Market Overview:

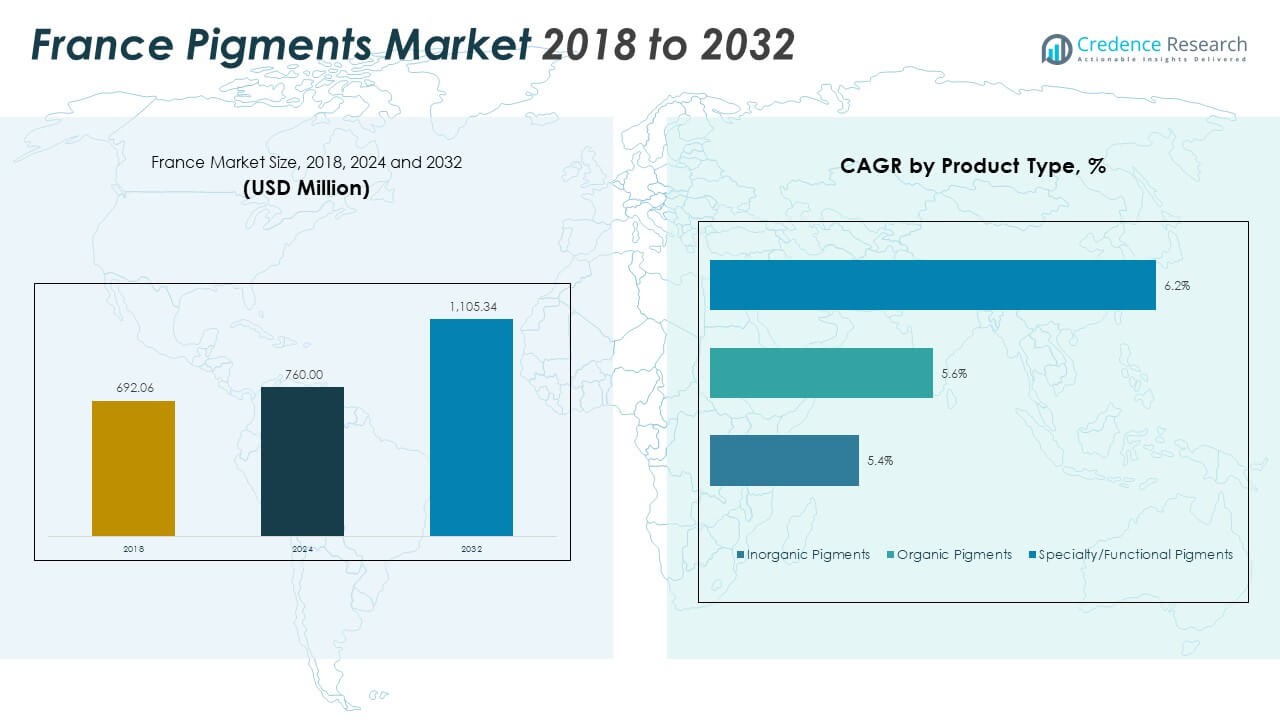

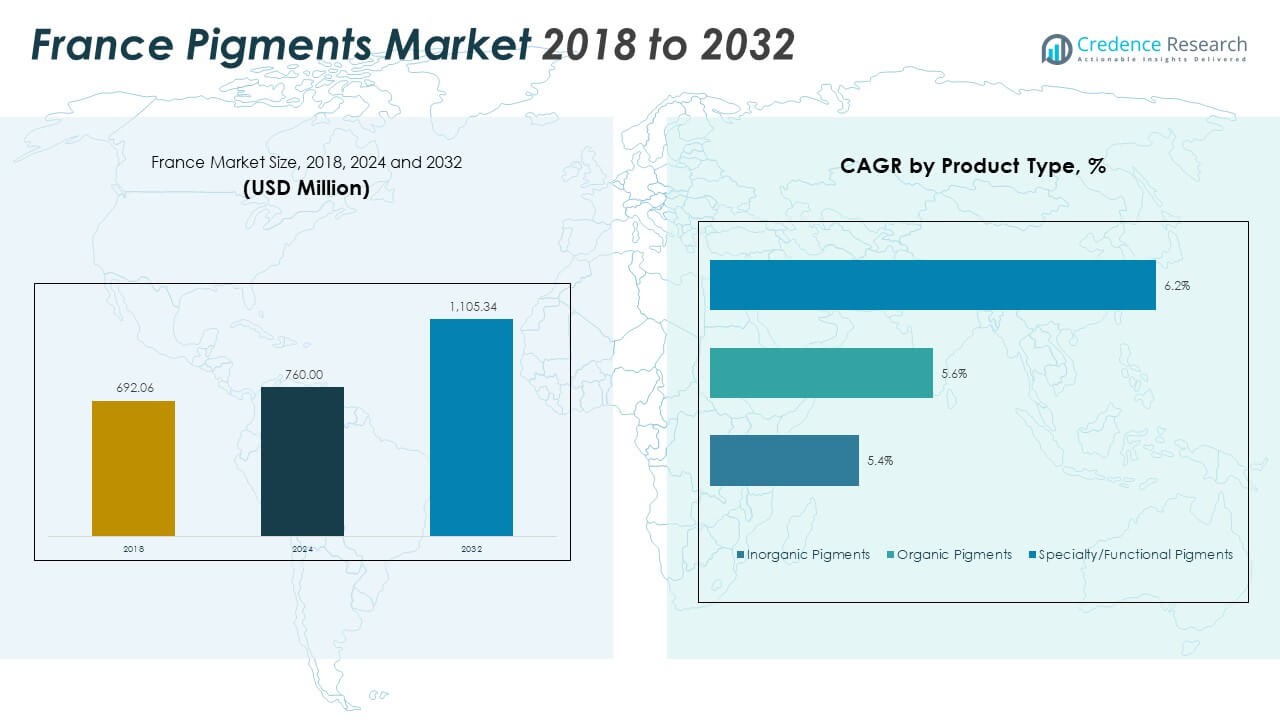

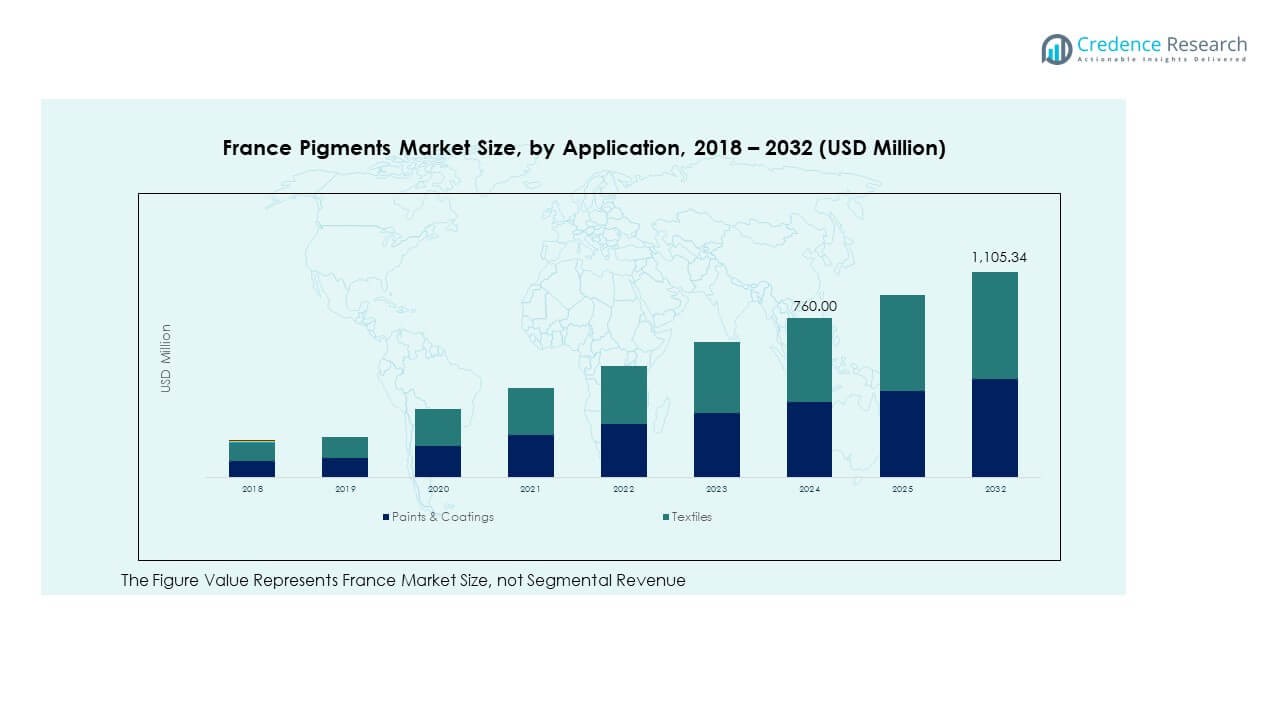

The France Pigments Market size was valued at USD 692.06 million in 2018 to USD 760.00 million in 2024 and is anticipated to reach USD 1,105.34 million by 2032, at a CAGR of 4.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Pigments Market Size 2024 |

USD 760.00 Million |

| France Pigments Market, CAGR |

4.79% |

| France Pigments Market Size 2032 |

USD 1,105.34 Million |

Market growth is driven by the expanding construction, automotive, and packaging industries that depend on high-quality pigments for coatings, plastics, and decorative finishes. The strong emphasis on sustainable and eco-friendly formulations encourages manufacturers to develop bio-based and low-VOC pigment alternatives. Innovation in digital printing technologies and increased use of pigments in smart coatings support product diversification. It continues to grow steadily due to industrial modernization and demand for visually enhanced, durable materials across multiple sectors.

Northern France leads the market due to its strong industrial base and presence of coating manufacturers. Île-de-France follows, supported by construction and packaging industries requiring premium-quality pigments. Western and Southern regions are emerging, driven by textile and marine coatings applications. The country benefits from proximity to major European pigment producers and robust export infrastructure. It shows balanced growth across regions, with ongoing expansion in production capacity and adoption of advanced pigment technologies in specialized end-use industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Pigments Market was valued at USD 692.06 million in 2018, reached USD 760.00 million in 2024, and is anticipated to attain USD 1,105.34 million by 2032, growing at a CAGR of 4.79%.

- Northern France leads with a 34% share, driven by strong automotive and industrial coatings demand supported by advanced production facilities.

- Île-de-France holds 29% due to its large construction, packaging, and printing base, while Southern and Western France collectively account for 37% led by marine coatings and textiles.

- The fastest-growing region is Southern France with a 19% share, benefiting from expanding textile manufacturing and adoption of natural pigment solutions.

