Market Overview:

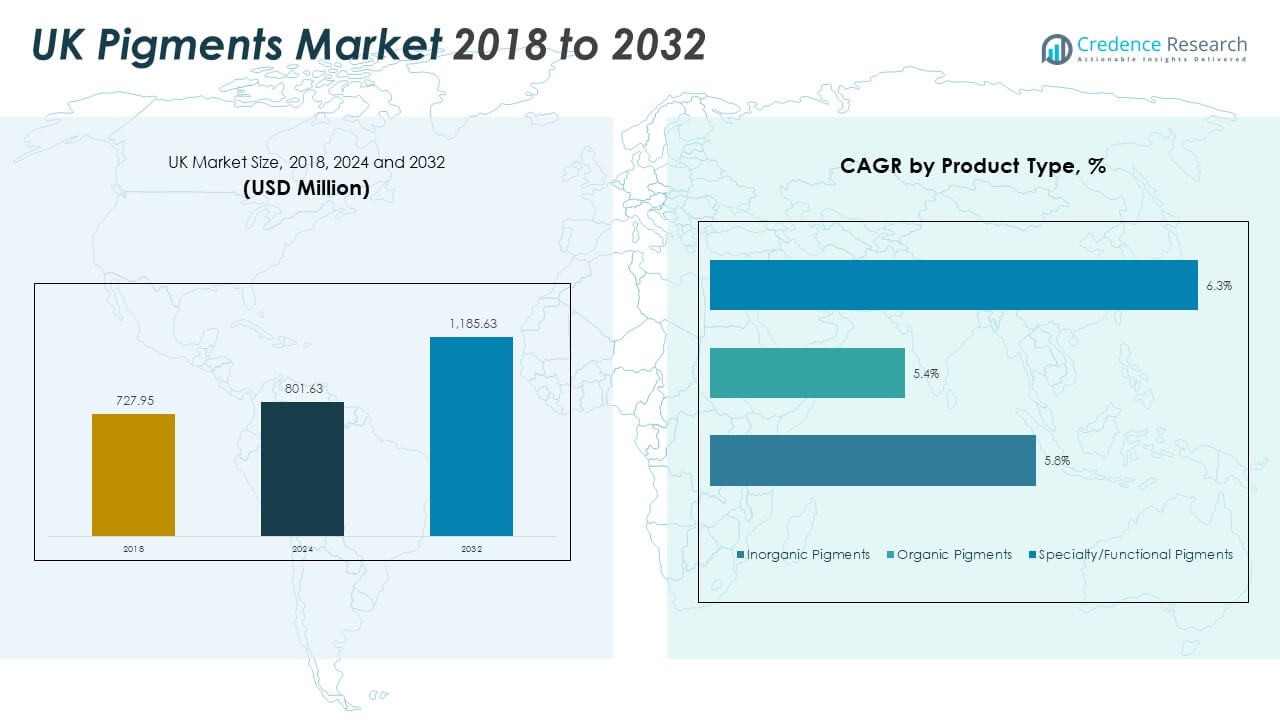

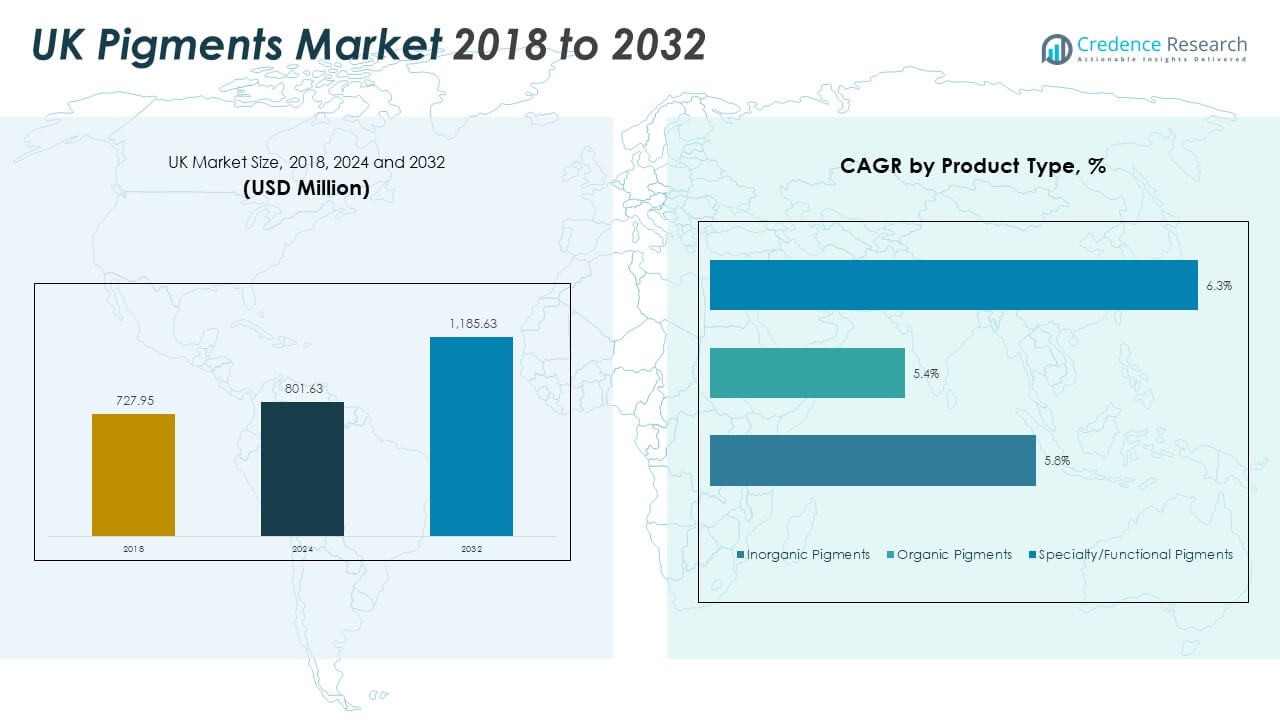

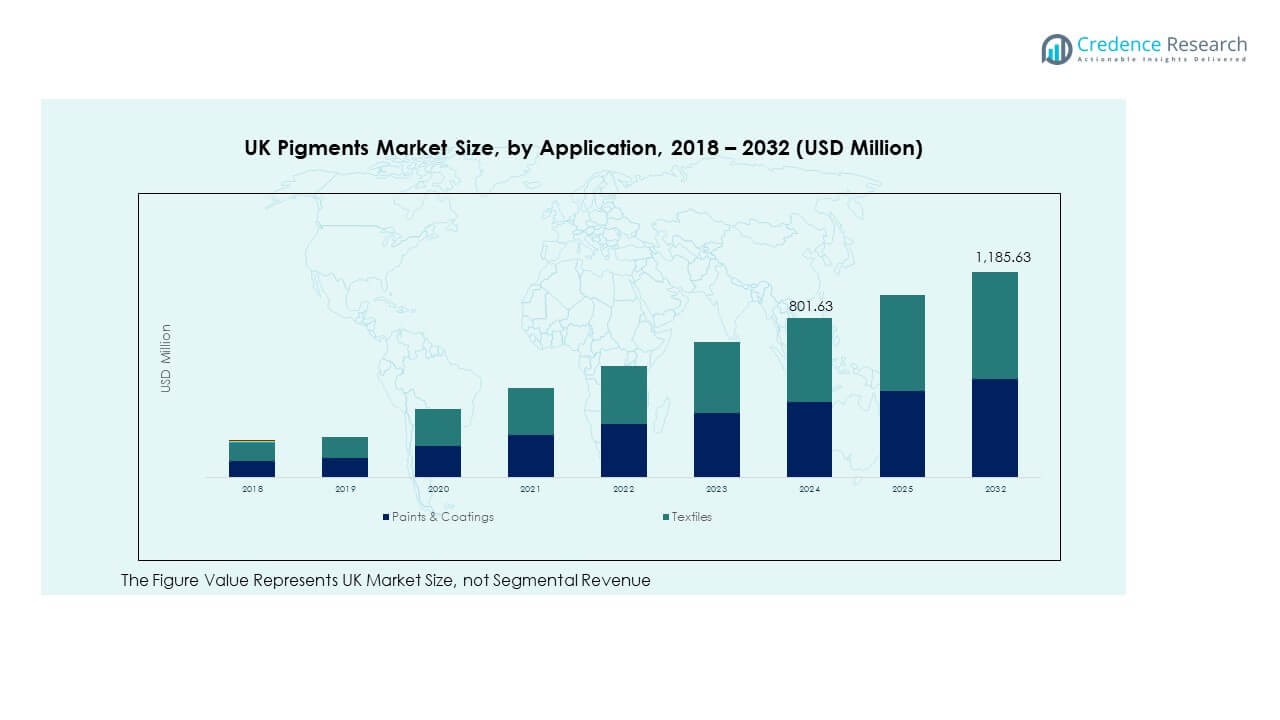

The UK Pigments Market size was valued at USD 727.95 million in 2018 to USD 801.63 million in 2024 and is anticipated to reach USD 1,185.63 million by 2032, at a CAGR of 5.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Pigments Market Size 2024 |

USD 801.63 Million |

| UK Pigments Market, CAGR |

5.01% |

| UK Pigments Market Size 2032 |

USD 1,185.63 Million |

Growth in the UK pigments market is primarily driven by rising demand across paints, coatings, plastics, and printing applications. Expanding construction activities and growing automotive production enhance the need for high-performance pigments with superior color stability and UV resistance. Increasing adoption of eco-friendly and sustainable pigments also supports market expansion. Ongoing R&D efforts by leading manufacturers to improve dispersion and heat resistance continue to strengthen the market’s technological foundation.

Regionally, England dominates the UK pigments market due to its well-established industrial base and presence of major manufacturing facilities. Scotland and Wales are emerging regions supported by industrial diversification and rising investments in sustainable pigment production. Northern Ireland contributes through export-driven pigment applications in specialized coatings. Strong logistics infrastructure and proximity to European trade networks further enhance regional growth opportunities, enabling balanced development across the UK pigment value chain.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Pigments Market was valued at USD 727.95 million in 2018, reached USD 801.63 million in 2024, and is projected to attain USD 1,185.63 million by 2032, registering a CAGR of 5.01% during 2024–2032.

- England leads with 56% market share, supported by its strong industrial base, advanced manufacturing infrastructure, and major pigment producers operating across coatings and plastics sectors.

- Scotland holds 22% share, driven by textile manufacturing, sustainable pigment initiatives, and growing use of eco-friendly formulations.

- Wales and Northern Ireland together account for 22% share, with Wales emerging fastest due to rising investments in specialty pigment production and decorative coatings.

