Market Overview:

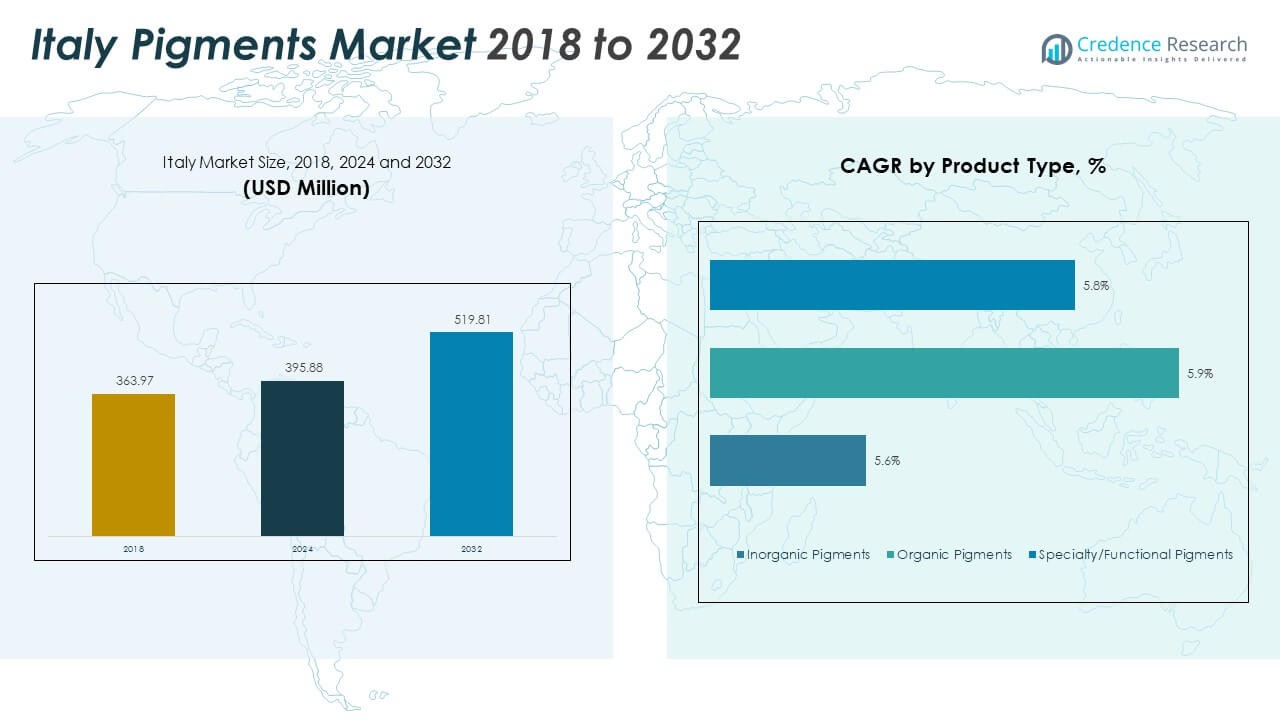

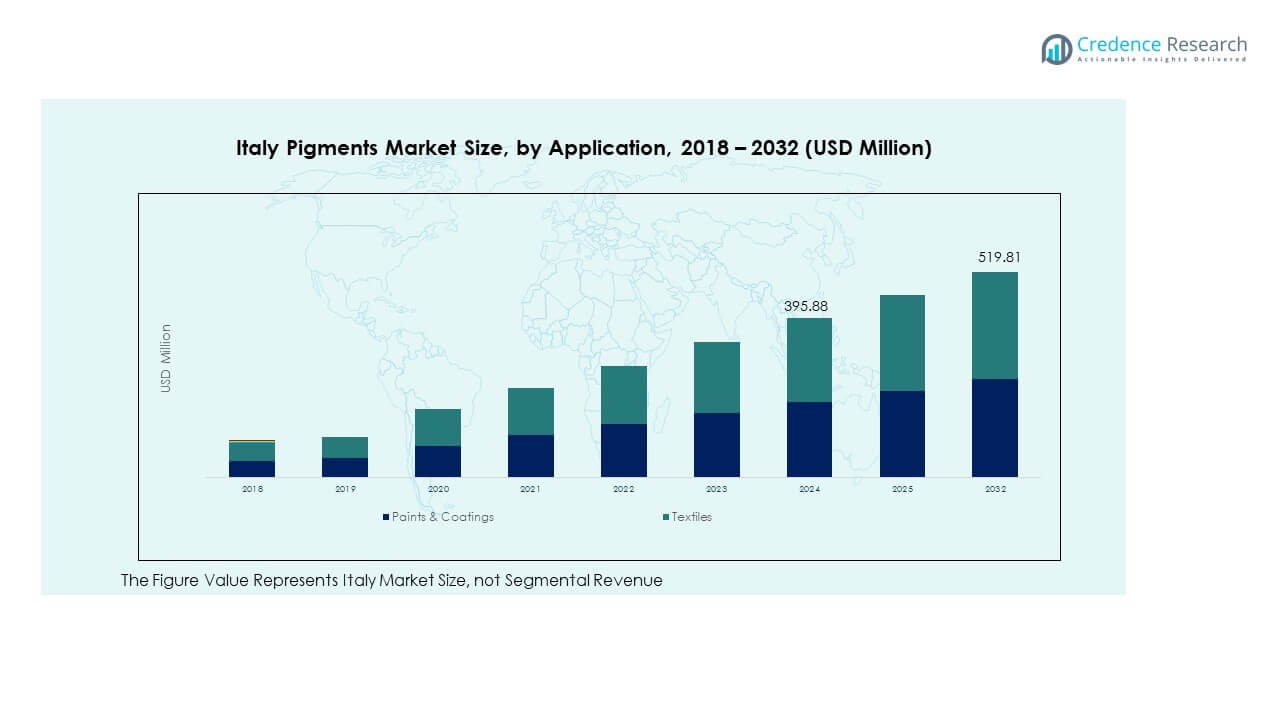

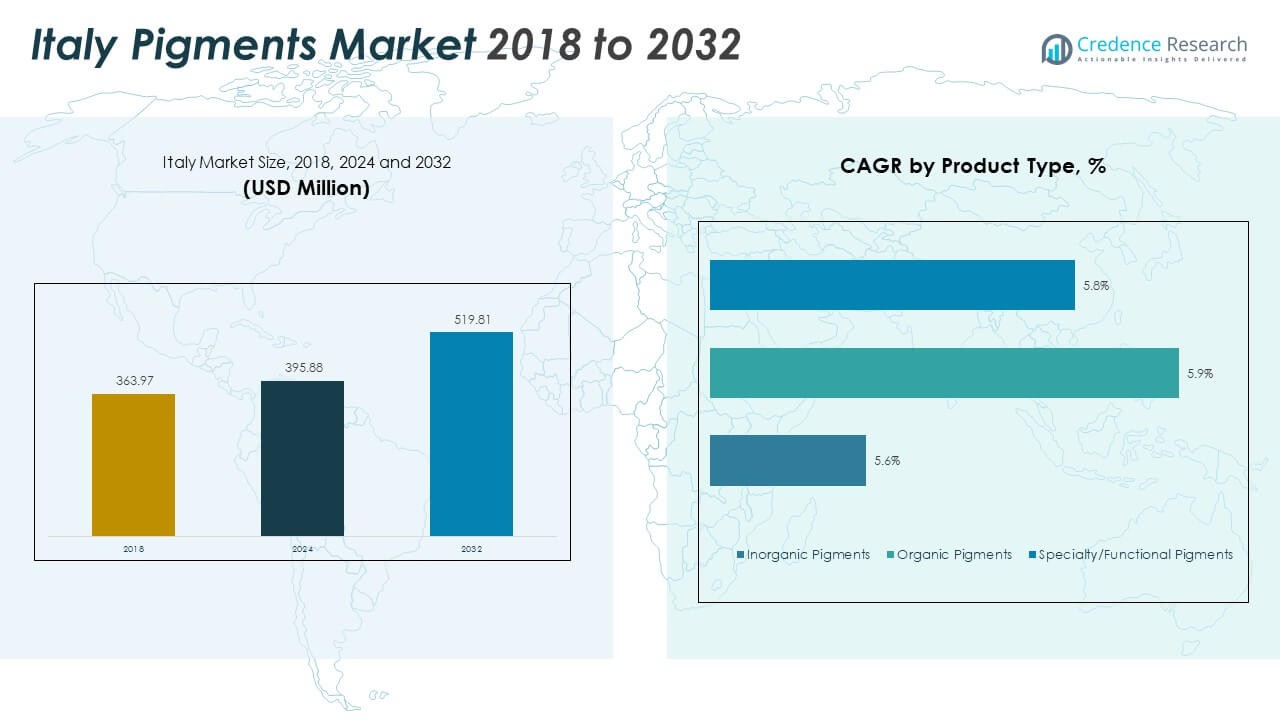

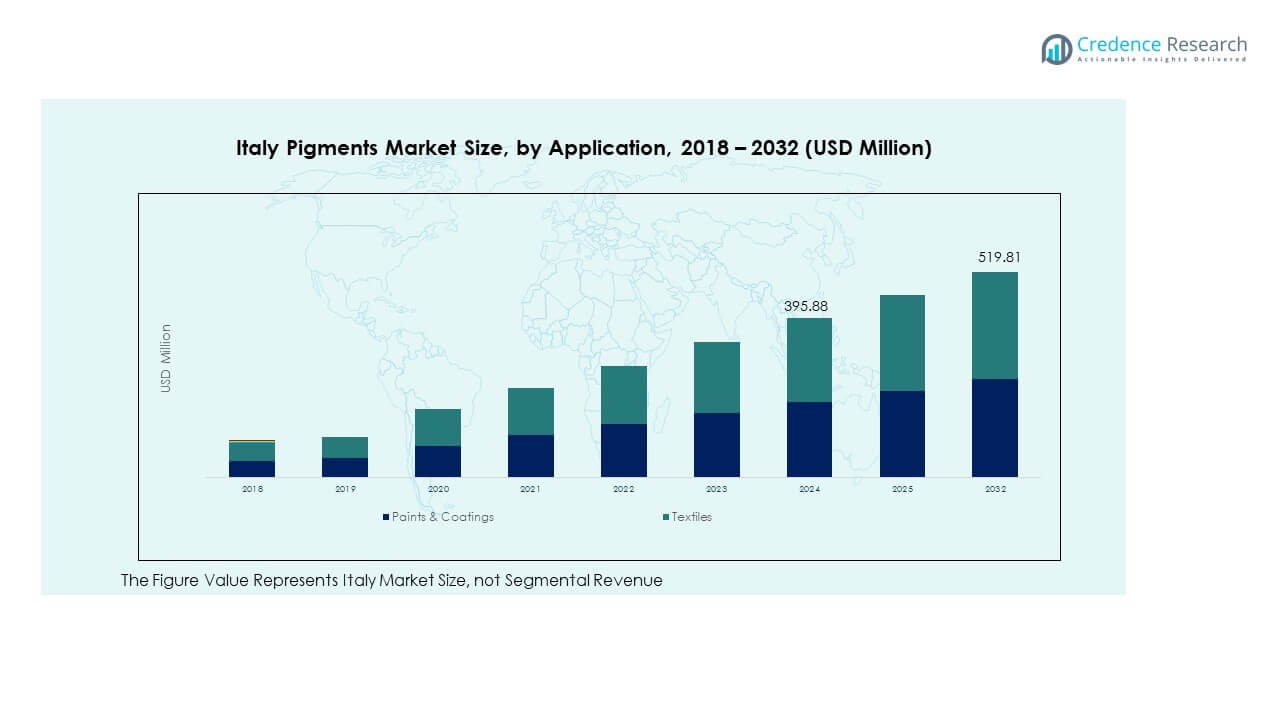

The Italy Pigments Market size was valued at USD 363.97 million in 2018 to USD 395.88 million in 2024 and is anticipated to reach USD 519.81 million by 2032, at a CAGR of 3.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Pigments Market Size 2024 |

USD 395.88 Million |

| Italy Pigments Market, CAGR |

3.46% |

| Italy Pigments Market Size 2032 |

USD 519.81 Million |

Growing demand from construction, automotive, and packaging industries drives the pigments market in Italy. Pigments are essential for coatings, decorative finishes, and plastics that require durability, UV resistance, and color stability. Increasing use of high-performance organic and inorganic pigments supports sustainability goals and enhances aesthetic appeal. The rise in eco-friendly paints and industrial coatings aligned with EU environmental standards further accelerates market expansion.

