Market Overview

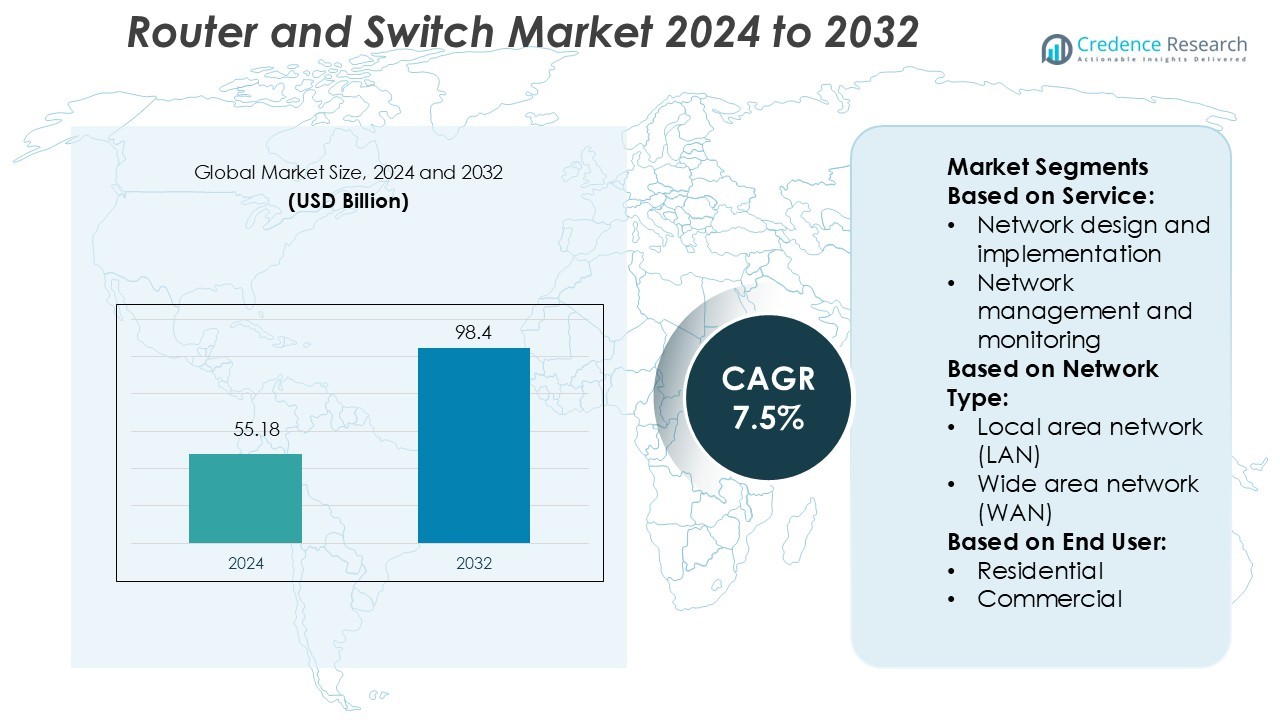

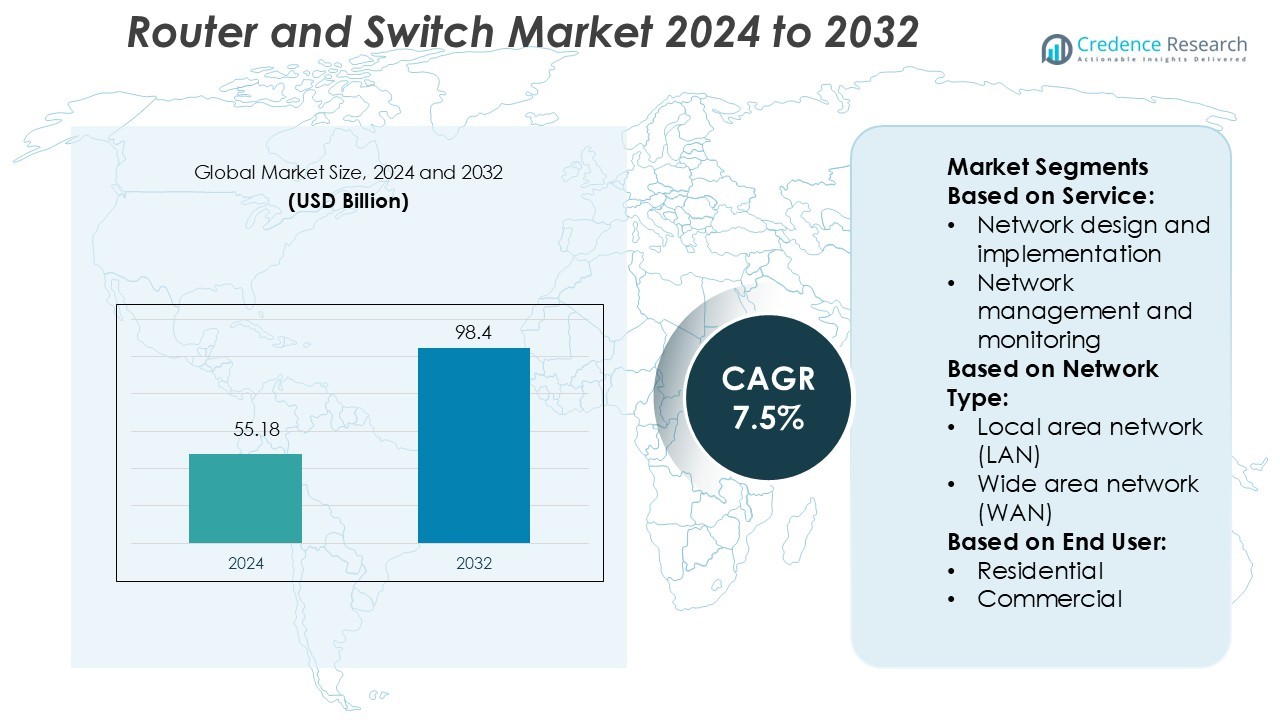

Router and Switch Market size was valued USD 55.18 billion in 2024 and is anticipated to reach USD 98.4 billion by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Router and Switch Market Size 2024 |

USD 55.18 Billion |

| Router and Switch Market, CAGR |

7.5% |

| Router and Switch Market Size 2032 |

USD 98.4 Billion |

The router and switch market is driven by major players including Schneider Electric SE, Juniper Networks, Arista Networks, Huawei Technologies Co., Ltd., Dell Technologies Inc., Nokia Networks, Siemens AG, Cisco Systems, Inc., Hewlett Packard Enterprise, and ABB Ltd. These companies focus on advanced routing and switching solutions that support cloud computing, 5G connectivity, and edge infrastructure. Many invest heavily in R&D, product innovation, and strategic alliances to strengthen their market position. North America leads the global router and switch market with a 34% share, supported by a strong enterprise ecosystem, early adoption of SDN technologies, and expanding data center infrastructure. This leadership is further reinforced by ongoing investments in network security and high-speed connectivity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The router and switch market was valued at USD 55.18 billion in 2024 and is projected to reach USD 98.4 billion by 2032, growing at a CAGR of 7.5%.

- Rising demand for high-speed connectivity, cloud integration, and 5G deployment is driving strong growth across enterprise and telecom segments.

- Leading players focus on SDN-enabled solutions, edge infrastructure, and network security to maintain competitive advantage and expand their global footprint.

- High deployment and maintenance costs, along with growing network complexity, remain key restraints affecting adoption in price-sensitive markets.

- North America leads with a 34% share, followed by Europe at 27% and Asia Pacific at 29%, with LAN solutions holding the largest segment share due to their reliability and high-speed performance.

Market Segmentation Analysis:

By Service

Network design and implementation dominates this segment with the largest market share. Enterprises prioritize this service to build scalable and secure network infrastructures. Growing adoption of cloud-based systems and hybrid IT environments is boosting demand. Companies are focusing on designing flexible architectures to support IoT, 5G, and edge computing. Network security services are also growing steadily due to rising cyber threats and compliance needs. Demand for BRAS and Ethernet services is expanding with the surge in broadband connectivity and digital transformation initiatives across sectors.

