precision parts and electronic systems exposes programs to supply chain risks. Delays in spare part availability can affect operational readiness and mission reliability. Ensuring sustained performance amid complex logistics and limited skilled workforce remains a major challenge for both operators and manufacturers.

Regional Analysis

North America

North America held the largest share of 38% in the Fighter Aircraft Market in 2024. The United States drives regional dominance through massive defense budgets, advanced R&D programs, and ongoing modernization of fleets such as the F-22 and F-35. Canada also contributes with upgrades to its CF-18 fleet and participation in international fighter programs. High investments in stealth technology, AI-based avionics, and precision weapon systems continue to strengthen regional leadership. Strong industrial collaboration between defense contractors and government agencies sustains North America’s competitive advantage in next-generation fighter production.

Europe

Europe accounted for 27% of the global market share in 2024, supported by major programs like the Eurofighter Typhoon and France’s Rafale. Increasing cross-border defense collaboration through projects such as the Future Combat Air System (FCAS) and Tempest is driving technological innovation. Countries including the UK, France, Germany, and Italy are investing in multirole fighters with enhanced stealth and electronic warfare features. Rising geopolitical tensions in Eastern Europe further accelerate procurement. Continuous modernization of NATO air fleets reinforces Europe’s position as a key region in advanced fighter aircraft development.

Asia-Pacific

Asia-Pacific captured a 24% market share in 2024, driven by expanding defense capabilities in China, India, Japan, and South Korea. China leads with indigenous developments like the J-20 and J-31, while India advances through the Tejas program and collaborations with global manufacturers. Japan’s F-X and South Korea’s KF-21 Boramae projects highlight strong regional innovation. Rapid military modernization, rising territorial disputes, and growing defense budgets propel demand. Increasing partnerships and local production initiatives strengthen Asia-Pacific’s position as the fastest-growing region in the fighter aircraft market.

Middle East & Africa

The Middle East & Africa region accounted for 7% of the market share in 2024, supported by modernization programs in Saudi Arabia, the UAE, and Israel. Nations are expanding their fleets with advanced fighters like the F-15, Rafale, and F-35 to enhance air defense capabilities. Rising geopolitical conflicts and regional security challenges drive procurement. Defense partnerships with the U.S. and European countries promote technology transfer and training programs. Strategic investments in airpower and modernization of legacy aircraft sustain regional growth in the coming years.

Latin America

Latin America held a 4% market share in 2024, driven by gradual fleet upgrades and limited procurement initiatives. Brazil leads with its Gripen E program, supporting indigenous manufacturing and regional defense capability. Countries such as Chile and Colombia are exploring modernization plans to enhance air defense readiness. Although budget constraints limit large-scale acquisitions, growing regional collaboration and economic recovery are improving procurement potential. Continuous efforts toward upgrading multirole fighters and establishing defense partnerships are expected to create moderate growth opportunities across Latin America’s fighter aircraft market.

Market Segmentations:

By Take-off and Landing Capability

- Conventional take-off and landing (CTOL)

- Short take-off and vertical landing (STOVL)

- Vertical take-off and landing (VTOL)

By Propulsion Type

- Single-engine fighter aircraft

- Twin-engine fighter aircraft

By Application

- Strike / ground attack

- Electronic warfare (EW)

- Reconnaissance & surveillance

- Air superiority

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fighter Aircraft Market is highly competitive, led by major players such as Boeing, Dassault Aviation, Hindustan Aeronautics, Saab Group, Leonardo, Lockheed Martin, Airbus, Korea Aerospace Industries, and BAE Systems. The market is characterized by strong technological innovation, large-scale defense contracts, and long-term government partnerships. Companies focus on advanced avionics, stealth capabilities, and sensor fusion technologies to enhance combat performance. Strategic collaborations, joint development programs, and export agreements strengthen their global presence. Continuous investments in research and manufacturing modernization enable faster production cycles and cost efficiency. Market participants are also emphasizing indigenous manufacturing and aftersales support to meet regional defense procurement policies. Growing competition from emerging defense manufacturers and increasing demand for multirole aircraft are driving further innovation and platform upgrades across all generations of fighter jets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boeing

- Dassault Aviation

- Hindustan Aeronautics

- Saab Group

- Leonardo

- Lockheed Martin

- Airbus

- Korea Aerospace Industries

- BAE Systems

Recent Developments

- In 2025, Boeing delivered the ninth new F-15EX Eagle II fighter jet to the Oregon Air National Guard’s 142nd Fighter Wing.

- In 2024, Lockheed Martin (USA) Delivered 110 F-35s, a number that included newly produced jets and those previously put into storage awaiting TR-3 fixes.

- In 2023, Saab Group (Sweden) Partnered with Embraer in Brazil to establish a joint final assembly line for the Gripen fighter jet in Brazil, aiming to expand its market presence in South America.

Report Coverage

The research report offers an in-depth analysis based on Take-off and Landing Capability, Propulsion Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fifth and sixth-generation fighters will grow with rising global defense modernization.

- Integration of AI and machine learning will enhance real-time decision-making in combat missions.

- Stealth technology adoption will expand across both developed and emerging defense programs.

- Nations will prioritize indigenous fighter production to reduce import dependency and boost self-reliance.

- Increased focus on multirole platforms will improve operational flexibility and cost efficiency.

- Hypersonic weapons integration will redefine future air superiority and strike capabilities.

- Cross-border defense collaborations will drive joint fighter development programs.

- Electric and hybrid propulsion research will emerge for enhanced fuel efficiency and sustainability.

- Upgrades to avionics and sensor fusion systems will improve situational awareness and mission accuracy.

- Defense budgets will continue to rise, supporting large-scale fleet expansion and technological innovation.