Market Overview:

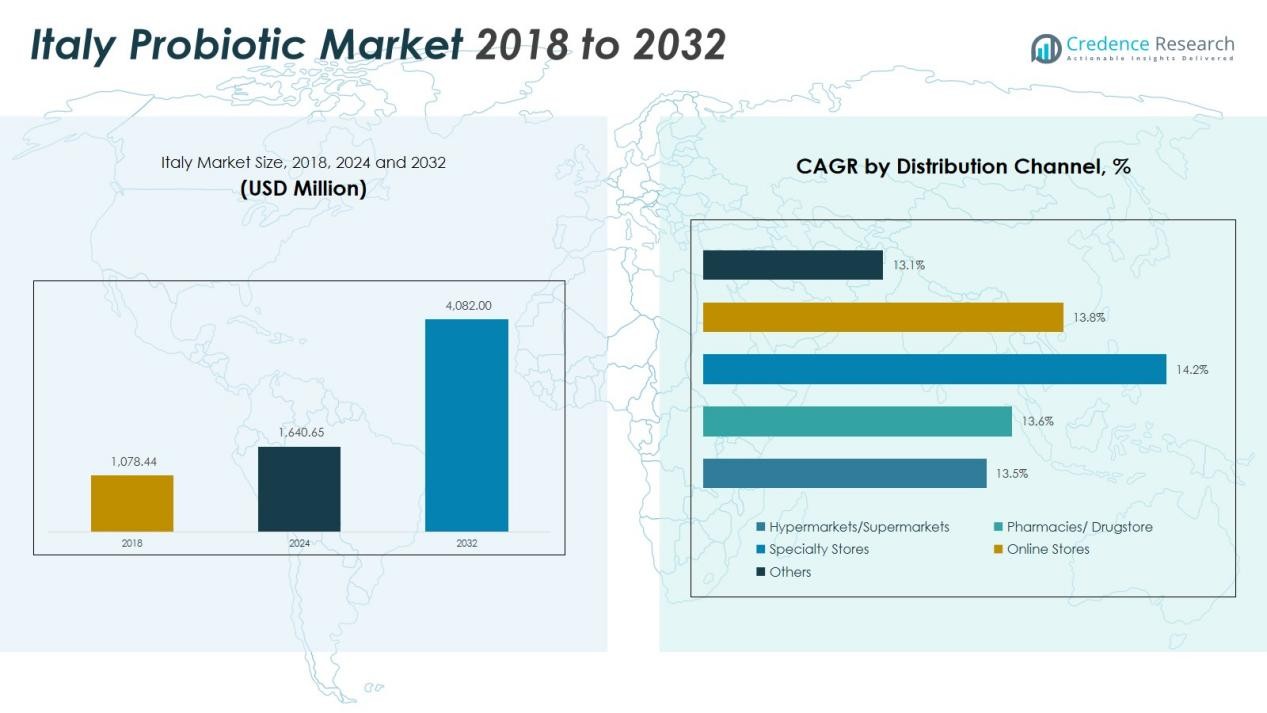

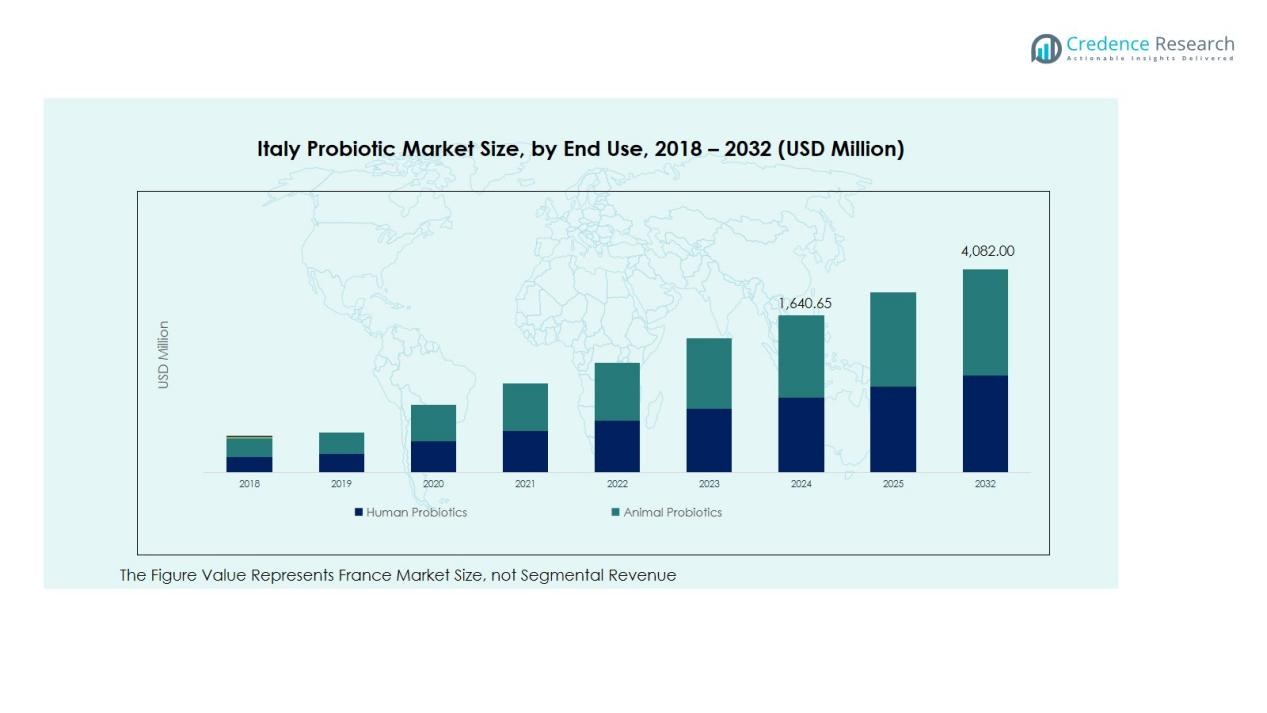

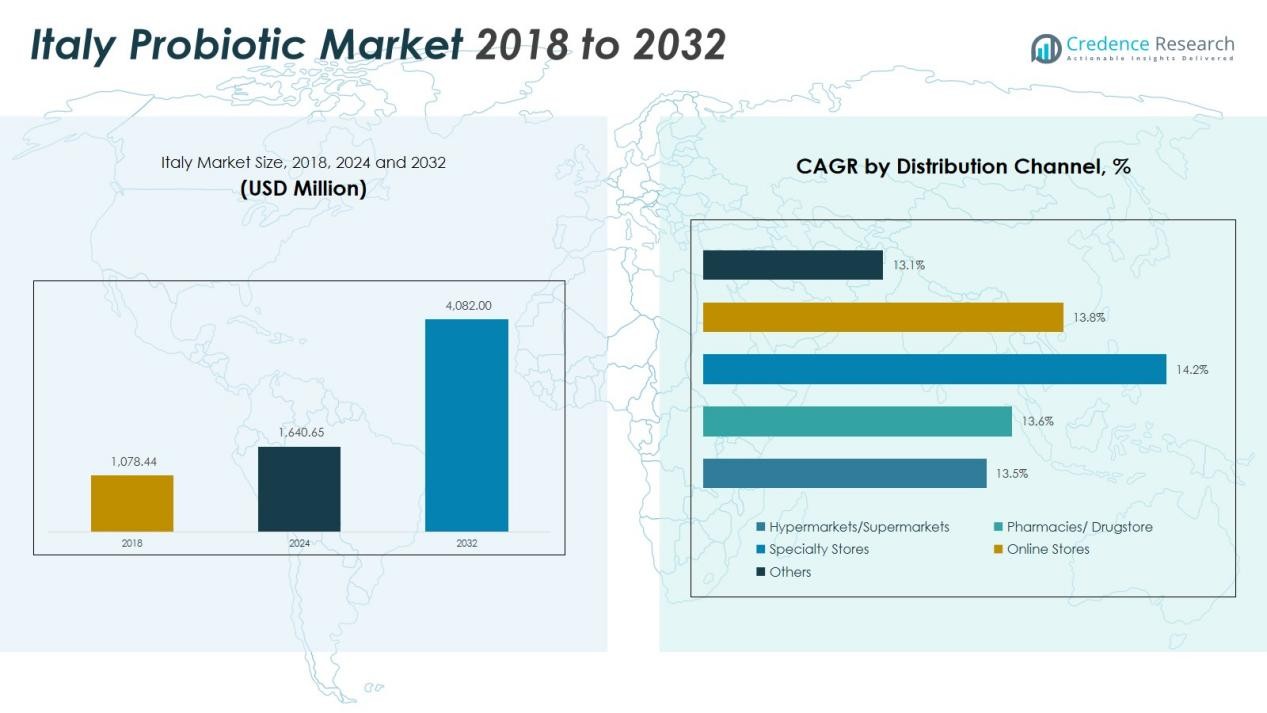

