Market Overview

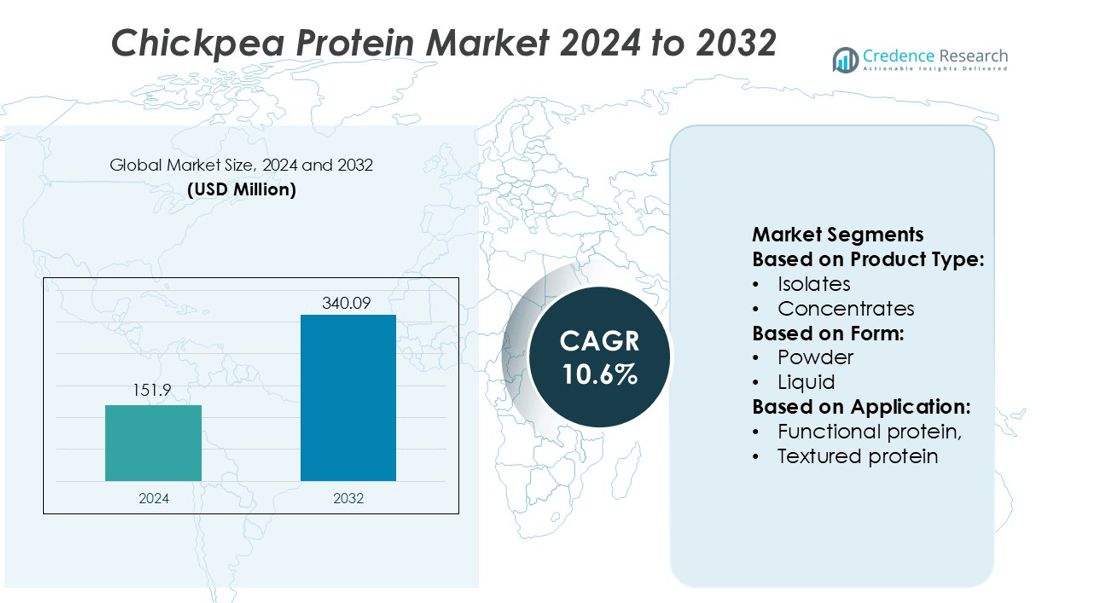

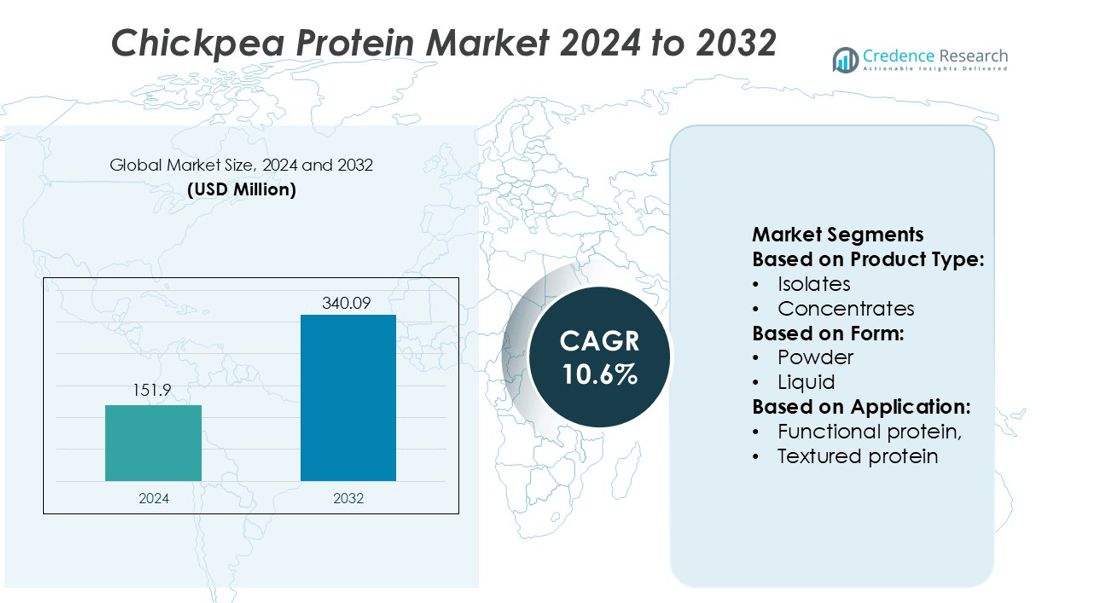

Chickpea Protein Market size was valued USD 151.9 million in 2024 and is anticipated to reach USD 340.09 million by 2032, at a CAGR of 10.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chickpea Protein Market Size 2024 |

USD 151.9 million |

| Chickpea Protein Market, CAGR |

10.6% |

| Chickpea Protein Market Size 2032 |

USD 340.09 million |

The chickpea protein market features strong participation from ingredient suppliers and plant-based food innovators offering isolates, concentrates, and functional flours for snacks, dairy substitutes, and sports nutrition. Companies expand distribution through bakeries, beverage brands, and ready-to-eat product manufacturers, while investing in cleaner labels and patented processing methods to improve solubility, taste, and texture. Producers also target gluten-free and allergen-friendly applications, strengthening adoption across retail and foodservice channels. North America leads the global market with a 34% share, driven by high demand for vegan and non-GMO foods, advanced processing infrastructure, and strong commercial presence across supermarkets and online platforms.

Market Insights

- The Chickpea Protein Market was valued at USD 151.9 million in 2024 and is projected to reach USD 340.09 million by 2032, growing at a CAGR of 10.6%.

- Rising demand for vegan and allergen-free ingredients drives usage in snacks, dairy alternatives, and sports nutrition, with isolates remaining the dominant segment due to better solubility and neutral taste.

- Clean-label and non-GMO trends support rapid product innovation, as companies invest in patented extraction methods to improve texture, foaming, and emulsification for beverages and ready-to-eat foods.

- Competition increases as ingredient suppliers expand partnerships with bakeries, beverage brands, and private-label manufacturers, though high processing cost and limited large-scale infrastructure act as restraints.

