Market Overview

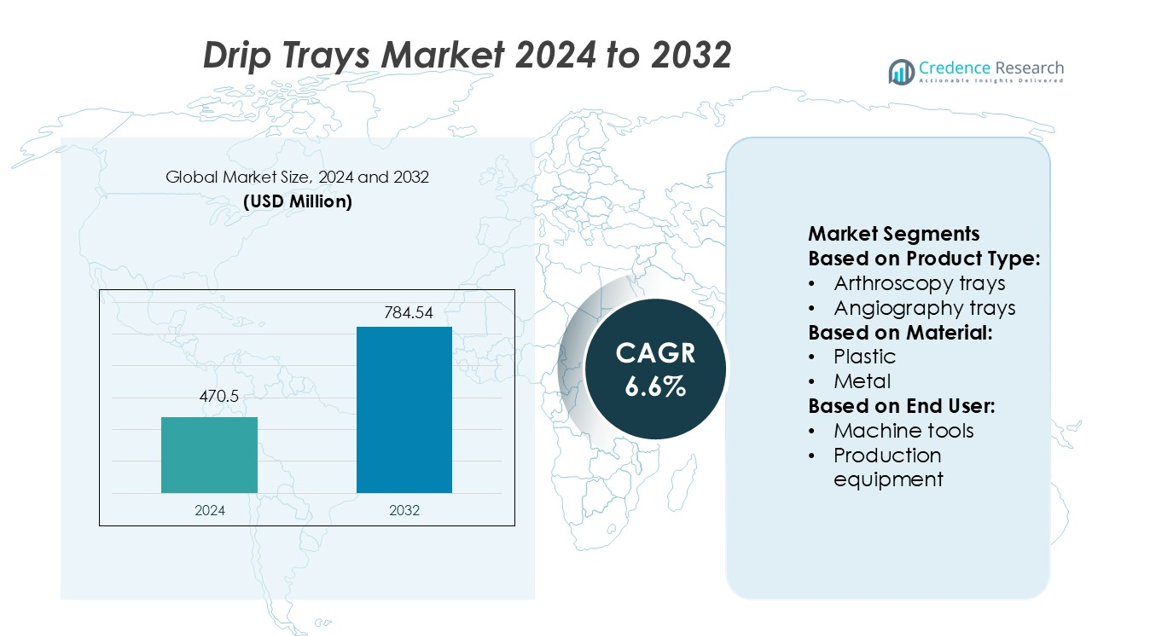

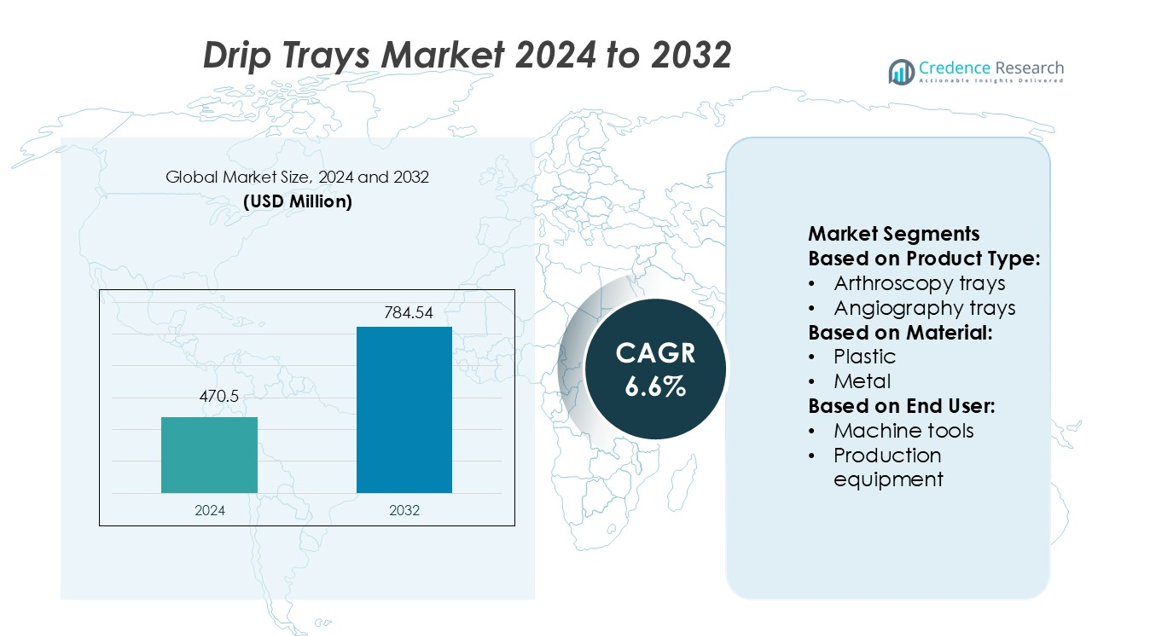

Drip Trays Market size was valued USD 470.5 million in 2024 and is anticipated to reach USD 784.54 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drip Trays Market Size 2024 |

