Market Overview:

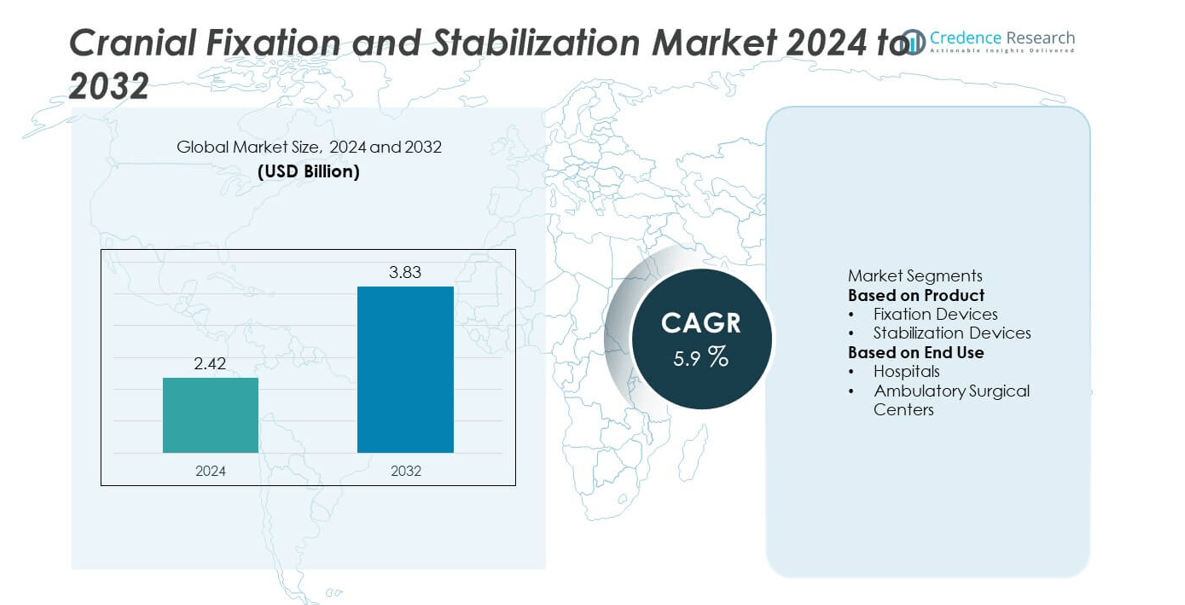

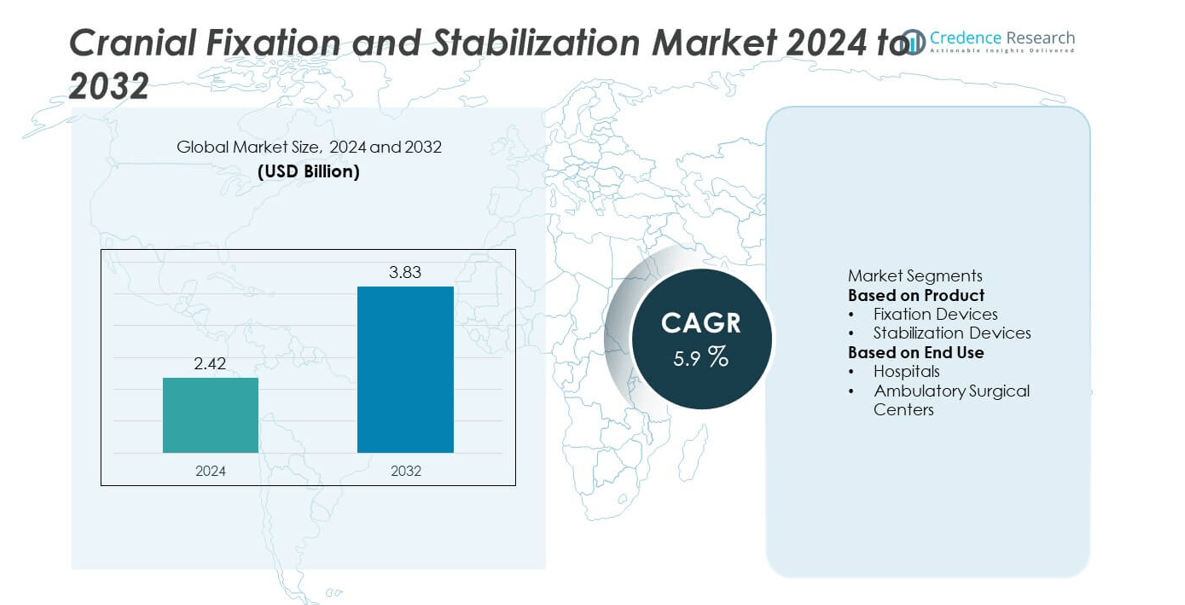

The global cranial fixation and stabilization market was valued at USD 2.42 billion in 2024 and is projected to reach USD 3.83 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cranial Fixation and Stabilization Market Size 2024 |

