Market overview

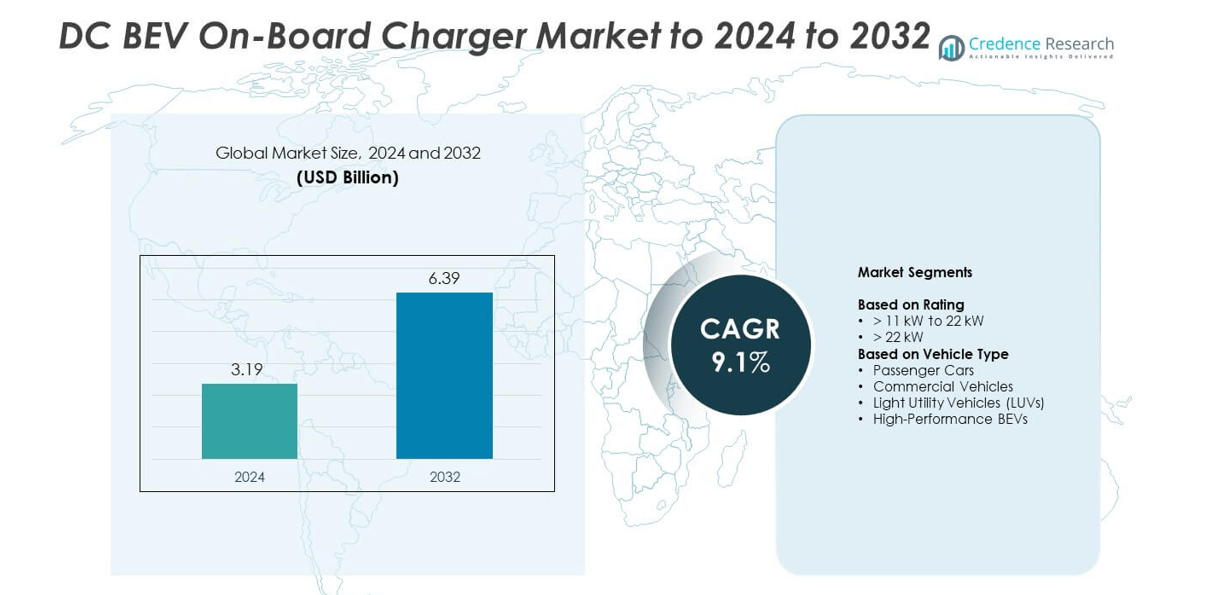

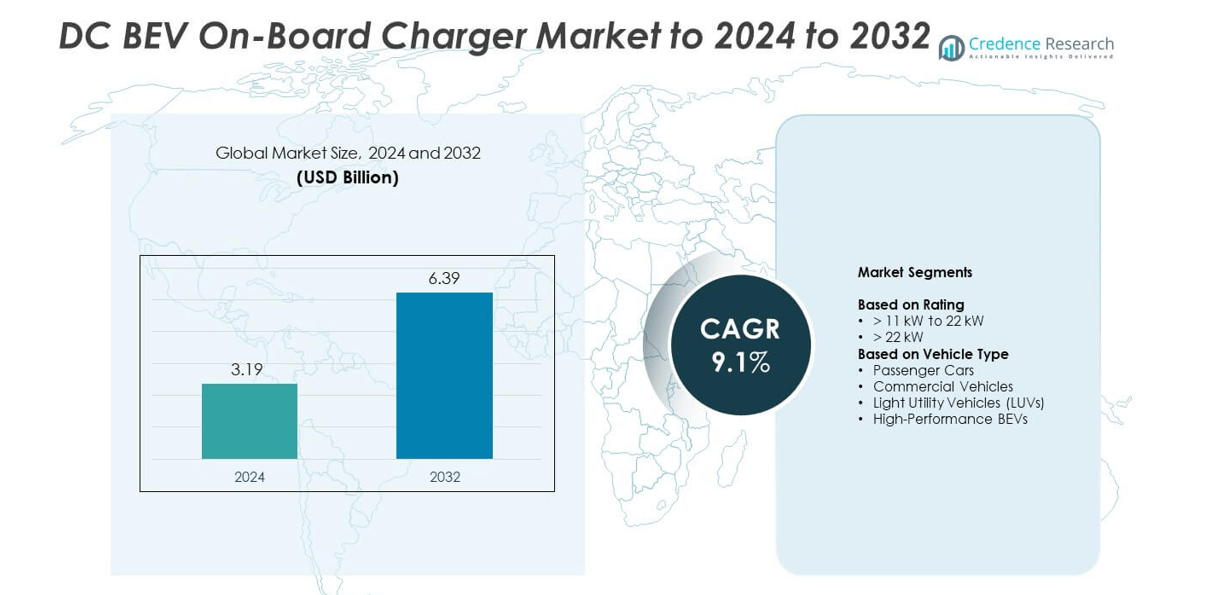

The DC BEV On-Board Charger Market size was valued at USD 3.19 billion in 2024 and is anticipated to reach USD 6.39 billion by 2032, at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC BEV On-Board Charger Market Size 2024 |

USD 3.19 billion |

| DC BEV On-Board Charger Market, CAGR |

9.1% |

| DC BEV On-Board Charger Market Size 2032 |

USD 6.39 billion |

The DC BEV On-Board Charger market is characterized by strong competition among major players such as Alfanar Group, Avid Technology, BorgWarner, Delta Energy Systems, STMicroelectronics, Toyota Industries Corporation, Valeo, and Infineon Technologies. These companies focus on developing compact, energy-efficient, and high-power onboard charging solutions to support the growing adoption of battery electric vehicles. Continuous R&D in silicon carbide and gallium nitride technologies enhances power density and charging efficiency. Asia-Pacific led the market with a 34% share in 2024, driven by large-scale BEV production in China, Japan, and South Korea, followed by North America with 33% and Europe with 29%.

Market Insights

- The DC BEV On-Board Charger market was valued at USD 3.19 billion in 2024 and is expected to reach USD 6.39 billion by 2032, growing at a CAGR of 9.1%.

• Market growth is driven by rising BEV adoption, government incentives for zero-emission vehicles, and rapid advancement in high-power charging technologies.

• Key trends include the integration of bi-directional and smart charging features, use of silicon carbide and gallium nitride components, and the shift toward lightweight, compact designs.

• Competition remains intense as leading companies focus on innovation, OEM collaborations, and compliance with global charging standards while managing high R&D costs.

• Asia-Pacific dominated with a 34% share in 2024, followed by North America at 33% and Europe at 29%, while the >11 kW to 22 kW segment led with a 57% share due to its balance of efficiency, performance, and cost-effectiveness across BEV models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Rating

