Market Overview:

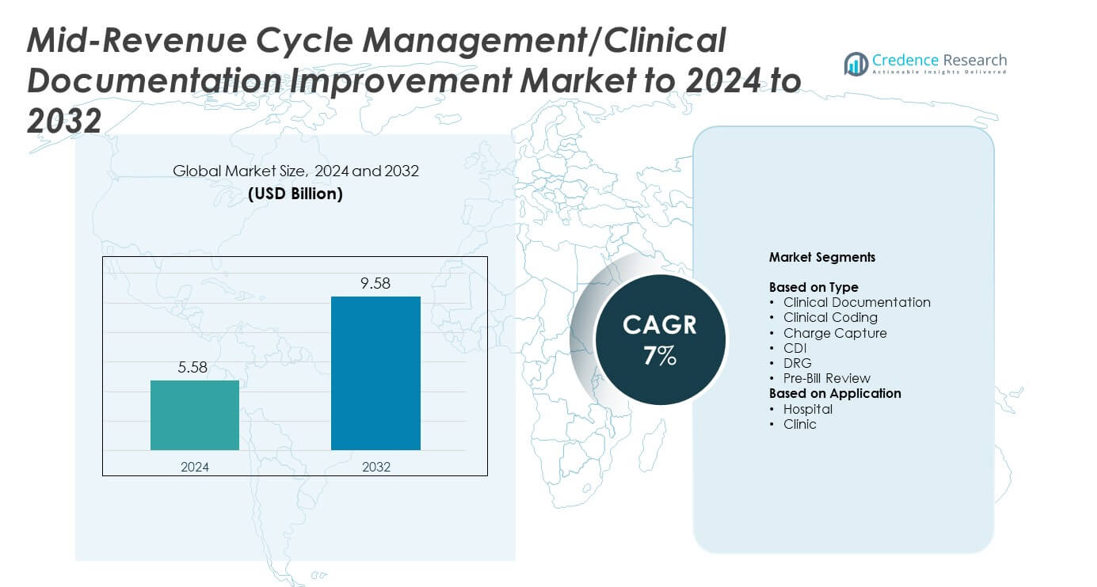

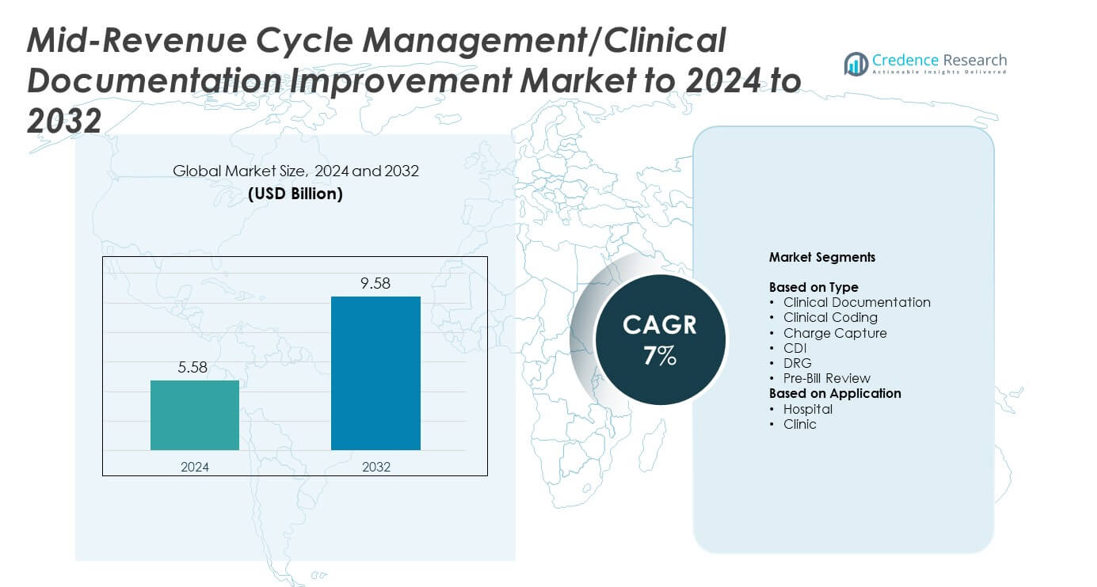

Mid-Revenue Cycle Management/Clinical Documentation Improvement Market size was valued at USD 5.58 Billion in 2024 and is anticipated to reach USD 9.58 Billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mid-Revenue Cycle Management/Clinical Documentation Improvement Market Size 2024 |