- For instance, Schneider Electric’s EcoStruxure™ platform connects over 1 billion devices across enterprise networks, leveraging advancements in IoT, mobility, and analytics to deliver enhanced value around safety, reliability, efficiency, sustainability, and connectivity.

By Network Type

Local area network (LAN) holds the dominant share in this segment. Businesses depend on LANs to ensure fast data transfer, lower latency, and reliable internal connectivity. The rising use of connected devices and data-intensive applications is driving deployment. LAN networks remain key in offices, educational institutions, and manufacturing plants. Wide area network (WAN) and metropolitan area network (MAN) segments are gaining traction as enterprises expand operations globally. Growing demand for SAN solutions reflects increased cloud storage and data management needs.

- For instance, Juniper Networks’ EX4000 series includes various switch models with different capacities. The highest-end model, the EX4000-48MP, achieves a bi-directional switching capacity of up to 200 Gbps, enabling high-throughput LAN environments when deployed using Virtual Chassis technology.

By End User

The commercial segment leads this segment with the highest market share. Enterprises in IT & ITES, retail, and BFSI sectors invest heavily in advanced routers and switches to support high-speed connectivity and secure transactions. Rising digitalization of workplaces and remote operations strengthens adoption in commercial spaces. The residential segment is growing rapidly due to demand for smart home connectivity and high-speed broadband. BFSI and healthcare sectors also see strong growth as network security and uptime become critical for operations and compliance.

Key Growth Drivers

Rising Demand for High-Speed Connectivity

The growing use of cloud applications, video streaming, and IoT is driving the need for high-speed and reliable connectivity. Enterprises and consumers demand low-latency networks to support real-time data transmission. This shift encourages investment in advanced routers and switches with high bandwidth and fast processing capabilities. Expansion of 5G infrastructure further boosts deployment. Businesses are upgrading existing network architectures to meet increasing traffic volumes. As a result, demand for scalable, high-performance networking equipment continues to rise across industries.

- For instance, the Arista 7100 Series switches were noted for their low-latency performance in RFC 2544 tests. Specific models, such as the 7124S, were documented with latency as low as 600 ns.

Expansion of Data Centers and Cloud Infrastructure

The surge in cloud adoption and data center expansion is a major growth driver. Organizations are investing in network infrastructure that supports hybrid and multi-cloud environments. Routers and switches play a vital role in enabling seamless communication between servers, storage, and external networks. The rise in colocation and edge data centers also drives infrastructure upgrades. Increased use of virtualization and software-defined networking enhances operational efficiency. This widespread digital infrastructure growth strengthens the market’s long-term demand trajectory.

- For instance, Huawei’s Digital Power unit reported that a 1,000-rack data centre build can be shortened from more than 18 months to 6–9 months using its FusionDC solution.

Rapid Digital Transformation Across Industries

Digital transformation initiatives in BFSI, retail, healthcare, and manufacturing are creating strong network infrastructure demand. Businesses are investing in secure, high-performance routers and switches to support automation, cloud-based services, and real-time analytics. Hybrid work models further accelerate upgrades to ensure reliable remote connectivity. IoT and AI-driven operations require advanced routing and switching capabilities for seamless data flow. Government digitalization projects and smart city programs also add momentum. This transformation is significantly reshaping networking priorities worldwide.

Key Trends & Opportunities

Growing Adoption of SDN and NFV Technologies

Software-defined networking (SDN) and network function virtualization (NFV) are transforming network architecture. These technologies reduce reliance on hardware-based infrastructure and enable agile, programmable networks. Businesses benefit from improved network management, automation, and reduced operational costs. Vendors are launching SDN-compatible routers and switches to meet enterprise demand. The trend aligns with the shift toward hybrid cloud and edge deployments, offering scalability and better resource utilization. This creates strong opportunities for innovation and market expansion.