Northern Italy remains the key manufacturing hub, led by regions such as Lombardy, Veneto, and Emilia-Romagna with strong industrial and automotive production bases. Central Italy demonstrates steady demand through its ceramics, textiles, and printing sectors. Southern Italy shows growth potential supported by infrastructure investments and expanding export activities. Emerging clusters in southern regions benefit from improved logistics, energy efficiency programs, and proximity to export routes across the Mediterranean.

Market Insights

- The Italy Pigments Market was valued at USD 363.97 million in 2018, reached USD 395.88 million in 2024, and is projected to attain USD 519.81 million by 2032, growing at a CAGR of 3.46% during the forecast period.

- Northern Italy leads with 52% share due to its strong industrial base and advanced coating technologies, while Central Italy holds 28% supported by textile and ceramic manufacturing, and Southern Italy contributes 20% through emerging production hubs.

- Southern Italy is the fastest-growing region, driven by industrial expansion, infrastructure investment, and export-focused pigment manufacturing supported by improved logistics.

- Paints & Coatings dominate the market with an estimated 60% share, driven by construction and automotive applications demanding durable and high-performance pigments.

- The Textiles segment holds roughly 25% share, supported by Italy’s strong fashion and design industries using pigments for colorfast and sustainable dyeing solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from the Construction and Automotive Industries

Strong growth in construction and automotive production drives pigment consumption in Italy. Pigments are essential for coatings, decorative finishes, and plastic components that require long-term durability and color retention. The expanding use of waterborne coatings and high-solid formulations enhances product efficiency and reduces emissions. Urbanization and infrastructure renovation projects increase the demand for architectural paints. In the automotive sector, pigments provide corrosion resistance and aesthetic appeal for OEM coatings. The Italy Pigments Market benefits from premium vehicle manufacturing that relies on advanced pigments for custom finishes. Eco-friendly materials and heat-reflective colors are also gaining traction. This trend sustains steady pigment usage across industrial applications.

- For instance, BASF’s ColorBrite Airspace Blue ReSource basecoat, developed using a biomass balance approach, achieves about a 20% lower product carbon footprint verified by a third-party sustainability consultant. The waterborne coating reflects BASF’s commitment to reducing emissions while maintaining high-quality color performance for automotive applications.

Technological Innovation in Pigment Dispersion and Processing Techniques

Manufacturers are focusing on advanced pigment dispersion technologies to improve consistency and reduce agglomeration. Improved milling and microencapsulation processes ensure uniform particle size and stable color intensity. Automation in pigment blending supports large-scale customization for specific end-use industries. Italian producers are investing in equipment that optimizes dispersion efficiency, reducing energy consumption during production. The Italy Pigments Market experiences continuous upgrades in coating formulations using nanotechnology. These innovations enhance gloss, opacity, and weathering performance of pigments. Companies focus on high-temperature stability pigments to meet industrial coating needs. Continuous process improvement supports better productivity and sustainability outcomes.

Shift Toward Environmentally Sustainable Pigment Formulations

Rising environmental regulations in the European Union are encouraging sustainable pigment production. Manufacturers adopt renewable energy sources and water-based formulations to reduce emissions. Pigment makers focus on removing heavy metals and hazardous chemicals from product lines. Italy’s industrial policies promote circular manufacturing practices for reduced waste generation. The Italy Pigments Market supports adoption of bio-based and recyclable pigment materials. This transition benefits manufacturers targeting eco-friendly paints, plastics, and printing inks. Investment in sustainable colorants helps brands meet EU Green Deal compliance goals. It creates a market landscape emphasizing low-impact production and green certification.

Growth in Consumer Preference for High-Performance and Aesthetic Products

Consumers increasingly demand durable and visually enhanced products across packaging, automotive, and textile sectors. Pigments play a critical role in improving color fastness and UV stability. High-performance pigments provide superior resistance to fading and chemical exposure. Fashion and interior design industries in Italy emphasize premium color quality. The Italy Pigments Market benefits from increasing investment in advanced pigment chemistries. Innovations in color-matching technologies enable manufacturers to deliver unique shades. The demand for vibrant and stable color formulations drives R&D in hybrid pigment structures. This preference supports long-term adoption of premium pigments across industries.

