Market Overview:

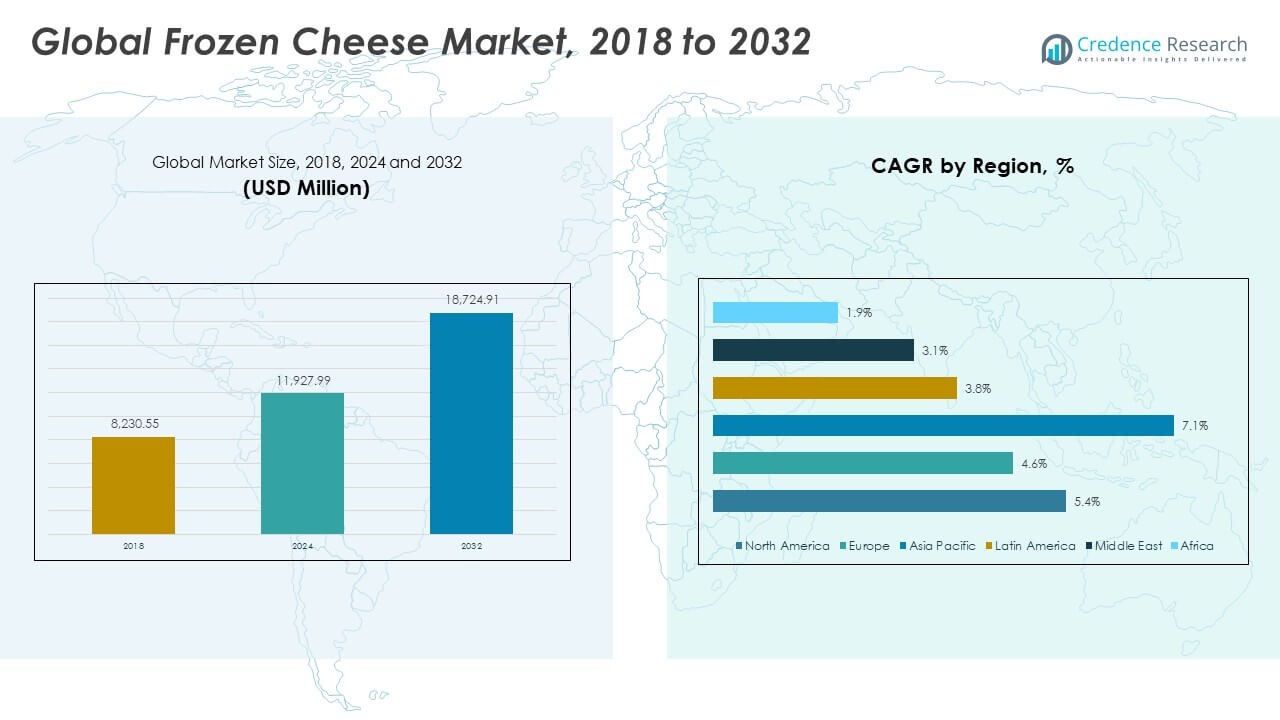

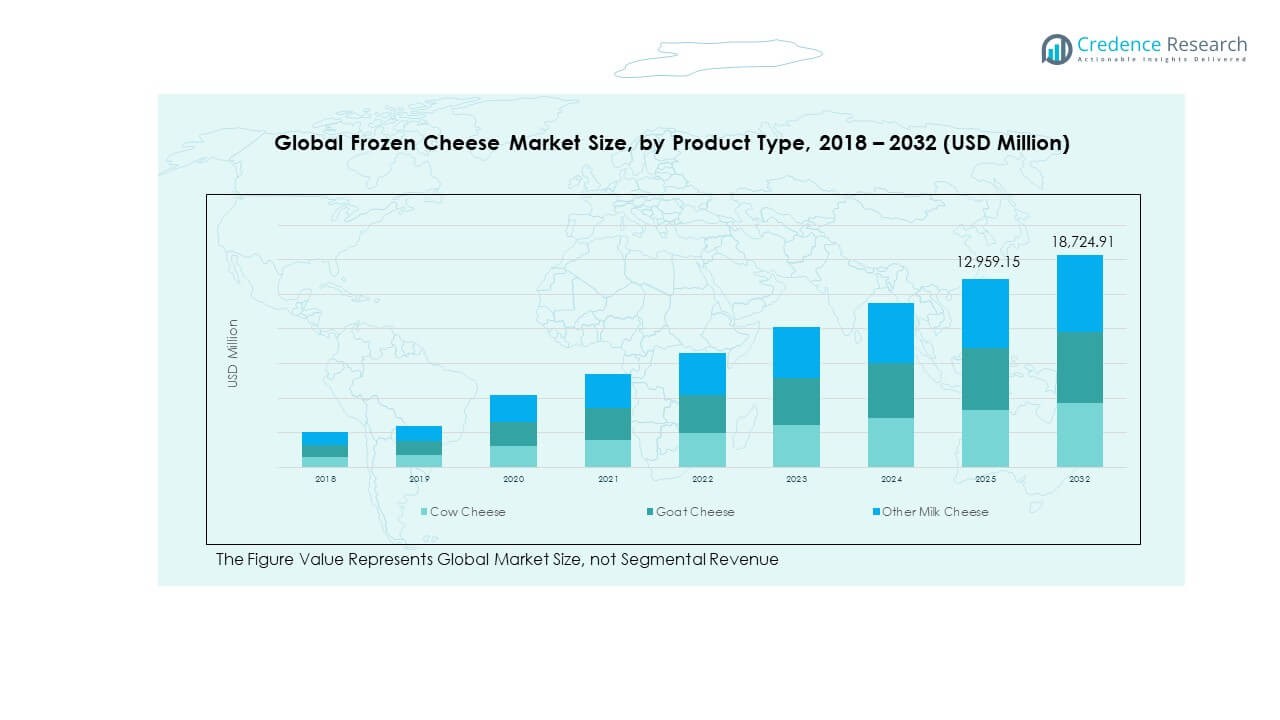

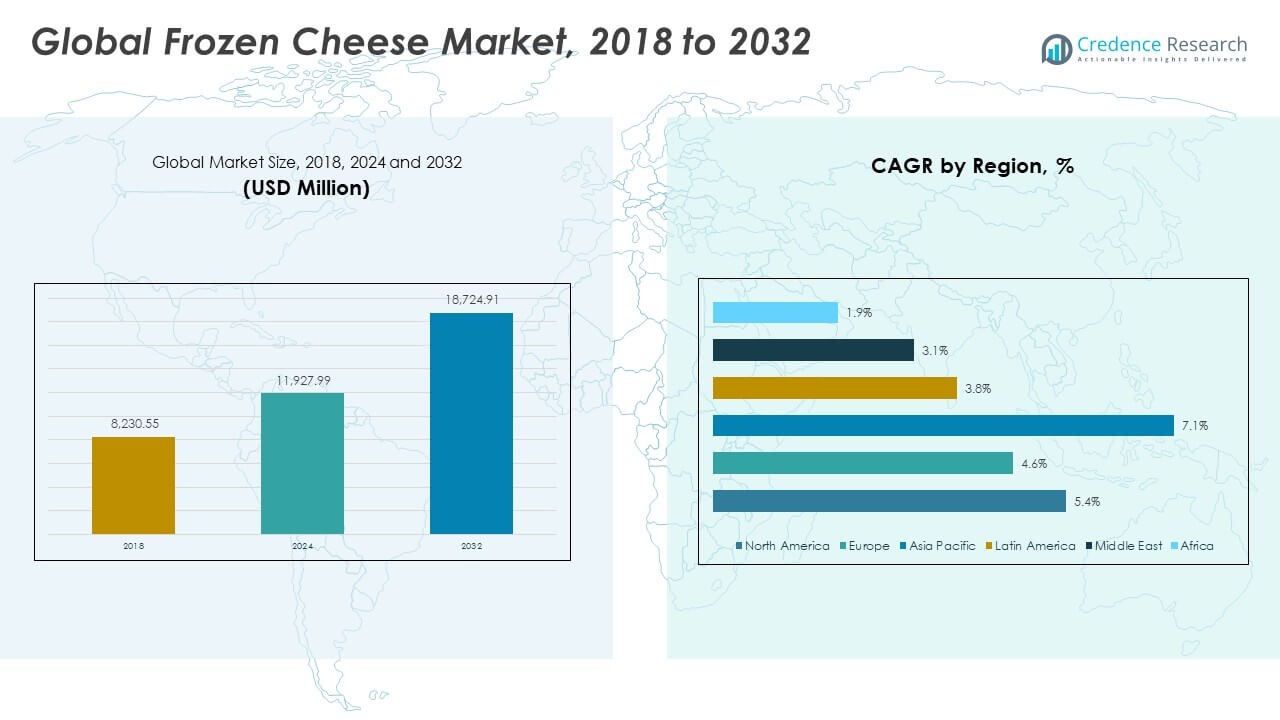

