Market Overview:

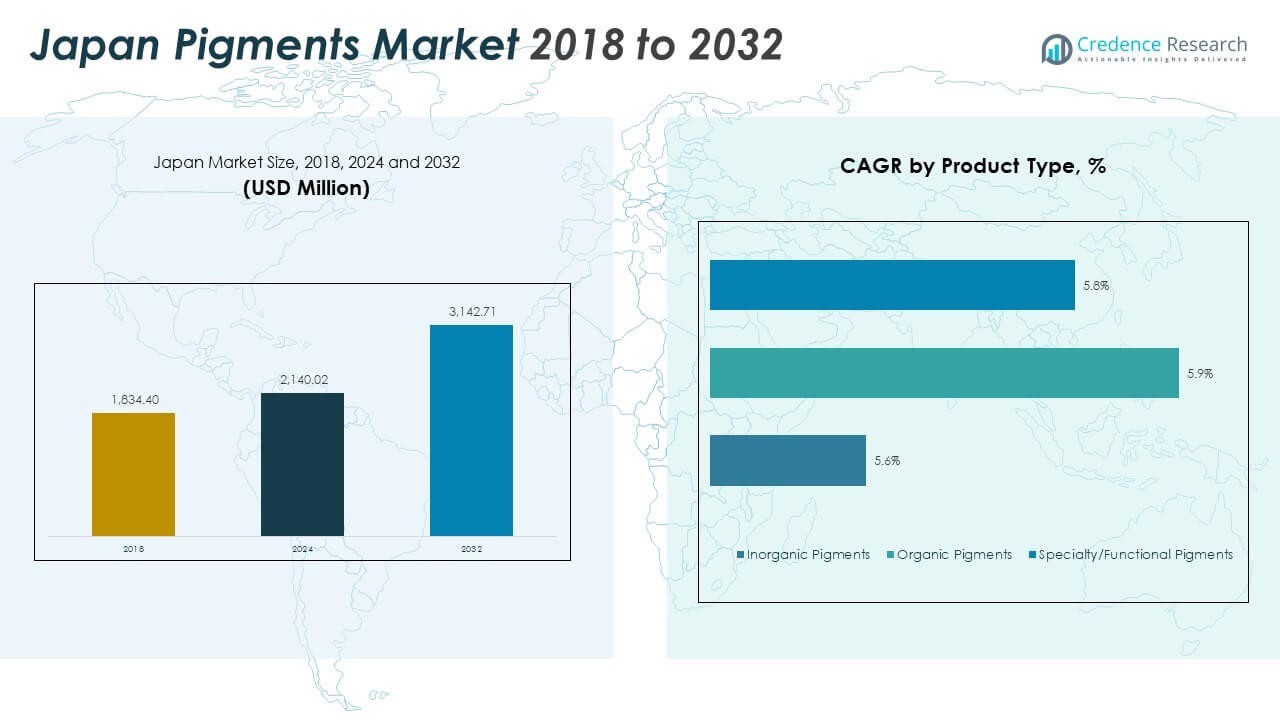

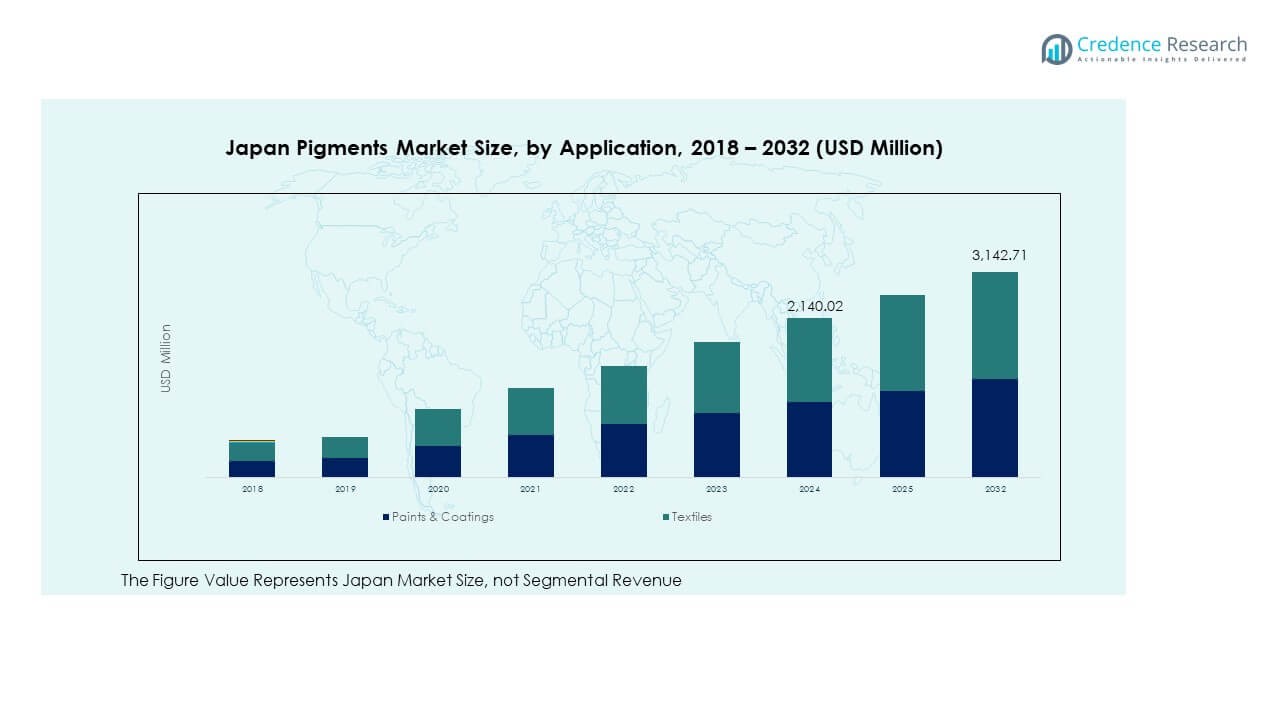

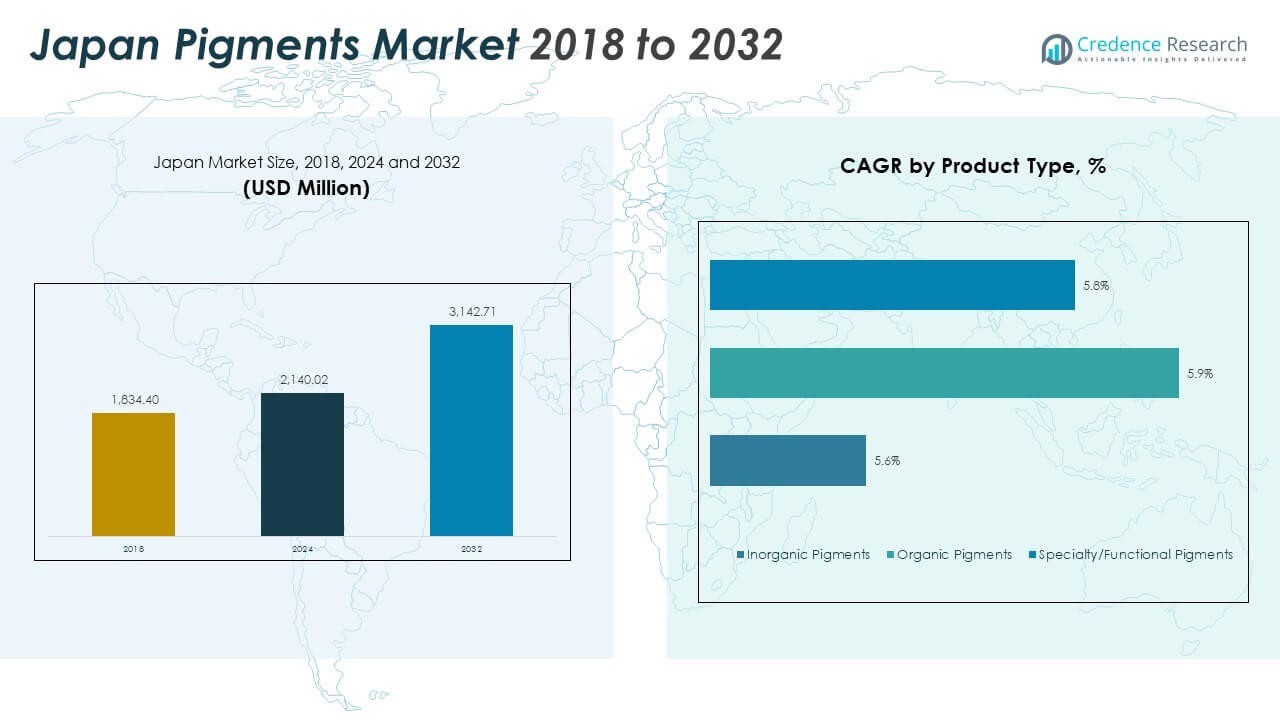

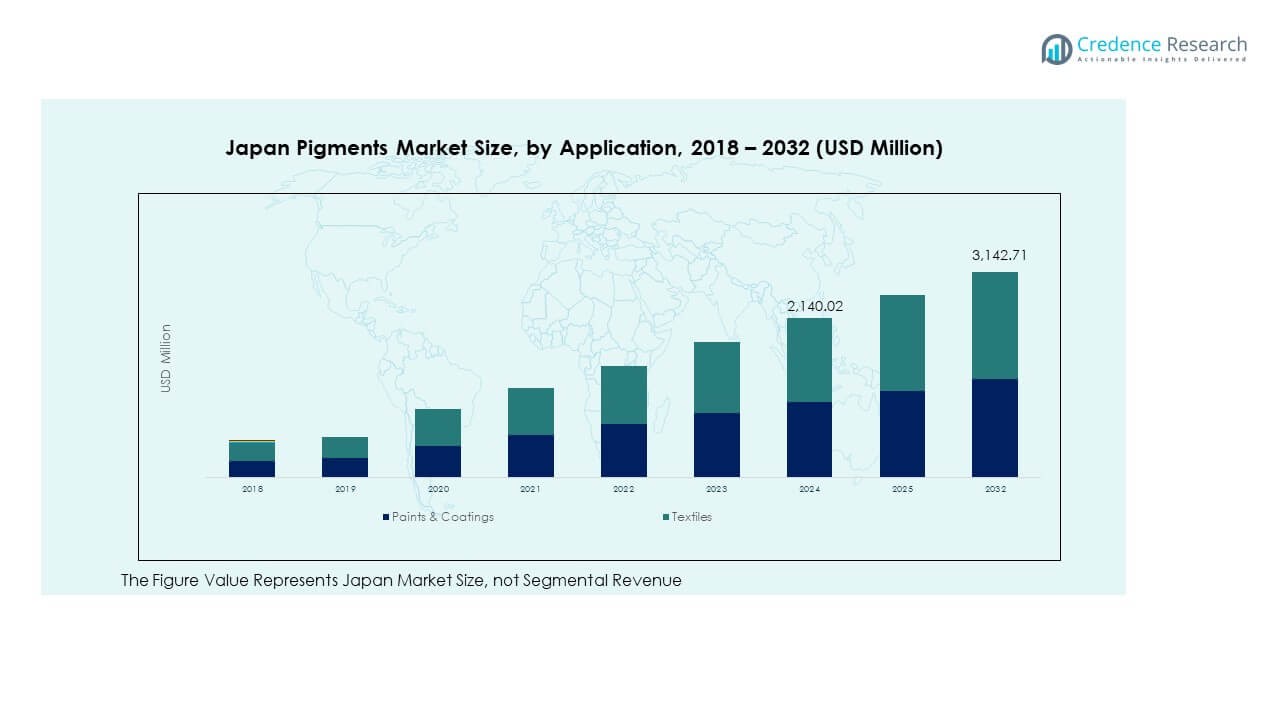

The Japan Pigments Market size was valued at USD 1,834.40 million in 2018 to USD 2,140.02 million in 2024 and is anticipated to reach USD 3,142.71 million by 2032, at a CAGR of 4.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Pigments Market Size 2024 |

USD 2,140.02 Million |

| Japan Pigments Market, CAGR |

4.92% |

| Japan Pigments Market Size 2032 |

USD 3,142.71 Million |

The market is growing steadily due to increasing demand from automotive coatings, plastics, and construction materials. Strong industrial activity and sustainability initiatives are driving innovations in eco-friendly pigments with low volatile organic compounds. Rising applications in packaging, textiles, and consumer goods further accelerate adoption. It benefits from advancements in dispersion technology and nanostructured pigments, enhancing product performance and color accuracy. These developments continue to support growth in high-end and specialized pigment segments.

