Market Overview

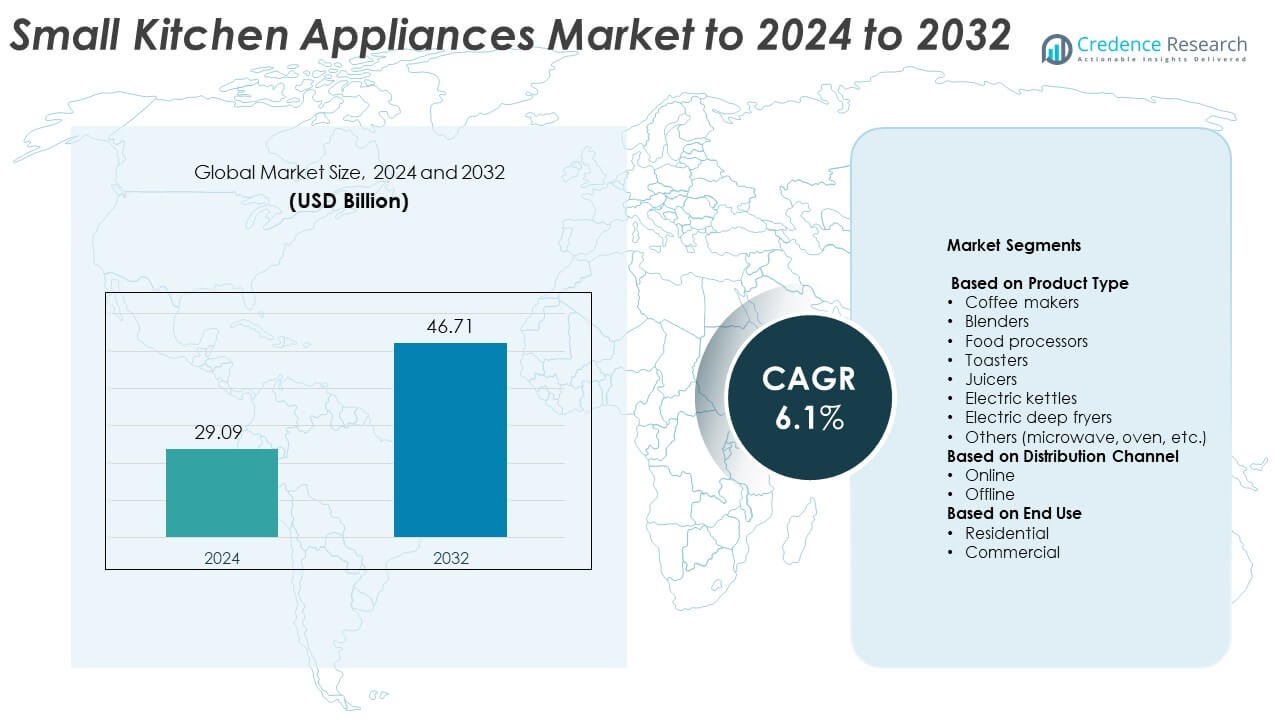

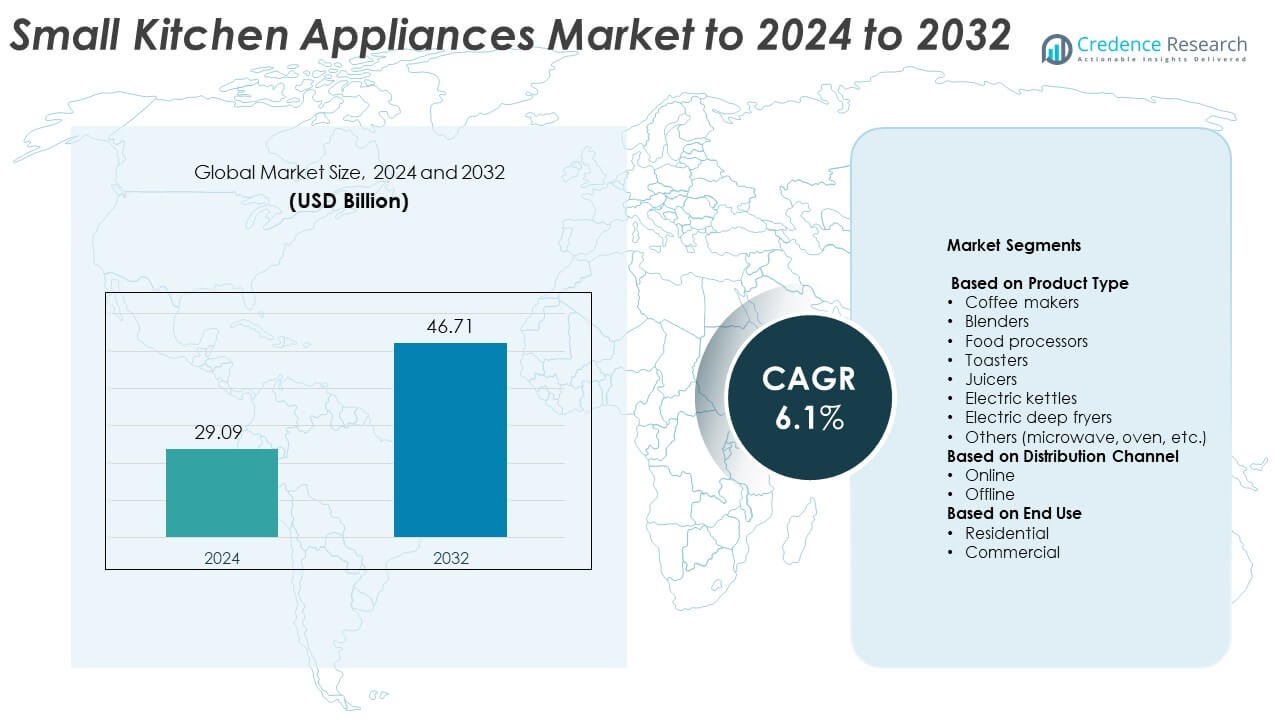

Small Kitchen Appliances Market size was valued at USD 29.09 billion in 2024 and is anticipated to reach USD 46.71 billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Kitchen Appliances Market Size 2024 |

USD 29.09 Billion |

| Small Kitchen Appliances Market, CAGR |

6.1% |

| Small Kitchen Appliances Market Size 2032 |

USD 46.71 Billion |

The small kitchen appliances market is dominated by major players such as Bosch, Whirlpool, Breville, Bajaj Electricals, Samsung Electronics, Panasonic, and LG Electronics. These companies lead through innovation, extensive product portfolios, and strong distribution networks. They focus on developing smart, energy-efficient, and multifunctional appliances to meet evolving consumer preferences. North America led the global market with a 33.8% share in 2024, supported by high demand for premium and connected kitchen products. Europe followed with a 28.4% share, driven by sustainability-focused product innovations and strong adoption of energy-efficient appliances across key economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The small kitchen appliances market was valued at USD 29.09 billion in 2024 and is projected to reach USD 46.71 billion by 2032, growing at a CAGR of 6.1%.

• Growing urbanization, rising disposable incomes, and increasing demand for time-saving appliances are key drivers of market growth.

• Smart and energy-efficient appliances, along with compact multifunctional designs, are emerging as major market trends.

• The market is moderately fragmented, with companies focusing on innovation, e-commerce expansion, and sustainability to maintain competitiveness.

