Market Overview

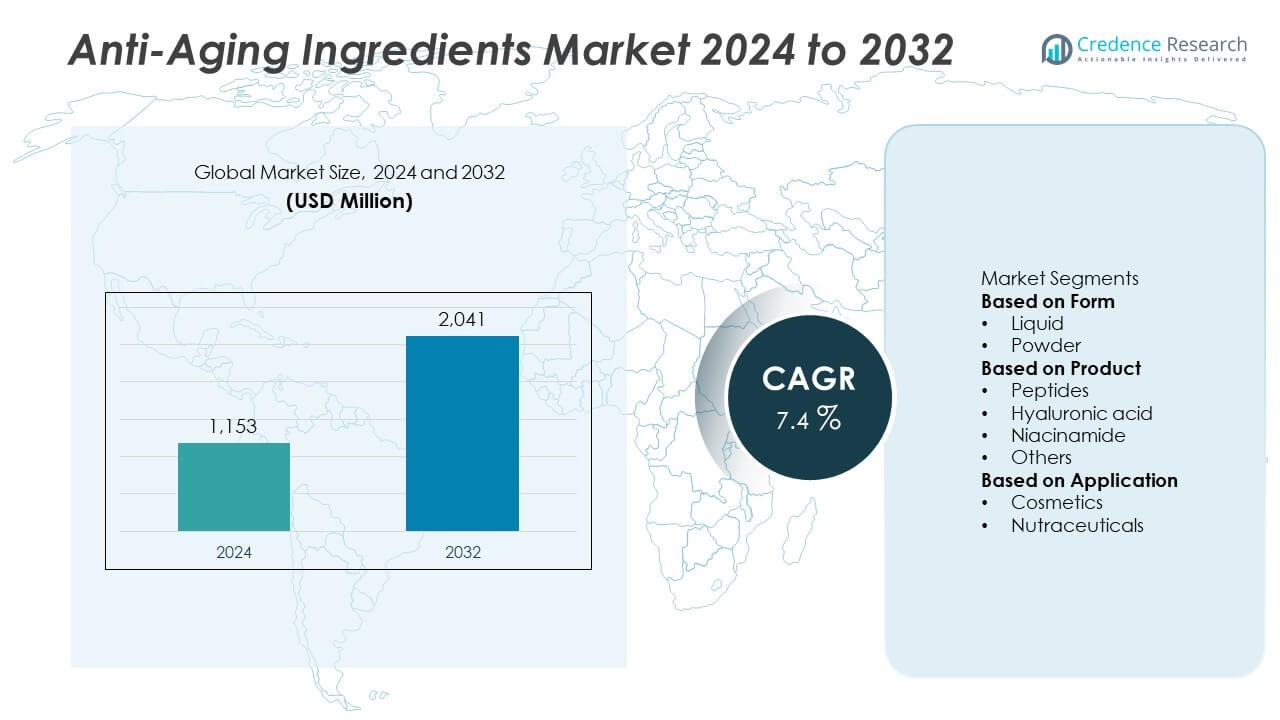

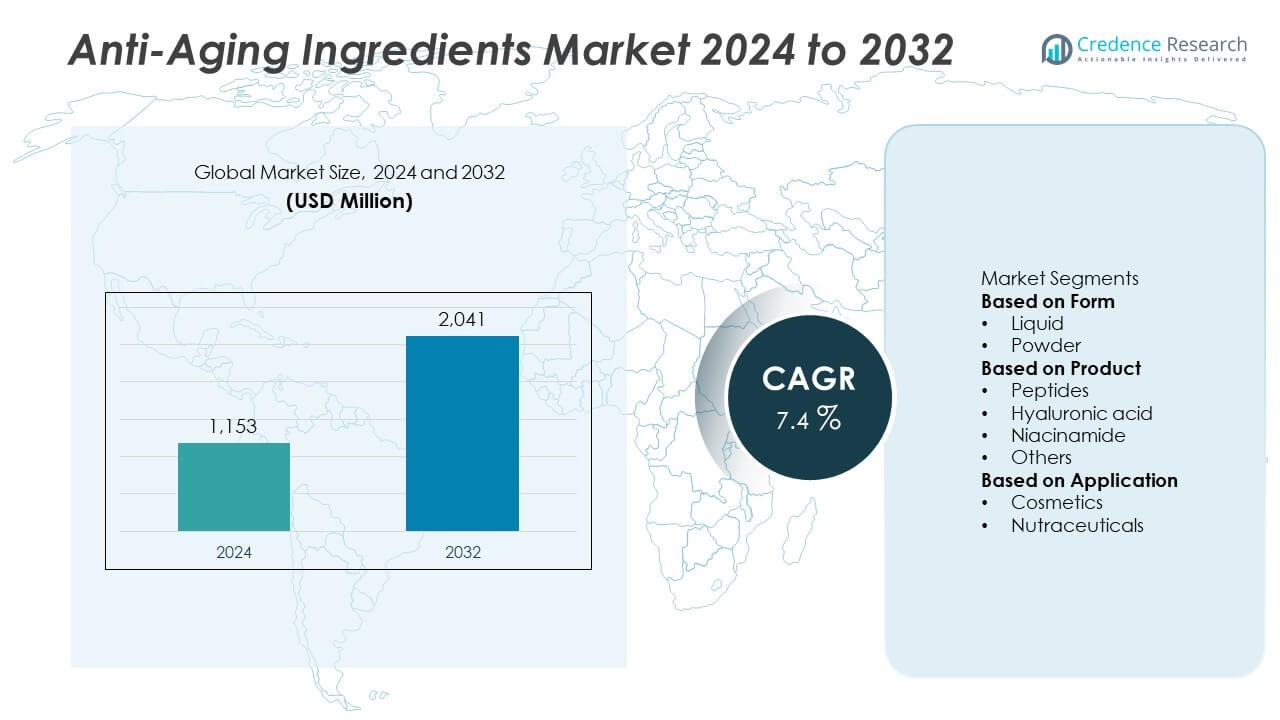

The Anti-Aging Ingredients Market was valued at USD 1,153 million in 2024 and is projected to reach USD 2,041 million by 2032, growing at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-Aging Ingredients Market Size 2024 |

USD 1,153 Million |

| Anti-Aging Ingredients Market, CAGR |

7.4% |

| Anti-Aging Ingredients Market Size 2032 |

USD 2,041 Million |

The anti-aging ingredients market is led by prominent companies including BASF, Unilever, Wacker Chemie, Lonza Group, Contipro, Croda International, Adeka, Dow Chemical, BioThrive Sciences, and Kao. These players dominate through innovative ingredient development, sustainable sourcing, and strong collaborations with cosmetic manufacturers. BASF and Lonza Group focus on bioactive peptides and natural antioxidants, while Unilever and Kao emphasize consumer-driven skincare formulations. North America led the global market in 2024 with a 36.9% share, supported by high consumer spending and advanced R&D infrastructure. Europe followed with a 30.2% share, driven by growing demand for organic and sustainable ingredients in premium skincare formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The anti-aging ingredients market was valued at USD 1,153 million in 2024 and is projected to reach USD 2,041 million by 2032, expanding at a CAGR of 7.4% during the forecast period.

- Increasing awareness of skincare and rising demand for anti-wrinkle and skin-firming products are driving market growth across both developed and emerging economies.

- The market trend is shifting toward clean-label, plant-based, and biotech-derived ingredients, with the liquid form segment holding a 61.3% share and peptides accounting for 37.8% of total demand.

- Leading players such as BASF, Unilever, Dow Chemical, Croda International, and Lonza Group dominate the market through innovation, sustainable sourcing, and partnerships with global cosmetic brands.

- North America leads with a 36.9% share, followed by Europe at 30.2% and Asia-Pacific at 25.7%, while Latin America and the Middle East & Africa continue to expand with increasing skincare awareness and product accessibility.

