Market Overview

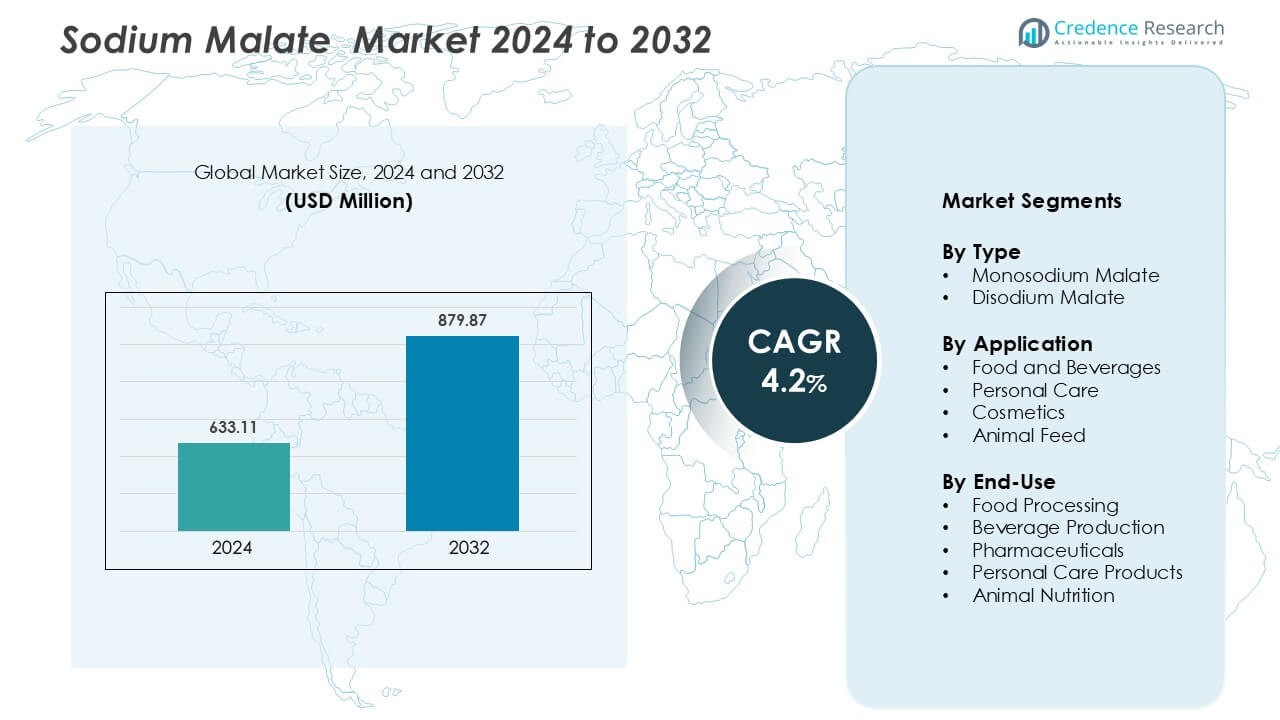

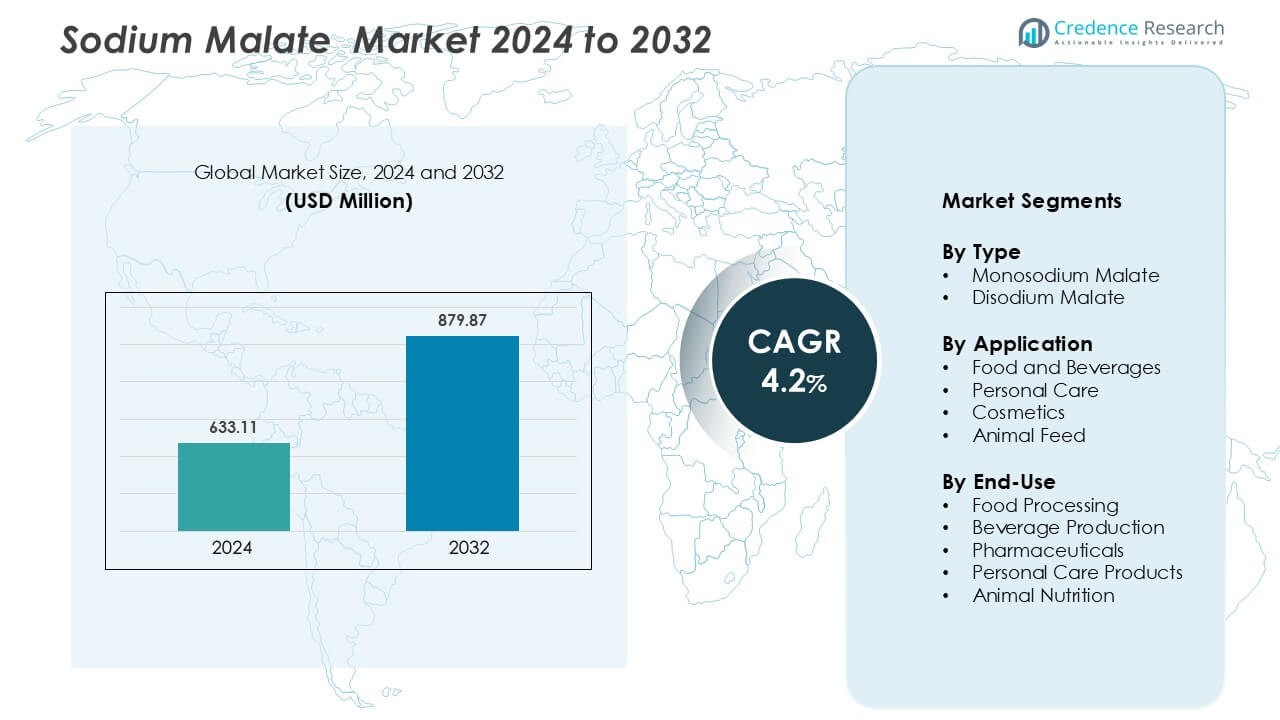

Sodium Malate market was valued at USD 633.11 million in 2024 and is anticipated to reach USD 879.87 million by 2032, growing at a CAGR of 4.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Malate Market Size 2024 |

USD 633.11 Million |

| Sodium Malate Market, CAGR |

4.2 % |

| Sodium Malate Market Size 2032 |

USD 879.87 Million |

The sodium malate market is highly competitive, with key players including Kerry Group, Jungbunzlauer Suisse AG, Tate & Lyle PLC, Bartek Ingredients Inc., Shandong Ruihong Biotechnology Co., Fuso Chemical Co., Emsland Group, Sigma-Aldrich Corporation, Sabinsa Corporation, and Ingredion Incorporated. These companies focus on enhancing production efficiency, product purity, and global reach through strategic alliances and R&D investments. Their efforts aim to meet rising demand from food, beverage, and pharmaceutical sectors. Asia-Pacific leads the global sodium malate market with a 34% share, supported by rapid industrialization, expanding food processing industries, and strong demand from China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global sodium malate market was valued at USD 633.11 million in 2024 and is projected to reach USD 879.87 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Strong demand from the food and beverage segment, holding the largest share, drives growth due to sodium malate’s use as a flavor enhancer and acidity regulator.

- Rising trends in clean-label and natural ingredient adoption across personal care, cosmetics, and nutraceutical applications are reshaping market dynamics.

- The market remains competitive, with key players such as Kerry Group, Tate & Lyle PLC, Jungbunzlauer Suisse AG, and Bartek Ingredients Inc. focusing on product innovation and regional expansion.

- Asia-Pacific leads with a 34% share, followed by North America at 31% and Europe at 28%, driven by industrial growth, expanding food processing activities, and increasing consumer awareness of product safety.

