Market Overview

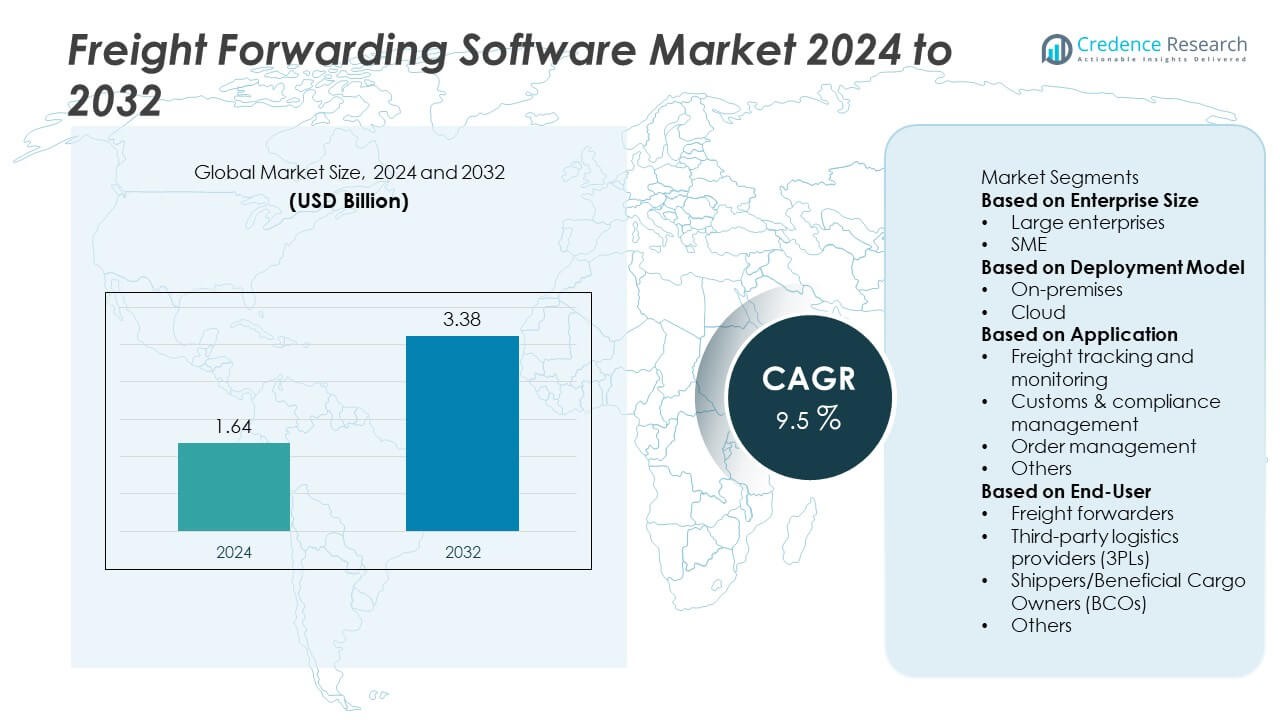

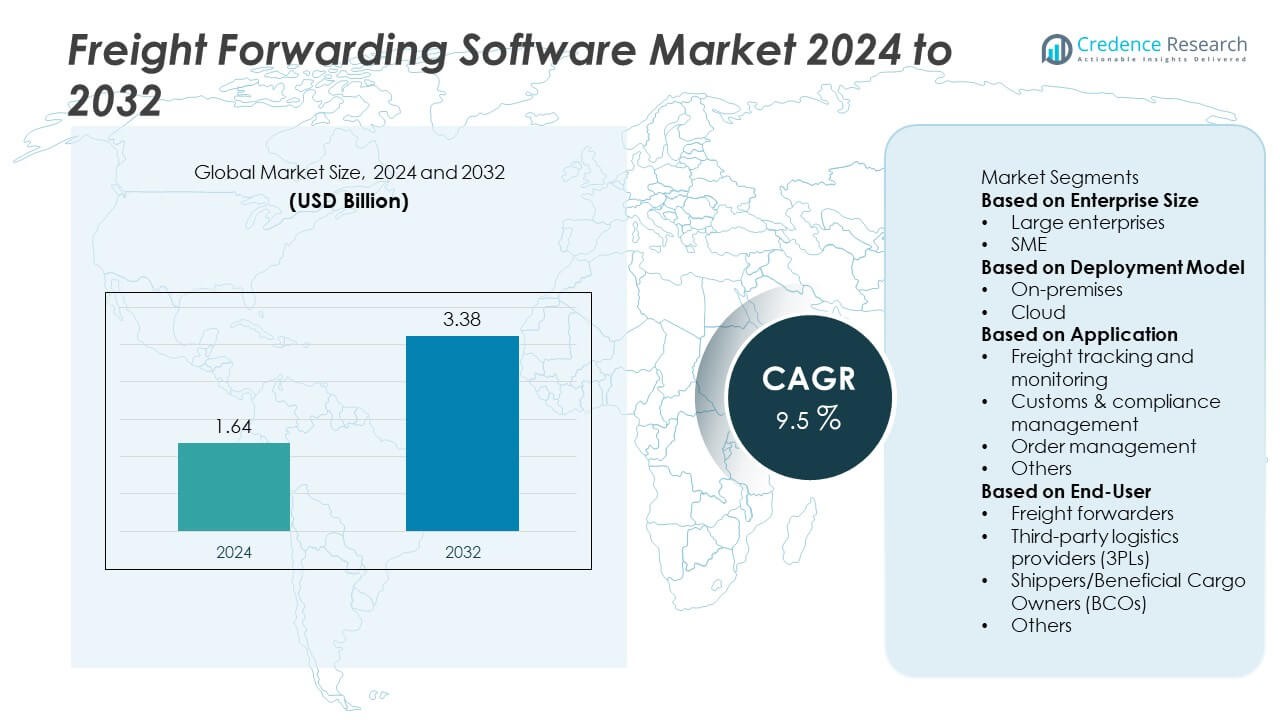

The Freight Forwarding Software market was valued at USD 1.64 billion in 2024 and is projected to reach USD 3.38 billion by 2032, growing at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Freight Forwarding Software market Size 2024 |

USD 1.64 Billion |

| Freight Forwarding Software market, CAGR |

9.5% |

| Freight Forwarding Software market Size 2032 |

USD 3.38 Billion |

The Freight Forwarding Software market is dominated by key players such as WiseTech Global, SAP SE, Oracle Corporation, Magaya Corporation, Descartes Systems Group, e2open, Reige Software, Softlink, Werner Enterprises, and Mercurygate International. These companies are expanding through innovations in cloud-based logistics platforms, automation, and AI-enabled shipment visibility. North America led the global market with a 39% share in 2024, supported by strong logistics infrastructure and widespread digital transformation. Europe followed with a 28% share due to increasing demand for compliance and sustainability solutions, while Asia Pacific accounted for 25%, driven by rapid e-commerce expansion and investments in smart logistics technology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Freight Forwarding Software market was valued at USD 1.64 billion in 2024 and is projected to reach USD 3.38 billion by 2032, growing at a CAGR of 9.5%.

- Rising demand for real-time freight visibility, automation, and digital logistics platforms is driving adoption across global supply chains.

- Cloud-based deployment held a 61% share in 2024, supported by scalability, low maintenance, and ease of integration with IoT and AI systems.

- Leading players such as WiseTech Global, SAP SE, and Oracle focus on automation, AI-driven analytics, and end-to-end shipment optimization to enhance competitiveness.

- North America led with 39% share, followed by Europe at 28% and Asia Pacific at 25%, driven by strong logistics infrastructure, growing e-commerce, and increased cross-border trade activities.

Market Segmentation Analysis:

By Enterprise Size