- North America leads with a 34% share due to advanced processing facilities and strong retail presence, while Europe and Asia-Pacific show growing adoption across gluten-free bakery, plant-based meat, and fortified beverages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Isolates lead the chickpea protein market with a 42% share. Food brands prefer isolates because they offer high protein content, low fat, and smooth taste. This makes isolates suitable for sports drinks, dairy-free yogurt, and medical nutrition. The fast rise of plant-based diets supports demand as isolates replace soy or whey in clean-label products. Bakery makers and snack producers also use isolates to improve texture and shelf life. Concentrates follow due to lower cost and balanced nutrition, while chickpea flour grows in gluten-free bread, pasta, and ready mixes.

- For instance, Nutriati Inc. developed its Artesa Chickpea Protein. The product has a protein concentration of approximately 62 grams per 100 grams (62%). It features a fine particle size, typically measured at below 75 microns, which is a key factor in its functional performance.

By Form

Powder form dominates with a 78% share. Powder offers longer shelf life, easier storage, and smooth blending in beverages, meat alternatives, nutrition bars, and bakery goods. Manufacturers prefer powder because it allows stable protein content and fast processing in dry mixes. Fitness brands use powdered chickpea protein in shakes aimed at vegan and lactose-intolerant buyers. Liquid form grows at a slower pace, mainly used in ready-to-drink shakes and dairy alternatives, but equipment upgrades and cold-fill technology are expected to improve its reach.

- For instance, The Bridge S.R.L. is an Italian company that produces a range of organic, plant-based drinks, including a chickpea-based drink (made from organic ingredients). The product is typically sold in 1000 ml cartons.

