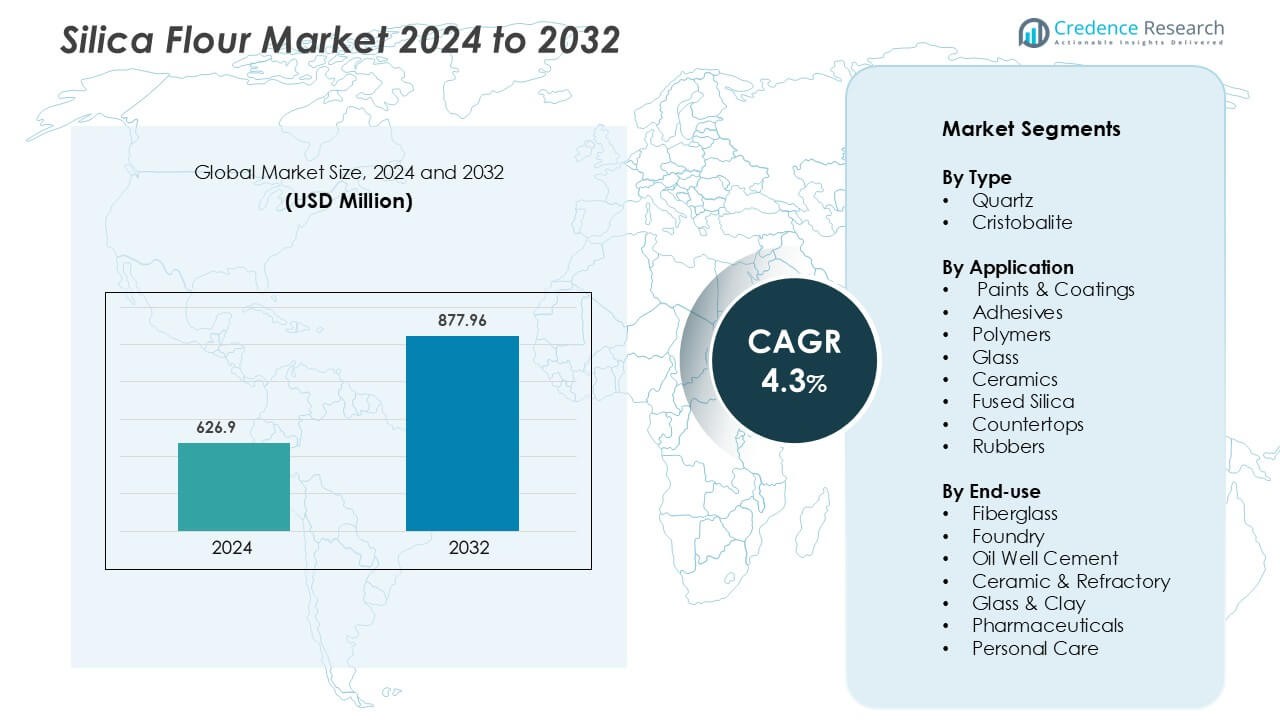

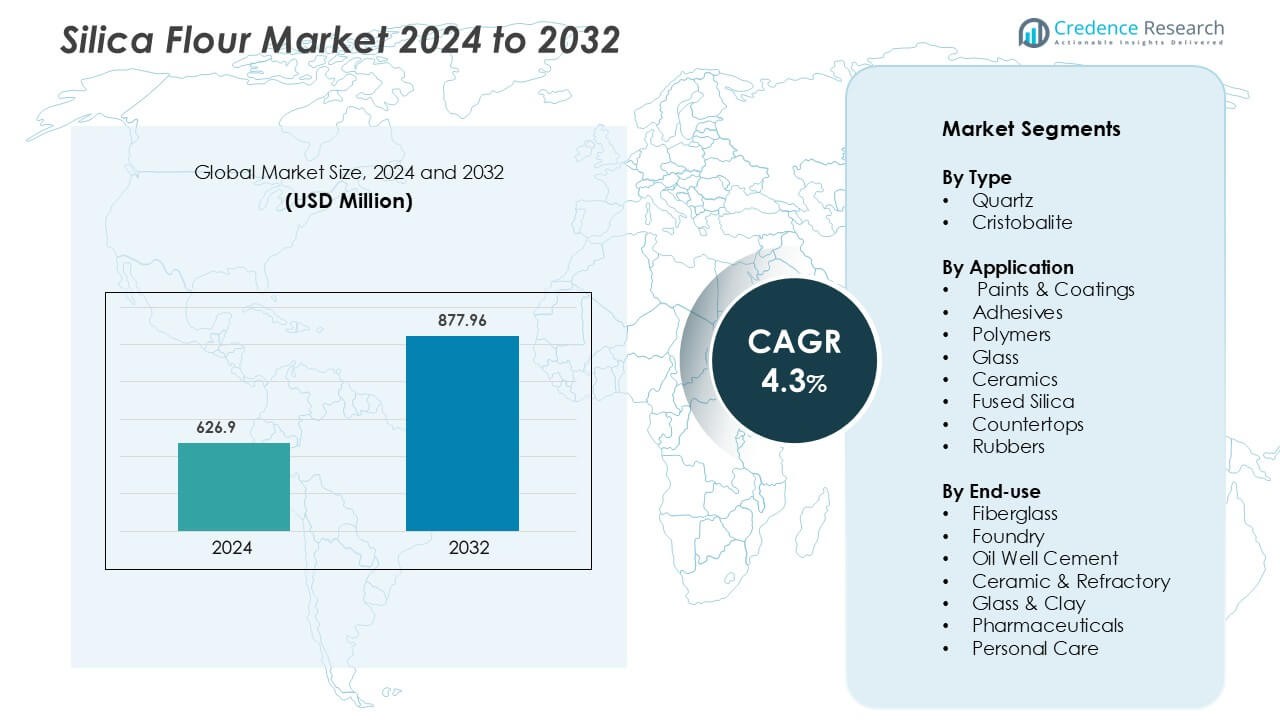

Silica Flour Market was valued at USD 626.9 million in 2024 and is anticipated to reach USD 877.96 million by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silica Flour Market Size 2024 |

USD 626.9 Million |

| Silica Flour Market, CAGR |

4.3% |

| Silica Flour Market Size 2032 |

USD Million |

The Silica Flour Market features strong competition among leading manufacturers focused on product innovation, purity enhancement, and regional expansion. Major players include Sibelco (Belgium), Finore Minerals LLP (India), Sil Industrial Minerals (Canada), Adwan Chemical Industries Co. Ltd. (Saudi Arabia), Euroquarz GmbH (Germany), AGSCO Corporation (U.S.), Fineton Industrial Minerals Limited (Hong Kong), U.S. Silica Holdings, Inc. (U.S.), Capital Sand Company (U.S.), and Hoben International Ltd. (UK). These companies prioritize customized silica grades for applications in glassmaking, foundry casting, and industrial coatings. North America leads the global Silica Flour Market with a 36% market share, supported by advanced manufacturing capabilities and strong demand from glass and construction industries. Europe and Asia-Pacific follow, driven by infrastructure growth and rising use in ceramics and paints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Silica Flour Market was valued at USD 626.9 million in 2024 and is projected to reach USD 877.96 million by 2032, growing at a CAGR of 4.3% during the forecast period.

- Growing demand from glass, paints, and ceramics industries drives the market as silica flour enhances durability, strength, and heat resistance.

- The market trend favors high-purity grades for solar glass and semiconductor manufacturing, supporting advanced industrial applications.

- Leading players such as Sibelco, U.S. Silica Holdings, and Adwan Chemical Industries are expanding production capacity and investing in refining technologies to maintain competitiveness.

- North America dominates with a 36% regional share, followed by Europe and Asia-Pacific, while the glass manufacturing segment holds a 28% market share due to strong construction and renewable energy growth.

Market Segmentation Analysis:

By Type

Quartz dominates the Silica Flour Market, accounting for the largest market share due to its high purity and superior hardness. Its widespread availability and consistent performance make it the preferred choice across multiple industrial processes. Cristobalite follows as a specialized variant used in applications demanding high thermal stability and brightness. The growth of the quartz segment is driven by its extensive use in glassmaking, foundry molds, and ceramics manufacturing, supported by technological advancements in micronization that improve particle uniformity and performance consistency in industrial formulations.

