Market Overview

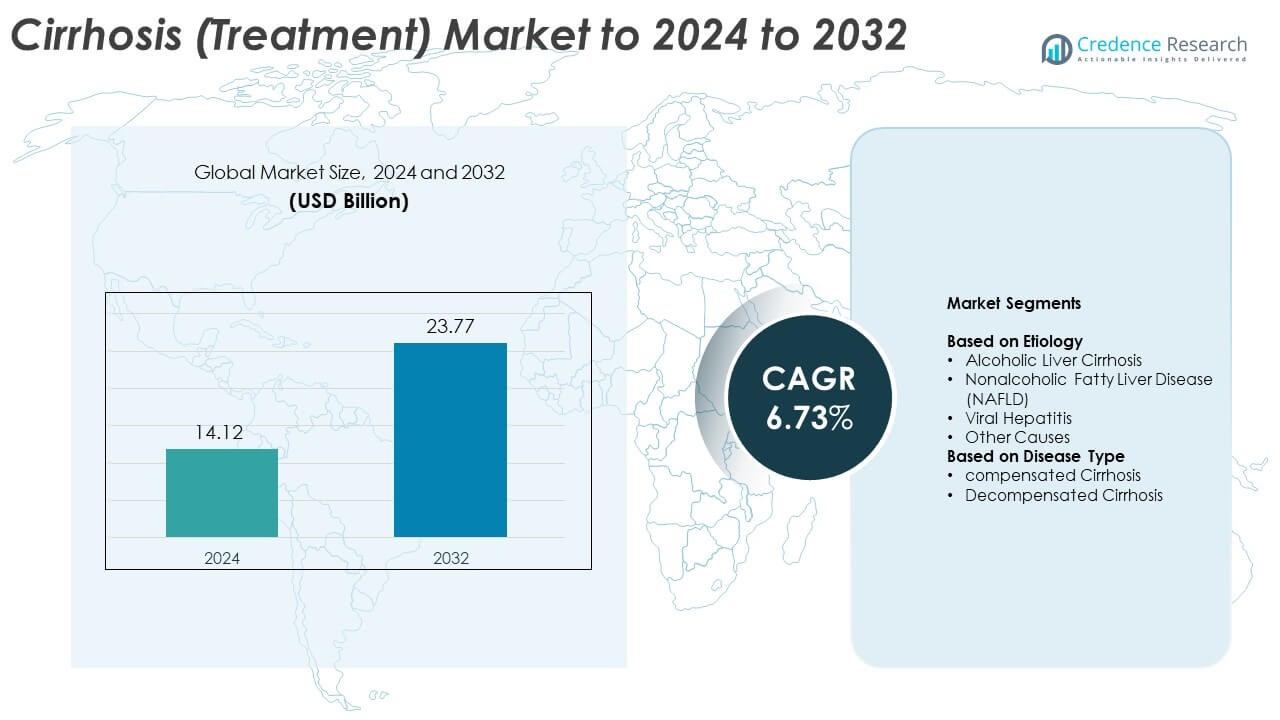

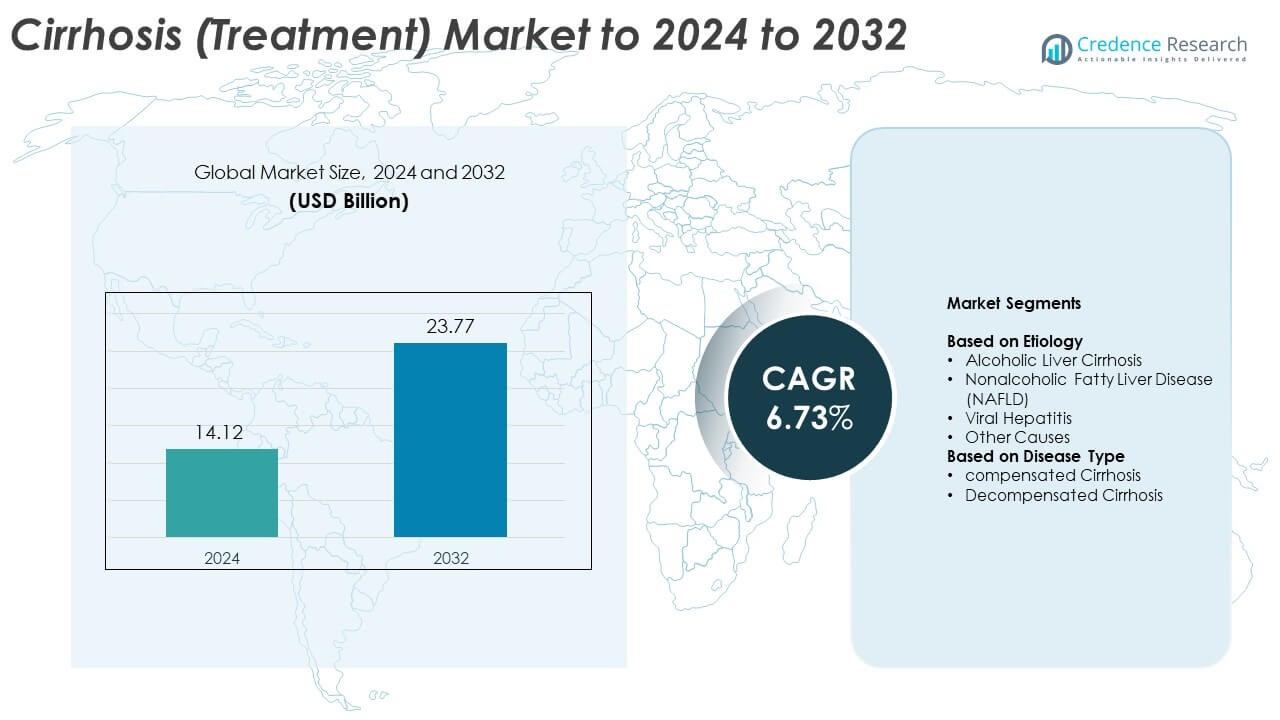

Cirrhosis (Treatment) Market size was valued USD 14.12 Billion in 2024 and is anticipated to reach USD 23.77 Billion by 2032, at a CAGR of 6.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cirrhosis (Treatment) Market Size 2024 |

USD 23.77 Billion |

| Cirrhosis (Treatment) Market, CAGR |

6.73% |

| Cirrhosis (Treatment) Market Size 2032 |

USD 23.77 Billion |

The Cirrhosis (Treatment) Market is shaped by major players such as Sequana Medical AG, Pfizer Inc, Epic Research & Diagnostics Inc, Stempeutics Research Pvt Ltd, Merck & Co. Inc, Novartis AG, Bayer AG, Histogen Inc, AstraZeneca, and B. Braun Medical Inc, each expanding their portfolios through advanced therapies, diagnostics, and clinical research. These companies focus on antifibrotic candidates, non-invasive monitoring tools, and improved transplant support to strengthen global competitiveness. North America leads the market with about 37% share in 2024 due to strong healthcare infrastructure, high diagnosis rates, and broad access to advanced treatment options, making it the dominant regional contributor.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cirrhosis (Treatment) Market reached USD 14.12 Billion in 2024 and is projected to hit USD 23.77 Billion by 2032, growing at a CAGR of 6.73%.

• Rising cases of alcohol-related liver disease and NAFLD drive strong treatment demand, with alcoholic cirrhosis holding about 38% share and decompensated cirrhosis dominating disease type with nearly 56%.

• Non-invasive diagnostics, precision therapies, and improved transplant support shape major market trends as hospitals adopt safer and faster assessment tools.

• Competition intensifies as leading players expand clinical pipelines, invest in antifibrotic research, and strengthen global partnerships to improve advanced care access.

• North America leads with around 37% share due to strong healthcare systems, while Europe accounts for about 30% and Asia Pacific holds nearly 22%, supported by growing viral hepatitis burden and rising metabolic disorders.