Market Segmentation Analysis:

By Type

Monosodium malate dominates the sodium malate market, holding the largest share due to its extensive use in food and beverage formulations as a flavor enhancer and acidity regulator. Its high solubility and stability make it suitable for processed foods, confectionery, and soft drinks. Disodium malate follows, serving mainly in functional beverages and personal care products for its superior buffering capacity. The increasing consumer preference for natural and clean-label ingredients continues to drive the demand for monosodium malate in global markets.

- For instance, Bartek Ingredients Inc. expanded its production capacity by 22,000 metric tons when commissioning a new maleic anhydride reactor system to feed its sodium malate-based product line.

By Application

The food and beverages segment accounts for the dominant share of the sodium malate market, driven by rising demand for flavor enhancement and pH control in processed foods. Sodium malate’s ability to balance tartness and extend shelf life supports its strong adoption across bakery, confectionery, and beverage categories. Personal care and cosmetics applications are also expanding as sodium malate serves as a humectant and pH adjuster in skincare and haircare products. Growing use in animal feed supports improved nutrition and digestion efficiency, adding to market diversity.

- For instance, feed-ingredient producers are utilizing sodium malate derivatives to enhance mineral absorption and gut health in livestock.

By End-Use

Food processing leads the sodium malate market by end-use, capturing the highest market share due to its broad use as an acidity regulator, emulsifier, and preservative in processed foods. Beverage production follows closely, supported by the use of sodium malate in soft drinks, sports drinks, and flavored water formulations. Pharmaceutical and personal care products segments are gaining traction as manufacturers adopt sodium malate for stability improvement and mild exfoliation properties. The animal nutrition segment benefits from its role in enhancing feed efficiency and mineral absorption.

Key Growth Drivers

Expanding Demand in the Food and Beverage Sector

The increasing use of sodium malate as an acidity regulator, flavor enhancer, and buffering agent in food and beverages is a major growth driver. Food manufacturers prefer sodium malate for its clean-label appeal, non-toxic nature, and ability to maintain product stability. It helps improve the taste and shelf life of processed foods, bakery items, and beverages. The growing trend toward natural additives and healthier food ingredients further strengthens its market position. As global food processing activities expand, sodium malate adoption continues to accelerate across developed and emerging economies.

- For instance, ADM primarily uses the established chemical synthesis method, specifically the hydration of maleic anhydride (derived from butane), which results in a racemic mixture (DL-malic acid).

Rising Adoption in Personal Care and Cosmetics

Sodium malate’s growing application in personal care and cosmetic formulations drives market expansion. It acts as a pH adjuster, exfoliating agent, and skin-conditioning compound, supporting its inclusion in skincare and haircare products. Brands focusing on mild, biodegradable, and natural-based ingredients are increasingly using sodium malate to align with consumer demand for clean beauty solutions. The compound’s compatibility with sensitive skin formulations also enhances its usage in dermatological products. The rising personal grooming awareness and higher disposable incomes globally contribute to sustained growth in this segment.

- For instance, Sodium malate and malic acid are widely used in skincare products primarily as pH adjusters (buffers) and skin-conditioning agents (humectants that help retain moisture). Malic acid also functions as a mild alpha-hydroxy acid (AHA) exfoliant.

Increasing Utilization in Pharmaceutical Formulations

The pharmaceutical industry’s expanding reliance on sodium malate as a stabilizer and pH regulator fuels its market growth. It ensures the optimal acidity of oral and injectable drugs, enhancing drug bioavailability and stability. Manufacturers favor sodium malate for its biocompatibility and low toxicity profile. Additionally, it serves as a buffering component in nutritional supplements and electrolyte formulations. The growing healthcare expenditure and production of advanced medicines globally are expected to further strengthen the compound’s presence in pharmaceutical manufacturing.

