Market Overview

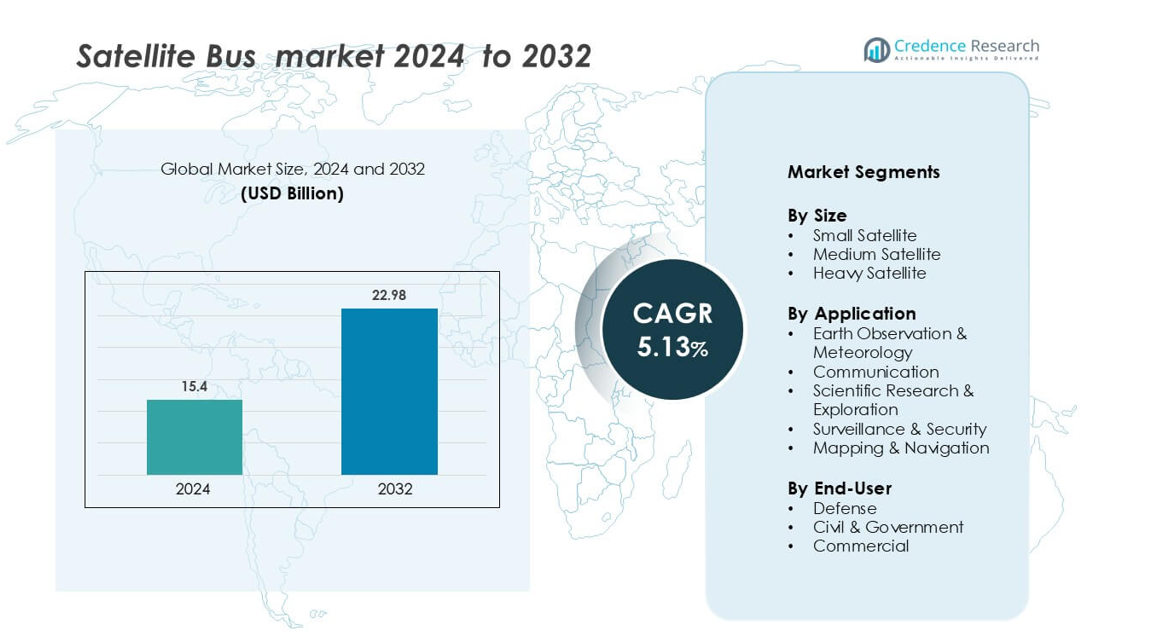

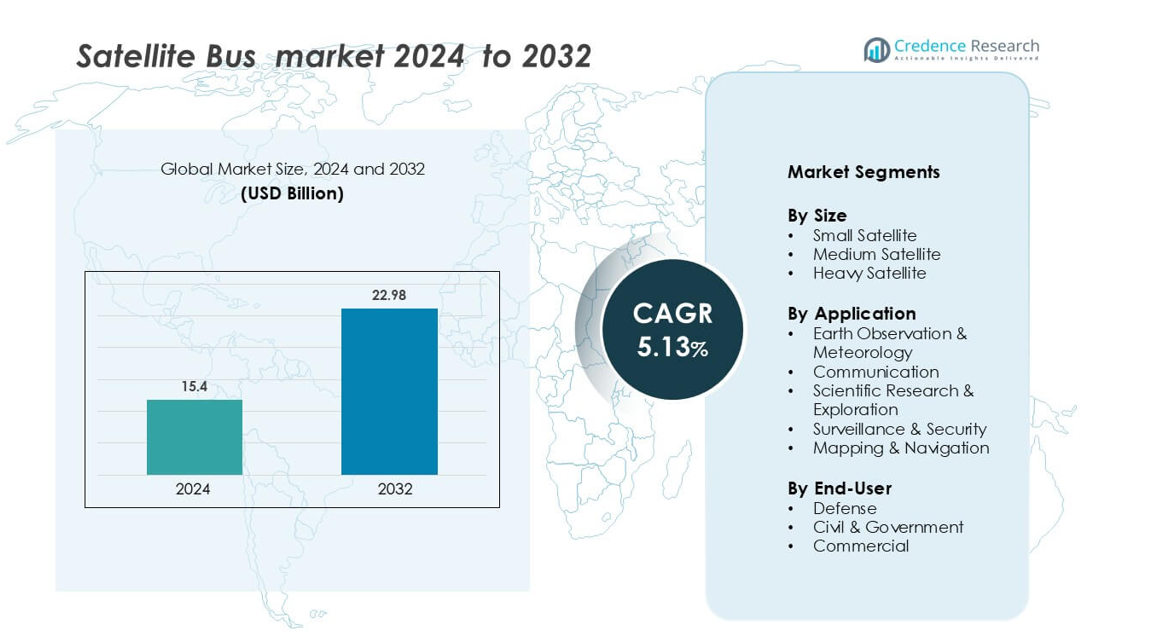

Satellite Bus Market size was valued USD 15.4 billion in 2024 and is anticipated to reach USD 22.98 billion by 2032, at a CAGR of 5.13 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Bus Market Size 2024 |

USD 15.4 billion |

| Satellite Bus Market, CAGR |

5.13% |

| Satellite Bus Market Size 2032 |

USD 22.98 billion |

The satellite bus market is shaped by strong competition among leading aerospace and defense companies investing in advanced technologies and modular designs. Key players include Northrop Grumman Corporation, Centum Electronics, Airbus SE, Maxar Technologies, L3Harris Technologies Inc., Mitsubishi Heavy Industries, Lockheed Martin Corporation, Israel Aerospace Industries Ltd., Honeywell International Inc., and The Boeing Company. These companies focus on lightweight structures, electric propulsion systems, and scalable bus platforms to support commercial, defense, and scientific missions. Strategic partnerships, constellation programs, and R&D initiatives enhance their market positioning. North America leads the global satellite bus market with a 37% share, driven by strong commercial investments, defense programs, and well-developed launch infrastructure. Europe and Asia Pacific follow with 26% and 22% shares, respectively, supported by national space missions and expanding private sector participation

Market Insights

- The satellite bus market is valued at USD 15.4 billion in 2024 and is projected to grow at a CAGR of 5.13% through the forecast period.

- Rising demand for small satellite constellations and growing investments in commercial and defense missions are driving market expansion.

- Modular and standardized bus designs, electric propulsion systems, and AI integration are key trends shaping technology advancement.

