Market Overview

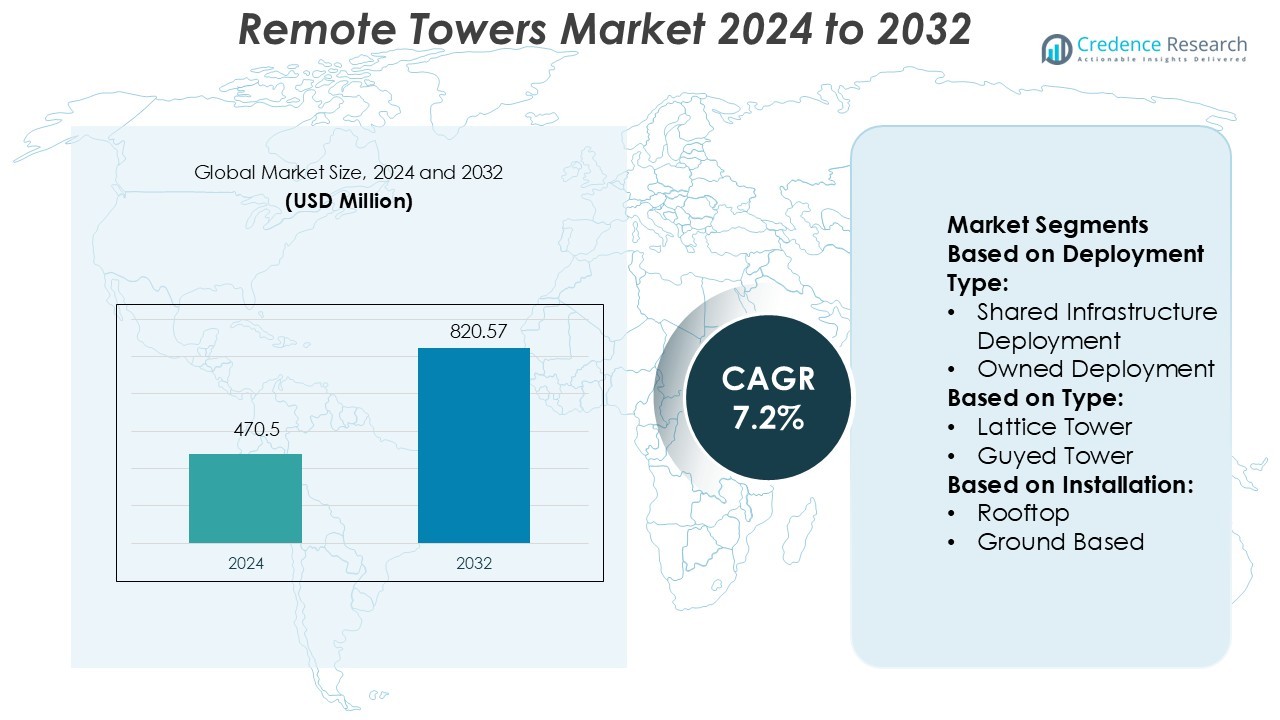

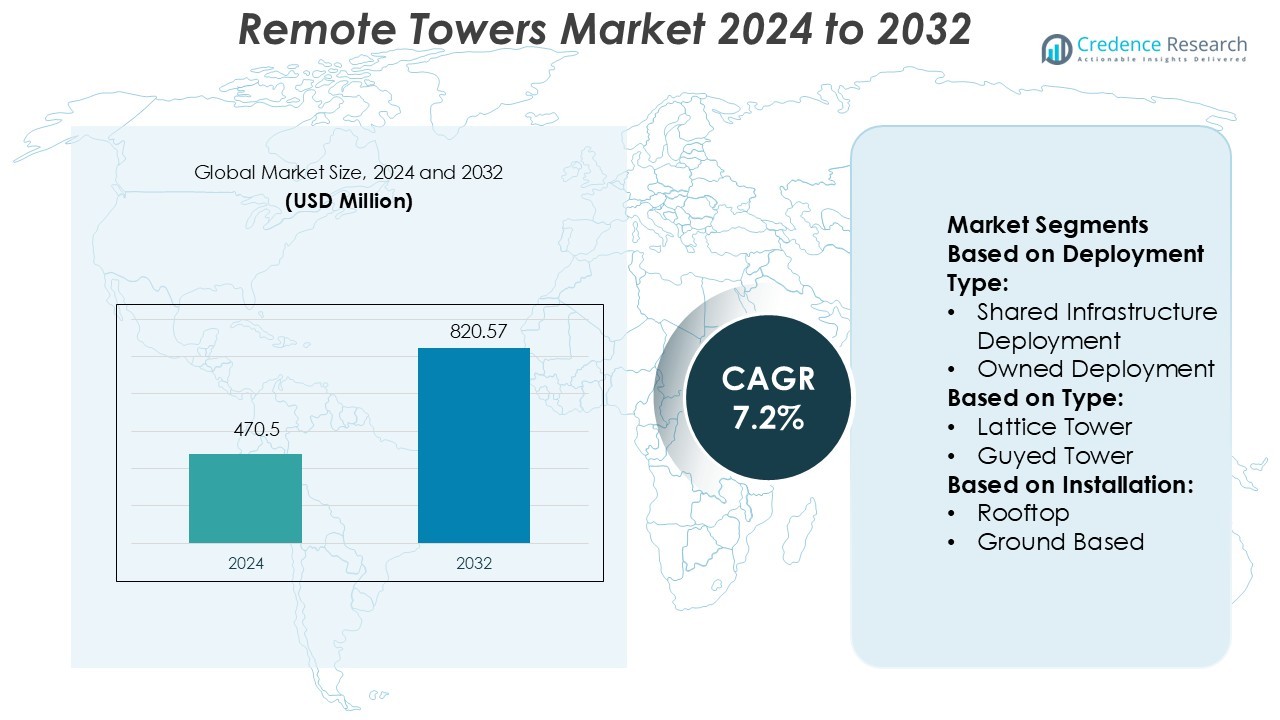

Remote Towers Market size was valued USD 470.5 million in 2024 and is anticipated to reach USD 820.57 million by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Remote Towers Market Size 2024 |

USD 470.5 Million |

| Remote Towers Market, CAGR |

7.2% |

| Remote Towers Market Size 2032 |

USD 820.57 Million |

The Remote Towers Market is supported by several strong industry participants driving continuous innovation and strategic growth. Companies are investing in advanced automation, multi-airport control systems, and AI-based surveillance to meet rising operational demands. Strategic collaborations with aviation authorities and airport operators are boosting large-scale deployments. Europe leads the global market with a 38% share, supported by well-established digital air traffic management infrastructure and early adoption of remote tower technology. The region benefits from strong regulatory frameworks and funding initiatives that accelerate implementation. This leadership is reinforced by ongoing modernization programs, increased air traffic efficiency goals, and growing interest in sustainable airport operations. Competitive intensity remains high, with vendors focusing on performance reliability, security integration, and cost-effective modular designs to maintain market positioning.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Remote Towers Market size was valued at USD 470.5 million in 2024 and is expected to reach USD 820.57 million by 2032, growing at a CAGR of 7.2%.

- The market is driven by the rising adoption of AI-based surveillance, automation, and multi-airport control systems, which enhance operational efficiency and reduce infrastructure costs.

- Strong competitive activity is observed as companies focus on performance reliability, cybersecurity, and cost-effective modular solutions to strengthen market positions.

- Europe leads the global market with a 38% share, supported by advanced infrastructure, strict regulations, and strong funding initiatives for air traffic modernization.

- The remote tower systems segment holds the largest share due to its flexibility and scalability, while surveillance and monitoring solutions are growing rapidly, reflecting increased investments in digital air traffic control solutions worldwide.

