Market Overview:

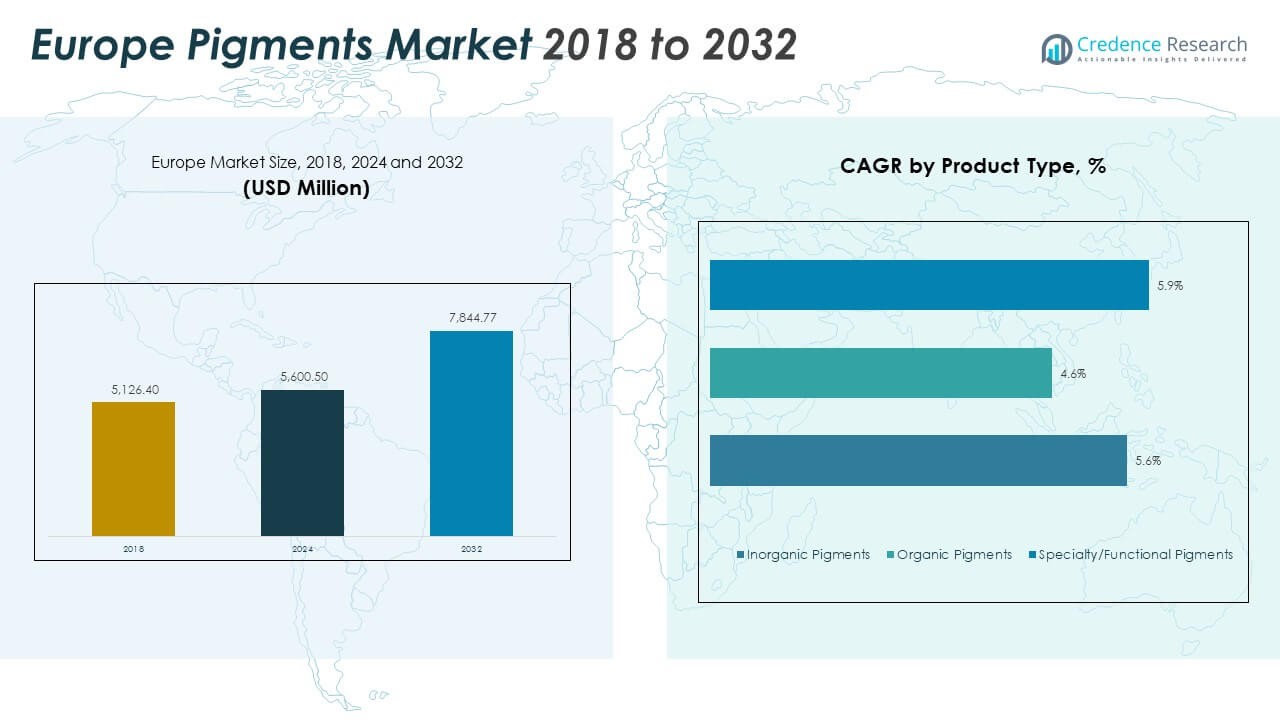

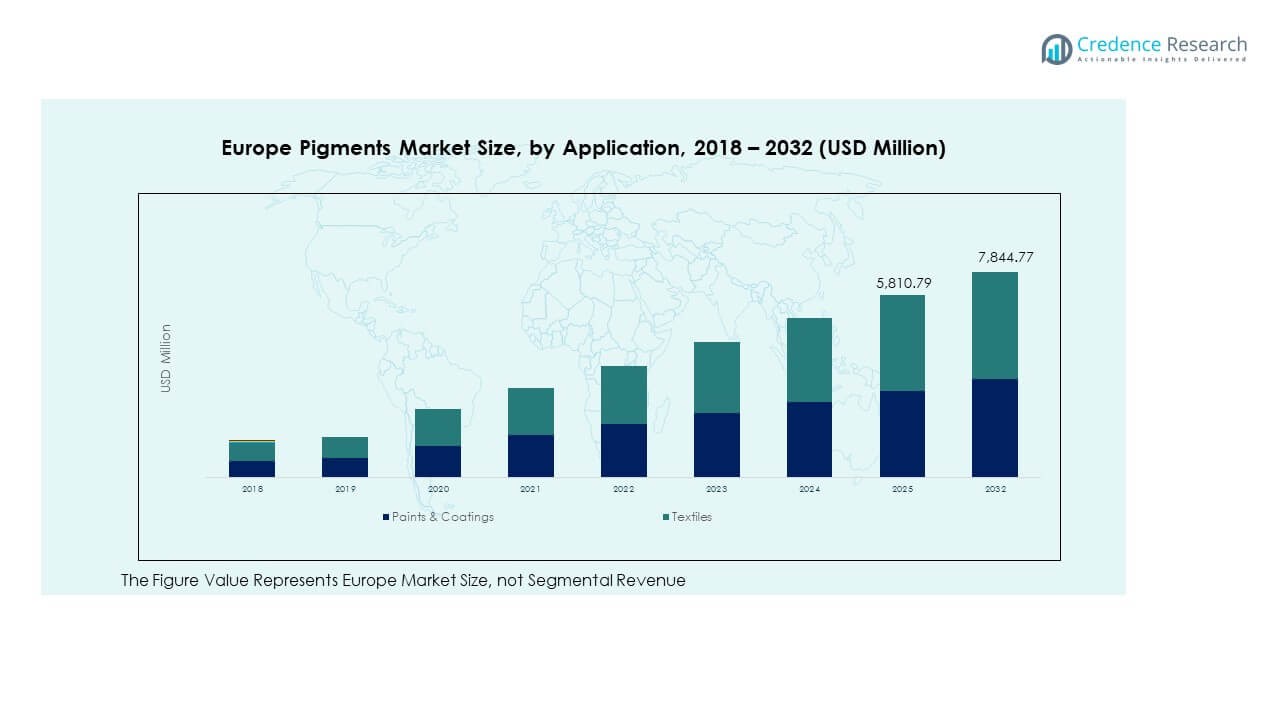

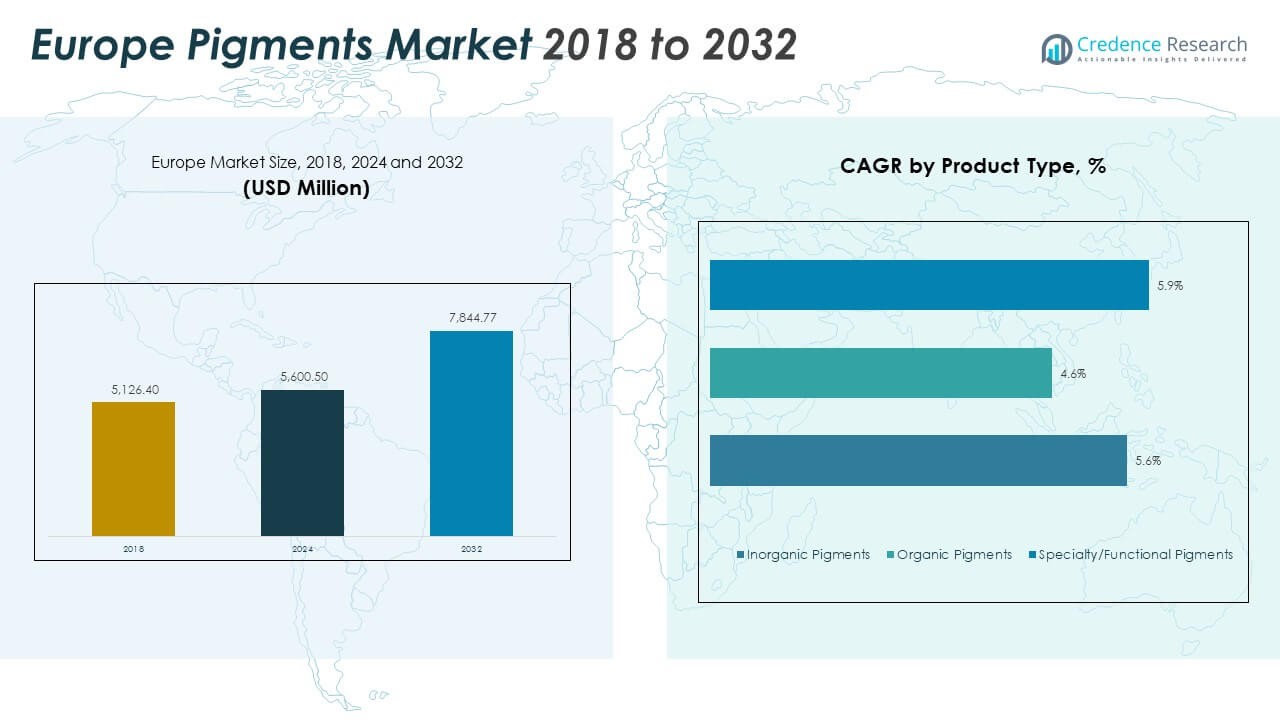

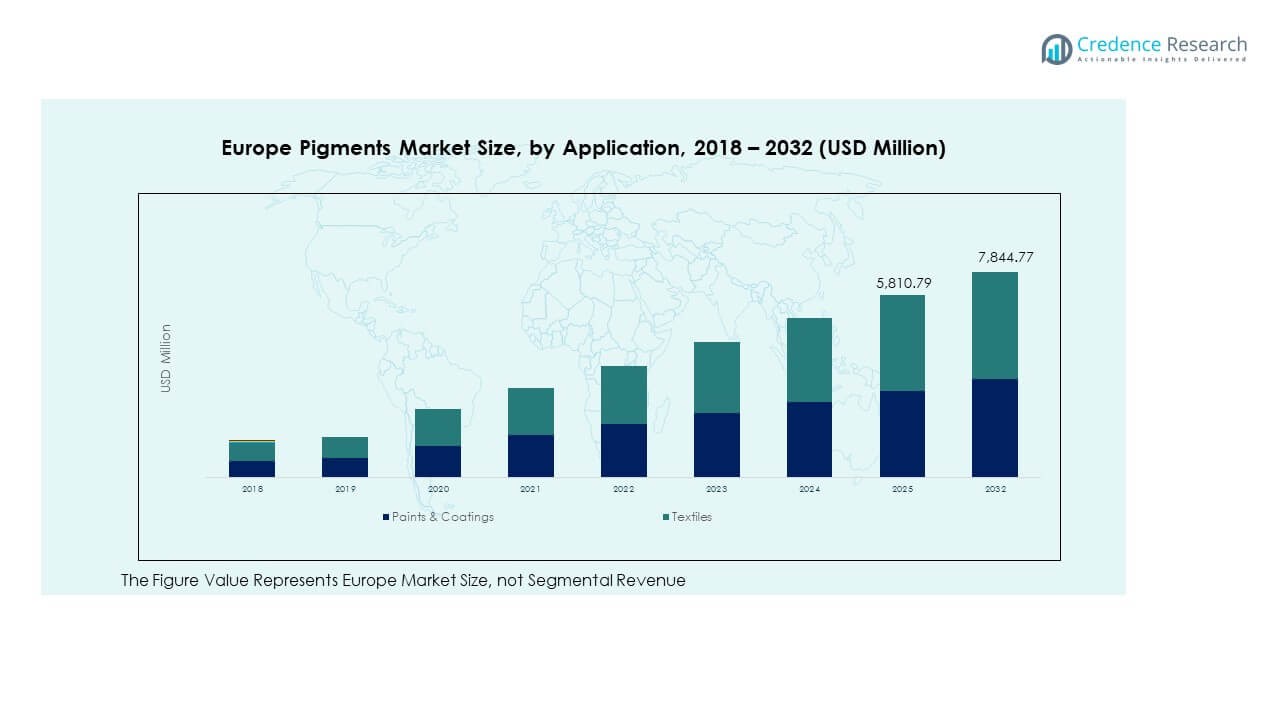

The Europe Pigments Market size was valued at USD 5,126.40 million in 2018 to USD 5,600.50 million in 2024 and is anticipated to reach USD 7,844.77 million by 2032, at a CAGR of 4.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Pigments Market Size 2024 |

USD 5,600.50 Million |

| Europe Pigments Market, CAGR |

4.33% |

| Europe Pigments Market Size 2032 |

USD 7,844.77 Million |

Market growth is primarily driven by robust demand from industries such as automotive, construction, and packaging. Increasing use of pigments in coatings, plastics, and inks enhances visual appeal, durability, and resistance to environmental factors. Manufacturers are investing in eco-friendly formulations that comply with European regulations, focusing on low-VOC, bio-based, and high-performance pigment technologies. The shift toward sustainable production and growing demand for advanced color solutions are strengthening product development and application diversity.