Market Segmentation Analysis:

By Form

The liquid segment dominated the anti-aging ingredients market in 2024, accounting for a 61.3% share. Liquids are preferred for their superior solubility, ease of formulation, and quick absorption into the skin. They are widely used in serums, lotions, and ampoules, allowing efficient delivery of active compounds like hyaluronic acid and peptides. Manufacturers favor liquid formulations for their compatibility with a wide range of cosmetic products. The growing demand for lightweight, fast-absorbing skincare solutions continues to drive the adoption of liquid anti-aging ingredients across premium and mass-market brands.

- For instance, L’Oréal developed its Revitalift Filler serum using 1.5% (15 mg/ml) of pure hyaluronic acid, demonstrating significant hydration improvement within one hour of application in a clinical study of 75 women.

By Product

The peptides segment led the market with a 37.8% share in 2024, driven by their proven efficacy in boosting collagen synthesis and reducing visible signs of aging. Peptides are widely incorporated in anti-wrinkle creams, serums, and eye care formulations. Growing consumer preference for clinically backed, high-performance ingredients has strengthened the demand for peptide-based products. Meanwhile, hyaluronic acid is witnessing strong growth due to its deep moisturizing and plumping properties. Continuous innovation in bioactive peptides and multifunctional formulations further supports market expansion.

- For instance, Procter & Gamble’s Olay Regenerist Micro-Sculpting Cream features Palmitoyl Pentapeptide-4 (also known as Matrixyl), which has been shown in independent dermatological trials to significantly improve skin elasticity, reduce the appearance of fine lines and wrinkles, and stimulate the production of collagen types I, III, and IV. One study noted that a cream containing this ingredient resulted in an 18% reduction in wrinkle depth and a 37% decrease in wrinkle thickness after 28 days.

By Application

The cosmetics segment accounted for a 72.6% share of the anti-aging ingredients market in 2024, emerging as the dominant application area. Rising consumer awareness about skincare routines and preventive aging care has fueled product demand across facial creams, serums, and sunscreens. The surge in premium beauty and personalized skincare products also contributes to the segment’s dominance. Nutraceuticals are gaining momentum as consumers increasingly adopt ingestible beauty supplements for holistic skin health. The convergence of inner and outer beauty trends continues to shape the long-term growth of both application segments.

Key Growth Drivers

Rising Consumer Focus on Skin Health and Appearance

Growing consumer awareness of skincare and aging prevention is a major factor driving the anti-aging ingredients market. Individuals are increasingly investing in products that reduce wrinkles, fine lines, and pigmentation. The influence of social media and beauty influencers has accelerated adoption among younger consumers. Expanding access to high-quality skincare through e-commerce platforms and the rising popularity of multi-functional products are further strengthening global demand for anti-aging ingredients.

- For instance, Estée Lauder reported that its Advanced Night Repair serum incorporates a Chronolux Power Signal Technology, and in a consumer test of 543 women, 89% said their skin felt firmer and had more bounce after using one bottle. The company provides 72-hour hydration with Hyaluronic Acid and offers 8-hour antioxidant protection.

Advancements in Biotech-Based and Natural Ingredients

Continuous innovation in biotechnology and natural extraction methods is fueling market growth. Manufacturers are developing bioactive ingredients like peptides, retinoids, and plant-derived antioxidants that deliver visible results with minimal irritation. The shift toward sustainable and organic formulations appeals to health-conscious consumers seeking chemical-free products. Growing investment in research for marine collagen, probiotic actives, and enzyme-based ingredients is enhancing formulation efficacy, providing companies a competitive advantage in product differentiation.

- For instance, DSM-Firmenich developed its SYN®-COLL tripeptide with verified in-vitro tests showing a 76% stimulation of collagen synthesis in fibroblast cultures. The ingredient is now widely used in global commercial formulations, demonstrating the company’s strength in peptide bioengineering and dermal innovation.

Expansion of Men’s Grooming and Premium Skincare Segments

The rapid rise of men’s grooming trends is expanding the customer base for anti-aging formulations. Increasing awareness about personal care and anti-wrinkle benefits among male consumers supports the use of active ingredients in aftershaves, moisturizers, and serums. At the same time, premium skincare brands are incorporating advanced formulations that offer both aesthetic and therapeutic benefits. This dual-market growth, supported by targeted marketing campaigns, has widened opportunities for manufacturers and ingredient suppliers globally.

