Market Overview

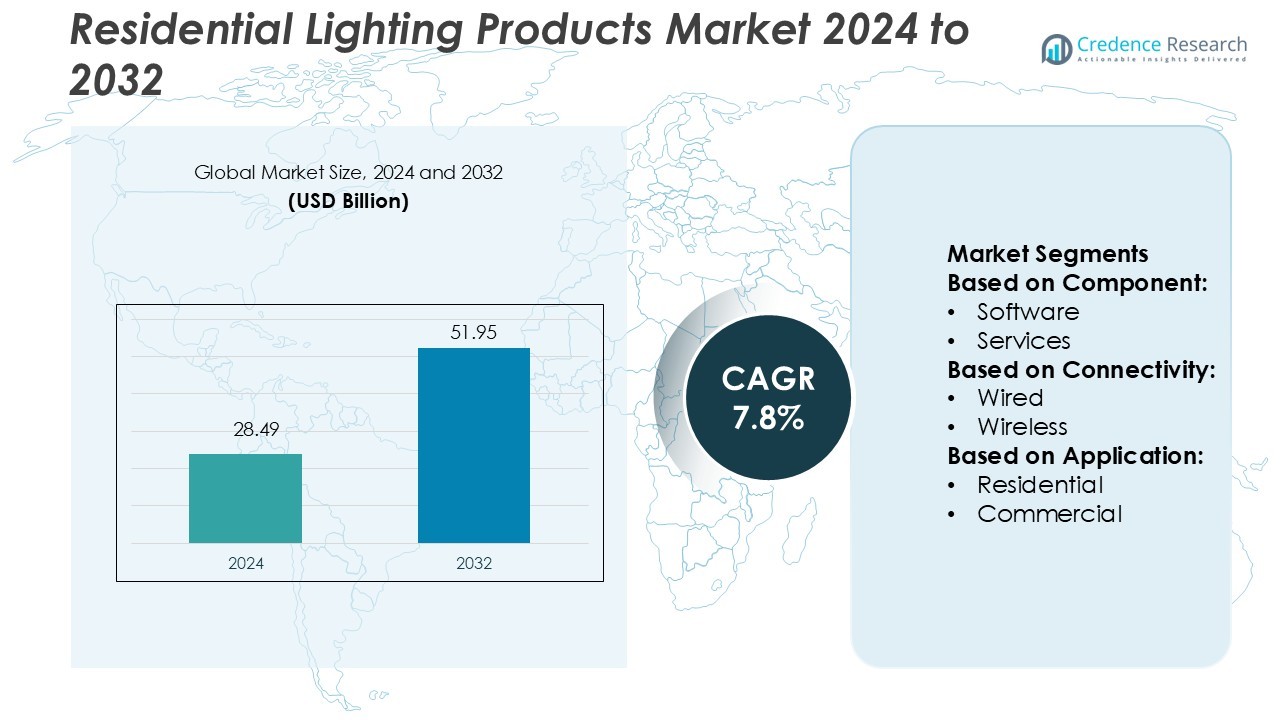

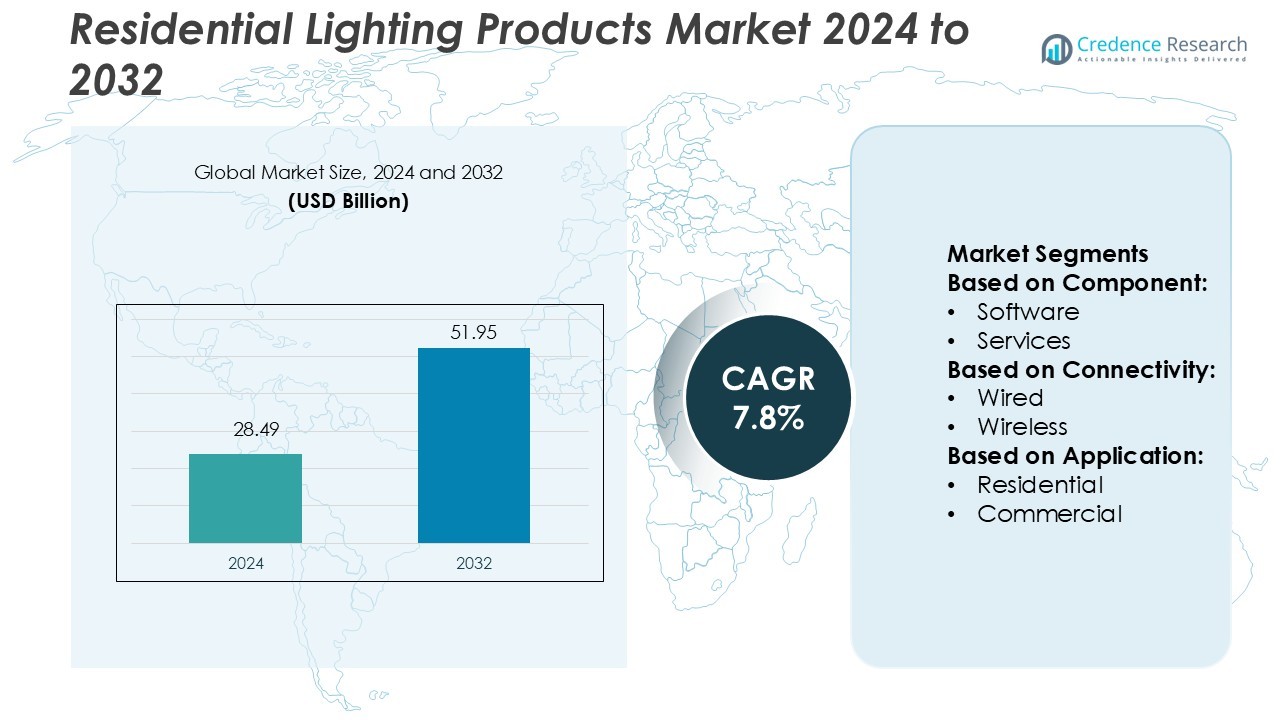

Residential Lighting Products Market size was valued USD 28.49 billion in 2024 and is anticipated to reach USD 51.95 billion by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Lighting Products Market Size 2024 |

USD 28.49 Billion |

| Residential Lighting Products Market, CAGR |

7.8% |

| Residential Lighting Products Market Size 2032 |

USD 51.95 Billion |

The residential lighting products market is shaped by top players such as Cree, Inc., Zumtobel Group AG, Everlight Electronics Co. Ltd., General Electric, Hubbell Incorporated, Nichia Corporation, Acuity Brands Inc., Lutron Electronics, Osram Licht AG, and Signify N.V. These companies focus on advanced LED technology, smart lighting integration, and energy-efficient designs to strengthen their global presence. They invest in R&D, expand product portfolios, and build strategic partnerships to enhance market competitiveness. Asia Pacific leads the market with a 34% share, driven by rapid urbanization, infrastructure development, and government-led energy efficiency initiatives. Strong manufacturing capabilities and rising consumer demand make the region a key growth hub for residential lighting solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The residential lighting products market was valued at USD 28.49 billion in 2024 and is projected to reach USD 51.95 billion by 2032, registering a CAGR of 7.8%.

- Rising demand for smart lighting and energy-efficient solutions is driving market expansion, supported by urbanization and government regulations promoting sustainable lighting adoption.

- LED lighting dominates the market due to its long lifespan, low energy use, and compatibility with wireless and sensor-based technologies.

- Strong competition is led by major players investing in product innovation, smart home integration, and strategic partnerships to strengthen their global reach.

- Asia Pacific holds a 34% market share, leading the market with strong manufacturing capacity and consumer demand, while North America and Europe follow with 28% and 26% respectively, supported by advanced infrastructure and energy efficiency programs.

Market Segmentation Analysis:

By Component

The hardware segment holds the dominant share in the residential lighting products market. Lamps and luminaires drive strong replacement demand due to energy efficiency upgrades and smart integration. Hardware offers high durability, better design flexibility, and easy installation, which encourages adoption in new and retrofit projects. For instance, smart LED luminaires with integrated motion sensors and dimming controls are increasingly replacing conventional bulbs in residential spaces. Software and services segments grow steadily, supported by demand for smart lighting management platforms and post-installation support services.