Western Europe leads the regional landscape due to its strong industrial base and technological advancement in pigment production. Germany, France, and Italy dominate due to established coatings and automotive sectors. The UK contributes through packaging and printing applications, emphasizing sustainable pigments. Eastern Europe, led by Poland and the Czech Republic, is emerging as a manufacturing hub with expanding construction activities. Northern Europe, including the Netherlands and Sweden, focuses on green pigment innovation supported by R&D initiatives and environmental policy alignment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Pigments Market was valued at USD 5,126.40 million in 2018, reached USD 5,600.50 million in 2024, and is projected to attain USD 7,844.77 million by 2032, registering a CAGR of 4.33% during the forecast period.

- Western Europe leads with a 46% share, supported by its advanced manufacturing base and strong demand from the construction and automotive sectors. Northern Europe follows with 27%, driven by technological innovation and sustainable pigment initiatives.

- Eastern and Southern Europe collectively hold 27% market share, fueled by expanding industrialization and increasing construction investments supported by EU infrastructure programs.

- Paints & Coatings dominate the segmental distribution with an estimated 60% share, reflecting broad use in architectural, automotive, and industrial applications across the region.

- Textiles hold around 25% share, boosted by rising adoption of eco-friendly dyes and colorants aligned with Europe’s sustainable production and fashion trends.

Market Drivers

Growing Demand for Sustainable and High-Performance Pigments Across Industrial Sectors

The Europe Pigments Market is driven by increasing adoption of sustainable pigment formulations across coatings, packaging, and plastics industries. Consumers and manufacturers prefer bio-based and non-toxic alternatives that meet environmental regulations such as REACH. Companies are investing in pigment technologies with reduced heavy metal content and improved lightfastness. The rise in eco-labeling requirements supports product differentiation and premium pricing. Continuous innovation in nanostructured pigments enhances color intensity and surface stability. Industrial players develop energy-efficient manufacturing processes to reduce carbon emissions. The trend strengthens circular economy initiatives across Europe.

- For instance, BASF Coatings launched more than 250 biomass-balanced pigment products in 2024, resulting in the verified reduction of around 8 million kilograms of CO₂ emissions across three regions, as announced by BASF in May 2025.

Expanding Construction and Automotive Industries Supporting Pigment Utilization

Growing infrastructure development and automotive coating demand fuel pigment consumption across Europe. Titanium dioxide pigments dominate in architectural coatings due to superior opacity and UV resistance. Automotive manufacturers integrate advanced pigment systems that enhance gloss and durability. The rise of electric vehicles accelerates pigment use in lightweight and reflective coatings. It benefits from the construction sector’s emphasis on decorative finishes and long-lasting surfaces. Infrastructure projects across Germany, France, and the UK increase demand for weather-resistant pigments. Pigment manufacturers expand local supply to meet OEM needs efficiently. This alignment boosts long-term regional market stability.

Technological Advancements in Specialty and Functional Pigments for Value Addition

Continuous technological upgrades in specialty pigments enhance color performance and material compatibility. Functional pigments such as thermochromic and photochromic types gain traction in smart coatings and packaging. The Europe Pigments Market benefits from advancements in dispersion control, nano-particle synthesis, and surface treatment. R&D efforts focus on improving pigment dispersion uniformity and chemical inertness. Enhanced color retention under extreme conditions boosts industrial adoption. Producers incorporate digital color matching systems for precision coating applications. These developments expand pigment versatility across sectors like electronics and consumer goods.

Stringent Environmental Regulations Encouraging Eco-Friendly Pigment Development

Tight European environmental norms encourage the transition toward sustainable pigment manufacturing. Restrictions on hazardous chemicals under the EU Green Deal foster demand for low-VOC and recyclable materials. Manufacturers invest in wastewater recycling and green synthesis routes to maintain compliance. The industry emphasizes circular production models and closed-loop pigment recovery. Increased regulatory pressure drives companies to adopt alternative raw materials. The Europe Pigments Market experiences growing collaboration between pigment producers and sustainability-focused research institutes. These efforts ensure resource efficiency, regulatory alignment, and long-term competitiveness in a low-carbon economy.

