Market Overview:

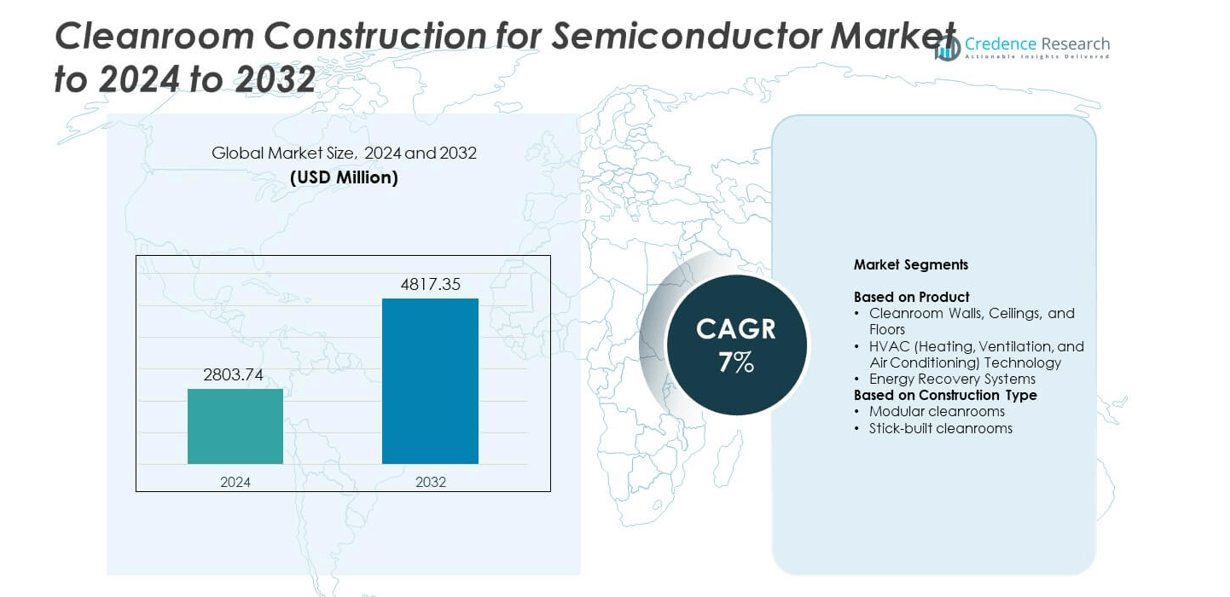

The Cleanroom Construction for Semiconductor Market size was valued at USD 2803.74 million in 2024 and is anticipated to reach USD 4817.35 million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cleanroom Construction for Semiconductor Market Size 2024 |

USD 2803.74 million |

| Cleanroom Construction for Semiconductor Market, CAGR |

7% |

| Cleanroom Construction for Semiconductor Market Size 2032 |

USD 4817.35 million |

The Cleanroom Construction for Semiconductor Market is led by prominent players including Exyte, Jacobs Engineering, CRB, AES Clean Technology, and SKAN Group. These companies hold strong positions through their expertise in modular cleanroom design, precision HVAC integration, and turnkey semiconductor facility solutions. They focus on energy-efficient systems and smart automation to meet strict contamination control standards. Asia-Pacific leads the global market with a 37.6% share, driven by rapid semiconductor fabrication expansion in China, Taiwan, South Korea, and Japan. North America follows with 34.8%, supported by strong government funding and advanced manufacturing infrastructure.

Market Insights

- The Cleanroom Construction for Semiconductor Market was valued at USD 2803.74 million in 2024 and is projected to reach USD 4817.35 million by 2032, expanding at a CAGR of 7% during the forecast period.

- Rising semiconductor fabrication projects and government-backed investments are driving cleanroom construction demand globally.

- Growing adoption of modular cleanrooms, energy-efficient HVAC systems, and automation technologies defines the latest market trends.

