Market Overview

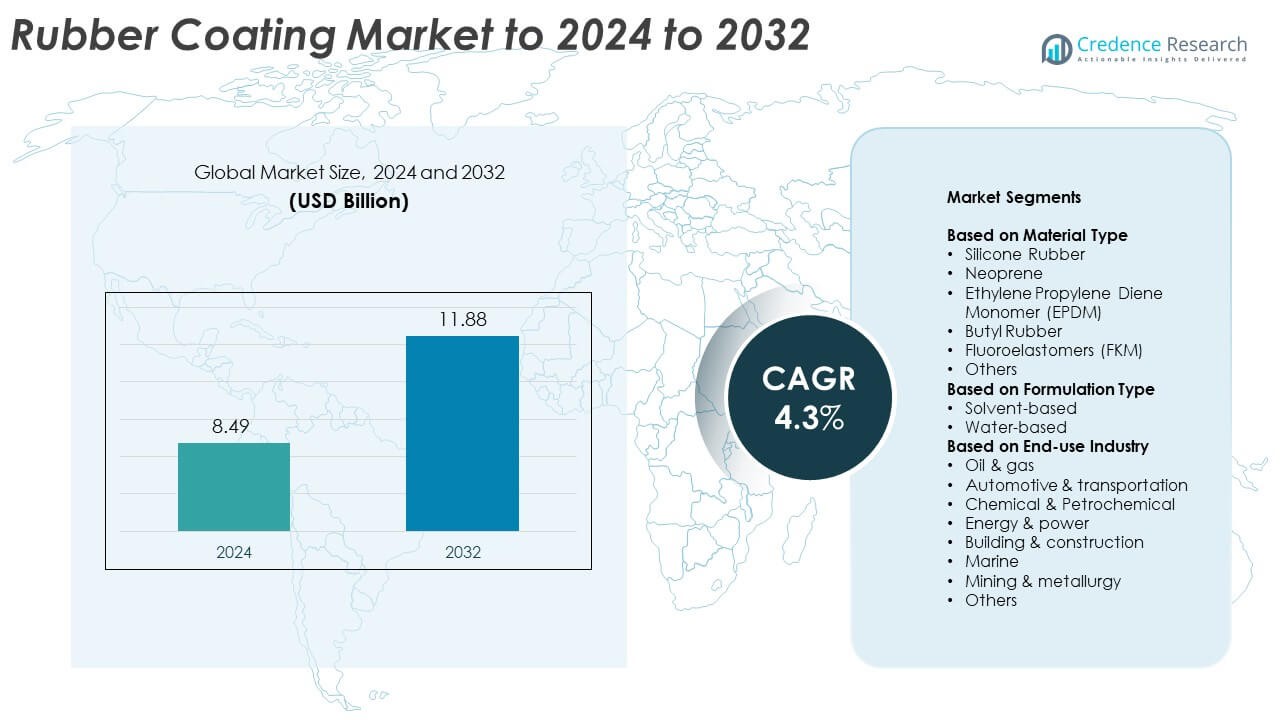

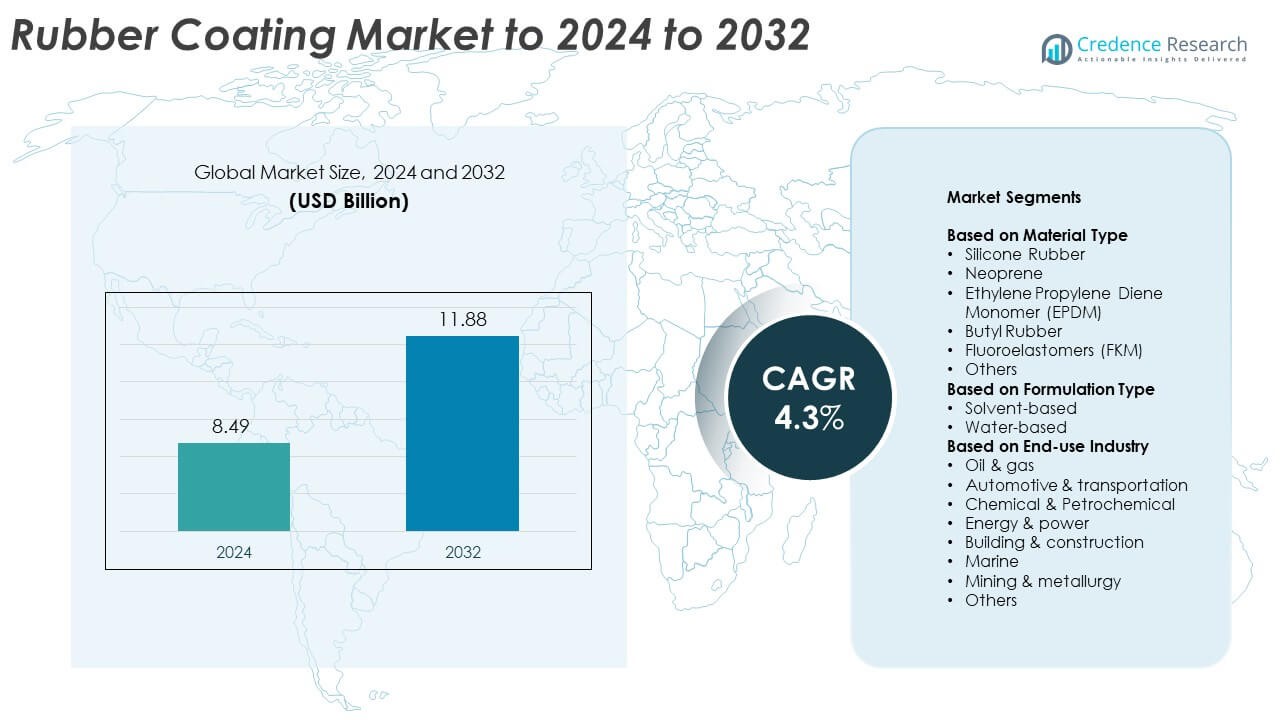

Rubber Coating Market size was valued USD 8.49 Billion in 2024 and is anticipated to reach USD 11.88 Billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber Coating Market Size 2024 |

USD 8.49 Billion |

| Rubber Coating Market, CAGR |

4.3% |

| Rubber Coating Market Size 2032 |

USD 11.88 Billion |

The global rubber coating market is led by major players such as 3M, AkzoNobel, BASF, PPG Industries, Sherwin-Williams, Axalta, and Hempel. These companies strengthen their market positions through continuous R&D, advanced coating technologies, and sustainable product innovation. Strategic collaborations and expansion into emerging markets further enhance their global footprint. The market is supported by rising industrial and construction activities, with increasing adoption of water-based and low-VOC coatings. Regionally, North America held the largest share of 34% in 2024, driven by strong automotive, infrastructure, and industrial demand, followed by Europe and Asia-Pacific showing significant growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The rubber coating market was valued at USD 8.49 billion in 2024 and is projected to reach USD 11.88 billion by 2032, growing at a CAGR of 4.3%.

- Rising demand from automotive, construction, and industrial sectors drives market expansion, supported by increasing adoption of eco-friendly and high-performance coatings.

- The market trends highlight a shift toward water-based and bio-based formulations, along with the integration of nanotechnology for improved durability and flexibility.

- Competition remains strong among global manufacturers focusing on R&D, sustainability, and strategic partnerships to expand product portfolios and regional presence.