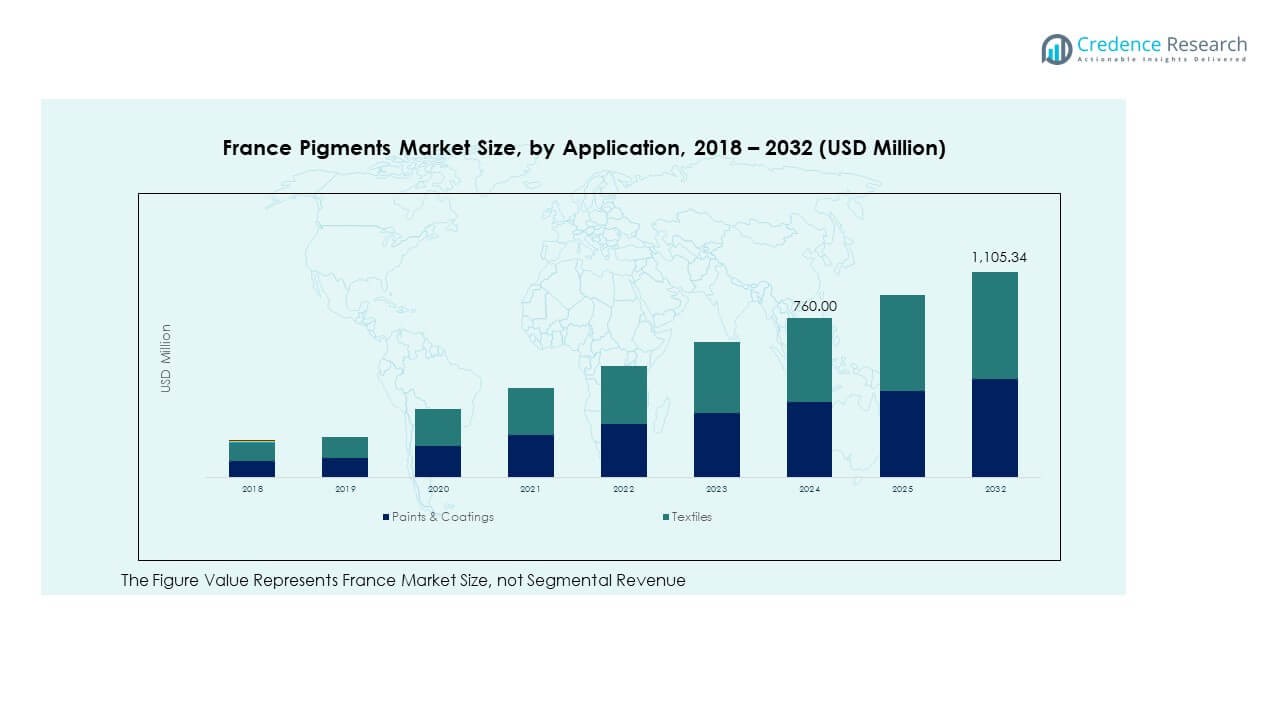

- Paints & Coatings represent nearly 60% of total application share, while Textiles account for around 40%, reflecting the balanced contribution of decorative and industrial pigment applications across the country.

Market Drivers

Growing Demand from Paints and Coatings Industry Supporting Pigment Consumption

The France Pigments Market benefits from strong demand from the paints and coatings sector. Rapid urbanization and rising construction activity increase the use of decorative and protective coatings. The automotive industry also drives pigment adoption for body coatings and surface finishes. Advanced pigment formulations enhance UV stability, corrosion protection, and weather resistance. Architectural paints demand high-performance colorants that meet durability standards. Industrial coatings utilize pigments for heat and chemical resistance. It continues to gain traction as industries emphasize visual appeal and product longevity. Manufacturers focus on high-dispersion pigments for consistent color performance.

- For instance, in June 2025, BASF Coatings, Renault Group, and Dürr jointly received the “Trophée de l’Industrie s’engage 2025” award for their breakthrough Overspray-Free Application (OFLA) process at Renault’s Maubeuge plant in France, achieving 100% paint transfer efficiency with zero overspray and launching an integrated, wet-on-wet two-tone paint application that set a new benchmark for automotive coatings production quality and sustainability.

Expansion of the Packaging and Plastics Industry Driving Volume Growth

Expanding packaging production across France fuels pigment consumption in films, containers, and rigid plastics. The growing demand for vibrant packaging enhances color visibility and branding impact. It supports the use of organic and specialty pigments that provide high tint strength and opacity. Manufacturers are focusing on lightweight and recyclable plastic solutions with color stability. Food-grade pigments are gaining traction due to safety compliance in packaging materials. Consumer preference for appealing and sustainable designs further supports pigment usage. Plastic product manufacturers invest in color masterbatches to achieve uniform dispersion. The shift toward eco-friendly packaging designs sustains pigment market expansion.

Increasing Industrial and Automotive Applications Strengthening Market Base

Industrial and automotive sectors use pigments for performance-based coatings and surface finishing. The France Pigments Market gains from OEM coating demand in vehicle manufacturing. Pigments enhance abrasion resistance and gloss levels while ensuring environmental compliance. Metallic and pearlescent pigments remain popular in automotive paints for premium finishes. Manufacturing facilities adopt low-VOC and lead-free pigments for cleaner production. It benefits from expanding automotive exports from France’s major assembly plants. Industrial coatings in machinery and heavy equipment also drive pigment utilization. Demand for consistent color quality and heat resistance continues to strengthen growth prospects.

