Market Overview:

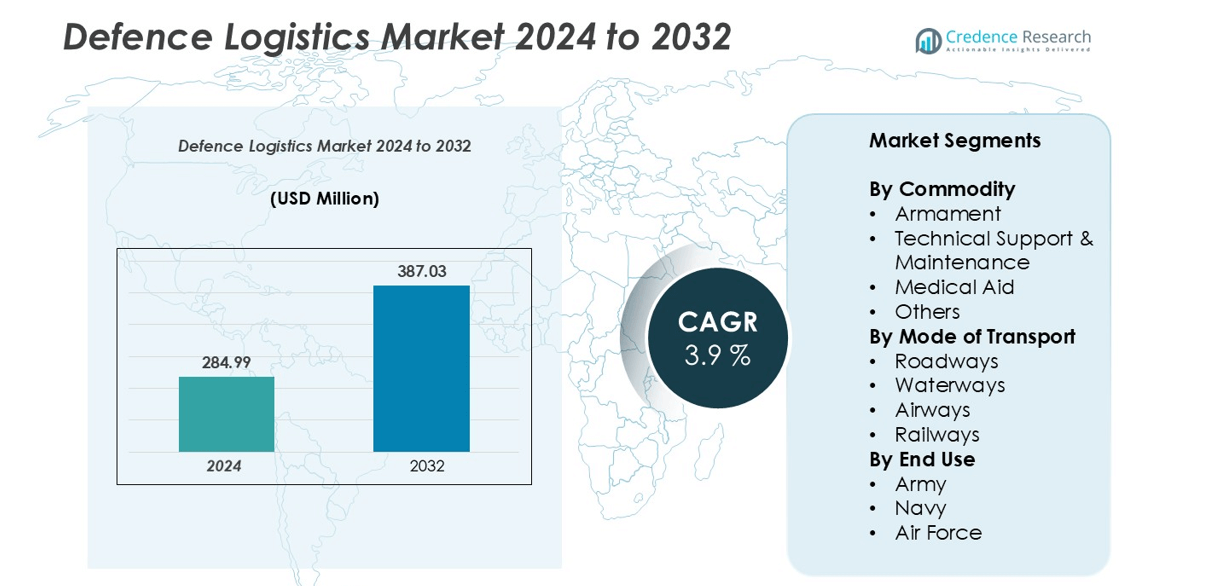

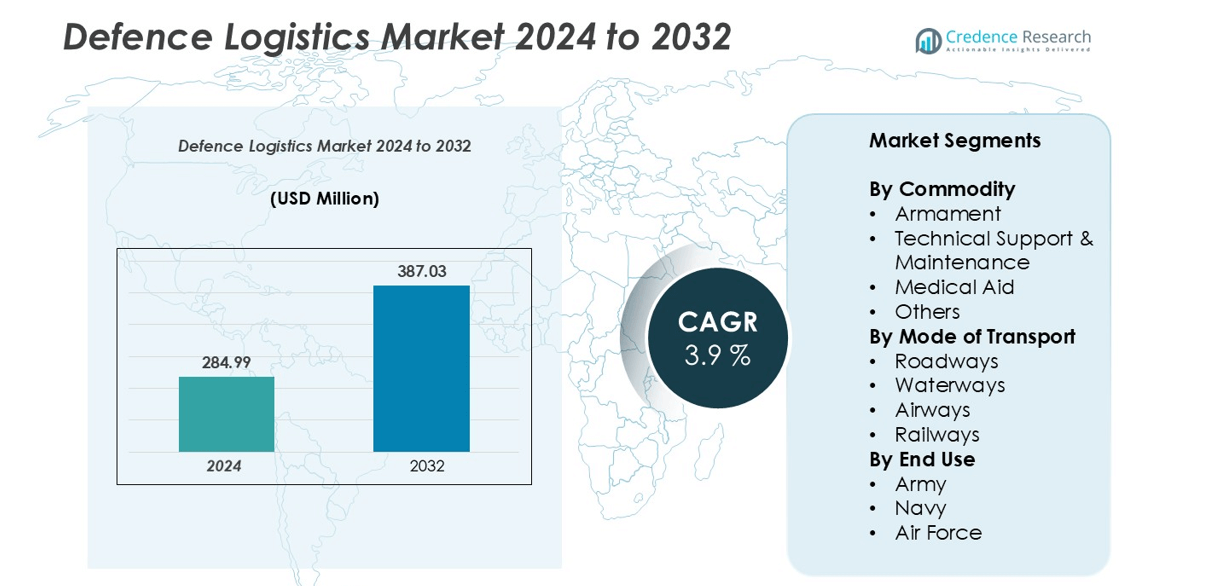

The defence logistics market size was valued at USD 284.99 million in 2024 and is anticipated to reach USD 387.03 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Defence Logistics Market Size 2024 |

USD 284.99 million |

| Defence Logistics Market, CAGR |

3.9% |

| Defence Logistics Market Size 2032 |

USD 387.03 million |

The defence logistics market is dominated by major players such as FedEx, A.P. Moller-Maersk, Kuehne+Nagel, CEVA Logistics, Deutsche Post AG, SEKO Logistics, Scan Global Logistics, Aero Cargo Logistics, CargoTrans, and Maritime Logistics. These companies leverage advanced multi-modal transport networks, automated warehouses, and technology-driven supply chain solutions to enhance operational efficiency and secure handling of armaments, medical aid, and technical support. North America leads the market with a 35% share, driven by high defense spending and modernization programs, followed by Europe at 28%, supported by NATO collaborations and integrated logistics initiatives. Asia Pacific accounts for 22%, propelled by rapid military modernization and regional security concerns, while the Middle East & Africa and Latin America hold 10% and 5%, respectively. Collectively, these players and regions shape a highly competitive and growth-oriented defense logistics landscape.

Market Insights

- The defence logistics market was valued at USD 284.99 million in 2024 and is projected to reach USD 387.03 million by 2032, growing at a CAGR of 3.9% during the forecast period.

- Growth is driven by increasing defense modernization programs, strategic military exercises, and adoption of technology-driven supply chain solutions, which enhance operational efficiency and rapid deployment capabilities.

- Key trends include rising adoption of multi-modal logistics solutions, focus on sustainable and green logistics, and expansion into emerging markets to support regional military operations.