- For instance, 20 Microns Limited produces ground quartz and silica flour powders in sizes ranging from 65 microns down to 10 microns from its Gujarat facility, enabling fine‐particle loadings for coatings and plastics.

By Application

The glass segment holds the dominant market share within the application category, driven by rising demand from the construction, automotive, and solar industries. Silica flour is a key ingredient in producing clear, durable, and high-strength glass. The paints and coatings segment also demonstrates significant growth, supported by silica’s role in enhancing durability, scratch resistance, and pigment dispersion. Increasing production of solar panels and architectural glass continues to strengthen the dominance of the glass sub-segment, with manufacturers emphasizing precision processing for optical clarity and energy efficiency.

- For instance, Quarzwerke Group supplies surface-treated silica flour under its SILBOND® brand, where one ultrafine grade reports a D50 of 0.3 µm and a BET surface area of 30 m²/g, tailored for high-performance powder coatings.

By End-use

Fiberglass represents the largest end-use segment in the Silica Flour Market, holding a substantial market share due to its extensive use in insulation, composites, and reinforced plastics. The segment benefits from strong demand across automotive, construction, and wind energy industries. Silica flour enhances fiberglass strength and reduces bubble formation during production. Growth in renewable energy projects and infrastructure development fuels further demand. Additionally, the foundry and ceramic & refractory segments maintain steady growth, supported by silica’s critical role in heat resistance and dimensional stability during metal casting and high-temperature operations.

Key Growth Drivers

Expanding Demand from the Glass and Construction Industries

The growing use of silica flour in the glass and construction industries remains a primary growth driver. It serves as a crucial raw material in the production of flat glass, fiberglass, and specialty glass used in architectural and automotive applications. The surge in infrastructure development, energy-efficient buildings, and solar installations further elevates consumption. Glass manufacturers rely on high-purity silica flour for improved transparency and thermal resistance. Additionally, its role in cement and concrete formulations enhances mechanical strength and durability, promoting widespread adoption. As global construction and urbanization trends accelerate, particularly in Asia-Pacific and the Middle East, silica flour demand continues to rise steadily, supported by technological improvements in material refinement and particle size control.

- For instance, Chemsize International Trading Co., Ltd. supplies high-purity fused silica flour with a D50 value of 3-5 µm, Fe₂O₃ content less than 0.003 %, and SiO₂ content above 99.9 %, ensuring excellent optical clarity in high-performance glass.

Rising Application in Industrial and Foundry Processes

The foundry and metallurgy industries are key contributors to silica flour consumption due to its superior refractory and molding properties. Silica flour provides excellent thermal stability and uniform mold casting, ensuring high precision in metal component manufacturing. In foundry cores and molds, its fine particle size minimizes surface defects, improving product finish and dimensional accuracy. The oil well cement segment also benefits from silica flour’s strength-enhancing and anti-retrogression properties in high-temperature conditions. Increasing demand for cast products in automotive and heavy engineering sectors drives further use. Moreover, the growing focus on advanced refractory linings for high-temperature furnaces in steel and aluminum industries supports steady market expansion, particularly across emerging industrial economies.

- For instance, industry literature notes that micronized crystalline silica (silica flour) is added to high-temperature oil-well cement (>110 °C) to prevent strength retrogression in more than 500,000 tons of material annually.

Growing Use in Paints, Coatings, and Polymers

Silica flour plays an essential role in the paints, coatings, and polymer sectors by improving surface finish, hardness, and abrasion resistance. It acts as a functional filler that enhances mechanical strength and weather durability. Paint manufacturers use silica flour to improve pigment dispersion, reduce gloss, and boost UV protection in architectural and industrial coatings. In the polymer industry, it provides dimensional stability and reinforcement for thermoplastics, adhesives, and sealants. Growing infrastructure modernization, coupled with increased consumer preference for long-lasting coatings, drives demand. The rising focus on eco-friendly coatings and performance-based composites further enhances silica flour utilization, supported by ongoing product innovation targeting high-performance, low-VOC formulations in developed markets.