- The market is moderately consolidated, with leading players including Northrop Grumman Corporation, Airbus SE, Lockheed Martin Corporation, The Boeing Company, and Maxar Technologies driving innovation through strategic partnerships and R&D.

- North America holds a 37% share, followed by Europe at 26% and Asia Pacific at 22%. Small satellite buses lead the segment share, supported by rapid constellation deployments for communication, Earth observation, and navigation applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Size

Small satellites hold the largest market share in the satellite bus market, driven by the surge in low Earth orbit (LEO) satellite constellations for commercial and government applications. Their lower production costs, faster deployment timelines, and adaptability make them ideal for Earth observation, communication, and navigation services. Advancements in miniaturization and modular satellite bus designs further support mass production and rapid launch capabilities. Medium and heavy satellites continue to play a critical role in high-capacity communication and defense missions, but small satellites dominate due to their scalability and cost efficiency.

- For instance, the satellites for the original OneWeb constellation were manufactured by Airbus OneWeb Satellites (AOS), a joint venture between Airbus and OneWeb that was established in 2016.

By Application

Earth observation and meteorology lead the market share, supported by rising demand for real-time imaging, weather forecasting, and environmental monitoring. Governments and private operators are investing in high-resolution imaging constellations to support defense, agriculture, and climate research. Communication satellites follow, driven by broadband connectivity projects and commercial network expansion. Scientific research, security, and navigation applications are growing steadily, supported by advanced bus platforms that offer improved power, thermal control, and payload capacity for multi-mission operations.