- North America led the market with a 34% share in 2024, followed by Europe at 28% and Asia-Pacific at 29%; silicone rubber dominated the material type segment with a 34% share, reflecting its superior resistance and performance in demanding applications.

Market Segmentation Analysis:

By Material Type

The silicone rubber segment dominated the rubber coating market in 2024 with a 34% share. Its leadership stems from superior heat resistance, flexibility, and chemical stability, making it ideal for automotive, electronics, and construction applications. The rising demand for high-temperature and weather-resistant coatings in industrial machinery further supports growth. Neoprene and EPDM follow due to their durability and oil resistance, while fluoroelastomers gain traction in specialized chemical and aerospace uses driven by advanced polymer innovations.

- For instance, Momentive’s Silopren LSR 2171 completed a 3,000-hour ASTM D471 IRM 903 oil-immersion test.

By Formulation Type

The water-based segment held the largest market share of 56% in 2024, driven by increasing environmental regulations and the shift toward low-VOC formulations. Water-based rubber coatings offer improved adhesion, easy cleanup, and reduced toxicity compared to solvent-based types. Their growing use in construction, automotive underbody protection, and corrosion-resistant applications enhances segment expansion. Solvent-based coatings continue serving heavy-duty industrial uses where high chemical and temperature resistance are required, supported by performance-oriented formulations.

- For instance, the elongation at break for Sika’s water-based roof coatings varies by product. While coatings like Sikalastic®-590 IN achieve an elongation at break of approximately 300% (ASTM D412), others such as Sikalastic®-510 BH have a lower elongation of approximately 72% (ASTM D638).