By Application

unctional protein holds the largest share at 65%, driven by demand from bakery, snacks, infant food, and fortified beverages. Producers adopt functional chickpea protein to enhance texture, stability, water binding, and mouthfeel in clean-label recipes. The textured protein segment shows strong growth as vegan burgers, nuggets, and sausages gain shelf space in supermarkets and foodservice chains. Brands choose textured chickpea protein to deliver firm bite and neutral flavor without soy allergens. Rising interest in plant-based menus at cafés and quick-service restaurants will continue to lift textured uses.

Key Growth Drivers

Rising Demand for Plant-Based and Allergen-Free Proteins

Demand for plant-based food continues to surge as consumers shift toward vegan, flexitarian, and lactose-free diets. Chickpea protein stands out because it is gluten-free, soy-free, and dairy-free, making it suitable for consumers with allergy concerns. Food brands add chickpea protein to milk alternatives, bakery mixes, snacks, and sports nutrition. Clean-label and non-GMO claims further strengthen adoption among health-conscious buyers. Growing awareness of digestive benefits and amino acid composition supports wider use across packaged foods and dietary supplements, boosting global demand for chickpea protein ingredients.

- For instance, Vestkorn Milling AS is a prominent producer of pulse ingredients and offers high-quality, fine-milled chickpea protein products. The product contains a high concentration of protein, within the typical industry range for chickpea protein concentrates (around 55% to 65%).

Growth of Nutraceutical and Sports Nutrition Products

Nutraceutical and sports nutrition manufacturers integrate chickpea protein for muscle recovery, weight management, and high satiety. The ingredient supports protein fortification in ready-to-drink beverages, powders, and bars. High fiber content appeals to digestive health consumers, while balanced nutrition enables use in adult and pediatric formulas. Private label brands and online channels make chickpea-based nutrition products more accessible. Fitness and wellness trends encourage athletes and everyday users to replace whey and soy protein with plant-based alternatives, driving consistent demand in the premium nutrition space.

- For instance, InnovoPro produces its chickpea-based protein platform using a patented solvent-free extraction method that yields a concentrate containing 70 g of protein per 100 g of product (CP-Pro70™).

Expansion of Sustainable and Ethical Food Production

Chickpea protein benefits from strong sustainability credentials. Chickpea crops require less water and synthetic fertilizer than traditional protein crops, reducing environmental footprint. Crop rotation potential improves soil health and supports regenerative farming programs. Food companies adopt chickpea protein to meet corporate sustainability targets and reduce reliance on animal ingredients. Governments and research bodies also promote low-carbon food options, encouraging manufacturers to expand chickpea-based product lines. Sustainable sourcing, transparent labeling, and ethical marketing continue to push chickpea protein into mainstream retail and foodservice channels.

Key Trends & Opportunities

Growing Use in Meat and Dairy Alternatives

Chickpea protein provides desirable texture, foaming, and emulsification properties, making it suitable for dairy-free yogurt, cheese, ice cream, and creamers. Plant-based meat producers use it to improve structure and moisture retention in vegan patties, nuggets, and sausages. The neutral flavor profile limits aftertaste, helping brands produce cleaner formulations without artificial masking agents. Blending chickpea protein with pea or fava protein further strengthens amino acid profiles. Expanding shelf space for vegan products in supermarkets presents a strong growth opportunity for chickpea ingredient suppliers.

- For instance, ChickP Protein Ltd. (based in Israel) developed a high-purity chickpea protein isolate. The product is an isolate containing 90 g of protein per 100 g of product (90% protein).

Clean-Label and Functional Ingredient Innovation

Consumers prefer short ingredient lists and minimally processed foods, encouraging manufacturers to use chickpea protein as a natural clean-label source of protein, fiber, and micronutrients. Companies invest in processing technologies that improve solubility, dispersibility, and taste, helping the ingredient perform better in beverages and baked foods. New applications emerge in gluten-free pasta, cereal snacks, sauces, and infant food. Functional health claims focused on satiety, gut health, and heart wellness attract premium buyers. This shift opens long-term opportunities for branded product launches.