Key Trends and Opportunities

Shift Toward Natural and Sustainable Ingredients

A key trend shaping the sodium malate market is the industry’s transition toward natural, eco-friendly, and sustainable ingredients. Consumers increasingly favor products with fewer synthetic chemicals, boosting the use of sodium malate derived from bio-based malic acid. This aligns with global sustainability goals and clean-label trends in both food and personal care industries. Manufacturers are investing in green chemistry processes to reduce carbon footprints and improve product traceability. Such developments open opportunities for companies to differentiate through environmentally responsible production.

- For instance, Bartek Ingredients announced an expansion of its malic and fumaric acid production capacity with a new facility that is projected to achieve a per-unit greenhouse gas (GHG) emissions reduction of more than 80%.

Growing Demand in Nutraceutical and Functional Beverages

The expanding nutraceutical sector presents significant opportunities for sodium malate manufacturers. It enhances the flavor profile and mineral balance of functional beverages, energy drinks, and dietary supplements. Consumers seeking healthier, fortified beverages are driving this trend. Sodium malate’s ability to stabilize active ingredients and regulate acidity makes it a preferred additive in this category. As health-conscious lifestyles continue to spread globally, its demand in functional and sports drink formulations is expected to rise steadily.

Key Challenges

Fluctuating Raw Material Costs

The sodium malate market faces challenges due to volatility in raw material prices, particularly malic acid and sodium hydroxide. Any disruption in their availability or increase in production costs directly impacts manufacturers’ profit margins. Dependence on petrochemical-based raw materials also exposes the industry to global supply chain uncertainties. Companies must adopt cost-efficient sourcing and alternative feedstocks to maintain competitiveness. Continuous monitoring of price trends and investments in localized supply networks are essential to mitigate these fluctuations.

Regulatory and Quality Compliance Barriers

Stringent food safety, cosmetic, and pharmaceutical regulations across regions pose compliance challenges for sodium malate producers. Differences in additive approval processes among countries require extensive testing and certification. Any non-compliance can lead to market restrictions or delays in product launches. Manufacturers must maintain consistent quality, adhere to international standards, and ensure transparency in labeling to gain consumer trust. Regulatory harmonization efforts and strong R&D support are crucial to overcoming these market entry barriers.

Regional Analysis

North America

North America holds a significant share of the sodium malate market, accounting for 31% of global revenue. Strong demand from the food and beverage industry, particularly in the U.S., drives market expansion. The region’s advanced food processing sector and consumer preference for clean-label additives support product adoption. Additionally, the widespread use of sodium malate in pharmaceuticals and personal care formulations boosts growth. Strategic collaborations among key manufacturers enhance supply reliability, while regulatory approvals from the FDA and Health Canada strengthen product credibility, sustaining regional dominance.

Europe

Europe captures 28% of the global sodium malate market, led by strong demand from Germany, France, and the U.K. The region’s emphasis on natural and sustainable food ingredients supports sodium malate’s widespread use in processed foods and beverages. Stringent EU regulations favor clean-label formulations, driving preference for naturally derived additives. The compound also finds growing use in personal care and cosmetic products due to its pH-regulating and moisturizing properties. Europe’s expanding pharmaceutical manufacturing base further strengthens market growth, with companies focusing on eco-friendly sourcing and compliance with REACH standards.

Asia-Pacific

Asia-Pacific dominates the sodium malate market with a 34% share, driven by rapid industrialization in China, Japan, and India. Expanding food processing and beverage production industries are the primary contributors to regional growth. Rising disposable incomes and urbanization increase the demand for processed and functional foods. Moreover, growing investments in cosmetics and pharmaceutical manufacturing strengthen product adoption. Regional manufacturers benefit from low production costs and easy access to raw materials. Government initiatives promoting food safety and quality certification further accelerate sodium malate market expansion across Asia-Pacific.