The large enterprises segment dominated the Freight Forwarding Software market in 2024 with a 61% share. Large logistics companies and global freight operators rely on advanced digital platforms to manage multi-route shipments and optimize supply chains. These firms prioritize automation, real-time visibility, and integration with ERP and CRM systems to improve operational efficiency. Their high investment capacity allows adoption of AI-driven analytics and cloud-based freight management tools. Meanwhile, SMEs are rapidly expanding adoption due to the availability of affordable subscription-based solutions that enhance competitiveness and streamline logistics operations.

- For instance, DHL integrated WiseTech Global’s CargoWise platform across 160 countries to unify its global forwarding network. The deployment automated customs documentation for over 2 million transactions per month and improved data synchronization across 45,000 users.

By Deployment Model

The cloud-based segment accounted for a leading 63% share of the Freight Forwarding Software market in 2024. Cloud deployment offers cost efficiency, scalability, and real-time collaboration between shippers, carriers, and customers. It supports global operations by enabling remote access, quick updates, and data-driven decision-making. Cloud platforms also integrate easily with IoT and blockchain systems, enhancing shipment transparency and traceability. The on-premises model, though declining, remains preferred among organizations requiring strict data control and regulatory compliance, particularly in defense and government-related logistics networks.

- For instance, Magaya Corporation’s cloud-based Digital Freight Platform enabled automated rate management and electronic document exchange, supported by a network of over 2,300 logistics service providers. In 2024, the company continued to expand its offerings and grow its customer base.

By Application

The freight tracking and monitoring segment held the largest 46% share of the Freight Forwarding Software market in 2024. This segment benefits from growing demand for end-to-end visibility, automated alerts, and predictive analytics in global trade. Real-time tracking helps logistics providers improve delivery accuracy and customer satisfaction while minimizing delays and losses. Integration with GPS, RFID, and AI tools enhances operational efficiency across multimodal transportation. Customs and compliance management solutions are also gaining traction as global trade regulations become more stringent, driving wider adoption of digital documentation and automated clearance systems.