- For instance, in February 2025, LANXESS introduced its Scopeblue micronized iron oxide yellow pigments Bayferrox 3910, 3910 LV, and 3920 featuring a verified product carbon footprint about 35% lower than conventional grades, underscoring the company’s commitment to sustainable pigment manufacturing in line with EU environmental goals.

Market Trends

Rising Integration of Digitalization and AI in Pigment Manufacturing Processes

The adoption of digital technologies in pigment manufacturing improves process accuracy and product quality. Automation and AI-driven analytics enable precise pigment formulation and defect detection. The Europe Pigments Market leverages machine learning for predictive maintenance and color consistency. Smart production systems minimize waste and improve energy efficiency. Manufacturers deploy digital twins to simulate pigment dispersion and optimize throughput. Data-driven R&D accelerates innovation in custom shades for niche applications. Digital transformation also strengthens supply chain transparency and traceability across pigment operations.

- For instance, in July 2024, BASF and Imperial College London supported the launch of SOLVE Chemistry, a spin-out company applying artificial intelligence and digital process technologies to improve chemical manufacturing efficiency and sustainability, strengthening BASF’s innovation capabilities in advanced production optimization.

Growing Preference for Organic Pigments in Textile and Packaging Applications

Organic pigments gain popularity in Europe’s textile and packaging industries due to their superior environmental profile. Bio-based pigments derived from renewable sources replace conventional petroleum-based options. Consumer inclination toward safe and biodegradable materials drives adoption. The Europe Pigments Market witnesses rising investment in natural pigment extraction and stabilization techniques. Companies improve thermal stability and solvent resistance to broaden application scope. Brands promote eco-friendly packaging using natural pigments to align with sustainability goals. The shift reinforces Europe’s leadership in sustainable colorant innovation.

Increasing Adoption of Specialty Pigments in High-Value End-Use Industries

Specialty pigments such as metallic, pearlescent, and fluorescent types experience growing demand across automotive and electronics sectors. These pigments provide aesthetic enhancement and functional benefits like heat reflection. The Europe Pigments Market sees rising integration of infrared-reflective and anti-corrosive pigments in coatings. Technological innovations expand application potential in aerospace, defense, and renewable energy components. Custom pigment formulations cater to design flexibility and branding consistency. Enhanced durability and surface finish characteristics strengthen product positioning. Specialty pigments become a key growth vector for manufacturers focusing on premium markets.

Shift Toward Circular Manufacturing Models and Raw Material Reuse

Circular economy principles reshape pigment production strategies across Europe. Manufacturers implement resource recovery and pigment recycling technologies to minimize waste. The Europe Pigments Market adopts life-cycle assessment models to measure environmental impact. Companies explore pigment recovery from industrial residues and post-consumer waste. Collaboration with recyclers supports closed-loop systems and cost optimization. Process innovation improves yield and reduces dependency on virgin materials. The trend aligns with EU carbon-neutral objectives and long-term sustainability frameworks. Circular pigment production becomes central to regional competitiveness and compliance.

- For instance, in January 2024, Sun Chemical’s pigment portfolio achieved ECO PASSPORT by OEKO-TEX® certification with ZDHC Level 3 conformance, confirming compliance with EU sustainability standards and strengthening the company’s closed-loop pigment manufacturing approach.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Vulnerability Impacting Cost Stability

Volatile raw material prices, especially titanium dioxide and metallic oxides, create uncertainty for manufacturers. The Europe Pigments Market faces supply disruptions due to geopolitical instability and trade restrictions. Dependence on imports for key feedstocks limits price control. Rising logistics costs and energy prices further strain profit margins. Companies face difficulty in passing cost increases to downstream users in competitive markets. Long procurement cycles delay production schedules and impact delivery reliability. Manufacturers invest in regional sourcing and supply diversification to ensure continuity. Maintaining price stability remains a strategic challenge for pigment producers.