- For instance, Cree announced plans to expand its silicon carbide (SiC) and gallium nitride (GaN) production capacity by 30 times via the development of a state-of-the-art automated SiC/GaN fabrication facility and materials factory.

By Connectivity

Wireless connectivity leads the market, driven by rising smart home adoption and easy system integration. Homeowners prefer wireless lighting systems because they enable remote control, voice activation, and automation without additional wiring. This segment benefits from compatibility with platforms like Alexa, Google Home, and Apple HomeKit. For instance, leading manufacturers offer app-based lighting solutions that allow customized scene settings and energy tracking. Wired systems remain relevant for large installations needing stable network connections, especially in premium and multi-storey residences.

- For instance, Zumtobel’s basicDIM Wireless luminaires support up to 250 wireless nodes per network via Bluetooth® mesh technology, depending on the firmware version.

By Application

Indoor applications account for the largest share of the residential lighting products market. Consumers invest in ambient and task lighting solutions to enhance energy efficiency and interior aesthetics. Indoor lighting includes living rooms, bedrooms, kitchens, and corridors, supported by the increasing adoption of LED and smart lighting fixtures. For instance, advanced indoor lighting systems use embedded sensors and timers to optimize energy consumption. Outdoor and architectural lighting show strong growth as demand for landscape and security lighting rises, while highway and roadway lighting remain a smaller but stable segment.

Key Growth Drivers

Rising Urbanization and Smart Home Adoption

Rapid urbanization is driving strong demand for advanced residential lighting solutions. Homeowners are adopting smart lighting systems to improve energy efficiency and comfort. Growing penetration of IoT and voice-controlled devices supports this shift. Smart bulbs and connected lighting platforms allow easy control through mobile apps and smart speakers. Manufacturers invest in product innovation to meet modern housing requirements. Government incentives for energy-saving products further fuel adoption. This combined push from consumers and regulations is strengthening the market growth for residential lighting products.

- For instance, Everlight’s EAHE2835WD03 white LED package offers a luminous flux of 28 lm to 38 lm at a test current of 65 mA, with a viewing angle of 120°, designed for general lighting applications.

Government Regulations Supporting Energy Efficiency

Stringent regulations on energy consumption and carbon emissions are accelerating the shift toward efficient lighting. Many countries have phased out incandescent bulbs, boosting demand for LED and CFL solutions. Energy labels and green building codes encourage the installation of sustainable lighting systems. Manufacturers focus on designing products that meet high energy performance standards. This regulatory push lowers operational costs for households and improves adoption rates. As compliance grows, the market sees faster penetration of smart and efficient lighting products in residential spaces.

- For instance, GE Lighting helped reduce 1.2 billion kWh of electricity usage by converting consumer homes to LED bulbs in collaboration with a major retailer over two years.

Advancements in LED and Connected Lighting Technology

LED technology continues to dominate the lighting market with its long lifespan and low energy usage. Innovations in color tuning, brightness control, and sensor-based automation enhance user experience. Integration with Wi-Fi, Bluetooth, and Zigbee improves system connectivity and flexibility. Many brands invest in R&D to develop dimmable and adaptive lighting solutions. These technological improvements reduce replacement costs and support sustainable energy goals. As connected lighting becomes more affordable, adoption in residential buildings increases significantly, driving consistent market expansion.

Key Trends & Opportunities

Key Trends & Opportunities

Expansion of Smart Lighting Ecosystems

The growing demand for home automation is creating new opportunities for lighting manufacturers. Smart lighting systems now integrate seamlessly with security, entertainment, and HVAC controls. Platforms support real-time monitoring and remote adjustments through cloud connectivity. Companies are expanding their product ranges to include sensors, hubs, and AI-based features. Consumers prefer customizable lighting that enhances both functionality and aesthetics. This ecosystem-based approach is driving higher adoption among tech-savvy homeowners and supporting the evolution of connected home environments.

