Market Overview

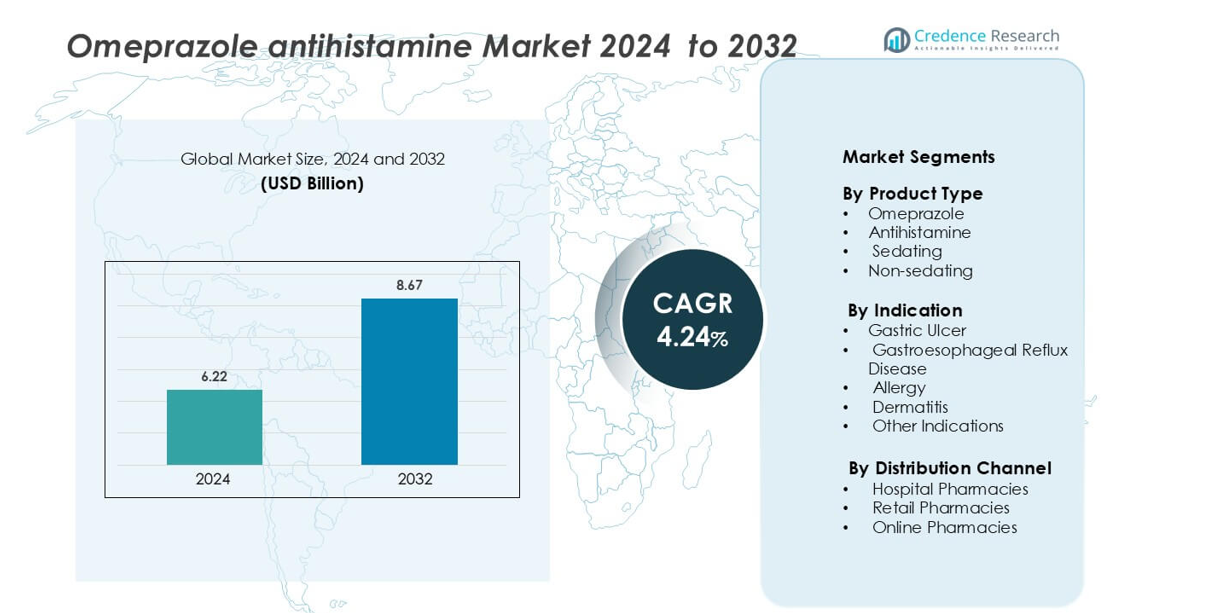

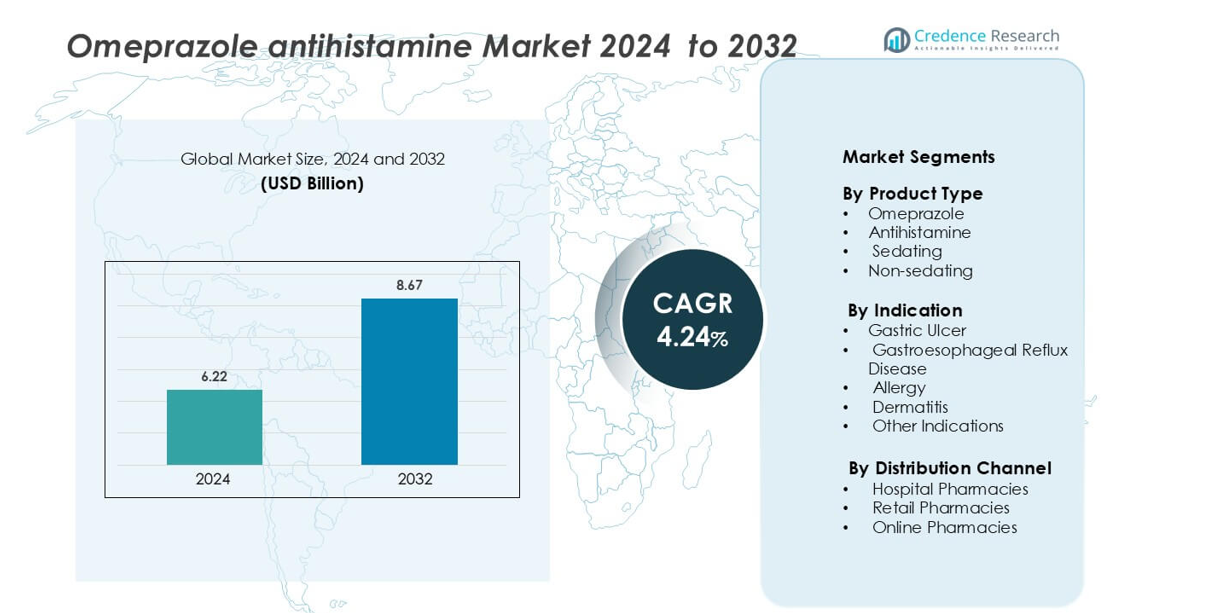

Omeprazole antihistamine Market size was valued USD 6.22 billion in 2024 and is anticipated to reach USD 8.67 billion by 2032, at a CAGR of 4.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Omeprazole Antihistamine Market Size 2024 |

USD 6.22 billion |

| Omeprazole Antihistamine Market, CAGR |

4.24% |

| Omeprazole Antihistamine Market Size 2032 |

USD 8.67 billion |

The omeprazole antihistamine market features strong competition among leading pharmaceutical companies focusing on innovation, safety, and treatment effectiveness. Major players include Pfizer Inc., Bayer AG, Takeda Pharmaceutical Company Limited, Johnson & Johnson, Novartis AG, GlaxoSmithKline PLC, AstraZeneca PLC, Sanofi S.A., Merck & Co., Inc., and Teva Pharmaceutical Industries Ltd. These companies are expanding their portfolios through improved formulations, long-acting non-sedating antihistamines, and enhanced omeprazole delivery systems. Asia Pacific dominates the global market with a 37% share, driven by high prevalence of acid reflux and allergic disorders, growing healthcare accessibility, and rapid urbanization across countries such as China, India, and Japan.

Market Insights

- The omeprazole and antihistamine market was valued at USD 6.22 billion in 2024 and is projected to reach USD 8.67 billion by 2032, growing at a CAGR of 4.24% during the forecast period.

- Rising prevalence of gastrointestinal and allergic disorders drives market growth, with omeprazole leading the product type segment holding a 46% share due to its effectiveness in GERD and ulcer treatment.

- Market trends include increasing adoption of non-sedating antihistamines and advanced oral formulations that improve patient compliance and therapeutic outcomes.

