Market Overview

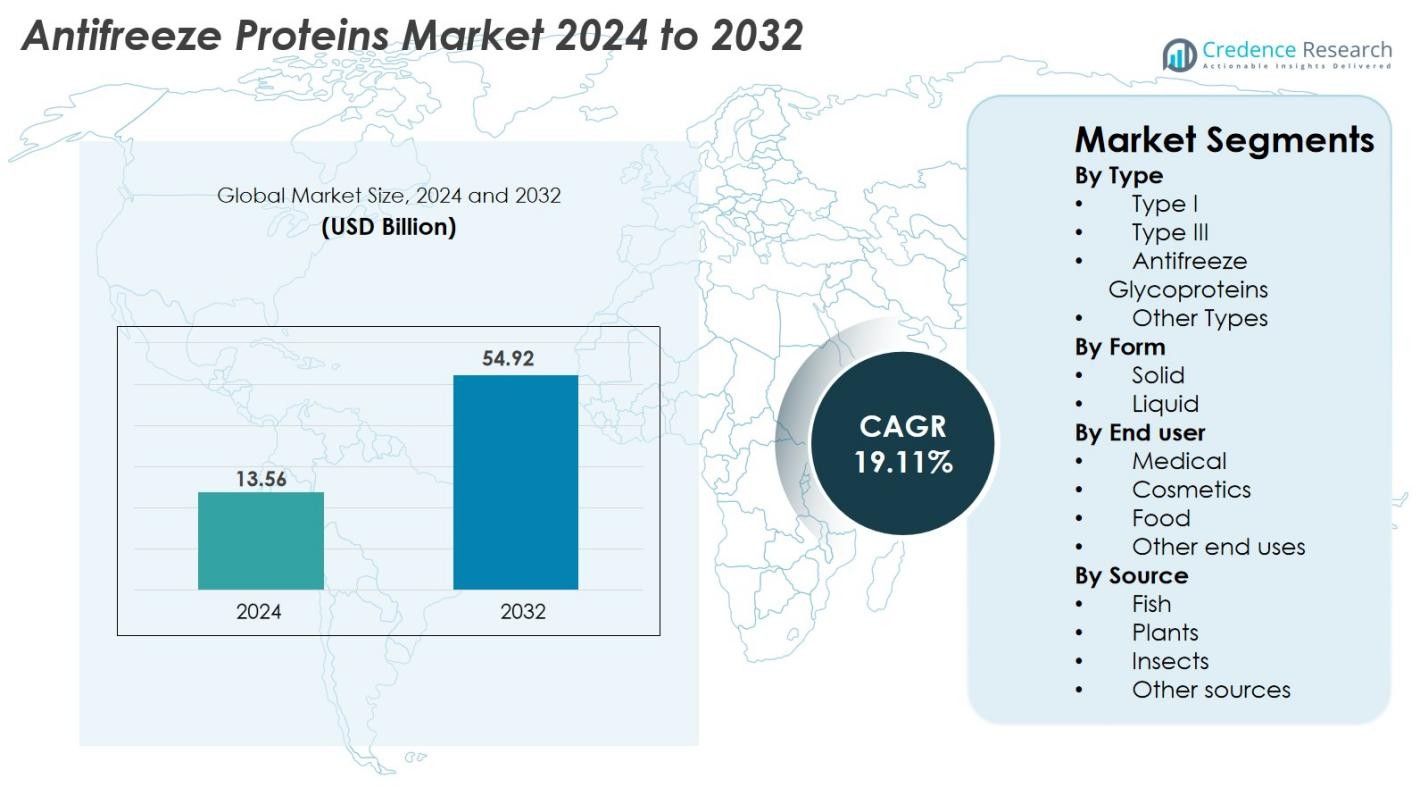

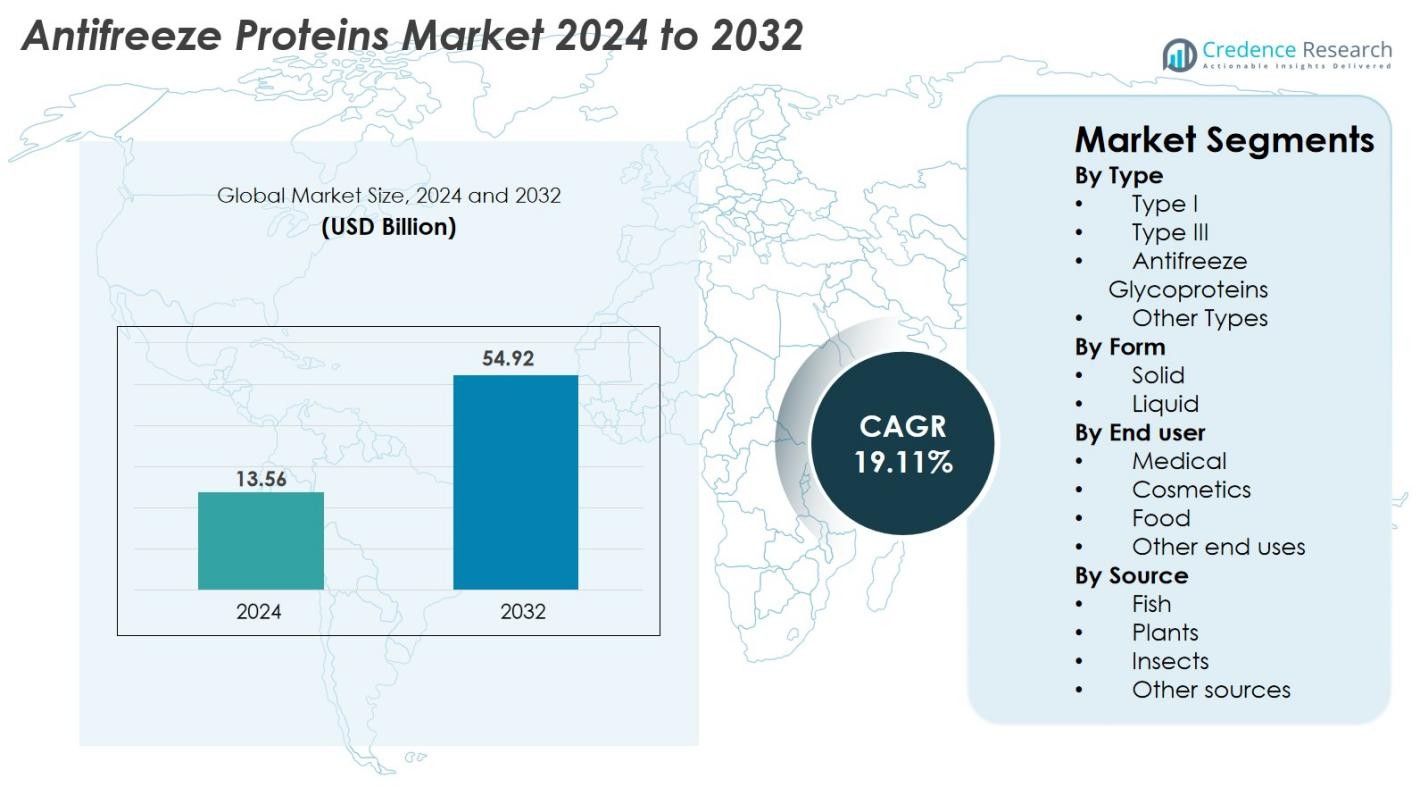

Antifreeze Proteins Market size was valued at USD 13.56 Billion in 2024 and is anticipated to reach USD 54.92 Billion by 2032, at a CAGR of 19.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antifreeze Proteins Market Size 2024 |

