Market Overview

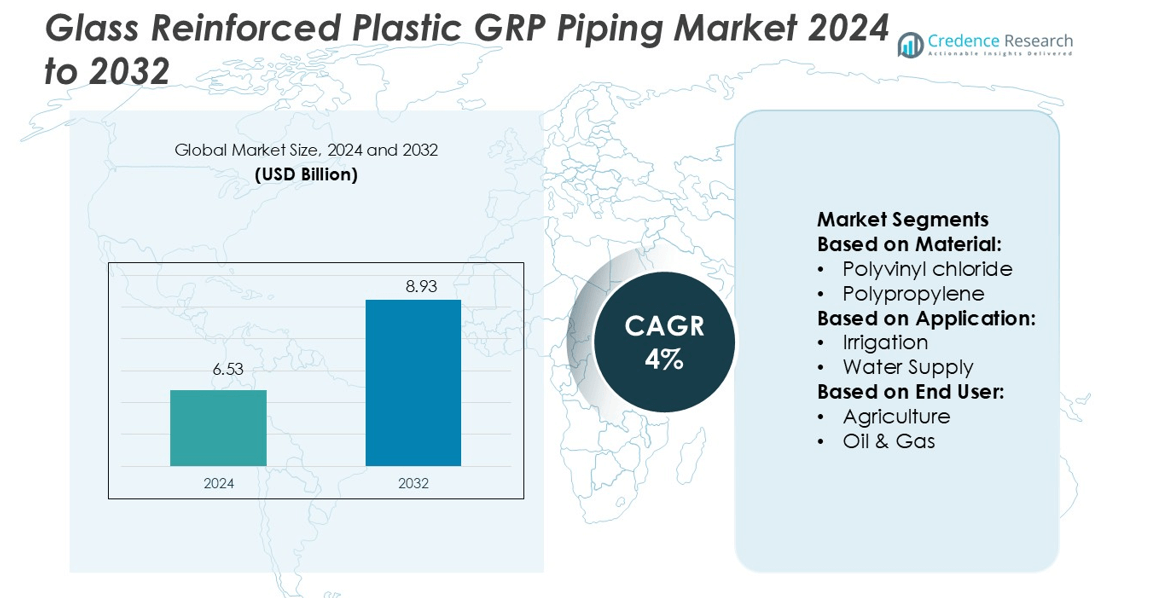

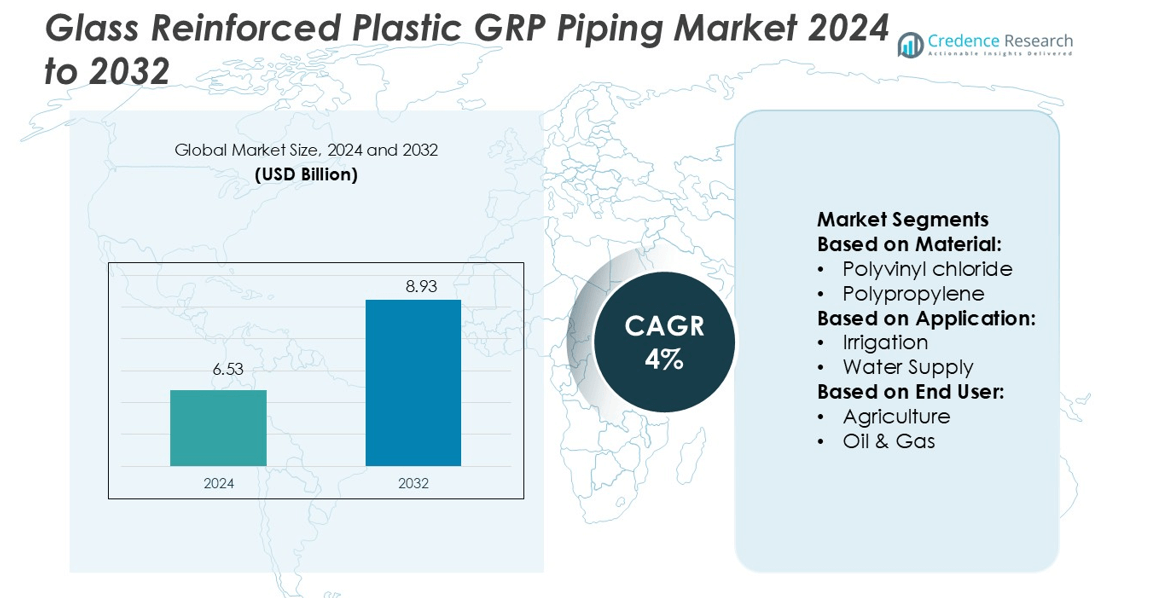

Glass Reinforced Plastic GRP Piping Market size was valued USD 6.53 billion in 2024 and is anticipated to reach USD 8.93 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass Reinforced Plastic (GRP) Piping Market Size 2024 |

