Market Overviews

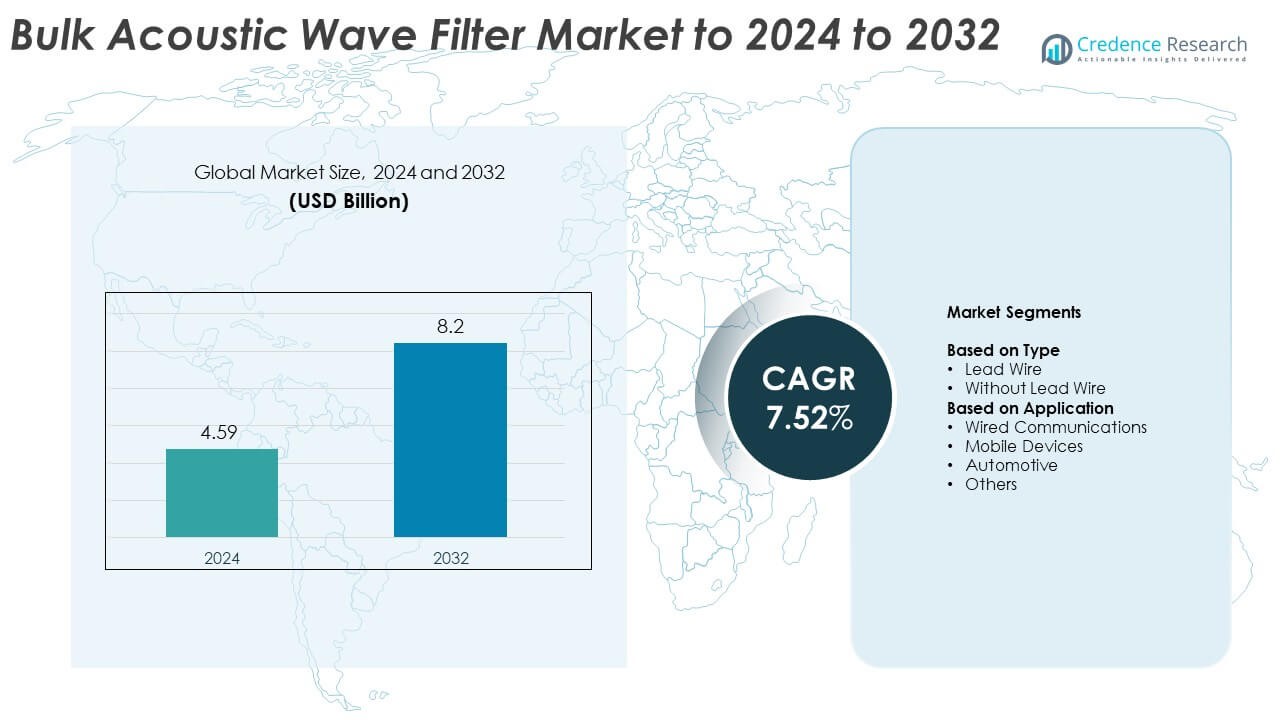

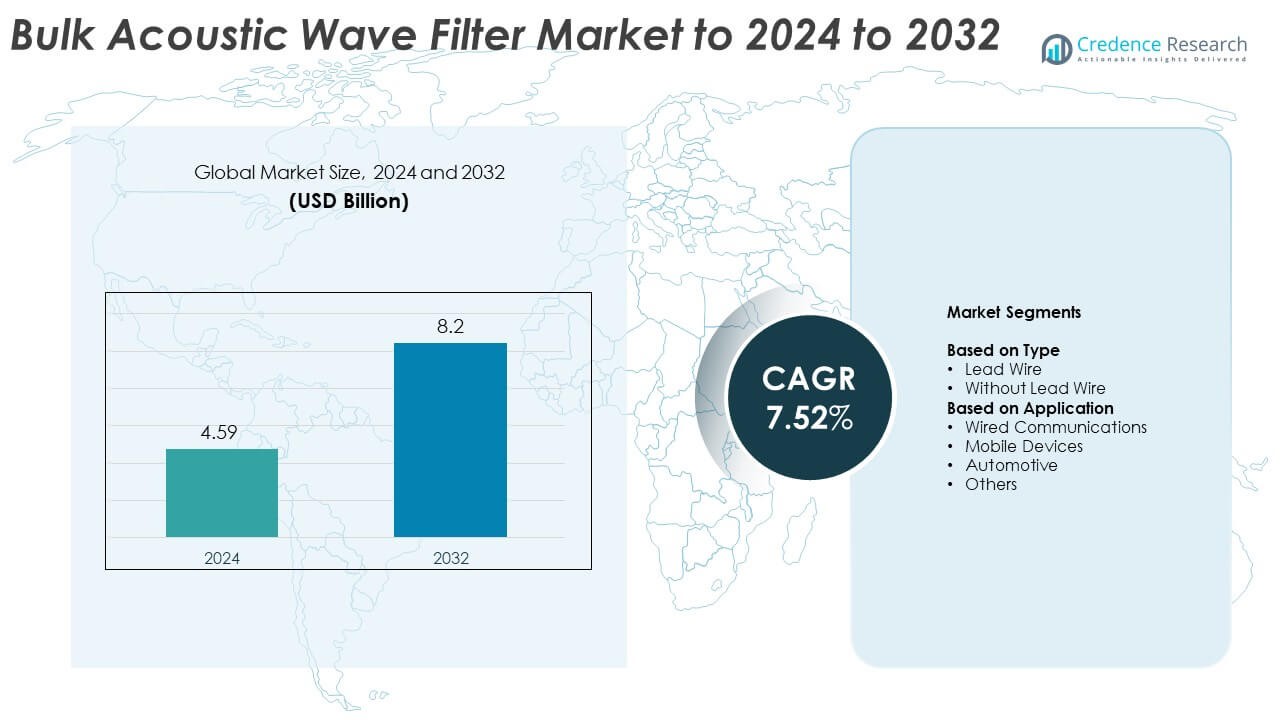

The Bulk Acoustic Wave Filter Market size was valued at USD 4.59 billion in 2024 and is anticipated to reach USD 8.2 billion by 2032, at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bulk Acoustic Wave Filter Market Size 2024 |

USD 4.59 Billion |

| Bulk Acoustic Wave Filter Market, CAGR |

7.52% |

| Bulk Acoustic Wave Filter Market Size 2032 |

USD 8.2 Billion |

The Bulk Acoustic Wave Filter market is characterized by the presence of major players such as Murata, Broadcom, TDK, Taiyo Yuden, Qorvo, Akoustis Technologies, and Avago Technologies. These companies focus on advanced RF component design to support 5G, IoT, and automotive communication applications. They emphasize innovation in thin-film processing, frequency stability, and multi-band integration to meet high-frequency network demands. Strategic collaborations and regional expansions are helping strengthen product portfolios and distribution reach. North America led the global market with a 34.6% share in 2024, followed by strong growth from Asia-Pacific due to its manufacturing capacity and rapid 5G adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Bulk Acoustic Wave Filter Market was valued at USD 4.59 billion in 2024 and is expected to reach USD 8.2 billion by 2032, growing at a CAGR of 7.52%.

- Market growth is fueled by the rising adoption of 5G networks, expansion of IoT-connected devices, and increased demand for high-frequency RF components in smartphones and communication systems.

- Miniaturization of RF modules, wafer-level packaging advancements, and integration in automotive radar systems are key trends driving technological progress.

- The market remains competitive, with companies focusing on innovation, strategic alliances, and cost optimization to gain an edge amid high manufacturing complexity and price pressure.

