Market Overview

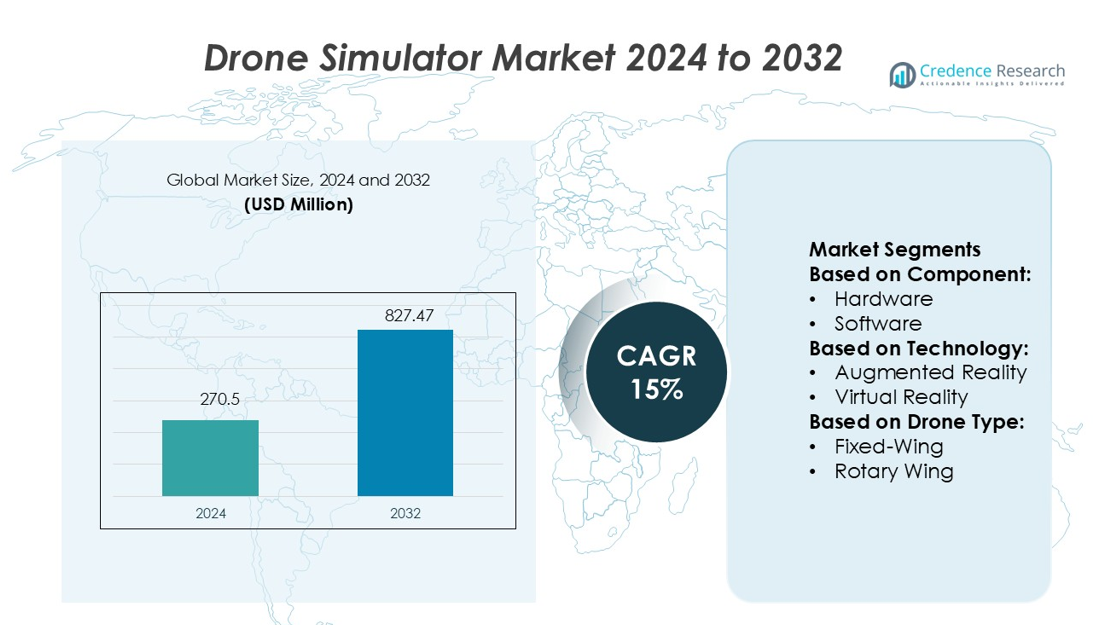

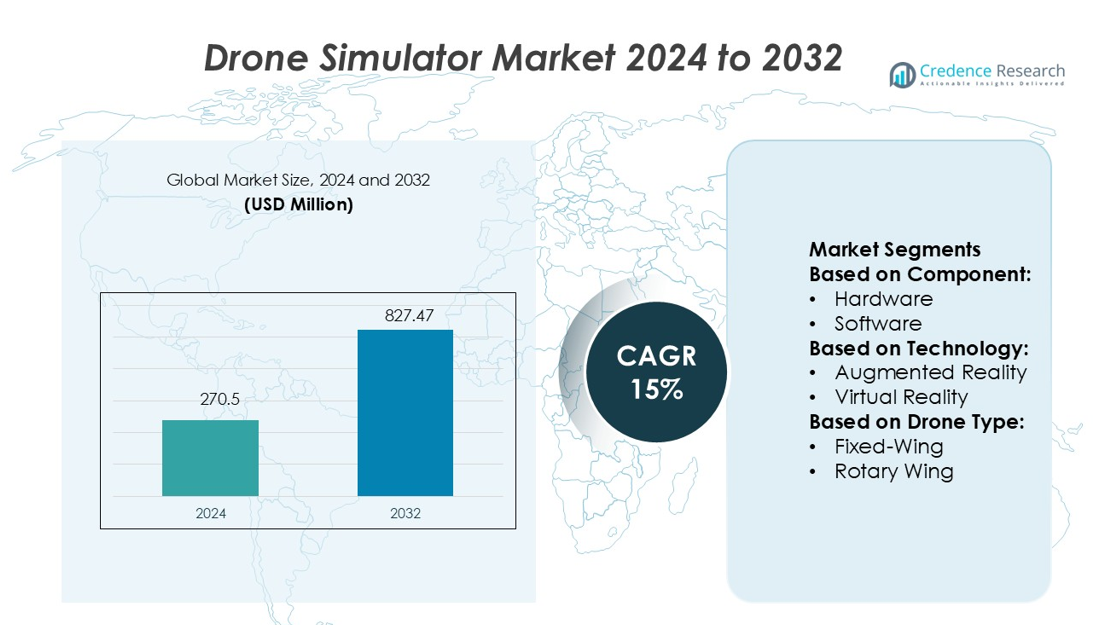

Drone Simulator Market size was valued USD 270.5 million in 2024 and is anticipated to reach USD 827.47 million by 2032, at a CAGR of 15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Simulator Market Size 2024 |