- For instance, Lockheed Martin’s own documents and independent sources confirm that the standard LM 2100 series satellite bus has a dry mass of approximately 2,300 kg (5,070 lbs) and typically supports a nominal payload mass of up to 1,000 kg (2,200 lbs), although this can be scalable to higher capacities depending on the specific mission configuration.

By End-User

The commercial segment holds the dominant market share in the satellite bus market, driven by increasing private investments in satellite constellations for broadband and Earth observation services. Companies are deploying cost-efficient small and medium satellite buses to reduce launch and operational costs. The civil and government segment follows, supported by climate monitoring, national security, and navigation programs. Defense applications also play a key role, particularly for surveillance, reconnaissance, and secure communication networks. Rising collaboration between private players and national agencies further boosts deployment of versatile satellite bus platforms.

Key Growth Drivers

Rising Demand for Small Satellite Constellations

The increasing deployment of small satellite constellations is a major driver of the satellite bus market. Governments, defense agencies, and private operators are investing in cost-effective satellite platforms for Earth observation, communication, and navigation services. Small satellite buses allow faster production cycles, lower launch costs, and easier integration with multiple payloads. Their scalability supports mega-constellation projects aimed at global coverage. Growing adoption of LEO constellations enhances connectivity in underserved regions and supports real-time data services. This surge in small satellite missions is significantly increasing demand for reliable and modular bus systems that meet diverse mission requirements.

- For instance, Airbus and OneWeb formed a joint venture, Airbus OneWeb Satellites, in 2016 to design and manufacture the satellites for the OneWeb constellation.

Expanding Commercial Satellite Applications

The commercial sector is playing a key role in market growth, driven by rising investments in satellite-based internet, imaging, and navigation services. Private companies are adopting lightweight and modular satellite buses to reduce operational costs and accelerate deployment timelines. These platforms support multiple payload types, enabling operators to serve various industries, including telecommunications, agriculture, transportation, and energy. The expansion of direct-to-device connectivity and global broadband networks further accelerates demand for bus systems. This commercial momentum is supported by flexible satellite manufacturing processes and frequent launch schedules from both private and government space agencies.

- For instance, Maxar Technologies’ 1300-class bus platform delivers payload power exceeding 20 kilowatts and supports multiple transponders, making it suitable for high-capacity communications and imaging services across commercial applications.

Increased Government and Defense Programs

Growing investment in national security, surveillance, and defense communication is another key growth driver. Satellite bus platforms are integral to secure communication networks, reconnaissance missions, and early warning systems. Governments are prioritizing advanced satellite infrastructure to enhance strategic capabilities and reduce dependency on foreign networks. Additionally, civil programs focused on weather monitoring, disaster management, and scientific research rely on high-performance satellite buses. Increased defense budgets and global space programs are boosting procurement and development of both small and large satellite bus systems, creating steady long-term demand across multiple regions.

Key Trends & Opportunities

Modular and Standardized Bus Platforms

The shift toward modular and standardized bus platforms is reshaping the market. Manufacturers are developing versatile buses that can support multiple payloads and mission profiles without extensive redesign. This approach reduces production timelines, simplifies integration, and cuts overall mission costs. It also allows operators to deploy large constellations efficiently. Standardized bus designs enable mass manufacturing and rapid launch readiness, addressing the growing demand for commercial and governmental satellite services. This trend supports flexible mission planning and opens new opportunities for both established aerospace firms and emerging space startups.

- For instance, Airbus Defence and Space’s OneSat satellite bus leverages a single generic design and all-electric propulsion, enabling satellite launches in pairs from a standardized production line.