- The market is competitive, with key players such as Pfizer Inc., Bayer AG, Takeda Pharmaceutical Company Limited, and AstraZeneca PLC focusing on product innovation, regulatory approvals, and OTC product expansion.

- Asia Pacific dominates with a 37% share, followed by North America at 29% and Europe at 26%, supported by rising healthcare expenditure and growing access to prescription and over-the-counter medications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

The omeprazole segment dominates the market with a 46% share, driven by its widespread use in managing acid-related disorders such as gastric ulcers and gastroesophageal reflux disease (GERD). Omeprazole’s strong efficacy in reducing stomach acid secretion and its inclusion in standard treatment protocols enhance its adoption globally. The availability of both prescription and over-the-counter formulations supports accessibility across diverse patient groups. Additionally, the increasing prevalence of gastrointestinal conditions caused by unhealthy diets and stress continues to strengthen demand for omeprazole-based products.

- For instance, in one multi-center trial, 81% of gastric ulcer patients receiving 20 mg daily healed after four weeks. Other studies confirm that most patients with peptic ulcers heal within this timeframe.

By Indication

Gastroesophageal reflux disease (GERD) leads the indication segment with a 39% share due to rising cases linked to obesity, sedentary lifestyles, and poor dietary habits. Omeprazole-based therapies are the preferred treatment for long-term acid suppression, improving patient outcomes and quality of life. The allergy segment also shows notable growth driven by non-sedating antihistamines used for respiratory allergies. Increasing awareness of early diagnosis and chronic GERD management supports the segment’s sustained market dominance.