USD 270.5 million |

| Drone Simulator Market, CAGR |

15% |

| Drone Simulator Market Size 2032 |

USD 827.47 million |

The Drone Simulator Market is shaped by strong competition from leading players such as Skydio, Autel Robotics, SZ DJI Technology, Inc., 3DR, Inc., Pix4D, Parrot Drone SAS, RedBird, AgEagle Aerial Systems Inc, Airware Limited, and Mapbox. These companies focus on enhancing simulation accuracy, integrating AI-driven features, and expanding VR and AR capabilities to strengthen their market positions. Strategic partnerships with defense agencies and commercial operators support product innovation and global reach. North America leads the Drone Simulator Market with a 36% share, supported by advanced aviation infrastructure, significant defense investments, and strong regulatory frameworks driving widespread simulator adoption.

Market Insights

- The Drone Simulator Market size was valued at USD 270.5 million in 2024 and is anticipated to reach USD 827.47 million by 2032, at a CAGR of 15% during the forecast period.

- Rising demand for AI-powered simulators and immersive VR/AR training solutions is driving rapid technology adoption across defense and commercial sectors.

- Strong competition among major companies is accelerating product innovation, platform integration, and strategic partnerships with operators and training institutions.

- High initial investment costs and limited standardization remain key restraints, particularly in emerging markets with slower regulatory alignment.

- North America leads the market with a 36% share, followed by Europe with 27% and Asia Pacific with 24%; hardware dominates the component segment with 62% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Hardware dominates the Drone Simulator Market with a 62% share. The strong growth of this sub-segment is driven by the rising demand for advanced control systems, flight control hardware, and high-performance computing platforms. High-fidelity simulators are increasingly used for pilot training, mission planning, and defense applications. Hardware-based simulators offer realistic flight conditions, improving training quality and reducing operational risks. The growing investment in military drone programs and commercial drone operations supports hardware adoption, making it the leading component in the market.

- For instance, Skydio, Inc. developed its X10 drone, which deploys in under 40 seconds as a backpack-ready unit and includes modular camera payloads. One configuration, the VT300-Z, features a 48 MP telephoto zoom and a 64 MP narrow-angle camera, while another, the VT300-L, offers a 50 MP wide-angle and 64 MP narrow-angle camera.

By Technology

Virtual Reality (VR) holds the largest market share of 68% in the technology segment. Its dominance is supported by its ability to deliver immersive flight experiences and enhance real-time decision-making. VR technology allows pilots to practice complex missions in controlled environments without physical risks. The demand is rising across defense, agriculture, and logistics sectors for training and operational readiness. VR simulators are cost-effective compared to live flight training, accelerating adoption among commercial and government agencies worldwide.

- For instance, Autel reports its industrial drone model Autel Alpha supports video transmission up to 20 kilometres via its SkyLink 3.0 system.

By Drone Type

Fixed-wing drones lead the market with a 54% share in the drone type segment. Their popularity stems from longer flight endurance, higher payload capacity, and superior performance for surveillance and mapping missions. Fixed-wing simulators support realistic mission training, making them essential for military and industrial use. The increasing use of fixed-wing drones in defense, environmental monitoring, and border security drives the need for accurate simulation tools. This dominance highlights the growing focus on strategic and operational training for long-range drone missions.

Key Growth Drivers

Rising Adoption of Drones for Defense and Commercial Applications

The increasing use of drones in defense, logistics, agriculture, and surveillance drives simulator demand. Military agencies rely on simulators for pilot training, mission planning, and risk reduction. Commercial operators use them to train staff without incurring high operational costs. This adoption enables safer, faster, and more efficient mission execution. Advanced simulation platforms replicate real-time flight conditions, improving operational accuracy. Growing defense budgets and commercial drone deliveries are strengthening the market, making simulators a critical training and operational tool.

- For instance, DJI’s Mavic 3 Enterprise series features a maximum flight time of 45 minutes and a maximum horizontal distance of 32 km under ideal conditions.

Technological Advancements in Simulation Systems

Continuous innovation in simulation hardware and software enhances the accuracy and immersion of training programs. Integrating virtual reality, haptic feedback, and AI improves pilot response and mission adaptability. These systems allow trainees to practice real-world scenarios, including emergency situations, without operational risks. Upgraded visualization and sensor integration increase demand from both defense and commercial users. As simulation platforms become more affordable and scalable, more organizations are investing in modernized drone training environments.