Regionally, the Kanto and Kansai regions dominate the Japan pigments market due to their concentration of major pigment producers and manufacturing hubs. The Kanto area benefits from strong demand in automotive and electronics industries, while Kansai serves as a major export base for specialty pigments. Emerging regions such as Kyushu and Chubu are expanding production capacities to meet industrial diversification. It strengthens domestic supply resilience and supports Japan’s growing focus on sustainable and high-performance pigment production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Pigments Market was valued at USD 1,834.40 million in 2018, reaching USD 2,140.02 million in 2024, and is projected to attain USD 3,142.71 million by 2032, growing at a CAGR of 4.92% during 2025–2032.

- The Kanto region (41%) dominates due to its strong automotive and electronics manufacturing base, followed by Kansai (33%) driven by pigment exports and material innovation, and Kyushu–Chubu (26%) benefiting from industrial diversification and electronics production.

- Kyushu emerges as the fastest-growing region with 26% share, supported by expanding semiconductor facilities and new pigment production investments aligned with sustainable manufacturing goals.

- Paints & Coatings hold the largest segment share at 54%, supported by automotive and architectural demand for durable, UV-resistant pigments.

- The Textiles segment follows with 27% share, reflecting increased pigment use in fashion, apparel printing, and high-quality fabric finishes driven by Japan’s design-oriented consumer markets.

Market Drivers

Rising Demand for High-Performance and Eco-Friendly Pigments in Industrial Applications

The growing demand for high-performance pigments is driving innovation across coatings, plastics, and textiles. Manufacturers in the Japan Pigments Market emphasize sustainable production to meet stricter environmental standards. Titanium dioxide and organic pigments are gaining attention for their brightness, chemical stability, and low environmental impact. The focus on waterborne coatings and bio-based pigments aligns with Japan’s carbon neutrality goals. It supports industries seeking durable and low-VOC coloring solutions. The expansion of eco-friendly formulations helps companies secure regulatory compliance. Continuous R&D investments strengthen the market’s innovation pipeline. Government-backed environmental policies enhance pigment modernization initiatives.

Expansion of Automotive and Construction Industries Fueling Pigment Utilization

Japan’s automotive and construction industries create major demand for decorative and functional pigments. Advanced coatings using color-stable and UV-resistant pigments improve durability and aesthetic performance. The Japan Pigments Market benefits from these industries’ need for long-lasting surface finishes. Pigments enable scratch resistance and thermal protection in automotive paints. In construction, pigment-based coatings improve building exteriors and materials like cement tiles. Strong urban development projects across Tokyo, Osaka, and Nagoya stimulate pigment consumption. It promotes higher adoption of inorganic and specialty pigments. The combination of innovation and industrial expansion supports steady market growth.

- For instance, Nippon Paint Holdings Co., Ltd. announced the construction of a new automotive coatings plant in Shoo-cho, Okayama Prefecture, in April 2021 to expand domestic production capacity. The facility was designed to meet growing demand from Japan’s major automotive manufacturers, with operations planned to commence in 2023.

Technological Advancements Enhancing Dispersion and Color Precision in Pigment Manufacturing

Advancements in pigment milling, dispersion, and crystallization technologies drive efficiency and product quality. Japanese manufacturers focus on achieving micro-level particle uniformity to ensure high tinting strength. The Japan Pigments Market witnesses adoption of advanced dispersion systems in coatings and inks. Automation and digital quality control improve consistency in large-scale pigment production. It helps achieve precise color control across multiple industrial applications. Nanotechnology-based pigments enhance transparency and optical performance in premium coatings. Continuous improvement in production techniques supports product differentiation and cost efficiency. These innovations strengthen Japan’s competitiveness in global pigment supply chains.

- For instance, in 2024, DIC Corporation announced that it was strengthening its investment in sustainable pigment innovation and advanced dispersion technologies as part of its global sustainability strategy. The company’s 2024 Integrated Report highlighted ongoing development of low-VOC colorants and bio-based pigment formulations aimed at reducing environmental impact across coatings and plastics sectors.

Shift Toward Bio-Based and Circular Economy Pigments Supporting Sustainability Goals

The growing emphasis on sustainability encourages pigment producers to adopt renewable raw materials. Bio-based pigments derived from natural sources offer biodegradable and low-emission alternatives. The Japan Pigments Market benefits from corporate sustainability goals and environmental certifications. Manufacturers are shifting toward closed-loop pigment recovery and waste reduction systems. It reduces dependency on synthetic feedstocks and lowers manufacturing footprints. Strategic collaborations between pigment producers and chemical companies promote sustainable pigment innovation. The trend aligns with Japan’s Green Growth Strategy, promoting clean industrial development. These initiatives position Japan as a leader in sustainable pigment production.