• North America held the largest 33.8% share in 2024, followed by Europe at 28.4%, while Asia-Pacific showed the fastest growth; among products, coffee makers dominated with a 27.4% share.

Market Segmentation Analysis:

By Product Type

The coffee makers segment dominated the small kitchen appliances market in 2024, accounting for a 27.4% share. Its growth is driven by the rising demand for convenient and premium home-brewing solutions. Increasing adoption of single-serve machines and smart coffee systems enhances product appeal among urban consumers. Major brands are focusing on energy-efficient designs and automated functions to improve ease of use. Expanding café culture and consumer preference for freshly brewed coffee further support the segment’s leadership position across North America and Europe.

- For instance, Keurig Dr Pepper reported that its brewing system was in 38 million U.S. households in 2022, marking a 10-million-household increase since 2018.

By Distribution Channel

The offline distribution channel led the market in 2024 with a 61.3% share. Supermarkets, specialty stores, and brand outlets remain key points of sale due to product visibility and consumer trust. Offline retail enables hands-on product comparison and immediate purchase, which appeals to household buyers. However, online channels are rapidly growing, driven by e-commerce expansion, digital discounts, and broader product accessibility. Retailers are integrating omnichannel strategies to enhance shopping convenience and improve after-sales service offerings.

- For instance, Walmart’s network of stores and clubs positions a location within 10 miles of approximately 90% of Americans, a footprint used to facilitate hands-on comparison and in-store pickup.

