Market Overview

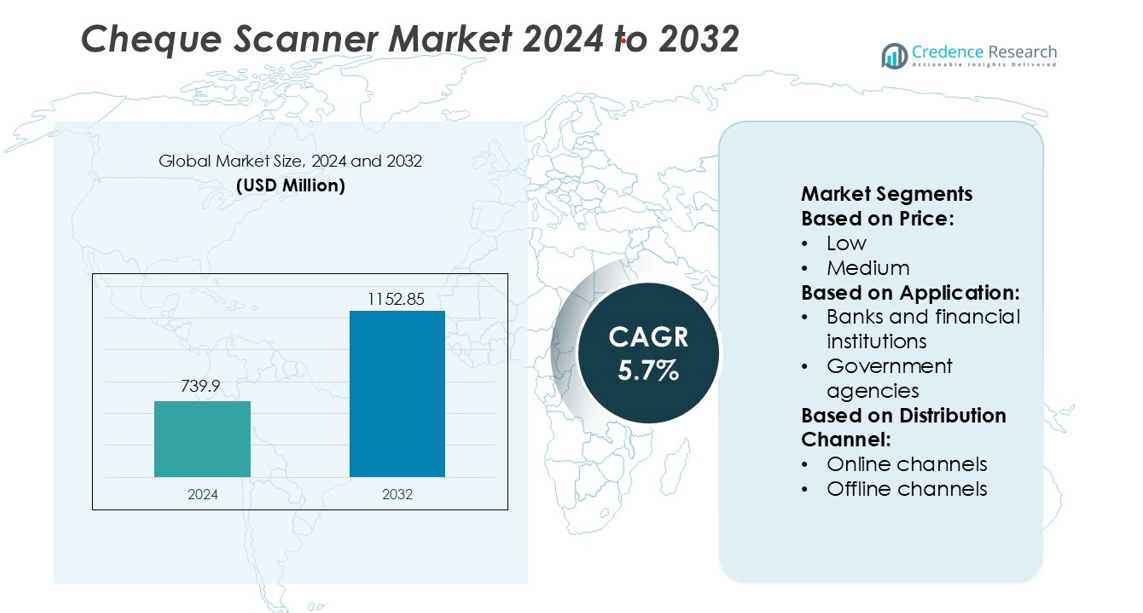

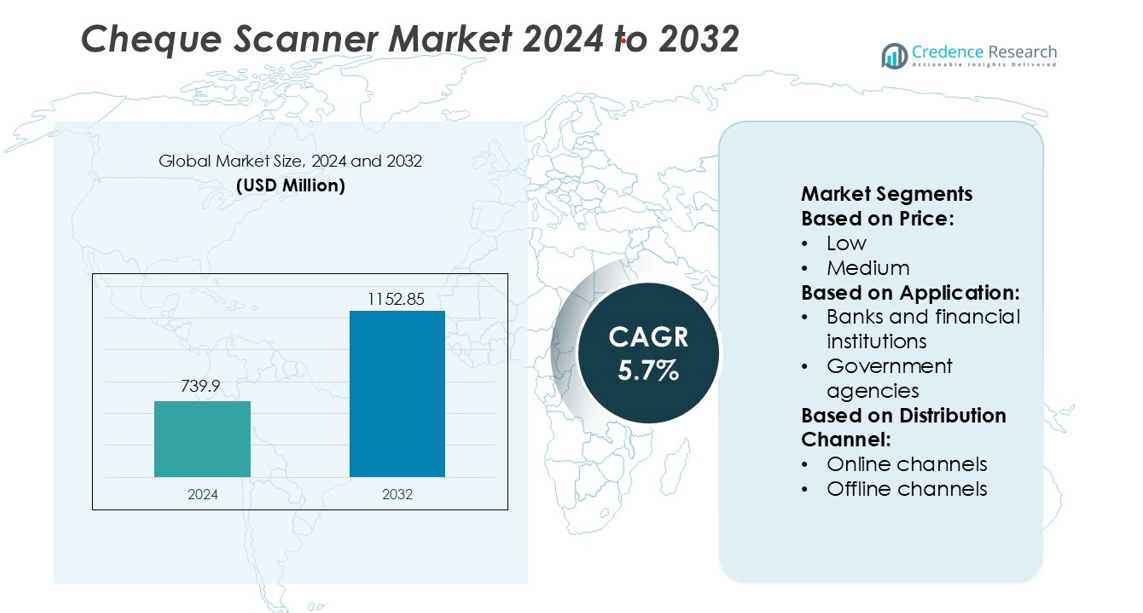

Cheque Scanner Market size was valued USD 739.9 million in 2024 and is anticipated to reach USD 1152.85 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cheque Scanner Market Size 2024 |

USD 739.9 million |

| Cheque Scanner Market, CAGR |

5.7% |

| Cheque Scanner Market Size 2032 |

USD 1152.85 million |

The cheque scanner market features strong participation from global and specialized manufacturers, with companies focusing on speed, accuracy, and secure data handling for digital clearing systems. North America leads the market with a 32% share, driven by high cheque volumes in commercial payments and strong adoption of image-based processing across banks and enterprises. Vendors invest in advanced MICR reading, UV-based fraud detection, and cloud-linked document management to support faster reconciliation and regulatory compliance. Growing demand for multi-feed scanners among financial institutions and compact devices for SMEs strengthens competition, while service contracts and software integration continue to influence long-term customer retention.

Market Insights

- The Cheque Scanner Market was valued at USD 739.9 million in 2024 and will reach USD 1152.85 million by 2032 with a CAGR of 5.7%.

- Growth is driven by rising digitization of cheque clearing, demand for faster settlement, and secure MICR-based authentication across banks, enterprises, and government offices.

- A key trend is the adoption of multi-feed and compact cheque scanners, cloud-linked document storage, UV verification, and remote deposit capture for SMEs and retail counters.

- Competition increases as vendors offer high-speed scanning, software integration, and service contracts, but high equipment cost and rising shift to digital payments restrain long-term adoption.