Latin America

Latin America accounts for 4% of the global sodium malate market, with Brazil and Mexico leading demand. The growing food and beverage industry, supported by urbanization and evolving consumer preferences, drives regional growth. Sodium malate’s use as an acidity regulator in packaged foods and carbonated beverages supports its adoption. Expanding local cosmetic manufacturing also contributes to demand. However, limited technological advancements and reliance on imports constrain large-scale production. Efforts to enhance domestic manufacturing capabilities and investments in cleaner processing methods present growth opportunities for sodium malate producers in the region.

Middle East & Africa (MEA)

The Middle East & Africa region holds a 3% share of the sodium malate market, primarily driven by the food processing and personal care sectors. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing increasing demand for processed foods and skincare products. Rising consumer awareness of ingredient safety and international product imports contribute to market growth. However, limited industrial infrastructure and fluctuating raw material costs challenge local production. Strategic partnerships with global suppliers and expansion of food-grade additive imports are expected to strengthen sodium malate availability in MEA.

Market Segmentations:

By Type

- Monosodium Malate

- Disodium Malate

By Application

- Food and Beverages

- Personal Care

- Cosmetics

- Animal Feed

By End-Use

- Food Processing

- Beverage Production

- Pharmaceuticals

- Personal Care Products

- Animal Nutrition

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sodium malate market is moderately consolidated, with key players focusing on purity improvement, application expansion, and sustainable production technologies. Kerry Group and Tate & Lyle PLC lead through extensive food-grade product portfolios supporting flavor enhancement, acidity regulation, and nutritional fortification in beverages and confectionery. Jungbunzlauer Suisse AG and Bartek Ingredients Inc. emphasize eco-efficient production of high-purity malates using bio-based fermentation processes. Shandong Ruihong Biotechnology Co. and Fuso Chemical Co. strengthen the Asian market through large-scale manufacturing and competitive pricing. Ingredion Incorporated and Emsland Group integrate sodium malate into functional food and starch-based formulations targeting the clean-label trend. Sabinsa Corporation focuses on nutraceutical applications, leveraging sodium malate’s metabolic and buffering properties. Sigma-Aldrich Corporation caters to research and specialty chemical sectors with laboratory-grade variants. Companies are investing in process optimization, food safety certifications, and regional partnerships to expand distribution networks and enhance compliance with global quality standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kerry Group

- Shandong Ruihong Biotechnology Co.

- Jungbunzlauer Suisse AG

- Tate & Lyle PLC

- Emsland Group

- Sigma-Aldrich Corporation

- Sabinsa Corporation

- Fuso Chemical Co.

- Ingredion Incorporated

- Bartek Ingredients Inc.

Recent Developments

- In July 2025, Jungbunzlauer showcased at IFT FIRST 2025 new solutions focusing on bioavailable organic mineral salts including sodium forms, emphasizing their biodegradable and natural-origin ingredients for food, beverage, and nutrition, which may include sodium malate applications.

- In January 2024, Tate & Lyle defended their patent related to allulose syrup, and although not specific to sodium malate, they continue enhancing their food preservative and ingredient solutions relevant to sodium malate use in 2024-2025.

- In December 2023, Kerry Group purchased part of Chr. Hansen and Novozymes’s worldwide lactase enzyme business, which may impact their preservative and ingredient portfolio, including sodium malate applications in food and nutrition sectors.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The sodium malate market will continue growing due to rising demand in food and beverages.

- Clean-label and natural ingredient trends will drive wider adoption across industries.

- Pharmaceutical applications will expand as sodium malate gains use as a stabilizer and pH regulator.

- Personal care and cosmetic manufacturers will increase usage in skincare and haircare products.

- Asia-Pacific will remain the dominant region, supported by strong food processing and manufacturing growth.

- Technological advancements in bio-based production will improve efficiency and sustainability.

- Companies will focus on strategic partnerships to strengthen global distribution and supply chains.

- Regulatory approvals will enhance product credibility and encourage market expansion.

- Increasing demand for functional and fortified beverages will boost sodium malate consumption.

- Continuous R&D investments will lead to new formulations catering to health-conscious consumers.