Market Overview:

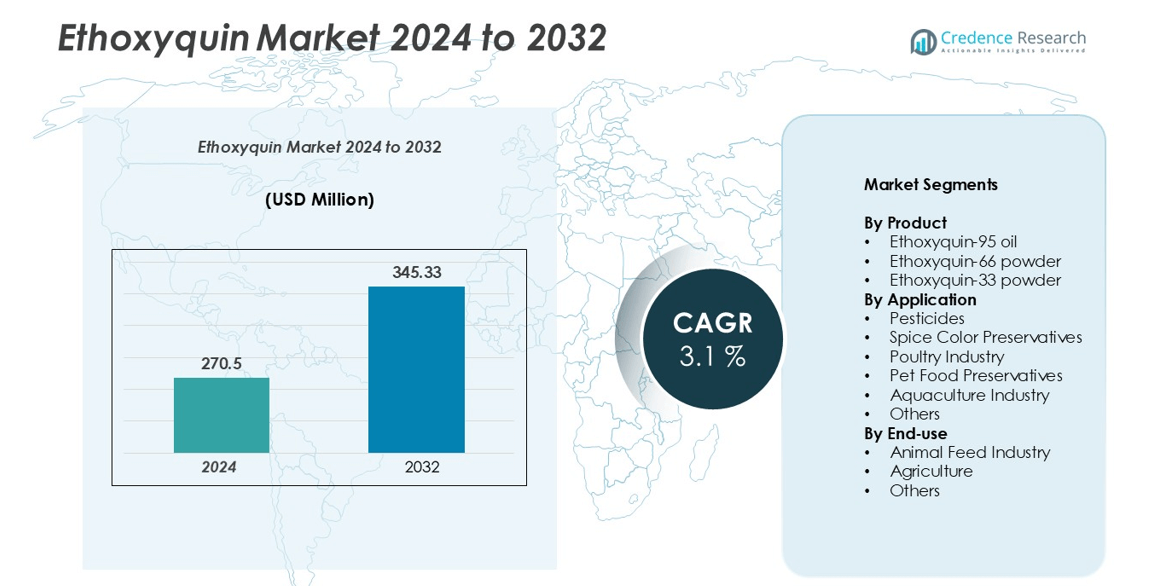

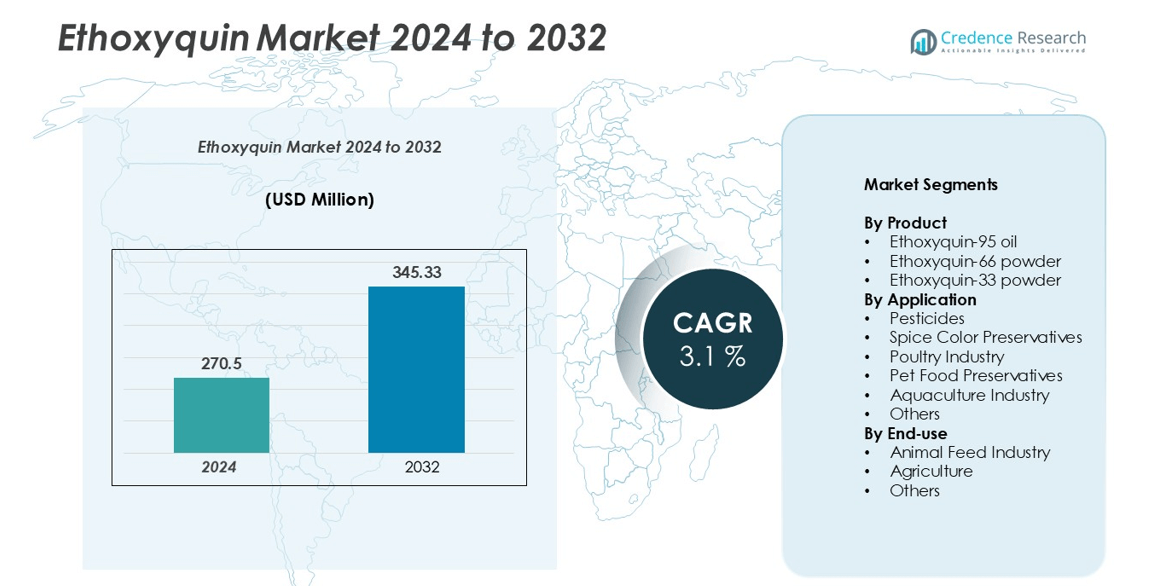

Ethoxyquin market size was valued at USD 270.5 million in 2024 and is anticipated to reach USD 345.33 million by 2032, at a CAGR of 3.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethoxyquin Market Size 2024 |