- North America leads with a 32% regional share, while Asia-Pacific records the fastest growth; banks hold the dominant end-user share due to high cheque volumes in commercial transactions and regulatory push for image-based cheque truncation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Price

Low-priced cheque scanners hold the dominant market share due to strong adoption among small businesses, retail counters, and regional financial institutions. Buyers in this segment prefer affordable devices that support basic MICR reading, image capture, and rapid cheque clearing without heavy investment. Bulk orders from cooperative banks and microfinance firms also strengthen sales. Medium-priced scanners gain demand from commercial banks and corporate entities that seek faster processing speed and higher scanning accuracy. High-priced scanners serve large enterprises handling heavy transaction loads, but the user base is smaller due to higher procurement and maintenance costs.

- For instance, Canon Inc. offers the compact imageFORMULA CR-L1 cheque scanner. It processes up to 45 cheques per minute (cpm) for black and white/grayscale images. The maximum optical scanning resolution is 300 dpi (dots per inch).

By Application

Banks and financial institutions lead the market with the largest share because cheque volumes remain high across loan processing, deposits, clearing services, and ATM cheque drop units. Automated cheque imaging, fraud detection tools, and secure data capture push banks toward modern compact scanners. Business organizations and government agencies adopt scanners to improve turnaround time and reduce manual errors in payment processing. Retailers deploy them to support in-store cheque acceptance and quick reconciliation. Other users include educational institutions and insurance companies requiring faster cheque verification and digital record creation.

- For instance, NCR has supplied the Digital Check-manufactured NCR TS215 and NCR TS230 models of check scanners. These scanners operate within the approximate speed range and resolution specified.

