Market Overview:

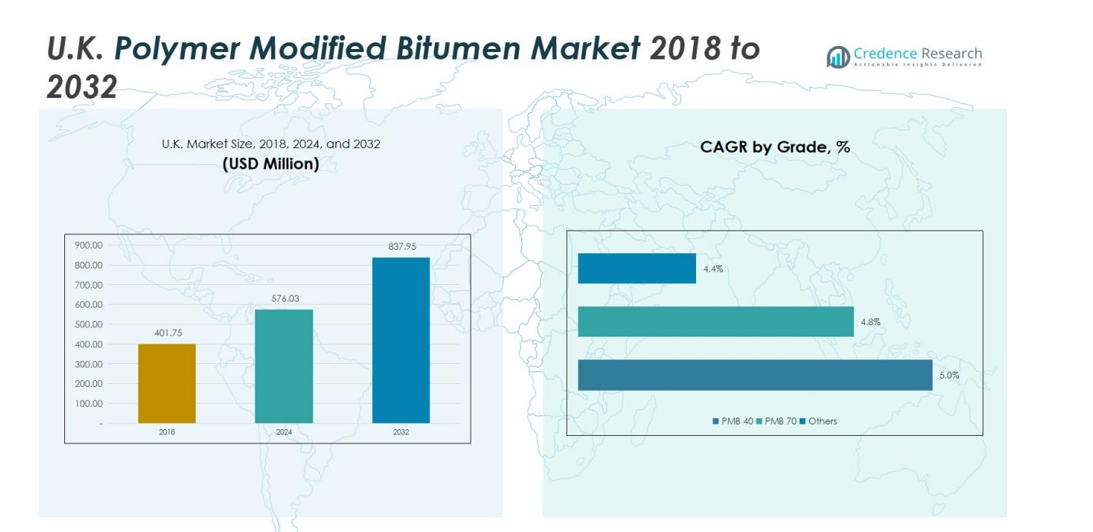

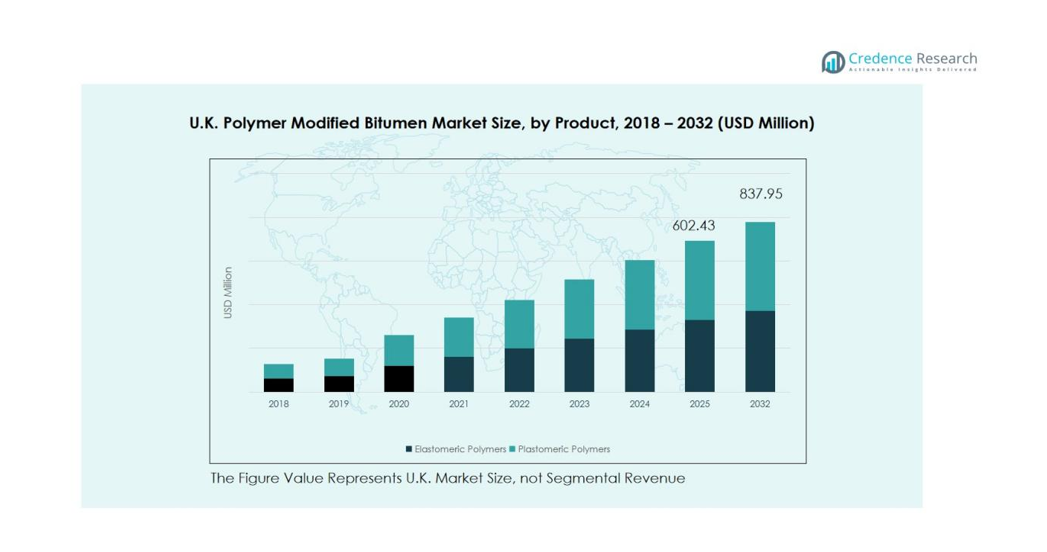

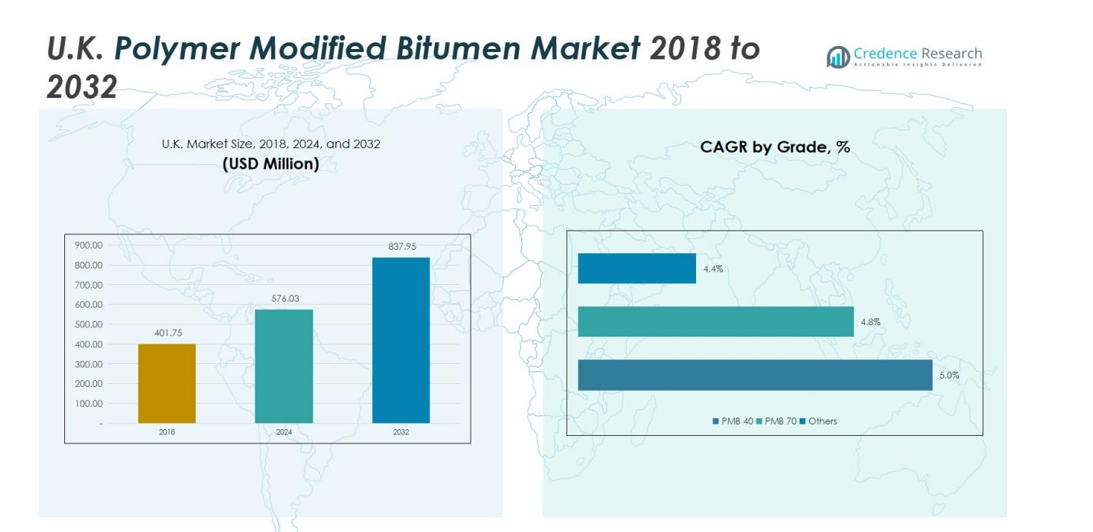

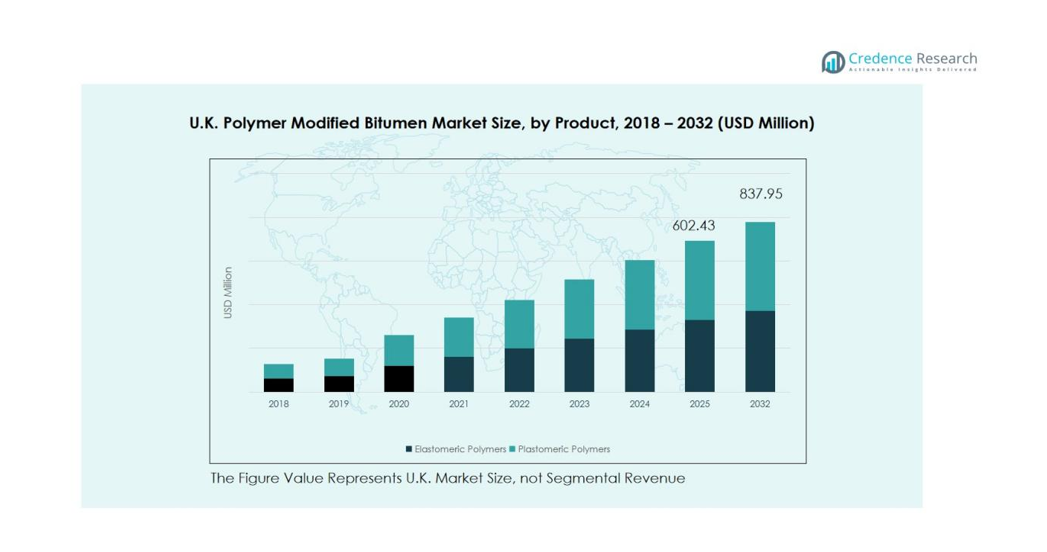

The UK Polymer Modified Bitumen Market size was valued at USD 401.75 million in 2018 to USD 576.03 million in 2024 and is anticipated to reach USD 837.95 million by 2032, at a CAGR of 5.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Polymer Modified Bitumen Market Size 2024 |

USD 576.03 million |

| UK Polymer Modified Bitumen Market, CAGR |

5.45% |

| UK Polymer Modified Bitumen Market Size 2032 |

USD 837.95 million |

Market growth is primarily driven by the UK government’s investments in transport and infrastructure upgrades, especially highways and airports. Increasing focus on sustainable construction practices, coupled with the need for materials that offer improved resistance to deformation, cracking, and harsh weather, is further fueling adoption. Rising urbanization and a shift toward cost-effective road surfacing solutions with extended service life are also key drivers enhancing market demand.

Regionally, the UK holds a strong position within Western Europe, which dominates the overall European PMB market with around 46% share. The country’s mature yet aging road network continues to create consistent opportunities for resurfacing and rehabilitation projects. Ongoing efforts to improve road durability, reduce maintenance costs, and align with sustainability goals are expected to sustain moderate but stable market growth in the coming decade.