- For instance, Omeprazole 20 mg once daily produced complete heartburn resolution in 48% of patients by week four, compared with just 5% in the placebo group.

By Distribution Channel

Retail pharmacies hold the largest share at 51%, supported by their widespread availability and consumer preference for direct access to both prescription and over-the-counter medications. Pharmacies play a crucial role in distributing omeprazole and antihistamine drugs for gastrointestinal and allergy-related conditions. Growing patient convenience and accessibility in urban and semi-urban areas further enhance their dominance. Online pharmacies are rapidly expanding due to digital health adoption and home delivery options, while hospital pharmacies remain vital for dispensing medications in inpatient care and chronic condition management.

Key Growth Drivers

Rising Prevalence of Gastrointestinal and Allergic Disorders

The increasing global incidence of gastrointestinal diseases such as GERD, peptic ulcers, and acid reflux is a primary growth driver for the omeprazole and antihistamine market. Sedentary lifestyles, poor dietary patterns, and stress have led to higher cases of gastric and acid-related conditions. Similarly, rising air pollution, changing weather patterns, and allergen exposure are fueling the demand for antihistamines to manage allergic rhinitis, dermatitis, and respiratory allergies. The dual therapeutic demand across digestive and allergy-related treatments supports strong market expansion. Growing adoption of combination therapies and self-medication practices further accelerates product consumption in both segments.

- For instance, a 2006 trial found that esomeprazole was significantly more effective than omeprazole for patients with moderate to severe esophagitis (LA grades C or D).

Expanding Over-the-Counter (OTC) Availability and Accessibility

The shift toward over-the-counter accessibility of omeprazole and non-sedating antihistamines has significantly improved patient convenience and boosted sales. Consumers increasingly prefer OTC medications for mild to moderate symptoms of acidity, allergies, and nasal congestion. Regulatory approvals allowing wider retail availability of drugs such as omeprazole and loratadine are strengthening distribution networks globally. Retail pharmacies and e-commerce platforms have become major sales channels, expanding reach in both developed and emerging markets. This growing accessibility, coupled with increasing healthcare awareness and self-treatment culture, continues to drive the market’s overall growth trajectory.

- For instance, Pfizer launched Nexium 24HR as an OTC product, extending access to over 20,000 retail stores across the U.S., leading to double-digit growth in its digestive health segment.

Technological Advancements and Product Innovation

Continuous innovation in drug formulations and delivery systems enhances treatment effectiveness and patient compliance. Pharmaceutical companies are investing in developing sustained-release capsules, chewable tablets, and orally disintegrating formulations to improve convenience and bioavailability. In antihistamines, advancements have focused on non-sedating and long-acting compounds that minimize side effects while offering 24-hour symptom relief. Digital health tools and AI-based prescription management systems further support appropriate usage and adherence. The increasing adoption of novel drug delivery platforms not only boosts treatment outcomes but also provides companies with opportunities for product differentiation and market competitiveness.

Key Trends and Opportunities

Growing Adoption of Combination Therapies

The market is witnessing a strong trend toward combination drugs that address multiple symptoms simultaneously. Physicians increasingly prescribe formulations combining omeprazole with antihistamines or antibiotics to manage reflux-related coughs, allergic rhinitis with GERD, or H. pylori infections. This integrated treatment approach enhances patient outcomes while reducing polypharmacy risks. Pharmaceutical companies are capitalizing on this trend by developing multi-symptom relief products with optimized dosages and minimal side effects. The growing clinical evidence supporting such combinations and the convenience of single-dose regimens present lucrative opportunities for market expansion, particularly in emerging economies with high self-medication rates.

- For instance, a crossover study with 12 volunteers showed that adding ranitidine (150 mg or 300 mg) at bedtime to a twice-daily omeprazole regimen was more effective at suppressing nocturnal acid secretion (keeping intragastric pH > 4) than adding a third dose of omeprazole.