- For instance, Merck KGaA’s Xirallic NXT pigmentsremain globally acclaimed for their crystal effect and advanced sparkle, with technical documentation showing proprietary aluminum oxide flakes engineered for ultra-high chroma and tight particle size distribution. The pigment system delivers measurable improvements in brilliance and UV durability for coatings and has seen wide adoption by European fashion and automotive brands for performance and lasting aesthetics.

Market Trends

Integration of Digital Printing Technologies Across Industrial Applications

Digital printing growth in textiles, packaging, and signage is transforming pigment demand. Pigments compatible with digital inks ensure color accuracy and stability under UV exposure. The adoption of pigment-based inks in textile printing enhances color penetration and wash resistance. Packaging industries use these pigments for high-resolution graphics and long-lasting visual appeal. The Italy Pigments Market benefits from investment in advanced printing technologies. Local producers develop micro-dispersed pigments suitable for inkjet systems. Increased demand for short-run, customized prints accelerates the pigment innovation cycle. It supports niche applications in fashion, décor, and advertising.

- For instance, EFI’s Reggiani HYPER digital textile printer delivers speeds up to 33,906 ft²/hr at 2400 dpi resolution with 72 printheads. It supports multiple ink types, including pigment inks, enabling high-precision, sustainable textile printing for industrial applications.

Expansion of Functional and Specialty Pigments in Industrial Coatings

Functional pigments such as anticorrosive, pearlescent, and thermochromic variants are gaining attention. These pigments improve durability, reflectivity, and optical effects across coating systems. Italian manufacturers integrate infrared-reflective pigments in architectural paints for energy-efficient designs. Specialty pigments enhance aesthetic differentiation and performance consistency under harsh conditions. The Italy Pigments Market is witnessing adoption of heat-stable and metallic pigments in industrial applications. Decorative coatings use special-effect pigments to deliver luxury finishes. Continuous R&D supports creation of light-sensitive and self-cleaning pigment types. This trend elevates product value for high-end and technical coatings.

Increasing Focus on Circular Economy and Recycling Initiatives

The Italian chemical sector promotes pigment production aligned with circular economy goals. Recycled materials from industrial waste are reprocessed to produce sustainable pigment sources. Local companies collaborate with recyclers to improve material traceability and reduce dependency on virgin raw inputs. The Italy Pigments Market supports pigment recovery technologies using advanced filtration and extraction systems. Green certifications encourage adoption of environmentally compliant production processes. Water reuse and waste minimization are now integral to pigment manufacturing strategies. Industry collaboration with environmental agencies accelerates sustainability implementation. These developments strengthen Italy’s leadership in green chemical manufacturing.

Emergence of Nanotechnology in Pigment Development and Surface Modification

Nanostructured pigments deliver enhanced optical performance and dispersion quality. They provide superior transparency, gloss, and mechanical resistance in coatings and plastics. Italian R&D centers focus on surface-treated pigments for better compatibility with resins. The Italy Pigments Market benefits from nanotechnology adoption in color formulation innovation. Manufacturers are introducing nanoparticles that resist UV degradation and chemical wear. Enhanced surface treatment processes improve adhesion and dispersion uniformity. Nanopigments enable high-intensity colors in automotive and architectural coatings. It supports premium design applications across construction and consumer goods sectors.

- For instance, Colorobbia Group, headquartered in Italy, produces stains and color concentrates for ceramics and glass industries. Its 7×7 series is designed for large-format tile applications, offering high color strength and uniform dispersion for advanced ceramic coatings.

Market Challenges Analysis

Rising Regulatory Pressure and Compliance Costs in Pigment Manufacturing

Environmental and safety regulations in the EU impose strict limits on hazardous substances used in pigments. Compliance with REACH and CLP frameworks increases production costs for manufacturers. The Italy Pigments Market faces pressure to reformulate products without lead, cadmium, and chromium compounds. This transition demands significant investment in testing and alternative chemistry development. Small and mid-sized enterprises encounter higher operational burdens due to complex certification processes. It becomes challenging to maintain competitive pricing while meeting quality standards. Extended approval timelines delay market entry for new formulations. Regulatory evolution continues to shape production and trade strategies in Italy.