USD 6.53 billion |

| Glass Reinforced Plastic (GRP) Piping Market, CAGR |

4% |

| Glass Reinforced Plastic (GRP) Piping Market Size 2032 |

USD 8.93 billion |

The Glass Reinforced Plastic (GRP) Piping Market is shaped by strong competition among top players, including Hanwei Energy Services Corp., Dubai Pipes Factory, Enduro Composites, Plasticon Composites, Veplas d.d., Graphite India Limited, Harwal Group, Future Pipe Industries, Composite Pipes Industry, and HOBAS. These companies focus on expanding their manufacturing capabilities, enhancing product performance, and securing large-scale infrastructure projects. Asia Pacific leads the global market with a 33% share, driven by rapid industrialization, infrastructure development, and water supply modernization. Strong investment in oil and gas pipelines and smart city projects further strengthens the region’s dominance. Strategic partnerships and product innovation continue to shape the competitive landscape.

Market Insights

- The Glass Reinforced Plastic (GRP) Piping Market size was valued at USD 6.53 billion in 2024 and is projected to reach USD 8.93 billion by 2032, growing at a CAGR of 4%.

- Strong investments in infrastructure, oil and gas, and water treatment drive product adoption across multiple industries.

- Asia Pacific leads with a 33% market share, supported by rapid industrialization and smart city projects.

- Key players focus on capacity expansion, advanced manufacturing technologies, and long-term supply contracts to strengthen their market position.

- High installation costs and limited standardization restrain growth in some regions, while the water supply segment holds the largest share due to strong demand from municipal and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Polyvinyl chloride (PVC) holds the dominant position in the GRP piping market with a 42% share. PVC offers excellent corrosion resistance, high tensile strength, and ease of installation, making it suitable for both underground and above-ground applications. Its cost-effectiveness and long service life drive adoption in large-scale infrastructure and municipal projects. Polypropylene and polyethylene are gaining traction for their flexibility and chemical resistance, especially in specialized industrial environments. The “Others” category includes advanced blends used in niche applications that demand high thermal stability and durability.

- For instance, Future Pipe Industries manufactures a range of composite piping systems, including Glass Reinforced Polyester (GRP), Vinyl Ester (GRV), and Epoxy (GRE). These pipes can have operating pressure ratings that, for certain series, exceed 25 bar.

By Application

Water supply dominates the application segment with a 39% market share. GRP pipes are preferred in water distribution networks due to their high pressure resistance, smooth internal surface, and minimal maintenance requirements. The lightweight structure of these pipes reduces installation time and costs, making them ideal for large utility networks. Sewerage and irrigation applications are also expanding, supported by growing investments in water management infrastructure. Plumbing and HVAC systems adopt GRP for its long operational life and compatibility with modern building standards.

- For instance, Dubai Pipes Factory manufactures GRP pipes up to 2,400 mm diameter with design pressures up to 32 bar. Pipe stiffness classes are 2,500, 5,000, and 10,000 N/m² (specific tangential initial stiffness).

By End-user

The building and construction sector leads the end-user segment with a 37% market share. The sector benefits from GRP’s corrosion resistance, lightweight properties, and ease of prefabrication, which support fast-paced construction projects. Urbanization and infrastructure expansion in developing regions strongly drive demand. Agriculture follows closely, using GRP piping for irrigation and drainage systems that ensure water efficiency and durability. In the oil and gas sector, GRP’s ability to handle high pressure and aggressive chemicals positions it as a reliable alternative to traditional metal pipes.

Key Growth Drivers

Rising Demand from Industrial Applications

Glass Reinforced Plastic (GRP) piping is gaining traction in industries like water treatment, oil and gas, and chemicals due to its corrosion resistance and long service life. The lightweight structure lowers installation costs, making GRP piping attractive for large-scale projects. Industries favor GRP over steel because it withstands harsh chemicals and high pressures without degrading. Its durability in aggressive environments reduces maintenance costs and downtime. This cost-efficiency drives strong adoption across both developed and emerging markets.

- For instance, Enduro’s launder troughs (used in chemical plants) are built with a minimum 1/4-inch fiberglass laminate, embed at least 30% glass by weight, and achieve tensile strength of 14,000 psi (ASTM D 638) and flexural strength of 27,500 psi (ASTM D 790).