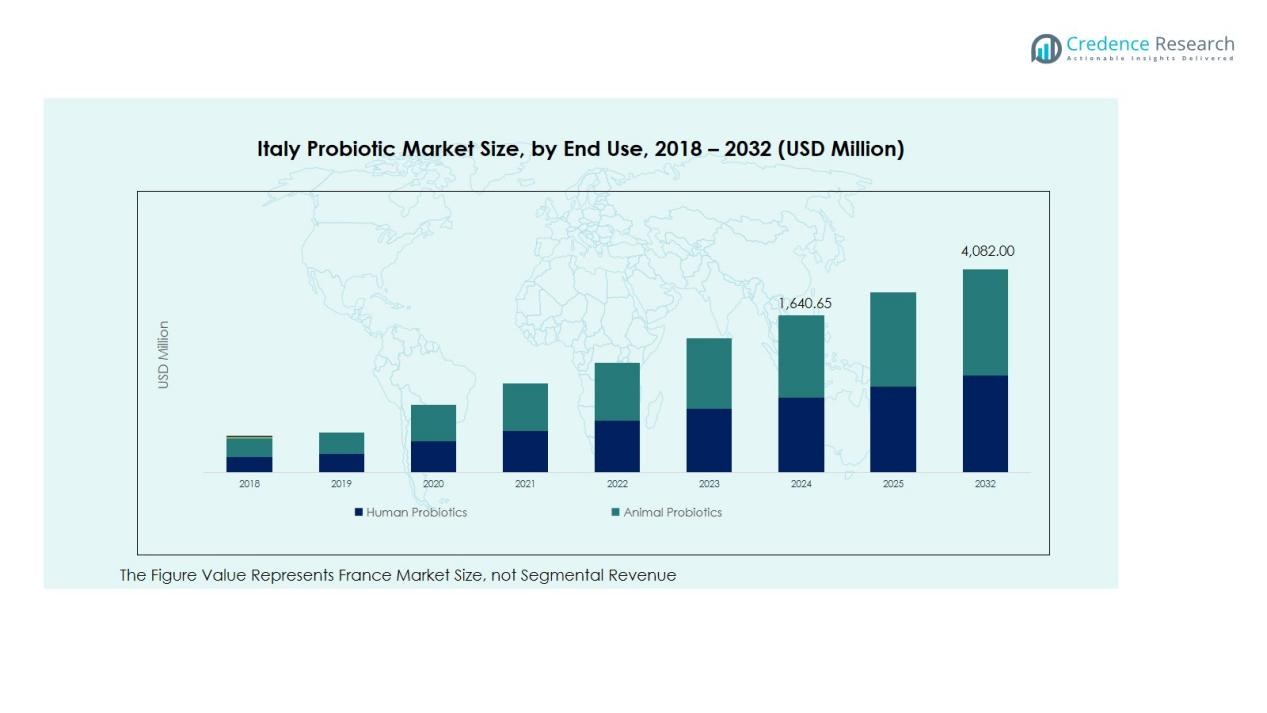

The Italy Probiotic Market size was valued at USD 1,078.44 million in 2018 to USD 1,640.65 million in 2024 and is anticipated to reach USD 4,082 million by 2032, at a CAGR of 12.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Probiotic Market Size 2024 |