By End Use

The residential segment held the dominant 71.6% share in 2024, supported by growing household adoption of compact, multifunctional appliances. Rising urbanization, smaller living spaces, and dual-income families are fueling demand for time-saving and space-efficient devices. Consumers increasingly prefer smart and energy-efficient appliances integrated with IoT for improved functionality. The commercial segment, including cafés, restaurants, and catering units, is expanding steadily with the rise in food service establishments and quick-service restaurant chains worldwide.

Key Growth Drivers

Rising Urbanization and Changing Lifestyles

Rapid urbanization and the growing number of nuclear households are driving demand for compact and efficient small kitchen appliances. Consumers seek appliances that save time and enhance convenience amid busy lifestyles. The rise in dual-income families increases disposable income, encouraging the purchase of premium and multifunctional products. Smart appliances with digital controls and connectivity further attract tech-savvy users, supporting steady market expansion across developed and emerging economies.

- For instance, Breville’s Bambino reaches brewing temperature in 3 seconds. Fast heat-up suits busy households. Quick start reduces wait time for daily coffee.

Expansion of E-Commerce Platforms

Online retail channels are transforming how consumers purchase small kitchen appliances. E-commerce platforms offer wider product availability, competitive pricing, and easy access to international brands. The surge in online reviews and influencer marketing enhances consumer confidence in digital purchases. Brands leverage online-exclusive launches and targeted advertising to attract urban and rural buyers, improving overall market penetration and driving rapid sales growth.

- For instance, Wayfair had 22.0 million active customers in 2024, a slight increase over 2023 but a notable decline from pandemic-era levels. By the first quarter of 2025, the active customer count had decreased further to 21.1 million.

Technological Advancements and Smart Integration

Innovation in product design and functionality is a central driver of market growth. Manufacturers integrate IoT, AI, and sensor technologies into appliances for enhanced control and energy efficiency. Smart coffee makers, app-connected blenders, and programmable ovens offer personalized experiences to users. Growing consumer interest in health-oriented appliances, such as air fryers and juicers, further boosts adoption, reinforcing the premiumization trend in the market.

Key Trends & Opportunities

Growing Popularity of Energy-Efficient Appliances

Energy-efficient appliances are gaining strong traction due to rising environmental awareness and increasing electricity costs. Consumers prefer devices certified with eco-labels and energy-saving technologies. Governments in Europe and North America are introducing efficiency regulations and incentives that encourage manufacturers to design low-power appliances. This shift creates opportunities for brands to develop sustainable product lines catering to environmentally conscious buyers.

- For instance, Electrolux/AEG ovens with CookSmart Touch can use up to 28% less energy. Efficiency aligns with rising power-cost awareness. Lower consumption supports eco-labels.

Increasing Demand for Multifunctional and Compact Designs

Compact and multifunctional appliances are becoming key purchase drivers in small living spaces. Consumers favor products combining multiple functions, such as blender-grinders and toaster ovens, to save time and counter space. Rising urban migration and smaller kitchen sizes enhance this trend. Manufacturers are capitalizing on it through sleek, portable designs and modular solutions, creating new opportunities for innovation and customization.

- For instance, Ninja’s PossibleCooker PRO replaces 14 cooking tools in one unit. Multi-function design saves counter space. One pot simplifies meal prep.

Key Challenges

Intense Market Competition and Price Pressure

The small kitchen appliances market faces heavy competition due to the presence of global and regional brands. Price wars, especially in entry-level segments, reduce profit margins for manufacturers. Frequent product launches and imitation designs further fragment the market. Companies must invest in innovation and brand differentiation to sustain growth and retain consumer loyalty in this competitive environment.

Supply Chain Disruptions and Raw Material Costs

Volatility in raw material prices and logistical challenges impact production and distribution costs. Shortages of electronic components and metals like aluminum and steel have affected manufacturing timelines. Fluctuating shipping rates and geopolitical tensions further strain global supply chains. Manufacturers are focusing on local sourcing, automation, and inventory optimization to mitigate these disruptions and maintain steady supply.

Regional Analysis

North America

North America dominated the small kitchen appliances market in 2024, accounting for a 33.8% share. High household income levels, widespread adoption of premium appliances, and strong consumer preference for convenience-driven products drive regional growth. The U.S. leads the market with robust sales of coffee makers, blenders, and air fryers, supported by extensive retail networks. Technological integration, such as voice-controlled and Wi-Fi-enabled devices, further enhances market penetration. The region’s well-established e-commerce sector and brand loyalty among consumers continue to support sustained demand across residential and commercial kitchens.