- For instance, Pix4D’s viDoc RTK Rover, when used with the PIX4Dcatch app, delivers centimeter-level absolute accuracy. In 2022, Bureau Veritas certified the device to be accurate to within 5 cm for trench measurements, demonstrating its capability for professional-grade terrestrial scanning.

Cost Efficiency and Operational Safety Benefits

Drone simulators reduce costs linked to maintenance, fuel, and operational risks during live flight training. Organizations prefer simulators for skill development and compliance training because they provide repeatable, safe environments. Simulations also minimize drone damage, lowering overall training expenses. High-fidelity platforms offer realistic mission planning and execution, ensuring precision in actual flights. These cost and safety advantages make simulation an attractive alternative to conventional flight training programs across industries.

Key Trends & Opportunities

Growing Integration of VR and AR Technologies

The use of virtual and augmented reality technologies is transforming drone training methods. These immersive tools provide lifelike flight environments, enhancing pilot performance and mission planning accuracy. VR and AR simulators help users gain real-time feedback and hands-on experience without physical risk. This integration creates opportunities for developers to offer more adaptive and cost-effective solutions. Industries like defense, logistics, and emergency response are expected to benefit the most from this trend.

- For instance, ANAFI USA platform supports full AES-XTS 512-bit encrypted SD cards and live feed streams in 720p via Skycontroller, enabling safe simulation of complex operational scenarios without physical risk.

Expansion of Commercial Drone Training Programs

The rising adoption of drones in logistics, agriculture, and surveillance is increasing the need for certified pilots. Training centers and companies are investing in simulation platforms to build skilled operator bases. Regulatory support for commercial drone operations is further driving demand. This trend is creating opportunities for simulator providers to develop scalable solutions tailored to enterprise training needs. Market players are focusing on portable and cloud-based simulators to meet growing global demand.

- For instance, Redbird reports over 2,000 training devices in service worldwide across its BATD and AATD platforms. Training centres and companies are investing in simulation platforms to build skilled operator bases.

Increasing Use of AI-Powered Simulation Tools

AI integration is enhancing simulation accuracy, predictive capabilities, and adaptability. These intelligent systems analyze trainee performance and adjust scenarios dynamically. Real-time feedback improves learning efficiency and operational preparedness. AI-based tools are becoming essential in high-risk missions such as defense surveillance and disaster management. This trend opens opportunities for companies offering intelligent, automated training solutions with strong analytical capabilities.

Key Challenges

High Initial Cost of Advanced Simulation Systems

Advanced drone simulators require significant investment in hardware, software, and integration. High acquisition and maintenance costs limit adoption among small training centers and commercial operators. This cost barrier restricts market penetration in price-sensitive regions. Although long-term savings are possible, upfront costs remain a key concern. Many organizations prefer cost-effective alternatives, slowing widespread adoption of high-end training platforms.

Limited Standardization and Regulatory Complexity

The lack of uniform global regulations for drone operations and training complicates simulator deployment. Different countries have varying certification and compliance standards. This inconsistency hinders cross-border training programs and simulator sales. Manufacturers must adapt products to meet multiple standards, raising development costs. The regulatory complexity delays market growth, especially for commercial drone applications in emerging economies.

Regional Analysis

North America

North America leads the Drone Simulator Market with a 36% share. Strong defense investments, advanced aviation infrastructure, and the presence of major simulator providers support this leadership. The U.S. Department of Defense and commercial drone operators are increasingly adopting simulators for pilot training and mission planning. Expanding drone use in logistics, agriculture, and surveillance drives demand. Technology adoption is high, with VR and AI integration enhancing simulation quality. Strategic partnerships between defense agencies and technology firms further strengthen regional dominance, ensuring sustained growth and innovation in training solutions.

Europe

Europe holds a 27% share of the Drone Simulator Market, driven by strong regulatory support and defense modernization programs. Countries like Germany, the U.K., and France invest in simulation systems for advanced pilot training and operational planning. The European Union’s drone integration framework also supports commercial training expansion. Growing demand in security, infrastructure inspection, and logistics enhances adoption. The presence of established aerospace and defense companies fuels technological advancement. Collaborations between public institutions and private firms are enabling greater innovation and driving long-term growth.