- The market is highly competitive, dominated by players such as FedEx, A.P. Moller-Maersk, Kuehne+Nagel, CEVA Logistics, and Deutsche Post AG, with North America holding 35% market share, Europe 28%, Asia Pacific 22%, Middle East & Africa 10%, and Latin America 5%.

- Challenges include high operational costs, infrastructure limitations in remote areas, and stringent security and regulatory compliance requirements affecting logistics efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Commodity

The commodity segment of the defence logistics market encompasses armament, technical support & maintenance, medical aid, and others. Armament dominates this segment, accounting for approximately 42% of the market share, driven by increasing defense modernization programs and procurement of advanced weaponry. The growing need for rapid deployment and supply of critical munitions to support operational readiness further fuels demand. Technical support and maintenance services also witness steady growth, supported by defense organizations’ focus on lifecycle management, equipment reliability, and reducing downtime of critical assets.

- For instance, BAE Systems delivered over 440 M777 lightweight howitzers to U.S. and allied armed forces, integrating titanium and aluminum alloys to reduce overall system weight to 4,200 kilograms, significantly enhancing deployability via CH-47 Chinook helicopters.

By Mode of Transport

In terms of mode of transport, roadways, waterways, airways, and railways are integral to defense logistics. Roadways remain the dominant sub-segment, contributing around 38% of the market share, owing to their flexibility, accessibility to remote locations, and cost-effectiveness in short- to medium-distance logistics operations. Air transport is gaining momentum for high-priority shipments due to its speed and reliability, particularly in conflict zones. The adoption of multi-modal logistics solutions and government investments in infrastructure enhance the efficiency and resilience of transportation networks.

- For instance, Rheinmetall MAN Military Vehicles (RMMV) manufactures and supplies the HX and TGS series military logistics vehicles, which are operated by the armed forces of various nations.