Integration of Advanced Propulsion and Power Systems

Emerging satellite bus platforms increasingly feature electric propulsion, high-efficiency power systems, and advanced thermal management. These enhancements extend satellite lifespan and reduce mass, enabling more cost-effective missions. Bus systems with electric propulsion provide higher delta-V capabilities, supporting complex orbital maneuvers and constellation maintenance. The growing adoption of high-power buses supports data-heavy applications like high-throughput communications and real-time imaging. As operators seek improved performance and operational efficiency, the integration of advanced propulsion technologies is becoming a critical differentiator in the competitive landscape.

- For instance, Dragonfly Aerospace’s Dragonfly Bus uses a xenon electric propulsion system rated at 28 mN thrust and up to 1,850 s specific impulse.

Growth in Public-Private Space Collaborations

Expanding collaboration between government agencies and private space companies is creating significant opportunities for satellite bus manufacturers. National space programs are increasingly partnering with commercial firms to accelerate mission deployment and reduce costs. Joint ventures in LEO and GEO constellations, Earth observation, and communication networks are expanding satellite infrastructure worldwide. This collaboration fosters innovation, improves production capacity, and encourages technology transfer, strengthening the overall satellite ecosystem. It also opens new avenues for small and medium enterprises to enter the market with specialized bus solutions.

Key Challenges

High Development and Launch Costs

Despite technological advancements, the satellite bus market faces high upfront costs for development, testing, and launch. Advanced bus systems require specialized manufacturing infrastructure, complex engineering, and extensive qualification testing. Launch costs remain a significant financial burden, especially for smaller operators with limited budgets. Although reusable launch vehicles and shared payload options are helping reduce expenses, overall mission costs still limit market participation. This financial barrier can slow adoption in emerging markets and delay large-scale deployment of satellite constellations.

Regulatory and Spectrum Allocation Constraints

Strict regulatory frameworks and spectrum allocation challenges pose major hurdles for satellite bus deployment. Operators must secure frequency rights, orbital slots, and export control clearances before launching missions. Complex approval processes can delay projects and increase operational risks. Growing congestion in popular orbital ranges, especially LEO, adds to the regulatory pressure. Compliance with international standards and national security protocols further complicates development timelines. These regulatory constraints make it essential for operators to plan well in advance and coordinate closely with regulatory authorities to ensure smooth mission execution.

Regional Analysis

North America

North America holds the largest market share of 37% in the satellite bus market, supported by strong investments in commercial satellite constellations and government-led space programs. The U.S. dominates regional activity with active participation from NASA, SpaceX, and private aerospace companies driving small satellite bus production. High adoption of modular bus platforms and advanced propulsion systems supports large-scale LEO constellation deployment. Robust defense budgets and national security missions further boost demand. Strong manufacturing capabilities, favorable regulatory frameworks, and frequent launch schedules strengthen North America’s leadership in satellite bus innovation and commercialization.

Europe

Europe accounts for 26% of the satellite bus market share, driven by growing investments in communication, navigation, and Earth observation programs. The European Space Agency (ESA) and national governments are collaborating with private firms to enhance satellite capabilities. Countries like France, Germany, and the U.K. lead developments through strong R&D and advanced manufacturing infrastructure. Focus on modular bus platforms and electric propulsion systems supports sustainable satellite deployment. Expanding commercial broadband networks, climate monitoring missions, and secure government communication initiatives continue to boost Europe’s position in the global satellite bus market.

Asia Pacific

Asia Pacific holds a 22% share of the satellite bus market and is the fastest-growing region, supported by expanding space programs in China, India, and Japan. National agencies like ISRO and CNSA are increasing satellite launches for communication, navigation, and Earth observation missions. Rising commercial investments, smart city initiatives, and defense modernization programs are driving demand for small and medium satellite buses. Regional manufacturing capacity is expanding rapidly, supported by cost-effective production and frequent launches. Asia Pacific’s growing presence in both commercial and government space activities strengthens its role in the global market.