Key Trends & Opportunities

Shift Toward High-Purity and Microfine Silica Grades

A growing trend in the Silica Flour Market is the shift toward high-purity and microfine silica grades for precision-based applications. Industries such as semiconductors, solar panels, and specialty coatings increasingly demand ultra-clean silica with controlled particle distribution. Manufacturers are investing in advanced purification technologies and automated grinding systems to meet strict quality requirements. High-purity silica enables superior performance in electronic components and optical materials where impurities can cause functional defects. This trend opens opportunities for companies to differentiate products through customized purity levels and particle engineering, catering to niche markets such as electronics and energy-efficient construction materials.

- For instance, high-purity quartz powder from Chida Mineral Co., Ltd. is available in sizes with D50 of 2 µm, 5 µm, 10 µm and purity levels reaching up to 99.995%.

Rising Adoption of Sustainable and Recycled Silica Sources

Sustainability is becoming a major focus in silica flour production, creating opportunities for manufacturers using recycled or eco-friendly silica sources. Producers are adopting low-emission manufacturing and waste-reduction technologies to align with environmental regulations. The use of recycled glass and industrial by-products to produce silica flour is gaining momentum due to its cost efficiency and lower carbon footprint. This shift benefits manufacturers targeting green construction materials, renewable energy infrastructure, and sustainable paints. The trend not only reduces dependence on virgin raw materials but also enhances brand reputation among environmentally conscious industries, providing a competitive edge in regulated markets like Europe and North America.

- For instance, a study indicated that every tonne of glass cullet recycled into silica feedstock avoided approximately 315 kg of CO₂ emissions compared tovirgin silica mining and processing.

Key Challenges

Stringent Occupational and Environmental Regulations

One of the major challenges in the Silica Flour Market is compliance with strict occupational and environmental safety standards. Prolonged exposure to fine silica dust can lead to respiratory illnesses such as silicosis, prompting governments to impose tighter regulations on handling, processing, and emissions. Industries face increased operational costs due to mandatory dust control systems, protective equipment, and periodic health monitoring. Compliance with regulations from bodies like OSHA and REACH adds administrative complexity and limits smaller manufacturers’ competitiveness. The challenge pushes companies to adopt safer, automated production methods and explore alternative materials, though it increases investment costs and slows production expansion in certain regions.

Volatile Raw Material Prices and Supply Constraints

Fluctuating prices of raw silica sand and transportation costs present ongoing challenges for market stability. Supply chain disruptions due to mining restrictions, trade policies, or geopolitical tensions can hinder consistent raw material availability. Producers dependent on natural quartz sources face uncertainty in procurement, affecting production continuity and profitability. Additionally, the energy-intensive grinding and purification processes contribute to rising operational costs, particularly during energy price surges. To mitigate these risks, companies are investing in resource optimization, localized sourcing, and long-term supplier agreements. However, price volatility remains a constraint on profit margins, especially for small and mid-sized players competing in cost-sensitive markets.

Regional Analysis

North America

North America captured a market share of approximately 22.0% in 2024. The region benefits from strong demand for fiberglass, oil-well cement, and high-performance glass applications. Investment in renewable energy, automotive lightweighting, and advanced manufacturing supports silica flour uptake. Suppliers exploit high-quality quartz resources and efficient logistics networks, enabling consistent supply across the U.S. and Canada. The regulatory environment emphasises industrial safety and quality standards, which further drives premium grade product adoption and fosters stable long-term growth.

Europe

Europe holds a significant portion of the global silica flour market, estimated at roughly 15-20%. (Exact share not publicly specified) The region’s well-established glass, ceramics and foundry industries, particularly in Germany, France and the UK, support robust demand. A strong focus on energy-efficient building materials and green manufacturing strengthens uptake of refined silica flour grades. Moreover, Europe’s stringent environmental and health regulations push manufacturers to adopt higher-purity and lower-emission materials, reinforcing market maturity.