By End Use

The end-use segment is categorized into the army, navy, and air force. The army represents the largest sub-segment, holding roughly 50% of the market share, driven by large-scale deployment of troops and land-based operations requiring extensive logistics support. Naval logistics growth is supported by the expansion of maritime defense capabilities and fleet modernization, while air force logistics are propelled by increasing fighter jet acquisitions and aerial mobility programs. Overall, strategic defense initiatives, modernization programs, and rapid response requirements are key factors driving end-use demand across segments.

Key Growth Drivers

Increasing Defense Modernization Programs

Rising defense modernization initiatives across major economies are a primary growth driver for the defence logistics market. Governments are investing heavily in upgrading military equipment, weaponry, and infrastructure, necessitating advanced logistics solutions to manage procurement, storage, and deployment efficiently. Modernization programs also emphasize rapid mobility, real-time tracking, and lifecycle management of assets, which boost demand for sophisticated logistics services. For instance, the integration of automated inventory management systems and predictive maintenance ensures minimal downtime for critical equipment, enhancing operational readiness. These programs also extend to procurement of medical aid and technical support services, further increasing the scope of logistics operations. Overall, modernization initiatives create a structured and sustainable demand for reliable, timely, and scalable logistics solutions.

- For instance, S. Army’s Integrated Visual Augmentation System (IVAS) program, originally developed by Microsoft, is now a partnership primarily led by the defense company Anduril Industries as of February 2025. The program aims to equip soldiers with mixed-reality headsets to enhance situational awareness, though development has faced numerous delays and setbacks due to technical and ergonomic issues.

Strategic Defense Alliances and Global Military Exercises

Defense alliances and joint military exercises among countries drive logistics demand by necessitating seamless transportation, coordination, and support across borders. Regular multinational drills require movement of armaments, medical aid, and personnel via roadways, airways, rail, and waterways, ensuring operational efficiency. These activities encourage investment in state-of-the-art transportation and storage solutions, as well as digital platforms for real-time tracking and supply chain optimization. The need for interoperability among allied forces also promotes standardized logistics practices, leading to expanded services and infrastructure. Consequently, defense collaborations directly contribute to sustained growth in procurement, technical support, and maintenance logistics across multiple regions.

- For instance, BAE Systems has integrated automation, including robotic systems, into its aircraft manufacturing and logistics operations at its Samlesbury, UK, site. The facility helps streamline the distribution of aircraft parts for key projects, including the F-35 fighter jet.

Technological Advancements in Supply Chain Management

Technological innovations such as AI-powered route optimization, IoT-enabled inventory tracking, and automated maintenance systems are transforming defense logistics. Advanced analytics enable predictive maintenance, reducing equipment downtime and improving mission readiness. Similarly, automated warehouses and smart transportation management systems enhance operational efficiency while minimizing human errors and costs. The adoption of digital twins, blockchain, and drone-assisted deliveries is further streamlining logistics operations, ensuring timely and secure transportation of critical assets. As armed forces prioritize agility and responsiveness, the integration of cutting-edge technologies continues to serve as a key driver, allowing defense organizations to handle complex logistics networks effectively and sustainably.

Key Trends & Opportunities

Rise of Multi-Modal and Integrated Logistics Solutions

The increasing adoption of multi-modal logistics solutions presents significant opportunities in the defense sector. Combining road, air, rail, and water transport allows for faster, more efficient, and cost-effective movement of equipment and personnel. Defense organizations are leveraging integrated platforms to monitor inventory, streamline deliveries, and coordinate operations across regions. This trend is supported by investments in advanced logistics hubs, automated warehouses, and real-time tracking systems. As military operations become more complex, multi-modal solutions ensure operational readiness, risk mitigation, and enhanced supply chain resilience, providing a significant growth opportunity for logistics providers.