Market Segmentation Analysis:

By Etiology

Alcoholic liver cirrhosis leads this segment with about 38% share in 2024 due to high global alcohol consumption and growing cases of chronic alcohol-related liver damage. Rising hospital admissions linked to alcohol misuse strengthen demand for structured treatment plans, including detox programs and antifibrotic therapies. NAFLD shows rapid growth as obesity, diabetes, and metabolic syndrome rise worldwide. Viral hepatitis contributes steady demand as vaccination gaps and untreated infections persist. Other causes such as autoimmune disorders and genetic conditions add further clinical need across advanced care settings.

- For instance, a pivotal six-month, randomized, double-blind, placebo-controlled clinical trial, known as the COMBINEstudy (published in the Journal of the American Medical Association (JAMA) in 2006), involved 1,383 recently abstinent alcohol-dependent adults recruited across 11 U.S. sites.

By Disease Type

Decompensated cirrhosis dominates this segment with nearly 56% share in 2024 because patients in advanced disease stages require intensive treatment, frequent monitoring, and higher therapeutic support. Increased hospitalization rates for complications such as ascites, hepatic encephalopathy, and variceal bleeding drive strong demand for specialist care. Compensated cirrhosis grows moderately as early diagnosis improves through imaging and biomarker use, yet decompensated patients remain the key revenue source due to greater drug use, longer treatment cycles, and complex clinical management needs.

- For instance, in Mallinckrodt’s CONFIRM trial of terlipressin for hepatorenal syndrome in advanced cirrhosis, 63 patients in the terlipressin group achieved verified HRS reversal compared with 17 on placebo, highlighting the intense therapeutic focus on decompensated disease complications.

Key Growth Drivers

Rising Prevalence of Alcohol-Related Liver Disease

Alcohol misuse continues to increase chronic liver injury across many countries, raising long-term cirrhosis cases. Hospitals report a steady rise in admissions linked to alcohol-related complications, creating higher need for advanced therapies. Governments highlight alcohol misuse as a major health risk, which pushes healthcare systems to expand treatment capacity. As more patients reach late stages due to delayed care, demand for structured management grows. This continued rise in alcohol-related cirrhosis remains one of the strongest drivers shaping the Cirrhosis (Treatment) Market.

- For instance, a US multicenter trial of acamprosate (Campral, then promoted by Forest Laboratories under license from Merck KGaA) enrolled 601 alcohol-dependent patients across acamprosate, placebo, and no-medication arms over 360 treatment days, reflecting the scale of pharmacologic efforts to curb alcohol use that drives cirrhosis burden.

Growth in NAFLD Driven by Obesity and Diabetes

NAFLD expands quickly as obesity, sedentary habits, and diabetes increase across global populations. Many patients with metabolic disorders progress toward fibrosis and cirrhosis, which raises the need for long-term monitoring and medication support. Clinics now focus on integrated metabolic care and liver health programs to reduce clinical risks. Rising awareness about fatty liver disease also encourages earlier visits to specialists. This broad and expanding patient base positions NAFLD as a major growth driver for the Cirrhosis (Treatment) Market.

- For instance, Novo Nordisk’s ESSENCE phase 3 trial is randomising an estimated 1,200 adults with metabolic dysfunction-associated steatohepatitis and stage 2 or 3 fibrosis to once-weekly semaglutide or placebo for 240 weeks, directly linking metabolic drug development to the growing pool of advanced NAFLD patients.

High Burden of Viral Hepatitis in Developing Regions

Hepatitis B and C remain widely underdiagnosed in many low- and middle-income regions, leading to chronic liver damage and cirrhosis. Limited access to early screening and antiviral therapy results in more late-stage diagnoses, increasing treatment complexity. Health systems face pressure to expand vaccination, testing, and antiviral coverage to reduce disease spread. Many affected patients require long-term follow-up and advanced treatment support. This persistent clinical burden stands as a significant driver supporting market expansion.

Key Trends and Opportunities

Rapid Adoption of Non-Invasive Diagnostic Technologies

Healthcare providers increasingly use elastography, advanced imaging, and blood-based biomarkers to identify fibrosis without biopsies. These tools help detect disease progression earlier and guide timely therapy choices. Faster and safer diagnostics support better patient experience and reduce invasive procedures. Adoption rises in both developed and developing regions as technology becomes more accessible. This growing preference for non-invasive assessment forms a major trend and opportunity in the Cirrhosis (Treatment) Market.