USD 1,640.65 Million |

| Italy Probiotic Market, CAGR |

12.07% |

| Italy Probiotic Market Size 2032 |

USD 4,082 Million |

The market expansion is supported by rising health awareness and an increasing focus on preventive healthcare. Growing preference for clinically validated, multi-strain formulations and lactose-free probiotic alternatives strengthens product adoption. Advancements in encapsulation technology enhance strain stability and extend shelf life, while collaborations between food producers and biotechnology firms accelerate product innovation and clinical validation.

Regionally, Northern Italy dominates the market due to high consumer purchasing power, developed retail infrastructure, and the strong presence of leading food and supplement manufacturers. Central Italy shows growing demand driven by expanding urban populations and health-oriented lifestyles. Southern Italy is emerging as a high-growth region, supported by improving distribution networks and the rising popularity of plant-based probiotic beverages. Together, these dynamics position Italy as one of Europe’s most promising probiotic markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Probiotic Market was valued at USD 1,078.44 million in 2018, reaching USD 1,640.65 million in 2024, and is projected to attain USD 4,082 million by 2032, registering a CAGR of 12.07% during the forecast period.

- Northern Italy leads the market with around 42% share due to high consumer spending, advanced retail infrastructure, and the presence of major probiotic producers.

- Central Italy accounts for nearly 33% share, supported by growing urbanization, health-oriented lifestyles, and strong demand for functional dairy and beverage products.

- Southern Italy holds about 25% share and is the fastest-growing region, driven by expanding e-commerce networks, rising plant-based product adoption, and improved logistics infrastructure.

- Probiotic food and beverages dominate the market with nearly 68% share, followed by dietary supplements at around 24%, supported by increasing preference for multi-strain and clinically validated formulations among health-conscious consumers.

Market Drivers:

Rising Focus on Preventive Health and Wellness

The Italy Probiotic Market is driven by a growing shift toward preventive healthcare. Consumers are prioritizing digestive balance, immunity, and gut health through natural dietary solutions. This shift supports higher consumption of probiotic-enriched foods, beverages, and supplements. It benefits from increasing healthcare awareness campaigns and endorsements from nutritionists and medical professionals emphasizing the daily use of probiotics.

Technological Advancements Enhancing Product Stability

Improved encapsulation and strain protection technologies are strengthening product quality and shelf life. Italian manufacturers are investing in microencapsulation and freeze-drying techniques to maintain bacterial viability during storage and transportation. It ensures consistent potency, encouraging trust among consumers and retailers. These innovations are helping local brands compete with multinational players by offering high-quality probiotic formulations suited to local preferences.

- For Instance, Probiotical S.p.A. uses an advanced microencapsulation process to improve the viability of probiotic strains like Lactobacillus rhamnosus GG.

Expanding Use of Multi-Strain and Clinically Validated Formulations

Manufacturers are shifting toward complex, multi-strain probiotic blends targeting specific health functions. Clinical research validating these formulations has enhanced product credibility among both consumers and healthcare professionals. It supports the adoption of probiotics across diverse applications such as women’s health, metabolism, and skin care. Continuous R&D collaborations between Italian universities and biotechnology firms further strengthen innovation.

- For instance, biotech firm AB-BIOTICS’ AB21 multi-strain blend comprises four probiotic strains validated in a clinical trial.

Growth in Functional Food and Beverage Applications

Probiotics are increasingly integrated into dairy, non-dairy, and plant-based products. The growing trend toward lactose-free and vegan alternatives has opened new market segments. It supports diversification in yogurt, smoothies, and functional beverages with added probiotic cultures. Supermarkets and online channels are expanding availability, allowing consumers greater access to everyday probiotic-enriched options that align with modern dietary habits.