Key Growth Drivers

Rising Global Trade and E-commerce Expansion

The rapid growth of international trade and e-commerce is driving demand for advanced freight forwarding software. Logistics companies require real-time tracking, digital documentation, and route optimization to manage rising shipment volumes. E-commerce platforms increasingly depend on automated systems for efficient cross-border operations. The software enhances visibility across supply chains, improving customer experience and delivery reliability. Growing trade digitalization and cross-border commerce are expected to accelerate software adoption across freight and logistics networks globally.

- For instance, WiseTech Global’s CargoWise platform processed over 54 billion data transactions in a year, supporting trade flows across 130 countries. The acquisition of Containerchain expanded its network coverage to more than 5 million container movement notifications annually, strengthening global port and depot visibility.

Increasing Adoption of Cloud-based Logistics Solutions

Cloud-based freight forwarding software enables flexible, scalable, and cost-efficient logistics operations. Businesses are shifting from legacy systems to cloud platforms that allow instant updates, remote access, and real-time data sharing. This model supports multi-location coordination, essential for global freight operators. Integration with AI and IoT enhances shipment visibility and predictive analytics. As logistics providers seek improved efficiency, the cloud segment continues to gain traction, driving modernization and digital transformation across freight forwarding ecosystems.

- For instance, e2open’s cloud-native supply chain platform now connects over 500,000 enterprises and trading partners worldwide, processing over 19.5 billion network transactions annually. This ecosystem allows real-time coordination between manufacturers, freight forwarders, and distributors.

Growing Focus on Automation and Process Optimization

Automation is transforming freight forwarding by reducing manual paperwork and human errors. Intelligent software systems automate key tasks such as invoicing, customs documentation, and cargo scheduling. This results in faster processing times, reduced costs, and enhanced data accuracy. Companies are adopting automation to meet customer expectations for transparency and on-time delivery. AI-driven analytics and robotic process automation (RPA) are further improving operational workflows, strengthening the role of automation as a key market growth driver.

Key Trends and Opportunities

Integration of Artificial Intelligence and Predictive Analytics

AI-driven freight forwarding software is improving decision-making and efficiency through predictive insights. These systems analyze shipment data to forecast delays, optimize routing, and reduce fuel consumption. Predictive analytics helps carriers and shippers enhance resource allocation and minimize risks. The integration of machine learning enables better demand forecasting and capacity planning. As global supply chains become more complex, AI-powered solutions are emerging as essential tools for competitive logistics management.

- For instance, SAP SE integrated AI-driven predictive analytics into its Transportation Management platform, utilizing massive amounts of data from various sources to enable proactive disruption management and route optimization across global carrier networks.

Expansion of Blockchain for Supply Chain Transparency

Blockchain technology is becoming a significant opportunity in the freight forwarding software market. It enables secure, transparent, and tamper-proof transactions across the logistics chain. Freight operators are adopting blockchain to improve trust, verify shipment authenticity, and automate smart contracts. This ensures compliance with trade regulations and minimizes disputes. Growing collaboration among logistics tech providers and blockchain startups is expected to accelerate its deployment, particularly in cross-border and high-value freight segments.

- For instance, Oracle Corporation implemented blockchain-based logistics tracking within its Intelligent Track and Trace system, securing data exchange and verifiable documentation between multiple trading partners, reducing fraud and paperwork errors.

Key Challenges

High Implementation Costs and Integration Barriers

Adopting advanced freight forwarding software involves substantial investment, especially for small and medium-sized enterprises. Integration with existing ERP, CRM, and transportation systems requires technical expertise and resources. Complex infrastructure setup and training costs further slow adoption in developing markets. Vendors are addressing this by offering modular, subscription-based solutions, but affordability remains a key barrier for smaller logistics firms operating under tight budgets.

Cybersecurity Risks and Data Privacy Concerns

With increasing digitalization, freight forwarding platforms face growing cybersecurity threats. Sensitive data such as shipment routes, customer details, and payment records are vulnerable to breaches. Cloud-based systems, while efficient, also expose organizations to potential cyberattacks if security measures are weak. Companies are investing in encryption, multi-factor authentication, and compliance frameworks like GDPR to mitigate risks. Ensuring data protection remains a top priority to maintain client trust and regulatory compliance across global logistics networks.

Regional Analysis

North America

North America dominated the Freight Forwarding Software market in 2024 with a 39% share. The region’s leadership stems from strong e-commerce growth, advanced logistics infrastructure, and early adoption of digital supply chain solutions. The United States drives regional demand due to the presence of key freight technology companies and major logistics providers. Cloud-based freight management tools and automation platforms are widely adopted to enhance real-time visibility and efficiency. Canada also contributes through increasing use of digital freight systems to streamline cross-border trade and improve operational transparency in logistics operations.