Rise in Demand for Eco-Friendly and Sustainable Pigments in Production

The transition toward environmentally sustainable pigments is shaping production across France. Growing restrictions on heavy metals and hazardous compounds drive innovation in bio-based pigments. The France Pigments Market experiences rising investments in non-toxic and biodegradable formulations. Natural pigment manufacturers develop renewable alternatives using plant and mineral sources. It supports alignment with EU environmental directives promoting reduced carbon emissions. Companies enhance their production efficiency using energy-saving technologies. Recycled pigment materials and waste-free synthesis methods gain market interest. The demand for green coatings and environmentally safe dyes continues to expand rapidly.

- For instance, Sun Chemical, a subsidiary of DIC Corporation, showcased its latest pigment and color material innovations for plastics and packaging applications at the K 2025 trade fair in Düsseldorf, Germany. The company presented sustainable pigment solutions designed to enhance color strength, durability, and environmental performance for the European market.

Market Trends

Adoption of Advanced Nanopigment Technology for High-Performance Applications

The adoption of nanotechnology-based pigments is expanding across multiple industries in France. Nanopigments deliver superior transparency, color intensity, and dispersion efficiency. The France Pigments Market leverages these properties to meet advanced coating and printing needs. Manufacturers integrate nanoparticles to improve UV stability and weather resistance in outdoor coatings. The shift toward functional nanomaterials supports innovation in high-end paints and cosmetics. It enables enhanced product performance while reducing material consumption. Firms collaborate with research institutions to optimize pigment particle uniformity. Nanopigments are gaining importance for next-generation formulations in coatings and plastics.

Integration of Digital Printing Technologies Transforming Pigment Utilization

Growing use of digital printing in textiles, packaging, and graphic design increases pigment application diversity. The France Pigments Market benefits from this shift as digital inks require finely dispersed colorants. Pigment-based inks provide long-lasting prints and fade resistance under UV exposure. Textile printing companies favor water-based pigment inks for sustainability and cost efficiency. It supports faster production cycles with lower waste output. Demand for high-resolution prints drives innovation in pigment dispersion technologies. Manufacturers improve ink jetting stability to ensure consistent tone accuracy. The digital transformation of print media continues to expand pigment opportunities.

- For instance, Fujifilm France unveiled AQUAFUZE inkjet ink technology in Autumn 2024, featuring UV-curable aqueous inks with proprietary water dispersion for stable print durability and enhanced stretchability, directly meeting the needs of France’s textile and graphics sectors.

Shift Toward Organic and Bio-Based Pigments Influencing Material Innovation

A clear trend toward organic pigment adoption is reshaping manufacturing strategies across France. The France Pigments Market witnesses an increase in research on bio-derived and plant-based colorants. Organic pigments reduce toxicity risks while offering bright hues for various end uses. Companies explore renewable feedstocks to replace petrochemical inputs in pigment synthesis. It supports alignment with European sustainability policies and consumer awareness goals. Bio-based pigment formulations offer biodegradability and reduced environmental impact. Chemical producers invest in scaling production for cost efficiency. The shift enhances market appeal across paints, textiles, and packaging industries.

- For instance, Clariant AG continues to expand its VITA portfolio of 100% bio-based pigment products, focusing on sustainable and high-performance water-based coatings for industrial use, with collaboration opportunities cited in its 2024 sustainability and innovation reports.

Increased Focus on Functional Pigments in Smart and Specialty Applications

Functional pigments such as luminescent, thermochromic, and infrared-reflective variants are gaining momentum. The France Pigments Market integrates these materials into high-end coatings and electronics. Thermochromic pigments allow color change under temperature variations, improving product utility. Luminescent pigments enhance safety coatings and signage performance under low light. It broadens pigment use in smart textiles, automotive interiors, and architectural coatings. Research-driven companies focus on enhancing stability under thermal and chemical stress. The integration of smart pigments adds value to specialty coatings. Rising demand for functional materials supports market differentiation strategies.