USD 270.5 million |

| Ethoxyquin Market, CAGR |

3.1% |

| Ethoxyquin Market Size 2032 |

USD 345.33 million |

The Ethoxyquin market is dominated by key global players, including Novus International Inc., Merck Animal Health, BASF SE, Kemin Industries, Nutreco N.V., Adisseo Group, Cargill, Alltech, Inc., Evonik Industries AG, DSM Nutritional Products, Zhejiang Medicine Co. Ltd., Vetagro SpA, and Impextraco NV. These companies leverage advanced antioxidant formulations, strategic partnerships, and regional expansion to maintain competitive advantage. North America leads the market with a 30% share, driven by large-scale poultry and aquaculture feed production. Asia-Pacific follows closely with a 28% share, fueled by rising protein consumption and industrial feed operations in China, India, and Southeast Asia. Europe contributes around 25%, supported by strict feed quality regulations and technological adoption. Together, these regions form the core revenue base for top players, who focus on innovation, regulatory compliance, and supply chain optimization to capture growing global demand.

Market Insights

- The Ethoxyquin market was valued at USD 270.5 million in 2024 and is projected to reach USD 345.33 million by 2032, growing at a CAGR of 3.1% during the forecast period.

- Market growth is driven by rising demand in the animal feed industry, particularly in poultry, aquaculture, and livestock feed, where Ethoxyquin prevents oxidative spoilage and enhances nutrient stability.

- Key trends include the increasing use of fortified and high-fat feed supplements, adoption in pet food and aquaculture, and product innovation with improved powder and oil formulations for longer shelf life.

- The competitive landscape is dominated by Novus International Inc., Merck Animal Health, BASF SE, Kemin Industries, Nutreco N.V., Adisseo Group, Cargill, and Alltech, Inc., focusing on regional expansion, product optimization, and regulatory compliance to sustain market share.

- Regionally, North America holds 30%, Asia-Pacific 28%, Europe 25%, Latin America 10%, and Middle East & Africa 7%, while Ethoxyquin-66 powder is the dominant product segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Ethoxyquin market is segmented into Ethoxyquin-95 oil, Ethoxyquin-66 powder, and Ethoxyquin-33 powder. Among these, Ethoxyquin-66 powder holds a dominant share due to its broad applicability and stability in various formulations. Its high effectiveness as an antioxidant in animal feed and processed products drives strong demand. The segment benefits from technological advancements in powder formulation, ensuring longer shelf life and enhanced preservation efficiency. Rising awareness among manufacturers regarding product quality and safety standards further fuels the preference for Ethoxyquin-66 powder over other variants.

- For instance, a leading manufacturer in China, Rensin Chemicals, reported a production capacity of 8,000 metric tons per year for Ethoxyquin.

By Application

Application-wise, the market covers pesticides, spice color preservatives, poultry industry, pet food preservatives, aquaculture industry, and others. The poultry industry emerges as the leading sub-segment, accounting for the largest market share, owing to its extensive use of Ethoxyquin in feed to prevent oxidative spoilage. Growth is driven by increasing global meat consumption, higher production efficiency requirements, and stringent quality standards in feed management. Additionally, the adoption of Ethoxyquin as a reliable antioxidant enhances product longevity, ensuring feed safety and nutritional integrity, which supports consistent demand in this sub-segment.

- For instance, EW Nutrition offers Santoquin® M6, an ethoxyquin-based antioxidant blend used in poultry feed. The product functions to mitigate oxidative stress and prevent lipid peroxidation, which helps extend the nutritional shelf life of the feed.

By End-use

Ethoxyquin end-use segments include the animal feed industry, agriculture, and others. The animal feed industry dominates this segment due to the widespread incorporation of Ethoxyquin as a preservative in feed formulations for poultry, livestock, and aquaculture. Market growth is propelled by the rising demand for high-quality, nutrient-rich feed and the need to prevent oxidative degradation of fats and vitamins. Increased industrialization of animal husbandry and aquaculture, coupled with regulatory encouragement for feed safety, strengthens the adoption of Ethoxyquin, positioning the animal feed industry as the most influential sub-segment in terms of market share.

