Market Overview:

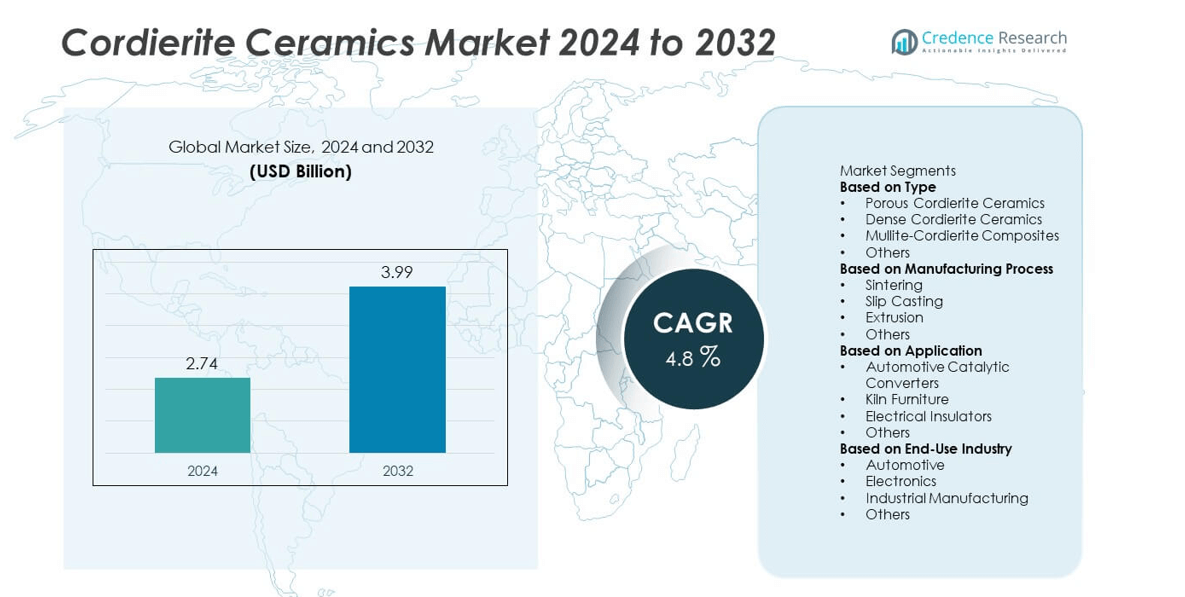

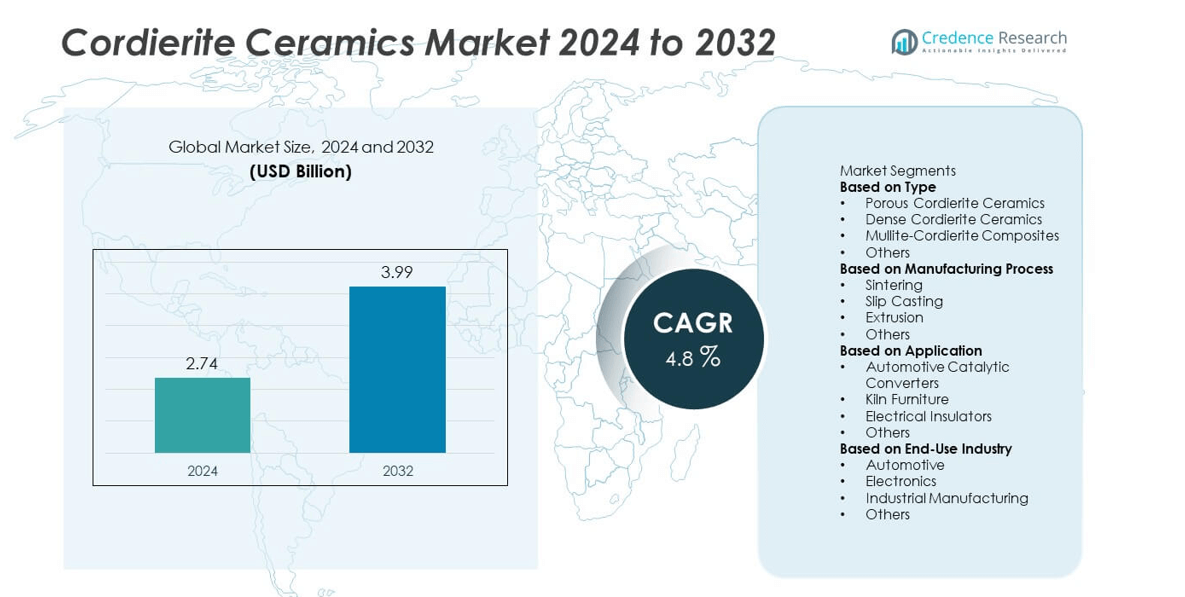

The global cordierite ceramics market was valued at USD 2.74 billion in 2024 and is projected to reach USD 3.99 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cordierite Ceramics Market Size 2024 |

