Market Overview:

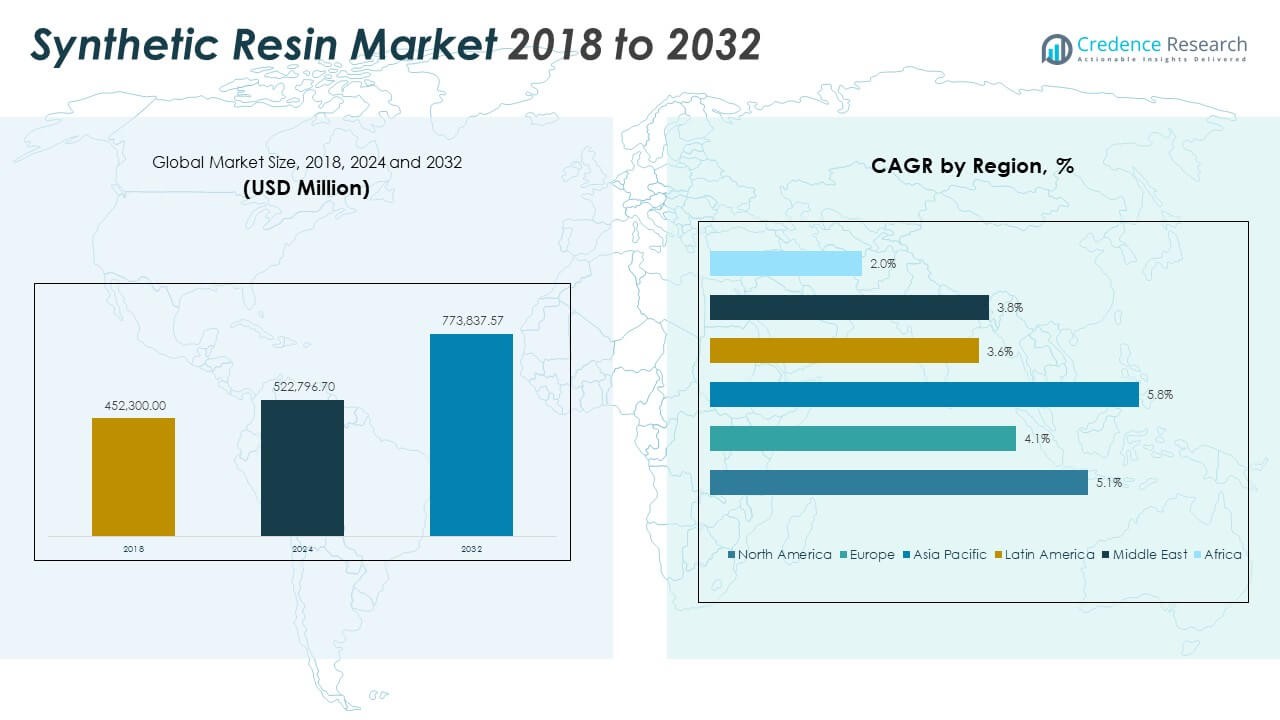

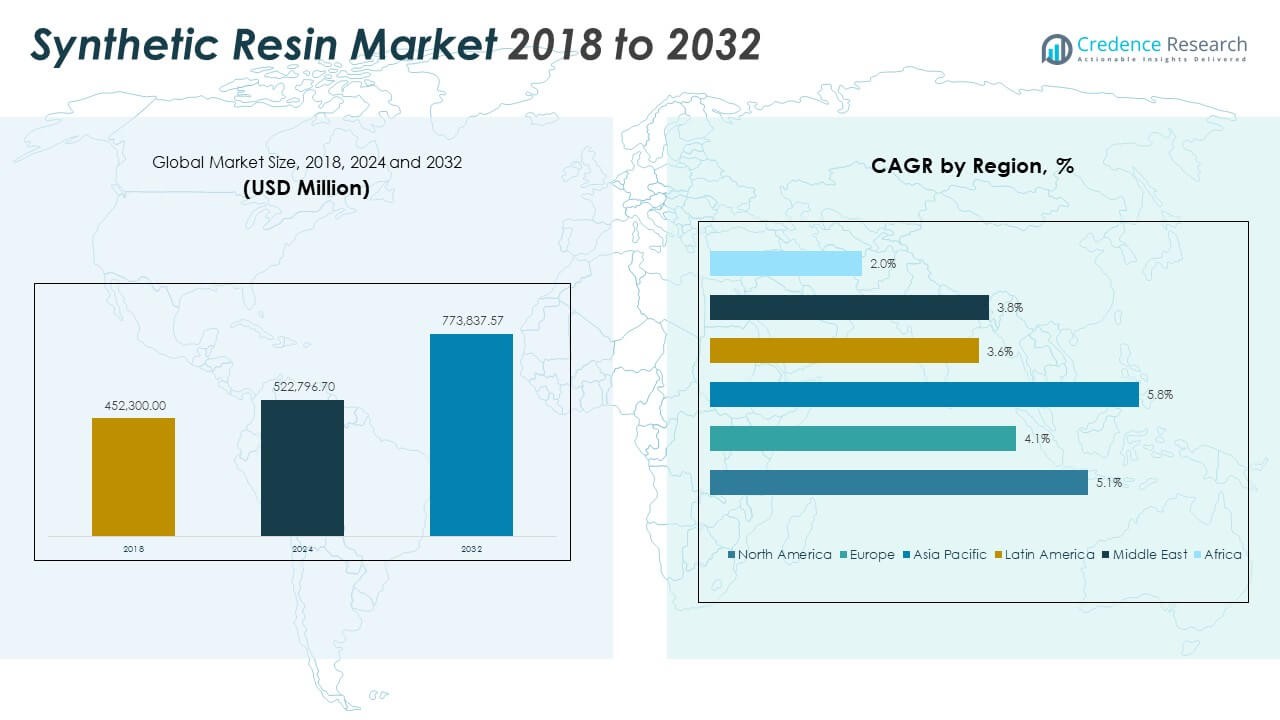

The Synthetic Resin Market size was valued at USD 452,300.00 million in 2018 to USD 522,796.70 million in 2024 and is anticipated to reach USD 773,837.57 million by 2032, at a CAGR of 5.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Synthetic Resin Market Size 2024 |

USD 522,796.70 Million |

| Synthetic Resin Market, CAGR |

5.08% |

| Synthetic Resin Market Size 2032 |

USD 773,837.57 Million |

The market is driven by rising demand from packaging, construction, automotive, and electronics industries. Synthetic resins offer durability, corrosion resistance, and cost-effective processing, making them essential for a wide range of products. It supports sustainable material innovations, particularly in lightweight and energy-efficient applications. Increasing infrastructure projects and growing urbanization create stable growth opportunities. Companies are also investing in advanced production technologies and bio-based resin alternatives to meet evolving environmental standards.

Asia Pacific leads the market due to its large manufacturing base and strong industrial demand. North America and Europe remain key markets, supported by technological innovation and regulatory compliance. Latin America and the Middle East show steady expansion with growing infrastructure projects. Africa is emerging with rising investment in packaging and construction industries. Regional growth patterns reflect a combination of industrial maturity, economic expansion, and strategic investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Synthetic Resin Market size was valued at USD 452,300.00 million in 2018, USD 522,796.70 million in 2024, and is projected to reach USD 773,837.57 million by 2032, registering a CAGR of 5.08% during the forecast period.

- Asia Pacific holds the highest regional share at 57.47%, driven by its strong manufacturing base and rising infrastructure investments. North America holds 27.6% and Europe 24.8%, supported by advanced technologies and regulatory frameworks.

- Asia Pacific is the fastest-growing region, driven by industrial expansion, cost advantages, and rising demand in packaging and construction industries.