By End-use Industry

The automotive and transportation segment accounted for the largest market share of 29% in 2024. Strong demand for underbody coatings, corrosion protection, and vibration-damping layers drives this dominance. Expanding electric vehicle production and the need for lightweight, durable coatings strengthen adoption. The building and construction sector follows, propelled by waterproofing and insulation applications. Meanwhile, oil and gas and marine industries rely on rubber coatings for resistance against harsh chemicals and saltwater exposure, ensuring long-term structural protection.

Key Growth Drivers

Rising Demand from Automotive and Transportation Sector

The automotive industry remains a major growth driver for the rubber coating market due to its extensive use in protecting vehicle parts from corrosion, vibration, and wear. Rubber coatings enhance noise reduction, improve durability, and extend component lifespan. The growing production of electric and hybrid vehicles further fuels demand for lightweight and thermally stable coatings. Manufacturers are focusing on advanced formulations that deliver superior flexibility and adhesion, meeting the rising performance requirements in modern automotive applications.

- For instance, Shin-Etsu silicone gel specifies an operating range from −40 °C to 200 °C for power modules.

Expansion in Construction and Infrastructure Projects

The expansion of global infrastructure and residential construction projects boosts rubber coating consumption. These coatings are widely applied for waterproofing roofs, decks, and concrete structures due to their elasticity and resistance to extreme weather conditions. Increasing investments in sustainable and energy-efficient buildings support this demand. Government-backed urban development projects across Asia-Pacific and the Middle East are strengthening market adoption. The rising preference for long-lasting, low-maintenance coating materials enhances segment growth.

- For instance, Dow’s DOWSIL 795 lists VOC content 30 g/L, joint movement capability ±50%, and 10,000-hour QUV data.

Growing Adoption of Eco-Friendly Water-Based Formulations

Environmental regulations promoting reduced volatile organic compounds (VOCs) drive the adoption of water-based rubber coatings. Industries are shifting from solvent-based systems toward sustainable formulations that offer similar durability and adhesion. Water-based coatings provide better environmental compliance, lower emissions, and safer handling. The trend aligns with corporate sustainability goals and international environmental standards, encouraging broader industrial and construction sector adoption. Continuous innovation in non-toxic polymers and bio-based elastomers supports long-term market expansion.

Key Trends & Opportunities

Integration of Nanotechnology in Coating Formulations

The integration of nanotechnology is emerging as a key trend, enhancing the performance of rubber coatings. Nano additives improve strength, chemical resistance, and UV protection while reducing material thickness. These advancements enable manufacturers to deliver coatings with superior mechanical stability and surface protection. Nanocoatings also support applications in automotive, marine, and oil industries requiring high endurance in harsh conditions. This trend creates opportunities for product differentiation and premium-grade coating solutions.

- For instance, Nanovere’s Nano-Clear NCI is certified to pass over 6,000 hours of salt spray testing (ASTM B117) with no rust or blisters.

Increased Adoption in Renewable Energy Applications

Rubber coatings are gaining traction in renewable energy sectors such as wind and solar due to their protective and insulating properties. They are applied on turbine blades, solar panels, and energy infrastructure to prevent corrosion and mechanical degradation. As global investment in renewable power grows, demand for weather-resistant and flexible coatings continues to expand. This opportunity supports product innovation targeting long-term durability under changing environmental conditions.

- For instance, 3M Wind Protection Tape 2.0 enables blades to return to service in 1–12 hours after application. Lab conditioning for rain-erosion tests uses 50 °C for 72 hours.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of synthetic rubbers and polymers pose a major challenge to market stability. These raw materials depend heavily on crude oil derivatives, making them sensitive to global energy price changes. Rising production costs affect profitability and limit pricing flexibility for manufacturers. Companies are increasingly exploring bio-based and recycled rubber alternatives to mitigate dependency on petrochemical inputs and ensure cost stability across production cycles.

Stringent Environmental and Safety Regulations

Tightening environmental regulations regarding chemical content and emissions present compliance challenges for producers. Restrictions on VOC levels and hazardous substances require reformulation of traditional solvent-based coatings. Achieving compliance without compromising performance or cost efficiency remains complex. Smaller manufacturers face higher costs related to testing, certification, and process upgrades. This challenge accelerates the shift toward sustainable coatings but demands significant investment in R&D and process innovation.

Regional Analysis

North America

North America held the largest share of 34% in the rubber coating market in 2024. Strong demand from automotive, construction, and oil and gas industries drives regional growth. The United States leads due to high investments in durable coating technologies and eco-friendly formulations. Expanding electric vehicle production and infrastructure modernization further enhance consumption. The region also benefits from advanced R&D capabilities and stringent quality standards that favor high-performance materials, supporting continuous market expansion across industrial and commercial sectors.

