Market Overview

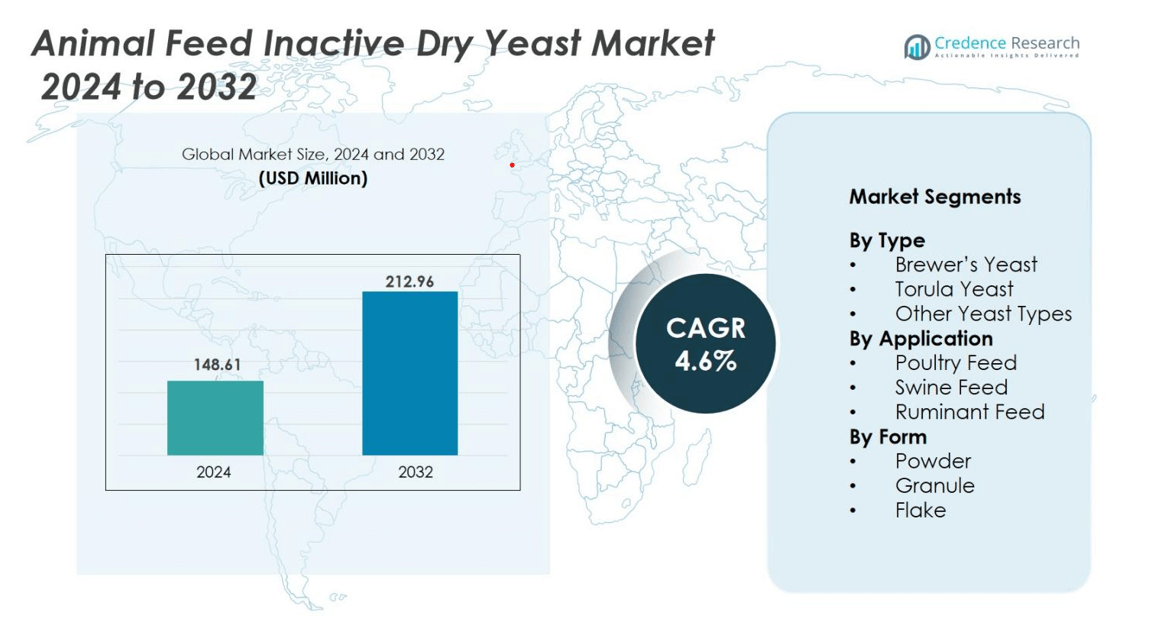

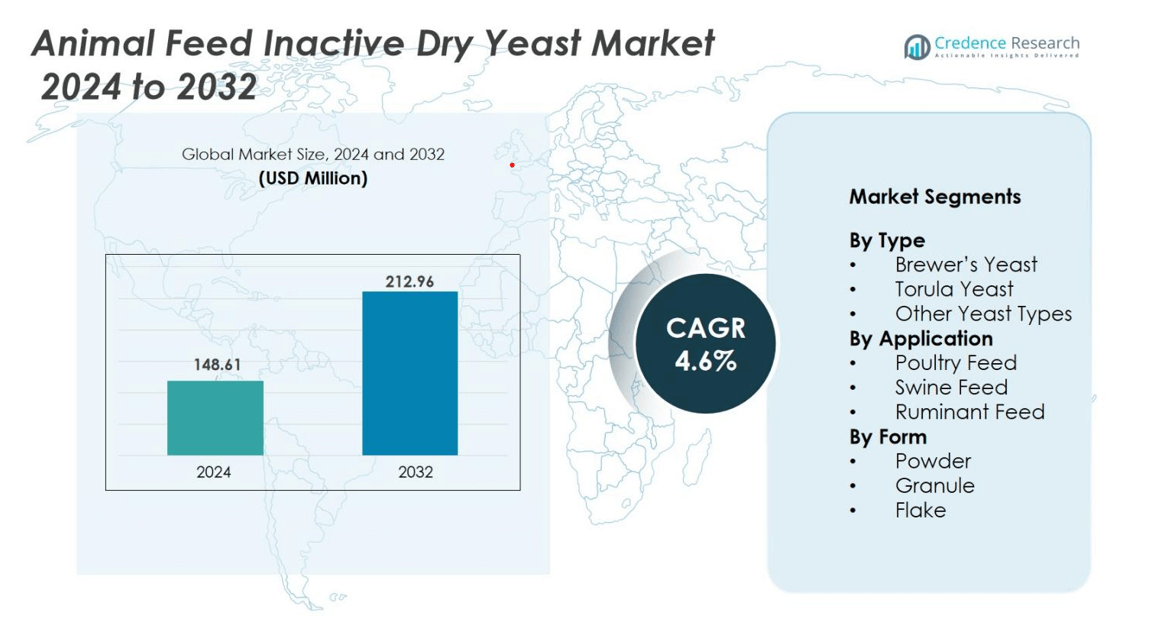

The Animal Feed Inactive Dry Yeast Market was valued at USD 148.61 million in 2024 and is projected to reach USD 212.96 million by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Feed Inactive Dry Yeast Market Size 2024 |