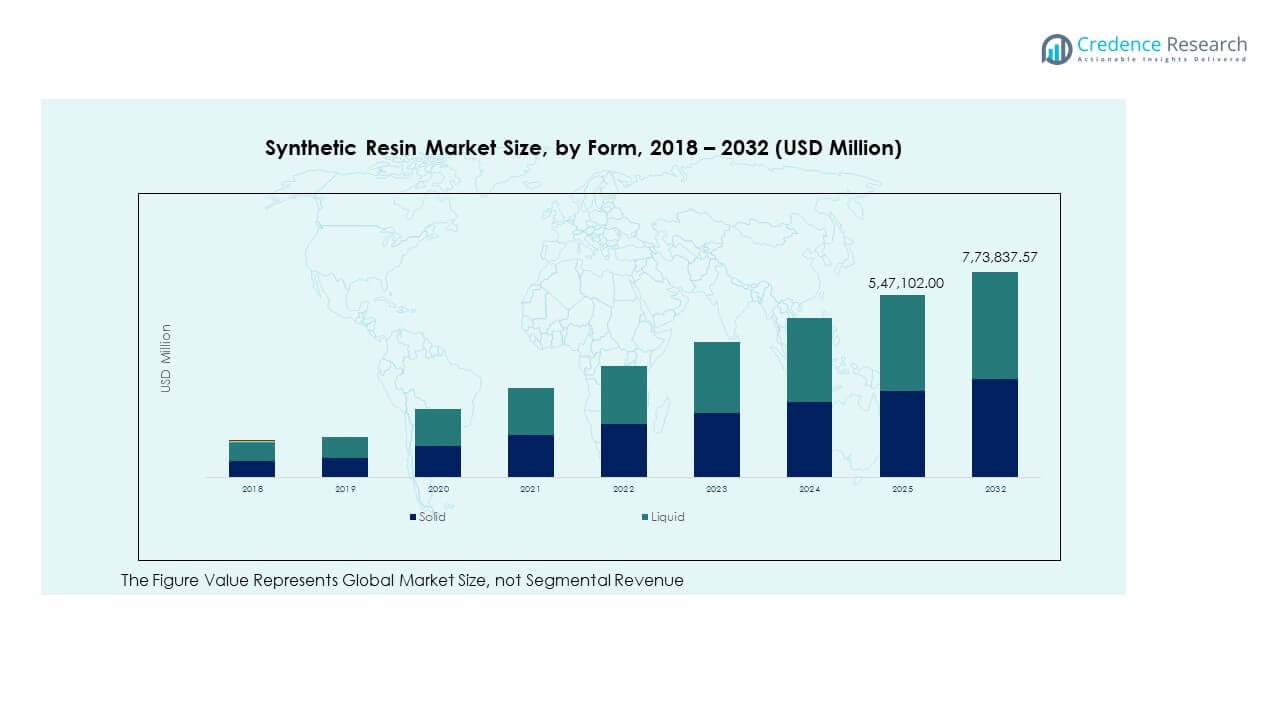

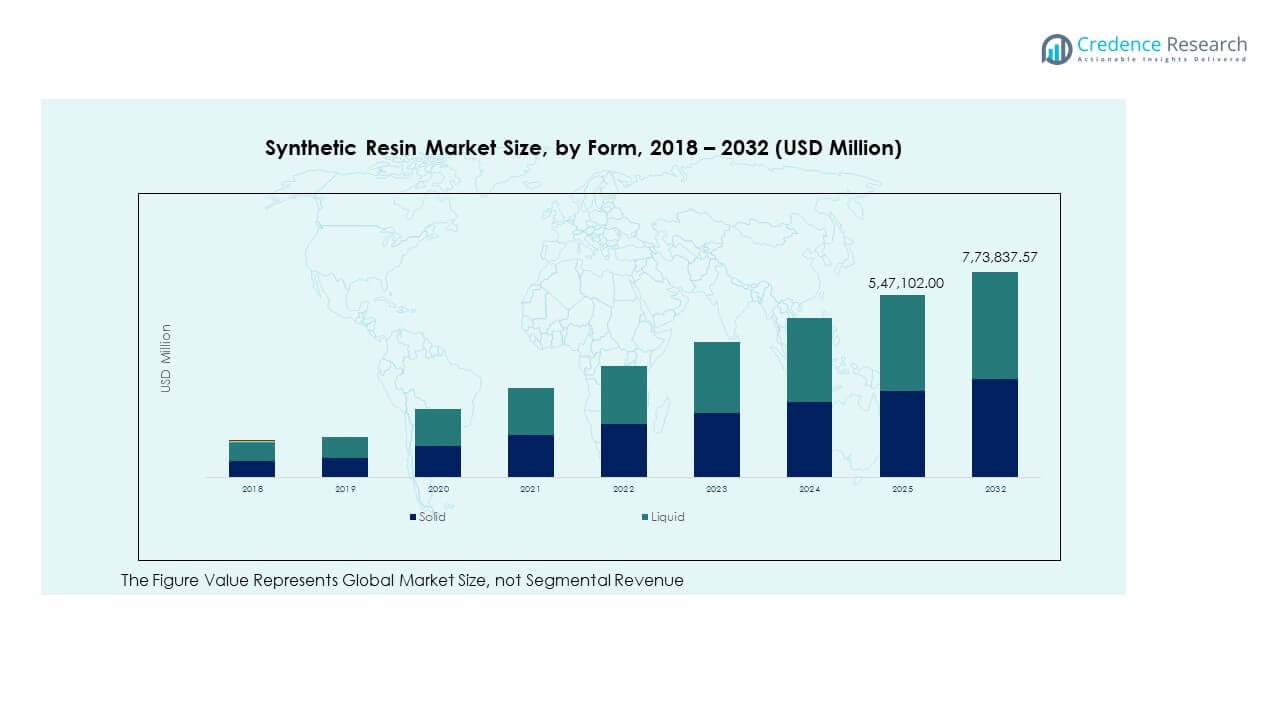

- The solid segment contributes 44% of the total market share, supported by strong use in coatings, adhesives, and structural materials.

- The liquid segment holds 56% of the market share, leading due to its flexibility, easy processing, and wide adoption in packaging and automotive applications.

Market Drivers

Rising Infrastructure Development and Expansion Across Construction and Transportation Sectors

The increasing demand for modern infrastructure is creating strong momentum for the Synthetic Resin Market. Rapid urbanization drives investments in construction, residential housing, and public transport networks. Resin materials support large-scale projects due to their durability, lightweight structure, and cost-effectiveness. Builders rely on high-performance coatings, adhesives, and sealants made from synthetic resins. Transportation sectors such as rail, aviation, and marine use resin-based composites for structural strength and corrosion resistance. Governments are introducing infrastructure stimulus packages that accelerate material demand. It benefits industries focusing on energy efficiency and sustainability. This growing requirement across multiple sectors strengthens the market’s long-term outlook.

Increasing Use of Lightweight Materials in the Automotive and Aerospace Industries

Automotive and aerospace companies are shifting toward lightweight materials to reduce fuel consumption and emissions. Synthetic resins offer strong adhesion, flexibility, and temperature resistance, supporting vehicle component manufacturing. It helps reduce overall weight without