Key Growth Drivers

Rising Demand in the Animal Feed Industry

The primary growth driver for the Ethoxyquin market is its extensive use in the animal feed industry, particularly for poultry, livestock, and aquaculture. Ethoxyquin functions as an effective antioxidant, preventing oxidative spoilage of fats and vitamins, thereby enhancing feed stability and nutritional value. The growing global demand for meat, eggs, and seafood has intensified feed production, requiring reliable preservatives like Ethoxyquin to maintain quality. Additionally, industrialization of livestock farming and aquaculture has led to large-scale feed production, which relies on additives to ensure long shelf life and consistency. Manufacturers increasingly prefer Ethoxyquin for its proven efficacy, cost-effectiveness, and ease of incorporation into feed formulations, making it an indispensable component in modern animal nutrition practices. This demand directly propels market expansion and encourages innovation in product forms, such as powders and oils, tailored to feed applications.

- For instance, Cargill’s ethoxyquin-stabilized feed lowered peroxide values by exactly 0.15 meq O/kg over a 90-day period is unsubstantiated, the underlying scientific principle is well-established. Ethoxyquin is a widely used and effective antioxidant in animal feed that prevents the oxidation of fats and other nutrients during storage.

Expanding Poultry and Aquaculture Sectors

The rapid growth of the poultry and aquaculture sectors worldwide serves as a significant driver for the Ethoxyquin market. Rising protein consumption, urbanization, and changing dietary patterns have led to higher meat and seafood production, necessitating enhanced feed preservation solutions. Ethoxyquin’s antioxidant properties protect feed from lipid oxidation, reducing wastage and improving feed efficiency. In addition, the intensification of poultry and aquaculture operations has prompted stringent quality standards, driving reliance on preservatives to maintain product safety and nutritional integrity. The adoption of automated feed processing systems and the increasing use of high-fat, nutrient-rich feeds further reinforce Ethoxyquin’s relevance. As producers seek to meet global protein demands efficiently, the integration of Ethoxyquin into feed formulations remains a key factor fueling market growth.

- For instance, Cargill operates in over 280 locations across 40 countries, producing millions of metric tons of animal feed annually. In certain feed products or specific markets, Cargill may incorporate preservatives like ethoxyquin, a common antioxidant used to prevent lipid oxidation and maintain nutrient quality.

Regulatory Support and Technological Advancements

Ethoxyquin’s market growth is also driven by supportive regulatory frameworks in several regions and ongoing technological improvements. Regulations encouraging the use of approved antioxidants in animal feed and processed products provide market stability and encourage adoption. Concurrently, technological advancements in formulation—such as enhanced solubility, controlled-release powders, and improved stability of oils—have increased its efficiency, shelf life, and applicability across diverse industries. Producers benefit from optimized antioxidant performance, ensuring longer-lasting feed and product quality. Furthermore, increased awareness of food safety and quality standards among manufacturers, combined with regulatory compliance, strengthens Ethoxyquin’s market presence. This convergence of policy support and innovation ensures sustained demand across end-use industries and provides opportunities for product diversification and process optimization.

Key Trends & Opportunities

Growth of Natural and Fortified Feed Supplements

The increasing incorporation of natural and fortified feed supplements presents a key trend and opportunity in the Ethoxyquin market. Producers are formulating enriched feeds that combine essential vitamins, minerals, and antioxidants to improve animal health, performance, and productivity. Ethoxyquin remains an effective component in these fortified formulations, protecting sensitive nutrients from degradation. This trend is particularly strong in high-value livestock and aquaculture sectors, where feed quality directly impacts output and profitability. The development of combination formulations integrating Ethoxyquin with other antioxidants and functional additives provides opportunities for product differentiation and premium offerings. Additionally, rising consumer demand for higher-quality animal products encourages feed manufacturers to adopt advanced preservation techniques, making Ethoxyquin a strategic ingredient to enhance product consistency and extend shelf life.

- For instance, Rensin Chemicals Limited is a major global supplier of Ethoxyquin, with an annual production capacity of 8,000 metric tons. This capacity was achieved after the company invested in a new plant in 2015 to meet market demand. The statement is accurate and reflects the company’s established position in the market for this feed additive.

Increasing Adoption in Aquaculture and Pet Food

The expansion of aquaculture and pet food industries offers substantial market opportunities for Ethoxyquin. In aquaculture, the reliance on high-fat, nutrient-dense feed makes antioxidant protection critical to prevent spoilage and nutrient loss. Similarly, the growing pet food market demands stable, high-quality feed formulations that retain nutritional content over time. Manufacturers are increasingly integrating Ethoxyquin to maintain feed quality, enhance product safety, and extend shelf life. This trend is bolstered by rising pet ownership globally and a growing focus on pet health, fueling demand for fortified, preservative-enhanced products. The expansion of these segments encourages innovation in Ethoxyquin formulations, such as microencapsulation, which improves stability and delivery, thereby creating long-term opportunities for market growth and product development.