USD 2.74 billion |

| Cordierite Ceramics Market, CAGR |

4.8% |

| Cordierite Ceramics Market Size 2032 |

USD 3.99 billion |

The cordierite ceramics market is led by major players such as Kyocera, CoorsTek, Insaco, Trans-Tech, STEATIT, E.R. Advanced Elan Technology, Du-Co Ceramics, Tianjin Century Electronics, Sonya Ceramics, and Morgan Advanced Materials. These companies dominate through strong R&D capabilities, extensive product portfolios, and technological expertise in high-performance ceramics. Asia Pacific held the leading 33% share of the global market in 2024, driven by robust automotive production and expanding electronics manufacturing. North America followed with 31%, supported by advanced industrial applications and emission control technologies, while Europe accounted for 28%, emphasizing sustainable manufacturing and regulatory-driven demand for eco-friendly ceramic materials.

Market Insights

- The cordierite ceramics market was valued at USD 2.74 billion in 2024 and is projected to reach USD 3.99 billion by 2032, growing at a CAGR of 4.8%.

- Rising adoption of cordierite ceramics in automotive catalytic converters and industrial furnaces drives global market expansion.

- Technological advancements in sintering and extrusion processes are improving product durability and efficiency, creating opportunities for high-temperature applications.

- Key players such as Kyocera, CoorsTek, and Morgan Advanced Materials focus on innovation, product diversification, and sustainable ceramic manufacturing to strengthen competitiveness.

- Asia Pacific led with a 33% share in 2024, followed by North America with 31% and Europe with 28%, while the porous cordierite ceramics segment accounted for 47% of the market due to its superior thermal shock resistance and lightweight properties.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The porous cordierite ceramics segment dominated the market with a 47% share in 2024. Its dominance is driven by superior thermal shock resistance, low thermal expansion, and lightweight characteristics, making it ideal for high-temperature applications. Porous cordierite is widely used in kiln furniture, catalytic substrates, and filtration systems due to its energy efficiency and mechanical strength. The increasing adoption of porous cordierite ceramics in automotive exhaust systems and industrial furnaces supports strong demand growth. Manufacturers are focusing on optimizing porosity and strength balance to enhance performance and durability in high-heat environments.

- For instance, CoorsTek’s silicates portfolio includes a cordierite grade available in both dense and open porous forms, with bulk densities that vary depending on the specific porous formulation.

By Manufacturing Process

The sintering segment accounted for the largest market share of 52% in 2024, supported by its ability to produce high-density, durable, and thermally stable ceramic components. Sintering ensures uniform microstructure and strength, essential for automotive and industrial applications. The process is preferred for mass production of catalyst substrates and kiln furniture due to its cost-effectiveness and consistent quality. Continuous advancements in sintering technology, including microwave and pressure-assisted sintering, further improve material efficiency and energy savings. The segment’s dominance is reinforced by growing demand for precision-engineered and heat-resistant ceramic components across industries.

- For instance, CoorsTek, Inc. achieved consolidation of a 99.9 % Al2O3 ceramic body using hot isostatic pressing at 1 600 °C and 100 MPa, which enabled the material to reach a density of 3.95 g/cm³ and a flexural strength of 580 MPa. The firm reports executing sintering cycles of 4 h to produce batches of 500 units of precision alumina tubes for automotive sensor applications.

By Application

The automotive catalytic converters segment led the cordierite ceramics market with a 58% share in 2024. This leadership stems from extensive use of cordierite substrates in vehicle emission control systems due to their excellent thermal stability and low thermal expansion. Stricter emission regulations and rising production of gasoline and hybrid vehicles continue to drive this segment’s growth. Cordierite’s ability to withstand thermal cycling and maintain high filtration efficiency enhances its suitability for exhaust gas treatment. Expanding adoption of lightweight, energy-efficient materials in automotive manufacturing further strengthens the segment’s global dominance.

Key Growth Drivers

Rising Demand in Automotive Emission Control Systems

The growing use of cordierite ceramics in automotive catalytic converters is a major market driver. Their high thermal shock resistance, low expansion coefficient, and cost-effectiveness make them ideal for emission control substrates. Increasing vehicle production and stricter global emission norms have accelerated adoption in passenger and commercial vehicles. The shift toward lightweight and fuel-efficient materials further supports demand. Manufacturers are developing improved cordierite formulations to enhance performance under high-temperature exhaust conditions, strengthening the material’s role in sustainable automotive solutions.