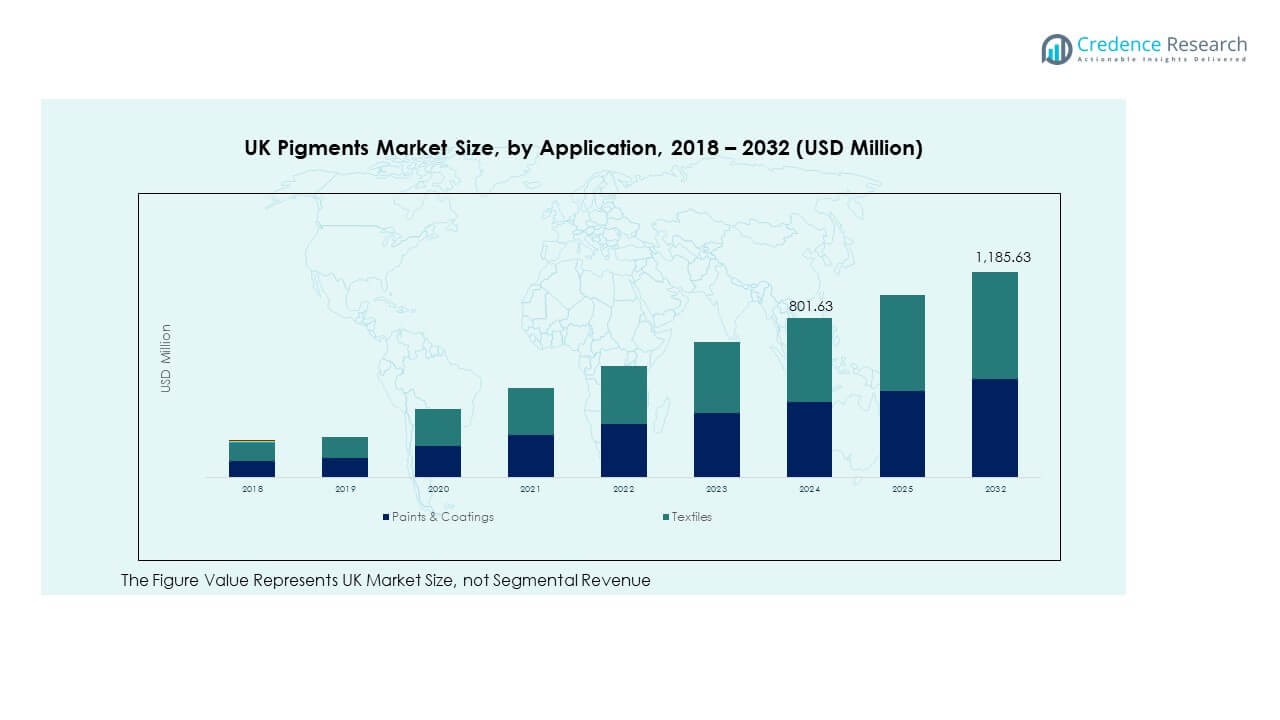

- Based on the figure, paints and coatings represent nearly 60% of total pigment demand, while textiles account for around 40%, reflecting balanced growth across construction, automotive, and fabric applications.

Market Drivers

Rising Demand from Paints and Coatings Industry Supporting Market Expansion

The paints and coatings industry serves as a primary driver for the UK Pigments Market. Rapid urbanization and infrastructure renovation projects increase the need for decorative and protective coatings. Manufacturers prefer pigments that provide improved color retention, gloss, and UV resistance. It benefits from innovation in pigment formulations tailored for sustainable coatings. Demand for titanium dioxide-based pigments continues to rise due to their durability and opacity. Strict regulations promote low-VOC products, accelerating eco-friendly pigment use. Increased investments in residential and commercial construction sustain steady pigment consumption.

- For instance, Sun Chemical, identified as a key player in the UK Pigments Market, was recognized by the British Coatings Federation in 2024 for deploying water-based pigment technologies that cut VOC emissions in architectural coatings, aligning with UK regulatory targets and sustainability awards.

Shift Toward Eco-Friendly Pigments and Regulatory Compliance Boosting Innovation

Environmental regulations encourage the development of organic and low-toxicity pigments across multiple sectors. Companies are shifting toward water-based formulations to comply with EU and REACH standards. The UK Pigments Market gains from technological advances enabling biodegradable and non-hazardous pigment solutions. Producers focus on replacing heavy-metal pigments with sustainable alternatives. Growing consumer preference for green products supports demand in paints, plastics, and textiles. R&D efforts target improved dispersion and thermal stability for industrial use. This shift enhances brand image while ensuring long-term compliance and reduced environmental impact.

Growing Utilization in Plastic Manufacturing Driving Long-Term Adoption

Plastic manufacturing industries increasingly rely on pigments to achieve enhanced aesthetics and UV stability. Demand for color masterbatches in packaging, automotive, and consumer goods supports growth. The UK Pigments Market benefits from durable pigments that withstand harsh processing conditions. Technological improvements ensure better heat resistance and consistency across polymer blends. Rising awareness of product appearance influences pigment selection across packaging applications. Companies invest in advanced dispersion technologies to optimize performance in lightweight plastic products. These developments strengthen pigment integration into sustainable polymer innovations.