Asia-Pacific

Asia-Pacific leads the global silica flour market with the largest share, reported at approximately 39.5% in 2019. Rapid industrialisation, urbanisation and infrastructure growth in China, India and Southeast Asia drive this dominance. Expanding glass, fiberglass, coatings and foundry sectors consume large volumes of silica flour. Additionally, abundant raw silica sand deposits and competitive production costs enhance Asia-Pacific’s position as a global manufacturing hub. Aggressive investment in renewable energy, construction and automotive lightweighting further amplifies regional demand.

Latin America

Latin America holds a modest yet growing share, estimated at 5-8% of the global market. While local production capacity remains limited, expanding construction, oil & gas cementing and industrial applications in Brazil and Mexico fuel growth. Import reliance from North America and Asia increases exposure to cost and logistics risks. Nevertheless, targeted infrastructure projects and rising manufacturing activity support gradual share expansion in the region.

Middle East & Africa

The Middle East & Africa region commands an estimated 3-6% market share globally. Driving factors include large-scale infrastructure and smart-city developments, oil-well cementing operations and emerging glass/ceramics manufacturing in GCC and South Africa. The market remains less mature than other regions but offers growth potential through local capacity expansion and demand for high-temperature industrial applications.

Market Segmentations:

By Type

By Application

- Paints & Coatings

- Adhesives

- Polymers

- Glass

- Ceramics

- Fused Silica

- Countertops

- Rubbers

By End-use

- Fiberglass

- Foundry

- Oil Well Cement

- Ceramic & Refractory

- Glass & Clay

- Pharmaceuticals

- Personal Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The silica flour market is moderately fragmented, with global and regional players focusing on purity enhancement, particle size consistency, and application diversification. Sibelco and U.S. Silica Holdings, Inc. lead with high-grade silica flour used in glass manufacturing, oilfield services, and foundry applications, supported by extensive mining operations and global distribution networks. Adwan Chemical Industries Co. Ltd. and Euroquarz GmbH emphasize precision processing and tailored grades for paints, coatings, and polymer industries. Sil Industrial Minerals and Capital Sand Company strengthen North American supply capabilities through advanced beneficiation and logistics optimization. Finore Minerals LLP and Fineton Industrial Minerals Limited expand their market presence in Asia through cost-efficient production and export-oriented strategies. AGSCO Corporation and Hoben International Ltd. specialize in engineered silica for abrasives and industrial filtration. Companies are increasingly investing in sustainable mining practices, dust control technologies, and automation to ensure quality consistency and environmental compliance across production facilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sibelco (Belgium)

- Finore Minerals LLP (India)

- Sil Industrial Minerals (Canada)

- Adwan Chemical Industries Co. Ltd. (Saudi Arabia)

- Euroquarz GmbH (Germany)

- AGSCO Corporation (U.S.)

- Fineton Industrial Minerals Limited (Hong Kong)

- S. Silica Holdings, Inc. (U.S.)

- Capital Sand Company (U.S.)

- Hoben International Ltd. (UK)

Recent Developments

- In March 2022, Sibelco completed the acquisition of Kremer Zande n Grind (KZG) to increase silica sand resources and reserves in Western Europe

- In July 2022, Sibelco completed acquisition of Echasa S.A. for expansion of its customer base in construction, foundry, and glass markets in Spain’s northern part, apart from extending silica sand resources and reserves in Western Europe

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Silica Flour Market will witness steady growth driven by rising glass and ceramics demand.

- Increasing infrastructure projects will boost the use of silica flour in construction materials.

- Advancements in high-purity processing will enhance product quality for industrial applications.

- Growing solar panel production will create strong demand for refined silica flour.

- The shift toward eco-friendly coatings will increase the use of silica flour-based additives.

- Expansion of foundry and oilfield industries will continue to support market growth.

- Asia-Pacific will emerge as the fastest-growing region due to rapid industrialization.

- Strategic mergers and capacity expansions will strengthen the presence of key producers.

- Rising demand for precision-engineered fillers in polymers and rubbers will drive innovation.

- Continuous R&D investments will focus on improving consistency, purity, and performance efficiency.