Volatility in Raw Material Prices and Supply Chain Constraints

Fluctuations in titanium dioxide and organic pigment intermediates affect production stability. Limited availability of high-grade feedstocks creates procurement challenges for manufacturers. The Italy Pigments Market is exposed to global price variations for solvents, metals, and precursors. Transportation disruptions and geopolitical factors add uncertainty to raw material supply. Producers implement long-term contracts to stabilize cost structures and ensure continuity. Rising logistics expenses further strain profitability margins in export operations. Companies explore localized sourcing to mitigate foreign dependency. Supply chain digitalization and inventory optimization emerge as key strategies for operational resilience.

Market Opportunities

Growing Demand for Eco-Friendly Pigments in Green Architecture and Design

Architectural and decorative coatings industries increasingly prefer low-VOC and bio-based pigments. Italian manufacturers leverage renewable resources to develop sustainable pigment systems. The Italy Pigments Market experiences opportunity growth from urban redevelopment projects promoting green buildings. Eco-certified pigments attract construction and interior design clients emphasizing environmental responsibility. Global brands source Italian pigments to comply with EU sustainability criteria. Energy-efficient coatings using reflective pigments contribute to carbon reduction goals. It positions Italy as a supplier of environmentally advanced pigment solutions.

Rising Adoption of Pigments in Advanced Manufacturing and 3D Printing Applications

The expansion of additive manufacturing technologies creates new avenues for pigment integration. Pigments enhance the surface quality and aesthetic customization of 3D-printed products. The Italy Pigments Market gains traction in supplying pigment powders suitable for polymers and resins. Demand from industrial prototyping and functional design sectors is rising. Manufacturers develop pigments with enhanced heat stability and chemical compatibility. Growth in design-driven consumer goods supports use of specialty pigments. It strengthens Italy’s role in advanced manufacturing ecosystems focused on precision color engineering.

Market Segmentation Analysis

By Product Type

Inorganic pigments dominate due to their excellent opacity, heat resistance, and UV stability. Titanium dioxide (TiO₂) remains the most widely used pigment in coatings, plastics, and inks. Zinc oxide finds increasing use in ceramic glazes and rubber applications for its brightness and durability. The Italy Pigments Market also includes other oxides and silicates serving industrial paints and composites. Organic pigments gain momentum for their vibrant hues and eco-friendly formulations. Specialty pigments such as pearlescent, metallic, and thermochromic variants support design innovation. These pigments enable high-value effects in packaging, automotive, and architectural coatings. Manufacturers focus on improving dispersion and gloss retention across product categories.

- For instance, Venator Materials announced that its 80,000-ton TiO₂ plant in Scarlino, Italy, remains offline pending regulatory developments and product market conditions, following its transformation plan in early 2024, while a 50,000-ton capacity shutdown in Duisburg and technology transfer to Uerdingen, Germany, was finalized to strengthen specialized pigment production for Europe.

By Application

Paints and coatings hold the largest share, driven by Italy’s strong construction and automotive sectors. Textiles and printing inks use pigments for durable and colorfast designs. Plastics applications expand due to lightweight manufacturing trends in consumer goods and packaging. The Italy Pigments Market also serves leather finishing and high-performance decorative materials. Specialty pigment formulations find applications in advanced polymers for industrial use. Demand from renewable energy and building materials sectors supports innovation in functional coatings. Continuous development of multifunctional pigment systems broadens market penetration. It strengthens Italy’s position as a leading pigment technology hub within Europe.

- For example, Clariant’s launch of 25 organic pigments for biodegradable plastics fully compliant with EN 13432 compostability standards enables durable, vibrant coloration for packaging and food contact polymers, implemented by major European plastics and food manufacturers since 2019.

Segmentation

By Product Type

- Inorganic Pigments

- Titanium Dioxide (TiO₂)

- Zinc Oxide

- Others

- Organic Pigments

- Specialty/Functional Pigments

By Application

- Paints & Coatings

- Textiles

- Printing Inks

- Plastics

- Leather

- Other Applications

Regional Analysis

Northern Italy: Leading Industrial and Production Hub (52% Market Share)

Northern Italy dominates the pigments market with a 52% share due to its strong manufacturing base. Lombardy, Emilia-Romagna, and Veneto host major pigment producers and coating manufacturers. The region benefits from developed infrastructure, skilled labor, and high R&D capabilities. Industrial applications in automotive, construction, and packaging drive steady pigment consumption. The Italy Pigments Market in this region thrives on innovation and technology partnerships with European chemical companies. It also supports export-driven production, benefiting from proximity to central EU markets. Continuous investment in eco-friendly pigment technologies reinforces Northern Italy’s leadership position.