- The market remains competitive, with leading players focusing on sustainable design, turnkey solutions, and rapid deployment to meet semiconductor manufacturing needs.

- Asia-Pacific leads with 37.6% share, followed by North America at 34.8% and Europe at 22.4%, while modular cleanrooms dominate product segments with 61.5% share due to faster installation and flexibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

HVAC (Heating, Ventilation, and Air Conditioning) technology dominated the cleanroom construction for semiconductor market with a 47.2% share in 2024. Its leadership stems from its critical role in maintaining temperature, humidity, and particulate control essential for semiconductor fabrication. High-efficiency filtration and airflow systems minimize contamination risk, improving yield rates and process stability. Cleanroom walls, ceilings, and floors follow closely due to increased use of modular materials that enhance assembly speed and structural integrity. Energy recovery systems are gaining attention as manufacturers prioritize sustainable and energy-efficient cleanroom operations to reduce operational costs and carbon emissions.

- For instance, Camfil’s Absolute V H14 filters reach 99.995% MPPS efficiency and support airflows above 3,400 m³/h, matching ISO 5–6 cleanroom needs.

By Construction Type

Modular cleanrooms accounted for 61.5% of the market in 2024, making them the dominant construction type. Their popularity arises from rapid installation, scalability, and reduced downtime compared to traditional stick-built structures. Modular units allow precise customization and compliance with ISO standards, enabling faster semiconductor plant expansions. Stick-built cleanrooms retain relevance for large-scale facilities requiring permanent, high-capacity configurations. However, increasing adoption of prefabricated modules and hybrid models continues to reshape cleanroom development strategies, driven by the demand for operational flexibility and improved project timelines in semiconductor manufacturing.

- For instance, Exyte delivered HLMC’s 300 mm fab in Shanghai with 130,000 m² total area and 34,000 m² of ISO 5/6 cleanroom space, illustrating modular interior build-outs.

Key Growth Drivers

Rising Semiconductor Fabrication Expansion

The surge in semiconductor demand is driving large-scale investments in fabrication plants, leading to increased cleanroom construction. Major chip manufacturers are expanding facilities across Asia-Pacific and North America to support advanced process nodes. Cleanrooms are critical for maintaining ultra-low particulate environments essential for producing smaller, high-performance chips. As semiconductor miniaturization accelerates, the need for precision-controlled environments continues to grow, directly fueling demand for advanced HVAC systems, modular cleanroom designs, and energy-efficient construction materials.

- For instance, SK ecoplant (for SK hynix) built cleanroom areas of 6,413 m² and 10,725 m² in recent M16/M15 projects, showing rapid capacity additions.

Technological Advancements in Cleanroom Design

Continuous innovation in cleanroom materials and design is enhancing operational efficiency and contamination control. Modern cleanroom systems now integrate automation, airflow simulation, and smart monitoring for temperature and humidity regulation. These innovations improve production yield and reduce maintenance costs for semiconductor fabs. The integration of energy recovery systems and adaptive HVAC technologies further supports sustainability goals. This advancement in technology stands as a major growth catalyst, driving adoption of next-generation cleanroom construction solutions in semiconductor manufacturing facilities worldwide.

- For instance, Bosch’s Dresden AIoT fab streams data equal to ~500 pages each second, enabling automated control and faster issue detection.

Government and Private Sector Investments

Strong financial support from both government initiatives and private companies is boosting semiconductor infrastructure projects. Nations such as the U.S., Japan, and South Korea are investing heavily in domestic chip manufacturing to reduce supply chain dependency. This investment wave includes funding for advanced cleanroom construction to meet the precision and safety requirements of cutting-edge fabs. Such initiatives are accelerating global capacity expansion, strengthening the cleanroom construction market’s growth trajectory and enabling technology-driven competitiveness across the semiconductor sector.