Expansion of Digital Health and Online Pharmacies

The integration of digital health solutions and e-commerce platforms is transforming the pharmaceutical distribution landscape. Online pharmacies enable easy access to omeprazole and antihistamine medications, supported by home delivery and teleconsultation services. This shift is particularly beneficial for chronic patients requiring regular refills. Moreover, digital prescription tools and patient adherence apps help ensure safe use and proper dosage. As internet penetration and digital literacy increase, especially in Asia-Pacific and Latin America, online pharmacy adoption is expected to grow. This digital shift creates new revenue streams and strengthens customer engagement in the long term.

- For instance, the UK-based digital health company Healthera rolled out a same-hour prescription delivery option and partnered with ride-share services to serve over 50 major pharmacies, offering direct-to-patient drug delivery for a broad range of medications.

Key Challenges

Side Effects and Drug Interaction Risks

Despite their effectiveness, both omeprazole and antihistamines face challenges related to side effects and potential drug interactions. Long-term omeprazole use can cause nutrient malabsorption, kidney complications, or gut microbiota imbalance. Sedating antihistamines may impair alertness, while non-sedating variants can still interact with other central nervous system medications. These safety concerns often lead to stricter prescription monitoring and limit extended use. Moreover, the growing emphasis on personalized medicine and regulatory oversight requires continuous pharmacovigilance efforts. Pharmaceutical companies must focus on patient education and risk mitigation strategies to maintain trust and compliance among healthcare professionals and consumers.

Rising Generic Competition and Price Pressure

The market faces significant pricing challenges due to the widespread availability of generic omeprazole and antihistamine formulations. Patent expirations have opened the market to multiple low-cost manufacturers, particularly in developing regions. While this expands accessibility, it also leads to intense price competition, compressing profit margins for branded producers. Additionally, reimbursement constraints in several countries push healthcare providers and consumers toward cost-effective generics. To remain competitive, leading companies are investing in brand differentiation, novel dosage forms, and patient-centric marketing. However, balancing affordability with innovation remains a persistent challenge across global markets.

Regional Analysis

North America

North America accounts for 29% of the global omeprazole and antihistamine market, driven by a high prevalence of GERD, allergies, and acid-related disorders. The United States leads the region due to a mature pharmaceutical sector and strong demand for OTC medications. Advanced healthcare infrastructure and high consumer awareness support market penetration across both urban and rural areas. Strategic partnerships among major drug manufacturers and retail pharmacy chains also enhance product accessibility. Canada contributes through expanding e-commerce drug distribution and rising self-medication practices for mild allergic and gastric conditions.

Europe

Europe holds a 26% share of the market, supported by well-established healthcare systems and strong demand for antihistamines in managing seasonal allergies. The United Kingdom, Germany, and France are key contributors due to high prescription rates for non-sedating antihistamines and proton pump inhibitors like omeprazole. Stringent drug quality regulations ensure safety and efficacy, boosting patient trust. Increasing adoption of generic formulations and online pharmacy expansion further strengthen the market. Moreover, Europe’s aging population and rising gastrointestinal health concerns continue to drive steady regional growth.

Asia Pacific

Asia Pacific leads the global omeprazole and antihistamine market with a 37% share, supported by rapid urbanization, population growth, and rising gastrointestinal and allergic disease prevalence. China, India, and Japan represent the largest consumer bases due to high pollution levels and dietary changes contributing to GERD and allergy cases. Expanding healthcare access and affordability of generic drugs further drive regional demand. Growing investment by domestic pharmaceutical companies and government efforts to improve OTC drug availability enhance market penetration. Strong e-commerce growth and digital pharmacy adoption continue to boost regional sales.