USD 148.61 million |

| Animal Feed Inactive Dry Yeast Market, CAGR |

4.6% |

| Animal Feed Inactive Dry Yeast Market Size 2032 |

USD 212.96 million |

Key players in the Animal Feed Inactive Dry Yeast market include Lallemand, Inc., Archer Daniels Midland Company, BioSpringer (part of Lesaffre Group), AB Mauri, Angel Yeast, Leiber GmbH, ICC Brazil, Ohly, ABN Spain (Aplicaciones Biológicas a la Nutrición SL), and Alltech Biotechnology. These companies focus on developing high-quality, nutrient-rich yeast formulations to enhance livestock performance and gut health. Lallemand and ADM lead global innovation through advanced fermentation and sustainable production technologies. Asia-Pacific emerged as the leading region in 2024, holding a 34% market share, driven by expanding livestock populations, growing feed production capacities, and rising demand for antibiotic-free nutrition solutions across China, India, and Southeast Asia.

Market Insights

- The Animal Feed Inactive Dry Yeast Market was valued at USD 148.61 million in 2024 and is projected to reach USD 212.96 million by 2032, growing at a CAGR of 4.6%.

- Rising demand for nutrient-dense and antibiotic-free animal feed is driving market growth, supported by increased livestock production and improved feed conversion efficiency.

- Technological advancements in yeast fermentation and drying processes are boosting product quality and expanding usage across poultry, swine, and ruminant feed applications.

- The market is moderately consolidated, with major players such as Lallemand, ADM, and Lesaffre focusing on innovation, sustainability, and regional expansion to maintain a competitive edge.

- Asia-Pacific leads the global market with a 34% share, followed by North America at 31%, while the brewer’s yeast segment dominates overall, accounting for 52% of the market due to its superior nutritional profile and high adoption in poultry feed formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The brewer’s yeast segment held the largest market share of 52% in 2024, driven by its high protein content, palatability, and digestibility for livestock feed. Its rich composition of amino acids, vitamins, and minerals supports improved animal growth and gut health, making it a preferred additive across feed formulations. Torula yeast and other yeast types are gaining attention for their potential in specialized animal diets, particularly due to their low nucleic acid content and ability to enhance immune function in poultry and ruminant nutrition programs.

- For instance, feed-grade brewer’s yeast (Brewer’s yeast) contains about 48.9% crude protein on a dry-matter basis and is cited as “an excellent source of protein, B-vitamins and minerals” in livestock rations.

By Application

The poultry feed segment dominated the market with a 47% share in 2024, supported by the expanding global poultry industry and rising demand for high-quality protein sources. Inactive dry yeast in poultry diets enhances feed intake, nutrient absorption, and disease resistance, improving production efficiency. Swine and ruminant feed applications are also increasing due to growing awareness of yeast-based prebiotics that improve gut microbiota balance, optimize digestion, and reduce antibiotic reliance in livestock farming practices.

- For instance, in swine feed, the yeast probiotic Actisaf® Sc 47 by Phileo has been documented to increase volatile fatty acids production in the hind gut, improving feed efficiency and growth performance with reduced energy requirements.

By Form

Powder form accounted for the largest share of 59% in 2024, driven by its high solubility, easy blending with other feed ingredients, and longer shelf life. Feed manufacturers prefer powdered yeast for its uniform distribution in feed mixtures, ensuring consistent nutrient delivery. The granule and flake forms are also witnessing steady demand, especially in aquafeed and ruminant feed applications, where gradual nutrient release supports digestive efficiency and performance. Continuous innovation in yeast drying and preservation technologies further supports product quality and stability across animal feed formulations.

Key Growth Drivers

Rising Demand for Nutrient-Rich and Functional Animal Feed

The growing focus on improving animal nutrition and productivity is driving the demand for inactive dry yeast in feed formulations. These yeast products enhance feed palatability, digestion, and nutrient absorption while supporting immune health and gut microbiota balance. Livestock producers are increasingly adopting yeast-based additives to replace synthetic growth promoters and antibiotics. The high protein, vitamin B-complex, and amino acid content in inactive dry yeast improves feed efficiency and meat quality. This trend aligns with the global shift toward sustainable and health-focused animal production systems.