Market Trends

Increasing Adoption of Nanostructured Pigments for Advanced Coating and Printing Applications

Nanostructured pigments are transforming color performance and durability in coatings and printing inks. Their ability to deliver superior opacity, gloss, and UV resistance makes them ideal for high-end uses. The Japan Pigments Market is witnessing adoption in automotive, electronics, and packaging sectors. Manufacturers are developing nano-scale pigment dispersions to ensure consistent color rendering. It improves surface smoothness and stability under extreme environmental conditions. Demand for nanotechnology-based pigment formulations is expanding in architectural and industrial coatings. Precision-engineered pigment nanoparticles enhance metallic and pearlescent effects. The advancement reflects Japan’s strong R&D and material science expertise.

- For instance, Kansai Paint Co., Ltd. has focused on developing next-generation automotive coatings emphasizing energy efficiency and sustainability. The company’s recent R&D initiatives highlight low-VOC and high-durability formulations designed to enhance coating performance and meet Japan’s evolving environmental standards.

Growing Use of Smart and Functional Pigments Across Multiple Industrial Sectors

Smart pigments offering thermochromic, photochromic, and luminescent properties are gaining traction. These pigments enable color changes in response to light or temperature variations. The Japan Pigments Market is integrating such innovations in textiles, packaging, and electronics. They enhance product appeal while adding functional value to materials. It helps manufacturers meet the increasing demand for interactive and intelligent design solutions. Smart pigments also support anti-counterfeiting and security features in high-value goods. Rising focus on multifunctional materials encourages further development in this domain. Japan’s leadership in electronics manufacturing supports rapid adoption of functional pigments.

Shift Toward Digital Color Management and Advanced Dispersion Technologies

Digital color management systems are optimizing pigment production precision and performance. Automated blending and dispersion technologies ensure uniform quality across applications. The Japan Pigments Market is adopting AI-driven systems to control pigment formulation accuracy. Integration of digital tools reduces color deviation and waste during production. It supports consistency in automotive and consumer goods coatings. Advanced dispersion aids improve pigment stability in high-shear environments. Digitalization enables real-time process control, enhancing efficiency and reproducibility. These innovations align with Japan’s industrial automation and smart manufacturing framework.

- For instance, Sakata INX Corporation introduced advanced color management and digital quality control systems in 2023 to improve pigment dispersion consistency in printing inks. The technology supports gravure and flexographic printing processes, ensuring stable color reproduction and reduced production waste across packaging applications.

Growing Popularity of Recycled and Renewable Pigment Sources in Green Manufacturing

Recycled pigments made from waste materials are gaining market attention. The Japan Pigments Market aligns with global sustainability goals through the use of recovered feedstocks. Pigments derived from recycled plastics and metals reduce landfill waste. It allows manufacturers to achieve circular production cycles and lower emissions. Demand for renewable pigments from algae or plant sources is increasing. These alternatives offer improved biodegradability without compromising color quality. Collaborative initiatives with universities and R&D centers promote innovation in this area. The shift reinforces Japan’s commitment to green chemistry and resource conservation.

Market Challenges Analysis

Stringent Environmental Regulations and Rising Compliance Costs Affecting Pigment Producers

Japan’s environmental policies impose strict rules on VOC emissions and hazardous materials. Compliance with REACH-like standards demands high investment in cleaner technologies. The Japan Pigments Market faces challenges in transitioning to low-emission formulations. Upgrading production lines to meet carbon-neutral targets increases operational costs. It limits smaller manufacturers’ ability to compete with large chemical producers. Waste disposal and solvent recovery requirements further strain profit margins. Delays in regulatory approval slow product introductions in niche pigment categories. Managing compliance while sustaining profitability remains a core challenge for many market participants.

Volatility in Raw Material Prices and Supply Chain Disruptions Impacting Production Stability

Raw materials such as titanium dioxide and organic intermediates experience frequent price fluctuations. The Japan Pigments Market is affected by dependency on imported chemical inputs. It faces challenges in maintaining steady supply and production costs during global disruptions. Transportation delays and raw material shortages disrupt delivery timelines. The instability pressures manufacturers to diversify sourcing and enhance inventory control. High logistics costs affect export competitiveness, particularly in Asia-Pacific markets. Fluctuating energy costs also influence overall manufacturing expenses. Balancing cost efficiency with consistent pigment quality remains a persistent industry concern.