Expansion of Construction and Automotive Sectors Encouraging High Pigment Consumption

The expanding construction and automotive industries are major consumers of performance pigments. Demand for coatings and colorants used in vehicles, machinery, and building materials drives market strength. The UK Pigments Market grows as manufacturers adopt color solutions that improve product appeal and corrosion resistance. Increasing use of energy-efficient and reflective coatings further supports adoption. Automotive OEMs focus on durable finishes, stimulating use of inorganic pigments. The sector’s transition toward electric vehicles fosters demand for heat-resistant pigment technologies. This widespread adoption reinforces the pigment industry’s presence across end-use sectors.

- For instance, the Chemours Company and Tronox Holdings plc provide state-of-the-art titanium dioxide pigments to major UK coatings and construction materials manufacturers, ensuring superior opacity and long-lasting color even in demanding exterior automotive and building applications, and are cited as key drivers behind the UK market’s technological progress.

Market Trends

Integration of Nanotechnology in Pigment Formulations Enhancing Product Efficiency

Nanotechnology is transforming pigment production by improving color strength, opacity, and stability. Companies are leveraging nanoparticles to develop pigments with enhanced weather and heat resistance. The UK Pigments Market benefits from nano-pigments offering superior dispersion and surface performance. These advancements help reduce pigment usage while maintaining strong visual appeal. Industries like automotive and electronics increasingly adopt nanostructured pigments for precision coatings. Research collaborations between universities and pigment manufacturers accelerate innovation. The trend reflects a clear shift toward performance-driven pigment solutions supporting advanced manufacturing needs.

- For instance, Hallcrest UK continues to lead the market in thermochromic pigment innovations, offering finished inks, pigments, and customizable liquid crystal screen inks with activation temperature ranges from −10°C to 69°C for industrial, automotive, and packaging applications, as documented on their technology and product pages.

Growing Penetration of Digital Printing Technologies Elevating Pigment Applications

The rapid adoption of digital printing is reshaping pigment demand across packaging and textile sectors. High-quality printing requires pigments with excellent dispersion, brightness, and lightfastness. The UK Pigments Market experiences growth through advanced ink formulations using organic pigments. Increasing customization in packaging fuels pigment use in digital inks. Improved pigment particle control enhances print durability and color depth. Companies invest in research to meet evolving print speed and resolution standards. The digital shift strengthens pigment applications in short-run, sustainable, and high-value printing markets.

Emergence of Smart and Functional Pigments Enhancing Product Versatility

Functional pigments that respond to heat, light, or chemicals are gaining strong traction. The UK Pigments Market witnesses rising interest in thermochromic, photochromic, and luminescent pigment technologies. These pigments find applications in automotive coatings, security printing, and consumer products. Smart pigments improve visual appeal and enable unique design possibilities. They also support advanced material development for anti-counterfeit and safety uses. Firms invest in R&D to enhance stability and application flexibility. This trend drives product differentiation and opens new commercial opportunities across multiple sectors.

Rising Focus on Circular Economy and Recycling Initiatives in Pigment Use

Growing sustainability initiatives influence pigment formulation and waste management practices. The UK Pigments Market aligns with circular economy principles promoting recyclable pigments. Manufacturers explore pigment recovery methods from industrial residues to minimize environmental impact. Eco-friendly pigment systems designed for recyclability gain traction in packaging and textiles. Companies integrate sustainable sourcing of raw materials to enhance lifecycle efficiency. This approach supports national carbon reduction goals and fosters responsible consumption. Continuous collaboration with recyclers and regulators helps shape greener pigment supply chains.

- For instance, Sun Chemical introduced its SunVisto® AquaSafe water-based ink series designed for direct food-contact and recyclable packaging, supporting reduced VOC emissions and compliance with UK sustainability standards for environmentally responsible coatings.

Market Challenges Analysis

Fluctuating Raw Material Costs and Supply Chain Constraints Affecting Profitability

Volatility in raw material prices presents a key challenge for pigment manufacturers. The UK Pigments Market faces cost fluctuations in titanium dioxide and organic intermediates. Dependence on imports from Asia and Europe increases exposure to supply chain disruptions. Energy price variations further affect production economics, raising pigment costs. Smaller producers struggle to maintain profit margins amid fluctuating input prices. The market demands stable procurement strategies and localized sourcing initiatives. Maintaining consistent quality and delivery timelines becomes difficult under unstable cost conditions.