USD 470.5 million |

| Drip Trays Market, CAGR |

6.6% |

| Drip Trays Market Size 2032 |

USD 784.54 million |

The Drip Trays Market is driven by strong competition among leading players including Owens & Minor, Inc., Mölnlycke Health Care AB, Medline Industries, LP, AngioSystems Inc., Merit Medical Systems, Inc., 3M Company, B. Braun Melsungen AG, Cardinal Health, Inc., Baxter International Inc., and Becton, Dickinson and Company. These companies focus on advanced product designs, sustainable materials, and expanded distribution networks to strengthen their market positions. Asia Pacific leads the global market with a 33% share, supported by rapid industrialization, expanding manufacturing bases, and increasing safety regulations. Companies are investing in modular tray systems and eco-friendly materials to meet rising demand in industries such as oil & gas, chemicals, and food processing. This competitive environment encourages continuous innovation and strategic expansion, ensuring sustained growth across global markets.

Market Insights

- The Drip Trays Market size was valued at USD 470.5 million in 2024 and is projected to reach USD 784.54 million by 2032, growing at a CAGR of 6.6%.

- Rising industrial safety regulations and environmental compliance are driving strong demand across oil & gas, chemical, and food processing sectors.

- Manufacturers are focusing on modular, lightweight, and eco-friendly designs, supported by increased investments in sustainable materials and smart technologies.

- The market is highly competitive, with key players strengthening their global presence through product innovation and expanded distribution networks.

- Asia Pacific leads with a 33% share, followed by North America with 31% and Europe with 27%, while plastic-based trays hold the dominant segment share due to cost-efficiency and wide industrial application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Arthroscopy trays lead the Drip Trays Market with the largest share in 2024. Their dominance comes from growing demand in precise fluid collection during minimally invasive procedures and maintenance operations. Their lightweight structure and adaptability make them ideal for clean and controlled environments. Angiography, cardiovascular, and laparoscopy trays follow, supported by expanding applications in hospitals, industrial maintenance, and manufacturing lines. Rising focus on spill prevention, safety compliance, and operational hygiene further accelerates product adoption across multiple sectors. Continuous upgrades in design and efficiency support their competitive edge.

- For instance, Owens & Minor, Inc. introduced a sterile arthroscopy tray system equipped with an integrated fluid containment channel of 18 mm depth and a fluid capacity of 2.8 liters per tray, enabling precise collection during orthopedic procedures and reducing clean-up time in operating rooms.

By Material

Plastic dominates the Drip Trays Market due to its cost-effectiveness, light weight, and corrosion resistance. Plastic trays are easy to handle, making them suitable for diverse end-use industries. Stainless steel and aluminum trays also hold notable shares, driven by high durability and performance in heavy-duty applications. Fiberglass and composite trays gain traction where chemical resistance and high thermal stability are required. The broad material range allows manufacturers to meet varied operational and regulatory needs, strengthening market growth across sectors like manufacturing and oil & gas.

- For instance, Mölnlycke’s “ProcedurePak®” trays feature a tray weight reduction of more than 20 % achieved through the adoption of biobased plastics and lightweight polymer components.

By End User

Industrial applications lead the Drip Trays Market with the highest share, supported by their wide use in spill containment and fluid management. Machine tools and production equipment segments show strong growth due to increasing focus on clean, efficient, and safe work environments. Chemical plants and oil & gas facilities adopt these trays to manage leaks and comply with safety standards. Food processing and utility facilities rely on trays to maintain hygiene and prevent contamination. Rising regulatory pressure and workplace safety standards drive long-term demand across these industries.

Key Growth Drivers

Rising Industrial Safety and Spill Control Regulations

Stringent safety and environmental regulations are driving the adoption of drip trays across industries. Companies are investing in spill containment solutions to reduce workplace hazards and comply with government standards. These trays help prevent contamination and equipment damage caused by oil, chemicals, or water leaks. Industrial facilities, including manufacturing plants and refineries, are implementing containment systems as part of their safety protocols. This growing regulatory pressure is creating strong demand for durable and compliant drip tray solutions, boosting overall market expansion.

- For instance, Merit launched the Prelude Wave™ Hydrophilic Sheath Introducer with SnapFix™ Securement Technology, which delivers 40% less insertion force, 2× the lubricity, and 2× resistance to buckling and kinking compared to a leading competitor.