Infrastructure Expansion and Urbanization

Rapid urbanization and rising investments in infrastructure development are driving the GRP piping market. Governments are upgrading water distribution, sewage, and drainage systems using GRP pipes for their strength and durability. These pipes offer better flow efficiency compared to traditional materials, improving overall system performance. The expanding construction sector in Asia Pacific, the Middle East, and Africa supports significant volume demand. Municipal infrastructure projects increasingly adopt GRP piping for its low lifecycle cost and extended operational reliability.

- For instance, GRP pipes, such as Graphite India Limited has the capability to produce GRP pipes with diameters up to 3,000 mm. Other manufacturers can produce similar or even larger diameters.

Technological Advancements in Manufacturing

Modern filament winding and resin transfer molding techniques are enhancing GRP pipe strength and customization. Advanced resins improve temperature resistance and mechanical performance, enabling broader industrial use. Manufacturers are focusing on precision molding and automated production to increase capacity and reduce defects. These innovations lower production costs while improving quality and performance. The integration of real-time monitoring and quality control systems further supports consistent output, making GRP pipes more copetitive against metal alternatives.

Key Trends & Opportunities

Shift Toward Sustainable Piping Solutions

Growing environmental regulations and sustainability goals are encouraging the use of recyclable and long-lasting materials like GRP. These pipes reduce leakage and energy loss during water transport, aligning with green infrastructure goals. Manufacturers are exploring bio-based resins and low-emission processes to meet regulatory standards. The rising preference for environmentally responsible materials offers growth opportunities in municipal, industrial, and energy projects worldwide.

- For instance, Harwal Group’s Cosmoplast division manufactures GRP pipes in nominal diameters ranging from 100 mm up to 1,400 mm. Their GRP pipeline systems are available with pressure ratings that go beyond PN 16 bar and are suitable for applications such as potable water and district cooling.

Rising Adoption in Offshore and Marine Applications

The marine industry increasingly uses GRP piping for desalination plants, offshore oil platforms, and shipbuilding. The material’s resistance to saltwater corrosion gives it an edge over conventional steel. Lightweight structure simplifies installation in offshore environments and lowers operational costs. This trend supports the expansion of GRP applications in regions investing in offshore energy, including the Middle East and Southeast Asia.

- For instance, FPI’s Fiberstrong® Industrial pipes, made from glass fiber-reinforced epoxy (GRE), are used for applications like reverse-osmosis brine lines. These pipes are available in various sizes and pressure ratings, with options including 500 mm diameters and an interior pressure rating of 16 bar, to meet the specific requirements of industrial processes.

Integration of Smart Monitoring Technologies

The adoption of smart sensors and IoT solutions in GRP piping systems is growing. Real-time performance monitoring helps detect leaks and pressure changes quickly, reducing maintenance costs. Utilities and industries are adopting these integrated solutions to improve system efficiency and reliability. This creates opportunities for advanced GRP piping products with embedded monitoring features, supporting long-term operational stability.

Key Challenges

High Initial Installation Costs

Although GRP piping offers long-term savings, the upfront installation cost remains higher than conventional materials like PVC or steel. Specialized fittings, skilled labor, and transport requirements increase overall expenses. For small and mid-scale projects, this cost gap can hinder adoption. End-users may delay GRP investments despite its performance benefits, slowing overall market penetration in price-sensitive regions.

Lack of Standardization and Technical Awareness

In many developing regions, limited technical knowledge and lack of standard installation guidelines restrict market growth. Contractors and end-users often prefer familiar materials, even when GRP offers better performance. Inconsistent technical standards also lead to quality variations among suppliers. This creates trust issues in large infrastructure projects, reducing broader adoption and slowing market expansion.

Regional Analysis

North America

North America holds a 28% share of the Glass Reinforced Plastic (GRP) Piping Market, driven by strong adoption in the oil and gas, water treatment, and chemical industries. The U.S. leads regional demand due to large-scale pipeline infrastructure modernization and wastewater management projects. Rising investments in energy-efficient and corrosion-resistant piping systems further boost market growth. Canada’s expansion in offshore exploration also supports product demand. Leading companies are focusing on lightweight and high-durability piping solutions to reduce operational costs and maintenance needs, strengthening their market position in industrial and municipal applications.

Europe

Europe accounts for 25% of the GRP piping market share, supported by stringent environmental regulations and advanced water infrastructure. Countries such as Germany, the U.K., and France lead the demand due to investments in sustainable piping systems. GRP pipes are widely adopted for their corrosion resistance and long service life in municipal and industrial applications. Ongoing upgrades in water and wastewater treatment networks also fuel growth. Major players focus on product certifications and quality standards to comply with EU norms, further enhancing regional adoption. Renewable energy projects also increase GRP piping deployment.