compromising safety and durability. Resin composites replace metals in body panels, interiors, and structural parts. The need for high-performance materials in electric vehicles is growing. Advanced manufacturing technologies improve resin application and reduce production costs. Strategic collaborations between OEMs and chemical producers enhance innovation. These advancements expand the industrial base and strengthen the market’s competitive position.

Growing Shift Toward Bio-Based and Sustainable Resin Production Technologies

Sustainability is becoming a central focus in global industries, pushing demand for bio-based resin solutions. Manufacturers invest in renewable feedstocks such as plant oils and biopolymers to reduce environmental impact. It enables industries to meet strict carbon and waste regulations. Bio-resins maintain similar performance levels to conventional resins, supporting their adoption in packaging, construction, and automotive applications. Regulatory frameworks encourage manufacturers to prioritize low-emission materials. New production technologies improve efficiency and lower energy consumption. Research initiatives enhance the quality and cost-competitiveness of bio-resins. This shift creates long-term growth potential for sustainable material production.

- For instance, in February 2024, Covestro inaugurated the world’s first pilot plant for bio-based aniline at its Leverkusen, Germany site, using 100% plant biomass via fermentation a breakthrough technology supporting insulation foam materials and reducing fossil CO₂ emissions, with initial industrial-scale quantities produced for wide testing in building and refrigeration applications.