USD 5.58 Billion |

| Mid-Revenue Cycle Management/Clinical Documentation Improvement Market, CAGR |

7% |

| Mid-Revenue Cycle Management/Clinical Documentation Improvement Market Size 2032 |

USD 9.58 Billion |

The Mid-Revenue Cycle Management and Clinical Documentation Improvement market is shaped by major players such as Optum, Craneware, Nuance, Streamline Health, Dolbey Systems, Vitalware, Chartwise, M*Modal, 3M, and nThrive. These companies focus on AI-enabled documentation tools, automated coding systems, and integrated pre-bill review platforms that help providers improve reimbursement accuracy. North America led the market in 2024 with about 41% share due to strong digital adoption and strict compliance demands. Europe followed with nearly 27% share, driven by expanding CDI programs, while Asia Pacific reached about 22% share as hospitals accelerated digital transformation across large healthcare networks.

Market Insights

- The Mid-Revenue Cycle Management and Clinical Documentation Improvement Market reached USD 5.58 Billion in 2024 and is projected to hit USD 9.58 Billion by 2032 at a CAGR of 7%.

• Demand grows as hospitals adopt CDI, coding automation, and pre-bill review tools to reduce denials and improve documentation accuracy.

• AI, NLP, and cloud platforms shape market trends, enabling faster chart reviews, stronger DRG assignment, and improved workflow efficiency across providers.

• Competition intensifies as leading vendors enhance analytics, expand interoperability with EHRs, and integrate CDI, coding, and charge capture into unified platforms.

• North America held 41% share in 2024, Europe accounted for 27%, Asia Pacific reached 22%, while hospitals led the application segment with nearly 68% share and clinical documentation held about 32% within type segmentation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Clinical documentation led the type segment in 2024 with about 32% share due to rising adoption of structured templates and real-time decision support tools that improve accuracy and reduce coding gaps. Hospitals expanded investments in documentation platforms to meet stricter payer requirements and reduce claim denials. Clinical coding grew as providers adopted automated coding engines to handle rising case volumes. Charge capture advanced with stronger focus on audit readiness, while CDI and DRG solutions gained traction as health systems pushed for improved reimbursement integrity and reduced revenue leakage.

- For instance, 3M reports that more than 2,000 hospitals and healthcare organizations have selected the 3M 360 Encompass System since its launch in October 2011 to unify clinical documentation and coding workflows.

By Application

Hospitals dominated the application segment in 2024 with nearly 68% share because large health networks rely heavily on advanced CDI, coding, and charge capture tools to manage high patient volumes and complex billing cycles. Hospital groups adopted AI-enabled review systems to cut documentation errors and enhance compliance. Clinics expanded adoption as smaller facilities sought to reduce reimbursement delays and support accurate charge capture. Growth across both settings was driven by rising administrative workloads, evolving coding mandates, and greater focus on reducing audit risks.

- For instance, Epic Systems states that more than 305 million patients have an electronic health record in Epic, showing how large hospital networks concentrate documentation and billing on a single digital platform.

Key Growth Drivers

Rising documentation accuracy demands

Healthcare providers face stronger pressure to capture complete and accurate clinical records to reduce coding errors and avoid claim denials. Hospitals are adopting structured documentation workflows and AI-assisted tools that help clinicians record diagnoses, treatments, and procedures with higher precision. This shift boosts reimbursement efficiency and reduces financial leakage. Growing compliance scrutiny from payers and regulators strengthens demand for advanced CDI platforms that support real-time validation and reduce administrative backlogs.

- For instance, Iodine Software’s solutions are now trusted by more than 1,000 hospitals and health systems to help eliminate revenue leakage and ensure accurate reimbursement.

Growing adoption of AI-driven coding and review systems

AI-enabled coding engines support faster chart review and reduce manual workload in busy health systems. Automated suggestions, error detection, and predictive scoring improve coding reliability across complex care settings. Hospitals invest in these tools to speed up revenue cycles and maintain accuracy under growing case volumes. The expansion of natural language processing in clinical workflows also helps organizations capture missing data points and enhance overall billing integrity.

