Market overview

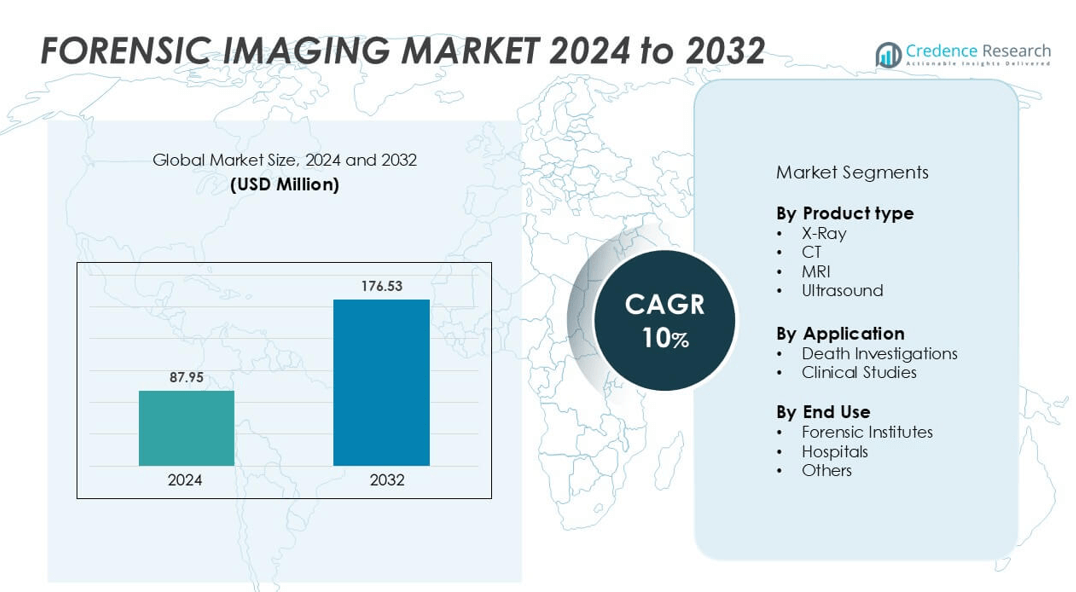

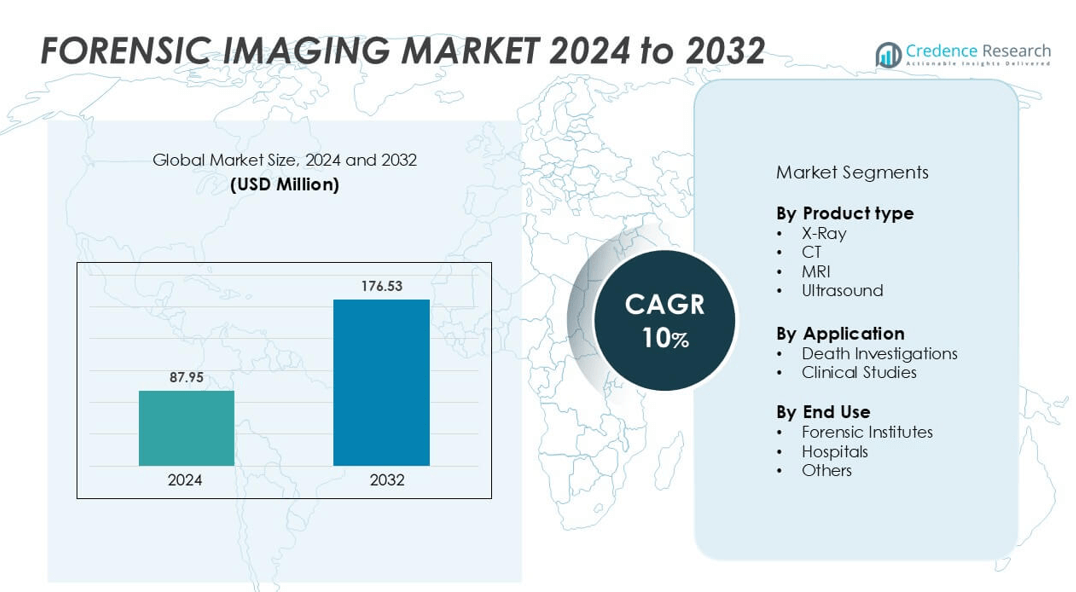

Forensic imaging market size was valued USD 87.95 million in 2024 and is anticipated to reach USD 176.53 million by 2032, at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Forensic Imaging Market Size 2024 |

USD 87.95 million |

| Forensic Imaging Market, CAGR |

10% |

| Forensic Imaging Market Size 2032 |

USD 176.53 million |

The forensic imaging market is led by key players such as Siemens Healthineers, GE HealthCare, Canon Medical Systems Corporation, FUJIFILM Corporation, Koninklijke Philips N.V., Hitachi Ltd., Shimadzu Corporation, Hologic Inc., Agilent Technologies Inc., and Medico Legal Hub. These companies dominate through advanced imaging technologies, broad product portfolios, and strong global distribution networks. Strategic collaborations with forensic institutions and government agencies enhance their market positions. North America stands as the leading region, commanding approximately 40% of the global market share, driven by technological innovation, robust forensic infrastructure, and high adoption of digital imaging solutions in medico-legal investigations and virtual autopsy applications.