- For instance, Siemens Healthineers’ Acuson S2000 ultrasound platform with its initial Virtual Touch imaging (qualitative) feature received US FDA 510(k) clearance in June 2013, which was shortly after the system itself was introduced around 2008.

Expansion of Precision and Combination Therapy Approaches

Demand rises for targeted antifibrotic candidates and combination regimens that improve outcomes in different cirrhosis stages. Drug research now focuses on pathways linked to inflammation, fibrosis, and metabolic stress. Doctors seek treatments that reduce complications, stabilize liver function, and prevent decompensation. These targeted methods raise clinical interest and attract investment from biotech firms. This momentum creates an important trend and opportunity for future therapeutic innovation.

- For instance, Galectin Therapeutics’ NASH-CX phase 2b trial randomised 162 patients with NASH cirrhosis and portal hypertension across belapectin 2 mg/kg, 8 mg/kg, and placebo arms for 52 weeks, using hepatic venous pressure gradient changes to test a targeted antifibrotic strategy in advanced cirrhosis.

Rising Investment in Transplant Infrastructure and Supportive Care

Transplant centers expand capacity as more patients reach end-stage disease and need surgical options. Supportive therapies such as nutritional care, fluid management, and portal hypertension control gain wider adoption. Health systems invest in modern equipment and digital monitoring tools to improve long-term outcomes. These improvements expand treatment pathways for advanced cases and attract higher patient inflow. This investment wave represents a growing opportunity across the Cirrhosis (Treatment) Market.

Key Challenges

Late Diagnosis and Insufficient Screening Programs

Many patients remain undiagnosed until they show serious symptoms, reducing the success of early-stage treatment. Screening programs remain limited in several regions, especially where access to imaging and specialist care is low. Late detection increases hospital admissions and complications, placing greater pressure on healthcare systems. Public awareness campaigns often lack reach, which slows progress in early prevention. This delay in diagnosis remains a major challenge for improving treatment outcomes.

High Treatment Costs and Unequal Access in Low-Income Regions

Advanced therapies, diagnostics, and transplant services carry high costs, limiting access for many patients. Low-income regions often lack trained specialists and modern facilities, creating treatment gaps. Patients face long travel distances for care, which increases overall burden. Reimbursement and insurance support also remain limited, restricting uptake of recommended therapies. This financial and structural imbalance stands as a key challenge in the Cirrhosis (Treatment) Market.

Regional Analysis

North America

North America leads the Cirrhosis (Treatment) Market with about 37% share in 2024, supported by high disease diagnosis rates, strong healthcare access, and widespread alcohol- and obesity-related liver disorders. The region benefits from advanced screening tools, well-established transplant centers, and rapid adoption of new therapies. Rising NAFLD and hepatitis C management programs strengthen treatment demand across hospitals and specialty clinics. Supportive insurance coverage and increasing awareness campaigns further expand patient reach. Strong clinical infrastructure and continuous R&D investment keep North America the dominant market contributor.

Europe

Europe holds nearly 30% share in 2024, driven by growing cases of alcohol-related liver damage, metabolic disorders, and chronic viral infections across major countries. Widespread screening programs and strong healthcare reimbursement improve patient access to advanced therapies. Hospitals report rising demand for non-invasive diagnostics and targeted treatment options as early detection rates improve. Increased investment in transplant capacity and stronger public health strategies support clinical outcomes. Stable regulatory frameworks and research focus help Europe maintain a significant share in the global market.

Asia Pacific

Asia Pacific accounts for about 22% share in 2024, influenced by high viral hepatitis prevalence, rapid lifestyle changes, and rising metabolic risk factors. Expanding healthcare infrastructure and growing access to imaging and diagnostic tools improve early detection. Countries with large populations face increasing cirrhosis cases linked to obesity, alcohol consumption, and untreated infections. Government programs promoting vaccination and antiviral therapy enhance long-term disease control. Growing investments in specialty care and rising awareness of liver health strengthen Asia Pacific’s emerging role in the global market.