Key Trends & Opportunities

Growing Demand for Natural and Clean Label Ingredients

Consumers are shifting toward natural, vegan, and cruelty-free skincare solutions, driving demand for plant-based anti-aging ingredients. Brands are increasingly adopting sustainable sourcing and transparent labeling practices to appeal to environmentally conscious buyers. Botanical actives like green tea extract, aloe vera, and resveratrol are gaining popularity for their antioxidant and anti-inflammatory benefits. This clean beauty trend provides opportunities for manufacturers to expand eco-friendly ingredient portfolios and tap into the growing sustainable skincare movement.

- For instance, Givaudan Active Beauty launched its Vetivyne™ ingredient derived from upcycled vetiver roots, leveraging an exclusive water-based, eco-friendly extraction process that is fully natural and sustainable.

Emergence of Nutricosmetics and Ingestible Beauty Products

The convergence of nutrition and skincare has fueled growth in the nutricosmetics segment. Consumers are embracing ingestible anti-aging solutions like collagen peptides, hyaluronic acid supplements, and antioxidant blends. These products enhance skin elasticity and hydration from within, complementing topical applications. The trend aligns with the rising preference for holistic wellness, encouraging companies to invest in edible beauty formulations. This cross-industry expansion is expected to significantly boost the global anti-aging ingredients market.

- For instance, Amway’s Nutrilite Collagen Shot delivers 2,500 mg of hydrolyzed collagen peptides and 50 mg of vitamin C per 25 ml serving, clinically shown to improve skin hydration within 12 weeks. The formulation leverages enzymatic hydrolysis technology for enhanced peptide bioavailability and absorption efficiency.

Key Challenges

High Development and Production Costs

Formulating effective anti-aging ingredients requires substantial R&D investment and advanced testing, leading to high production costs. Premium-grade bioactive compounds like peptides and retinoids are expensive to synthesize and stabilize. This limits accessibility in cost-sensitive markets and restricts adoption by smaller cosmetic brands. Additionally, stringent quality control and safety standards further increase operational expenses, challenging manufacturers to balance innovation with affordability.

Stringent Regulatory and Safety Requirements

The anti-aging ingredients market faces strict regulations related to ingredient safety, labeling, and claims validation. Regulatory bodies in the U.S., EU, and Asia impose rigorous testing requirements for efficacy and skin tolerance. Frequent updates to cosmetic compliance standards create challenges for global manufacturers to maintain certification. Delays in approval processes and restrictions on certain synthetic compounds can slow product launches, compelling companies to invest more in documentation, clinical trials, and compliance systems.

Regional Analysis

North America

North America dominated the anti-aging ingredients market in 2024 with a 36.9% share, driven by strong consumer awareness and high spending on premium skincare products. The United States leads the region due to widespread adoption of anti-wrinkle and collagen-boosting formulations. Continuous innovation in biotechnology-based ingredients and strong brand presence from global players such as Estée Lauder, Procter & Gamble, and Unilever further support market growth. The expanding male grooming segment and rising preference for clean-label products continue to drive demand, supported by advanced R&D capabilities and strong e-commerce infrastructure.

Europe

Europe accounted for a 30.2% share of the global anti-aging ingredients market in 2024, supported by increasing demand for sustainable and organic formulations. The U.K., France, and Germany remain major markets due to the popularity of premium skincare and dermocosmetic products. European consumers favor natural and vegan-friendly ingredients, encouraging brands to adopt eco-certified sourcing practices. Regulatory emphasis on product safety and environmental sustainability drives innovation in bio-based actives. The growing aging population and high disposable income further fuel demand for effective anti-aging solutions across the continent.