Central Italy: Expanding Coating and Decorative Application Base (28% Market Share)

Central Italy contributes 28% of the market, driven by growth in decorative paints, ceramics, and printing applications. Tuscany and Lazio play key roles due to their focus on design-oriented industries and artisanal manufacturing. The region’s architectural heritage encourages use of sustainable pigment-based coatings in restoration projects. Local SMEs are adapting pigment formulations for high-end textile and ceramic applications. The Italy Pigments Market benefits from this region’s emphasis on customized, aesthetic materials with enhanced performance. It also experiences rising demand from interior décor and digital printing sectors. Collaboration between research institutes and local manufacturers strengthens product quality and differentiation.

Southern Italy: Emerging Industrial Zone with Growing Export Potential (20% Market Share)

Southern Italy accounts for 20% of the market, with notable growth across Campania, Puglia, and Sicily. Industrial development programs and new manufacturing facilities are improving regional competitiveness. Local producers focus on cost-effective pigment production for plastics, inks, and coatings. The Italy Pigments Market in this region benefits from improved logistics and port connectivity. It shows growing participation in EU-funded sustainability projects supporting green manufacturing. Rising exports to North Africa and the Middle East further boost demand. It remains an emerging center for pigment production expansion and supply diversification.

Key Player Analysis

- Gi-Emme Srl

- Richard Colorants

- EuroColori

- Venator Pigments Italy SAS

- Arkema S.A.

- BASF SE

- Clariant AG

- Harold Scholz & Co. GmbH

- Farbenwerke Wunsiedel GmbH

Competitive Analysis

The Italy Pigments Market is highly competitive, featuring both multinational and regional manufacturers. Key players include BASF SE, Clariant AG, DIC Corporation, LANXESS AG, Venator Materials PLC, Ferro Corporation, Heubach GmbH, Merck KGaA, Sibelco, and Sun Chemical. These companies focus on product innovation, capacity expansion, and sustainability initiatives to strengthen market presence. It demonstrates an increasing shift toward specialty pigments catering to advanced coating and plastic applications. Local firms emphasize customized formulations for decorative paints, ceramics, and printing industries. Multinationals such as BASF and Clariant lead with advanced dispersion technologies and high-purity product lines. Strategic partnerships and acquisitions enhance product portfolios and customer reach. Continuous investment in R&D supports innovation in eco-friendly pigments aligning with EU Green Deal goals. This competitive environment encourages innovation-driven growth and reinforces Italy’s position within the European pigment industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In October 2025, Tronox Holdings plc, one of the leading global producers of high-quality titanium dioxide pigments, announced the declaration of its fourth quarter dividend as part of its broader market operations, reflecting active engagement in the pigment sector and highlighting the company’s ongoing presence within the Italy pigments market.

- In October 2025, LANXESS showcased its diverse polymer additives, colorants, and heat-stable inorganic pigments at the K 2025 event from October 8 to 15, emphasizing product innovation in the specialty chemicals sector that supports the pigments market in Europe.

- In October 2024, Heubach GmbH agreed to be acquired by Sudarshan Chemical Industries Limited in a strategic move that cements a global pigment powerhouse with strong European market influence. This acquisition will address Heubach’s recent financial and operational challenges.

Report Coverage

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for eco-friendly and low-VOC pigments will drive product innovation across coatings and plastics.

- Italian manufacturers will expand capacity through automation and energy-efficient production technologies.

- Nanotechnology-based pigments will gain traction due to superior performance in color depth and stability.

- The shift toward digital and inkjet printing applications will create new growth opportunities for pigment producers.

- Partnerships between pigment manufacturers and architectural firms will boost adoption in sustainable construction projects.

- Italy will strengthen exports within the EU, supported by technological leadership and product quality.

- Specialty pigments with smart and functional features will gain higher demand in luxury automotive coatings.

- Local firms will invest in R&D to meet EU Green Deal compliance and improve circular production systems.

- Advanced dispersion technologies will enhance pigment consistency and energy efficiency in processing operations.

- The Italy Pigments Market will experience steady expansion driven by design-focused industries and green innovations.