- For instance, NX Distributed Intelligence™ lighting platform from Hubbell supports a network of up to 1,000 wireless devices under a single NX Area Controller via dual-radio mesh architecture.

Increasing Focus on Sustainable and Eco-friendly Solutions

Sustainability is becoming a core trend in the residential lighting market. Consumers are favoring products that lower energy bills and reduce environmental impact. Manufacturers are launching LED lighting made from recyclable materials with lower hazardous content. Solar-powered lighting solutions are gaining traction in regions with high renewable energy use. Certification programs like ENERGY STAR and BEE are influencing purchase decisions. This rising focus on sustainability offers opportunities for companies to differentiate their products and meet regulatory standards.

- For instance, Nichia’s deep-UV-C LED (NCSU334B) at a peak wavelength of 280 nm, tested in collaboration with Tokushima University, demonstrated 99.99% inactivation of SARS-CoV-2 in 30 seconds, a more rigorous result than the 99.9% in 20 seconds stated in the claim.

Growing Demand for Aesthetic and Mood Lighting

Lighting is increasingly used to enhance interior design and well-being. Homeowners seek customizable products with adjustable tones and brightness. Ambient and accent lighting products are seeing higher demand in modern homes. Brands are launching fixtures that combine elegant design with smart features. Mood lighting also supports wellness, promoting better sleep cycles and productivity. As consumer preferences shift toward personalization, the market sees greater investment in design-focused and decorative lighting innovations.

Key Challenges

High Initial Costs of Smart Lighting Systems

While LED and smart lighting solutions offer long-term savings, their upfront costs remain high. Installation of connected lighting often requires hubs, controllers, and integration services. This cost barrier slows adoption, especially in price-sensitive markets. Consumers in developing regions still prefer low-cost traditional lighting. Manufacturers must balance pricing with innovation to expand their reach. Overcoming this challenge is key to achieving wider residential market penetration and driving consistent sales growth.

Lack of Standardization and Interoperability

The absence of common communication protocols limits integration between different lighting brands and smart devices. Consumers face compatibility issues when combining products from multiple vendors. This fragmentation complicates installation and raises maintenance costs. Manufacturers are investing in open-source platforms to address these concerns. However, market fragmentation continues to affect user experience and slows the shift to fully connected smart homes. Establishing unified standards will be crucial to ensure smooth adoption at scale.

Regional Analysis

North America

North America holds a 28% market share in the residential lighting products market. The region benefits from early smart home adoption, strong energy efficiency regulations, and advanced infrastructure. The U.S. drives demand with widespread use of LED and connected lighting solutions in residential buildings. Consumers prefer smart bulbs and automated lighting systems integrated with voice assistants. Government incentives supporting sustainable energy use further boost market penetration. Leading companies focus on design, energy savings, and retrofit installations. The region’s mature market and high purchasing power strengthen opportunities for innovative lighting solutions and eco-friendly product development.

Europe

Europe accounts for a 26% market share in the residential lighting products market. The region’s growth is supported by strict energy regulations, sustainability goals, and strong retrofit programs. Countries like Germany, France, and the U.K. lead adoption of LED and solar-integrated lighting systems. High consumer awareness drives demand for energy-efficient and design-focused products. Smart lighting is gaining traction in urban households, supported by advanced home automation systems. Government incentives for green technologies encourage market expansion. Strong environmental policies and investments in smart cities position Europe as a key growth hub for sustainable lighting solutions.

Asia Pacific

Asia Pacific dominates the market with a 34% market share, driven by rapid urbanization, infrastructure expansion, and rising disposable income. Countries like China, India, and Japan are major contributors, supported by government initiatives promoting LED adoption. Large-scale housing developments and energy-saving programs fuel demand for efficient lighting systems. Local manufacturers focus on affordable smart lighting to cater to the mass market. The growing middle-class population prefers cost-effective, durable, and modern lighting solutions. Technological advancements, combined with aggressive expansion strategies by global players, make Asia Pacific the fastest-growing region in the residential lighting market.

