Market overview

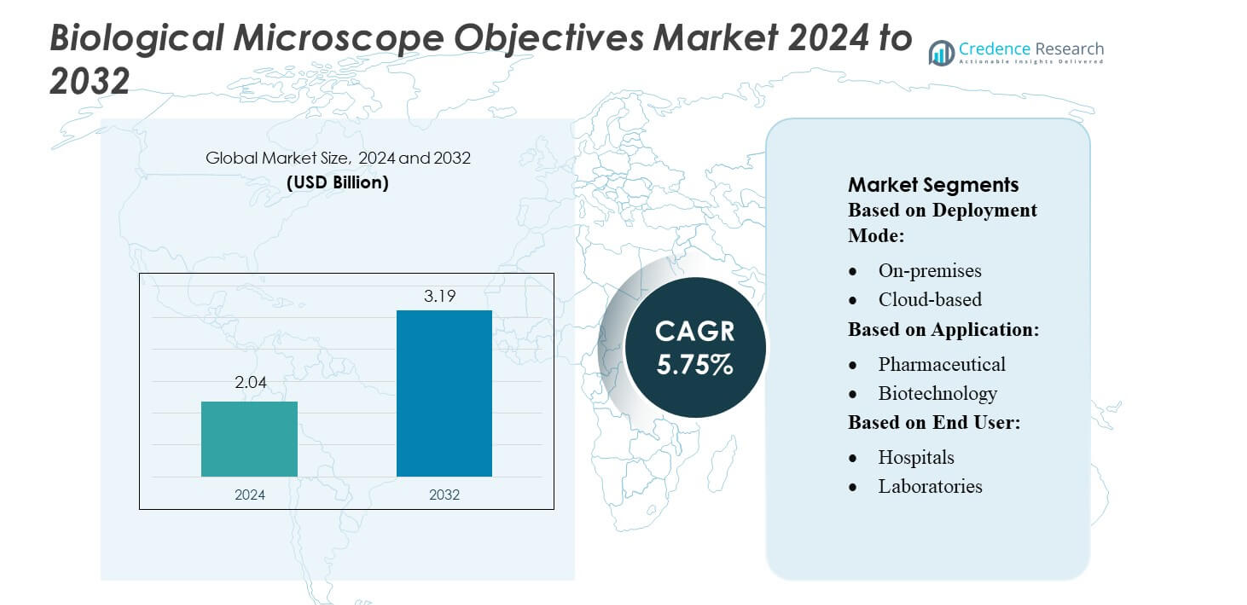

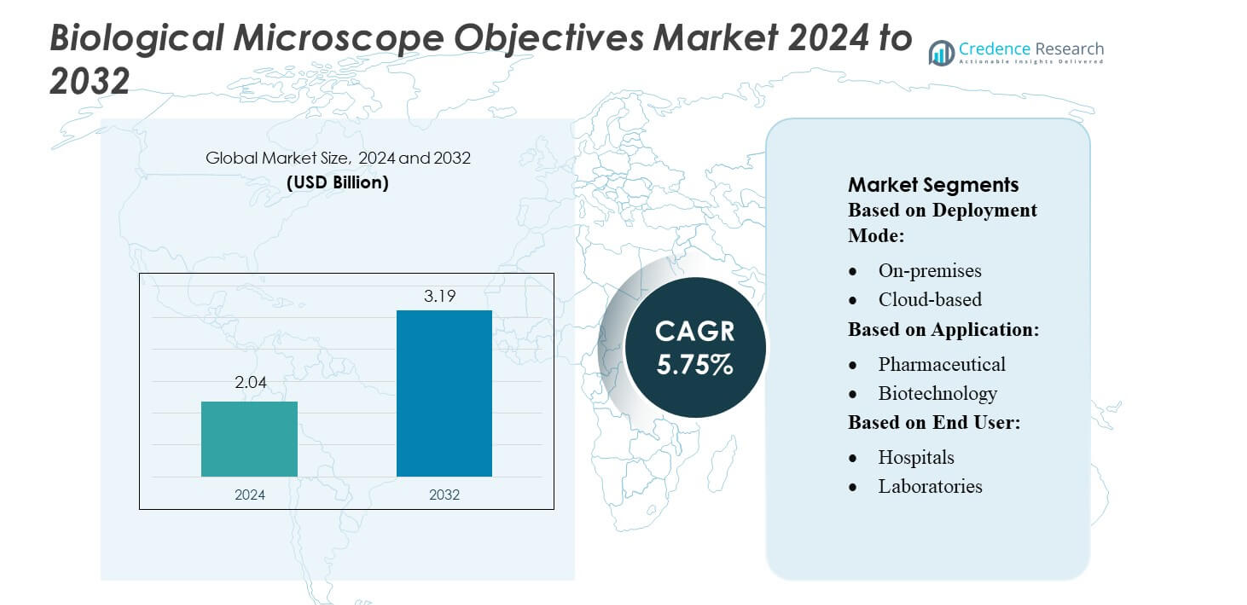

Biological Microscope Objectives Market size was valued USD 2.04 billion in 2024 and is anticipated to reach USD 3.19 billion by 2032, at a CAGR of 5.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biological Microscope Objectives Market Size 2024 |

USD 2.04 billion |

| Biological Microscope Objectives Market, CAGR |

5.75% |

| Biological Microscope Objectives Market Size 2032 |

USD 3.19 billion |

The biological microscope objectives market is shaped by the strong presence of leading manufacturers that continue to advance optical performance and precision imaging capabilities. Key players—including Olympus Corporation, Nikon Corporation, Zeiss Group, Thermo Fisher Scientific, Inc., Bruker Corporation, Hitachi High-Tech Corporation, JEOL Ltd., CAMECA, NT-MDT SI, and Oxford Instruments (Asylum Research)—compete through innovation in high-NA objectives, fluorescence optimization, and multi-modal compatibility. These companies maintain a global footprint supported by research partnerships and technology upgrades across life science and clinical sectors. North America leads the market with an approximate 35% share, driven by high R&D investment and strong adoption of advanced microscopy platforms.

Market Insights

- The Biological Microscope Objectives Market was valued at USD 2.04 billion in 2024 and is projected to reach USD 3.19 billion by 2032, registering a CAGR of 5.75%, supported by rising adoption of high-precision imaging in research and clinical diagnostics.

- Growing demand for high-NA, multi-modal, and fluorescence-optimized objectives drives market expansion as life science and pharmaceutical research increasingly depend on advanced cellular and molecular imaging.

- The market shows strong trends toward automation, digital microscopy integration, and AI-enabled workflows, encouraging manufacturers to develop objectives compatible with high-speed, high-stability imaging systems.