Market Trends:

Growing Demand for Functional and Fortified Food Products

The Italy Probiotic Market is witnessing strong momentum from the rising demand for functional foods and fortified beverages. Consumers are increasingly choosing probiotic-enriched dairy, yogurt, and non-dairy alternatives for digestive and immune benefits. Manufacturers are launching premium product lines with enhanced strain diversity and improved palatability to meet lifestyle and dietary preferences. It benefits from strong consumer confidence in naturally sourced ingredients and scientifically backed formulations. The expansion of clean-label, organic, and vegan-friendly products also reflects changing consumer priorities toward healthier, transparent choices. Leading food brands are collaborating with biotechnology firms to develop new probiotic strains with targeted health functions. This trend continues to position probiotics as an essential component of daily nutrition across various demographic groups.

- For instance, in August 2025, Danone Canada launched Activia Expert, a new fermented yogurt containing a combination of probiotic and prebiotic strains designed to optimize gut health and improve digestion, with each 100g serving featuring over 1 billion live cultures per serving.

Expansion of Digital Health Awareness and Retail Platforms

Digital transformation and online health education are reshaping probiotic consumption patterns in Italy. Social media campaigns, e-commerce platforms, and influencer marketing have amplified awareness about gut health and the role of probiotics. It is encouraging higher product engagement among young consumers who prefer online shopping and detailed nutritional transparency. Pharmacies and health-focused online retailers are expanding probiotic portfolios to include supplements, capsules, and drinkable formulations. Increased accessibility through digital channels supports broader consumer reach and consistent repurchasing behavior. The ongoing digital shift also enables brands to collect consumer insights and personalize marketing strategies effectively. This evolution strengthens brand loyalty and sustains steady market growth across both urban and semi-urban regions.

- For Instance, Danone’s Activia launched its ‘Little Lessons on Gut Health’ digital campaign globally in 2023, and it likely continued into 2024, running across various platforms including YouTube and TikTok.

Market Challenges Analysis:

Regulatory Complexity and Strain Approval Barriers

The Italy Probiotic Market faces significant challenges due to complex regulatory frameworks governing health claims and strain approvals. European Food Safety Authority (EFSA) requirements for probiotic labeling remain stringent, limiting the ability of brands to promote specific health benefits. It creates obstacles for product differentiation and delays the introduction of innovative formulations. Smaller manufacturers often face high costs and lengthy approval timelines for new strains. These challenges restrict flexibility in marketing and slow down product innovation. Companies must invest in clinical trials and documentation to ensure compliance, increasing overall operational costs.

Limited Consumer Awareness and High Price Sensitivity

Despite growing health consciousness, consumer understanding of probiotic efficacy and strain-specific benefits remains limited. Many buyers still view probiotics as general wellness products rather than targeted therapeutic solutions. It restricts the adoption of premium or advanced formulations. Price sensitivity further challenges market expansion, especially among middle-income consumers outside major cities. Retail competition from imported brands also pressures local manufacturers to balance affordability with quality. Building long-term trust and education remains essential for sustaining demand and broadening probiotic acceptance in Italy’s evolving health and wellness landscape.

Market Opportunities:

Rising Demand for Personalized and Targeted Probiotic Solutions

The Italy Probiotic Market presents strong opportunities through the growing demand for personalized nutrition and targeted formulations. Consumers are showing interest in probiotics designed for specific health conditions such as gut balance, women’s health, and metabolic support. It creates scope for brands to introduce strain-specific and function-driven products supported by clinical research. Advances in microbiome profiling and diagnostic testing enable the development of customized probiotic blends. Partnerships between food manufacturers, biotech firms, and healthcare providers are expanding product innovation pipelines. The focus on science-backed and condition-specific formulations is expected to enhance product credibility and market adoption.

Expansion Across Non-Dairy and Plant-Based Product Categories

Growing vegan and lactose-intolerant populations are accelerating opportunities for non-dairy probiotic applications. It supports the expansion of probiotic-infused beverages, snacks, and plant-based yogurts. Brands introducing shelf-stable, ready-to-drink, and clean-label formats are gaining traction among health-conscious consumers. The rise of functional plant-based nutrition aligns well with Italy’s trend toward sustainable dietary habits. Collaborations with retail chains and online platforms can enhance visibility and distribution reach. Continuous product diversification across alternative food categories will help probiotic manufacturers capture emerging market segments and drive long-term growth potential.

