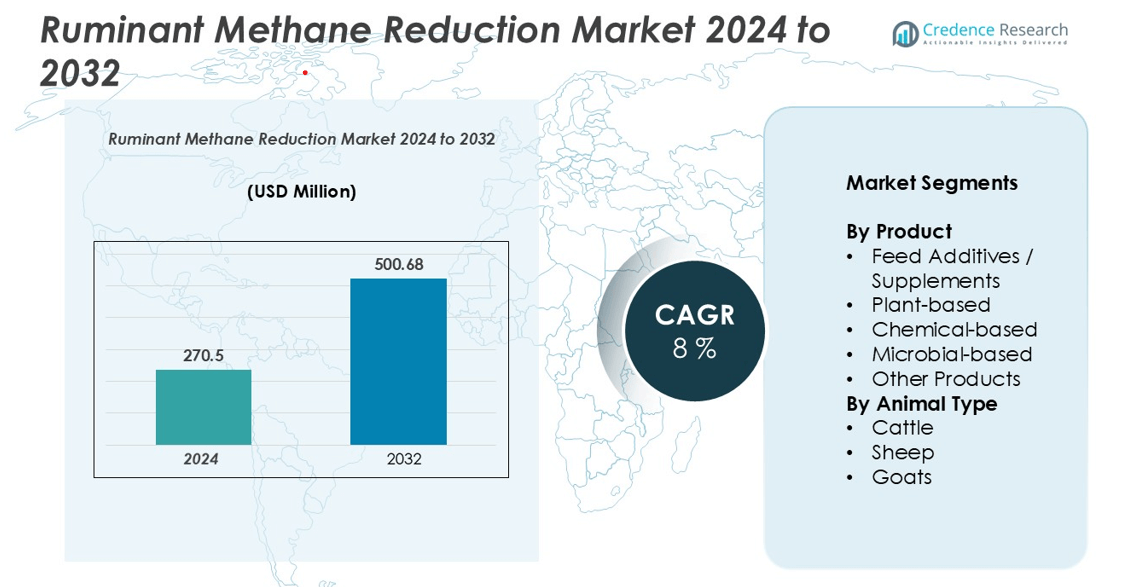

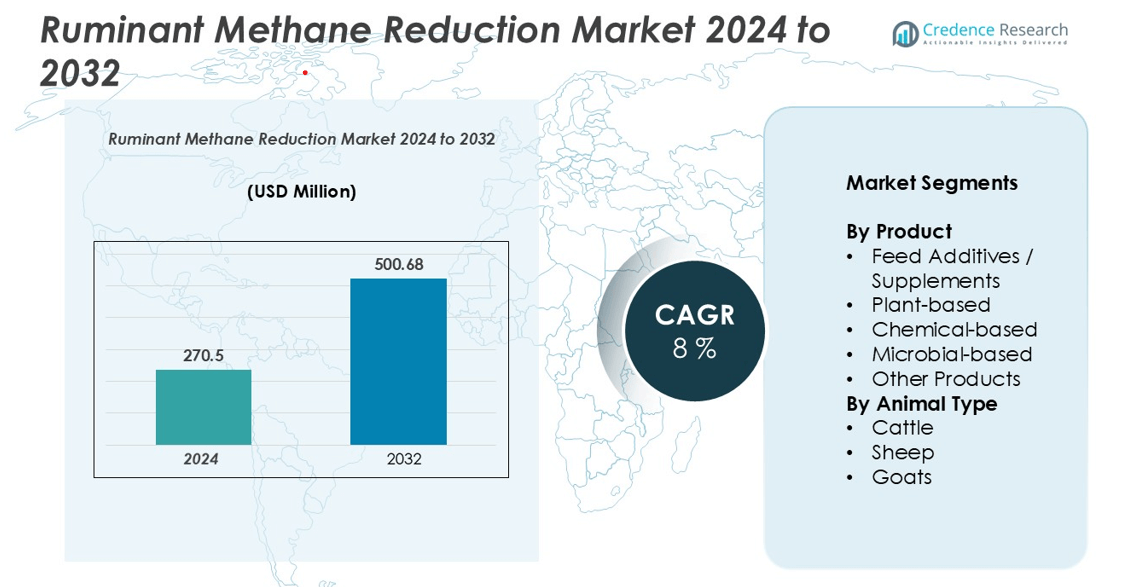

Ruminant methane reduction market size was valued at USD 270.5 million in 2024 and is anticipated to reach USD 500.68 million by 2032, at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ruminant Methane Reduction Market Size 2024 |