- For instance, Ingredion’s press release notes that InnovoPro’s solvent-free extraction method delivers a chickpea protein concentrate with 70 g of protein per 100 g of product.

Expansion Through Online Retail and Private Labels

E-commerce platforms increase visibility for vegan and high-protein foods. Direct-to-consumer brands launch chickpea protein snacks, powders, and ready meals with subscription delivery. Supermarkets introduce private label chickpea-based products at competitive prices, increasing affordability in developing and developed markets. Cross-border online trade helps small manufacturers access international buyers. Social-media-driven wellness trends encourage trial and repeat purchases. These digital channels broaden global reach for suppliers and speed up product innovation cycles.

Key Challenges

High Processing Costs and Limited Large-Scale Infrastructure

Chickpea protein extraction requires advanced technology to achieve consistent concentration, flavor, and functionality. Many regions lack large-scale milling and fractionation infrastructure, increasing production cost. When compared with soy and pea protein, chickpea protein remains more expensive, limiting adoption in cost-sensitive markets. Manufacturers also face challenges in optimizing solubility for beverages. Investment in modern processing units and partnerships between ingredient suppliers and food producers remain essential to scale production and reduce overall cost.

Competition from Established Plant Proteins

Soy, pea, and wheat proteins dominate the plant-protein landscape due to well-developed supply chains and lower cost. These ingredients already have broad application across snacks, sports drinks, meat substitutes, and bakery products. Chickpea protein must compete on performance, nutrition, and taste to gain wider market share. Some manufacturers hesitate to reformulate due to price differences and limited long-term stability data. Educating food producers, improving product trials, and securing reliable raw material sourcing will be crucial to reduce competitive pressure.

Regional Analysis

North America

North America holds the largest share of the chickpea protein market with a 34% contribution. Rising demand for plant-based dairy, bakery mixes, protein snacks, and fortified beverages supports rapid adoption. The U.S. and Canada lead product innovation in ready-to-drink nutrition, textured protein, and allergen-free foods. Strong retail penetration, clean-label preference, and vegan consumer groups drive repeat purchases. Foodservice chains add chickpea-based sauces, patties, and dairy substitutes, boosting usage beyond packaged retail. Investments in fractionation technology, gluten-free formulations, and sustainable sourcing further strengthen regional growth and long-term product development.

Europe

Europe accounts for 29% share of the chickpea protein market, driven by clean-label and vegan food trends. Germany, France, Italy, and the U.K. record high spending on meat and dairy alternatives, boosting demand for chickpea-based cheese, yogurt, and bakery items. Regulatory support for sustainable plant proteins and carbon-reduced food systems attracts investment from ingredient suppliers. Private label supermarket brands introduce chickpea-based snacks and high-protein cereals, widening availability. Consumers show strong preference for organic, non-GMO, and allergen-friendly options. Food manufacturers also blend chickpea protein with pea and fava protein to enhance amino acid profiles in premium formulations.

Asia-Pacific

Asia-Pacific captures 23% share of the global market, supported by strong chickpea cultivation in India, Australia, and Myanmar. Rapid growth of vegan and flexitarian diets boosts demand for dairy substitutes, snacks, and fortified beverages. Domestic brands incorporate chickpea flour and isolates into ready meals, protein powders, and healthy bakery products. Rising sports nutrition demand across China, Japan, and South Korea creates opportunities for high-protein beverages. Government-backed clean-label regulations encourage plant-based innovation. Local ingredient suppliers benefit from lower raw material cost, helping price-sensitive markets adopt chickpea protein more easily across retail and foodservice channels.

Latin America

Latin America holds 8% share of the chickpea protein market, supported by emerging adoption in Brazil, Argentina, and Chile. Growth in vegan snacks, blended protein beverages, and gluten-free bakery products drives early-stage expansion. Domestic food processors explore chickpea protein to replace soy in allergen-sensitive consumer groups. Supermarkets expand shelf space for plant-based meat and dairy products, increasing visibility of chickpea-based items. Limited processing infrastructure and high technology costs restrict large-scale output, but rising export partnerships and online sales support long-term opportunities for both ingredient suppliers and regional food manufacturers.