Environmental and Regulatory Pressures Limiting Product Innovation Flexibility

Strict European Union environmental regulations restrict the use of heavy metals and solvent-based pigments. Compliance costs increase due to frequent regulatory updates and documentation requirements. The Europe Pigments Market struggles to balance innovation speed with regulatory conformity. Development of eco-friendly pigments requires high R&D investment and long validation timelines. Smaller producers face barriers in achieving certification and scaling operations. Market participants must reformulate products without compromising performance. These constraints slow innovation cycles and elevate production complexity across the pigment supply chain.

Market Opportunities

Expanding Role of Pigments in Renewable Energy and Smart Coating Applications

The growth of solar and smart material industries opens new opportunities for pigment innovation. The Europe Pigments Market benefits from functional pigments used in energy-efficient coatings and photovoltaic modules. Heat-reflective and light-absorbing pigments support thermal management in green buildings. Smart coatings incorporating photochromic and thermochromic pigments enhance sustainability and functionality. Collaboration with energy technology companies accelerates R&D in advanced pigment systems. Emerging opportunities in smart cities and building automation strengthen long-term demand potential across Europe.

Rising Potential in 3D Printing, Bioplastics, and Specialty Packaging Industries

Pigment manufacturers explore integration with bioplastic materials and 3D printing filaments. The Europe Pigments Market gains traction through additive manufacturing and customized color solutions. Innovations in biodegradable pigments meet regulatory and consumer expectations. Advanced dispersion technologies improve pigment performance in polymer composites. Growing packaging design innovation promotes the use of high-precision and sustainable colorants. Expansion into these niche segments offers strong profit margins and product diversification potential.

Market Segmentation Analysis

By Product Type

Inorganic pigments dominate the Europe Pigments Market due to their durability, opacity, and high weather resistance. Titanium dioxide leads this segment as the most widely used pigment in paints and coatings for superior whiteness and brightness. Zinc oxide and other metallic oxides contribute to anti-corrosive and UV-resistant coatings. Organic pigments gain ground with rising sustainability awareness and vivid color performance in packaging and textiles. Specialty and functional pigments see increased use in electronics, automotive coatings, and architectural glass for reflective and smart applications.

- For instance, Venator Materials’ UK facility utilized the environmentally friendly chloride process technology with an annual titanium dioxide production capacity of approximately 150,000 metric tons, making it a key European producer before its administration in 2025.

By Application

Paints and coatings represent the largest application segment in the Europe Pigments Market, driven by strong demand from the construction and automotive industries. Pigments enhance surface protection, aesthetics, and long-term durability in architectural and industrial coatings. Printing inks and plastics follow, supported by expanding packaging needs and technological advances in dispersion. The textile sector adopts eco-friendly pigments to meet sustainable fashion trends. Leather and other applications, including electronics and ceramics, present niche growth driven by material innovation and customized color solutions.

- For instance, AkzoNobel’s Dulux Weathershield range, widely utilized in Europe, features titanium dioxide pigments that contribute to superior reflectivity and resistance to weathering, tested through thousands of hours of accelerated exposure.

Segmentation

By Product Type

- Inorganic Pigments

- Titanium Dioxide (TiO₂)

- Zinc Oxide

- Others

- Organic Pigments

- Specialty/Functional Pigments

By Application

- Paints & Coatings

- Textiles

- Printing Inks

- Plastics

- Leather

- Other Applications

Regional Analysis

Western Europe – Established Industrial Base and High Pigment Consumption

Western Europe holds the largest share of the Europe Pigments Market, accounting for 46% in 2024. The region benefits from a mature industrial ecosystem and well-established end-use sectors, including automotive, construction, and packaging. Germany leads pigment production due to its advanced chemical manufacturing capabilities and continuous innovation in coatings and plastics. France and Italy follow with strong demand from the decorative paints and industrial coatings sectors. Stringent environmental standards encourage the development of low-VOC and bio-based pigments. The region’s focus on energy-efficient and recyclable materials sustains market leadership and long-term competitiveness.