- Regionally, North America leads with a 34.6% share, followed by Asia-Pacific at 30.7%, while the lead wire type segment dominates with 63.4% share, supported by strong demand from mobile devices and telecommunications infrastructure.

Market Segmentation Analysis:

By Type

The lead wire segment dominated the Bulk Acoustic Wave Filter market in 2024, accounting for around 63.4% share. Its dominance is driven by widespread use in high-frequency signal filtering and compact RF modules for smartphones and wireless infrastructure. Lead wire filters offer better mechanical stability and reliability under variable thermal conditions, making them suitable for 5G base stations and IoT devices. Increasing demand for miniaturized components and enhanced signal precision across consumer electronics continues to strengthen adoption, while the without lead wire segment gains traction in lightweight, compact device applications.

- For instance, Qorvo its BAW technology performs in the 1 GHz up to 20 GHz range, with products for mobile devices focused up to the 9 GHz range, enabling compact wafer-level packages.

By Application

The mobile devices segment held the largest market share of approximately 48.7% in 2024, driven by the rising integration of RF filters in smartphones and tablets. Growing 5G network deployment and multi-band frequency support in mobile communication systems propel demand for high-performance BAW filters. These filters ensure low signal interference and improved bandwidth efficiency. Expanding global smartphone production, coupled with higher adoption of advanced connectivity standards such as Wi-Fi 6 and LTE-Advanced, continues to drive growth in this dominant application segment.

- For instance, industry reports indicate that a modern 5G smartphone may utilize 50 or more RF filters, with a significant number of these, potentially over 15, employing FBAR/BAW technology to address complex, high-frequency band requirements.