By Distribution Channel

Offline channels hold the dominant share, driven by procurement norms of banks, government bodies, and corporate customers that require demonstrations, service agreements, and long-term maintenance support. Vendors secure bulk deals through authorized distributors and system integrators, strengthening offline sales. Online channels grow steadily as SMEs and retailers prefer quick price comparison and doorstep delivery. E-commerce platforms promote compact, plug-and-play cheque scanners, attracting users that have lower integration needs and limited purchase volumes. Growing digital procurement behavior will continue improving online channel penetration.

Key Growth Drivers

Growing Digitization of Cheque Processing

Banks and financial institutions continue to digitize cheque clearing workflows to reduce manual handling, improve accuracy, and shorten settlement time. Cheque scanners support automated MICR reading, high-resolution image capture, and secure data transfer, enabling same-day or near-real-time clearance. Large banks deploy multi-feed scanners to manage high volumes, while SMEs adopt compact models for counter transactions. Regulatory support for image-based cheque clearing and rising customer expectations for faster fund availability further accelerate adoption. This shift allows institutions to reduce labor-intensive verification, minimize errors, and maintain strong audit trails.

- For instance, Burroughs, Inc. offers the SmartSource Elite 5 It uses a high-quality 600 dpi color image sensor. While the sensor’s capability is 600 dpi, the standard resolution used for check image processing and transmission is typically 300 dpi (or 200 dpi)

Rising Banking Expansion in Developing Regions

Emerging economies see continuous banking expansion driven by rural financial inclusion, ATM cheque deposit deployments, and branch network growth. Cooperative banks, microfinance institutions, and payment banks invest in cheque scanners to improve service delivery and ensure secure document digitization. Government-backed initiatives promote cashless transactions, but cheque usage remains significant in business payments, insurance settlements, and public sector disbursements. The need for reliable verification and fraud prevention strengthens demand for scanners that combine OCR, UV scanning, and tamper detection. Expansion into underserved regions boosts the installed base across Asia, Africa, and Latin America.

- For instance, Digital Check Corporation offers the high-speed TellerScan TS500 check scanner. It processes up to 200 documents per minute (dpm).It incorporates a high-quality 600 dpi color image sensor (used for ID cards, standard check resolution is typically 300 dpi).

Automation and Workflow Efficiency in Enterprises

Corporates, insurers, and government agencies adopt cheque scanners to streamline payment reconciliation, reduce back-office workload, and improve compliance. High-speed multi-feed scanners help large organizations process bulk cheques for vendor payments, claims, and refunds. Integration with ERP and treasury management systems further shortens processing cycles and reduces human error. Automated audit trails and digital storage also support fraud mitigation and regulatory reporting. As enterprises seek faster financial closing and smoother cash flow management, scanners become essential tools for secure document capture and digital record retention.

Key Trends & Opportunities

Increase in Remote Deposit Capture and Mobile Cheque Scanning

Remote cheque deposits gain momentum as banks enable customers and field agents to scan cheques at branches, retail counters, or off-site locations. Compact scanners support remote banking kiosks, courier collection centers, and doorstep services for SMEs. Financial institutions deploy cloud-linked scanning platforms to speed clearing and eliminate physical transport of cheques. Vendors gain opportunities by offering lightweight scanners with API integration, secure data encryption, and smartphone-paired deposit systems. This trend supports cost reduction, faster capital access, and wider financial reach.

- For instance, MagTek, Inc. offers scanners such as the single-feed ImageSafe and the batch-feed Excella STX. The Excella STX model processes approximately 50 documents per minute (dpm). The ImageSafe is a single-feed device.

Demand for Multi-Function and High-Speed Scanning Systems

Organizations seek scanners that combine cheque reading with ID scanning, barcode capture, and document archiving. Multi-function devices reduce equipment cost and simplify workflow in banks and retail counters. High-speed multi-feed scanners attract large enterprises handling bulk payments and refunds. Manufacturers explore compact designs, low noise operation, and long-life feeder mechanisms to reduce maintenance needs. The rise of cloud-based document storage and automated verification tools creates room for value-added software bundles and subscription-based scanning platforms.