Northern Europe – Technological Leadership and Focus on Sustainable Pigment Innovation

Northern Europe represents a 27% share, driven by innovation-led economies such as the UK, Netherlands, and Sweden. The region emphasizes green chemistry and sustainable pigment manufacturing processes supported by government incentives. High R&D investment fosters the production of organic and hybrid pigments with enhanced performance and reduced toxicity. The market benefits from early adoption of advanced colorant technologies in packaging, printing, and specialty coatings. Strategic partnerships between pigment producers and research institutions accelerate eco-friendly pigment development. Northern Europe’s commitment to environmental compliance and circular economy initiatives ensures stable market growth and technological leadership.

Eastern and Southern Europe – Rapid Industrialization and Expanding Manufacturing Capacities

Eastern and Southern Europe together account for 27% of the Europe Pigments Market, emerging as key growth hubs due to expanding infrastructure and manufacturing sectors. Countries such as Poland, the Czech Republic, Spain, and Turkey experience strong pigment demand from construction and automotive coatings. Rising foreign investments in industrial and chemical production boost local pigment output. It benefits from cost-effective labor and favorable trade frameworks within the European Union. Growing consumer demand for durable and aesthetic coatings supports regional diversification. The increasing establishment of regional pigment manufacturing facilities strengthens supply reliability and competitiveness across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DIC Corporation

- Kronos Worldwide, Inc.

- Sudarshan Chemical Industries Limited

- Heubach GmbH

- The Chemours Company

- Tronox Holdings Plc

- ALTANA AG

- Lanxess AG

- LB Group

- Shepherd Color Company

- Trust Chem Co., Ltd.

- Venator Materials PLC

Competitive Analysis

The Europe Pigments Market is characterized by strong competition among global and regional manufacturers focusing on product innovation and sustainability. Leading companies include BASF SE, Clariant AG, Lanxess AG, Heubach GmbH, and DIC Corporation. These firms emphasize eco-friendly formulations, high dispersion stability, and advanced surface treatment technologies to meet regulatory and performance standards. Strategic collaborations with coating and polymer producers enhance market penetration across key applications. It focuses on expanding production facilities and developing bio-based pigment ranges to align with European Green Deal objectives. Continuous investment in R&D and supply chain optimization reinforces brand competitiveness and customer retention across industrial sectors.

Recent Developments

- In October 2025, LANXESS showcased its diverse polymer additives, colorants, and heat-stable inorganic pigments at the K 2025 event from October 8 to 15, emphasizing product innovation in the specialty chemicals sector that supports the pigments market in Europe.

- In February 2025, The Chemours Company launched Ti-Pure™ TS-6706, a TMP- and TME-free titanium dioxide pigment aimed at European coatings applications. The product is part of Chemours’ sustainability series, offering regulatory-compliant solutions for appearance-critical uses and responding to evolving EU chemical regulations.

- In October 2024, Sudarshan Chemical Industries Limited entered into a definitive agreement to acquire the global pigment business operations of Germany’s Heubach Group, including assets in Germany, Switzerland, Luxembourg, India, and the USA. The transaction, valued at €127.5 million, will create one of the world’s largest pigment producers, significantly strengthening Sudarshan’s portfolio and European presence.

- In October 2024, Heubach GmbH agreed to be acquired by Sudarshan Chemical Industries Limited in a strategic move that cements a global pigment powerhouse with strong European market influence. This acquisition will address Heubach’s recent financial and operational challenges.

Report Coverage

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe Pigments Market will witness steady expansion supported by strong construction, packaging, and automotive demand.

- Rising environmental compliance standards will accelerate innovation in low-VOC and bio-based pigment formulations.

- Technological integration such as AI-based color management and automated production will enhance efficiency and consistency.

- Organic pigments will continue gaining market traction driven by consumer preference for sustainable materials.

- Specialty pigments offering smart, reflective, and functional features will expand use across electronics and architectural coatings.

- Western Europe will maintain market leadership due to advanced infrastructure and industrial sophistication.

- Northern Europe will emerge as a hub for green pigment innovation through research-led collaborations.

- Eastern and Southern Europe will experience rapid growth with expanding manufacturing capacities and infrastructure projects.

- Strategic alliances among pigment producers and coating manufacturers will strengthen product innovation pipelines.

- Continuous R&D investment will drive competitive differentiation and long-term sustainability across the pigment ecosystem.