Market Segmentation Analysis:

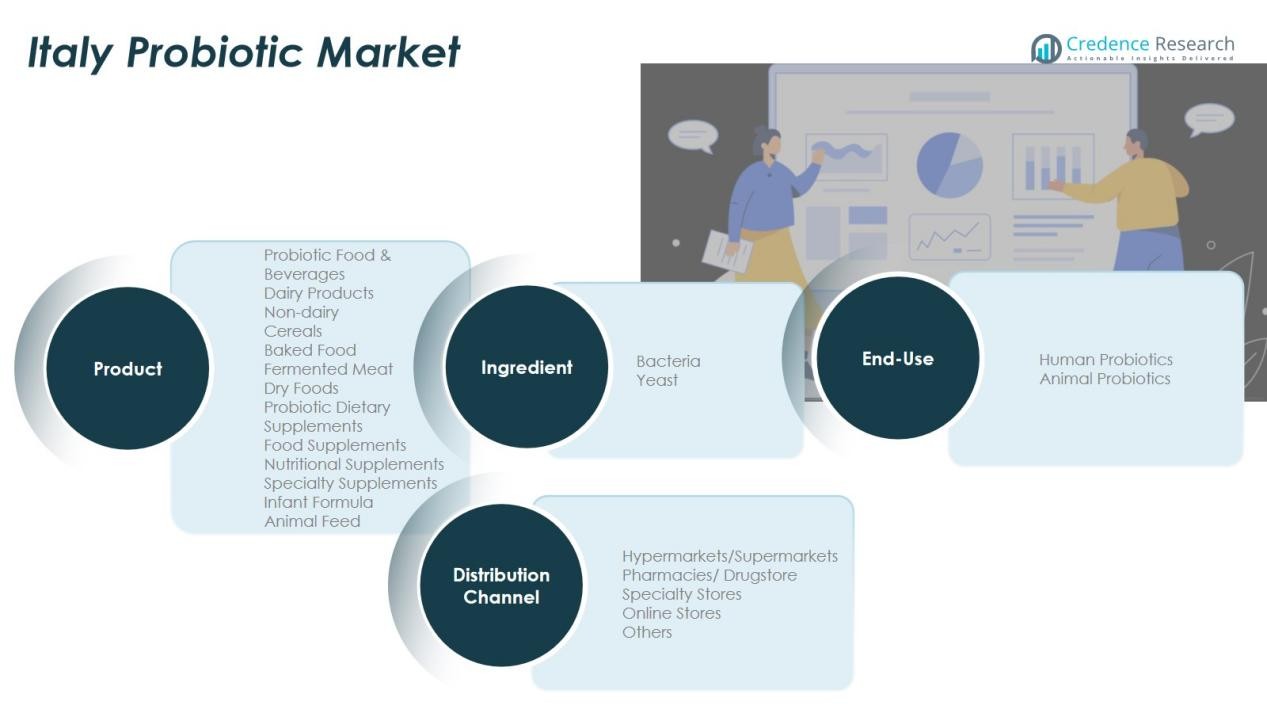

By Type

The Italy Probiotic Market is segmented into probiotic food and beverages, dietary supplements, and animal feed. Probiotic food and beverages dominate the segment due to high consumption of yogurt, fermented milk, and non-dairy alternatives. Demand for dietary supplements is expanding rapidly, driven by growing awareness of digestive and immune health. It benefits from rising acceptance of capsules, powders, and gummies with clinically proven strains. The animal feed segment is also gaining traction, supported by efforts to improve livestock gut health and productivity through natural additives.

- For instance, Yakult Original delivers at least 20 billion CFUs of Lacticaseibacillus casei Shirota per 65 ml bottle, ensuring a consistent probiotic dose in every serving.