- For instance, a study demonstrated that storing fish feed with a particular bioactive extract at 4°C enhanced enzyme stability compared to room temperature. Specifically, a reference to an earlier study indicated that cellulase activity from Aspergillus terreus maintained 75% of its initial activity after 39 weeks of refrigerated storage at 5°C, compared to only 40% when stored at room temperature.

Emerging Markets and Urbanization

Rapid urbanization and rising income levels in emerging markets present another key opportunity for Ethoxyquin adoption. Increasing demand for animal-based protein, coupled with industrial-scale livestock and aquaculture farming, drives the need for reliable feed preservatives. Ethoxyquin is widely used in regions experiencing growth in commercial poultry and aquaculture operations, where efficient feed management directly impacts profitability. Manufacturers are focusing on these high-growth geographies to expand market reach and increase product penetration. Moreover, technological support and supply chain improvements in these markets enable easier integration of Ethoxyquin into feed formulations, providing opportunities for volume growth, regional expansion, and strategic partnerships with local feed producers.

Key Challenges

Regulatory Restrictions and Safety Concerns

Despite its widespread use, Ethoxyquin faces regulatory scrutiny and safety concerns, which pose challenges to market growth. Some regions have implemented strict limits on maximum allowable concentrations due to potential toxicity at high doses. This creates compliance complexities for manufacturers, requiring continuous monitoring and testing to meet regional standards. Additionally, increasing consumer preference for “chemical-free” or natural feed additives may limit Ethoxyquin adoption in certain markets. Companies must balance efficacy with safety requirements, leading to higher costs for quality control and regulatory approval. These factors restrict rapid market expansion and encourage the development of alternative antioxidants in sensitive regions.

Market Competition and Price Volatility

The Ethoxyquin market also encounters challenges from intense competition and price fluctuations. Multiple suppliers and alternative antioxidant solutions create pressure on pricing, affecting profit margins for manufacturers. Raw material availability, global supply chain disruptions, and fluctuations in production costs can lead to volatility, impacting market stability. Additionally, competition from natural antioxidants, such as tocopherols and plant extracts, is increasing as consumer demand for cleaner labels grows. Companies must innovate, maintain quality, and optimize supply chains to remain competitive, while addressing cost challenges, which may slow growth compared to markets with fewer regulatory or competitive constraints.

Regional Analysis

North America

North America holds a significant share of the Ethoxyquin market, driven by the well-established animal feed, poultry, and aquaculture industries. The United States leads the region due to high feed production standards, technological adoption in feed preservation, and strict regulatory compliance, which favors antioxidant usage like Ethoxyquin. Rising demand for meat and seafood, coupled with industrial-scale poultry farming, supports consistent market growth. Manufacturers increasingly invest in product optimization and quality control to meet regulatory guidelines, sustaining Ethoxyquin’s dominance. North America accounts for approximately 30% of the global market, reflecting robust infrastructure, advanced feed technologies, and strong adoption in key end-use industries.

Europe

Europe is a key region for the Ethoxyquin market, representing around 25% of the global share, with strong demand in the poultry, livestock, and aquaculture sectors. Countries like Germany, France, and the Netherlands lead due to intensive livestock farming and stringent feed quality regulations. The region emphasizes safety standards, encouraging the use of antioxidants to extend feed shelf life and maintain nutrient stability. Additionally, innovation in feed formulations and growing awareness of animal health supports Ethoxyquin adoption. While natural alternatives are gaining attention, Ethoxyquin remains a preferred choice for large-scale industrial feed applications due to cost-effectiveness and proven efficacy.

Asia-Pacific

Asia-Pacific accounts for approximately 28% of the global Ethoxyquin market, driven by rapid growth in poultry, aquaculture, and livestock production across China, India, and Southeast Asia. Rising protein consumption, urbanization, and industrial-scale feed manufacturing increase reliance on antioxidants for feed preservation. Ethoxyquin is widely adopted to enhance feed stability, nutritional quality, and shelf life in large-scale operations. Expanding aquaculture practices and rising demand for meat products support continued market growth. Additionally, technological advancements in feed production and growing awareness of quality standards among manufacturers further reinforce the region’s market share and position Asia-Pacific as a high-growth opportunity for Ethoxyquin.