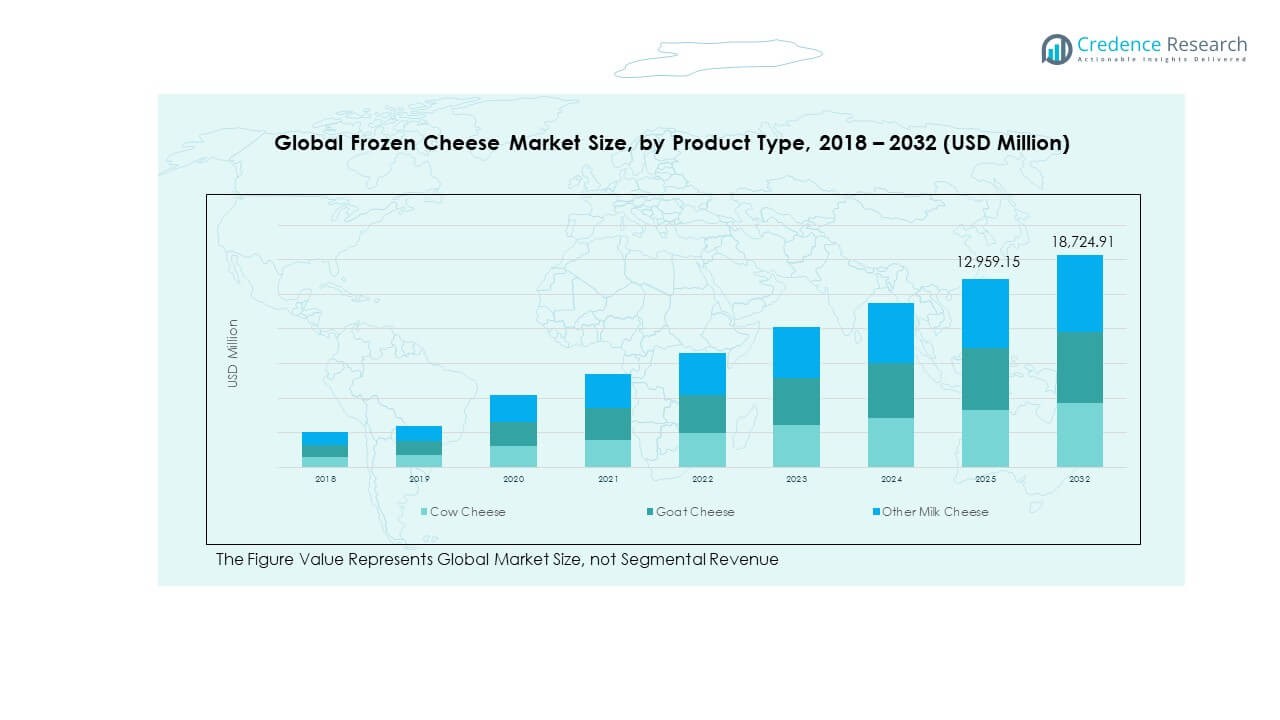

The Global Frozen Cheese Market size was valued at USD 8,230.55 million in 2018 to USD 11,927.99 million in 2024 and is anticipated to reach USD 18,724.91 million by 2032, at a CAGR of 5.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen Cheese Market Size 2024 |