- Competitive intensity remains high as major players invest in optical engineering innovations, collaborative R&D programs, and portfolio upgrades; however, high equipment costs and technical complexity restrain adoption in budget-limited laboratories.

- North America leads with a 35% regional share, while the pharmaceutical application segment holds the largest contribution at around 40%, driven by extensive use of precision optics in drug discovery and cell-based research.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Mode

The on-premises segment holds the dominant position with an estimated market share of around 60%, driven by the need for secure, high-precision imaging environments in institutions handling sensitive or proprietary biological samples. This model enables users to maintain full control over data, calibration workflows, and hardware maintenance, which remains essential for advanced microscopy laboratories. Cloud-based deployment continues to expand as remote-access imaging, automated software updates, and scalable storage gain traction, particularly among research groups seeking greater collaboration and reduced infrastructure costs.

- For instance, Olympus’ X Line objectives achieve a numerical aperture of 1.45 and enhance uniform optical performance across a 25 mm field of view, enabling laboratories to maintain uncompromised resolution during high-precision imaging.

By Application

The pharmaceutical segment leads the market with roughly 40% share, driven by the high demand for precision optical systems supporting drug discovery, compound screening, and cellular imaging. Pharmaceutical research requires consistent, high-resolution optics to validate molecular interactions and document early-stage therapeutic responses, positioning advanced objectives as essential tools. Biotechnology applications follow closely as imaging-intensive workflows expand in genomic and proteomic studies. Neuroscience also represents a strong growth area, supported by rising adoption of multi-photon and high-NA objectives for mapping neuronal circuits and tracking cellular dynamics.