USD 13.56 Billion |

| Antifreeze Proteins Market, CAGR |

19.11% |

| Antifreeze Proteins Market Size 2032 |

USD 54.92 Billion |

Antifreeze Proteins Market is driven by strong participation from leading biotechnology and food innovation companies, including Unilever, Kaneka Corporation, Nichirei Corporation, Sirona Biochem, ProtoKinetix Inc., A/F Protein Inc., Shanghai Yu Tao Industrial Co., Ltd., Beijing Huacheng Jinke Technology Co., Ltd., and Rishon Biochem Co., Ltd. These players focus on advanced protein engineering, recombinant production, and high-performance formulations for medical, cosmetic, and frozen food applications. Regionally, North America leads the market with approximately 37% share, supported by strong biopharmaceutical research and cryopreservation adoption, while Europe and Asia-Pacific follow with significant technological advancement and rising demand in food, cosmetics, and aquaculture sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Antifreeze Proteins Market was valued at USD 13.56 Billion in 2024 and is projected to reach USD 54.92 Billion by 2032, registering a CAGR of 19.11% during the forecast period.

- Strong market growth is driven by rising demand in cryopreservation, regenerative medicine, frozen food stabilization, and cosmetic formulations, supported by advancements in biotechnology and protein engineering.

- Key trends include increasing adoption of recombinant AFPs, expanding applications in climate-resilient agriculture, and growing use of AFP-infused premium skincare products across global markets.

- Major companies such as Unilever, Kaneka Corporation, Nichirei Corporation, Sirona Biochem, ProtoKinetix Inc., and A/F Protein Inc. strengthen market competitiveness through innovation, partnerships, and large-scale production initiatives.

- Regionally, North America leads with around 37% share, followed by Europe at 29% and Asia-Pacific at 24%, while the medical end-user segment dominates with nearly 42% share due to high demand in cryobiology and advanced preservation systems.

Market Segmentation Analysis

By Type

The Antifreeze Proteins Market by type is dominated by Type I proteins, accounting for 38% of the market share in 2024. Their widespread use in food preservation, cryopreservation, and aquaculture enhancement drives this dominance. Type I proteins offer superior ice-growth inhibition efficiency, making them preferred in cold-chain logistics and biotechnological applications. Type III and antifreeze glycoproteins also gain traction due to increasing demand in biomedical research and organ preservation. Growing adoption in frozen food processing, regenerative medicine, and cosmetics further accelerates the expansion of all sub-types.

- For instance, Unilever incorporated an ice-structuring protein derived from ocean pout into its “Soft Scoop” product line, using concentrations as low as 0.01% to reduce ice crystal size during repeated freeze–thaw cycles, enabling smoother texture and enhanced stability.

By Form

The market by form is led by the solid segment, holding 57% share in 2024. Solid antifreeze proteins are widely used in pharmaceuticals, frozen foods, and biotechnology because of their stability, longer shelf life, and ease of transport. Their robust performance in controlled-dose formulations makes them ideal for research laboratories and clinical applications. The liquid form, while growing quickly due to rising demand in cosmetic formulations and food emulsions, still trails due to shorter stability. Increasing R&D investments continue to strengthen the adoption of solid-form antifreeze proteins.

- For instance, A/F Protein Inc. supplies lyophilized AFGP powders used at concentrations between 1 mg and 10 mg per vial for organ- and tissue-preservation research, enabling stable transport at –20°C without degradation for more than 12 months.

By End User

Among end users, the medical sector dominates the market with 42% share in 2024. The strong presence of antifreeze proteins in cryosurgery, organ preservation, cell storage, and regenerative medicine drives its leadership. Their ability to prevent ice crystal formation makes them essential in advanced biomedical applications. The food industry is the next major contributor, using AFPs for shelf-life extension and texture enhancement in frozen products. Cosmetics also record notable growth due to AFPs’ skin-protection and anti-freeze stability benefits. Other end uses expand steadily with increasing industrial adoption.