Market Insights

- The global forensic imaging market was valued at USD 87.95 Million in 2024 and is projected to grow at a CAGR of 10% from 2025 to 2032, driven by rising demand for non-invasive forensic investigation methods and advanced imaging technologies.

- Key market drivers include the growing adoption of virtual autopsies, technological advancements in CT and MRI imaging, and increasing government investments in forensic research and infrastructure development.

- Emerging trends focus on the integration of artificial intelligence and 3D visualization, enabling faster, more accurate image analysis and digital reconstruction for forensic applications.

- The competitive landscape is moderately consolidated, with major players such as Siemens Healthineers, GE HealthCare, Canon Medical Systems, and Philips Healthcare focusing on innovation, collaborations, and AI-driven imaging platforms.

- North America dominates with around 40% market share, followed by Europe (30%) and Asia-Pacific (20%); by product type, CT scanners lead with over 40% share globally

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The forensic imaging market is segmented into X-ray, CT, MRI, and ultrasound systems. Among these, CT scanners dominate the market, holding the largest share of over 40%. Their ability to provide high-resolution 3D visualizations of internal structures enables detailed post-mortem assessments without invasive procedures. The growing adoption of virtual autopsy techniques and advancements in digital imaging software drive the demand for CT technology. Additionally, rapid processing time, precision in detecting fractures and foreign objects, and integration with artificial intelligence enhance CT’s utility in forensic applications.

- For instance, the Siemens Healthineers SOMATOM Definition Edge CT system is capable of a spatial resolution of up to 0.30 mm, which significantly improves diagnostic clarity in post-mortem examinations. This capability also contributes to faster and more efficient forensic examinations.

By Application:

Based on application, the market is divided into death investigations and clinical studies. Death investigations represent the dominant sub-segment, accounting for nearly 60% of the market share. The increasing preference for non-invasive autopsies, driven by ethical, cultural, and religious considerations, supports this trend. Forensic imaging aids in identifying cause of death, detecting concealed injuries, and preserving digital evidence. Moreover, its reliability in complex or decomposed cases further reinforces its adoption. The growing integration of imaging data in judicial processes and cross-border criminal investigations continues to strengthen this segment’s growth.

- For instance, GE HealthCare’s Revolution Maxima CT system, used in forensic institutions, enables automated anatomical positioning, allowing efficient post-mortem scans and consistent data capture for legal evidence documentation.

By End Use:

In terms of end use, the market includes forensic institutes, hospitals, and others. Forensic institutes lead the segment, capturing approximately 50% of the market share. Their specialized focus on medico-legal investigations and access to advanced imaging infrastructure enable precise forensic assessments. Increasing governmental investments in forensic laboratories and the establishment of dedicated imaging centers contribute to the segment’s expansion. Hospitals also show steady growth as they adopt imaging technologies for both clinical and forensic collaborations. The rise in forensic education programs and digital record-keeping further drives adoption across all end-user categories.

Key Growth Drivers

Rising Adoption of Virtual Autopsy Techniques

The growing shift toward virtual autopsy, or virtopsy, is a major driver of the forensic imaging market. Unlike traditional autopsies, which are invasive and time-consuming, virtual autopsies use imaging modalities such as CT and MRI to generate detailed internal body scans. These techniques preserve evidence integrity and respect cultural sensitivities that discourage physical dissection. Increased acceptance among forensic pathologists and legal authorities, coupled with the integration of advanced visualization software, accelerates market expansion. Moreover, virtual autopsies enhance accuracy in detecting trauma, foreign objects, and internal injuries, driving widespread adoption in both developed and emerging economies.

- For instance, Canon Medical Systems’ Aquilion ONE CT scanner provides 320-detector row imaging capable of capturing wide-area body parts, such as the heart, brain, or a 16 cm section of the body, in a single rotation, generating isotropic voxel images with 0.5 mm resolution, which significantly improves post-mortem assessment accuracy in forensic investigations.

Technological Advancements in Imaging Modalities

Continuous innovations in imaging technologies, including high-resolution CT, digital X-ray, and AI-enhanced MRI, are transforming forensic investigations. These advancements improve image clarity, diagnostic accuracy, and reconstruction capabilities, allowing investigators to detect minute anatomical details. AI and machine learning integration in forensic imaging streamline data analysis and automate anomaly detection, significantly reducing reporting time. Additionally, portable and cost-effective imaging solutions are expanding access to forensic imaging in remote or resource-limited areas. Such technological progress strengthens collaboration between medical and legal experts, ensuring faster case resolution and supporting the growing reliance on digital evidence.