Market Challenges Analysis

Fluctuating Raw Material Prices and Dependence on Imports Affecting Production Cost

Raw material price instability poses a persistent challenge for pigment producers. The France Pigments Market faces volatility in the availability of key chemicals and intermediates. Dependence on imported feedstocks such as titanium dioxide and organic dyes affects pricing stability. Supply chain disruptions create cost pressure for manufacturers relying on consistent input quality. It increases financial risks and limits small-scale producers’ competitiveness. Regulatory compliance costs further amplify production constraints. Companies invest in alternative sourcing strategies and local production initiatives. Price fluctuations continue to impact profitability and supply consistency across pigment categories.

Stringent Environmental Regulations and Waste Management Compliance Limiting Operations

Strict environmental policies across Europe present operational hurdles for pigment manufacturers. The France Pigments Market experiences compliance burdens under EU REACH and RoHS regulations. Pigment plants must implement advanced wastewater treatment and emission control systems. It leads to higher operating costs and capital investments for regulatory adherence. Non-compliance risks result in production halts or license revocations. Manufacturers adopt sustainable synthesis routes to minimize waste and chemical discharge. Transitioning to greener technologies requires time and technical expertise. Regulatory constraints continue to restrict flexibility in production and product diversification.

Market Opportunities

Emergence of Smart Coatings and High-Performance Pigments Creating Growth Scope

Smart coatings incorporating functional pigments offer a promising expansion area. The France Pigments Market can capitalize on thermochromic and photochromic pigment demand in architecture and automotive applications. Growing use of heat-reflective coatings for energy efficiency drives innovation. It enables manufacturers to design pigment systems with multi-functional benefits. Opportunities also arise in anti-microbial and corrosion-resistant pigments. Collaborations between chemical producers and nanotechnology firms are strengthening product portfolios. Expanding end-use industries enhance adoption of advanced color solutions.

Growth in Eco-Friendly Pigments and Circular Economy Initiatives

Increasing preference for recyclable and bio-derived pigments offers long-term potential. The France Pigments Market benefits from EU-driven sustainability goals promoting waste minimization. Green pigment innovations align with brand strategies emphasizing environmental responsibility. It creates opportunities in packaging, paints, and cosmetics sectors adopting low-toxicity materials. Companies are developing water-based dispersion systems to replace solvent-based types. Demand for carbon-neutral and biodegradable pigments enhances research partnerships. Circular production processes are emerging as a major investment focus area.

Market Segmentation Analysis

By Product Type

Inorganic pigments, particularly titanium dioxide, dominate the France Pigments Market due to their superior opacity, brightness, and weather resistance. Zinc oxide and other inorganic variants support demand in coatings, plastics, and ceramics. Organic pigments are gaining attention for their vivid color strength and reduced toxicity, making them suitable for consumer goods. Specialty and functional pigments cater to advanced applications such as automotive finishes, cosmetics, and electronics. It benefits from technological innovation emphasizing efficiency and environmental safety.

- For instance, The Chemours Company launched its Ti-Pure™ TS-6706 titanium dioxide pigment in February 2025. The TMP- and TME-free grade is produced using 100 % renewable electricity and serves as a direct replacement for Ti-Pure™ R-706, offering improved dispersion and opacity while meeting EU sustainability and regulatory standards.

By Application

Paints and coatings represent the largest segment, supported by France’s expanding construction and automotive industries. Textiles and printing inks follow, driven by the adoption of digital and eco-friendly printing methods. The plastics industry uses pigments for packaging and consumer product coloration. Leather applications utilize pigments to enhance finish quality and wear resistance. Other industrial uses include ceramics and composites requiring stable color performance. The France Pigments Market maintains steady demand across these applications due to versatility and continuous material advancements.

- For instance, Arkema confirmed in October 2023 an investment of €130 million in its Carling, France, facility to implement a patented purification technology cutting site CO₂ emissions by 20% and enabling an incremental increase in specialty resin and additive capacity.

Segmentation

Segmentation

By Product Type

- Inorganic Pigments

- Titanium Dioxide (TiO₂)

- Zinc Oxide

- Others

- Organic Pigments

- Specialty/Functional Pigments

By Application

- Paints & Coatings

- Textiles

- Printing Inks

- Plastics

- Leather

- Other Applications

Regional Analysis

Northern France – Industrial and Automotive Hub (Market Share: 34%)

Northern France leads the France Pigments Market with a 34% share, driven by strong industrial and automotive activity. The Hauts-de-France region hosts several automotive assembly plants and coating manufacturers, contributing to steady pigment consumption. High demand for durable pigments in metal finishing, protective paints, and automotive coatings supports market dominance. Industrial clusters benefit from access to major ports such as Dunkirk, enabling efficient raw material import and export. It experiences consistent investments in modern pigment production technologies to enhance sustainability. The growing emphasis on environmentally compliant coatings further reinforces market leadership in this region.