Expansion of Consumer Goods and Packaging Applications Driving Market Growth

Packaging remains one of the largest end-use sectors for synthetic resins, supported by rising demand for durable and flexible packaging solutions. It meets the requirements of FMCG, food, and healthcare industries. Resin-based films and containers provide excellent barrier properties and extended shelf life. Consumer goods manufacturers adopt lightweight packaging to reduce logistics costs. E-commerce growth increases the need for protective packaging solutions. Innovative resin formulations enhance recyclability and product performance. Companies integrate advanced molding technologies to meet customized packaging demands. This expansion creates strong opportunities across both developed and emerging economies.

- For instance, in October 2024, Dow Chemical and Ambipar partnered to target recycling of 60,000 tons of polyethylene annually in Brazil by 2030, converting post-consumer plastic waste into high-value resins supporting durable and flexible food and consumer goods packaging, as part of a broader transition to circular economy models in the packaging sector.

Market Trends

Increased Investment in Advanced Resin Formulations for High-Performance Applications

R&D investments are rising to create advanced resin formulations with superior strength and resistance properties. Companies are developing new polymer blends that support demanding industrial uses. It improves thermal stability, impact resistance, and chemical durability in multiple end-use industries. High-performance resins enable advanced applications in automotive, electronics, and renewable energy sectors. Strategic alliances between material developers and OEMs accelerate innovation. Regulatory pressure for safer and sustainable materials encourages further advancements. Pilot production facilities test scalable solutions to meet industrial standards. This investment trend strengthens market differentiation and global competitiveness.

Rapid Digitalization of Production Processes Through Industry 4.0 Integration

Manufacturers are deploying Industry 4.0 tools to modernize resin production facilities. Automation, IoT, and data analytics improve process control and reduce waste. It supports better resource utilization and enhances operational efficiency. Digital twins and predictive maintenance models ensure consistent production quality. Smart manufacturing technologies help reduce downtime and optimize energy consumption. Global producers use digital platforms to monitor supply chains in real time. Integration of AI enhances decision-making in formulation and process optimization. This transformation improves production agility and cost-effectiveness.

Surge in Adoption of Circular Economy Models and Closed-Loop Recycling Systems

Circular economy principles are becoming a central focus of leading material producers. Companies implement closed-loop systems to recycle and reuse resin materials. It reduces dependency on virgin raw materials and aligns with sustainability goals. Advanced chemical recycling technologies improve resin recovery without compromising quality. Governments support recycling initiatives through policy incentives and targets. Packaging and automotive industries are early adopters of these models. Partnerships with recycling technology firms accelerate scalable implementation. This shift enhances resource efficiency and strengthens environmental compliance.

- For instance, SABIC and Plastic Energy established the SPEAR (SABIC Plastic Energy Advanced Recycling) plant in Geleen, Netherlands, to process 20,000 metric tons of mixed post-consumer plastic annually. The facility converts this waste into TACOIL™, a pyrolysis oil used to produce circular polymers. The joint venture aims to supply high-quality recycled materials for advanced applications in multiple industries.

Rising Application of Smart Functional Resins in Emerging High-Tech Sectors

Smart resins with electrical, thermal, or self-healing properties are entering new markets. These resins enhance product performance in electronics, healthcare, and renewable energy. It supports miniaturization, energy efficiency, and durability in modern devices. High-tech industries demand tailored solutions that meet strict performance standards. Material science advancements enable functional modifications at the molecular level. Companies invest in application-specific formulations to meet niche requirements. Intellectual property portfolios expand, driving competitive advantages. This trend diversifies the scope of resin technology in advanced applications.

- For instance, Henkel’s Loctite® 3D 3843 HDT60 resin features an IZOD notched impact strength of 53 J/m, a tensile strength of 51 MPa, and a heat deflection temperature of 63 °C. Its elongation at break is 43%, supporting advanced 3D printing applications that require strong, durable, and heat-resistant components.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Instability

Fluctuating crude oil prices directly impact resin production costs. Synthetic resins depend heavily on petrochemical feedstocks, making pricing highly sensitive to market disruptions. It creates cost uncertainty for manufacturers and downstream industries. Global supply chains face challenges from geopolitical tensions and transportation delays. Limited raw material availability in some regions increases procurement risk. Companies face difficulties in maintaining stable profit margins during price spikes. Long-term supply contracts and diversification strategies help reduce exposure but do not fully eliminate volatility. This challenge affects production planning and investment decisions.