Latin America

Latin America captures 5% of the market, with Brazil and Mexico as leading contributors. The region’s growth is driven by expanding access to affordable medications and rising awareness of gastrointestinal and allergy treatments. Increasing retail pharmacy networks and improving healthcare infrastructure support the wider availability of omeprazole and antihistamine drugs. Economic development and lifestyle changes have also contributed to higher acid reflux and allergy cases. Local pharmaceutical manufacturing and government-supported healthcare reforms are expected to strengthen regional distribution channels and product accessibility.

Middle East & Africa

The Middle East & Africa region holds a 3% market share, driven by growing healthcare investments and improving pharmaceutical distribution systems. The UAE, Saudi Arabia, and South Africa are key markets supported by the rising burden of allergies, GERD, and skin-related disorders. Expanding retail pharmacies and increasing use of OTC medications are contributing to market growth. Government health programs promoting access to essential drugs are also improving patient outcomes. As awareness of gastrointestinal and allergic conditions increases, the region is poised for gradual but consistent market expansion

Market Segmentations:

By Product Type

By Indication

- Gastric Ulcer

- Gastroesophageal Reflux Disease

- Allergy

- Dermatitis

- Other Indications

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The omeprazole antihistamine market features intense competition among major global pharmaceutical companies. Leading participants such as Pfizer Inc., Bayer AG, Takeda Pharmaceutical Company Limited, and Johnson & Johnson are expanding portfolios through innovative gastrointestinal therapies and combination drug formulations. Novartis AG and GlaxoSmithKline PLC focus on clinical advancements and strategic collaborations to improve efficacy and patient compliance. AstraZeneca PLC and Sanofi S.A. emphasize research partnerships and regional expansion to strengthen brand presence in emerging economies. Merck & Co., Inc. and Teva Pharmaceutical Industries Ltd. invest in generic omeprazole formulations to capture cost-sensitive markets. Continuous product innovation, patent extensions, and regulatory approvals drive competition, while increased emphasis on over-the-counter (OTC) availability enhances consumer accessibility. Strategic alliances, mergers, and targeted marketing campaigns support sustained growth and broader market penetration across therapeutic segments and regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pfizer Inc.

- Bayer AG

- Takeda Pharmaceutical Company Limited

- Johnson & Johnson

- Novartis AG

- GlaxoSmithKline PLC

- AstraZeneca PLC

- Sanofi S.A.

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

Recent Developments

- In February 2024, Alkaloid developed the ready-to-use liquid omeprazole, which is primarily designed to treat reflux esophagitis and GERD in young children unable to swallow tablets, as well as in adult patients who have difficulty swallowing.

- In November 2023, Cipla officially launched the authorized generic version of its own branded product in the U.S. market. This is a common strategy to capture market share before patent challenges from other generic companies succeed.

- In March 2023, Tiefenbacher Pharmaceuticals launched bilastine, an innovative anti-allergy medicine for patients suffering from allergic symptoms, such as hay fever and urticaria, as an over-the-counter (OTC) drug in Germany.

- In June 2022, Purna Pharmaceuticals, with its marketing partner Cipla, received the first and only FDA approval for the FDC of Fexofenadine Hydrochloride and Omeprazole Magnesium (60 mg/20 mg and 180 mg/20 mg). The product is branded for the treatment of symptoms associated with gastroesophageal reflux disease (GERD) in patients with a history of acid-related damage who also require histamine-1 (H1) receptor antagonist therapy.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Indication, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to rising cases of GERD and allergic disorders.

- Demand for non-sedating antihistamines will increase because of better safety and longer relief.

- OTC availability of omeprazole and antihistamine drugs will expand in developing regions.

- Technological innovations will enhance formulation stability and bioavailability of oral drugs.

- Pharmaceutical companies will focus on digital marketing and e-pharmacy partnerships.

- Asia Pacific will remain the leading regional market with strong consumer demand.

- North America will benefit from high awareness and established healthcare infrastructure.

- Increasing adoption of combination therapies will create new treatment opportunities.

- Regulatory emphasis on product safety and quality control will drive innovation.

- Continuous R&D investment in drug delivery systems will strengthen market competitiveness