USD 2.42 billion |

| Cranial Fixation and Stabilization Market , CAGR |

5.9% |

| Cranial Fixation and Stabilization Market Size 2032 |

USD 3.83 billion |

The cranial fixation and stabilization market is led by key players such as Zimmer Biomet Holdings, Inc., evonos GmbH & Co. KG, Medtronic, Colson Medical, Inc. (Acumed LLC), KLS Martin Group, Integra LifeSciences Corporation, B. Braun SE, Medicon eG, Johnson & Johnson, and Stryker. These companies drive market growth through advanced cranial implant solutions, innovation in bioresorbable materials, and patient-specific 3D printing technology. North America led the market with a 39% share in 2024, driven by high neurosurgical volumes and strong adoption of advanced fixation systems. Europe followed with 29% share, supported by favorable healthcare policies, while Asia Pacific held 24%, reflecting rapid healthcare expansion and increased trauma-related surgeries.

Market Insights

- The cranial fixation and stabilization market was valued at USD 2.42 billion in 2024 and is projected to reach USD 3.83 billion by 2032, growing at a CAGR of 5.9%.

- Rising incidence of traumatic brain injuries, cranial deformities, and neurosurgical interventions are driving steady market growth worldwide.

- Advancements in 3D-printed implants and bioresorbable fixation systems are key trends enhancing surgical precision and biocompatibility.

- Major players such as Stryker, Medtronic, Zimmer Biomet Holdings, and Integra LifeSciences focus on innovation, partnerships, and R&D to strengthen their global presence.

- North America led with 39% market share in 2024, followed by Europe with 29% and Asia Pacific with 24%, while fixation devices dominated product segmentation with a 69% share due to their reliability in cranial reconstruction and trauma care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The fixation devices segment dominated the cranial fixation and stabilization market with a 69% share in 2024. This dominance is driven by their extensive use in neurosurgical and craniofacial procedures to ensure stable bone reconstruction. Titanium plates, screws, and mesh systems are preferred for their high strength, biocompatibility, and corrosion resistance. Advancements in bioresorbable materials and patient-specific 3D-printed implants have further enhanced fixation precision and recovery outcomes. Increasing adoption of minimally invasive fixation techniques and rising cases of traumatic brain injuries continue to strengthen demand for fixation devices globally.

- For instance, Zimmer Biomet offers patient-specific 3D-printed cranial implants, which use advanced manufacturing techniques like electron beam melting. Studies have affirmed the capability of this technology in providing a high degree of accuracy and improved clinical outcomes for patients.

By End Use

The hospitals segment held the largest share of 74% in 2024, supported by the availability of advanced neurosurgical infrastructure and skilled professionals. Hospitals perform the majority of cranial stabilization and reconstructive procedures due to high patient inflow and access to specialized surgical tools. Growing incidence of trauma, tumor resections, and congenital cranial deformities is boosting hospital-based surgical volumes. Investments in neurosurgical units, coupled with increased adoption of image-guided and robotic-assisted systems, further drive the dominance of hospitals in the cranial fixation and stabilization market.

- For instance, Medtronic’s StealthStation™ S8 surgical navigation system can be used during cranial fixation surgeries, enabling high-precision, sub-millimeter level accuracy in certain applications.

Key Growth Drivers

Increasing Incidence of Traumatic Brain Injuries

Rising cases of head trauma from road accidents, sports injuries, and falls are significantly driving the cranial fixation and stabilization market. According to WHO, millions experience traumatic brain injuries annually, requiring surgical intervention. Surgeons increasingly prefer advanced fixation systems to enhance postoperative outcomes and reduce complications. The growing adoption of titanium and bioresorbable implants ensures greater surgical precision and patient recovery, fueling consistent market growth across developed and emerging economies.