Asia-Pacific

Asia-Pacific held a 25.7% share in 2024 and emerged as the fastest-growing regional market. Rising consumer awareness, rapid urbanization, and growing middle-class income levels are fueling demand for anti-aging products in China, Japan, and South Korea. The region benefits from a strong cosmetic manufacturing base and technological advancements in ingredient synthesis. K-beauty and J-beauty trends emphasizing preventive skincare have accelerated innovation in peptides and natural actives. Increasing adoption of Western skincare routines and e-commerce expansion across emerging economies continue to support robust market growth.

Latin America

Latin America captured a 4.2% share of the anti-aging ingredients market in 2024, driven by growing interest in skincare and beauty enhancement products. Brazil and Mexico dominate the region, supported by rising disposable incomes and an expanding beauty industry. Local manufacturers are increasingly incorporating natural extracts and botanical ingredients to cater to evolving consumer preferences. However, limited access to high-cost bioactive ingredients and slower regulatory approvals hinder rapid market growth. The rising influence of social media and beauty influencers continues to expand consumer awareness of anti-aging solutions.

Middle East & Africa

The Middle East & Africa accounted for a 3.0% share of the global anti-aging ingredients market in 2024, supported by an expanding beauty and personal care sector. Countries such as Saudi Arabia, the UAE, and South Africa are leading regional growth through increasing adoption of anti-aging creams, serums, and nutraceuticals. Rising disposable incomes, growing youth population, and demand for luxury skincare products fuel market expansion. However, limited local manufacturing capacity and high product import costs remain key challenges. Strategic partnerships and distribution network expansion are expected to enhance regional accessibility.

Market Segmentations:

By Form

By Product

- Peptides

- Hyaluronic acid

- Niacinamide

- Others

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the anti-aging ingredients market is defined by the strong presence of major players such as BASF, Unilever, Wacker Chemie, Lonza Group, Contipro, Croda International, Adeka, Dow Chemical, BioThrive Sciences, and Kao. These companies lead through extensive product portfolios, global distribution networks, and consistent innovation in bioactive compounds. BASF and Dow Chemical focus on advanced peptide and retinoid technologies, while Croda International and Lonza Group emphasize sustainable, plant-based ingredients. Unilever and Kao are strengthening their market position through consumer-focused skincare innovations and digital brand engagement. Collaborations with biotech firms and research institutions are driving the development of next-generation ingredients that combine efficacy with safety. Intense competition is pushing manufacturers to adopt clean-label formulations, improve supply chain transparency, and enhance product customization to meet evolving consumer demands across premium and mass-market skincare segments.

Key Player Analysis

- BASF

- Unilever

- Wacker Chemie

- Lonza Group

- Contipro

- Croda International

- Adeka

- Dow Chemical

- BioThrive Sciences

- Kao

Recent Developments

- In April 2025, Evonik Industries AG introduced Vecollage® Fortify GP, a vegan collagen-polypeptide active featuring a dual anti-aging mechanism to address collagen degradation. The launch took place at the in-cosmetics Global 2025 exhibition.

- In April 2025, Lubrizol Corporation launched Lectroglaze™, a biotech-derived ingredient designed to enhance the skin’s electrical balance, improve antioxidant defense, and support a healthy microbiome.

- In February 2025, The Estée Lauder Companies, Inc. entered a collaboration with Serpin Pharma Inc. to integrate Serpin’s anti-inflammatory biotechnology into advanced skin-care formulations, supporting innovation in longevity and anti-aging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and sustainable anti-aging ingredients will continue to rise globally.

- Innovation in bioactive peptides and plant-derived antioxidants will drive product development.

- Advancements in biotechnology will enhance ingredient efficacy and skin compatibility.

- Clean-label and vegan formulations will gain stronger consumer preference.

- Expansion of men’s skincare and grooming products will create new growth opportunities.

- Collaboration between ingredient manufacturers and cosmetic brands will strengthen innovation pipelines.

- Digitalization and e-commerce growth will boost product accessibility and brand visibility.

- Asia-Pacific will experience rapid growth due to rising skincare awareness and premiumization.

- Stringent regulatory standards will encourage higher-quality and safety-driven formulations.

- Investment in research for multifunctional and personalized skincare solutions will shape the future market landscape.