- For instance, Bruker’s Luxendo MuVi SPIM light-sheet system enables volumetric imaging at acquisition speeds of up to 60 volumes per second, supporting rapid phenotypic screening in drug development.

By End-user

Research and academic institutes dominate the market with an approximate 45% share, propelled by continual investments in advanced microscopy infrastructure to support multidisciplinary scientific programs. These institutions rely heavily on high-resolution objectives for cell biology, molecular imaging, and translational studies, reinforcing sustained procurement of specialized optics. Laboratories also contribute significantly as imaging workflows intensify in diagnostic and analytical settings. Hospitals adopt biological objectives primarily for pathology and clinical research, while pharmaceutical and biotech companies continue to expand usage to accelerate discovery cycles and strengthen evidence-based development pipelines.

Key Growth Drivers

Rising Demand for High-Resolution Cellular Imaging

The growing need for precise visualization of cellular structures drives strong demand for advanced biological microscope objectives. Research programs in cell biology, regenerative medicine, and molecular diagnostics increasingly depend on objectives offering high numerical apertures, improved contrast, and enhanced depth of field. As laboratories adopt multi-modal imaging workflows, the requirement for objectives compatible with fluorescence, phase contrast, and confocal systems continues to rise. This demand accelerates upgrades to premium optics that enable more detailed and reproducible imaging outcomes across research and clinical settings.

- For instance, JEOL’s JEM-F200 transmission electron microscope achieves a high spatial resolution, typically a point resolution of 1.9 Å (0.19 nm) or a lattice resolution of 1.0 Å (0.1 nm), enabling ultrastructural cell imaging with nanometer-scale clarity.”

Expansion of Life Science Research and Drug Discovery Programs

Life science research institutes and pharmaceutical companies are rapidly scaling their imaging capabilities to support complex assays, automated screening, and early-stage drug validation. This expansion fuels higher uptake of objectives engineered for stability, low aberration, and compatibility with high-throughput platforms. The push toward understanding disease mechanisms at the cellular level reinforces the need for precision optics that can reliably capture live-cell dynamics and biomolecular interactions. Consequently, biological microscope objectives play an integral role in accelerating discovery timelines and improving data accuracy in experimental workflows.

- For instance, CAMECA’s NanoSIMS 50L enables isotopic and molecular imaging with a lateral resolution of down to 50 nm, allowing precise quantification of intracellular elemental distributions.

Technological Advancements in Optical Engineering

Continuous innovations in lens coatings, glass formulations, and objective design significantly enhance imaging performance, driving market growth. Advances such as apochromatic correction, improved chromatic aberration control, and enhanced light transmission support superior clarity in fluorescence and widefield imaging. Additionally, development of objectives optimized for long working distances and deep-tissue visualization expands their applicability in tissue engineering and neurobiology. These engineering improvements enhance research versatility, allowing users to conduct complex, high-resolution imaging tasks with greater consistency and minimal optical distortion.

Key Trends & Opportunities

Increasing Adoption of Automated and Digital Microscopy Platforms

Automation in biological imaging is expanding rapidly as laboratories shift toward digital microscopy, AI-assisted analysis, and integrated imaging ecosystems. This trend creates opportunities for objectives optimized for automated focusing, multi-position scanning, and stable performance during long-duration imaging sessions. Digital workflows require objectives that maintain clarity across diverse illumination and sensor configurations, strengthening demand for optically adaptable designs. As remote imaging and cloud-based analysis become more common, manufacturers have the opportunity to develop objectives tailored for compatibility with emerging digital microscopy infrastructures.

- For instance, Nikon’s Perfect Focus System (PFS) maintains focus with a precision of within 10 nm, enabling uninterrupted automated time-lapse imaging. Digital workflows require objectives that maintain clarity across diverse illumination and sensor configurations, strengthening demand for optically adaptable designs.