USD 11,927.99 Million |

| Frozen Cheese Market, CAGR |

5.40% |

| Frozen Cheese Market Size 2032 |

USD 18,724.91 Million |

The Global Frozen Cheese Market is expanding steadily due to rising demand for convenient, ready-to-use dairy products in households, restaurants, and foodservice chains. Increasing consumption of fast foods like pizzas and burgers, combined with longer shelf-life and easier storage of frozen cheese, drives market growth. Technological advancements in freezing methods improve texture, flavor, and nutritional value, encouraging wider adoption among consumers seeking premium quality and convenience.

North America dominates the market due to high consumption of frozen dairy products and well-established cold chain infrastructure. Europe follows closely with strong demand from the bakery and food processing industries. Asia-Pacific is emerging rapidly, supported by growing urbanization, rising disposable incomes, and expanding retail networks. Latin America and the Middle East show steady growth driven by shifting dietary preferences toward western-style cuisines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Frozen Cheese Market was valued at USD 8,230.55 million in 2018, reached USD 11,927.99 million in 2024, and is projected to attain USD 18,724.91 million by 2032, growing at a CAGR of 5.40% during 2025–2032.

- North America (38%), Europe (29%), and Asia Pacific (24%) hold the top three regional shares due to established dairy industries, strong cold-chain logistics, and rising quick-service restaurant penetration.

- Asia Pacific, the fastest-growing region with a share of about 24%, benefits from urbanization, expanding retail networks, and rising consumer demand for Western-style cheese-based foods.

- By product type, Cow Cheese dominates with roughly 68% share, supported by high global consumption and easy availability across applications.

- Goat Cheese accounts for 22% of the segment, while Other Milk Cheese contributes 10%, appealing mainly to niche premium and gourmet markets.

Market Drivers:

Rising Demand for Convenient and Ready-to-Use Dairy Products

The Global Frozen Cheese Market is growing due to the rising preference for convenient and ready-to-use dairy items among consumers. Busy lifestyles and increasing urbanization encourage buyers to choose frozen cheese for its longer shelf life and easy preparation. Foodservice outlets and restaurants prefer frozen cheese for consistent quality and quick meal assembly. The expanding quick-service restaurant network, including pizza and burger chains, has intensified product consumption. Manufacturers are improving product texture and taste to meet consumer expectations. The convenience factor supports retail expansion and product diversification. Frozen cheese also fits modern home cooking trends, where consumers seek fast yet high-quality meal options. Its flexibility across cuisines continues to drive market penetration globally.

- For instance, Saputo Inc. in Canada offers an IQF (Individually Quick Frozen) pizza mozzarella product with a 365-day frozen shelf life and 7–10 days thawed shelf life, supporting rapid meal assembly. Busy lifestyles and increasing urbanization encourage buyers to choose frozen cheese for its longer shelf life and easy preparation. Foodservice outlets and restaurants prefer it for consistent quality and quick meal assembly.

Expansion of Foodservice and Quick-Service Restaurant (QSR) Chains Globally

The rise of fast-food chains and global restaurant franchises has created strong demand for frozen cheese. It ensures consistency in taste, melt quality, and portion control, making it ideal for commercial kitchens. Quick-service restaurants prefer frozen cheese due to its long storage capability and reduced wastage. The product supports bulk procurement and reduces supply chain disruptions. It also complements the growing trend of cheese-based menu innovation across QSR outlets. The Global Frozen Cheese Market benefits from partnerships between dairy producers and foodservice brands. Expansion of global pizza, pasta, and sandwich chains boosts product demand. High consumption rates in urban regions with busy lifestyles sustain continuous growth in this sector.