Market Insights:

- The UK Polymer Modified Bitumen Market was valued at USD 401.75 million in 2018, reached USD 576.03 million in 2024, and is expected to reach USD 837.95 million by 2032, growing at a CAGR of 5.45%.

- England accounted for the largest share of about 46% of the regional market due to ongoing road modernization and smart infrastructure projects.

- Scotland and Wales together represented nearly 35% share, driven by rising investments in industrial facilities, renewable energy projects, and resilient transport networks.

- Northern Ireland held around 19% share and is the fastest-growing region, supported by infrastructure integration, cross-border trade expansion, and industrial development.

- By product, elastomeric polymers dominated with over 60% share, led by high usage of SBS and SBR in road construction and bridge applications.

- Plastomeric polymers accounted for nearly 40% share, mainly used in roofing systems and waterproofing applications for their UV and thermal resistance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Infrastructure Development and Road Modernization Programs

Government-led infrastructure investments are driving the expansion of the UK Polymer Modified Bitumen Market. The country continues to prioritize the maintenance and modernization of its extensive road network, emphasizing long-lasting and weather-resistant materials. Projects under the National Infrastructure and Construction Pipeline are creating sustained demand for PMB in highways, bridges, and airport pavements. It supports improved surface performance and reduces the need for frequent resurfacing, offering strong lifecycle value.

For instance, Hanson UK in partnership with National Highways resurfaced 500 meters of the A30 Cutteridge to Alphington Eastbound using its CarbonLock asphalt with Shell’s Cariphalte CarbonSink binder, which enhanced pavement durability and reduced maintenance cycles by extending surface life by more than 20% compared with standard PMB asphalt.

Growing Preference for Durable and Sustainable Road Materials

The increasing focus on sustainability and performance efficiency is fueling market adoption. The construction sector is shifting toward eco-friendly binders that minimize environmental impact and extend pavement life. The UK Polymer Modified Bitumen Market benefits from stricter government regulations promoting the use of modified bitumen with lower emissions and better recyclability. It helps achieve durability targets and aligns with the nation’s carbon-reduction commitments.

- For Instance, Shell Bitumen’s “Shell Cariphalte” polymer modified bitumen was used to resurface the M25 motorway at Reigate Hill in the late 1990s, demonstrating its effectiveness on a high-stress section of the road.

Expanding Use in Roofing and Industrial Applications

Demand is not limited to transportation infrastructure. PMB is gaining ground in waterproofing membranes, roofing systems, and industrial coatings due to its superior elasticity and thermal stability. The UK Polymer Modified Bitumen Market is witnessing increasing application diversity as construction and industrial sectors seek advanced materials for protection against extreme weather and mechanical stress. It ensures stronger performance and longer service life across multiple end uses.

Technological Advancements and Product Innovation

Continuous innovation in polymer modification technology supports product differentiation and quality improvement. Leading manufacturers are developing customized PMB formulations tailored to regional climate and traffic conditions. The UK Polymer Modified Bitumen Market benefits from enhanced production efficiency and consistent performance characteristics. It strengthens market competitiveness and supports long-term growth in infrastructure resilience and sustainability.

Market Trends:

Shift Toward Sustainable and Eco-Efficient Bitumen Solutions

Growing environmental awareness and policy emphasis on carbon reduction are reshaping product development in the UK Polymer Modified Bitumen Market. Manufacturers are focusing on bio-based polymers and recyclable additives to lower emissions and support circular economy goals. The market is witnessing an increased preference for low-temperature mix technologies that reduce energy use during production and laying. It reflects the construction sector’s effort to balance performance with sustainability mandates. Companies are also exploring blends that enhance recyclability without compromising mechanical strength or adhesion. These innovations strengthen industry alignment with the UK’s long-term sustainability and infrastructure durability objectives.

- For instance, Aggregate Industries has introduced its SuperLow asphalt range, produced at 20°C–40°C lower than traditional hot-mix asphalt, resulting in substantial energy savings and quicker road reopening times—up to 90 minutes earlier—while maintaining the same performance standards as conventional materials.

Integration of Advanced Polymers and Smart Performance Monitoring

Technological innovation is redefining the competitive landscape of the market. The UK Polymer Modified Bitumen Market is adopting advanced polymer chemistries, including styrene-butadiene-styrene (SBS) and ethylene-vinyl-acetate (EVA), to improve elasticity and temperature stability. It enables pavements to endure heavier traffic and extreme climatic variations. Smart monitoring systems are being integrated to assess road surface health, enabling predictive maintenance and reducing lifecycle costs. Manufacturers are also investing in performance-grade classification and laboratory testing for consistent product quality. The convergence of polymer innovation, digital monitoring, and performance optimization continues to drive modernization in the UK bitumen industry.