Latin America

Latin America captures around 7% share in 2024, shaped by widespread alcohol consumption, persistent viral hepatitis, and limited screening access in rural areas. Urban hospitals adopt advanced diagnostics and treatment protocols, but disparities remain between public and private facilities. Growing awareness of NAFLD and metabolic risks boosts early consultations in major cities. Investment in specialist training and improved imaging availability helps expand treatment reach. Despite constrained resources, rising healthcare reforms and digital monitoring adoption support steady market development across the region.

Middle East and Africa

Middle East and Africa hold nearly 4% share in 2024 due to restricted healthcare access, late diagnosis, and high burden of viral hepatitis in several countries. Urban centers show improved adoption of imaging tools and antiviral therapies, but rural areas face major gaps in specialist care. Alcohol-related liver disease remains lower in many regions, but metabolic disorders and obesity continue to rise. International health initiatives support screening and vaccination programs, aiding early management efforts. Gradual expansion of hospital infrastructure and awareness campaigns drives slow but stable market growth.

Market Segmentations:

By Etiology

- Alcoholic Liver Cirrhosis

- Nonalcoholic Fatty Liver Disease (NAFLD)

- Viral Hepatitis

- Other Causes

By Disease Type

- Compensated Cirrhosis

- Decompensated Cirrhosis

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cirrhosis (Treatment) Market features leading companies such as Sequana Medical AG, Pfizer Inc, Epic Research & Diagnostics Inc, Stempeutics Research Pvt Ltd, Merck & Co. Inc, Novartis AG, Bayer AG, Histogen Inc, AstraZeneca, and B. Braun Medical Inc. These firms compete through new drug pipelines, wider clinical trials, and growing focus on antifibrotic research. Market players invest in non-invasive tools, digital tracking systems, and improved transplant support to strengthen care quality. Companies also expand global reach through partnerships with hospitals and research groups. Rising patient numbers push firms to produce safer drugs and faster diagnostic options. Strategic acquisitions and long-term R&D spending shape future innovation. Regulatory approvals across major regions support stronger product portfolios and better treatment access. Firms aim to reduce progression risk and improve survival rates through targeted therapies. The competitive field continues to grow as demand for advanced cirrhosis care rises worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sequana Medical AG

- Pfizer Inc

- Epic Research & Diagnostics Inc

- Stempeutics Research Pvt Ltd

- Merck & Co. Inc

- Novartis AG

- Bayer AG

- Histogen Inc

- AstraZeneca

- B. Braun Medical Inc

Recent Developments

- In 2025, AstraZeneca is conducting a two-part Phase IIa/b multicentre, randomized, double-blind, placebo-controlled study to assess the efficacy, safety, and tolerability of a combination of Zibotentan and Dapagliflozin versus placebo in participants with cirrhosis with features of portal hypertension.

- In 2024, Sequana Medical received US FDA approval for its alfapump System, designed to treat recurrent or refractory ascites due to liver cirrhosis.

- In 2023, Merck announced it was acquiring Prometheus Biosciences, a clinical-stage biotechnology company developing therapeutics for immune-mediated diseases

Report Coverage

The research report offers an in-depth analysis based on Etiology, Disease Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as early diagnosis tools become more accurate and accessible.

- Demand for non-invasive monitoring will rise with wider adoption across hospitals.

- Precision therapies will gain momentum as research improves targeting of fibrosis pathways.

- NAFLD-driven cases will increase treatment needs in both developed and emerging regions.

- Antiviral therapy uptake will grow as hepatitis screening programs expand.

- Digital tools will support long-term disease management and reduce hospital visits.

- Transplant infrastructure will strengthen in high-burden regions due to rising late-stage cases.

- Combination treatment strategies will improve patient outcomes across disease stages.

- Investment in public awareness programs will boost early clinic visits and reduce complications.

- Global research funding will accelerate development of next-generation antifibrotic drugs.