- For instance, Lallemand Inc. launched YELA PROSECURE, a hydrolyzed yeast product that enhances nutrient digestibility, gut health, and feed conversion efficiency in animals, contributing to better growth rates and disease resistance.

Expansion of the Livestock and Poultry Industries

Rapid growth in global meat and dairy consumption has boosted livestock production, creating strong demand for performance-enhancing feed additives. Inactive dry yeast plays a vital role in enhancing feed conversion ratios, improving reproductive performance, and supporting growth in poultry, swine, and cattle. Developing regions such as Asia-Pacific and Latin America are witnessing strong livestock population growth due to rising incomes and urbanization. Feed manufacturers are increasingly integrating yeast-based products to optimize animal performance, reduce mortality, and improve profitability in large-scale farming operations.

- For instance, Lallemand, Inc. offers AGRIMOS, a yeast cell wall product that improves animal nutrition and gut health, widely used in poultry farming to enhance feed conversion ratios.

Regulatory Push Toward Antibiotic-Free Feed Additives

Stringent regulations banning antibiotic growth promoters have accelerated the adoption of natural feed additives like inactive dry yeast. Governments and international agencies encourage yeast-based solutions due to their proven efficacy in promoting gut health without harmful residues. These products enhance intestinal flora balance and immunity, offering a natural alternative to chemical additives. This regulatory shift is particularly strong in the European Union and North America, where consumer demand for antibiotic-free meat is growing. As a result, manufacturers are investing in research to develop yeast strains with enhanced probiotic functionality.

Key Trends & Opportunities

Growing Popularity of Yeast-Derived Bioactive Compounds

R&D efforts are expanding toward extracting specific bioactive components from inactive dry yeast, such as β-glucans, mannan-oligosaccharides, and nucleotides. These compounds exhibit strong immunomodulatory and antioxidant properties that enhance animal health and resilience to stress. Feed manufacturers are leveraging such bioactives to design functional feeds that support disease prevention and growth performance. This innovation-driven trend creates new market opportunities, particularly in aquaculture and pet nutrition, where demand for natural, health-enhancing feed ingredients is increasing rapidly.

- For instance, Lallemand Inc. produces a range of yeast-based functional feeds that improve microbial balance and immune support across aquaculture, poultry, and swine sectors, backed by data-driven product development.

Rising Adoption of Precision Livestock Nutrition

Technological integration in feed formulation is enabling more targeted nutrition using yeast-based ingredients. Precision nutrition focuses on tailoring diets to specific animal species, growth stages, and environmental conditions. Inactive dry yeast fits well into this approach, as its consistent nutrient profile supports customized formulations for maximum productivity. Data-driven tools in livestock management, combined with yeast-enhanced feed, are expected to reduce feed waste and improve cost-efficiency. This opportunity is encouraging collaborations between biotechnology firms and feed producers to optimize yeast formulations for diverse livestock needs.

- For instance, Alltech’s yeast-based feed additives have demonstrated improved feed conversion and daily weight gain in beef cattle, helping animals reach market weight faster and boosting efficiency as documented in their field studies.

Key Challenges

High Production and Processing Costs

The production of high-quality inactive dry yeast requires controlled fermentation, drying, and preservation techniques that add to manufacturing costs. Price fluctuations in raw materials such as molasses and corn further affect cost stability. These expenses can limit adoption, especially among small and medium-scale feed producers in developing markets. Moreover, maintaining the nutritional integrity of yeast during processing demands advanced equipment and energy input, which increases operational costs. This cost challenge compels manufacturers to focus on efficiency optimization and sustainable production technologies.

Limited Awareness and Technical Knowledge Among Feed Producers

In many emerging economies, feed manufacturers and farmers lack adequate awareness of yeast-based nutrition and its benefits. Traditional feeding practices, coupled with low access to technical expertise, restrict market penetration. Inactive dry yeast’s advantages—such as improved gut health and feed conversion—are often underutilized due to limited understanding of optimal inclusion rates and formulations. Bridging this knowledge gap through training programs, field demonstrations, and technical support is essential for expanding adoption. Without education initiatives, the market’s growth potential remains underexploited, particularly in rural livestock sectors.

Regional Analysis

North America

North America held a market share of 31% in 2024, driven by strong livestock production and high demand for functional feed additives. The U.S. leads the region, supported by intensive poultry and swine farming and a growing preference for antibiotic-free nutrition. Advanced feed manufacturing infrastructure and rising adoption of yeast-based performance enhancers further boost market growth. Companies such as ADM and Lallemand play a key role through R&D investments in yeast formulations. The region’s regulatory focus on sustainable animal health continues to strengthen market expansion for inactive dry yeast products.