Key Trends & Opportunities

Adoption of Modular and Prefabricated Cleanrooms

Manufacturers are increasingly adopting modular and prefabricated cleanrooms to reduce setup time and costs. These systems allow flexible scalability and faster deployment in semiconductor fabs. Prefabricated units also offer improved compliance with ISO standards, making them ideal for rapidly evolving chip production lines. The shift toward modular designs supports agile manufacturing, reduces project complexity, and enables quick adaptation to next-generation technologies. This trend presents strong opportunities for suppliers offering turnkey cleanroom construction solutions with integrated environmental control systems.

- For instance, Technical Air Products reports rigid-wall modular cleanrooms install in a few days to weeks, while soft-wall rooms often install in 1–3 days.

Focus on Sustainability and Energy Efficiency

The market is witnessing a growing focus on energy-efficient cleanroom construction aligned with global sustainability goals. Semiconductor manufacturers are integrating renewable energy systems and efficient HVAC solutions to reduce operational costs and emissions. Green building materials and recyclable components are also being prioritized to minimize environmental impact. The adoption of sustainable construction practices not only improves brand value but also meets tightening environmental regulations, opening new opportunities for eco-friendly cleanroom design providers worldwide.

- For instance, Samsung Electronics set a net-zero target for Scope 1–2 by 2050, pushing energy-efficient HVAC and sustainable fab design.

Key Challenges

High Capital and Operational Costs

Cleanroom construction for semiconductor manufacturing involves significant capital investment due to complex HVAC systems, filtration, and material costs. Ongoing operational expenses related to energy consumption and maintenance further add to financial pressure. These costs can limit adoption among smaller fabs or new market entrants. The need for constant upgrades to meet evolving semiconductor standards also escalates expenses. Balancing cost efficiency while ensuring contamination control remains one of the industry’s most persistent challenges.

Shortage of Skilled Workforce and Technical Expertise

The construction of semiconductor cleanrooms demands specialized engineering and precision expertise, which remain in short supply globally. The lack of trained professionals in HVAC system integration, contamination control, and modular design slows project timelines. This talent gap is especially visible in emerging semiconductor hubs with limited technical infrastructure. Addressing this challenge requires investment in workforce training and collaboration between cleanroom technology providers and educational institutions to sustain market growth.

Regional Analysis

North America

North America held a 34.8% share of the cleanroom construction for semiconductor market in 2024. The region benefits from strong investments in advanced chip manufacturing facilities by major players in the U.S. and Canada. Expanding fabrication capacity for AI processors and next-generation chips is fueling demand for high-specification cleanrooms. Government initiatives like the CHIPS Act are further strengthening domestic semiconductor production. The presence of leading construction technology providers and strict contamination control standards continues to drive steady growth in cleanroom development across the region.

Europe

Europe accounted for 22.4% of the market in 2024, supported by rising semiconductor manufacturing in Germany, the Netherlands, and France. The region focuses on advanced cleanroom standards to meet stringent EU regulations for precision engineering and environmental compliance. Ongoing projects under the European Chips Act are boosting cleanroom investments for localized production. Sustainable construction practices and energy-efficient HVAC technologies are gaining importance as European firms aim to lower carbon emissions while enhancing operational efficiency. Collaborative projects between semiconductor producers and research institutions also strengthen regional competitiveness.

Asia-Pacific

Asia-Pacific dominated the market with a 37.6% share in 2024, driven by large-scale semiconductor fabrication in China, Taiwan, South Korea, and Japan. Strong presence of leading foundries and continuous capacity expansion for logic and memory chips fuel growth. Governments in the region are providing financial incentives to attract cleanroom construction projects for advanced process nodes. Rapid adoption of modular and energy-efficient designs further enhances cost efficiency. The region’s dominance is reinforced by robust supply chain integration, skilled workforce availability, and ongoing technological innovations in cleanroom infrastructure.