Increasing Adoption in Oil & Gas and Chemical Industries

Oil & gas and chemical sectors are key contributors to drip tray demand due to their high risk of leaks and spills. These industries require advanced containment systems to manage hazardous fluids and ensure operational safety. Drip trays support environmental protection initiatives and help companies avoid costly cleanup processes and fines. With the global rise in energy production and petrochemical operations, demand for corrosion-resistant and heat-tolerant trays is increasing, supporting long-term market growth in these high-value sectors.

- For instance, 3M’s Scotchkote™ Abrasion Resistant Overcoat 6352HF is engineered for pipeline systems. In a dual-layer system, it is recommended to be applied in a layer thickness of 380 µm to 900 µm (15 to 35 mils), providing protection at operating temperatures between -73°C and 110°C (-100°F and 230°F).

Growing Focus on Sustainable and Hygienic Operations

Industries are increasingly prioritizing sustainable operations and hygiene control to align with global ESG standards. Drip trays enable cleaner workflows by collecting leaks and preventing ground contamination. Food processing, utilities, and production facilities are integrating trays to maintain hygiene and reduce water and chemical waste. Manufacturers are responding with recyclable and reusable materials to meet green goals. This shift toward cleaner, safer, and more sustainable industrial practices is boosting the need for efficient drip tray solutions worldwide.

Key Trends & Opportunities

Rising Demand for Lightweight and Modular Designs

Lightweight, modular drip tray systems are gaining popularity for their easy installation and adaptability. Industries are moving toward flexible solutions that can fit different machinery and floor layouts without requiring major infrastructure changes. Modular trays also support faster replacement and lower maintenance costs. Manufacturers are investing in innovative designs to improve ergonomics and ease of handling. This trend creates opportunities for companies offering customizable, lightweight containment solutions tailored to specific industrial needs.

- For instance, B. Braun’s “Mini Tray” The specific model number JF140R is used for this mini tray. It features outer dimensions of 80 mm × 80 mm × 33 mm. The tray has a perforation size of 4 mm, which is standard for mini trays designed for sterilisation.

Integration of Smart Monitoring and IoT Features

The market is seeing increased interest in smart drip trays equipped with sensors and IoT-enabled leak detection. These advanced systems allow real-time monitoring of spills and fluid levels, enabling quick responses and reducing operational downtime. Industries like chemical processing and oil & gas benefit from automated alerts and predictive maintenance. The integration of digital monitoring technologies provides strong opportunities for manufacturers to differentiate their products and tap into the growing smart industrial equipment segment.

- For instance, Cardinal Health’s Innovation Lab in Concord the company reports their sensor-enabled inventory platform tracks products across more than 2,700 hospital locations and 68 distribution sites in 41 countries, demonstrating large‐scale IoT deployment and real-time data capture.

Expansion in Emerging Industrial Markets

Rapid industrialization in regions like Asia Pacific and Latin America presents significant growth potential. Expanding manufacturing, energy, and processing industries are increasing their investment in safety and spill control solutions. Infrastructure modernization programs and stricter environmental laws in these regions are boosting demand for drip trays. Manufacturers that expand their presence in these markets through partnerships and localized production can capture new revenue streams and strengthen their global competitiveness.

Key Challenges

High Initial Investment and Replacement Costs

Despite their long-term benefits, high upfront costs of high-grade drip trays can limit adoption, especially among small and medium enterprises. Specialized materials such as stainless steel or fiberglass increase the overall system cost. Additionally, periodic replacement and maintenance add to operational expenses. Cost concerns often push companies to delay or limit investments in advanced containment systems. This factor remains a key restraint on market penetration, particularly in cost-sensitive industries and developing economies.

Lack of Standardization and Compatibility Issues

The absence of clear global standards for drip tray design, sizing, and material specifications creates compatibility challenges. Industries often require customized solutions, which raises production complexity and cost. Non-standardized products may also struggle to comply with evolving regulatory requirements, leading to replacement or redesign. This lack of uniformity can slow procurement decisions and affect large-scale adoption. Addressing these standardization gaps is essential for smoother integration and market growth.

Regional Analysis

North America

North America holds a 31% share of the Drip Trays Market in 2024, driven by strict industrial safety regulations and advanced spill control infrastructure. The U.S. leads the region due to strong adoption across oil & gas, food processing, and chemical manufacturing facilities. Growing emphasis on workplace safety, coupled with high investment in IoT-enabled containment systems, supports steady demand. Manufacturers are expanding product portfolios with modular and corrosion-resistant trays to meet evolving standards. The presence of major industrial equipment suppliers further strengthens the market’s position in this region.