Latin America

Latin America represents 8% of the satellite bus market share, with Brazil, Mexico, and Argentina leading regional activity. Growing interest in Earth observation, communication, and security applications is driving demand for cost-effective small satellite buses. Government initiatives to enhance digital connectivity and private investments in space technology are strengthening the ecosystem. Partnerships with international aerospace companies are supporting technology transfer and capacity building. While the region is still developing its launch infrastructure, rising investments in satellite manufacturing and application-focused projects are helping Latin America gradually expand its global market footprint.

Middle East & Africa

The Middle East & Africa region holds a 7% share of the satellite bus market, supported by strategic investments in defense and telecommunication satellites. Countries such as the UAE, Saudi Arabia, and South Africa are leading developments through national space agencies and international collaborations. Rising demand for broadband connectivity, surveillance, and navigation solutions is driving adoption of small and medium satellite buses. Governments are increasingly focusing on domestic manufacturing and joint ventures to build technical capabilities. Expanding infrastructure and defense-led programs are expected to strengthen the region’s position in the global satellite bus market.

Market Segmentations:

By Size

- Small Satellite

- Medium Satellite

- Heavy Satellite

By Application

- Earth Observation & Meteorology

- Communication

- Scientific Research & Exploration

- Surveillance & Security

- Mapping & Navigation

By End-User

- Defense

- Civil & Government

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The satellite bus market is characterized by strong competition among major aerospace and defense companies focusing on innovation, modular designs, and global deployment. Key players include Northrop Grumman Corporation, Centum Electronics, Airbus SE, Maxar Technologies, L3Harris Technologies Inc., Mitsubishi Heavy Industries, Lockheed Martin Corporation, Israel Aerospace Industries Ltd., Honeywell International Inc., and The Boeing Company. These companies invest heavily in advanced propulsion systems, lightweight structures, and standardized bus platforms to support both commercial and defense satellite missions. Strategic partnerships, technology collaborations, and large-scale constellation projects drive market leadership. North America leads the global satellite bus market with a 37% share, supported by a robust space infrastructure and active commercial and government programs. Europe follows with 26% market share, while Asia Pacific holds 22%, driven by rapid expansion of national space initiatives and private investments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Northrop Grumman Corporation (U.S.)

- Centum Electronics (India)

- Airbus SE (France)

- Maxar Technologies (U.S.)

- L3Harris Technologies Inc. (U.S.)

- Mitsubishi Heavy Industries (Japan)

- Lockheed Martin Corporation (U.S.)

- Israel Aerospace Industries Ltd. (Israel)

- Honeywell International Inc. (U.S.)

- The Boeing Company (U.S.)

Recent Developments

- In July 2024, Airbus was awarded a SATCOMBw 3 prime contract for next-generation military satellite systems with several European governments for advanced military satellite systems to enhance defense capabilities for the upcoming 15 years.

- In June 2024, Airbus secured a contract with Al Yah Satellite Communications Company PJSC (Yahsat), the UAE’s flagship satellite solutions provider, for construction of its new Geostationary Telecommunications Al Yah 4 and 5 satellites. The contract also includes the delivery of two Airbus’s ARROW satellite buses for future deployment in Low Earth Orbit (LEO).

- In April 2024, U.S. defense contractor, SAIC, secured a contract with the Pentagon to integrate a small satellite, leveraging partnerships to demonstrate advanced technologies such as AI and machine learning

Report Coverage

The research report offers an in-depth analysis based on Size, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Deployment of small satellite constellations will increase, driving demand for modular bus platforms.

- Advancements in electric propulsion will enhance satellite performance and operational lifespan.

- Standardized bus designs will enable faster production and lower integration costs.

- Public-private partnerships will accelerate innovation and constellation deployment.

- Integration with AI and IoT will improve in-orbit operations and mission efficiency.

- Defense and security programs will boost demand for high-performance satellite buses.

- Commercial broadband expansion will strengthen the role of small and medium buses.

- Regional manufacturing capabilities will grow in Asia Pacific and Europe.

- Sustainability initiatives will drive the adoption of lightweight and reusable bus components.

- Strategic mergers and collaborations will reshape the competitive landscape globally.