- For instance, Saputo’s IQF product format is designed for pizza and pasta applications, enabling operators to shorten prep time and labour costs. It ensures consistency in taste, melt quality, and portion control, making it ideal for commercial kitchens. Quick-service restaurants prefer frozen cheese due to its long storage capability and reduced wastage.

Technological Advancements in Freezing and Packaging Methods

Modern freezing technologies preserve the texture, flavor, and nutritional content of cheese, improving consumer satisfaction. Manufacturers invest in advanced cryogenic and blast-freezing systems that maintain product integrity. Innovative packaging materials extend shelf life and protect against moisture loss or contamination. Vacuum-sealed and portion-based packaging formats appeal to both retail and foodservice users. The Global Frozen Cheese Market gains traction through continuous innovation in freezing techniques. Automated processing and smart packaging enhance supply chain efficiency and reduce waste. Companies are also developing eco-friendly packaging solutions to meet sustainability standards. The shift toward technology-driven preservation ensures higher quality and greater export potential for producers.

Growing Popularity of Western Food Culture in Emerging Economies

The adoption of Western dietary habits, particularly in Asia-Pacific and Latin America, supports the rising demand for frozen cheese. Consumers are increasingly embracing products like pizza, pasta, and sandwiches, which rely heavily on cheese. Rising disposable incomes and expanding retail chains have made these products accessible to a larger population. The Global Frozen Cheese Market benefits from this cultural shift toward convenience and indulgence. Food manufacturers and restaurant chains are expanding operations in emerging regions to meet growing appetite for dairy-rich meals. E-commerce channels make international cheese brands more visible to new consumers. The integration of cheese into local cuisines further diversifies consumption patterns. The trend continues to reshape frozen dairy product preferences across developing economies.

Market Trends:

Adoption of Advanced Cold Chain Logistics and Distribution Networks

The growth of advanced cold chain infrastructure is a major trend supporting product availability and quality. Reliable temperature-controlled logistics systems reduce spoilage and extend product reach to remote areas. The Global Frozen Cheese Market gains momentum from the adoption of automation and IoT-based monitoring in storage facilities. Logistics companies invest in energy-efficient refrigeration units to reduce costs and emissions. Expansion of supermarket and hypermarket chains increases access to diverse frozen cheese varieties. Integration of online grocery platforms with frozen logistics further improves market penetration. Exporters benefit from improved cross-border cold chain standards that preserve cheese freshness. The trend ensures consistent product quality and customer satisfaction worldwide.

- For instance, a case study notes that an IoT monitoring system deployed by a dairy-focused logistics provider offers 30-minute temperature updates and vehicle tracking during last-mile delivery of frozen dairy products. Reliable temperature-controlled logistics systems reduce spoilage and extend product reach to remote areas.

Introduction of Innovative Flavors and Cheese Varieties

Manufacturers are launching a wider range of cheese types, including mozzarella, cheddar, gouda, and specialty blends. Innovation in flavoring and ingredient combinations caters to changing consumer preferences. The Global Frozen Cheese Market reflects strong experimentation with herbs, spices, and low-fat formulations. Companies introduce regional flavors to attract diverse customer bases. Frozen cheese with reduced sodium, organic certification, or clean-label attributes appeals to health-conscious buyers. Continuous product innovation enhances brand differentiation in a crowded market. Producers also emphasize premium and gourmet varieties for high-income consumers. Expanding product lines ensures competitive advantage and sustained market engagement.

- For instance, monitoring of dairy processing shows that alternative renneting agents and high-pressure processing technologies are used to create novel cheese textures and clean-label attributes. Innovation in flavoring and ingredient combinations caters to changing consumer preferences.