Europe

Europe accounted for 28% of the global market share in 2024, supported by stringent regulations restricting antibiotic usage and promoting natural feed ingredients. Countries like Germany, France, and the Netherlands lead adoption due to well-established livestock industries and advanced feed technology. The region emphasizes feed efficiency, traceability, and animal welfare, encouraging the use of yeast-based additives. European companies such as Leiber GmbH and BioSpringer have expanded production capacities to meet growing demand. The push for sustainable and organic livestock production continues to enhance the market outlook across the region.

Asia-Pacific

Asia-Pacific dominated the global market with a 34% share in 2024, driven by rapid livestock population growth and expanding feed production in China, India, and Vietnam. Rising meat consumption, urbanization, and government initiatives to improve feed quality strengthen the regional demand for yeast-based nutrition. Local and international players are investing in production facilities to meet the region’s high-volume demand. The shift toward antibiotic-free feed and the need for cost-effective protein sources position Asia-Pacific as the fastest-growing region in the animal feed inactive dry yeast market.

Latin America

Latin America captured a 5% share of the market in 2024, with Brazil and Argentina leading due to expanding poultry and cattle farming industries. The adoption of inactive dry yeast is increasing as feed producers focus on improving animal performance and reducing disease-related losses. Government incentives promoting efficient livestock production and sustainable farming practices also support growth. Regional companies such as ICC Brazil contribute to local innovation through product diversification and export expansion. The rising focus on export-quality meat and feed modernization further enhances regional market opportunities.

Middle East & Africa

The Middle East & Africa region held a 2% market share in 2024, showing steady growth driven by improving animal nutrition standards and increasing demand for protein-rich diets. Countries such as South Africa, Saudi Arabia, and Egypt are witnessing rising investment in feed manufacturing infrastructure. Feed producers are incorporating inactive dry yeast to improve livestock resilience and production efficiency under harsh climatic conditions. Growing awareness of yeast’s role in gut health and immune function supports adoption. Although still emerging, the region offers long-term potential for yeast-based animal feed solutions.

Market Segmentations:

By Type

- Brewer’s Yeast

- Torula Yeast

- Other Yeast Types

By Application

- Poultry Feed

- Swine Feed

- Ruminant Feed

By Form

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Animal Feed Inactive Dry Yeast market is moderately consolidated, with key players focusing on product innovation, capacity expansion, and strategic collaborations. Leading companies such as Lallemand, Inc., Archer Daniels Midland Company, BioSpringer (Lesaffre Group), AB Mauri, and Angel Yeast dominate the market through advanced fermentation technologies and diversified product portfolios. These firms emphasize research to enhance nutritional efficiency, improve palatability, and strengthen gut health benefits. Regional players like ICC Brazil and Leiber GmbH are expanding their presence by offering cost-effective, high-protein yeast solutions tailored to local livestock needs. Strategic alliances with feed manufacturers and distributors enhance market penetration across Asia-Pacific and Europe. Companies are also prioritizing sustainability through energy-efficient production and the use of agricultural by-products. The competition is expected to intensify as demand for antibiotic-free and natural feed additives continues to grow, prompting further innovation and market consolidation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Lesaffre completed the acquisition of dsm-firmenich’s yeast extract business, expanding its capabilities in yeast derivatives and fermentation solutions for animal feed applications.

- In March 2024, Lallemand Animal Nutrition and microXpace announced a collaboration entering the product-development phase on a yeast-based immunity solution for poultry and aquaculture.

- In October 2022, Archer Daniels Midland (ADM) launched AquaTrax, an inactivated Pichia guilliermondii-based feed additive designed to improve gut health and performance in aquaculture species.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and sustainable feed additives will continue to rise globally.

- Brewer’s yeast will remain the dominant product segment due to its nutritional efficiency.

- Asia-Pacific will sustain its leadership position, driven by expanding livestock production.

- Technological advances in yeast processing will improve nutrient stability and

- Feed manufacturers will increasingly integrate yeast-based ingredients into precision nutrition programs.

- Regulatory restrictions on antibiotics will further accelerate yeast adoption in animal diets.

- Strategic collaborations between biotechnology and feed companies will boost product

- Expansion in aquaculture and pet nutrition will open new market opportunities.

- Producers will focus on energy-efficient and low-emission fermentation technologies.

- Awareness programs and farmer education will enhance yeast feed adoption in developing regions.