- For instance, CTS Electronics (now part of Arca) offers the multi-function scanner LS150. It processes documents at speeds up to 150 documents per minute (dpm). It captures dual-side images at a maximum optical resolution of 300 dpi (with typical settings of 100/200 dpi).

Growing Focus on Fraud Detection and Compliance

Rising cheque fraud and regulatory scrutiny drive demand for scanners equipped with UV detection, watermark verification, and image enhancement algorithms. Banks prefer devices that flag tampering, duplicate cheques, and signature inconsistencies in real time. Integration with analytics tools and risk engines helps institutions detect anomalies quickly and maintain compliance with anti-money laundering frameworks. Vendors see strong opportunities in offering scanners with built-in encryption, audit logs, and secure transmission protocols to support safe digital cheque handling.

Key Challenges

Rising Shift Toward Real-Time Digital Payments

Real-time payment platforms and mobile wallets reduce cheque usage in retail and consumer transactions. Businesses shift to electronic transfers for vendor payments due to faster processing and lower handling cost. This growing preference for digital payments can restrict long-term scanner demand, especially in developed economies where paper-based transactions decline. Vendors must focus on niche markets like government disbursements, insurance payouts, and corporate transactions where cheques remain relevant.

High Equipment and Maintenance Cost for Large Deployments

High-speed and feature-rich scanners require significant upfront investment and ongoing maintenance. Banks and large enterprises purchasing devices in bulk face additional costs in AMC contracts, integration, and staff training. Smaller institutions often prefer manual processes or low-cost scanners with limited features. Without cost reduction or flexible financing, adoption may slow in price-sensitive regions. Manufacturers need to offer tiered pricing, leasing models, and modular features to improve accessibility across customer categories.

Regional Analysis

North America

North America holds 32% of the market share due to strong cheque usage in commercial payments, advanced banking infrastructure, and wide adoption of image-based clearing. U.S. banks deploy high-speed scanners to handle bulk processing and reduce human verification. Remote deposit capture continues to rise among enterprises and customers. Financial institutions also integrate fraud analytics, UV detection, and encrypted data transmission to meet regulatory needs. Consistent modernization of branch and back-office systems keeps North America the leading revenue contributor.

Europe

Europe accounts for 27% of the market share, supported by mature banking networks and regulatory standards for digital cheque clearing. Banks invest in multi-feed scanners to enhance settlement speed and reduce physical handling. Countries such as the UK, Germany, and France lead adoption of secure imaging systems with tamper-detection and long-term digital archiving. Corporate and government users apply cheque scanners to speed reimbursement, tax settlements, and insurance payouts. Steady demand from enterprises and fintech-enabled platforms sustains regional growth.

Asia-Pacific

Asia-Pacific holds 24% of the market share and shows the fastest growth. Banks in India, China, and Southeast Asia adopt cheque truncation systems, driving higher procurement of compact and multi-feed scanners. Rural banking expansion and large public-sector disbursements keep cheque volumes strong despite rising digital payments. Microfinance institutions favor low-cost scanners for branch counters. Increasing fraud prevention needs promote devices with watermark and UV verification. Rapid digitization and financial inclusion programs continue to expand market penetration across developing economies.

Latin America

Latin America commands 10% of the market share as banks transition from manual clearance to image-based processing. Brazil, Mexico, and Chile lead adoption through digital cheque clearing rules, remote deposit features, and ATM-based depositing. Retailers and enterprises integrate scanners to speed vendor payments and reconciliation. Cost remains a key factor, pushing demand for compact devices rather than high-end systems. Expanding internet connectivity and growth of digital banking services support gradual market development.