Europe

Europe held a 28.4% share of the small kitchen appliances market in 2024. The region benefits from strong demand for energy-efficient and sustainable appliances, especially in Germany, the U.K., and France. Consumers increasingly prefer compact, multifunctional devices that match urban living conditions. Stringent EU energy regulations encourage manufacturers to innovate toward eco-friendly models. The growing trend of home cooking and café culture also supports sales of coffee machines and toasters. Established brands with local production bases maintain a competitive edge through high-quality manufacturing and regional product customization.

Asia-Pacific

Asia-Pacific accounted for a 26.7% share of the market in 2024, driven by expanding middle-class populations and rising disposable incomes. China, India, and Japan represent major growth hubs due to rapid urbanization and lifestyle changes. Consumers in the region increasingly favor affordable yet technologically advanced kitchen appliances. E-commerce growth and strong local manufacturing capacities enhance accessibility. The rising popularity of smart and energy-saving appliances, coupled with increasing demand from small households, positions Asia-Pacific as the fastest-growing regional market through the forecast period.

Latin America

Latin America captured a 6.5% share of the small kitchen appliances market in 2024. Brazil and Mexico lead the regional demand, supported by growing urban populations and expanding retail distribution. Rising consumer awareness of convenience-based cooking solutions and improving economic conditions contribute to steady growth. Affordable product ranges and promotional offers drive high adoption rates among middle-income households. The region is witnessing increasing investments from global brands seeking to strengthen their presence through local partnerships and online retail platforms.

Middle East & Africa

The Middle East & Africa region held a 4.6% share of the market in 2024. Rising disposable incomes and growing residential construction activities support appliance demand across urban centers. The UAE and South Africa represent key markets with strong demand for premium and smart kitchen appliances. Expanding retail infrastructure, coupled with digital sales channels, improves product availability. Consumers increasingly seek energy-efficient and compact appliances suitable for modern kitchens. Continued tourism growth and the expansion of hospitality sectors further boost the regional market outlook.

Market Segmentations:

By Product Type

- Coffee makers

- Blenders

- Food processors

- Toasters

- Juicers

- Electric kettles

- Electric deep fryers

- Others (microwave, oven, etc.)

By Distribution Channel

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The small kitchen appliances market is highly competitive, with leading players such as Bosch, Whirlpool, Breville, Bajaj Electricals, Samsung Electronics, Panasonic, LG Electronics, KitchenAid, Voltas, Morphy Richards, Haier, Philips, Havells, V-Guard, Electrolux, and Vitamix. These companies compete through innovation, product differentiation, and strong distribution networks across global markets. Manufacturers are focusing on expanding product portfolios featuring energy efficiency, smart connectivity, and compact multifunctional designs. Strategic initiatives such as mergers, acquisitions, and regional collaborations are strengthening market positions. Continuous investment in R&D drives the development of intelligent appliances with enhanced automation, catering to changing consumer lifestyles. Companies are also improving customer engagement through digital marketing, e-commerce expansion, and localized after-sales services. The growing focus on sustainability and eco-friendly materials is further reshaping competitive strategies. Emerging brands are leveraging online platforms and cost-effective models to challenge established players, fostering an environment of continuous innovation and price competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bosch

- Whirlpool

- Breville

- Bajaj Electricals

- Samsung Electronics

- Panasonic

- LG Electronics

- KitchenAid

- Voltas

- Morphy Richards

- Haier

- Philips

- Havells

- V-Guard

- Electrolux

- Vitamix

Recent Developments

- In 2024, KitchenAid unveiled its first Grain and Rice Cooker, an appliance that automatically senses the amount of grain and dispenses the correct amount of water for consistent cooking

- In 2023, Vitamix launched the Eco 5, a FoodCycler with double the capacity, addressing the growing consumer interest in sustainability and reducing kitchen waste.

- In 2023, Electrolux launched a built-in range of kitchen appliances in India in February, marking an expansion in the growing Indian market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart and connected kitchen appliances will gain higher adoption in urban households.

- Energy-efficient and eco-friendly models will become a key focus for manufacturers.

- Compact and multifunctional product designs will attract consumers in smaller homes.

- The e-commerce channel will continue expanding, driving faster product accessibility.

- Premiumization trends will strengthen with increasing demand for high-performance appliances.

- Voice and app-controlled appliances will enhance convenience and automation in daily cooking.

- Asia-Pacific will emerge as the fastest-growing regional market due to urbanization.

- Customizable and modular kitchen appliances will gain popularity among modern consumers.

- Manufacturers will invest more in AI and sensor-based technologies for innovation.

- Partnerships with retail and online platforms will improve brand visibility and market penetration.