- For instance, Integra LifeSciences’ titanium cranial fixation sets include plates, screws, and instruments, which enhance efficiency in the operating room. Some systems feature low-profile titanium implants for better aesthetics and easier screw insertion.

Advancements in Cranial Implant Technologies

Technological innovations such as 3D printing and computer-assisted surgery have transformed cranial reconstruction procedures. Patient-specific implants made from biocompatible materials provide enhanced accuracy and comfort. These innovations reduce surgery time and improve cosmetic and functional results, gaining strong acceptance in neurosurgical centers. The use of digital modeling also supports personalized cranial defect restoration, driving wider clinical adoption of customized fixation and stabilization solutions globally.

- For instance, evonos GmbH & Co. KG manufactures patient-specific cranial implants using polyetheretherketone (PEEK) with precision below 0.3 mm, improving anatomical fit and reducing revision rates.

Rising Neurosurgical Procedure Volume

The increasing prevalence of neurological disorders, tumors, and craniofacial deformities continues to boost demand for cranial stabilization systems. Hospitals worldwide report growing numbers of elective and emergency neurosurgeries. Advancements in minimally invasive and image-guided techniques further expand procedural capabilities. As healthcare infrastructure improves in developing nations, access to specialized neurosurgical care rises, enhancing the adoption of fixation plates, clamps, and pins across both adult and pediatric patients.

Key Trends & Opportunities

Adoption of Bioresorbable Fixation Systems

The market is witnessing a rapid shift toward bioresorbable fixation materials as an alternative to traditional titanium systems. These implants dissolve naturally in the body, eliminating the need for secondary surgeries. Their excellent biocompatibility, reduced infection risk, and flexibility in pediatric applications make them highly preferred. Continuous R&D in polymer composites and hybrid materials offers opportunities for long-term market expansion and improved patient outcomes.

- For instance, Inion Oy’s CPS bioresorbable plates, composed of a polylactic acid blend, provide complete absorption within 2–4 years, reducing the need for implant removal in over 120,000 craniofacial cases globally

Integration of 3D Printing and Custom Implants

3D-printed cranial implants are gaining prominence due to their precision, structural strength, and customization capability. Surgeons can now design patient-specific models that fit perfectly to the cranial contour, improving surgical accuracy and recovery. This technology also reduces operating time and postoperative complications. Collaboration between medical device manufacturers and 3D printing firms creates new growth avenues for personalized cranial fixation and stabilization solutions.

- For instance, Stryker’s CMF Personalized Solutions produces customized cranial implants, which are available in various materials including PEEK, MEDPOR, and titanium. These implants are designed for a precise fit based on each patient’s anatomy.

Key Challenges

High Cost of Cranial Fixation Procedures

The high cost associated with cranial implants, surgical tools, and advanced fixation systems remains a major challenge, especially in low-income countries. Expensive titanium and bioresorbable devices limit accessibility to specialized neurosurgical care. Limited reimbursement coverage and high hospital procedure costs further restrict widespread adoption. Manufacturers must focus on cost-effective production methods and pricing strategies to improve affordability and market penetration.

Stringent Regulatory and Approval Requirements

Cranial fixation devices are subject to rigorous approval processes due to their direct impact on patient safety. Regulatory bodies like the FDA and EMA impose strict guidelines on product testing, biocompatibility, and clinical validation. These lengthy approval timelines and compliance costs often delay product launches. Smaller manufacturers face challenges in meeting these standards, which can hinder innovation and slow market entry across regions.

Regional Analysis

North America

North America dominated the cranial fixation and stabilization market with a 39% share in 2024. The region’s leadership is driven by advanced healthcare infrastructure, a high volume of neurosurgical procedures, and early adoption of innovative implant technologies. The United States leads due to increasing traumatic brain injury cases and strong reimbursement systems supporting cranial surgeries. Key players focus on introducing bioresorbable and patient-specific implants to meet growing clinical demand. Rising investments in medical device research and expanding access to specialized neurosurgical centers further strengthen North America’s position in the global market.

Europe

Europe held a 29% share of the cranial fixation and stabilization market in 2024, supported by rising incidence of head trauma and expanding neurorehabilitation services. Countries such as Germany, France, and the U.K. are leading markets due to advanced surgical infrastructure and favorable reimbursement policies. Growing adoption of 3D-printed cranial implants and bioresorbable fixation systems contributes to market expansion. Continuous product innovation by regional manufacturers and the presence of skilled neurosurgeons sustain steady growth. Increasing government focus on improving neurosurgical outcomes further enhances Europe’s position in this industry.