Rising Popularity of Plant-Based and Lactose-Free Frozen Cheese Alternatives

The growing vegan and lactose-intolerant population is reshaping product innovation. Manufacturers now produce frozen cheese made from nuts, soy, or oats to meet dietary restrictions. The Global Frozen Cheese Market is witnessing inclusion of plant-based options that mimic dairy cheese texture and taste. Companies invest in R&D to enhance meltability and nutritional composition of vegan cheese. Retailers allocate more shelf space to alternative dairy products. Rising environmental awareness drives demand for sustainable cheese formulations. Producers promoting allergen-free and cholesterol-free alternatives attract a broader audience. The trend reflects an evolving shift toward inclusivity in the frozen dairy category.

Increasing Penetration of E-Commerce and Direct-to-Consumer Channels

Digital transformation and online grocery delivery platforms have improved consumer access to frozen cheese products. The Global Frozen Cheese Market benefits from e-commerce growth in both developed and developing economies. Online retailers offer detailed product descriptions, storage guidance, and brand comparisons, improving consumer trust. Subscription-based models encourage repeat purchases and customer retention. Direct-to-consumer delivery ensures freshness through temperature-controlled packaging. Online distribution also supports smaller brands in reaching niche markets. Growing digital literacy and mobile app usage boost online frozen cheese sales. The trend continues to shape future retail models and marketing strategies.

Market Challenges Analysis:

Maintaining Product Quality and Supply Chain Efficiency During Distribution

Ensuring consistent product quality during transport remains a major challenge for producers and distributors. Frozen cheese requires precise temperature management to prevent texture loss and spoilage. Any deviation in the cold chain may lead to reduced shelf life or contamination. The Global Frozen Cheese Market faces logistical complexities in developing regions lacking reliable refrigeration infrastructure. Rising fuel and energy costs increase distribution expenses and retail prices. Manufacturers must balance between cost efficiency and quality assurance. Stringent regulations on dairy product handling add compliance burdens. Supply chain disruptions caused by weather, power outages, or geopolitical tensions further intensify the challenge. Companies continue investing in digital monitoring systems and energy-efficient storage to mitigate risks.

Fluctuating Raw Material Costs and Consumer Price Sensitivity

Volatile milk prices directly affect production costs and profitability. Fluctuations in global dairy supply impact frozen cheese pricing structures. The Global Frozen Cheese Market experiences pressure from competition with fresh and processed cheese segments. Consumers in price-sensitive regions often choose lower-cost substitutes or local brands. High packaging and storage costs add financial strain on manufacturers. Currency fluctuations in international trade affect export margins. Producers must continuously innovate to optimize production efficiency and maintain affordability. Maintaining a balance between quality, price, and sustainability remains an ongoing challenge for the industry.

Market Opportunities:

Rising Expansion Potential in Emerging Economies and Retail Growth

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer strong growth opportunities for frozen cheese producers. Rising incomes, changing dietary habits, and increasing retail penetration support demand. The Global Frozen Cheese Market benefits from urbanization and improved cold chain facilities in these regions. Foodservice expansions and supermarket growth make frozen cheese accessible to wider audiences. Partnerships with local distributors and retailers enhance brand visibility. Companies entering new regions can leverage growing demand for Western cuisines. Product localization through flavor customization enhances acceptance among regional consumers. The sector continues to show long-term potential for investment and brand expansion.

Focus on Sustainable Packaging and Health-Oriented Product Innovation

Consumers increasingly favor eco-friendly packaging and healthier cheese options. The Global Frozen Cheese Market is adapting through biodegradable packaging solutions and reduced-fat or low-sodium variants. Manufacturers emphasizing clean-label, organic, or non-GMO ingredients attract environmentally conscious buyers. Investments in recyclable and reusable materials enhance brand image and regulatory compliance. Health-oriented innovation strengthens customer loyalty in premium segments. Companies focusing on transparency and sustainability position themselves for long-term competitiveness. The trend aligns with global shifts toward responsible consumption and environmental protection.