The >11 kW to 22 kW segment dominated the DC BEV On-Board Charger market in 2024, accounting for around 57% share. This range is preferred for most passenger and light commercial BEVs due to its balance between charging speed and energy efficiency. The segment’s dominance is driven by expanding deployment of mid-range electric vehicles and government mandates for faster home and public charging. Automakers are increasingly adopting 11–22 kW chargers to support overnight and workplace charging needs, aligning with growing consumer demand for accessible and reliable charging solutions.

- For instance, BorgWarner’s 800 V OBC supports 19.2 kW single-phase and 22 kW three-phase.

By Vehicle Type

Passenger cars held the largest share of approximately 62% in the DC BEV On-Board Charger market in 2024. The segment’s growth is supported by the rapid adoption of electric cars across urban regions and advancements in compact high-efficiency chargers. Rising EV sales in China, Europe, and the U.S., along with expanding incentives for private EV ownership, continue to boost demand. Manufacturers are integrating lightweight, high-power onboard chargers that enhance range efficiency and charging flexibility, further strengthening passenger car dominance in the overall market.

- For instance, LG Magna e-Powertrain lists OBC outputs of 3.6 kW, 7.2 kW, and 11 kW with up to 95% efficiency.

Key Growth Drivers

Rising Adoption of Battery Electric Vehicles (BEVs)

Growing BEV adoption globally is a major driver for the DC On-Board Charger market. Governments are implementing strict emission norms and offering incentives to accelerate electric mobility. Increased consumer preference for sustainable transport and falling battery prices are further supporting market expansion. Automakers are boosting BEV production to meet rising demand, directly increasing the need for efficient DC onboard chargers. The transition toward electrified fleets and mass-market EV availability reinforces consistent demand across both passenger and commercial segments.