Key Growth Drivers

Expanding Applications in Cryopreservation and Regenerative Medicine

The antifreeze proteins market experiences strong growth driven by rapid advancements in cryopreservation and regenerative medicine. These proteins prevent ice crystal formation during the freezing of cells, tissues, and organs, significantly improving post-thaw viability. Their adoption is rising in stem cell banking, IVF procedures, engineered tissues, organ transplant logistics, and blood preservation. Healthcare institutions increasingly invest in advanced cryotechnologies to support precision medicine and reduce transplant wait times. Biobanks and large-scale cell repositories rely on high-performance cryoprotective solutions, positioning AFPs as superior alternatives to conventional cryoprotectants like glycerol or DMSO, which can be cytotoxic. Expanding R&D in cell-based therapies, cancer immunology, and gene editing further strengthens the need for optimized preservation tools, making AFPs essential for next-generation biomedical innovation.

· For instance, ProtoKinetix reported that its AAGP® molecule improved survival of human islet cells during preclinical cryopreservation trials, maintaining viability after 72-hour storage at –80°C when used at 100–200 mcg/mL.

Rising Demand from the Frozen Food and Cold-Chain Industry

Global growth in frozen and processed foods significantly supports the demand for antifreeze proteins. As consumers increasingly choose ready-to-eat meals, frozen seafood, bakery items, confectionery, and plant-based foods, AFPs help enhance texture retention, prevent ice recrystallization, and maintain product quality during storage. Cold-chain expansion—driven by e-commerce grocery delivery, multinational food exports, and temperature-sensitive logistics—amplifies their use. Leading food manufacturers integrate AFPs to improve freeze–thaw stability and reduce wastage. Emerging economies are rapidly investing in cold-chain infrastructure, opening new avenues for AFP incorporation. The clean-label trend also encourages adoption as AFPs offer natural, bio-based alternatives to synthetic stabilizers, strengthening their presence across global frozen food categories.

- For instance, Unilever incorporated an ice-structuring protein into its frozen dessert formulations at concentrations as low as 0.01 g per kg, enabling smoother texture during repeated freeze–thaw cycles.

Increasing Use in Cosmetic Formulations and Personal Care Products

The cosmetics industry contributes substantially to antifreeze protein market growth due to increasing demand for protective, moisturizing, and anti-aging ingredients. AFPs support skin hydration, improve barrier function, and protect against cold-induced stress, making them suitable for winter-care, anti-pollution, and premium skincare lines. Their molecular structure helps maintain product stability under extreme temperatures, improving consistency during global shipping. Top beauty brands incorporate AFPs in serums, creams, under-eye formulas, and anti-stress skincare due to their bio-inspired functionality. Growing consumer interest in biotech-based beauty, clean formulations, and high-performance actives elevates AFP demand. Adoption is especially strong in South Korea, Japan, Europe, and the United States, where innovation in dermo-cosmetics drives continuous product expansions.

Key Trends & Opportunities

Biotechnological Advancements in AFP Engineering and Large-Scale Production

Significant technological progress in biotechnology is creating major opportunities for large-scale, cost-effective AFP production. Historically, extraction from marine species was costly and limited, but modern synthetic biology, recombinant DNA technology, precision fermentation, and protein engineering now enable scalable manufacturing. Engineered AFP variants with improved ice-binding performance, enhanced stability, and application-specific characteristics are emerging for medical, food, and cosmetic use. AI-enabled protein modeling supports the design of next-gen AFPs optimized for harsh temperature environments. Additionally, research into plant-based, algae-based, and microbe-derived AFPs reduces reliance on marine organisms and aligns with sustainability mandates. As industries prioritize eco-friendly, clean-label, and high-functionality ingredients, advancements in AFP engineering unlock significant commercial potential across global markets.

· For instance, A/F Protein Inc. supplies Antifreeze Glycoprotein (AFGP) variants purified from natural fish sources, producing individual fractions with molecular masses typically between 2.6 kDa and 33 kDa.

Growing Opportunities in Agriculture, Aquaculture, and Climate-Resilient Food Production

Climate change is generating strong opportunities for antifreeze proteins across agriculture and aquaculture. AFPs protect crops from frost damage by inhibiting ice formation within plant tissues, offering a promising pathway for frost-resistant crop development. Researchers are integrating AFP genes into plants to reduce seasonal crop losses and enhance climate resilience. In aquaculture, AFPs support the survival of cold-water species, improve feed stability, and enhance post-harvest quality of frozen fish products. Controlled-environment farms, greenhouses, and vertical farming systems are exploring AFP-based solutions to maintain crop vitality under temperature stress. As governments and industries invest in climate-smart agriculture, AFP-based technologies present new opportunities to strengthen food security and improve production efficiency globally.