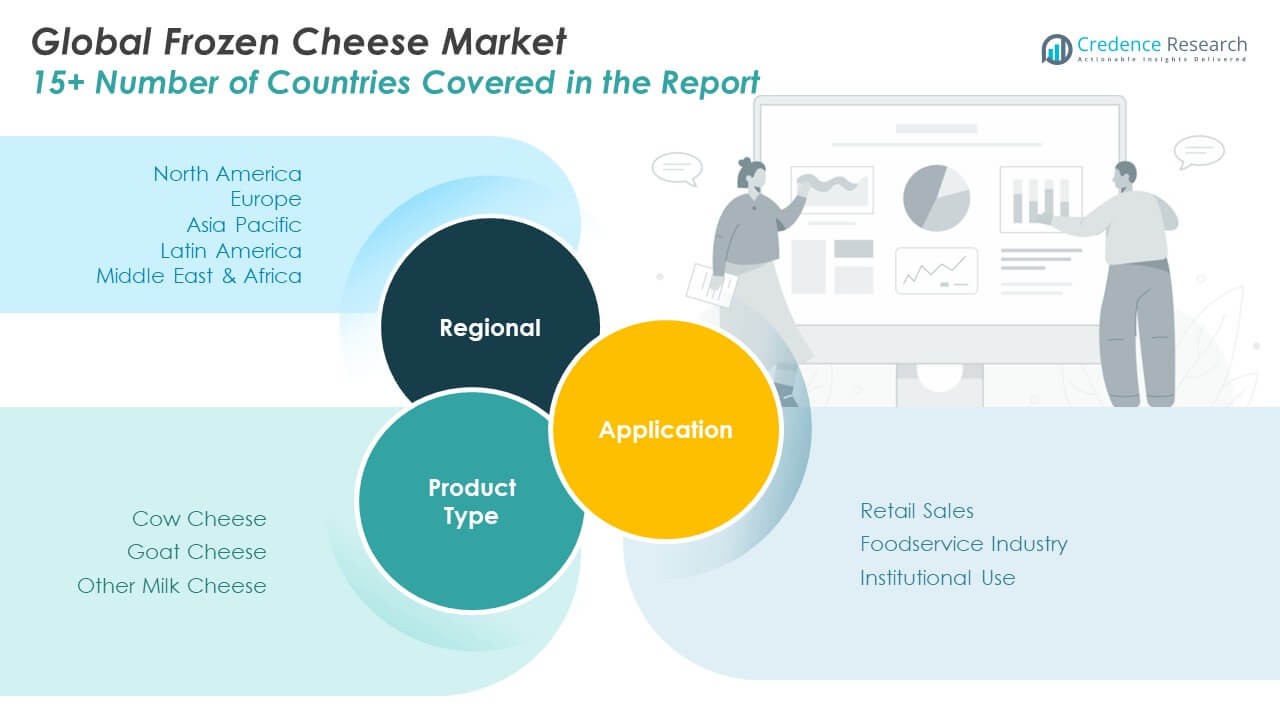

Market Segmentation Analysis:

By Product Type

The Global Frozen Cheese Market is segmented into cow cheese, goat cheese, and other milk cheese. Cow cheese holds the dominant share due to its rich texture, high protein content, and wide availability across retail and foodservice channels. It serves as a key ingredient in pizzas, sandwiches, and baked goods. Goat cheese is gaining popularity for its distinctive flavor and digestibility, appealing to health-conscious consumers. The segment benefits from rising demand in gourmet and specialty foods. Other milk cheese, including buffalo and sheep varieties, attracts niche markets emphasizing premium quality. Product innovation and improved freezing technology enhance texture and shelf life across all categories.

- For instance, U.S. industry data indicate the cheese industry increased production by over 1.1 million metric tons in a decade, supporting consistent supply of cow-milk cheese. Goat cheese is gaining popularity for its distinctive flavor and digestibility, appealing to health-conscious consumers.