Market Opportunities

Emerging Demand for Sustainable Pigments in Consumer Goods and Packaging Industries

The global move toward eco-friendly materials creates strong opportunities for pigment suppliers. The Japan Pigments Market benefits from increased use of recyclable and non-toxic pigments in packaging. It encourages adoption of waterborne and solvent-free formulations across consumer products. Expanding e-commerce and branding requirements drive demand for high-quality printing inks. The transition toward biodegradable pigments provides new business avenues for local producers. Rising consumer awareness supports the preference for cleaner pigment technologies. These factors enhance growth prospects for sustainable pigment solutions in multiple industries.

Rising Innovation in High-Performance Pigments for Electronics and Automotive Coatings

Japan’s strong manufacturing base in electronics and automotive sectors drives new pigment innovations. The Japan Pigments Market experiences high demand for heat-resistant, conductive, and anti-corrosive pigments. It creates opportunities for functional pigment development targeting high-performance coatings. Advanced metallic and interference pigments are gaining traction in luxury finishes. Collaborations between chemical firms and automotive OEMs accelerate new product launches. Integration of nanostructured pigments enhances the visual and functional performance of components. The growing focus on durable and energy-efficient coatings expands investment potential in this field.

Market Segmentation Analysis

By Product, in the Japan Pigments Market, inorganic pigments lead due to their superior durability, color consistency, and cost-effectiveness across multiple industries. Titanium dioxide (TiO₂) continues to dominate because of its high opacity, whiteness, and UV resistance, while zinc oxide supports anti-corrosive and heat-resistant applications in coatings and ceramics. Other inorganic pigments, such as iron oxides, remain vital for construction and architectural uses owing to their chemical stability. Organic pigments follow, driven by rising demand for vibrant, eco-friendly colors in textiles, packaging, and printing inks. Specialty and functional pigments, including pearlescent, thermochromic, and conductive types, are gaining traction for their unique optical and protective properties in electronics, automotive coatings, and high-end consumer goods. It supports Japan’s focus on advanced material innovation and sustainability, where producers are developing bio-based and solvent-free formulations to meet environmental standards while maintaining superior performance and visual appeal.

- For instance, Nature Coatings a 2025 Hokkaido F Village x HFX cohort selection deployed its BioBlack™ pigment, which is 100% bio-based and carbon-negative, derived from FSC-certified wood waste, and contains zero detectable toxins (PAHs, PFAS, VOCs).

By Application – Paints and coatings represent the largest application segment due to their extensive use in automotive, architecture, and industrial surfaces. Textiles and printing inks utilize pigments for durable color performance and improved aesthetics. The Japan Pigments Market records growing pigment demand in plastics for packaging, electronics, and consumer goods. It ensures color consistency and resistance under varying temperatures. Leather and specialty applications use pigments to enhance appearance and durability. Expanding construction and consumer product industries continue to sustain strong pigment consumption across Japan.

- For instance, Nikko Chemicals showcased advanced pigment dispersion technology at in-cosmetics Asia 2025 (BITEC, Bangkok, November 2025), enabling foundation color-matching with high-definition dispersion for a wide spectrum of skin tones. The demonstration cited improved color adaptability and shade versatility, and visitors actively tested pigment technology developed by Nikko Chemicals’ R&D Center for cosmetics and sunscreens.

Segmentation

By Product Type

- Inorganic Pigments

- Titanium Dioxide (TiO₂)

- Zinc Oxide

- Others

- Organic Pigments

- Specialty/Functional Pigments

By Application

- Paints & Coatings

- Textiles

- Printing Inks

- Plastics

- Leather

- Other Applications

Regional Analysis

Kanto Region – Leading Hub with Strong Industrial and Manufacturing Base (Share: 41%)

The Kanto region dominates the Japan Pigments Market, supported by a robust concentration of automotive, electronics, and construction industries. Tokyo and Kanagawa serve as primary centers for pigment consumption due to their dense manufacturing and design clusters. High adoption of high-performance pigments in coatings and inks contributes to steady growth. It benefits from advanced R&D infrastructure and the presence of major pigment producers. Strong demand from automotive OEMs for durable and low-VOC coatings further enhances regional dominance. Expanding architectural and packaging applications sustain pigment utilization across industrial sectors.