- For instance, Eurovia’s PolyBitumens facility in Thurrock, Essex, manufactures polymer-modified bitumen achieving elastic recovery ratings exceeding 80% and softening points greater than 75°C, enabling pavements to endure heavier traffic and extreme climatic variations.

Market Challenges Analysis:

High Production Costs and Raw Material Price Volatility

Fluctuating prices of crude oil and polymers continue to challenge profitability across the UK Polymer Modified Bitumen Market. The dependence on imported raw materials exposes producers to currency fluctuations and global supply chain instability. It raises production costs and limits pricing flexibility for contractors and end users. The complex formulation process of PMB requires precise temperature control and polymer blending, increasing operational expenses. Many small and medium enterprises face difficulties maintaining margins while competing with large, integrated suppliers. The cost pressure often delays infrastructure upgrades or limits adoption of premium PMB grades.

Technical Limitations and Lack of Standardization in Application

Variations in formulation standards and inconsistent application practices affect performance reliability. The UK Polymer Modified Bitumen Market faces challenges due to limited alignment between national specifications and evolving EU standards. It leads to performance discrepancies under different climatic and traffic conditions. Contractors often lack technical expertise in handling PMB during mixing and laying, which can reduce its expected lifespan. Storage and transport complexities further add to logistical burdens and project delays. These operational inefficiencies hinder consistent quality delivery and slow large-scale implementation across regional infrastructure projects.

Market Opportunities:

Expansion of Green Infrastructure and Smart City Projects

Government initiatives promoting sustainable infrastructure and smart mobility are opening new growth avenues for the UK Polymer Modified Bitumen Market. Rising investment in eco-friendly road construction aligns with the UK’s carbon neutrality goals for 2050. It creates strong demand for PMB with low carbon footprints and extended durability. The integration of PMB in smart city road networks supports noise reduction, energy efficiency, and longer maintenance cycles. Expanding public-private partnerships in infrastructure development further strengthen adoption. The shift toward climate-resilient urban planning enhances opportunities for PMB suppliers offering advanced and customized formulations.

Growing Demand for High-Performance and Specialty Grades

Innovation in polymer technology is enabling the production of high-performance grades suitable for extreme climates and heavy traffic. The UK Polymer Modified Bitumen Market benefits from growing demand for advanced materials in airports, ports, and industrial zones. It supports higher flexibility, improved adhesion, and better fatigue resistance. Increasing adoption in waterproofing and roofing systems also extends PMB’s reach beyond transport infrastructure. The development of region-specific formulations tailored to the UK’s temperature cycles can strengthen local manufacturing competitiveness. Strategic collaboration between research institutions and producers can accelerate product innovation and enhance market penetration.

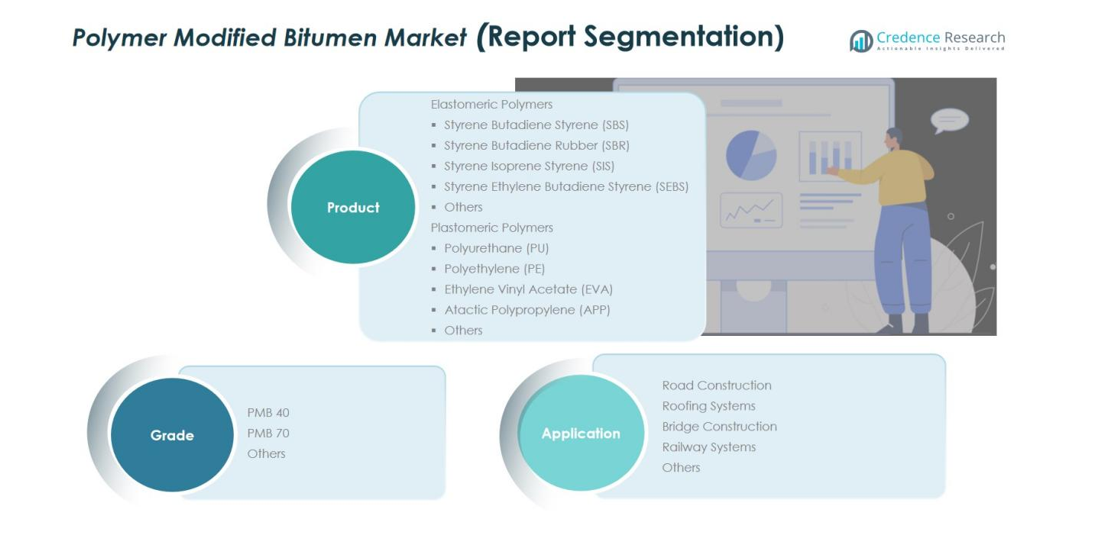

Market Segmentation Analysis:

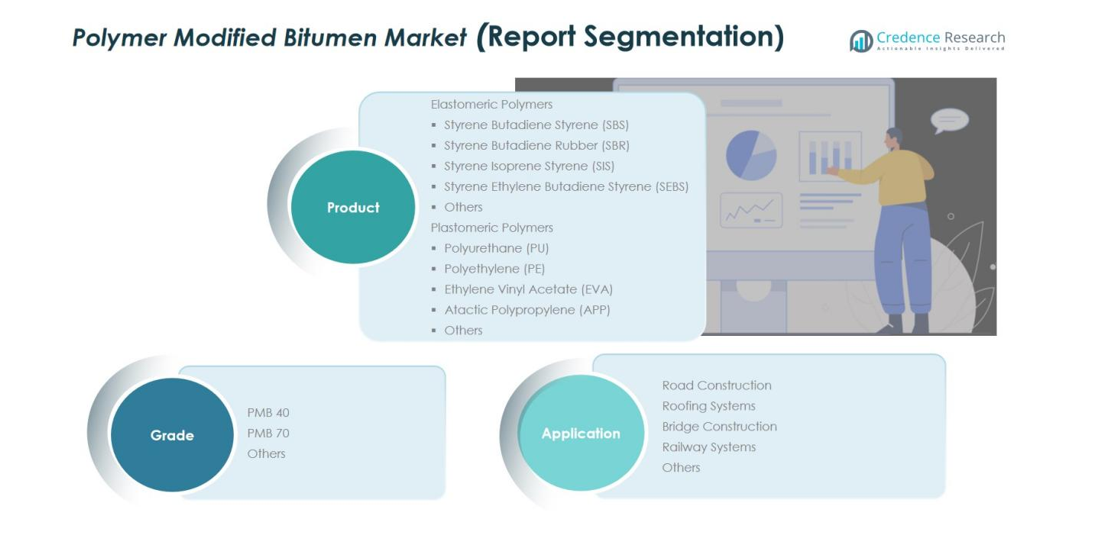

By Product Segment

The UK Polymer Modified Bitumen Market is segmented into elastomeric and plastomeric polymers. Elastomeric polymers, such as Styrene Butadiene Styrene (SBS) and Styrene Butadiene Rubber (SBR), dominate due to their superior flexibility and crack resistance in fluctuating temperatures. It ensures improved elasticity and durability, which makes SBS the most preferred modifier for road construction and bridge applications. Plastomeric polymers, including Atactic Polypropylene (APP) and Ethylene Vinyl Acetate (EVA), are gaining demand in roofing and industrial coatings due to their excellent UV and weather resistance. The steady growth of both polymer categories supports material diversification across infrastructure applications.

- For instance, SBS-modified bitumen has flexibility well below freezing, while the APP-modified bitumen has superior flow resistance at high temperatures.

By Grade Segment

PMB 40 and PMB 70 are the key grades driving product differentiation. PMB 40 is widely used for heavy-traffic highways and airports, offering high deformation resistance. PMB 70, with better workability and adhesion, is favored in urban and moderate-traffic roads. The UK market is shifting toward customized grades suited for regional climates and load-bearing conditions. It supports tailored performance and longer maintenance cycles.

- For instance, TotalEnergies’ Styrelf® PMB 40 (HYMA), a highly modified elastomeric binder using cross-linking technology, demonstrated the capability to reduce pavement thickness by up to 20% while maintaining structural integrity in perpetual pavement designs, making it particularly suitable for airport runway applications, critical junction areas, and flyovers where structural stability is paramount.

By Application Segment

Road construction leads the application share, supported by ongoing resurfacing and highway expansion projects. Roofing systems represent a fast-growing segment, fueled by demand for waterproof and energy-efficient solutions. Bridge construction and railway systems also contribute to steady uptake. The UK’s focus on sustainable infrastructure and longer service life continues to drive polymer-modified bitumen use across diverse applications.