By Application

The market is classified into retail sales, foodservice industry, and institutional use. Retail sales lead the segment with growing consumer preference for frozen dairy products offering convenience and extended freshness. Supermarkets and online stores contribute to increasing product visibility and accessibility. The foodservice industry shows strong growth as quick-service restaurants and catering businesses rely on frozen cheese for consistent quality and reduced waste. Institutional use, including schools, hospitals, and military catering, provides a steady revenue base due to large-scale procurement. The Global Frozen Cheese Market benefits from expanding cold storage infrastructure and rising consumption of ready-to-eat meals across all application areas.

Segmentation:

- By Product Type

- Cow Cheese

- Goat Cheese

- Other Milk Cheese

- By Application

- Retail Sales

- Foodservice Industry

- Institutional Use

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Write Regional Analysis * in professional tone of * [ Global Frozen Cheese Market ] in separate para for [NorthAmerica, Europe, Asia Pacific, Latin America, Middle east, Africa[ paragraphs with 8-9 sentences under 400 words, maintain professional tone, direct style and active voice.

. Use the [ Global Frozen Cheese Market ] one times in a paragraphs, use “it” as a subject if required more. Dont use “as a result”, limit “ing” form of verb. Dont start sentences with “as”. Dont use “Additionally”, “Moreover”, “in conclusion”.

Before each region add this para [The [Region name] Global Frozen Cheese Market size was valued at USD W million in 2018 to USD X million in 2024 and is anticipated to reach USD Y million by 2032, at a CAGR of Z during the forecast period. , pick up the relavant market value n cagr from the table given below. With sub headings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- FrieslandCampina

- Lactalis Group

- Saputo Inc.

- PepsiCo Inc.

- Dairy Farmers of America

- Kraft Heinz Company

- Danone

- Schreiber Foods

- TINE SA

- Bel Group

Competitive Analysis:

The Global Frozen Cheese Market features intense competition among major dairy and food-service companies that drive innovation and scale. Leading players differentiate through superior freezing technologies and global distribution systems to secure shelf space and logistical efficiency. Brands invest heavily in R&D to preserve texture, flavor, and nutritional value after freezing. The market rewards those who deliver consistent performance in foodservice and retail channels, which places pressure on smaller regional players. Several firms leverage acquisitions and partnerships to strengthen their footprint in emerging markets. They also expand product lines into goat and specialty cheeses to diversify beyond cow-milk bases. Global cold-chain expansion raises entry barriers for newcomers, giving established firms a competitive edge. The market continually shifts toward premium formats and value-added offerings, increasing the cost of staying ahead.

Recent Developments:

- In August 2025, Lactalis Group announced a major acquisition: the purchase of Fonterra’s Mainland Group, expanding Lactalis’s ambition and reach in the frozen and specialty cheese sector. This strategic move increases its production footprint in high-growth regions and solidifies its role as a global dairy leader. The acquisition’s completion is expected in the first half of 2026.

- Saputo Inc. introduced its new Saputo spicy mozzarella cheese, a premium product launch at the 2025 International Pizza Expo. This debut reinforces Saputo’s reputation for innovative mozzarella blends, with the product aimed at professional food service and restaurant clients seeking vibrant flavors in frozen cheese applications.

Report Coverage:

The research report offers an in-depth analysis based on Product Type and Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for frozen cheese will expand into plant-based milk alternatives and specialty cheese formats.

- Growth in online grocery and direct-to-consumer channels will broaden market reach.

- Foodservice innovation around ready-to-cook formats will boost usage of frozen cheese.

- Developing regions will capture higher growth as cold-chain infrastructure improves.

- Premiumisation of formats (e.g., gourmet blends, single-serve cheese snacks) will increase average revenue per unit.

- Sustainability in packaging and sourcing will influence brand competitiveness.

- Manufacturers will integrate IoT and automation in freezing and storage to reduce cost and waste.

- Trade liberalization and export growth will deepen cross-border frozen cheese flows.

- Reformulation efforts will target reduced salt, fat or allergens in frozen cheese products.

- Strategic partnerships between dairy producers and food-service chains will expand new application areas.