Regulatory Pressure and Environmental Compliance Complexity in Global Markets

Tighter regulations on emissions, waste, and chemical safety create compliance burdens for producers. The Synthetic Resin Market faces stricter guidelines related to volatile organic compound (VOC) content and end-of-life management. It requires costly investments in cleaner production technologies. Companies must track and certify sustainability across supply chains. Varying regional regulations complicate market entry strategies for international firms. Non-compliance risks heavy penalties and brand damage. Smaller producers struggle to meet complex reporting and testing requirements. This regulatory landscape slows product launches and increases operational costs.

Market Opportunities

Growing Adoption of Advanced Composites in Renewable Energy and Green Building Projects

The increasing shift toward renewable energy and sustainable construction creates major growth prospects. Resin-based composites support lightweight, durable, and high-strength structures in wind turbines and solar panel components. It enhances energy efficiency in building envelopes and infrastructure. Developers focus on cost-effective material solutions with high performance. Green building certifications encourage wider use of low-impact resins. Collaboration with renewable energy firms expands industrial opportunities. Integration with digital manufacturing technologies improves design flexibility. This shift aligns market growth with global sustainability goals.

Rising Demand in Emerging Economies Driven by Urbanization and Industrial Expansion

Emerging markets in Asia, Latin America, and Africa offer new opportunities for producers. Rapid urbanization increases demand for construction, automotive, and packaging applications. It creates a strong foundation for capacity expansion and technological investment. Government infrastructure programs enhance industrial activity and material consumption. Strategic partnerships with local firms accelerate market entry. Growing consumer spending power drives higher product penetration. Technological upgrades improve competitiveness against established global players. These opportunities make emerging economies key growth engines for future market expansion.

Market Segmentation Analysis:

By Form

The Synthetic Resin Market is segmented into solid, liquid, emulsion, and dispersion forms. Solid and liquid segments dominate due to their wide use in packaging, coatings, and construction applications. These forms offer superior durability, chemical resistance, and processing ease. Emulsion and dispersion segments cater to specialized uses in adhesives, paints, and printing inks. Their flexibility and compatibility with advanced manufacturing processes strengthen their position in high-performance applications. This form-based segmentation allows industries to select tailored solutions for structural, decorative, and functional needs.

By Application

Packaging leads the application segment due to rising demand from food, beverage, and e-commerce industries. Paints and coatings, adhesives and sealants, and electronic fabrications follow, driven by product performance requirements and manufacturing flexibility. Pipes and hoses, printing inks, and transportation components support diverse end-use sectors. These applications enhance structural integrity, product protection, and aesthetics. The broad application base ensures stable demand across consumer and industrial markets, reinforcing its strategic role in global supply chains.

By End Use

Transportation, building and construction, and electrical and electronics hold the largest shares in end use. These industries rely on synthetic resins for lightweight components, corrosion resistance, and durability. Food and beverage packaging uses resins to enhance shelf life and safety. Personal care and cosmetics adopt resin materials for functional and aesthetic product features. Oil and gas sectors use specialized resins for insulation and protection. This end-use segmentation supports steady industrial growth and diversified market penetration.

- For instance, Amcor’s AmLite Ultra Recyclable is a high-barrier packaging film designed to maintain product freshness and support recyclability. The film has been developed to replace traditional multilayer packaging while meeting food protection and shelf-life requirements. It is certified recyclable in several European countries.

By Product Type

Thermosetting resins, including epoxy, phenolic, polyurethane, and polyester, support applications requiring high strength and structural integrity. These resins are preferred in construction, automotive, and coatings. Thermoplastic resins such as polyethylene, polypropylene, PVC, polycarbonate, PET, and nylon dominate mass production due to their flexibility and cost-effectiveness. They enable easy processing, recycling, and broad functional use. This product type segmentation ensures that industries can access materials tailored to both high-performance and large-scale applications.