- For instance, Waystar notes that its revenue cycle platform supports more than 500,000 providers, 1,000 health systems and hospitals, and 5,000 payers and health plans, illustrating broad use for claims and denial management.

Increase in denial management efforts across providers

Rising claim denials push hospitals to adopt proactive CDI and charge capture solutions to identify errors before submission. Health systems are analyzing denial patterns, integrating pre-bill review tools, and improving documentation completeness to limit revenue losses. This demand grows stronger as payers tighten rules and shift toward value-based reimbursement. Providers using advanced mid-cycle tools report better recovery rates and stronger financial performance, driving wider adoption across care networks.

Key Trends and Opportunities

Expansion of cloud-based CDI platforms

Hospitals increasingly favor cloud deployment to lower IT costs, enable remote access, and support multi-site integration. Cloud CDI systems offer faster upgrades, enhanced security layers, and scalable analytics that suit both large health systems and smaller clinics. Vendors are adding automation, workflow intelligence, and interoperability features that help organizations standardize documentation and coding practices. This shift opens opportunities for broader market penetration and improved collaboration between clinical and revenue cycle teams.

- For instance, Dell Medical School at the University of Texas partnered with Rackspace Technology in 2025 to host its Epic electronic health record on Rackspace’s private cloud, the first medical school deployment of this dedicated Epic cloud service.

Rising integration of NLP and real-time analytics

NLP-powered engines help providers capture clinical intent more accurately and reduce ambiguity in physician notes. Real-time analytics support early identification of documentation gaps and improve DRG accuracy. Adoption grows as organizations look for tools that reduce review time and support informed decision-making. Vendors are enhancing platforms with predictive insights, quality indicators, and automated alerts, creating new opportunities to optimize mid-cycle performance and strengthen billing reliability.

- For instance, Abridge reports clinicians at over 200 health systems generate around one million clinical notes weekly using its platform.

Increasing focus on pre-bill optimization

Hospitals are strengthening pre-bill review processes to minimize avoidable errors and reduce delays in reimbursement. Pre-bill automation helps teams verify documentation completeness, coding consistency, and charge accuracy before claim submission. This trend offers strong opportunities for vendors offering integrated CDI, coding, and charge capture solutions. Growth continues as providers adopt unified platforms that streamline financial workflows and reduce revenue leakage.

Key Challenges

High implementation and integration complexity

Many healthcare providers face difficulty integrating CDI, coding, and charge capture tools with legacy EHR systems. Complex workflows, data migration issues, and customization needs slow adoption. Smaller clinics often delay investments due to limited budgets and staffing constraints. These challenges increase the time and cost of deployment. Organizations must allocate resources for training and support to achieve full system performance, which can hinder market growth.

Shortage of skilled CDI and coding professionals

The industry continues to face a notable shortage of experienced coders and CDI specialists who can manage rising case complexity. Increased regulatory changes add to the workload and require continuous training. Providers without skilled teams struggle to use advanced tools effectively, reducing the value of technology investments. Staffing gaps increase review times, raise the risk of errors, and limit the scalability of mid-cycle improvement programs.

Regional Analysis

North America

North America held the largest share in 2024 with about 41% due to strong adoption of advanced CDI, coding automation, and pre-bill review technologies across hospitals and integrated delivery networks. Health systems in the United States expanded investment in AI-enabled documentation tools to reduce denials and support value-based reimbursement programs. Large EHR vendors and RCM service providers strengthened mid-cycle integration, which improved workflow efficiency. Growth also came from rising clinical complexity, increasing inpatient volumes, and the need for accurate DRG assignment. Canada followed similar trends with expanding digital health initiatives and stronger compliance frameworks.

Europe

Europe accounted for nearly 27% share in 2024, supported by rising demand for structured documentation processes and regulatory pressure to improve coding accuracy. Hospitals in Germany, France, and the United Kingdom expanded CDI programs to reduce claim disputes and strengthen audit readiness. Adoption of AI-based review tools increased as providers sought more efficient clinical coding workflows. Health systems continued modernizing legacy infrastructure, which boosted the need for interoperable mid-cycle solutions. Growth across the region benefited from national digital health programs and increasing focus on financial transparency within healthcare institutions.