Latin America

Latin America holds a 7% market share in the residential lighting products market. The region’s growth is driven by increasing urban housing projects and gradual energy transition efforts. Brazil and Mexico lead adoption, focusing on replacing inefficient lighting with LEDs. Government policies promoting energy savings and reduced emissions support market development. Price-sensitive consumers are shifting toward affordable smart lighting solutions. Rising internet penetration and smart home adoption also create new opportunities. However, economic fluctuations and limited infrastructure slow growth. International and regional manufacturers are targeting partnerships to strengthen distribution networks and reach more households.

Middle East & Africa

The Middle East & Africa region represents a 5% market share in the residential lighting products market. Growth is supported by urban development projects, rising energy efficiency initiatives, and infrastructure investments. The UAE and Saudi Arabia lead the market with strong demand for modern and decorative lighting in residential spaces. Consumers increasingly prefer LED and solar-powered products due to their durability and cost benefits. Government programs promoting sustainable energy solutions support the shift toward advanced lighting systems. Although adoption remains lower than other regions, rapid modernization and housing expansion create strong future growth potential.

Market Segmentations:

By Component:

By Connectivity:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the residential lighting products market features leading companies such as Cree, Inc., Zumtobel Group AG, Everlight Electronics Co. Ltd., General Electric, Hubbell Incorporated, Nichia Corporation, Acuity Brands Inc., Lutron Electronics, Osram Licht AG, and Signify N.V. The residential lighting products market is defined by rapid technological innovation and strong emphasis on energy efficiency. Companies focus on expanding their product portfolios with smart lighting solutions that integrate seamlessly with home automation systems. Advanced LED technology, wireless control, and sensor-based features are key areas of development. Manufacturers are also prioritizing design aesthetics to meet growing consumer demand for modern and customizable lighting. Strategic partnerships, mergers, and acquisitions are common strategies to enhance market reach. R&D investments support advancements in tunable lighting, energy optimization, and connected ecosystems. This innovation-driven environment is intensifying competition and reshaping market dynamics globally.

Key Player Analysis

- Cree, Inc.

- Zumtobel Group AG

- Everlight Electronics Co. Ltd.

- General Electric

- Hubbell Incorporated

- Nichia Corporation

- Acuity Brands Inc.

- Lutron Electronics

- Osram Licht AG

- Signify N.V.

Recent Developments

- In April 2024, Signify Holding introduced ultra-efficient and 3D-printed lighting innovations to support energy-efficient and sustainable workspaces. The new products significantly reduce energy consumption and carbon footprint while maintaining high performance. With 3D printing technology, Signify enhances circular economic efforts by reducing waste and material usage.

- In October 2024, Acuity Brands launched its Nightingale healthcare lighting platform, incorporating circadian rhythm technology and infection-control features designed for hospital and long-term care applications.

- In August 2024, Philips Hue ventured into affordability with the launch of the new Tento ceiling light lineup. Philips has tons of fully integrated smart lamps – and with modern LEDs, it’s not like you’ll be changing a lot of bulbs, anyway. To those existing offerings, we can soon add the new Hue Tento lineup, as reported by Hueblog.

- In February 2024, Panasonic Holdings Corporation expanded its lighting business by inaugurating a new facility in Daman, India. This strategic move is aimed at strengthening its presence in the lighting market, focusing on energy-efficient solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart lighting adoption will grow rapidly with wider home automation integration.

- LED technology will dominate as consumers shift toward energy-efficient solutions.

- Wireless and sensor-based lighting systems will become more common in residential spaces.

- Sustainable and eco-friendly lighting products will see higher demand due to regulations.

- Product design and aesthetics will play a stronger role in consumer purchase decisions.

- Voice control and AI-driven lighting systems will enhance user experience.

- Retrofit installations will increase as households upgrade to modern lighting systems.

- Regional manufacturers will expand their portfolios to compete with global brands.

- Government incentives and energy-saving programs will boost market penetration.

- Innovation in connected lighting ecosystems will drive new revenue opportunities.

Key Trends & Opportunities

Key Trends & Opportunities