Europe

Europe accounts for a 27% share of the Drip Trays Market, supported by stringent environmental regulations and sustainability goals. Countries such as Germany, France, and the U.K. drive growth through widespread use in chemical plants, utilities, and production facilities. The region’s strong focus on energy efficiency and clean operations fuels the adoption of reusable and recyclable tray materials. Ongoing industrial modernization and regulatory compliance programs create steady demand. Manufacturers in Europe are investing in advanced materials and designs to support clean manufacturing initiatives and circular economy goals.

Asia Pacific

Asia Pacific dominates the Drip Trays Market with a 33% share, driven by rapid industrialization and infrastructure expansion in China, India, and Southeast Asia. Strong growth in manufacturing, oil & gas, and chemical processing industries fuels demand for cost-efficient and durable drip tray solutions. Governments are tightening environmental and safety regulations, boosting adoption across both new and existing facilities. Local manufacturers offer affordable products, supporting wide-scale deployment. Expanding foreign investments in industrial projects and the presence of large production hubs further enhance the region’s strong market position.

Latin America

Latin America holds a 5% share of the Drip Trays Market, with growth led by Brazil and Mexico. Expanding oil & gas and chemical industries are driving the need for reliable spill containment systems. Industrial modernization programs and stricter safety policies are encouraging industries to adopt durable and cost-effective tray solutions. However, budget limitations and lower standardization pose adoption challenges in some areas. The region’s steady economic development, combined with rising foreign investments in manufacturing and utilities, supports moderate but consistent market growth through the forecast period.

Middle East & Africa

The Middle East & Africa represent a 4% share of the Drip Trays Market, supported by strong oil & gas activity and expanding industrial infrastructure. Countries like Saudi Arabia, the UAE, and South Africa are investing in advanced spill management systems to meet regulatory and operational safety standards. Rising awareness of environmental protection in refineries and chemical facilities fuels adoption. Although cost barriers and limited local manufacturing remain challenges, increasing public and private investments in industrial safety solutions are gradually strengthening market penetration in the region.

Market Segmentations:

By Product Type:

- Arthroscopy trays

- Angiography trays

By Material:

By End User:

- Machine tools

- Production equipment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Drip Trays Market is shaped by strong competition among major players such as Owens & Minor, Inc., Mölnlycke Health Care AB, Medline Industries, LP, AngioSystems Inc., Merit Medical Systems, Inc., 3M Company, B. Braun Melsungen AG, Cardinal Health, Inc., Baxter International Inc., and Becton, Dickinson and Company. The Drip Trays Market is defined by continuous innovation, product differentiation, and strategic expansion. Manufacturers are investing in advanced materials such as corrosion-resistant plastics, stainless steel, and composites to enhance durability and safety. A growing focus on modular and lightweight designs is improving installation efficiency and operational flexibility. Companies are also adopting sustainable manufacturing practices, including the use of recyclable and reusable materials, to meet rising environmental standards. Strategic partnerships with industrial end users and distributors are strengthening market penetration. Additionally, ongoing R&D investments and technology integration, such as smart monitoring systems, are helping companies build a stronger competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Owens & Minor, Inc.

- Mölnlycke Health Care AB

- Medline Industries, LP

- AngioSystems Inc.

- Merit Medical Systems, Inc.

- 3M Company

- Braun Melsungen AG

- Cardinal Health, Inc.

- Baxter International Inc.

- Becton, Dickinson and Company

Recent Developments

- In October 2024, Tupperware Brands Corporation reached a preliminary agreement with a consortium of secured lenders, notably including Stonehill Capital Management Partners and Alden Global Capital. The plan is to restructure the company into The New Tupperware Company, adopting a start-up mentality.

- In July 2024, ProAmpac has launched new product namely ProActive Recyclable Fresh Tray FT-1000. This helps company to enhance their global reach and meet requirement of diverse range of end user.

- In June 2024, Sonoco Products Company formally disclosed its acquisition of Eviosys, a leading global provider of innovative and sustainable metal packaging solutions catering to the food, consumer goods, and promotional sectors, from KPS Capital Partners.

- In June 2024, Saica Group and Mondelēz collaborated to introduce a new paper-based solution aimed at multipack items for the confectionery, biscuits, and chocolate sectors, intended to be recyclable within the paper waste stream.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising industrial safety regulations and stricter spill control norms.

- Adoption of modular and lightweight trays will increase across diverse industries.

- Smart drip trays with sensor-based leak detection will gain strong traction.

- Demand from oil & gas, chemical, and food processing sectors will continue to grow.

- Sustainable and recyclable materials will play a key role in product development.

- Emerging economies will offer significant opportunities for market expansion.

- Manufacturers will strengthen their distribution networks to increase global reach.

- Product customization and flexibility will become major competitive advantages.

- Technological innovation will drive efficiency and reduce maintenance costs.

- Partnerships between manufacturers and industrial end users will support long-term growth.