- For instance, Dell’s SmartFabric OS10 (a Linux-based, disaggregated network OS) supports automation via Ansible, Puppet and Chef and runs on hardware platforms capable of 1G/10G/25G/40G/100G/400G port speeds.

Edge Computing and IoT Integration

The rising deployment of IoT devices and edge computing solutions is shaping new opportunities. Routers and switches are increasingly used to manage data closer to the source, reducing latency and improving performance. Edge infrastructure supports real-time decision-making for industries such as manufacturing, healthcare, and logistics. Vendors are introducing compact, high-capacity switches to meet edge network demands. This growing ecosystem of connected devices drives the need for more flexible and resilient network architectures.

- For instance, Nokia and Keysight Technologies successfully completed an end-to-end “Ultra Ethernet” test of UET traffic across Nokia’s data center switch families, including the 7220 IXR and 7250 IXR.

Surge in Network Security Investments

As cyber threats grow, enterprises prioritize secure network infrastructures. Advanced routers and switches are being equipped with integrated security features like firewalls, intrusion detection, and encrypted traffic management. This shift creates opportunities for vendors offering secure and compliant solutions. The demand is strong across regulated sectors such as BFSI and healthcare. Integration of AI-based threat detection tools enhances protection and reduces response time. Rising awareness of data security fuels investment in next-generation network security solutions.

Key Challenges

High Deployment and Maintenance Costs

The cost of deploying advanced routers and switches remains a key barrier for many organizations. High-performance networking equipment involves significant capital investment and skilled labor for installation and maintenance. Small and medium enterprises often face budget limitations, slowing adoption. Upgrading legacy infrastructure adds complexity and expense. Ongoing costs for software updates, network management, and security patches further increase the financial burden. This cost factor can limit market growth, especially in price-sensitive regions.

Rising Network Complexity and Cybersecurity Risks

Modern networks are increasingly complex due to cloud integration, edge computing, and IoT expansion. Managing these diverse environments requires advanced tools and skilled personnel. Cybersecurity risks are also intensifying, with routers and switches becoming frequent targets for attacks. Failure to secure networks can result in data breaches, downtime, and regulatory penalties. Organizations face challenges in balancing performance, security, and manageability. This rising complexity slows deployment and demands robust, integrated solutions.

Regional Analysis

North America

North America leads the router and switch market with a 34% share. The region benefits from a mature IT infrastructure, strong enterprise adoption of cloud services, and rapid 5G rollout. Major companies invest heavily in high-performance networking equipment to support data center growth and digital transformation. Demand for advanced routing solutions is high across BFSI, IT & ITES, and retail sectors. Strong cybersecurity regulations also drive upgrades to secure network infrastructure. The presence of leading technology vendors and early adoption of SDN and edge computing strengthen North America’s dominant market position.

Europe

Europe holds a 27% market share, driven by increasing investments in next-generation broadband and smart city projects. Countries across Western Europe lead in deploying fiber-based and 5G networks. Enterprises in the region are modernizing legacy systems to support cloud integration and digital services. High data privacy standards, such as GDPR, push companies to adopt secure and efficient networking solutions. Rising industrial automation in Germany, France, and the UK fuels the adoption of advanced switches and routers. Government incentives for digital infrastructure further enhance market growth across the region.

Asia Pacific

Asia Pacific accounts for a 29% market share and shows the fastest growth rate. Expanding 5G infrastructure, growing data center investments, and rapid digitalization in countries like China, India, and Japan are key growth drivers. The region has seen a surge in broadband penetration, enterprise cloud adoption, and smart manufacturing initiatives. Government programs supporting digital connectivity boost network infrastructure upgrades. The commercial and IT & ITES sectors dominate demand, while residential usage grows steadily with smart home expansion. Asia Pacific’s strong investment momentum positions it as a critical growth engine for the global market.