Growing Use of Advanced Imaging Techniques in Neuroscience and Live-Cell Research

Neuroscience and live-cell imaging introduce substantial opportunities for objectives capable of supporting deep-tissue, fast-frame, and low-light imaging techniques. The increasing adoption of multiphoton, super-resolution, and high-speed fluorescence microscopy creates demand for high-NA and water-immersion objectives that preserve specimen viability while enhancing clarity. Researchers continue to prioritize optics that reduce phototoxicity and enable long-term observation of cellular behavior. These requirements open avenues for manufacturers to innovate in objective design, particularly for applications involving dynamic cellular processes and complex biological structures.

- For instance, Thermo Fisher’s Invitrogen™ EVOS™ M7000 system supports time-lapse acquisition with automated stage repeatability of ±1 µm, enabling stable long-term live-cell monitoring. Researchers continue to prioritize optics that reduce phototoxicity and enable long-term observation of cellular behavior.

Rising Interest in Modular and Customizable Optical Systems

Users are increasingly seeking modular microscope setups that allow customization of optical paths, objective types, and imaging configurations. This trend supports opportunities for manufacturers offering interchangeable objectives tailored to specific imaging modes such as confocal, DIC, and fluorescence. The need for flexible systems is particularly strong in multi-disciplinary laboratories where equipment must support varied research protocols. As customization becomes a purchasing priority, brands that deliver adaptable, high-performance objectives with standardized mounting and precision alignment features are positioned to gain a competitive advantage.

Key Challenges

High Cost of Advanced Optical Components

Premium biological microscope objectives often require complex manufacturing processes, specialized glass materials, and precision coatings, resulting in high acquisition costs. These expenses pose a challenge for smaller laboratories, academic institutions with tight budgets, and emerging research centers in developing regions. The cost barrier can limit adoption of high-end objectives, particularly apochromatic and immersion types essential for advanced imaging. As imaging requirements evolve, institutions may struggle to maintain updated optical inventories, leading to slower modernization of microscopy infrastructure.

Technical Complexity and Maintenance Requirements

The increasing sophistication of microscope objectives introduces challenges related to handling, alignment, cleaning, and long-term maintenance. High-resolution optics are sensitive to contamination, improper immersion media, and temperature fluctuations, which can degrade imaging quality and shorten product lifespan. Users often require specialized training to manage objectives safely, especially those used in fluorescence and immersion-based imaging. This complexity can hinder optimal utilization in laboratories lacking technical expertise, resulting in inconsistent performance, workflow downtime, and higher operational costs.

Regional Analysis

North America

North America holds the largest share in the biological microscope objectives market, accounting for approximately 35% of global demand. The region benefits from a strong concentration of advanced research institutions, high R&D spending, and widespread adoption of high-resolution imaging technologies. Growth is further supported by the presence of major biotechnology and pharmaceutical companies that rely on precision optics for drug discovery and cell-based studies. Increasing investment in digital microscopy platforms across universities and clinical laboratories also fuels adoption. Regulatory emphasis on high-quality imaging standards consistently sustains demand for premium objectives.

Europe

Europe represents around 28% of the market, supported by well-established academic research infrastructures and a strong network of clinical laboratories adopting advanced microscopy technologies. Countries such as Germany, the UK, and France lead demand due to robust funding for life science programs and active participation in neuroscience, molecular biology, and translational research initiatives. The region’s commitment to high manufacturing standards and adoption of optical innovations encourages steady upgrades to advanced objective lenses. Additionally, the continuing shift toward digital pathology and automation across European healthcare systems reinforces the market’s growth trajectory.

Asia-Pacific

Asia-Pacific accounts for approximately 25% of the global market and is the fastest-growing region, driven by rising investment in biotechnology, academic research, and healthcare modernization. China, Japan, South Korea, and India significantly contribute to demand as laboratories expand their imaging capabilities and universities strengthen life science programs. Government-backed research initiatives and increasing adoption of high-resolution optical tools in pharmaceuticals and diagnostics support strong market momentum. The region’s growing manufacturing ecosystem also enhances access to advanced microscope objectives, enabling broader deployment in both established institutions and emerging research centers.