USD 270.5 million |

| Ruminant Methane Reduction Market, CAGR |

8% |

| Ruminant Methane Reduction Market Size 2032 |

USD 500.68 million |

The ruminant methane reduction market is dominated by key players including DSM, Alltech, Cargill, Elanco Animal Health, Fonterra Co-operative Group, Mootral Private, Symbrosia Inc., Rumin8 Ltd, Zelp Ltd, Blue Ocean Barns, CH4 Global, Inc., and FutureFeed. These companies lead through innovation in feed additives, plant-based inhibitors, and microbial solutions, as well as strategic partnerships and geographic expansion. North America leads the market with a 32% share, supported by stringent environmental regulations and advanced livestock management practices. Europe follows closely with approximately 29%, driven by strong regulatory frameworks and consumer demand for sustainable dairy and meat products. Asia-Pacific holds around 26%, benefiting from rapid livestock sector growth and increasing adoption of methane-reducing solutions. These top players leverage R&D, precision nutrition technologies, and sustainability initiatives to maintain market leadership and expand their presence across emerging regions.

Market Insights

- The ruminant methane reduction market was valued at USD 270.5 million in 2024 and is projected to reach USD 500.68 million by 2032, growing at a CAGR of 8% during the forecast period. Feed additives/supplements dominate the product segment, while cattle represent the largest animal type sub-segment.

- Market growth is driven by increasing regulatory pressure for sustainable livestock practices, rising adoption of advanced feed additives, and growing awareness of environmental and consumer sustainability demands across developed and emerging regions.

- Key trends include the emergence of plant-based and natural methane inhibitors, integration of digital and precision livestock farming, and expansion into emerging markets such as Asia-Pacific and Latin America.

- The market is highly competitive, with top players such as DSM, Alltech, Cargill, Elanco, Fonterra, Mootral, Symbrosia, Rumin8, Zelp, Blue Ocean Barns, CH4 Global, and FutureFeed focusing on R&D, partnerships, and regional expansion.

- High costs of advanced solutions and limited awareness in traditional livestock practices act as key restraints, particularly in regions like MEA and Latin America, though adoption is gradually increasing.

Market Segmentation Analysis:

By Product

The ruminant methane reduction market by product is segmented into feed additives/supplements, plant-based, chemical-based, microbial-based, and other products. Among these, feed additives/supplements dominate the market, capturing a significant share due to their proven efficacy in reducing enteric methane emissions while enhancing animal productivity. The rising adoption of precision livestock nutrition and increasing awareness of sustainable farming practices are key drivers. Additionally, innovations in plant-derived additives and enzyme-based supplements are further expanding their application, enabling farmers to improve feed efficiency while contributing to environmental sustainability.

- For instance, DSM-Firmenich’s marketing materials and other reporting indicate that its Bovaer® feed additive has demonstrated average methane reduction levels of 30% for dairy cows and 45% for beef cattle in various trials. The approximate CO₂ equivalent reduction figures also align with the company’s messaging. However, this is an average, and the actual effect can vary based on factors like the animal’s diet and the dosage.

By Animal Type

In terms of animal type, the market is segmented into cattle, sheep, and goats. Cattle represent the dominant sub-segment, accounting for the largest market share owing to their higher methane emission levels and the extensive adoption of mitigation strategies in beef and dairy farming. Market growth is driven by the intensification of cattle farming, demand for sustainable dairy products, and regulatory pressure to lower greenhouse gas emissions. Sheep and goat segments are growing steadily as producers explore targeted feed formulations and methane inhibitors to improve productivity and sustainability in smaller ruminants.

- For instance, in 2021, researchers at the University of California, Davis, published a study showing that adding a small amount of Asparagopsis taxiformis seaweed to the feed of beef steers significantly reduced their enteric methane emissions. A separate study published in 2019 found that including 1% Asparagopsis armata in the feed of lactating dairy cows reduced their methane production.