Europe

Europe accounted for 28% of the global rubber coating market in 2024, driven by sustainable construction projects and strict environmental regulations. Germany, France, and the United Kingdom dominate demand through strong automotive manufacturing and renewable energy applications. The region’s focus on green building standards and low-emission materials encourages adoption of water-based coatings. Ongoing innovations in polymer chemistry and government incentives for eco-friendly infrastructure boost regional market growth. Rising refurbishment activities in aging buildings further sustain product demand.

Asia-Pacific

Asia-Pacific captured a 29% share of the rubber coating market in 2024, supported by rapid industrialization and expanding automotive manufacturing hubs. China, Japan, South Korea, and India lead the market through strong infrastructure development and high construction output. The growing need for durable and weather-resistant coatings in industrial facilities drives product consumption. Rising investment in renewable energy and marine sectors enhances demand. Increasing local production capacity and lower manufacturing costs also make the region a key global exporter.

Middle East & Africa

The Middle East and Africa region held a 6% market share in 2024, driven by the expansion of oil and gas projects and infrastructure development. Countries such as Saudi Arabia, the UAE, and South Africa are major contributors. Demand for rubber coatings is rising in pipelines, offshore platforms, and power plants due to high temperature and chemical exposure. Growing focus on industrial safety and environmental compliance promotes advanced coating use. The region’s strategic shift toward renewable energy also offers emerging opportunities.

Latin America

Latin America accounted for 3% of the rubber coating market in 2024, led by Brazil and Mexico. The region’s market growth is fueled by expansion in construction and automotive assembly operations. Increasing urbanization and industrialization drive infrastructure coating demand, particularly in waterproofing and corrosion-resistant applications. Economic recovery and investments in energy and mining industries support steady product adoption. Local manufacturers are focusing on affordable, eco-friendly formulations to meet environmental regulations and strengthen regional competitiveness.

Market Segmentations:

By Material Type

- Silicone Rubber

- Neoprene

- Ethylene Propylene Diene Monomer (EPDM)

- Butyl Rubber

- Fluoroelastomers (FKM)

- Others

By Formulation Type

- Solvent-based

- Water-based

By End-use Industry

- Oil & gas

- Automotive & transportation

- Chemical & Petrochemical

- Energy & power

- Building & construction

- Marine

- Mining & metallurgy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rubber coating market is characterized by the presence of key players such as 3M, AkzoNobel, BASF, PPG Industries, Sherwin-Williams, Axalta, Hempel, Contitech, Liquid Rubber, Luxa Pool, Kimball Midwest, APOC, and Advance Drubber Coatings. These companies compete through technological innovation, product quality, and distribution efficiency. The competitive environment is shaped by growing demand for eco-friendly and high-performance coatings across industrial, automotive, and construction sectors. Major manufacturers emphasize R&D to develop low-VOC, water-based formulations that meet regulatory standards. Strategic mergers, capacity expansions, and digital coating technologies enhance global reach and customer engagement. Partnerships with construction and automotive OEMs strengthen supply reliability, while focus on cost efficiency and customized formulations supports market penetration. Continuous innovation in advanced polymers, nanocomposite materials, and corrosion-resistant coatings remains central to gaining a competitive edge, ensuring long-term growth amid evolving industrial requirements and sustainability-driven transitions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M

- AkzoNobel

- BASF

- PPG Industries

- Sherwin-Williams

- Axalta

- Hempel

- Contitech

- Liquid Rubber

- Luxa Pool

- Kimball Midwest

- APOC

- Advance Drubber Coatings

Recent Developments

- In 2024, Hempel’s Hempaguard X7 hull coating achieved verification by DNV that reduces fuel consumption by 20%.

- In 2023, PPG Industries Announced “Limitless” as its 2024 Color of the Year and launched a new line of industrial coatings.

- In 2023, Axalta Coating Systems Named “Techno Blue” as its Automotive Color of the Year and received an Edison Award for its low-VOC, flame-spray powder coating, Abcite 2060.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Formulation Type, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth due to rising industrial and infrastructure investments.

- Increased use of rubber coatings in electric vehicles will boost demand for heat-resistant materials.

- Expansion in marine and offshore projects will drive need for corrosion-protective coatings.

- Water-based and bio-based coatings will gain traction under stricter emission standards.

- Automation in manufacturing will improve coating efficiency and consistency across industries.

- Asia-Pacific will remain a leading growth hub driven by strong industrial expansion.

- Integration of nanotechnology will enhance durability and surface performance of coatings.

- Rising refurbishment and maintenance activities will sustain long-term product demand.

- Technological advancements will support customized formulations for diverse end-use sectors.

- Strategic partnerships and acquisitions will strengthen global supply networks and innovation.