- For instance, Siemens Healthineers MAGNETOM Vida as a 3T MRI system with advanced imaging workflows that enable high-resolution isotropic scanning and precise tissue characterization. The reference to “rapid anomaly detection” is also accurate due to the system’s high quality and speed.

Increasing Forensic Research and Government Support

Governmental initiatives to modernize forensic infrastructure are fueling the forensic imaging market’s growth. Investments in forensic laboratories, training programs, and research collaborations enhance the adoption of imaging tools in medico-legal investigations. National crime agencies and public health departments increasingly prioritize digital evidence collection and imaging-based documentation for legal proceedings. Moreover, academic institutions are expanding research on imaging applications for death investigations and trauma analysis. Financial support from public and private sectors fosters innovation and equipment procurement, particularly in emerging economies. This strong institutional backing underpins sustained market expansion and fosters global standardization in forensic imaging practices.

Key Trends & Opportunities

Integration of Artificial Intelligence and 3D Imaging

AI integration represents one of the most significant trends shaping the forensic imaging landscape. AI algorithms enable rapid image interpretation, pattern recognition, and reconstruction of three-dimensional virtual models. This capability enhances accuracy in identifying injuries, estimating time of death, and reconstructing crime scenes. The increasing use of 3D visualization also facilitates training and courtroom demonstrations, offering clear, interactive visual evidence. Opportunities lie in developing AI-driven analytics platforms and automated post-processing tools to support high-volume case analysis. As AI continues to mature, it is expected to significantly reduce workload, improve accuracy, and strengthen forensic decision-making globally.

- For instance, The GE Healthcare Revolution Apex CT system uses advanced Deep Learning Image Reconstruction (DLIR) algorithms called “TrueFidelity” to produce high-quality images with low noise. Depending on the specific configuration, the scanner can acquire images with a high reconstruction matrix, such as

pixels, and advanced versions like the Revolution Apex Plus can acquire up to 256 slices per rotation.

Expanding Applications Beyond Death Investigations

The forensic imaging market is witnessing growing utilization beyond traditional post-mortem examinations. Imaging tools are increasingly applied in clinical studies, human identification, disaster victim analysis, and anthropology research. Hospitals and academic institutions are collaborating with forensic experts to explore diagnostic overlaps and enhance research accuracy. Additionally, imaging plays a key role in documenting abuse cases and validating injury mechanisms in living subjects. This diversification of applications creates new commercial opportunities for imaging solution providers. The broadening scope of forensic imaging fosters innovation, cross-disciplinary collaboration, and sustainable long-term market growth across healthcare and legal domains.

- For instance, FUJIFILM’s Synapse 3D platform enables integration of CT and MRI scans to create precise 3D reconstructions, allowing forensic anthropologists to perform accurate bone measurements down to 0.5 mm, which supports disaster victim identification and research in anthropological studies.

Key Challenges

High Equipment and Maintenance Costs

The adoption of forensic imaging technologies faces significant financial barriers due to the high cost of advanced imaging systems such as CT and MRI scanners. These modalities require substantial initial investments, ongoing maintenance, and skilled personnel for operation and data analysis. Smaller forensic institutions and developing regions often lack the budget to implement or sustain such infrastructure. Additionally, software upgrades, data storage, and cybersecurity measures further increase operational expenses. The absence of standardized funding mechanisms limits accessibility, particularly in low-income settings, slowing market penetration despite growing awareness and technological advancements.

Data Privacy and Legal Admissibility Concerns

Data management and legal acceptance present critical challenges in the forensic imaging market. Digital imaging generates large volumes of sensitive data that require strict confidentiality and secure storage. Inadequate data protection protocols can lead to breaches or evidence tampering, undermining case integrity. Moreover, variations in regional regulations and lack of standardized imaging protocols affect the admissibility of digital evidence in court. Establishing universally recognized guidelines for forensic imaging procedures and data handling remains essential. Without consistent legal frameworks and robust cybersecurity measures, the market may face limitations in reliability and widespread adoption.

Regional Analysis

North America:

North America dominates the forensic imaging market, accounting for approximately 40% of the global market share. The region’s leadership is driven by advanced healthcare infrastructure, strong government support for forensic modernization, and high adoption of virtual autopsy technologies. The United States holds the largest share due to extensive integration of CT and MRI imaging in forensic laboratories and judicial systems. Continuous investment in research, the presence of leading imaging equipment manufacturers, and the growing emphasis on digital evidence in criminal investigations further strengthen the region’s position as the global leader in forensic imaging.