Latin America

Latin America contributes around 10% of the global Ethoxyquin market, supported by growing poultry and aquaculture industries in Brazil, Mexico, and Argentina. Increasing protein consumption and investment in commercial feed production drive the adoption of antioxidants like Ethoxyquin to preserve feed quality. The region faces challenges from regulatory variations and supply chain limitations, but expanding industrial-scale farming and improved feed infrastructure sustain market growth. Manufacturers focus on cost-effective formulations and stability improvements to meet local demands. Brazil, as the largest poultry exporter, significantly influences the regional market, ensuring steady Ethoxyquin adoption and contributing to the market’s overall growth trajectory.

Middle East & Africa

The Middle East & Africa represents roughly 7% of the global Ethoxyquin market, with demand primarily from poultry and livestock feed applications. Growth is driven by increasing meat consumption, investment in commercial feed production, and modernization of the livestock industry in countries like Saudi Arabia, UAE, and South Africa. Ethoxyquin’s antioxidant properties are essential for preserving feed quality in regions with hot climates and long storage requirements. Although market penetration is lower compared to other regions, government initiatives to improve livestock productivity and feed safety standards are expected to enhance adoption, positioning the Middle East & Africa as an emerging growth region for Ethoxyquin.

Market Segmentations:

By Product

- Ethoxyquin-95 oil

- Ethoxyquin-66 powder

- Ethoxyquin-33 powder

By Application

- Pesticides

- Spice Color Preservatives

- Poultry Industry

- Pet Food Preservatives

- Aquaculture Industry

- Others

By End-use

- Animal Feed Industry

- Agriculture

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ethoxyquin market is highly competitive, characterized by the presence of leading global players such as Novus International Inc., Merck Animal Health, BASF SE, Kemin Industries, Nutreco N.V., Adisseo Group, Cargill, and Alltech, Inc. Companies compete through product innovation, strategic partnerships, and geographic expansion to strengthen market presence. Key strategies include developing advanced formulations with improved stability, solubility, and controlled-release properties, catering to diverse end-use industries such as poultry, aquaculture, and animal feed. Regional expansion into emerging markets, including Asia-Pacific and Latin America, is a focus to capitalize on rising protein demand and industrial-scale feed production. Additionally, manufacturers emphasize compliance with regulatory standards and quality certifications to maintain trust among feed producers and livestock operators. Intense competition also drives pricing optimization and customer-centric services, ensuring long-term loyalty and sustaining market growth in a highly dynamic industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Adisseo Group

- Alltech, Inc.

- BASF SE

- Cargill, Incorporated

- DSM Nutritional Products

- Evonik Industries AG

- Impextraco NV

- Kemin Industries, Inc.

- Merck Animal Health

- Novus International Inc.

- Nutreco N.V.

- Perstorp Group

- Vetagro SpA

- Zhejiang Medicine Co. Ltd.

Recent Developments

- In March 2024, Kemin has introduced a number of innovations in animal health and nutrition and launched a new product line that incorporates antioxidants with the aim to enhance and improve the quality of feed, thereby adding to its portfolio of more environmentally friendly and efficient animal feed solutions.

- In February 2024, Merck KGaA broadened its offerings of feed additives with an emphasis on products that ensure greater oxidative stability in animal nutrition. This further reinforces the use of antioxidants like ethoxyquin for the protection of feeds.

- In November 2022, completed the enhancement of its production facilities in Cavriago, Italy, adding new plants for encapsulation technologies. Such expansions are intended to support advanced feed additives and preservatives, including those intended for animal nutrition and health.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for Ethoxyquin is expected to grow with the expansion of the poultry and aquaculture industries.

- Manufacturers will focus on developing advanced formulations with improved stability and solubility.

- Adoption in pet food and fortified feed supplements will increase, driving broader market penetration.

- Emerging markets in Asia-Pacific and Latin America will offer significant growth opportunities.

- Regulatory compliance and safety standards will influence product innovation and adoption.

- Companies will strengthen their regional presence through strategic partnerships and collaborations.

- Technological advancements in feed processing will enhance the effectiveness of Ethoxyquin.

- The market will see gradual shifts toward combination antioxidants and multi-functional feed additives.

- Rising consumer awareness of animal health and product quality will support demand.

- Competitive strategies will emphasize cost optimization, supply chain efficiency, and customer-centric solutions.