- For instance, Covestro’s Desmopan® thermoplastic polyurethane (TPU) is recognized for its high flexibility, abrasion resistance, and durability in demanding applications such as footwear and industrial components. It is widely used in performance materials requiring resilience and long service life. These properties make it a key material for functional and structural applications across multiple industries.

Segmentation:

By Form

- Solid

- Liquid

- Emulsion

- Dispersion

By Application

- Packaging

- Printing Inks

- Pipes & Hoses

- Sheets & Films

- Paints & Coatings

- Adhesives & Sealants

- Electronic Fabrications

- Transportation Components

- Other Applications

By End Use

- Transportation

- Food & Beverage

- Personal Care & Cosmetic

- Building & Construction

- Oil & Gas

- Electrical & Electronics

- Other End Uses

By Product Type

· Thermosetting Resin

- Epoxy Resins

- Phenolic Resins

- Polyurethane Resins

- Polyester Resins

- Other Thermosetting Resin

· Thermoplastic Resin

- Polyethylene

- Polypropylene

- Polyvinyl Chloride (PVC)

- Polycarbonate

- Polyethylene Terephthalate (PET)

- Nylon

- Other Thermoplastic Resin

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Synthetic Resin Market size was valued at USD 101,767.50 million in 2018 to USD 115,325.82 million in 2024 and is anticipated to reach USD 170,323.04 million by 2032, at a CAGR of 4.92% during the forecast period. North America holds a significant market share driven by its strong industrial base and advanced manufacturing capabilities. The region benefits from high consumption across packaging, construction, and automotive sectors. It leverages advanced material technologies to enhance product performance and reduce operational costs. Major players in the region invest heavily in R&D to support sustainable and high-performance resin solutions. Regulatory frameworks encourage the use of eco-friendly materials, supporting market expansion. Strong demand from the U.S. and Canada creates stable revenue streams. The integration of smart production processes continues to strengthen regional competitiveness.

Europe

The Europe Synthetic Resin Market size was valued at USD 92,269.20 million in 2018 to USD 101,303.71 million in 2024 and is anticipated to reach USD 139,099.36 million by 2032, at a CAGR of 4.03% during the forecast period. Europe remains a key market due to its strong regulatory standards, advanced technologies, and growing focus on sustainability. The region leads in adopting bio-based and recyclable resin solutions, particularly in packaging and construction industries. Germany, France, and the UK drive technological innovation and manufacturing excellence. Automotive and building sectors generate consistent demand for durable and lightweight materials. Industry collaborations between producers and end users enhance product development. Europe’s emphasis on circular economy principles strengthens long-term market growth. Regional companies maintain a strong export presence across global value chains.

Asia Pacific

The Asia Pacific Synthetic Resin Market size was valued at USD 214,842.50 million in 2018 to USD 253,998.58 million in 2024 and is anticipated to reach USD 396,437.61 million by 2032, at a CAGR of 5.73% during the forecast period. Asia Pacific dominates the global market, supported by large-scale manufacturing in China, India, Japan, and South Korea. Rapid urbanization, strong infrastructure development, and rising consumer spending drive material demand. Packaging, construction, and electronics industries account for the largest share of consumption. Regional governments support capacity expansion and industrial modernization. Cost-efficient production and availability of raw materials enhance the region’s export competitiveness. It attracts significant foreign investment in polymer and resin production facilities. This growth trajectory positions Asia Pacific as the most dynamic and fast-growing market globally.

Latin America

The Latin America Synthetic Resin Market benefits from expanding infrastructure and rising demand across construction, automotive, and consumer goods industries. Brazil and Argentina lead the region in industrial resin use. It is experiencing growing investment in downstream petrochemical facilities to support local production. Demand for cost-effective and flexible materials drives adoption across packaging and transportation components. Regulatory reforms and trade agreements are improving access to new technologies and partnerships. Packaging and construction industries remain the main demand generators. Rising urban population supports stable growth in resin consumption. Industrial expansion initiatives are expected to improve the region’s share in global trade.