By Ingredient

Bacteria hold the leading share in the market, with Lactobacillus and Bifidobacterium strains widely used in foods and supplements. These bacterial strains are preferred for their proven efficacy in maintaining gut balance and supporting immune health. Yeast-based probiotics are emerging, favored for their resistance to environmental conditions and suitability in non-dairy products. It provides an effective alternative for consumers with lactose intolerance or vegan preferences.

- For Instance, Lactiplantibacillus plantarum PBS067, Lactobacillus acidophilus PBS066, and Bifidobacterium animalis subsp. lactis BL050 can reduce the average duration of cold symptoms by 32.7% compared to a placebo is true, based on one specific clinical trial.

By Distribution Channel

Hypermarkets and supermarkets dominate sales, offering wide product visibility and consumer accessibility. Pharmacies and specialty stores maintain steady demand through trusted recommendations and premium offerings. Online stores are witnessing strong growth supported by convenience, digital marketing, and expanding e-commerce adoption. It enables broader product reach across regions, especially among younger consumers preferring home-delivered health products.

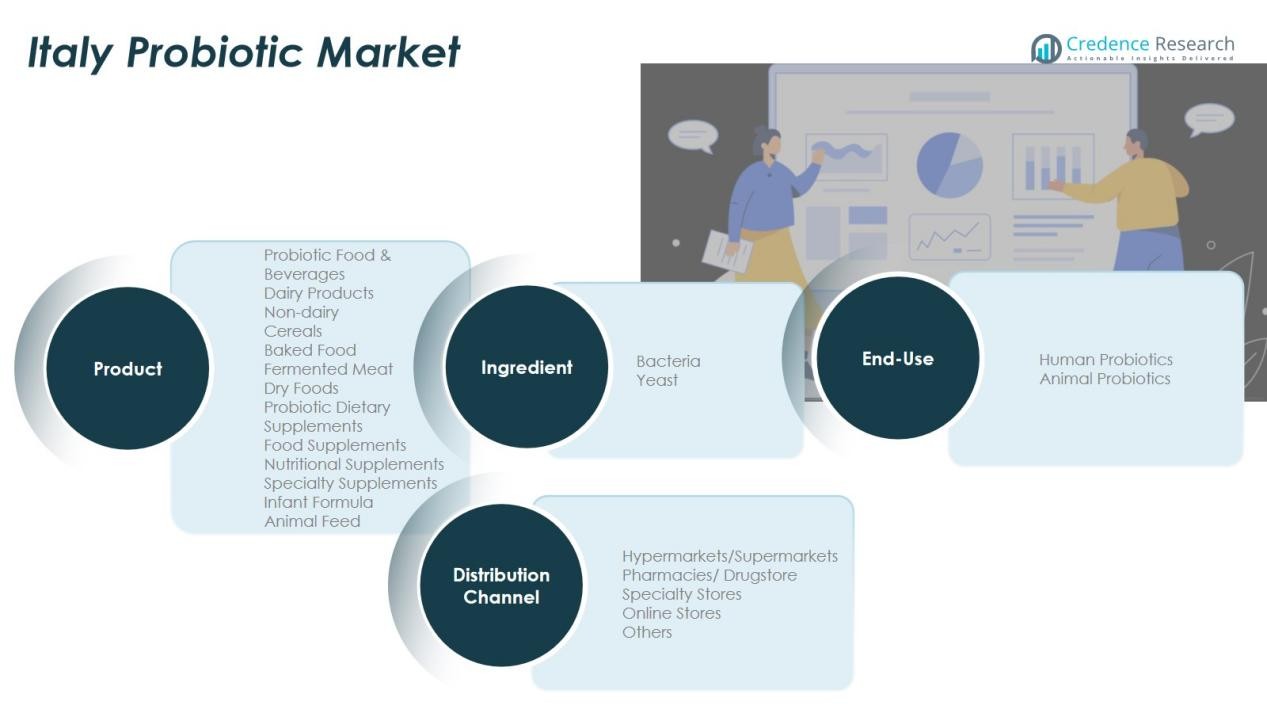

Segmentations:

By Type

Probiotic Food & Beverages

- Dairy Products

- Non-dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

By Ingredient

By End-Use

- Human Probiotics

- Animal Probiotics

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Online Stores

- Others

Regional Analysis:

Dominance of Northern Italy with Established Market Infrastructure

Northern Italy holds the largest share of the Italy Probiotic Market due to its advanced retail infrastructure and higher consumer purchasing power. The region benefits from a strong presence of global and domestic food manufacturers specializing in probiotic-enriched products. It maintains a mature distribution network supported by supermarkets, pharmacies, and online platforms. Consumers in cities like Milan and Turin demonstrate high awareness of gut health and preventive nutrition. Ongoing product innovation and premium brand availability further strengthen market penetration in the north. The concentration of biotechnology and nutraceutical firms also drives research collaborations and the launch of clinically validated formulations.

Steady Growth in Central Italy Driven by Urbanization

Central Italy exhibits steady growth, supported by expanding urban populations and changing dietary preferences. Consumers are increasingly integrating probiotics into daily routines through fortified dairy and beverage products. It benefits from the growing number of health-focused retail stores and pharmacies in urban centers such as Rome and Florence. Local producers are launching region-specific product lines emphasizing organic and locally sourced ingredients. Rising interest in digestive wellness and functional food consumption continues to support demand across both middle- and high-income groups. The presence of health institutions and awareness programs further promotes adoption.

Emerging Potential in Southern Italy and Island Regions

Southern Italy and the island regions represent the fastest-growing areas within the national probiotic landscape. Improving healthcare infrastructure and expanding e-commerce access are increasing consumer reach. It benefits from the rising popularity of plant-based and non-dairy probiotic beverages among younger consumers. Smaller towns are witnessing gradual adoption driven by awareness campaigns and improved product affordability. Strategic investments in logistics and cold-chain management are enhancing market accessibility. The growing influence of digital retail and health-conscious lifestyles positions the southern region as a promising frontier for future probiotic expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Italy Probiotic Market features moderate competition with a mix of global leaders and specialized domestic firms. Key players include Danone S.A., Yakult Italy, Probiotical S.p.A., CSL Centro Sperimentale del Latte, Biopharma Group, SynBalance, and Lactalis Group. It is characterized by continuous product innovation, clinical validation, and brand diversification across functional foods, beverages, and supplements. Companies are investing in strain research, encapsulation technologies, and consumer education to strengthen brand credibility. Partnerships between biotechnology firms and food manufacturers are fostering advancements in shelf stability and targeted health formulations. Local firms focus on niche applications and customized probiotic blends, while global brands leverage strong retail networks and marketing strength to maintain dominance. The competitive landscape remains dynamic, with ongoing R&D, regulatory compliance, and expansion into non-dairy and plant-based probiotic segments shaping future market positioning.

Recent Developments:

- In July, 2025, Danone completed the acquisition of a majority stake in Kate Farms, a U.S.-based plant-based nutrition company, enhancing its specialized nutrition portfolio.

- In September 2025, CSL Centro Sperimentale del Latte entered a long-term probiotic license partnership with Scitop Bio-tech in China to promote probiotic strain commercialization and support dietary supplement innovation across the Asia-Pacific market.

Report Coverage:

The research report offers an in-depth analysis based on Type, Ingredient, End-Use and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Italy Probiotic Market is expected to maintain strong growth driven by evolving consumer lifestyles.

- Growing awareness of digestive and immune health will continue to expand the demand base.

- Manufacturers will focus on personalized formulations and strain-specific applications for targeted benefits.

- Non-dairy and plant-based probiotic products will gain stronger market traction among lactose-intolerant consumers.

- E-commerce and digital health platforms will strengthen brand visibility and consumer engagement.

- Partnerships between biotech companies and food producers will foster innovation and new product launches.

- Sustainable and clean-label formulations will appeal to environmentally conscious and health-aware consumers.

- Premium product lines supported by clinical validation will enhance trust and encourage repeat purchases.

- Regional expansion in Southern and Central Italy will improve market accessibility and distribution coverage.

- The continued integration of probiotics into everyday food and drink formats will secure long-term market relevance and consumer loyalty.