Europe

Europe accounted for a 28% share of the Freight Forwarding Software market in 2024. The region benefits from established logistics networks, strict trade regulations, and a growing emphasis on sustainability in transport operations. Countries such as Germany, the United Kingdom, and the Netherlands lead in adopting integrated freight platforms for route optimization and customs compliance. The European Union’s digital trade policies and e-invoicing standards promote widespread adoption of freight automation. Rising demand for multimodal logistics management and efficient customs handling continues to drive steady software integration across the region’s freight forwarding ecosystem.

Asia Pacific

Asia Pacific held a 24% share of the Freight Forwarding Software market in 2024 and is projected to be the fastest-growing region. The expansion of manufacturing hubs, cross-border e-commerce, and digital trade initiatives in China, Japan, and India are key growth drivers. Rapid urbanization and rising exports are fueling the adoption of digital freight systems among logistics providers. Local governments are investing in digital infrastructure and smart port technologies to enhance freight efficiency. Global vendors are forming partnerships with regional players to offer scalable cloud solutions tailored to the fast-growing logistics sectors in emerging economies.

Latin America

Latin America captured a 5% share of the Freight Forwarding Software market in 2024. Growth is supported by increasing international trade, port modernization, and expansion of e-commerce logistics. Brazil and Mexico are leading adopters of digital freight systems to improve cargo tracking and customs management. Logistics firms are integrating automated solutions to address inefficiencies and reduce shipping delays. However, economic instability and limited digital infrastructure in smaller economies remain challenges. Continued investments in logistics automation and regional trade digitalization are expected to accelerate market development over the forecast period.

Middle East and Africa

The Middle East and Africa accounted for a 4% share of the Freight Forwarding Software market in 2024. The region is witnessing steady growth driven by expanding trade routes, port development, and logistics digitization initiatives. Gulf countries such as the UAE and Saudi Arabia are leading with smart freight management projects to support global supply chain connectivity. Africa’s market is expanding gradually due to improved e-commerce logistics and government-backed digitalization programs. Although adoption remains moderate, increasing infrastructure investment and foreign partnerships are expected to strengthen the regional software demand in coming years.

Market Segmentations:

By Enterprise Size

By Deployment Model

By Application

- Freight tracking and monitoring

- Customs & compliance management

- Order management

- Others

By End-User

- Freight forwarders

- Third-party logistics providers (3PLs)

- Shippers/Beneficial Cargo Owners (BCOs)

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Freight Forwarding Software market features major players such as WiseTech Global, SAP SE, Magaya Corporation, Descartes Systems Group, Oracle Corporation, Reige Software, e2open, Werner Enterprises, Mercurygate International, and Softlink. These companies focus on enhancing logistics automation, real-time data visibility, and end-to-end shipment management through advanced digital platforms. WiseTech Global and Descartes Systems Group dominate with comprehensive cloud-based logistics ecosystems, offering integrated solutions for freight tracking, documentation, and customs compliance. Oracle and SAP leverage AI and analytics to streamline multimodal operations and improve efficiency. Meanwhile, emerging firms like Magaya and Softlink are expanding through affordable, scalable solutions targeting small and mid-sized enterprises. Strategic partnerships, software upgrades, and regional expansions are key competitive approaches driving innovation and differentiation. The market remains dynamic, with growing emphasis on predictive analytics, API integration, and automation to improve supply chain transparency and operational accuracy across global freight networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Magaya published a “Future-Focused Preparedness” report on freight forwarding trends.

- In August 2025, Descartes acquired cloud inventory software Finale Inventory to expand ecommerce capabilities.

- In April 2025, WiseTech Global added new features in CargoWise for exports, bookings and compliance.

- In March 2025, WiseTech Global agreed to acquire Opentecnología to deepen Latin American customs capabilities.

Report Coverage

The research report offers an in-depth analysis based on Enterprise Size, Deployment Model, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud-based freight forwarding platforms will continue to dominate due to scalability and flexibility.

- Integration of AI and machine learning will enhance route optimization and predictive analytics.

- Real-time shipment tracking and visibility solutions will gain wider adoption across global supply chains.

- Automation in customs compliance and documentation will reduce operational delays.

- Demand for multi-modal freight management systems will increase among logistics providers.

- Small and medium-sized enterprises will increasingly adopt subscription-based logistics software.

- Data security and cybersecurity solutions will become critical for cloud logistics systems.

- Partnerships between logistics firms and tech companies will drive product innovation.

- Asia Pacific will emerge as the fastest-growing regional market driven by e-commerce expansion.

- Sustainability-focused digital tools will gain traction as companies aim to reduce carbon emissions.