Île-de-France – Construction and Packaging Concentration (Market Share: 29%)

Île-de-France holds a 29% share of the France Pigments Market, supported by its large-scale construction, printing, and packaging industries. Demand for high-performance architectural coatings drives pigment usage in building applications. The region’s packaging and plastics sectors also consume organic and specialty pigments for brand differentiation. Strong R&D investments from major chemical firms sustain innovation in eco-friendly and functional pigments. It benefits from close proximity to corporate headquarters and advanced distribution networks. Rising adoption of bio-based colorants aligns with regional environmental policies promoting low-emission materials.

Southern and Western France – Emerging Growth Corridors (Market Share: 37%)

Southern and Western France collectively account for 37% of the France Pigments Market, led by growth in textiles, marine coatings, and food packaging. The Nouvelle-Aquitaine and Provence-Alpes-Côte d’Azur regions show rising pigment demand driven by coastal industrial activities and export-oriented manufacturing. Marine coatings require corrosion-resistant and UV-stable pigments, boosting inorganic pigment utilization. The textile sector increasingly adopts natural and organic pigments for sustainable dyeing solutions. It benefits from infrastructure development and expanding industrial facilities. Growth in specialized pigment applications within agriculture and cosmetics also strengthens the market base across these subregions.

Key Player Analysis

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Competitive Analysis

The France Pigments Market features strong competition among leading domestic and multinational manufacturers. Key players include Color Chemie, Richard Colorants, Ocres de France, Venator Pigments France SAS, Arkema S.A., BASF SE, and Clariant AG. Companies focus on product differentiation through innovation in high-performance, low-toxicity, and sustainable pigments. It remains dynamic with firms introducing bio-based and nanostructured pigment technologies to meet regulatory and performance standards. Strategic collaborations and mergers strengthen supply chain resilience and expand market presence. Players such as Arkema and BASF emphasize R&D in pigment dispersion and color stability. Local producers like Ocres de France maintain niche leadership in natural pigment offerings, while global brands compete through advanced product portfolios and strong distribution networks.

Recent Developments

- In October 2025, LANXESS showcased its diverse polymer additives, colorants, and heat-stable inorganic pigments at the K 2025 event from October 8 to 15, emphasizing product innovation in the specialty chemicals sector that supports the pigments market in Europe.

- In March 2025, Venator Pigments France SAS launched the TMP-free and TME-free TIOXIDE TR81 pigment, supporting sustainable titanium dioxide (TiO2) industry transformation and regulatory compliance for French clients.

- In February 2025, The Chemours Company launched Ti-Pure™ TS-6706, a TMP- and TME-free titanium dioxide pigment aimed at European coatings applications. The product is part of Chemours’ sustainability series, offering regulatory-compliant solutions for appearance-critical uses and responding to evolving EU chemical regulations.

Report Coverage

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing construction and automotive production will sustain pigment consumption in coatings and paints.

- Rising adoption of organic and bio-based pigments will drive sustainable product innovation.

- Expanding digital printing and textile industries will create higher demand for dispersion-stable pigments.

- Development of nanostructured pigments will enhance UV resistance and surface performance across applications.

- Environmental regulations will push manufacturers toward low-VOC and non-toxic pigment formulations.

- Increasing investment in R&D will accelerate production of functional pigments for smart coatings.

- The packaging sector will expand pigment demand with a focus on recyclable and food-safe materials.

- Regional clusters in Northern and Île-de-France will strengthen domestic pigment supply and export capacity.

- Strategic partnerships between local and global players will enhance innovation and market competitiveness.

- Rising consumer preference for durable, aesthetic, and sustainable materials will continue to shape long-term growth.

Segmentation

Segmentation