Key Growth Drivers

Increasing Regulatory Pressure for Sustainable Livestock Practices

Governments and environmental agencies worldwide are implementing stringent regulations to curb greenhouse gas emissions from the livestock sector. These policies mandate adoption of methane reduction strategies, particularly in large-scale cattle and dairy operations. Farmers are increasingly incentivized to integrate feed additives, plant-based supplements, and microbial solutions to meet emission targets. Regulatory compliance not only helps reduce environmental impact but also enhances farm reputation and access to eco-conscious markets. The push for carbon-neutral livestock farming drives investments in research and development of innovative methane-reducing products, further fueling market growth. Additionally, subsidies and grants offered by governments for sustainable farming practices accelerate adoption, making regulatory pressure a central driver for market expansion.

- For instance, FutureFeed, established by CSIRO in collaboration with industry partners, commercializes Asparagopsis seaweed as a methane-reducing feed supplement.

Rising Adoption of Advanced Feed Additives and Nutritional Solutions

Feed additives and supplements that target enteric methane production have emerged as highly effective solutions for improving feed efficiency while lowering emissions. Precision nutrition, including plant-based compounds, enzymes, and microbial formulations, enables farmers to optimize rumen fermentation and reduce methane output without compromising productivity. The growing emphasis on value-added livestock products, such as low-carbon milk and meat, encourages the integration of these solutions across dairy and beef operations. Continuous innovation in additive formulations, supported by livestock nutrition research, enhances product efficacy and drives large-scale adoption. This trend not only mitigates environmental concerns but also aligns with global sustainability objectives, positioning feed additives as a primary growth engine in the ruminant methane reduction market.

- For instance, Elanco’s and dsm-firmenich’s feed additive, Bovaer® (3-NOP), has been shown to reduce methane emissions from dairy cows by approximately 30%. This reduction is equivalent to approximately 1.2 metric tons of CO₂ equivalent per cow annually.

Increasing Awareness of Environmental and Consumer Sustainability Demands

Consumers and stakeholders are becoming more conscious of the environmental impact of livestock production, prompting demand for sustainable farming practices. Dairy and meat producers are under pressure to adopt methane reduction solutions to meet market expectations and achieve carbon footprint reduction goals. Educational campaigns, industry partnerships, and sustainability certifications are driving awareness among farmers about the benefits of methane-reducing products. The trend toward eco-friendly livestock products not only strengthens brand image but also opens premium market opportunities for producers implementing these solutions. As a result, the market is witnessing accelerated growth, fueled by a combination of consumer-driven demand and increasing commitment to environmentally responsible livestock management.

Key Trends & Opportunities

Emergence of Plant-Based and Natural Methane Inhibitors

The shift toward natural and plant-derived methane inhibitors represents a significant trend in the market. Products incorporating tannins, saponins, essential oils, and other bioactive compounds are increasingly preferred due to their efficacy, safety, and compatibility with organic farming practices. Advances in extraction technologies and formulation techniques are improving potency and stability, creating opportunities for product differentiation. Additionally, partnerships between feed additive manufacturers and research institutions are fostering innovation in bioactive compounds, expanding the range of effective, natural methane reduction solutions. This trend not only meets regulatory and consumer demands but also enhances the sustainability profile of livestock operations, driving long-term market growth.

- For instance, DSM Firmenichdeveloped Bovaer®, a feed additive containing 3-nitrooxypropanol (3-NOP) that reduces methane emissions in cattle.

Integration of Digital and Precision Livestock Farming

The integration of digital technologies, such as precision feeding systems and real-time animal monitoring, is creating new opportunities in methane reduction. These technologies allow farmers to optimize feed composition, monitor rumen health, and assess the impact of additives on methane emissions with high accuracy. Data-driven decision-making enhances operational efficiency while reducing environmental impact, attracting investment in precision livestock farming solutions. This convergence of technology and feed-based mitigation strategies enables customized interventions for different animal types, improving effectiveness and return on investment. As a result, technology-enabled solutions are emerging as a key opportunity area for market players seeking differentiation and enhanced adoption rates.