- For instance, the University of Guelph engineered cold-tolerant tomato lines by expressing a Type I AFP gene from winter flounder, achieving detectable protein levels between 5 and 18 µg per gram of fresh tissue.

Key Challenges

High Production Costs and Limited Large-Scale Commercial Availability

High production costs remain a major challenge limiting widespread adoption of antifreeze proteins. Extraction from natural sources yields small volumes and requires expensive purification processes. Although recombinant production and synthetic biology offer improvements, current manufacturing costs still exceed those of conventional cryoprotectants. Industries such as food and cosmetics, which are sensitive to pricing and volume availability, face financial constraints when integrating AFPs into large-scale formulations. Limited commercial infrastructure, strict quality control requirements, and the need for temperature-regulated manufacturing environments further elevate operational expenses. Without broader adoption of high-yield fermentation systems and cost-optimized downstream processing, AFPs may struggle to achieve mass-market penetration despite strong demand.

Regulatory Complexities and Safety Compliance Across Industries

Regulatory hurdles remain a critical challenge for AFP commercialization, especially in food, medical, and cosmetic sectors. AFPs must undergo extensive safety assessments, allergenicity evaluations, and environmental impact studies before approval. Differences in global regulatory frameworks across regions such as the U.S., EU, Japan, and China lead to complex approval pathways that slow down product introductions. Medical-grade AFPs require rigorous clinical validation, while food-grade AFPs derived from genetically modified organisms face heightened scrutiny and labeling restrictions. Cosmetics require comprehensive toxicology and stability testing to meet compliance standards. These regulatory constraints create barriers for smaller manufacturers and extend development timelines, limiting faster market growth.

Regional Analysis

North America

North America leads the antifreeze proteins market, accounting for 37% of global share in 2024. The region benefits from strong biotechnology capabilities, advanced cryopreservation practices, and increasing adoption in regenerative medicine and stem cell banking. The United States drives demand with major investments in biopharmaceutical research, precision medicine, and clinical applications requiring high-performance cryoprotectants. Rising use of AFPs in frozen foods, specialty cosmetics, and aquaculture further strengthens market penetration. The expanding presence of leading biotech companies and academic research centers ensures continuous innovation, solidifying North America as the dominant revenue-generating region.

Europe

Europe represents 29% of the global market, driven by strong advancements in pharmaceutical biotechnology, clinical cryopreservation technologies, and sustainable food processing. Countries such as Germany, the U.K., France, and the Netherlands adopt antifreeze proteins widely in cryobiology, dermatology cosmetics, and frozen food stabilization. The region also benefits from significant investments in climate-resilient agricultural solutions, including AFP-supported frost management systems. Stringent EU regulations promote the use of natural and bio-derived stabilizing agents, increasing AFP adoption. Strong R&D collaborations between biotech firms, food processors, and academic institutions continue to enhance market growth across Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, holding 24% share in 2024 and expanding rapidly due to increasing demand in biotechnology, aquaculture, and frozen food manufacturing. China, Japan, and South Korea lead adoption through strong pharmaceutical pipelines, active cosmetic innovation, and rising investments in climate-adaptive agriculture. Growing aquaculture production in China and Southeast Asia drives AFP use in fish preservation and cold-water species protection. The region’s large consumer base for cosmetics and packaged foods accelerates AFP incorporation in premium formulations. Supportive government funding for biotech research and rapid industrialization further elevate Asia-Pacific’s growth potential.