- For instance, manufacturers of certain advanced ceramics or specialized glass-ceramics have achieved substrates with very low coefficients of linear thermal expansion and compressive strength exceeding hundreds of megapascals at room temperature. Some advanced composites can also be engineered to exhibit this combination of properties.

Expansion of Industrial and Kiln Applications

Cordierite ceramics are extensively used in kiln furniture, industrial furnaces, and refractory linings due to their excellent heat resistance and mechanical stability. Rapid growth in glass, ceramics, and metallurgical industries drives consistent demand. Their low density and superior insulation reduce energy consumption during high-temperature operations. The rise of energy-efficient industrial equipment across Asia and Europe further enhances market expansion. Continuous innovation in material composition and production methods ensures longer service life and cost-effectiveness, promoting widespread industrial usage.

- For instance, a kiln furniture product made of cordierite-mullite could have a bulk density of 1.85 g/cm³, a porosity of 28%, and a modulus of rupture of 10 MPa when tested at 1250 °C.

Growth in Electronic and Electrical Components

Cordierite ceramics are increasingly used in electronic substrates and insulators due to their excellent dielectric properties and dimensional stability. The rapid expansion of the electronics and telecommunications industries, particularly in Asia Pacific, is fueling this demand. Their ability to maintain performance under high temperatures makes them suitable for resistors, filters, and heat sinks. Growing miniaturization of electronic components and rising investments in semiconductor manufacturing further boost market penetration. Manufacturers are developing fine-grain, high-purity cordierite to meet advanced electronic application requirements.

Key Trends & Opportunities

Adoption of Lightweight and Eco-Friendly Materials

The shift toward lightweight, environmentally friendly materials is creating new opportunities for cordierite ceramics. Their recyclability, low environmental footprint, and high thermal efficiency align with global sustainability goals. Automotive and industrial sectors are replacing heavy metals with cordierite to improve energy efficiency. Manufacturers are investing in green production technologies to reduce emissions during ceramic processing. The trend supports broader market adoption across electric vehicles, renewable energy systems, and low-carbon manufacturing industries.

- For instance, Du‑Co Ceramics reports a cordierite grade operating safely up to 1000 °C, with water absorption of 10 %, compressive strength of 70 kpsi, and tensile strength of 7 kpsi, showcasing eco-friendly performance under high-heat conditions.

Technological Advancements in Ceramic Manufacturing

Advancements in manufacturing technologies, including 3D printing and precision extrusion, are transforming cordierite ceramic production. These methods enable complex geometries, consistent microstructure, and cost-efficient customization for diverse applications. Improved sintering techniques enhance strength and heat resistance, widening the use of cordierite in advanced industrial processes. Automation and digital monitoring are also improving quality control and scalability. These technological improvements open new opportunities in high-performance electronics, aerospace, and environmental systems.

- For instance, a research project printed porous cordierite lattice structures via robocasting, demonstrating significant control over microstructure for production scalability.

Key Challenges

High Production and Processing Costs

Cordierite ceramic manufacturing involves high raw material, energy, and equipment costs. The precision required for maintaining uniform composition and sintering temperature increases production expenses. Small and medium manufacturers often face financial barriers in scaling operations. Additionally, advanced formulations and fine-grain ceramics demand sophisticated processing technologies, further elevating costs. To remain competitive, companies must focus on optimizing production efficiency, adopting renewable energy sources, and enhancing automation to lower manufacturing expenses.

Limited Availability of Raw Materials

The availability and quality of raw materials such as alumina, magnesia, and silica significantly affect production consistency. Supply chain disruptions and fluctuations in raw material prices pose challenges to manufacturers. Dependence on specific geographic sources limits flexibility and increases procurement risks. The shortage of high-purity inputs may lead to compromised product performance. Companies are investing in alternative sourcing strategies and material recycling techniques to ensure supply stability and cost control in long-term production.

Regional Analysis

North America

North America held a 31% share of the cordierite ceramics market in 2024, driven by strong demand from the automotive and electronics industries. The United States leads regional growth due to stringent vehicle emission standards and the presence of major catalytic converter manufacturers. Advancements in ceramic material engineering and widespread adoption in high-temperature industrial equipment further support market expansion. Continuous R&D investments in lightweight and heat-resistant materials enhance product innovation. Growing focus on energy-efficient industrial processes and sustainable manufacturing practices continues to strengthen North America’s market position.

Europe

Europe accounted for a 28% share of the cordierite ceramics market in 2024, supported by increasing environmental regulations and the region’s commitment to reducing automotive emissions. Germany, France, and the U.K. are key contributors, driven by advanced automotive production and industrial furnace applications. Demand for cordierite ceramics in electric vehicles and catalytic converters is rising with stricter EU emission norms. The region also benefits from strong R&D infrastructure and technological advancements in ceramic composites. Ongoing investment in green manufacturing and renewable energy projects further supports the market’s steady growth trajectory.