Stringent Environmental Regulations and Disposal Limitations Restricting Growth

Strict regulatory norms on heavy metal and solvent-based pigments challenge traditional pigment producers. The UK Pigments Market must comply with REACH and local environmental guidelines limiting hazardous substances. Compliance increases production costs and delays product approvals. Waste disposal of pigment by-products requires advanced treatment technologies. High compliance costs discourage small manufacturers from innovation. The shift to water-based systems demands major investment in reformulation. Balancing product performance with environmental standards remains a major operational challenge across the industry.

Market Opportunities

Increasing Demand for Sustainable and Bio-Based Pigments Creating New Avenues

The shift toward eco-conscious production creates strong opportunities for sustainable pigment solutions. The UK Pigments Market benefits from rising investments in bio-based pigments derived from natural sources. These pigments meet growing consumer demand for green coatings, packaging, and textiles. Advancements in organic synthesis enhance color performance and durability. Partnerships between pigment manufacturers and biotechnology firms foster innovative product development. Expanding environmental awareness among end-users fuels further adoption of low-toxicity pigments. This transition positions bio-based pigment producers for long-term market leadership.

Technological Advancements in High-Performance Pigments Expanding Industrial Reach

Continuous improvements in pigment technology create new industrial opportunities. The UK Pigments Market gains from developments in infrared-reflective and corrosion-resistant pigment formulations. These pigments find applications in automotive, electronics, and energy-efficient construction materials. Technological progress enhances pigment stability and extends coating lifespans. Companies focusing on smart material integration can tap into advanced manufacturing demand. Collaboration with industrial designers supports innovative pigment applications in high-performance coatings. This evolution strengthens market adaptability across both traditional and emerging industries.

Market Segmentation Analysis

By Product Type

Inorganic pigments dominate the UK Pigments Market due to their durability, opacity, and cost efficiency. Titanium dioxide remains the leading sub-segment because of its strong light-scattering and UV-resistant properties. Zinc oxide contributes to niche applications in coatings and ceramics. Organic pigments, offering superior color brilliance and low toxicity, see rising demand in printing and packaging. Specialty or functional pigments such as metallic, fluorescent, and thermochromic types cater to advanced and customized applications. Innovation in environmentally safe formulations continues to redefine product preferences.

- For instance, Venator Materials Plc launched its TMP- and TME-free TIOXIDE TR81 pigment in March 2025, ensuring high opacity, brightness, and dispersibility for coatings and plastics while meeting new UK and EU chemical regulations; this product allows seamless compliance without sacrificing performance so that customers can maintain standards across sectors including inks, coatings, and plastics.

By Application

Paints and coatings lead the application segment owing to their widespread use in construction, automotive, and industrial sectors. The UK Pigments Market benefits from increasing demand for durable colorants in protective coatings. Textiles and printing inks represent significant contributors driven by design innovation and digital printing trends. Plastics applications expand with packaging growth and aesthetic product design requirements. Leather and other industrial uses maintain steady adoption due to diverse pigment needs. The versatility of pigments ensures broad applicability across multiple manufacturing domains.

- For instance, AkzoNobel’s Intergard 5000 epoxy coating system is tested according to ISO 8502-6 surface standards, ensuring proper salt contamination control and long-term corrosion protection for marine and industrial structures, while Tronox Holdings plc supplies titanium dioxide pigments known for high weatherability and opacity in coatings and plastics applications.

Segmentation

By Product Type

- Inorganic Pigments

- Titanium Dioxide (TiO₂)

- Zinc Oxide

- Others

- Organic Pigments

- Specialty/Functional Pigments

By Application

- Paints & Coatings

- Textiles

- Printing Inks

- Plastics

- Leather

- Other Applications

Regional Analysis

England Leading with 56% Market Share Driven by Industrial and Construction Growth

England holds 56% of the UK Pigments Market, supported by strong demand from manufacturing and construction sectors. Major pigment producers and coating manufacturers are concentrated in regions such as the Midlands and South East. High consumption in architectural paints, automotive coatings, and plastics drives market dominance. Investments in green building projects and infrastructure renewal enhance pigment usage. It benefits from advanced R&D facilities that promote innovation in sustainable formulations. England’s well-developed industrial base ensures consistent pigment demand across multiple end-use industries.