- For instance, Tesla delivered 1,789,226 vehicles in 2024, which marked the company’s first year-over-year decline in annual deliveries, down from 1,808,581 in 2023.

Advancements in High-Power Charging Technologies

Rapid technological improvements in power electronics and semiconductor materials are enhancing charger efficiency and reducing energy loss. The adoption of wide bandgap semiconductors like SiC and GaN allows compact, lightweight, and thermally stable onboard chargers. These innovations support higher voltage platforms, improving charging speed and vehicle performance. As automakers shift to 800V architectures, demand for DC onboard chargers capable of handling faster, high-current charging continues to surge, fueling market growth during the forecast period.

- For instance, Infineon’s REF-DAB board delivers up to 11 kW at 800 V.

Government Incentives and Infrastructure Development

Government-backed incentives and charging infrastructure investments play a vital role in market expansion. Initiatives such as tax credits, subsidies, and zero-emission mandates are encouraging both manufacturers and consumers to embrace BEVs. Parallel development of DC fast-charging networks is improving accessibility and reducing range anxiety. These combined efforts create favorable conditions for integrating advanced onboard chargers across vehicle categories, ensuring stable demand in developed and emerging markets alike.

Key Trends and Opportunities

Integration of Smart and Bi-Directional Charging Features

The emergence of bi-directional charging and Vehicle-to-Grid (V2G) technology presents strong opportunities for market growth. Advanced DC onboard chargers now support two-way energy flow, enabling EVs to act as mobile energy storage units. This functionality supports grid stabilization and renewable energy balancing. As energy management becomes a priority, automakers and utilities are investing in V2G-compatible chargers to enhance grid resilience and enable new revenue streams through energy trading and demand response services.

- For instance, Delta Electronics offers bidirectional OBCs enabling V2G, V2H, V2V, and V2L functions, with product variants up to 22 kW.

Shift Toward Compact and Lightweight Designs

Manufacturers are focusing on compact, modular, and lightweight charger designs to enhance vehicle efficiency and performance. Advanced cooling systems, miniaturized components, and integrated architectures are reducing charger size while maintaining high power density. These developments support vehicle weight reduction and better energy utilization. Growing demand for space-efficient onboard components, especially in high-performance and light utility BEVs, is driving innovation in charger form factors and design optimization.

- For instance, innolectric’s OBC42 outputs up to 22 kW with over 96% maximum efficiency and over 94% from 2–22 kW.

Key Challenges

High Development and Integration Costs

Developing advanced DC onboard chargers involves significant R&D investment, high-cost components, and complex integration with vehicle systems. The need for thermal management, electromagnetic compatibility, and safety compliance increases overall design cost. These expenses limit affordability for entry-level BEVs and slow mass adoption. Manufacturers are exploring cost optimization strategies through modular architectures and economies of scale, but initial cost barriers remain a notable challenge in achieving widespread deployment.

Standardization and Compatibility Issues

Lack of uniform charging standards across regions poses a major challenge for DC onboard charger manufacturers. Variations in voltage levels, connector types, and grid interfaces complicate global product deployment. This fragmentation restricts interoperability between vehicles and public charging networks. To overcome this, industry players are collaborating on unified charging protocols and cross-platform compatibility solutions, but full standardization remains incomplete, hindering smooth adoption across international markets.

Regional Analysis

North America

North America held a 33% share of the DC BEV On-Board Charger market in 2024, supported by rising EV adoption and expanding charging networks across the United States and Canada. Federal and state incentives for zero-emission vehicles are accelerating the integration of high-power DC chargers. Leading automakers and startups are increasing BEV production, creating strong demand for onboard charging solutions. The presence of advanced semiconductor manufacturers and technology suppliers further strengthens the region’s supply chain, making North America a key market for innovation in high-efficiency charging architectures.

Europe

Europe accounted for around 29% share in 2024, driven by strong regulatory support for electrification and growing consumer preference for sustainable mobility. Countries such as Germany, France, and the Netherlands are investing heavily in EV infrastructure and smart charging networks. Automakers are focusing on high-voltage DC charging compatibility to meet EU emission targets. The region’s emphasis on carbon neutrality and advanced automotive R&D fosters demand for compact, lightweight onboard chargers. Additionally, cross-country charging standardization initiatives are enhancing interoperability, promoting broader BEV deployment across European markets.