Market Segmentation Analysis:

By Deployment Type

Shared infrastructure deployment holds the largest market share in the remote towers market. This approach enables multiple airports to use a common system, reducing operational costs and improving resource efficiency. Shared setups allow regional airports to enhance air traffic management without heavy capital investments. The demand is driven by increased air traffic in smaller hubs and the growing need for flexible control center configurations. Technological advancements in virtual tower platforms and secure data networks further support the rapid adoption of shared deployments globally.

- For instance, Indra’s digital remote tower platform at HungaroControl for Budapest Ferenc Liszt International Airport supports over 120 000 aircraft movements per year while enabling operations from a remote centre outside the airport area.

By Type

Lattice towers dominate the market, supported by their strong structural design and cost efficiency. Their open framework enables better wind resistance and easier maintenance compared to other tower types. These towers are widely used in remote air traffic management systems, offering stable support for advanced sensor and camera technologies. The growing deployment of surveillance and communication systems in rural and regional airports drives this demand. Lattice towers are preferred for their scalability, making them a suitable choice for both temporary and permanent installations.

- For instance, L3Harris supplied 81 ADS-B receiver units to Aireon for integration into the Iridium NEXT satellite network, which enables advanced air traffic surveillance coverage across remote regions for air navigation service providers like the Federal Aviation Administration.

By Installation

Ground-based installations account for the largest market share in the remote towers market. These installations provide higher stability, better line-of-sight coverage, and enhanced capacity for advanced surveillance equipment. Airports prefer ground-based setups to support high-definition cameras, radar systems, and other monitoring technologies. Their easier maintenance and upgrade potential also contribute to strong adoption. Rising investments in modernizing airport infrastructure and improving air traffic efficiency are key factors driving this segment’s growth across both developed and emerging regions.

Key Growth Drivers

Rising Air Traffic and Airport Capacity Constraints

Growing passenger and cargo volumes are pushing airports to expand operational capacity. Remote tower technology allows air traffic control to manage multiple airports from a centralized location, easing congestion and improving flight handling. This approach helps reduce delays and enhances operational flexibility. Regional airports benefit most from these solutions, as they enable cost-effective modernization without building new control towers. Increasing demand for efficient airspace management continues to drive investments in remote tower programs worldwide.

- For instance, Searidge’s Digital Apron and Tower Management System (DATMS) was selected by Airport Authority Hong Kong (AAHK) and the Civil Aviation Department (CAD) to support apron and tower operations with a system in which over 240 camera sensors feed live views into the Integrated Airport Centre, a single remote control centre.

Cost-Effective Operations and Infrastructure Optimization

Remote towers offer lower capital and operational expenses compared to traditional air traffic control towers. They require fewer personnel on-site, streamline maintenance, and reduce infrastructure costs. Airports can use shared or centralized control centers to manage multiple locations, improving resource utilization. This cost efficiency attracts both small and medium-sized airports seeking to upgrade services without heavy investments. Governments and airport operators are adopting remote tower systems to modernize infrastructure and strengthen operational resilience.

- For instance, Saab’s r-TWR digital tower solution can deploy a full system on a trailer and become operational in 30 minutes in its deployable model.

Advancements in Sensor and Communication Technologies

Technological progress in cameras, radar systems, and secure communication networks is boosting remote tower adoption. High-definition imaging, infrared sensors, and real-time data transfer enhance situational awareness for air traffic controllers. Integration with automation and AI-driven decision-support systems further improves safety and operational efficiency. These advancements make remote towers more reliable and scalable, enabling broader deployment across regional and international airports. Enhanced technology is a key driver supporting the shift toward digital and virtual air traffic management solutions.

Key Trends & Opportunities

Growth of Multi-Airport Remote Tower Centers

Multi-airport control centers are becoming more common, enabling centralized management of several airports from one location. This model improves coordination, reduces operational costs, and optimizes staff deployment. It is particularly effective for low-traffic airports in remote or rural areas. National aviation authorities are adopting this approach to improve regional connectivity and resource efficiency. This trend creates strong opportunities for system integrators and technology vendors to offer scalable and interoperable solutions tailored to different airport sizes and needs.