Key Growth Drivers

Rising Adoption of 5G Technology

The expansion of 5G networks globally is a major driver for the Bulk Acoustic Wave (BAW) filter market. These filters are essential for managing higher frequency bands and reducing signal interference in advanced communication systems. Growing deployment of 5G infrastructure and increasing smartphone penetration amplify demand for compact, high-performance BAW filters. Manufacturers are focusing on enhancing filter efficiency to support multi-band operations, ensuring reliable and fast connectivity for data-intensive applications in mobile and IoT devices.

- For instance, Akoustis documented 15 Wi-Fi 6/6E BAW design wins by mid-2022, adding multiple wins that year across leading SoC ecosystems.

Increasing Demand for High-Frequency Components

The surge in high-frequency communication systems and connected devices significantly drives market growth. BAW filters deliver superior frequency selectivity and temperature stability compared to surface acoustic wave filters, making them suitable for next-generation RF front-end modules. Their use in Wi-Fi 6, satellite communication, and defense electronics supports performance consistency under extreme environments. This growing requirement for precision frequency control and improved data throughput is pushing manufacturers toward advanced BAW technology integration.

- For instance, TDK detailed a multilayer band-pass filter (DEA102450BT-1278A1) rated for −40 °C to +85 °C operation with high-Q performance in a 1005 package size.

Expansion of IoT and Smart Devices

The growing number of IoT-enabled devices and smart home applications boosts the need for efficient signal filtering solutions. BAW filters are widely used in connected sensors, wearables, and networked industrial devices to ensure stable wireless communication. As IoT ecosystems expand across sectors such as healthcare, manufacturing, and logistics, the requirement for compact and power-efficient filters rises. Continuous innovation in RF design and low-power wireless protocols is expected to further strengthen BAW filter deployment.

Key Trends & Opportunities

Miniaturization and Integration in RF Front-End Modules

The trend toward device miniaturization is creating strong opportunities for BAW filter adoption. These filters support compact form factors and enable multi-band operation within smaller RF modules. The increasing integration of filters with power amplifiers and switches enhances system efficiency while reducing footprint. This design trend aligns with growing consumer demand for sleek, high-performing smartphones and connected devices, encouraging semiconductor manufacturers to invest in advanced BAW packaging and hybrid module designs.

- For instance, Skyworks offers the SKY33100-360LF BAW band-pass filter in a 2 × 2 mm QFN-8 package with very low in-band loss.

Adoption in Automotive Electronics

Automotive applications represent an emerging opportunity for BAW filters due to the expansion of vehicle connectivity. BAW filters are increasingly used in advanced driver-assistance systems (ADAS), vehicle-to-everything (V2X) communication, and infotainment systems. These filters help maintain signal clarity across multiple communication channels, improving safety and reliability. With growing EV adoption and connected car ecosystems, automakers are integrating BAW solutions to support stable wireless connectivity and over-the-air software updates.

- For instance, Qualcomm shows C-V2X direct links with >450 m range and support for relative speeds up to 500 km/h, benefiting connected-vehicle radios.

Advancements in Manufacturing Processes

Ongoing improvements in BAW filter manufacturing, such as thin-film deposition and wafer-level packaging, are enhancing performance and cost efficiency. These innovations reduce insertion loss and increase frequency stability, making filters suitable for high-density applications. Advanced fabrication enables mass production with higher yield rates, addressing growing demand from consumer electronics and telecom sectors. This continuous progress in process technology presents opportunities for scalability and greater market penetration.

Key Challenges

High Production Cost and Design Complexity

The manufacturing of BAW filters involves advanced materials and precision microfabrication techniques, leading to higher production costs. Complex design requirements for high-frequency operation increase engineering challenges, especially for multi-band and high-power applications. These factors raise barriers for small and mid-sized manufacturers, affecting price competitiveness. The industry faces constant pressure to reduce cost while maintaining high performance and reliability across diverse communication standards.

Competition from Surface Acoustic Wave (SAW) Filters

SAW filters continue to compete with BAW filters in lower-frequency applications due to their cost-effectiveness and simpler design. While BAW filters outperform at higher frequencies, many consumer devices still use SAW technology where performance demands are moderate. This competition limits BAW adoption in price-sensitive segments, particularly in entry-level smartphones and IoT modules. Manufacturers must demonstrate clear performance advantages and develop hybrid solutions to balance cost and functionality in competitive markets.