- For instance, the integration of precision feeding systems enables farmers to tailor diets to individual animals, optimizing nutrient intake and reducing methane emissions.

Expansion in Emerging Markets

Emerging regions, particularly in Asia-Pacific and Latin America, are witnessing rising adoption of ruminant methane reduction solutions due to intensifying livestock production and increased awareness of sustainability requirements. The growing livestock sector in these regions presents a vast untapped market for feed additives, plant-based supplements, and microbial solutions. Investments in infrastructure, technology transfer, and farmer training are enabling wider penetration. Companies expanding into these regions can capitalize on rising demand for sustainable livestock products while benefiting from supportive government initiatives. This trend offers significant growth potential, positioning emerging markets as a key driver for long-term industry expansion.

Key Challenges

High Cost of Advanced Methane-Reduction Solutions

The adoption of advanced feed additives, microbial formulations, and precision nutrition strategies is often constrained by high implementation costs. Small-scale and resource-limited farmers may find these solutions economically challenging, slowing market penetration. Additionally, the cost of research, product development, and regulatory approvals contributes to higher prices for end-users. While government subsidies and bulk procurement can mitigate some financial barriers, cost remains a significant hurdle for widespread adoption, particularly in developing regions. Companies must balance efficacy and affordability to ensure scalable market growth.

Limited Awareness and Adoption in Traditional Livestock Practices

In regions where conventional livestock practices dominate, limited awareness of methane reduction technologies presents a key challenge. Farmers may be hesitant to adopt new additives or microbial solutions due to knowledge gaps, skepticism, or lack of technical expertise. Training programs, demonstrations, and advisory services are essential to increase adoption rates, but these initiatives require time and investment. Without sufficient farmer engagement and education, market growth may be slower than projected, particularly in areas where traditional feeding and husbandry methods are deeply entrenched.

Regional Analysis

North America

North America holds a significant share in the ruminant methane reduction market, driven by stringent environmental regulations and advanced livestock management practices. The U.S. and Canada dominate the region, with widespread adoption of feed additives, microbial solutions, and plant-based inhibitors to reduce enteric methane emissions. Strong R&D infrastructure and investments in precision nutrition support market growth. Increasing consumer demand for sustainable dairy and beef products further encourages adoption of methane-reducing solutions. North America’s market share is estimated at approximately 30–32%, reflecting the region’s leadership in regulatory compliance, technological innovation, and sustainable livestock practices.

Europe

Europe accounts for a major portion of the global market, with Germany, France, and the Netherlands leading adoption. Regulatory frameworks, including the European Green Deal and national emissions targets, incentivize farmers to implement methane reduction solutions. Feed additives and plant-based supplements dominate the European market due to their effectiveness and compliance with organic farming standards. Collaborative research initiatives and government subsidies drive innovation and adoption. Europe’s share is estimated at 28–30%, supported by a high awareness of environmental sustainability, consumer preference for eco-friendly livestock products, and technological advancements in feed formulation and methane mitigation strategies.

Asia-Pacific

Asia-Pacific is witnessing rapid growth in the ruminant methane reduction market, led by countries such as China, India, and Australia. Rising livestock populations, intensifying dairy and beef production, and growing awareness of environmental impacts are fueling adoption. Feed additives, plant-based supplements, and microbial solutions are gaining traction, while government initiatives promote sustainable livestock practices. The market is supported by investments in precision nutrition technologies and research collaborations. Asia-Pacific holds an estimated 25–27% market share, reflecting strong growth potential driven by expanding livestock industries, increasing regulatory focus, and rising consumer demand for sustainable animal products.

Latin America

Latin America represents a growing market for ruminant methane reduction solutions, with Brazil, Argentina, and Mexico leading adoption. The region’s large-scale cattle farming operations face increasing pressure to reduce greenhouse gas emissions and enhance productivity. Feed additives and plant-based inhibitors are increasingly integrated into cattle and small ruminant diets to mitigate methane emissions effectively. Government support programs, sustainability initiatives, and collaborations with global feed additive manufacturers are accelerating market penetration. Latin America accounts for an estimated 10–12% market share, driven by high livestock density, expanding production scale, and rising interest in environmentally responsible farming practices.