Latin America

Latin America captured a 3.2% market share in 2024, supported by emerging semiconductor assembly and testing operations. Countries like Brazil and Mexico are witnessing gradual investments in cleanroom infrastructure to support electronics manufacturing and regional R&D centers. The market is benefiting from partnerships with global cleanroom constructors and technology providers. Growth remains moderate due to limited local expertise and high installation costs. However, rising demand for consumer electronics and regional supply chain diversification efforts are expected to improve investment inflow in the coming years.

Middle East & Africa

The Middle East & Africa region held a 2% share in 2024, representing a nascent but growing market segment. Increasing government focus on industrial diversification and digital infrastructure is encouraging investment in semiconductor-related cleanroom projects, particularly in the UAE and Israel. The development of high-tech manufacturing clusters and free zones is creating new opportunities for cleanroom construction firms. While adoption is currently limited, the region’s emphasis on advanced technology manufacturing and foreign partnerships is expected to enhance future market potential.

Market Segmentations:

By Product

- Cleanroom Walls, Ceilings, and Floors

- HVAC (Heating, Ventilation, and Air Conditioning) Technology

- Energy Recovery Systems

By Construction Type

- Modular cleanrooms

- Stick-built cleanrooms

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cleanroom Construction for Semiconductor Market is shaped by key players such as Exyte, Jacobs Engineering, Clean Air Products, SKAN Group, Horton Automatics, CRB, AES Clean Technology, Integrated Project Services, Envirotec, Cleanroom Industries Sdn Bhd, Gillbane Building Co., and Clean Room International. The competitive landscape is characterized by strong emphasis on turnkey solutions, modular construction, and high-efficiency contamination control systems. Companies focus on integrating advanced HVAC technologies, energy recovery systems, and automation for precision manufacturing environments. Strategic collaborations with semiconductor manufacturers are enhancing design customization and compliance with ISO cleanroom standards. Many firms are also investing in sustainable construction practices and digital project management tools to optimize timelines and operational efficiency. Competitive differentiation relies on expertise in handling complex fabrication projects, adherence to strict regulatory frameworks, and the ability to deliver rapid, scalable cleanroom setups that align with the semiconductor industry’s evolving production and environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exyte

- Jacobs Engineering

- Clean Air Products

- SKAN Group

- Horton Automatics

- CRB

- AES Clean Technology

- Integrated Project Services

- Envirotec

- Cleanroom Industries Sdn Bhd

- Gillbane Building Co.

- Clean Room International

Recent Developments

- In 2025, Exyte and JGC Corporation launched a new joint Engineering, Procurement, and Construction (EPC) brand named “Nixyte” to serve high-tech industries, including semiconductors, across Southeast Asia.

- In 2024, AES Clean Technology launched the CleanLock Module, a new airlock solution designed to enhance cleanliness and operational efficiency in controlled environments crucial for high-stakes industries like semiconductors.

- In 2024, Jacobs was appointed by CG Semi Private Limited (a joint venture involving Renesas Electronics) for the engineering design of a new Outsourced Semiconductor Assembly and Test (OSAT) facility in India.

Report Coverage

The research report offers an in-depth analysis based on Product, Construction Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing semiconductor demand will continue to drive large-scale cleanroom construction projects worldwide.

- Modular cleanroom designs will gain preference for faster installation and flexible scalability.

- Integration of smart monitoring systems will enhance contamination control and energy management.

- Governments will boost domestic semiconductor capacity through policy incentives and funding support.

- Energy-efficient HVAC and filtration systems will become standard to reduce operational costs.

- Asia-Pacific will remain the primary hub for cleanroom development due to strong fabrication expansion.

- Sustainability-focused materials will dominate future cleanroom construction projects.

- Automation and robotics will streamline cleanroom assembly and maintenance processes.

- Collaboration between cleanroom engineers and semiconductor manufacturers will drive design innovation.

- Demand for skilled cleanroom construction specialists will rise with increasing global fabrication plant projects.