- For instance, Kongsberg’s network architecture enables remote towers located more than 1 000 km from their control centre, with bandwidth requirements under 100 Mbit/s, enabling deployment in low-infrastructure regions.

Integration with AI and Automation

The integration of AI and automation in remote tower systems is transforming air traffic management. AI enhances real-time decision-making, improves threat detection, and supports predictive traffic flow control. Automation reduces human workload, improves operational accuracy, and supports scalable deployment. This trend is creating opportunities for advanced system providers to develop intelligent air traffic solutions. The combination of remote tower technology and AI can significantly enhance safety and operational efficiency, especially in high-density airspace regions.

- For instance, Leidos signed a 19-year contract with Kazaeronavigatsia covering work at 4 control centres and 21 towers in Kazakhstan for their implementation of the SkyLine-X automation platform.

Rising Investments in Regional Airport Modernization

Government and private sector investments are increasing in regional airport modernization projects. Remote towers provide a flexible and cost-effective solution for these airports to meet ICAO and regulatory standards. These projects aim to enhance connectivity and support economic growth in underserved regions. The growing focus on digital infrastructure and efficient resource allocation presents opportunities for remote tower suppliers and service providers to expand their market reach.

Key Challenges

Cybersecurity and Data Protection Risks

Remote tower systems rely heavily on digital infrastructure and real-time data exchange. This dependence makes them vulnerable to cyber threats, such as hacking and data breaches. Ensuring secure communication and network resilience is critical to maintaining operational safety. Any disruption can impact multiple airports simultaneously, increasing potential risks. Addressing cybersecurity concerns requires advanced encryption, intrusion detection systems, and compliance with strict aviation security standards, posing both technical and financial challenges for operators.

Regulatory and Certification Barriers

Strict aviation regulations and complex certification processes slow down remote tower deployment. National and international authorities require extensive testing and validation to approve remote tower operations. These procedures increase project timelines and costs, particularly for smaller airports with limited budgets. Harmonizing regulations across regions remains a challenge, affecting cross-border deployments. Delays in regulatory approval can limit investment momentum and slow market expansion despite strong technological readiness.

Regional Analysis

North America

North America holds the largest market share of 36% in the remote towers market. The strong presence of advanced airport infrastructure, combined with early technology adoption, drives this dominance. The U.S. and Canada are leading deployments, supported by initiatives to modernize air traffic management systems and enhance operational safety. High passenger volumes, strong regulatory frameworks, and major investments in digital air traffic technologies contribute to steady growth. Leading technology vendors and system integrators are expanding collaborations with regional airports, further strengthening the region’s leadership position in the global market.

Europe

Europe accounts for a 31% market share, supported by early regulatory approvals and successful operational deployments. The region pioneered remote tower technology with multiple certified sites in countries such as Sweden, Germany, and the U.K. Strong government support for digital transformation in aviation and multi-airport control center models accelerates growth. Investments in air traffic modernization programs, such as SESAR initiatives, further enhance adoption. The presence of key industry players and well-established aviation infrastructure positions Europe as a mature and expanding market.

Asia Pacific

Asia Pacific represents 22% of the global market, driven by rapid air traffic growth and airport infrastructure expansion. Countries like China, India, Japan, and Australia are investing heavily in advanced air traffic control solutions to meet rising passenger demand. Government-backed modernization programs and private sector involvement support the deployment of remote tower technologies. Regional airports are adopting these solutions to improve coverage and operational efficiency. Growing cross-border collaborations with European technology providers further strengthen Asia Pacific’s role in the global market.

Latin America

Latin America holds a 6% share in the remote towers market, supported by increasing interest in cost-effective air traffic control solutions. Countries like Brazil and Mexico are modernizing secondary airports to improve connectivity and reduce operational costs. Remote towers provide flexible deployment options suitable for low-traffic and remote regions. Government aviation agencies are evaluating pilot projects to enhance airport efficiency and safety. Although still in early stages, strategic partnerships with global vendors and regional modernization initiatives are expected to drive growth in this market.