Regional Analysis

North America

North America held the largest share of around 34.6% in the Bulk Acoustic Wave Filter market in 2024. Strong demand from the telecommunications sector, driven by 5G network rollout and advanced smartphone adoption, supports market growth. The presence of major semiconductor manufacturers and R&D centers enhances technological innovation in RF components. Increasing integration of BAW filters in automotive electronics and defense communication systems further strengthens regional dominance. Government initiatives promoting next-generation wireless infrastructure continue to drive large-scale deployment across the United States and Canada.

Europe

Europe accounted for approximately 25.8% of the market share in 2024, supported by expanding 5G infrastructure and industrial IoT applications. Countries such as Germany, France, and the United Kingdom lead in deploying advanced wireless networks and connected vehicle technologies. Rising adoption of BAW filters in automotive electronics, aerospace, and consumer devices drives regional growth. European manufacturers emphasize sustainable semiconductor production and precision design for high-frequency communication systems. Continuous innovation in automotive radar and telematics systems contributes to Europe’s steady expansion in the BAW filter market.

Asia-Pacific

Asia-Pacific dominated with a 30.7% market share in 2024, driven by strong consumer electronics manufacturing and rapid digital transformation. China, Japan, South Korea, and Taiwan are major hubs for smartphone and RF component production. The widespread adoption of 5G-enabled devices and expansion of telecom infrastructure accelerate BAW filter demand. Local players invest heavily in advanced wafer fabrication and packaging technologies to meet growing global supply needs. Rising IoT deployment and smart city initiatives further position the region as a key growth contributor to the global market.

Latin America

Latin America captured around 5.6% share in the Bulk Acoustic Wave Filter market in 2024. Growth is supported by increasing mobile connectivity, expanding 4G and 5G infrastructure, and the rising use of connected consumer electronics. Brazil and Mexico are leading markets, driven by telecom modernization and increasing smartphone penetration. The shift toward digital communication and enterprise mobility solutions promotes BAW filter demand. However, higher import dependency and limited semiconductor manufacturing capabilities may slightly restrict faster growth across the region in the near term.

Middle East & Africa

The Middle East & Africa accounted for 3.3% share of the Bulk Acoustic Wave Filter market in 2024. Expanding telecommunications networks, especially in Gulf countries, are fueling demand for advanced RF filtering solutions. The rising adoption of 5G services, smart devices, and IoT platforms supports steady market growth. Governments are investing in digital transformation initiatives to improve connectivity infrastructure. While regional production capabilities remain limited, increasing imports of semiconductor components from Asia-Pacific and Europe are helping address the growing local demand for BAW filters.

Market Segmentations:

By Type

- Lead Wire

- Without Lead Wire

By Application

- Wired Communications

- Mobile Devices

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Bulk Acoustic Wave Filter market features strong competition among leading players such as Murata, Broadcom, TDK, Taiyo Yuden, Qorvo, Akoustis Technologies, and Avago Technologies. Companies focus on developing high-performance, miniaturized RF filter solutions that meet the increasing frequency demands of 5G and advanced communication systems. Continuous investment in R&D enables innovation in thin-film and wafer-level packaging technologies to enhance efficiency and reduce signal interference. Manufacturers are expanding their production capacities and forming partnerships with telecom providers and device OEMs to strengthen supply networks. Strategic mergers, technology licensing, and vertical integration initiatives support cost optimization and product differentiation. The competitive environment is also shaped by regional production capabilities, with Asia-Pacific remaining a core manufacturing hub. As the market evolves toward higher frequency applications and greater integration within RF front-end modules, competition is intensifying around quality, scalability, and innovation-driven product design.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Murata

- Broadcom

- TDK

- Taiyo Yuden

- Qorvo

- Akoustis Technologies

- Avago Technologies

Recent Developments

- In 2025, Qorvo Launched new compact high-rejection BAW filters (QPQ3550) for 5G infrastructure applications.

- In 2025, Murata Manufacturing Launched a new family of BAW RF filters for 5G smartphones.

- In 2023, Taiyo Yuden Launched a new series of compact RF filters for consumer electronics.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of 5G technology will continue to drive strong demand for BAW filters.

- Integration of BAW filters in automotive radar and communication systems will expand.

- Advancements in wafer-level packaging will enhance performance and reduce production costs.

- Increasing IoT device connectivity will create new opportunities in industrial and consumer sectors.

- Asia-Pacific will remain the primary hub for large-scale BAW filter manufacturing and exports.

- Demand for compact and multi-band RF front-end modules will accelerate innovation.

- Emerging applications in satellite communication and defense electronics will strengthen market presence.

- Collaboration between telecom operators and semiconductor firms will improve product standardization.

- Continuous R&D investment will enhance frequency precision and temperature stability.

- Expansion of EV and smart vehicle ecosystems will further boost BAW filter adoption globally.