Asia Pacific

Asia Pacific captured around 22% share in 2024, driven by rapid digital transformation in hospitals across China, India, Japan, and Australia. Providers adopted CDI and coding automation tools to manage rising patient volumes and support accurate reimbursement within expanding insurance systems. Growth accelerated as hospitals modernized EHR platforms and adopted cloud-based mid-cycle solutions. Increasing emphasis on documentation quality and stronger compliance rules boosted demand for structured workflows. Vendors expanded regional partnerships, making advanced mid-cycle tools more accessible to both public and private healthcare facilities.

Latin America

Latin America held close to 6% share in 2024, supported by gradual adoption of CDI and coding improvement technologies in major markets such as Brazil and Mexico. Hospitals focused on reducing documentation errors and improving reimbursement accuracy as insurance coverage expanded. Digital health investments increased, encouraging the use of cloud-based RCM tools. Despite infrastructure gaps, interest in automated review systems continued to grow. Regional growth remained steady as providers sought to reduce claim rejection rates and streamline revenue processes across both private and public healthcare sectors.

Middle East and Africa

Middle East and Africa accounted for about 4% share in 2024, with adoption driven by healthcare modernization programs in the Gulf countries. Hospitals in the United Arab Emirates and Saudi Arabia increased investment in CDI and coding automation to strengthen compliance and support advanced insurance reimbursement models. Growth was slower in parts of Africa due to limited digital infrastructure, though leading hospitals adopted cloud-based documentation tools. Regional demand continued to rise as governments encouraged digital transformation and providers focused on improving billing accuracy and clinical record quality.

Market Segmentations:

By Type

- Clinical Documentation

- Clinical Coding

- Charge Capture

- CDI

- DRG

- Pre-Bill Review

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Mid-Revenue Cycle Management and Clinical Documentation Improvement market features leading participants such as Optum, Craneware, Nuance, Streamline Health, Dolbey Systems, Vitalware, Chartwise, M*Modal, 3M, and nThrive. The competitive landscape is shaped by rapid advancements in AI-assisted documentation, NLP-based coding tools, and automated pre-bill review solutions. Vendors focus on delivering integrated mid-cycle platforms that support accurate documentation, faster coding turnaround, and improved denial prevention. Many companies are strengthening their analytics capabilities to help providers identify documentation gaps and optimize DRG assignment. Cloud-based deployment continues to expand, enabling flexible access and easier scalability for hospitals and clinics. Competition also intensifies as firms enhance interoperability with major EHR systems to streamline workflows. Partnerships with healthcare organizations and technology providers are increasing as vendors aim to deliver unified solutions that reduce administrative burden and support value-based reimbursement models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Optum

- Craneware

- Nuance

- Streamline Health

- Dolbey Systems

- Vitalware

- Chartwise

- M*Modal

- 3M

- nThrive

Recent Developments

- In 2025, Optum Launched Optum Integrity One, an AI-powered integrated revenue-cycle platform to streamline admin workflows and financial performance.

- In 2024, Nuance announced the general availability of its DAX Copilot embedded in Epic Systems, automating clinical documentation and streamlining CDI workflows for better documentation accuracy

- In 2023, 3M Health Information Systems expanded its collaboration with AWS to scale ambient clinical documentation using generative AI technology aimed at improving mid-revenue cycle efficiency.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of AI-driven CDI and coding tools to improve accuracy.

- Hospitals will expand real-time analytics to strengthen denial prevention and optimize billing workflows.

- Cloud-based mid-cycle platforms will grow as providers seek scalable and cost-efficient deployment models.

- NLP capabilities will deepen integration with clinical notes to enhance documentation completeness.

- Pre-bill review automation will expand as health systems work to reduce avoidable claim errors.

- Interoperability between EHRs and RCM platforms will improve to support smoother data exchange.

- Value-based care programs will push providers to refine documentation quality and clinical specificity.

- Vendor partnerships will increase to deliver unified CDI, coding, and charge capture solutions.

- Demand for outsourced coding and CDI services will rise as staffing shortages persist.

- Training programs for CDI and coding teams will expand to support complex regulatory requirements.