- For instance, Lockheed Martin uses AI-driven supply chain analytics to enhance efficiency at its major facilities, such as the Aeronautics plant in Fort Worth. Through automation and the “digital factory” approach, it tracks components and materials in real-time within its networked supply chain to improve production and logistics. Similarly, DHL Global Forwarding utilizes its SmartSensor and IoT solutions to provide real-time, multimodal shipment monitoring across its logistics network. This technology is applied to sensitive cargo, such as for the life sciences and healthcare sectors, and could be utilized by its Defense Logistics division to track military cargo.

Focus on Sustainable and Green Logistics

Environmental sustainability is emerging as a critical trend within defense logistics. Armed forces are increasingly exploring energy-efficient vehicles, low-emission transport options, and eco-friendly packaging for supplies. Green logistics practices, including fuel optimization, route planning, and waste reduction, help reduce operational costs while aligning with global sustainability targets. These initiatives not only enhance the efficiency of defense supply chains but also promote compliance with regulatory frameworks. Companies investing in sustainable solutions can differentiate themselves, creating new business opportunities while supporting long-term strategic goals.

- For instance, BAE Systems has developed hybrid electric drive (HED) technology for military vehicles, which has demonstrated significant fuel efficiency improvements and can enable features like silent watch capability.

Expansion in Emerging Markets

Emerging economies are rapidly expanding their defense infrastructure, creating opportunities for logistics services. Rising defense budgets, modernization of armed forces, and strategic partnerships with global defense suppliers drive demand for sophisticated logistics solutions. Companies can capitalize on this growth by establishing regional supply hubs, offering end-to-end logistics services, and providing technology-driven solutions tailored to local requirements. The trend of increasing procurement of advanced weaponry and medical aid in these markets presents a lucrative opportunity for specialized logistics providers to expand their footprint.

Key Challenges

High Operational Costs and Infrastructure Constraints

High operational costs pose a significant challenge to the defense logistics market. Transportation, storage, and handling of sensitive military equipment require specialized infrastructure and skilled personnel, leading to substantial capital and operational expenditure. Limited infrastructure in remote or conflict-prone areas can hinder timely delivery and increase logistical risks. Additionally, maintaining multi-modal supply chains with real-time tracking and security features adds to the overall cost. Logistics providers must balance efficiency with expenditure while ensuring uninterrupted supply chains, making cost management a persistent challenge.

Security and Regulatory Compliance Risks

Ensuring the security of sensitive assets and complying with strict regulations is a key challenge in defense logistics. Armaments, classified equipment, and medical supplies require secure transport, advanced surveillance, and adherence to national and international protocols. Failure to comply with regulations can result in legal penalties, operational delays, and reputational damage. Additionally, cyber threats targeting logistics management systems pose risks to data integrity and operational continuity. Providers must invest in robust security measures, secure communication channels, and comprehensive compliance frameworks to mitigate these risks while maintaining operational efficiency.

Regional Analysis

North America

North America dominates the defence logistics market, holding approximately 35% of the global share. The region’s leadership is driven by substantial defense budgets, modernization programs, and the presence of major defense contractors. The U.S. and Canada invest heavily in advanced logistics infrastructure, automated supply chains, and multi-modal transportation solutions to ensure rapid deployment of armaments, medical aid, and technical support. High adoption of technology-driven logistics platforms and predictive maintenance systems enhances operational efficiency. Strong government initiatives supporting defense readiness, combined with frequent military exercises, continue to reinforce North America’s dominant position in the global defense logistics market.

Europe

Europe accounts for nearly 28% of the global defence logistics market, propelled by defense modernization, NATO collaborations, and strategic mobility initiatives. Countries such as the U.K., Germany, and France focus on integrated supply chains, advanced inventory management, and rapid deployment capabilities. Multi-modal transport solutions, including road, rail, air, and maritime logistics, support operational flexibility across diverse terrains. Increased focus on sustainability and eco-friendly logistics solutions further shapes the regional market. Strong defense alliances and continuous investment in technical support, maintenance, and medical logistics contribute to Europe’s significant share, maintaining steady growth in the global defense logistics landscape.