Latin America

Latin America accounts for 6% of the global market, with steady growth fueled by expanding frozen food consumption, aquaculture development, and increasing interest in cryopreservation technologies. Brazil, Chile, and Mexico represent the leading adopters due to advancements in fisheries, seafood export operations, and medical biotechnology. Rising industrial investments in cold-chain logistics support greater use of AFPs in frozen meats, bakery items, and confectionery. Although adoption levels remain lower than in developed regions, growing partnerships with North American and European biotech suppliers are helping accelerate market penetration across the region.

Middle East & Africa (MEA)

The Middle East & Africa holds 4% market share, characterized by emerging adoption in food processing, cosmetic formulations, and medical research. Gulf countries such as the UAE and Saudi Arabia invest in temperature-controlled food logistics, supporting the use of AFPs in frozen food imports and premium beauty products. In Africa, demand is gradually increasing with the growth of aquaculture and cold-storage infrastructure. However, limited R&D capabilities and higher product costs restrict widespread adoption. Ongoing improvements in healthcare biotechnology and partnerships with global suppliers are expected to drive modest future growth in MEA.

Market Segmentations

By Type

- Type I

- Type III

- Antifreeze Glycoproteins

- Other Types

By Form

By End user

- Medical

- Cosmetics

- Food

- Other end uses

By Source

- Fish

- Plants

- Insects

- Other sources

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Antifreeze Proteins market is moderately concentrated, with companies focusing on biotechnology innovation, recombinant production, and expansion into high-value applications such as cryopreservation, regenerative medicine, cosmetics, and frozen food processing. Leading players including Unilever, Kaneka Corporation, Nichirei Corporation, Sirona Biochem, ProtoKinetix Inc., A/F Protein Inc., Shanghai Yu Tao Industrial Co., Ltd., Beijing Huacheng Jinke Technology Co., Ltd., Rishon Biochem Co., Ltd., and Kodera Herb Garden Co., Ltd. actively invest in R&D to develop advanced AFP variants with enhanced stability and performance. Many companies are shifting toward sustainable and scalable production through microbial fermentation and synthetic biology. Strategic collaborations between biotech firms and research institutes support the development of next-generation AFPs for medical and agricultural applications. Expansion into clean-label food ingredients, derma-cosmetic formulations, and aquaculture preservation further strengthens competitive positioning, while regulatory approvals and cost-efficient production remain key differentiators across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Unilever (Netherlands)

- Shanghai Yu Tao Industrial Co., Ltd. (China)

- ProtoKinetix, Inc. (US)

- Sirona Biochem (Canada)

- Kaneka Corporation (Japan)

- Beijing Huacheng Jinke Technology Co., Ltd. (China)

- Nichirei Corporation (Japan)

- Rishon Biochem Co., Ltd (China)

- Kodera Herb Garden Co., Ltd (Japan)

- A/F Protein Inc. (US)

Recent Developments

- In 2025, a collaboration at University of New Hampshire (UNH) reported scientists working on antifreeze protein applications for agriculture and biotechnology.

- In March 2024, Kaneka Corporation launched an innovative production process for synthetic antifreeze proteins aimed at reducing manufacturing costs and improving scalability.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End-User, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rapid expansion as cryopreservation and regenerative medicine increasingly integrate advanced antifreeze protein technologies.

- Demand for AFP-enhanced frozen foods will rise as manufacturers prioritize texture stability and clean-label ingredients.

- Cosmetic brands will adopt more AFP-based actives to develop high-performance, cold-resistant, and anti-aging formulations.

- Biotechnology innovation will improve large-scale recombinant production, reducing costs and boosting commercial availability.

- AFP use in climate-resilient agriculture will grow as frost-protection technologies become essential for crop sustainability.

- Aquaculture applications will expand as producers seek improved cold tolerance and enhanced preservation for export logistics.

- Strategic collaborations between biotech firms and research institutions will accelerate next-generation AFP development.

- Regulatory clarity across major markets will support wider industrial adoption and reduced approval timelines.

- Asia-Pacific will emerge as the fastest-growing region due to rising biotechnology capabilities and food industry demand.

- Increased investment in synthetic biology will enable engineered AFP variants with higher performance and broader industrial applicability.