Asia Pacific

Asia Pacific dominates the GRP piping market with a 33% share, driven by rapid industrialization and infrastructure development. China, India, and Japan are major contributors, supported by government investments in water supply networks, irrigation, and oil and gas infrastructure. GRP pipes offer high strength-to-weight ratios and chemical resistance, making them ideal for harsh environments. Growing construction activity and smart city projects accelerate market penetration. Regional manufacturers are expanding production capacities to meet increasing demand. Favorable government initiatives for sustainable infrastructure and rising foreign investments further strengthen the region’s leadership in the global market.

Latin America

Latin America holds a 7% share of the GRP piping market, led by Brazil and Mexico. The region’s demand is fueled by growing investments in oil and gas exploration, wastewater treatment, and agricultural irrigation systems. GRP pipes are preferred for their lightweight, easy installation, and low maintenance requirements. Regional infrastructure modernization and industrial growth are improving market opportunities. Companies are targeting cost-effective solutions tailored to local conditions to expand their customer base. Rising government focus on clean water access and pipeline efficiency supports further adoption across both public and private sector projects.

Middle East & Africa

The Middle East & Africa region represents 7% of the GRP piping market share, supported by significant oil and gas projects and water distribution infrastructure. Countries like Saudi Arabia, the UAE, and South Africa drive demand through large-scale pipeline expansions and desalination initiatives. GRP pipes are used extensively due to their resistance to high temperatures and corrosive environments. Growing investments in energy, construction, and irrigation further fuel market penetration. International and regional players are collaborating on turnkey pipeline solutions to meet rising infrastructure needs, positioning the region as a key emerging growth hub.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Material:

- Polyvinyl chloride

- Polypropylene

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Glass Reinforced Plastic (GRP) Piping Market features leading players such as Hanwei Energy Services Corp., Dubai Pipes Factory, Enduro Composites, Plasticon Composites, Veplas d.d., Graphite India Limited, Harwal Group, Future Pipe Industries, Composite Pipes Industry, and HOBAS. The Glass Reinforced Plastic (GRP) Piping Market is defined by strong product innovation, strategic expansion, and technological advancement. Manufacturers focus on enhancing corrosion resistance, structural strength, and service life to meet rising demand across industries. Advanced production methods such as filament winding and resin transfer molding support efficient large-scale manufacturing. Companies prioritize certifications and compliance with international quality standards to strengthen global presence. Strategic partnerships and long-term supply agreements with engineering and construction firms help secure major infrastructure contracts. Competitive pricing, reliable performance, and customized solutions remain key factors driving market competition.

Key Player Analysis

Recent Developments

- In January 2025, Future Pipe Industries (FPI) led the way in sustainable logistics by utilizing rail transport in Egypt. This initiative aligns with the Egyptian Government’s efforts to enhance transportation efficiency and reduce environmental impact. The company is now transporting GRP pipes between the Dry Port and Alexandria Sea Port.

- In June 2024, Rollepaal, the world’s leading supplier of pipe extrusion technology, is pleased to announce it has developed an exclusive relationship in India with accepted and acknowledged Sintex, part of the Welspun Group.

- In June 2024, Borealis announced the launch of Borcycle GD3600SY, a glass-fiber reinforced polypropylene (PP) compound featuring 65% post-consumer recycled (PCR) content. Initially utilized in automotive interiors, this innovative material contains 30% glass fibers, enhancing its strength and sustainability.

- In March 2024, SAPPMA LAUNCHES PROJECT “SUPERIOR QUALITY 2024″. The Southern African Plastic Pipe Manufacturers Association (SAPPMA), a pivotal entity a pivotal entity in the Southern African plastics pipe industry, announced the launch of the project “Superior Quality 2024″ (SQ24).

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising infrastructure and utility investments.

- Adoption in water and wastewater treatment will expand due to corrosion resistance.

- Oil and gas pipeline upgrades will increase demand for durable GRP solutions.

- Technological advancements will enhance product strength and service life.

- Lightweight piping will gain popularity in cost-sensitive construction projects.

- Manufacturers will focus on expanding production capacity across key regions.

- Government regulations will push for more sustainable and long-lasting pipeline materials.

- Smart monitoring integration in GRP systems will improve operational efficiency.

- Emerging economies will drive strong demand through rapid industrialization.

- Strategic collaborations will support market expansion and long-term growth.