Middle East & Africa

The Middle East & Africa (MEA) market is emerging, supported by growing livestock sectors in countries such as South Africa, Saudi Arabia, and Egypt. Rising awareness of environmental sustainability, coupled with the adoption of advanced feed solutions and microbial additives, is driving growth. Challenges such as cost sensitivity and limited access to advanced technologies affect adoption rates but are gradually being addressed through government programs and international partnerships. MEA holds an estimated 5–6% market share, reflecting its nascent stage. Market expansion is expected as awareness, infrastructure, and investment in sustainable livestock management increase across the region.

Market Segmentations:

By Product

- Feed Additives / Supplements

- Plant-based

- Chemical-based

- Microbial-based

- Other Products

By Animal Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The ruminant methane reduction market is highly competitive, driven by the presence of global feed additive manufacturers, biotechnology firms, and innovative start-ups. Leading players such as DSM, Alltech, Cargill, Elanco Animal Health, and Fonterra Co-operative Group focus on product innovation, strategic partnerships, and geographic expansion to strengthen their market positions. Emerging companies, including Mootral Private, Symbrosia Inc., Rumin8 Ltd, Zelp Ltd, and Blue Ocean Barns, are introducing specialized plant-based, microbial, and chemical solutions targeting enteric methane reduction. The market is characterized by continuous R&D investments aimed at enhancing additive efficacy, optimizing rumen fermentation, and improving feed efficiency. Companies are also leveraging sustainability trends and regulatory compliance requirements to differentiate their offerings. Collaborative initiatives with research institutions and pilot programs with livestock farmers further enhance adoption rates. Competitive strategies center on innovation, product portfolio diversification, and expanding presence in emerging markets, driving overall market growth and technological advancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Alltech

- Blue Ocean Barns

- Cargill, Incorporated

- CH4 Global, Inc.

- DSM

- Elanco Animal Health Inc.

- Fonterra Co-operative Group Limited

- FutureFeed

- Mootral Private

- Rumin8 Ltd

- Symbrosia Inc.

- Zelp Lt

Recent Developments

- In October 2024, Rumin8, an Australian climate tech company, has received feed ingredient approval from Brazil’s Ministry of Agriculture for its methane-reducing supplement for livestock. This marks a significant step towards commercialization, especially in Brazil, which has the world’s largest cattle herd. Rumin8’s technology, using the compound Tribromomethane (TBM), has shown methane reductions of up to 86% and improved cattle weight gain in trials.

- In February 2024, dsm-firmenich and Donau Soja partnered to highlight the environmental impact of feed ingredients using Sustell, aiding businesses in measuring & improving sustainability in the animal protein value chain. Their collaboration aimed to reduce greenhouse gas emissions from food production and enhance transparency in the feed & food industry.

- In January 2024, Rumin8 has successfully opened its manufacturing demonstration plant in Perth, Western Australia, to refine production processes for its methane-reducing feed and water supplements for livestock.

- In November 2023, Athian.ai introduced the first voluntary livestock carbon in setting marketplace, collaborating with Elanco Animal Health to reduce enteric methane emissions and enhance feed utilization in the dairy industry.

Report Coverage

The research report offers an in-depth analysis based on Product, Animal Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of feed additives and microbial solutions is expected to increase across large-scale livestock farms.

- Plant-based methane inhibitors will gain popularity due to rising demand for natural and sustainable products.

- Precision livestock farming technologies will enhance monitoring and effectiveness of methane reduction strategies.

- Expansion into emerging markets like Asia-Pacific and Latin America will drive significant growth opportunities.

- Regulatory frameworks will continue to push farmers toward sustainable livestock practices.

- Collaboration between feed additive manufacturers and research institutions will accelerate product innovation.

- Consumer demand for low-carbon dairy and meat products will influence market adoption.

- Cattle will remain the dominant animal segment, with increasing focus on sheep and goats.

- Small-scale farmers will gradually adopt cost-effective methane reduction solutions as awareness rises.

- Companies will continue strategic partnerships, mergers, and acquisitions to strengthen global presence.