Asia-Pacific

Asia-Pacific dominated the DC BEV On-Board Charger market with a 34% share in 2024, led by China, Japan, and South Korea. The region benefits from large-scale BEV production, strong government incentives, and rapid expansion of domestic charging infrastructure. China’s aggressive EV policies and extensive manufacturing ecosystem give it a leading position in high-power onboard charger development. Japan and South Korea continue to innovate in fast-charging technology and energy management. The growing preference for affordable electric passenger cars and light utility vehicles supports long-term market growth across the region.

Middle East & Africa

The Middle East & Africa captured around 2% share of the DC BEV On-Board Charger market in 2024. Although adoption is currently limited, the region is witnessing gradual growth driven by national clean energy goals and smart mobility initiatives in the UAE and Saudi Arabia. Governments are introducing pilot EV programs and public charging stations to encourage consumer adoption. Collaborations with global automakers are expected to enhance local EV availability. As sustainability targets expand, investments in DC charging infrastructure will play a crucial role in accelerating market penetration.

Latin America

Latin America held nearly 2% share of the DC BEV On-Board Charger market in 2024, with Brazil and Mexico leading adoption. The market is supported by rising urban electrification programs and tax incentives for EV imports. Expansion of public charging networks in metropolitan regions is encouraging early BEV adoption. Local automakers are gradually incorporating DC onboard charging systems to align with emission reduction policies. Although market development remains at an early stage, ongoing infrastructure modernization and renewable integration are expected to create future growth opportunities in the region.

Market Segmentations:

By Rating

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Light Utility Vehicles (LUVs)

- High-Performance BEVs

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The DC BEV On-Board Charger market features strong competition among leading players including Alfanar Group, Avid Technology, Bell Power Solution, BorgWarner, Brusa Elektronik, Current Ways, Delphi Technologies, Delta Energy Systems, Eaton Corporation, Ficosa International, Innolectric, Kirloskar Electric Company, Powell Industries, Stercom Power Solutions, STMicroelectronics, Toyota Industries Corporation, Valeo, Xepics Italia, Stellantis, and Infineon Technologies. Market participants focus on developing compact, lightweight, and thermally efficient chargers that meet increasing BEV power demands. Strategic alliances, OEM collaborations, and R&D investments in silicon carbide and gallium nitride technologies enhance product performance and energy efficiency. Companies emphasize vehicle-to-grid compatibility, bi-directional charging, and modular designs to maintain competitive advantage, while adherence to evolving safety and efficiency standards ensures consistent market growth and global expansion opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Alfanar Group

- Avid Technology

- Bell Power Solution

- BorgWarner

- Brusa Elektronik

- Current Ways

- Delphi Technologies

- Delta Energy Systems

- Eaton Corporation

- Ficosa International

- Innolectric

- Kirloskar Electric Company

- Powell Industries

- Stercom Power Solutions

- STMicroelectronics

- Toyota Industries Corporation

- Valeo

- Xepics Italia

- Stellantis

- Infineon Technologies

Recent Developments

- In 2024, Delta declared that its 500kW DC Ultra-fast EV Charger UFC 500 would be available in the EMEA market.

- In 2024, Stellantis Established a joint venture named Ionna with other automakers to build a new, high-speed charging infrastructure in North America.

- In 2023, Infineon Technologies Launched the 650 V CoolMOS CFD7A in a QDPAK package for efficient, rapid charging in on-board chargers and DC-DC converters.

Report Coverage

The research report offers an in-depth analysis based on Rating, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising global adoption of battery electric vehicles.

- Advancements in silicon carbide and gallium nitride technologies will enhance charger efficiency.

- Automakers will increasingly integrate compact and lightweight onboard charging systems.

- Vehicle-to-grid and bi-directional charging functions will gain commercial adoption.

- Standardization of DC charging protocols will improve interoperability across regions.

- Government incentives and emission regulations will continue to drive BEV infrastructure growth.

- High-performance and premium BEVs will demand higher-capacity onboard chargers.

- Integration of smart energy management systems will optimize grid interaction.

- Asia-Pacific will remain the manufacturing hub for advanced DC charging systems.

- Collaborative R&D between automakers and power electronics firms will shape future innovations.