Asia Pacific

Asia Pacific dominated the cordierite ceramics market with a 33% share in 2024, led by rapid industrialization, expanding automotive production, and increasing demand for energy-efficient materials. China, Japan, and India are major contributors, supported by robust manufacturing bases and government initiatives for emission control. The growth of the electronics and power industries enhances demand for cordierite-based insulators and substrates. Local manufacturers focus on cost-effective production and export-oriented strategies. Continuous expansion in infrastructure, energy, and transportation sectors positions Asia Pacific as the fastest-growing region in the global cordierite ceramics market.

Latin America

Latin America captured a 5% share of the cordierite ceramics market in 2024, driven by gradual industrial development and growing automotive manufacturing activities. Brazil and Mexico lead the region with expanding demand for catalytic converters and refractories. The rise in environmental awareness and emission regulations supports increasing use of cordierite substrates in vehicle exhaust systems. However, limited domestic production and reliance on imports hinder faster growth. Strengthening trade partnerships and investment in regional production facilities are expected to improve supply chain stability and stimulate future market growth.

Middle East & Africa

The Middle East & Africa region held a 3% share of the cordierite ceramics market in 2024. Growth is supported by increasing industrialization, expanding energy infrastructure, and rising use of heat-resistant materials in refineries and power plants. Saudi Arabia, the United Arab Emirates, and South Africa represent key markets with growing interest in sustainable industrial ceramics. The demand for cordierite-based kiln furniture and insulation components is rising across the construction and manufacturing sectors. However, limited technological capability and high import dependence restrict growth, though ongoing infrastructure projects offer promising opportunities.

Market Segmentations:

By Type

- Porous Cordierite Ceramics

- Dense Cordierite Ceramics

- Mullite-Cordierite Composites

- Others

By Manufacturing Process

- Sintering

- Slip Casting

- Extrusion

- Others

By Application

- Automotive Catalytic Converters

- Kiln Furniture

- Electrical Insulators

- Others

By End-Use Industry

- Automotive

- Electronics

- Industrial Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cordierite ceramics market is defined by the presence of leading players such as Kyocera, CoorsTek, Insaco, Trans-Tech, STEATIT, E.R. Advanced Elan Technology, Du-Co Ceramics, Tianjin Century Electronics, Sonya Ceramics, and Morgan Advanced Materials. These companies compete through innovation in high-temperature materials, product customization, and global distribution capabilities. Market leaders focus on developing cordierite ceramics with enhanced thermal shock resistance and mechanical strength for automotive, industrial, and electronic applications. Strategic initiatives such as partnerships, acquisitions, and technology upgrades strengthen their global market position. Regional manufacturers emphasize cost efficiency and tailored solutions to cater to diverse end-use industries. Rising demand for eco-friendly and energy-efficient ceramic materials encourages companies to invest in advanced sintering technologies and sustainable production methods, ensuring competitiveness in an evolving market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kyocera

- CoorsTek

- Insaco

- Trans-Tech

- STEATIT

- R. Advanced Elan Technology

- Du-Co Ceramics

- Tianjin Century Electronics

- Sonya Ceramics

- Morgan Advanced Materials

Recent Developments

- In August 2025, Morgan Advanced Materials published the half-year results and noted material-development priorities aligned with advanced ceramics applications.

- In June 2025, Morgan Advanced Materials conducted its first real-time ceramic sintering research supported by Diamond Light Source.

- In November 2024, Kyocera’s European unit, KYOCERA Fineceramics Europe GmbH, presented two new applications for its Fine Cordierite mirror at the Space Tech Expo Europe 2024 held in Bremen, Germany.

- In June 2024, Kyocera Corporation announced its “Fine Cordierite” ceramic mirror had been selected for use in experimental optical-communication equipment aboard the International Space Station

Report Coverage

The research report offers an in-depth analysis based on Type, Manufacturing Process, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cordierite ceramics will grow steadily due to rising use in automotive emission systems.

- Advancements in sintering and extrusion will improve material strength and heat resistance.

- Porous cordierite ceramics will remain dominant for their lightweight and thermal stability advantages.

- Manufacturers will increase investment in eco-friendly and energy-efficient ceramic production technologies.

- The automotive industry will continue to be the largest consumer, driven by strict emission regulations.

- Asia Pacific will maintain its leading position, supported by industrial expansion and export growth.

- The electronics sector will offer new opportunities through demand for high-temperature insulators.

- Research in composite cordierite materials will enhance performance for industrial and energy applications.

- Strategic partnerships and acquisitions among global players will strengthen supply networks.

- Growing focus on sustainability and recycling in ceramics manufacturing will shape future market development.