Middle East & Africa

Middle East & Africa account for 7% of the market share, driven by ongoing banking modernization and government efforts to digitize cheque-dependent services. Gulf countries adopt high-speed scanners for corporate and cross-border transactions, while African microfinance institutions invest in low-cost models for rural branch digitization. Infrastructure and regulatory gaps slow migration from manual processing in some nations. However, rising financial inclusion, secure document imaging, and demand for fraud detection features gradually improve regional adoption.

Market Segmentations:

By Price:

By Application:

- Banks and financial institutions

- Government agencies

By Distribution Channel:

- Online channels

- Offline channels

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cheque scanner market includes key players such as MiTek Systems, Inc., Canon Inc., NCR Corporation, Burroughs, Inc., Digital Check Corporation, MagTek, Inc., CTS Electronics, ARCA, IBML, and Burroughs Smart Source. The cheque scanner market features a mix of global technology vendors and specialized financial hardware manufacturers. Competition centers on delivering faster cheque processing, higher MICR accuracy, and secure image capture to support digital clearing systems. Vendors focus on compact, multi-feed scanners that reduce manual verification and improve branch workflow efficiency. Software-driven innovation plays a major role, with automated image correction, fraud detection algorithms, and encrypted data transmission becoming standard features. Companies also strengthen their offerings through remote deposit capture solutions and integration with banking, ERP, and treasury platforms. Price-sensitive regions encourage development of low-cost scanners with basic imaging, while advanced markets demand high-speed, tamper-resistant systems with long-term storage compliance. Strong customer service, extended warranties, and maintenance contracts help vendors retain large financial institutions. As banks digitize back-office operations and enterprises automate reconciliation, competition intensifies around performance reliability, reduced downtime, cloud-based document management, and seamless IT integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MiTek Systems, Inc.

- Canon Inc.

- NCR Corporation

- Burroughs, Inc.

- Digital Check Corporation

- MagTek, Inc.

- CTS Electronics

- ARCA

- IBML

- Burroughs Smart Source

Recent Developments

- In April 2025, SmartSource Expert Elite adds SimpleSwitch for USB/network convertibility with a button press; shipments with this capability began in March 2025, easing branch and RDC deployments across Windows, macOS, and Linux via IP/Ethernet-over-USB options.

- In April 2025, Hyland Software, Inc. expanded its product portfolio with enhanced AI capabilities to elevate intelligent content management. Through powerful updates to Hyland Automate, Hyland Knowledge Discovery, and significant improvements to Hyland OnBase and Hyland Alfresco, the company is equipping organizations with advanced tools to optimize content, process, and application intelligence.

- In March 2025, IBM Corporation introduced IBM Storage Ceph as a Service, expanding its portfolio of flexible on-premises infrastructure solutions. This new offering complements IBM Power delivered as a service, providing a distributed compute platform with various form factors and flexible consumption models.

- In February 2025, Genesys Technologies deployment of AES‑256 encryption via MagTek’s Reader Management API for DynaProx contactless readers; while not a new check scanner, it reflects MagTek’s current security stack (Magensa, AES‑256, DUKPT) that also underpins its encrypting check scanners used in banking and retail environments

Report Coverage

The research report offers an in-depth analysis based on Price, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as banks continue shifting to image-based cheque clearing for faster settlement.

- Remote deposit capture will expand across SMEs, field agents, and branchless banking models.

- Multi-feed and high-speed scanners will gain preference in enterprises handling bulk payments.

- Compact, plug-and-play scanners will see higher adoption in retail counters and microfinance institutions.

- Integration with cloud storage and automated reconciliation software will become more common.

- Fraud detection features such as UV scanning and watermark verification will become standard.

- Subscription-based software and service bundles will grow as banks seek lower upfront ownership costs.

- Developing regions will contribute strongly as cheque truncation systems and digital banking expand.

- Eco-friendly, low-maintenance designs will gain traction as institutions reduce operational cost and downtime.

- Long-term demand will remain in corporate, government, and insurance segments even as digital payments rise.