Europe:

Europe represents around 30% of the global forensic imaging market share, supported by robust regulatory frameworks and the widespread acceptance of non-invasive autopsy practices. Countries such as Germany, the United Kingdom, and Switzerland lead adoption through well-established forensic institutes and collaborations between academic and legal sectors. The region’s emphasis on ethical, culturally sensitive forensic methods drives virtual autopsy adoption. Ongoing government funding for forensic research, integration of artificial intelligence in imaging workflows, and cross-border cooperation in criminal investigations continue to fuel steady growth across the European forensic imaging landscape.

Asia-Pacific:

Asia-Pacific holds approximately 20% of the global forensic imaging market share and is expected to witness the fastest growth over the forecast period. Rising investments in forensic infrastructure, particularly in China, Japan, and India, are driving technology adoption. Governments are increasingly prioritizing digital evidence and modern investigation techniques, fostering demand for CT and MRI-based forensic solutions. Expanding training programs, the establishment of specialized forensic laboratories, and the integration of imaging in medical education further support regional market development. Growing awareness of virtual autopsy applications and cost-effective imaging solutions enhances Asia-Pacific’s long-term growth prospects.

Latin America:

Latin America accounts for nearly 6% of the global forensic imaging market share, with Brazil and Mexico emerging as the primary contributors. The region’s growth is supported by government initiatives to enhance crime investigation efficiency and strengthen forensic infrastructure. Adoption remains moderate due to limited access to advanced imaging equipment; however, collaborations with international forensic organizations are improving capabilities. Increasing demand for non-invasive investigation methods and digital evidence management is gradually fostering market expansion. Efforts to modernize public forensic institutions and improve training standards are expected to boost future adoption across the region.

Market Segmentations:

By Product type

By Application

- Death Investigations

- Clinical Studies

By End Use

- Forensic Institutes

- Hospitals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The forensic imaging market features a moderately consolidated competitive landscape, with a mix of established medical imaging companies and specialized forensic technology providers. Leading players such as Siemens Healthineers, GE HealthCare, Canon Medical Systems, Philips Healthcare, and Shimadzu Corporation dominate the market through their advanced imaging systems, broad product portfolios, and global distribution networks. These companies focus on continuous innovation, integrating artificial intelligence, 3D reconstruction, and digital imaging software to enhance forensic accuracy. Strategic partnerships with forensic institutes and government agencies are expanding their market presence and supporting customized imaging solutions. Additionally, emerging players are contributing to technological diversification by developing portable and cost-effective imaging systems tailored for forensic applications. The competitive environment is characterized by increasing investments in R&D, product differentiation, and service-based models such as equipment leasing and maintenance contracts, enabling manufacturers to strengthen their positions in this rapidly evolving forensic imaging landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Healthineers

- GE HealthCare

- Canon Medical Systems Corporation

- FUJIFILM Corporation

- Koninklijke Philips N.V.

- Hitachi, Ltd.

- Shimadzu Corporation

- Hologic, Inc.

- Agilent Technologies, Inc.

- Medico Legal Hub

Recent Developments

- In December 2024, Canon Medical Systems USA introduced an expanded suite of AI-powered solutions designed to automate end-to-end workflows, enhancing its CT portfolio. These solutions include remote scan support, protocol management, and automated processing for CT neuro and chest studies. The AI-driven workflow aims to improve operational efficiency across healthcare systems by streamlining clinical workflows from protocol setup to image processing, reducing manual tasks, and enabling care teams to focus more on patient care.

- In March 2024, General Atomics Electromagnetic Systems (GA-EMS) launched the Full Spectrum Imaging System Crime Scene Examiner (FSIS-CSE), a portable forensic imaging tool designed for crime scene evidence capture. This compact system features a high-resolution camera mounted on a tablet, enabling faster scans and sharper image capture of latent biological, chemical, and trace evidence in confined spaces. The FSIS-CSE integrates all necessary LEDs and filters, enhancing efficiency and providing a significant advantage in field operations for law enforcement and forensic laboratories, ensuring compatibility with AFIS systems.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The forensic imaging market will continue expanding with rising global adoption of virtual autopsy techniques.

- Integration of artificial intelligence will enhance accuracy and speed in forensic image analysis.

- 3D visualization and reconstruction technologies will become standard tools in post-mortem examinations.

- Growing collaboration between forensic institutes and medical device companies will accelerate innovation.

- Portable and cost-effective imaging systems will improve accessibility in developing regions.

- Digital data management and secure cloud storage will play a larger role in forensic workflows.

- Increasing government funding will strengthen forensic infrastructure and research capabilities.

- Training programs for forensic professionals will expand to include advanced imaging techniques.

- Legal acceptance of digital imaging evidence will grow, improving court admissibility and reliability.

- The Asia-Pacific region will emerge as the fastest-growing market due to modernization and technological adoption.