Asia Pacific

Asia Pacific accounted for a 24% share of the cranial fixation and stabilization market in 2024 and is expected to experience the fastest growth. Rising cases of road accidents, expanding healthcare infrastructure, and increasing investments in advanced surgical technologies are driving demand. China, Japan, and India dominate regional growth through improved hospital capacity and adoption of modern neurosurgical devices. Favorable government initiatives promoting trauma care and medical innovation further support expansion. Local manufacturing of affordable fixation systems and growing awareness about neurotrauma management strengthen Asia Pacific’s market potential.

Latin America

Latin America captured a 5% share of the cranial fixation and stabilization market in 2024, driven by increasing access to surgical care and growing public healthcare funding. Brazil and Mexico lead the region due to expanding hospital networks and rising incidence of cranial trauma. Multinational companies are entering the market through partnerships to offer cost-effective and high-quality fixation systems. However, limited availability of skilled neurosurgeons and uneven healthcare infrastructure remain key barriers. Ongoing modernization of trauma centers is expected to gradually boost market adoption in the coming years.

Middle East & Africa

The Middle East & Africa region held a 3% share of the cranial fixation and stabilization market in 2024. Market growth is fueled by increasing prevalence of head injuries, expanding healthcare infrastructure, and rising awareness of neurotrauma management. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are investing heavily in modern surgical technologies. However, limited access to advanced implants and high procedure costs hinder faster adoption. Government-led healthcare reforms and collaborations with global medical device companies are expected to enhance market development across the region.

Market Segmentations:

By Product

- Fixation Devices

- Stabilization Devices

By End Use

- Hospitals

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cranial fixation and stabilization market is shaped by leading players such as Zimmer Biomet Holdings, Inc., evonos GmbH & Co. KG, Medtronic, Colson Medical, Inc. (Acumed LLC), KLS Martin Group, Integra LifeSciences Corporation, B. Braun SE, Medicon eG, Johnson & Johnson, and Stryker. These companies compete through continuous innovation, product diversification, and strategic collaborations. Market leaders focus on developing advanced fixation devices, bioresorbable implants, and patient-specific 3D-printed solutions to enhance surgical precision and recovery outcomes. Investments in R&D for lightweight and biocompatible materials are expanding product portfolios. Strategic mergers and partnerships with hospitals and research institutions help strengthen global market presence. Additionally, regional manufacturers are introducing cost-effective systems to increase accessibility in emerging economies, intensifying overall competition. The growing focus on minimally invasive and personalized neurosurgical solutions continues to define the industry’s competitive dynamics worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Johnson & Johnson MedTech announced a showcase of digital orthopaedic innovations at AAOS 2025, emphasizing data-driven implants across trauma, spine and craniomaxillofacial surgery.

- In 2025, Integra LifeSciences Holdings Corporation issued an urgent device recall for its Codman Disposable Cranial Perforator and associated craniotomy kits following ten reported injuries including device lodging and procedural delays.

- In August 2024, DePuy Synthes (a subsidiary of Johnson & Johnson) introduced the MatrixSTERNUM™ Fixation System, delivering three times greater locking strength compared to a leading competitor and featuring 1.5 mm low-profile plates.

Report Coverage

The research report offers an in-depth analysis based on Product, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for cranial fixation and stabilization devices will rise with increasing traumatic brain injuries.

- Advancements in bioresorbable materials will improve surgical outcomes and reduce complications.

- 3D printing will become a standard for patient-specific cranial implants across major hospitals.

- Minimally invasive neurosurgical procedures will drive adoption of lightweight and flexible fixation systems.

- Hospitals will remain the leading end users due to advanced infrastructure and skilled neurosurgeons.

- Emerging markets in Asia Pacific will experience rapid growth through healthcare expansion and local manufacturing.

- Partnerships between medical device companies and research institutions will boost innovation and design improvements.

- Automation and image-guided surgery systems will enhance fixation accuracy and patient recovery rates.

- Regulatory reforms will support faster approval of novel cranial implant technologies.

- Rising healthcare spending and awareness of neurotrauma management will sustain long-term market growth globally.