Middle East

The Middle East Synthetic Resin Market is expanding due to increased industrial diversification and petrochemical production investments. GCC countries lead with strong capacity and cost advantages in resin manufacturing. It benefits from abundant raw materials and strategic trade positions. Infrastructure development, packaging, and oil and gas industries drive demand growth. Regional producers are expanding their export footprints into Asia and Europe. Technology partnerships are improving production efficiency and product quality. Regulatory incentives support industrial modernization and diversification. The region shows steady growth potential in both domestic and export markets.

Africa

The Africa Synthetic Resin Market is developing steadily, supported by construction, packaging, and industrial expansion. South Africa and Egypt lead consumption, driven by urbanization and infrastructure development. It is attracting international partnerships to improve manufacturing capacity. Demand growth is supported by consumer goods, automotive, and building industries. The market faces infrastructure challenges but shows strong potential for regional investment. Governments are promoting industrialization strategies to increase local production. Packaging industries remain the primary demand drivers. Growing economic activity and urban development support long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- SABIC

- Covestro AG

- Mitsubishi Chemical Group Corporation

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

- DSM-Firmenich

- Dow Inc.

- DuPont de Nemours, Inc.

- Westlake Chemical Corporation

- Hexion Inc.

- Huntsman Corporation

- Ashland Global Holdings Inc.

- Ingevity

- AOC, LLC

- Reichhold LLC

Competitive Analysis:

The Synthetic Resin Market is characterized by strong competition among global and regional players focused on capacity expansion, technological innovation, and sustainable product development. Leading companies such as BASF SE, SABIC, Covestro AG, Dow Inc., DuPont de Nemours, LG Chem, Mitsubishi Chemical Group Corporation, Arkema S.A., DSM-Firmenich, and Huntsman Corporation invest heavily in R&D to enhance material performance and lower production costs. It emphasizes bio-based resin development and recycling technologies to meet regulatory and customer expectations. Strategic initiatives include mergers, acquisitions, and regional expansions to strengthen market presence. Key players adopt digital manufacturing, advanced processing, and product customization to target high-growth sectors like packaging, automotive, and construction. Competitive intensity remains high, driven by cost optimization, product differentiation, and global distribution networks.

Recent Developments:

- In August 2025, Covestro AG acquired two HDI derivative production sites in Rayong (Thailand) and Freeport (USA) from Vencorex, strengthening its supply and innovation capabilities for polyurethane coatings and adhesives across major global industries.

- In April 2025, SABIC showcased an expanded portfolio of synthetic resin innovations at CHINAPLAS in Shenzhen, emphasizing sustainable materials tailored to renewable energy, EVs, and electronics. The company highlighted ongoing local expansions and partnerships in China, including a new thermoplastics compounding plant in Fujian and a world-scale petrochemical complex started in 2024.

- In March 2025, Westlake Corporation unveiled the EpoVIVE portfolio from its Westlake Epoxy division, a new collection of epoxy phenolic resins and curing agents with a sustainability focus.

- In February 2025, Mitsubishi Chemical Group launched sample production of its BiOpreg #500 series, a new generation of sustainable prepreg materials using plant-derived epoxy resin. Manufactured at its Tokai Plant in Aichi, Japan, the series secured ISCC PLUS certification, paving the way for sustainable composites in sectors such as sports, automotive, and industry.

Report Coverage:

The research report offers an in-depth analysis based on Form, Application, End Use and Product Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand from packaging, construction, and automotive industries will drive steady market expansion.

- Bio-based resin innovation will accelerate adoption across regulated sectors seeking low-carbon materials.

- Advanced manufacturing technologies will enhance production efficiency and support large-scale customization.

- Rising urbanization and infrastructure investment in emerging economies will boost long-term material demand.

- Smart resin technologies with functional and high-performance properties will create new application areas.

- Strategic mergers and acquisitions will strengthen global presence and supply chain integration.

- Regulatory frameworks will continue to influence material selection and promote sustainable solutions.

- Expansion of recycling infrastructure will increase the share of circular resin use.

- Technological partnerships between producers and end-use industries will foster faster product innovation.

- Regional capacity expansion in Asia Pacific will sustain its leadership position in global trade.