Latin America

Latin America represents a 6% share of the global router and switch market. The region is gradually expanding network infrastructure with rising investments in broadband and fiber deployment. Countries such as Brazil, Mexico, and Chile are adopting advanced networking solutions to support growing data usage and digital services. Economic development initiatives and cloud expansion projects contribute to infrastructure upgrades. Although the region faces cost and deployment challenges, rising demand from commercial and telecom sectors strengthens market opportunities. Network modernization remains a key priority to support future digital transformation.

Middle East & Africa

The Middle East & Africa holds a 4% market share, supported by increasing investments in ICT infrastructure. Governments are investing in smart city programs and 5G deployment, particularly in the UAE, Saudi Arabia, and South Africa. Enterprises in BFSI, retail, and IT sectors are adopting high-speed connectivity solutions to support digital expansion. International partnerships with technology vendors are helping bridge infrastructure gaps. Although adoption rates are lower than other regions, improving broadband access and growing enterprise digitalization are expected to drive steady market growth in the coming years.

Market Segmentations:

By Service:

- Network design and implementation

- Network management and monitoring

By Network Type:

- Local area network (LAN)

- Wide area network (WAN)

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The router and switch market is shaped by major players such as Schneider Electric SE, Juniper Networks, Arista Networks, Huawei Technologies Co., Ltd., Dell Technologies Inc., Nokia Networks, Siemens AG, Cisco Systems, Inc., Hewlett Packard Enterprise, and ABB Ltd. The router and switch market is highly competitive, driven by rapid technological advancements and rising global connectivity demands. Companies focus on developing high-performance, energy-efficient, and secure networking solutions to support growing data traffic and enterprise digitalization. Strategic partnerships, acquisitions, and product innovations are central to gaining market share. Vendors are investing in SDN-enabled solutions, edge computing infrastructure, and 5G-ready platforms to meet evolving customer needs. The competitive landscape also reflects a strong emphasis on software-driven networking and cloud integration. Continuous R&D investments, expansion into emerging markets, and portfolio diversification further intensify competition and shape long-term growth strategies.

Key Player Analysis

- Schneider Electric SE

- Juniper Networks

- Arista Networks

- Huawei Technologies Co., Ltd.

- Dell Technologies Inc.

- Nokia Networks

- Siemens AG

- Cisco Systems, Inc.

- Hewlett Packard Enterprise

- ABB Ltd.

Recent Developments

- In June 2025, Minda collaborated with Toyodenso to produce advanced automotive switches for the Indian market. This partnership aims to deliver comprehensive solutions for two-wheelers and passenger vehicles, including design and manufacturing. A new manufacturing facility is planned to be set up in Noida, Uttar Pradesh, with operations expected to begin in the latter half of FY 2026-27.

- In March 2025, Infineon Technologies unveiled its Power PROFET + 24/48V switch family, tailored for today’s vehicle power systems. Engineered to reduce power losses in high-current situations, these devices meet the stringent requirements of modern automotive electrical systems.

- In November 2024, NOVOSENSE, unveiled a suite of high-side switches. These switches were designed to drive traditional resistive, inductive, and halogen lamp loads in automotive body control modules (BCM). Additionally, they catered to large capacitive loads typically found in first and second-level power distribution within zone control units (ZCU).

- In October 2023, Legrand launched its latest product range, enhanced its market presence. The new switches are designed to offer improved functionality and aesthetics, targeting both residential and commercial applications. This launch underscored Legrand’s commitment to innovation and meeting the evolving needs of Indian consumers in the switch market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service, Network Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-speed and low-latency networks will continue to grow globally.

- Adoption of 5G infrastructure will drive upgrades in routing and switching equipment.

- Edge computing expansion will create strong demand for compact, high-capacity solutions.

- Software-defined networking will become a standard for flexible network management.

- Cloud integration will increase, pushing enterprises to modernize their network infrastructure.

- AI and automation will enhance network monitoring, security, and performance optimization.

- Rising IoT deployments will accelerate the need for scalable and secure networks.

- Cybersecurity integration in network equipment will become a top industry priority.

- Emerging markets will see rapid infrastructure investments and network modernization.

- Strategic collaborations and R&D efforts will shape the next wave of product innovations.