Segmentations:

By Product Segment

Elastomeric Polymers

- Styrene Butadiene Styrene (SBS)

- Styrene Butadiene Rubber (SBR)

- Styrene Isoprene Styrene (SIS)

- Styrene Ethylene Butadiene Styrene (SEBS)

- Others

Plastomeric Polymers

- Polyurethane (PU)

- Polyethylene (PE)

- Ethylene Vinyl Acetate (EVA)

- Atactic Polypropylene (APP)

- Others

By Grade Segment

By Application Segment

- Road Construction

- Roofing Systems

- Bridge Construction

- Railway Systems

- Others

Regional Analysis:

Dominance of England in Infrastructure and Road Modernization Projects

England holds the largest share of the UK Polymer Modified Bitumen Market due to its extensive transport infrastructure and ongoing highway modernization programs. Major cities such as London, Manchester, and Birmingham are investing heavily in resurfacing and smart mobility projects. The government’s focus on reducing congestion and improving road durability supports strong demand for polymer-modified binders. It benefits from continuous funding under the Road Investment Strategy (RIS) and local authority maintenance programs. The dense urban network and high traffic loads further drive the need for advanced PMB formulations to improve performance and lifespan.

Steady Growth Across Scotland and Wales Driven by Urban and Industrial Development

Scotland and Wales are emerging as important regional contributors due to expanding urban development and industrial infrastructure. The UK Polymer Modified Bitumen Market in these regions benefits from ongoing investments in renewable energy facilities, logistics hubs, and transport links. It supports the adoption of PMB in both road and roofing applications. Local authorities are emphasizing sustainability and climate resilience, creating new opportunities for high-performance bitumen products. Harsh weather conditions across these regions further strengthen demand for polymers that enhance flexibility and temperature tolerance.

Rising Opportunities in Northern Ireland through Transport and Cross-Border Trade Links

Northern Ireland is witnessing growing PMB consumption due to road improvement projects and cross-border trade routes connecting Ireland and the UK mainland. The UK Polymer Modified Bitumen Market in this region gains momentum from collaborative public infrastructure initiatives and private logistics expansions. It plays a key role in enhancing surface quality and load-bearing capacity on key transport corridors. Ongoing investments in industrial estates and regional airports are increasing bitumen usage in non-road applications. The focus on infrastructure integration and improved transport resilience continues to drive long-term market potential across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The UK Polymer Modified Bitumen Market is characterized by moderate competition, driven by innovation, quality differentiation, and regional supply strength. Major players include Bitumina Group, Biotum LLC, FM Conway, CEPSA, MOL Group, NIS Group, and Durafalt PMB. These companies focus on enhancing polymer formulations, improving performance characteristics, and meeting sustainability goals through low-emission and recyclable products. It remains competitive due to continuous product innovation and compliance with UK infrastructure and environmental standards. Local manufacturers emphasize customized PMB grades tailored to regional climates, while international firms invest in strategic partnerships and capacity expansions. The market favors players capable of maintaining consistent quality, technical support, and long-term supply reliability for large-scale road and industrial projects.

Recent Developments:

- In August 2025, FM Conway was awarded Lots 2 and 3 of the Royal Borough of Kensington and Chelsea’s Highways Maintenance Contracts 2025, under which it will lead infrastructure upgrades and public works projects across key London districts.

- In October 2025, Sika AG announced the acquisition of Marlon Tørmørtel A/S, a mortar manufacturer in Denmark, expanding its footprint in the Nordic construction market with enhanced sustainability integration and cross-selling potential.

Report Coverage:

The research report offers an in-depth analysis based on Product, Grade and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Polymer Modified Bitumen Market will experience steady expansion supported by infrastructure modernization and sustainability initiatives.

- Government investments in transport and smart city projects will strengthen long-term demand for high-performance PMB materials.

- Manufacturers will focus on developing eco-friendly and low-carbon formulations to align with national climate goals.

- The use of advanced polymers like SBS and EVA will rise, enhancing road durability and flexibility under extreme conditions.

- Technological innovation in blending and temperature control will improve production efficiency and quality consistency.

- Smart monitoring systems and digital infrastructure management will increase PMB adoption in intelligent transportation networks.

- Public-private partnerships will expand, driving new opportunities in road, bridge, and airport construction.

- Urbanization and logistics expansion will support market growth in roofing, industrial coatings, and non-road applications.

- Local production capacity will increase as firms aim to reduce import dependency and improve supply chain resilience.

- Sustainability-driven procurement policies will favor PMB solutions that extend pavement life and reduce maintenance costs.