Middle East & Africa

The Middle East & Africa region accounts for a 5% market share, with growth supported by infrastructure development and aviation expansion projects. Gulf countries are investing in advanced technologies to support large passenger hubs and remote airport operations. In Africa, remote towers offer practical solutions for managing low-traffic airports with limited infrastructure. Supportive regulatory developments and collaborations with global technology providers are accelerating adoption. While the market is still emerging, rising investments in airport modernization programs indicate strong potential for future expansion.

Market Segmentations:

By Deployment Type:

- Shared Infrastructure Deployment

- Owned Deployment

By Type:

- Lattice Tower

- Guyed Tower

By Installation:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Remote Towers Market is shaped by key players such as Indra Sistemas S.A., L3Harris Technologies, Inc., Searidge Technologies, Saab AB, RTX Corporation, Kongsberg Gruppen ASA, Rohde & Schwarz GmbH & Co. KG, Northrop Grumman, Frequentis AG, and Leidos, Inc. The Remote Towers Market is defined by strong technological advancements and strategic industry collaborations. Companies are focusing on enhancing system capabilities through AI integration, data analytics, and remote surveillance technologies to improve operational efficiency. Strategic alliances with airport operators and aviation authorities are enabling faster adoption of remote tower solutions, particularly at regional and low-traffic airports. Vendors are also investing in modular and scalable architectures that support multiple airports from a single control center. This approach helps reduce infrastructure costs and improve airspace management. Additionally, cybersecurity, regulatory compliance, and real-time monitoring remain top priorities, ensuring safe and secure air traffic operations. The growing emphasis on automation and digital transformation continues to drive innovation and intensify competition in this market.

Key Player Analysis

- Indra Sistemas S.A.

- L3Harris Technologies, Inc.

- Searidge Technologies

- Saab AB

- RTX Corporation

- Kongsberg Gruppen ASA

- Rohde & Schwarz GmbH & Co. KG

- Northrop Grumman

- Frequentis AG

- Leidos, Inc.

Recent Developments

- In January 2025, FourKites, a leading supply chain solutions provider, announced the launch of its Intelligent Control Tower. This innovative tool is designed to autonomously manage complex supply chain operations, provide actionable insights, evaluate risks, and deliver prescriptive recommendations.

- In July 2024, Indra Sistemas S.A. signed an agreement to deliver technology for the surveillance and monitoring of surface aircraft for airports in the U.S. The United States Federal Aviation Administration has included the company’s Surface Awareness Initiative (SAI) technology on its Qualified Product List, which will enable its deployment for any 450 airports in the country with staffed air traffic control towers.

- In June 2024, Rohde & Schwarz GmbH & Co. KG received a contract from the Polish Armaments Agency for multiple VHF/UHF R&S M3SR Series4400 software-defined radio stations from the SOVERON range of air traffic control. This deal comprises modernizing existing infrastructure according to stringent conditions and regulations. Moreover, software updates will be introduced in VHF/UHF radio stations to facilitate secure communication functionalities such as SATURN and HAVE QUICK II.

- In March 2024, Leidos, Inc. announced the opening of an Air Traffic Management Research and Collaboration Center in Singapore to address the rapidly changing demands of aviation. This initiative aims to deliver efficient and safe solutions to the Air Navigation Service Providers and the Civil Aviation Authority of Singapore (CAAS) in the Indo-Pacific region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Deployment Type, Type, Installation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of remote tower solutions will expand to more regional and low-traffic airports.

- AI and automation will enhance real-time monitoring and decision-making capabilities.

- Multi-airport control centers will become more common to improve operational efficiency.

- Cybersecurity measures will strengthen to meet stricter aviation safety regulations.

- Cloud-based platforms will support faster data sharing and remote operations.

- Integration with digital air traffic management systems will accelerate modernization.

- Strategic collaborations between technology providers and airport operators will increase.

- Regulatory approvals will drive large-scale implementation across developed regions.

- Cost-efficient modular solutions will support market growth in emerging economies.

- Innovation in surveillance and sensor technology will further boost market competitiveness.