Scotland Accounting for 22% Market Share with Expanding Industrial and Textile Applications

Scotland represents 22% of the market share, supported by a growing focus on industrial coatings and textiles. The presence of chemical processing units and textile manufacturers strengthens pigment demand. The UK Pigments Market in Scotland gains from the expansion of eco-friendly pigment manufacturing units. Increasing urban projects and decorative applications stimulate pigment use in architectural coatings. Research collaborations between Scottish universities and pigment producers promote innovation in organic pigments. It benefits from government initiatives promoting low-emission manufacturing and sustainable material adoption.

Wales and Northern Ireland Collectively Holding 22% Market Share through Niche Applications

Wales and Northern Ireland together contribute 22% of the market, driven by niche pigment applications in packaging and printing. Localized manufacturing and export-driven production support pigment usage in plastics and coatings. Wales witnesses growing adoption of specialty pigments in decorative and industrial coatings. Northern Ireland’s small-scale pigment producers focus on tailored solutions for automotive and consumer goods. The UK Pigments Market benefits from ongoing trade expansion and logistics connectivity in these regions. Continuous investment in innovation and sustainability initiatives sustains competitive regional performance.

Key Player Analysis

- Venator Materials PLC

- Tronox Pigment UK Ltd

- BASF plc

- The Chemours Company

- Huntsman Corporation

- Clariant AG

- LANXESS AG

- Elementis plc

- Croda International plc

Competitive Analysis

The UK Pigments Market features a competitive landscape dominated by global and domestic players such as BASF SE, Clariant AG, DIC Corporation, LANXESS AG, Huntsman Corporation, and Sun Chemical. It focuses on developing high-performance and eco-friendly pigment formulations that align with environmental standards. Companies emphasize R&D to create advanced organic and inorganic pigments with enhanced durability and color consistency. Strategic mergers, acquisitions, and collaborations strengthen supply chain efficiency and expand regional reach. Local producers compete through cost-effective production and customized pigment solutions targeting industrial and decorative sectors. Continuous innovation and regulatory compliance define competitive positioning across the market.

Recent Developments

- In October 2025, Venator Materials UK Ltd signed an agreement to sell its Greatham, UK titanium dioxide pigment site and assets to the Chinese TiO₂ maker LB Group. This decision followed a period of financial strain in the global titanium dioxide manufacturing sector, which led Venator into administration. The transaction is aimed at reviving operations and expanding LB Group’s international presence in the titanium dioxide market.

- In May 2025, Elementis plc announced the completion of the sale of its Talc business to IMI Fabi. This transaction shifts Elementis’s strategy further toward premium specialty additives and coatings, allowing the company to focus more closely on its core UK and global performance additive businesses.

- In February 2025, Chemours launched Ti-Pure™ TS-6706, a TMP- and TME-free version of its flagship universal TiO₂ pigment, tailored for coatings applications with rigorous appearance demands. This launch demonstrates Chemours’s responsiveness to evolving regulatory and customer needs for safer, sustainable pigment solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Pigments Market is expected to witness strong demand from paints, coatings, and plastic industries driven by construction and automotive expansion.

- Increasing adoption of eco-friendly and bio-based pigments will redefine product innovation and sustainability standards.

- Technological advancements such as nanotechnology and smart pigment applications will boost performance and versatility across end-use sectors.

- Growing investments in R&D will lead to the development of high-durability and energy-efficient pigment formulations.

- Expansion in digital printing and packaging will create new opportunities for color-intensive and functional pigment solutions.

- Regulatory focus on reducing heavy-metal pigments will accelerate the transition toward safer organic alternatives.

- Strategic partnerships between pigment producers and manufacturers will improve product efficiency and supply reliability.

- Rising demand for aesthetic and protective coatings in infrastructure projects will sustain steady pigment consumption.

- Continuous modernization of pigment production facilities will enhance competitiveness and environmental compliance.

- Strong growth prospects in specialty pigments will open pathways for innovation in performance coatings and advanced materials.