Asia Pacific

The Asia Pacific region holds approximately 22% of the defence logistics market, driven by rising defense budgets, military modernization, and regional security concerns. Countries such as India, China, Japan, and Australia are investing in advanced logistics infrastructure, multi-modal transport systems, and automated inventory management to support armaments and technical maintenance requirements. Growing regional tensions and frequent military exercises boost demand for rapid deployment capabilities and resilient supply chains. The focus on integrating technology-driven logistics solutions and expanding military bases across the region is expected to further strengthen Asia Pacific’s position, offering lucrative opportunities for logistics providers and defense contractors.

Middle East & Africa

The Middle East & Africa region contributes around 10% of the global defence logistics market, driven by strategic defense investments, modernization programs, and geopolitical dynamics. Nations like Saudi Arabia, the UAE, and South Africa emphasize rapid deployment capabilities, advanced transportation infrastructure, and secure logistics networks for armaments, medical aid, and technical support. Growing investments in smart warehouses, multi-modal transport solutions, and digital logistics platforms enhance operational efficiency. Regional security challenges, coupled with modernization initiatives, create a consistent demand for robust defense logistics services, reinforcing the region’s emerging significance in the global defense supply chain landscape.

Latin America

Latin America accounts for approximately 5% of the global defence logistics market, with growth fueled by increasing defense modernization programs and rising investments in operational readiness. Countries such as Brazil and Mexico are focusing on improving transport infrastructure, multi-modal logistics capabilities, and secure handling of armaments and medical aid. Limited technological adoption and budget constraints pose challenges, yet growing regional collaborations and government initiatives enhance logistics efficiency. The need for efficient supply chains to support army, navy, and air force operations drives demand, offering opportunities for defense logistics providers to expand services and modernize existing frameworks across the region.

Market Segmentations:

By Commodity

- Armament

- Technical Support & Maintenance

- Medical Aid

- Others

By Mode of Transport

- Roadways

- Waterways

- Airways

- Railways

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The defence logistics market is highly competitive, characterized by the presence of global and regional players offering end-to-end logistics solutions, including armament transport, technical support, and medical aid services. Leading companies such as FedEx, A.P. Moller-Maersk, Kuehne+Nagel, CEVA Logistics, and Deutsche Post AG leverage advanced technologies, multi-modal transport networks, and digital supply chain platforms to enhance operational efficiency and reliability. Strategic partnerships with defense agencies, investments in automated warehouses, and adoption of predictive maintenance solutions strengthen their market positioning. Regional players focus on niche services, including rapid deployment and secure handling of sensitive assets, to capture local demand. Companies also compete through expansion of geographic presence, sustainable logistics solutions, and integration of AI and IoT for real-time tracking, ensuring resilience and agility in complex military supply chains, thereby maintaining a competitive edge in the evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2024, A.P. Moller-Maersk announced the opening of a new air freight in-transit gateway in Miami, Florida, to enhance connectivity between Asia, Latin America, and the U.S., providing a strategic node in its global air freight network. The 90,000-square-foot facility, fully staffed by Maersk professionals, aims to support transshipping European and Asian cargo to Latin America, improving transit times, connectivity, and reliability for customers.

- In May 2022, FedEx. and Aurora Innovation, Inc. jointly announced the extension of their pilot program aimed at autonomously transporting FedEx shipments. The extension involved the inclusion of an additional commercial lane in Texas, marking a strategic advancement in their collaborative efforts toward autonomous shipping solutions.

Report Coverage

The research report offers an in-depth analysis based on Commodity, Mode of Transport, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth due to ongoing defense modernization programs.

- Adoption of advanced technology and automation will enhance operational efficiency across supply chains.

- Multi-modal transport solutions will become increasingly important for rapid deployment of resources.

- Integration of AI, IoT, and blockchain will improve tracking, inventory management, and security.

- Emerging markets in Asia Pacific and the Middle East will offer significant growth opportunities.

- Investment in sustainable and green logistics solutions will increase to reduce environmental impact.

- Strategic military collaborations and joint exercises will continue to drive demand for logistics services.

- Companies will focus on expanding regional presence and building specialized logistics hubs.

- Demand for technical support, maintenance, and medical aid logistics will grow alongside armament transport.

- Security and regulatory compliance measures will evolve to address emerging threats and operational challenges.