Middle East & Africa

Middle East & Africa account for 6% share, driven by chickpea-heavy diets and regional food traditions. Manufacturers incorporate chickpea protein into hummus, snacks, confectionery, and infant nutrition. GCC countries show growing interest in clean-label, halal-certified plant proteins, attracting investment from ingredient companies. Retail demand rises for vegan beverages and high-protein bakery mixes, but pricing remains a barrier across low-income markets. Limited local processing capacity increases reliance on imports. However, expanding foodservice demand, government-backed health campaigns, and rising supermarket penetration offer future potential for chickpea protein across packaged and ready-to-eat categories.

Market Segmentations:

By Product Type:

By Form:

By Application:

- Functional protein,

- Textured protein

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the chickpea protein market players such as Nutriati, Inc., The Bridge, Vestkorn Milling AS, Archer Daniels Midland Company, InnovoPro Ltd., Socius Ingredients, ChickP Protein Ltd., Batory Foods, Ingredion Incorporated, and The Scoular Company. The chickpea protein market continues to expand as food and ingredient manufacturers invest in cleaner, allergen-free, and plant-based formulations. Companies focus on developing high-solubility protein isolates, concentrates, and flours suitable for beverages, dairy alternatives, snacks, and meat analogues. Partnerships with bakeries, sports nutrition brands, and ready-to-eat food producers enable wider commercial adoption. Many participants emphasize patented extraction techniques that improve functional properties such as emulsification, foaming, and moisture retention. Investment in R&D, sustainable farming practices, and large-scale processing infrastructure supports long-term growth. New product launches and private label expansion across supermarkets and online retail further intensify market competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nutriati, Inc.

- The Bridge

- Vestkorn Milling AS

- Archer Daniels Midland Company

- InnovoPro Ltd.

- Socius Ingredients

- ChickP Protein Ltd.

- Batory Foods

- Ingredion Incorporated

- The Scoular Company

Recent Developments

- In July 2025, ADM focused on expanding its presence in the Asia-Pacific market by collaborating with local food manufacturers to integrate chickpea protein into ready-to-eat meal products.

- In July 2025, MyProtein introduced Splash Of- a new line of clear whey isolate beverages offering around 20 grams of protein per serving with under 90 calories. Available in multiple fruit-based flavors, the range caters to consumers seeking a lighter, refreshing alternative to traditional creamy protein shakes.

- In May 2025, GNC India launched two functional whey protein products-Pro Performance 100% Whey + Nitro Surge and Pro Performance 100% Whey + Keto Surge. The new formulations target consumers seeking performance enhancement and metabolic benefits, incorporating ingredients such as L-arginine, L-citrulline, and CLA.

- In May 2025, Eat Just, Inc., a company that applies innovative science and technology to create healthier, more sustainable foods, announced the launch of its Just One protein, available in U.S. locations of Whole Foods Market

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Plant-based diets will continue to increase demand for chickpea-derived proteins across snacks, beverages, and dairy alternatives.

- Food manufacturers will expand use of chickpea protein in meat substitutes due to its clean flavor and functional properties.

- Processing technologies will improve solubility and texture, supporting growth in ready-to-drink nutrition products.

- More supermarkets will introduce private-label chickpea protein products to offer cost-friendly options.

- Sports nutrition brands will adopt chickpea protein for high-fiber, allergen-free formulations.

- E-commerce and subscription models will boost global availability of chickpea-based foods.

- Ingredient suppliers will strengthen sourcing through sustainable and regenerative farming practices.

- Partnerships between food companies and research institutions will accelerate innovation in new applications.

- Blends with pea, fava, and rice proteins will gain popularity to improve amino acid profiles.

- Rising demand for clean-label and non-GMO foods will support long-term market expansion.