Asia Pacific

Asia Pacific accounts for a 24% market share, supported by rapid drone adoption in defense, commercial, and agricultural applications. China, Japan, and India are major contributors to regional growth. Government investments in drone programs and training infrastructure are expanding. Cost-effective simulator solutions appeal to both military and private operators. The rise in commercial drone delivery services also drives demand for skilled pilots. Strong manufacturing capabilities and growing technology adoption make the region a key hub for future drone simulation development.

Latin America

Latin America holds a 5% share of the Drone Simulator Market, with growing interest in agricultural monitoring, infrastructure inspection, and security applications. Brazil and Mexico lead regional adoption due to expanding drone programs. Simulator demand is rising as governments and private sectors invest in cost-efficient training solutions. Limited infrastructure remains a challenge, but ongoing regulatory improvements support market expansion. Partnerships with international simulator providers are improving access to advanced technology. Gradual modernization of commercial and defense sectors will likely drive future market growth in this region.

Middle East & Africa

The Middle East & Africa region captures an 8% share of the Drone Simulator Market. Rising investments in border surveillance, oil infrastructure monitoring, and security applications drive demand. Countries such as the UAE and Saudi Arabia are actively adopting simulation systems to strengthen operational training. Government-led modernization programs support simulator integration across defense and civil sectors. The growing presence of global players through partnerships boosts technology transfer. Although adoption is slower than other regions, increasing security focus creates strong long-term growth potential.

Market Segmentations:

By Component:

By Technology:

- Augmented Reality

- Virtual Reality

By Drone Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Drone Simulator Market is highly competitive with key players including Skydio, Autel Robotics, SZ DJI Technology, Inc., 3DR, Inc., Pix4D, Parrot Drone SAS, RedBird, AgEagle Aerial Systems Inc, Airware Limited, and Mapbox. The Drone Simulator Market is characterized by strong competition and rapid technological innovation. Companies are focusing on enhancing simulation accuracy, integrating advanced virtual and augmented reality, and improving flight data visualization. Continuous investments in AI-powered training platforms and cloud-based solutions are enabling more flexible and cost-efficient training environments. Market participants are also targeting both defense and commercial sectors through scalable, high-fidelity simulation systems. Strategic collaborations with training centers, regulatory bodies, and aviation authorities are strengthening market presence. The emphasis on immersive experiences, operational safety, and regulatory compliance continues to shape the competitive dynamics of this growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Skydio

- Autel Robotics

- SZ DJI Technology, Inc.

- 3DR, Inc.

- Pix4D

- Parrot Drone SAS

- RedBird

- AgEagle Aerial Systems Inc

- Airware Limited

- Mapbox

Recent Developments

- In February 2025, Pix4D and Freefly Systems announced a partnership aimed at enhancing drone data workflows by integrating Pix4D’s advanced photogrammetry software with Freefly’s cutting-edge drone technology. This collaboration seeks to streamline the process of capturing, processing, and analyzing aerial data, making it more efficient for industries such as construction, surveying, and agriculture.

- In January 2025, SZ DJI Technology Co., Ltd. launched the DJI Flip, a lightweight and foldable drone designed for vloggers, resembling a mini unicycle. Weighing just 249 grams, it features a 1/1.3-inch 48MP CMOS sensor capable of recording 4K HDR videos at 60 fps and slow-motion at 100 fps, along with SmartPhoto technology for enhanced clarity.

- In December 2024, MVRsimulation (MVR) has unveiled a streamlined first-person-view (FPV) UAV simulator at the Interservice/Industry Training, Simulation and Education Conference.

- In May 2024, Droneshield announced the release of DroneSentry C2 Next-Gen v1.00, an advanced command-and-control system that enhances the capabilities of anti-drone systems by providing centralized monitoring and control functionalities. It allows users to efficiently manage multiple sensors and countermeasures to protect critical infrastructure, public events, military installations, and other sensitive areas from potential drone threats

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Drone Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for drone simulators will grow with rising adoption of unmanned systems in multiple industries.

- Virtual and augmented reality integration will enhance training realism and mission readiness.

- AI-powered platforms will improve pilot performance tracking and adaptive learning.

- Cloud-based simulation systems will expand access for remote and large-scale training programs.

- Defense modernization programs will drive strong investments in advanced simulation tools.

- Commercial drone operators will increasingly rely on simulators to cut training costs.

- Regulatory developments will push for standardized simulation-based certification.

- Portable and modular simulators will gain popularity for flexible deployments.

- Partnerships between simulator developers and drone manufacturers will accelerate innovation.

- Advanced analytics and real-time scenario modeling will shape the next generation of training systems.