Latin America

Latin America holds roughly 7% of the biological microscope objectives market, with demand primarily concentrated in Brazil, Mexico, and Argentina. Growth is fueled by expanding academic research capabilities and gradual modernization of laboratory infrastructure in clinical and biomedical settings. As universities and medical institutions increase adoption of fluorescence and high-contrast imaging systems, the need for reliable objectives with improved numerical apertures continues to rise. Despite budget constraints and slower procurement cycles, international collaborations and increasing participation in global research programs support incremental market expansion across the region.

Middle East & Africa

The Middle East & Africa region represents nearly 5% of market share, driven by growing investments in healthcare infrastructure, medical education, and diagnostic capabilities. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption as they enhance laboratory facilities and expand research programs in pathology, molecular biology, and clinical imaging. Demand for biological microscope objectives is supported by initiatives to improve disease surveillance and strengthen academic research capacity. Although market growth is moderated by limited high-end equipment budgets, gradual technology adoption and partnerships with global manufacturers continue to contribute to steady development.

Market Segmentations:

By Deployment Mode:

By Application:

- Pharmaceutical

- Biotechnology

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The biological microscope objectives market features key players such as Olympus Corporation, Hitachi High-Tech Corporation, Bruker Corporation, JEOL Ltd., CAMECA, Nikon Corporation, Thermo Fisher Scientific, Inc., NT-MDT SI, Oxford Instruments (Asylum Corporation), and Zeiss Group. The biological microscope objectives market is defined by continuous innovation, strong research collaborations, and growing emphasis on precision imaging technologies. Manufacturers consistently invest in advanced optical engineering to enhance numerical aperture, improve chromatic correction, and support high-resolution fluorescence and live-cell imaging. Competition intensifies as companies expand product lines tailored for automated microscopy, digital platforms, and multi-modal imaging systems used in academic, clinical, and pharmaceutical environments. Strategic partnerships with research institutions accelerate validation of new objective designs, while global distribution networks strengthen market accessibility. Overall, the industry competes on performance, technical reliability, and compatibility with next-generation imaging workflows.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Leica Microsystems released the Visoria series of upright microscopes for clinical, life science, and industrial applications. The series includes three models: the Visoria B for life science and clinical work, the Visoria M for materials science, and the Visoria P for polarization microscopy.

- In March 2025, Zeiss, a photonics and optics technology giant, announced the launch of Lightfield 4D, a new microscopic system. The technology is developed to address the critical need for 4D printing and also enables instant volumetric high-speed fluorescence imaging.

- In February 2025, Bruker Corporation Leader of the Post-Genomic Era, announced the launch of the new X4 POSEIDON, a high-performance 3D X-ray microscope (XRM) using micro-Computed Tomography. This innovation offers advanced resolution and is applicable in industrial applications and scientific research.

- In April 2023, Nikon unveiled the ECLIPSE Ui, Japan’s first digital imaging microscope for medical use, aimed at improving pathological observation by eliminating the need for eyepieces and enabling real-time, remote data sharing

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt high-NA and advanced aberration-corrected objectives to meet rising demand for ultra-resolution imaging.

- Automated and AI-integrated microscopy platforms will drive the need for objectives optimized for long-duration, high-stability imaging workflows.

- Growth in live-cell and deep-tissue research will accelerate development of specialized water-immersion and multiphoton-compatible objectives.

- Digital pathology expansion will boost demand for objectives designed for high-speed scanning and consistent color fidelity.

- Manufacturers will focus on modular and customizable objective systems to support diverse imaging modalities.

- Adoption of lightweight, low-distortion objectives will rise as portable and compact microscopes gain traction.

- Integration with cloud-based imaging ecosystems will support objectives tailored for remote-access microscopy setups.

- Increasing interdisciplinary research will encourage development of versatile objectives usable across multiple biological applications.

- Sustainability goals will drive innovations in durable materials and energy-efficient optical manufacturing processes.

- Collaborations between industry and research institutions will accelerate introduction of next-generation high-precision objective technologies.