Kansai Region – Key Export-Oriented Center for High-Quality Pigment Production (Share: 33%)

The Kansai region ranks second in market share, driven by its advanced chemical and material industries. Osaka and Hyogo prefectures lead in pigment manufacturing and export activities. The Japan Pigments Market benefits from this region’s strong production capacity and innovation ecosystem. It focuses on developing eco-friendly and specialty pigments aligned with green manufacturing trends. The local supply chain supports efficient distribution to domestic and global markets. Kansai’s expertise in precision chemicals and dyes ensures consistent product quality. Ongoing investments in digital pigment technologies reinforce the region’s competitiveness.

Kyushu and Chubu Regions – Emerging Pigment Manufacturing Clusters (Share: 26%)

Kyushu and Chubu regions are emerging centers for pigment expansion due to increasing industrial diversification. The Japan Pigments Market in these areas benefits from proximity to electronics, semiconductor, and plastic processing facilities. It enables faster pigment integration into high-tech applications. Kyushu’s growing chemical industry supports capacity expansion in eco-friendly pigment production. Chubu’s strong automotive supply chain boosts pigment demand for coatings and components. Regional policies promoting industrial innovation and sustainability attract new pigment manufacturers. This growing footprint enhances Japan’s overall pigment production network and market resilience.

Key Player Analysis

- DIC Corporation

- SANYO COLOR WORKS, Ltd.

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- Fuji Pigment Co., Ltd.

- Ishihara Techno Corporation

- Nagase & Co., Ltd.

- Nemoto & Co., Ltd.

- Nihon Koken Kogyo Co., Ltd.

- Eidai Kagaku Co., Ltd.

- Nippon Light Metal Co., Ltd.

Competitive Analysis

The Japan Pigments Market features a competitive landscape led by multinational and domestic producers focusing on innovation, quality, and sustainability. Key companies include DIC Corporation, Sakai Chemical Industry Co., Ltd., Toyo Ink SC Holdings Co., Ltd., Fujifilm Corporation, Nippon Kayaku Co., Ltd., and Merck KGaA Japan. It emphasizes continuous development of high-performance pigments with superior dispersion, brightness, and durability. Manufacturers are investing in nanostructured and low-carbon pigment technologies to meet environmental regulations. Strategic collaborations with automotive and electronics manufacturers enhance product integration across key applications. Firms leverage automation and digital color management to ensure consistency and reduce production costs. Global players strengthen their regional footprint through R&D expansion and sustainable production facilities in Japan. This competition fosters technological advancement and drives the transition toward eco-efficient pigment solutions across the Japanese market.

Recent Developments

- In August 2025, DIC Corporation established a new sustainable production facility in Indonesia for coatings designed for direct food contact materials. This state-of-the-art facility, operated by subsidiary PT. DIC Graphics, demonstrates DIC’s commitment to sustainable manufacturing in the coatings and pigments domain. The investment supports growing demand for sustainable packaging solutions worldwide.

- In March 2025, Sudarshan Chemical Industries Limited finalized the acquisition of Germany-based Heubach Group through a combination of asset and share deals. This strategic move creates a global pigment leader, expanding Sudarshan’s portfolio and presence to 19 global sites, with enhanced technologies and market strength, especially in Europe and the Americas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan Pigments Market will advance through stronger demand for eco-friendly and low-VOC formulations across industrial sectors.

- Continuous innovation in nanostructured and bio-based pigments will enhance performance and sustainability in coatings and plastics.

- Expanding automotive and construction activities will sustain long-term pigment consumption, driven by high-quality color and durability needs.

- Growth in digital printing and packaging will increase demand for high-dispersion organic and specialty pigments.

- Rising integration of smart pigments with thermochromic and luminescent properties will support advanced material applications.

- The shift toward circular manufacturing will promote pigment recycling and waste reduction within production facilities.

- Regional expansion in Kyushu and Chubu will strengthen domestic supply chains and reduce import dependency.

- Collaboration between pigment producers and electronic component manufacturers will drive functional pigment innovations.

- Automation and digital color management systems will improve manufacturing precision and reduce operational inefficiencies.

- The market will continue to align with Japan’s carbon-neutral goals, supporting growth through green chemistry initiatives and regulatory compliance.